Updated on: Dec 9, 2025

PLEASE READ THESE IMPORTANT LEGAL NOTICES & DISCLOSURES

- Forge Price™ is a custom data-point calculated and disseminated by Forge Data LLC (“Forge Data”) and is a mark of Forge Data. Forge Price may rely on a very limited number of inputs in its calculation. Forge Price is prepared and disseminated solely for informational purposes. Redistribution is permitted solely with Forge’s written consent. While Forge has obtained information from sources it believes to be reliable, Forge does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives. Forge does not guarantee the accuracy, completeness, timeliness, or availability of Forge Price, and are not responsible for any errors or omissions, regardless of the cause, or any results obtained from the use of Forge Price. Forge Price is derived from secondary activity on the Forge platform and other private market trading platforms, and other publicly-available datapoints collected by Forge. Forge Price is not intended to, and does not necessarily, represent the market price of any securities (I.e., the price at which you could buy or sell such securities). Neither reference to company names, nor calculation of Forge Price for a specific company, implies any affiliation between Forge and that company, any endorsement or sponsorship by Forge of any company or vice versa, or any partnership, joint venture or other commercial relationship between Forge and any company. Rights with respect to any company marks referred to herein are owned by the company. The dollar-figure and percentage displayed indicates the per share change in dollar amount and percentage since the most recent Forge Price change. Percentages are rounded to the nearest whole number.

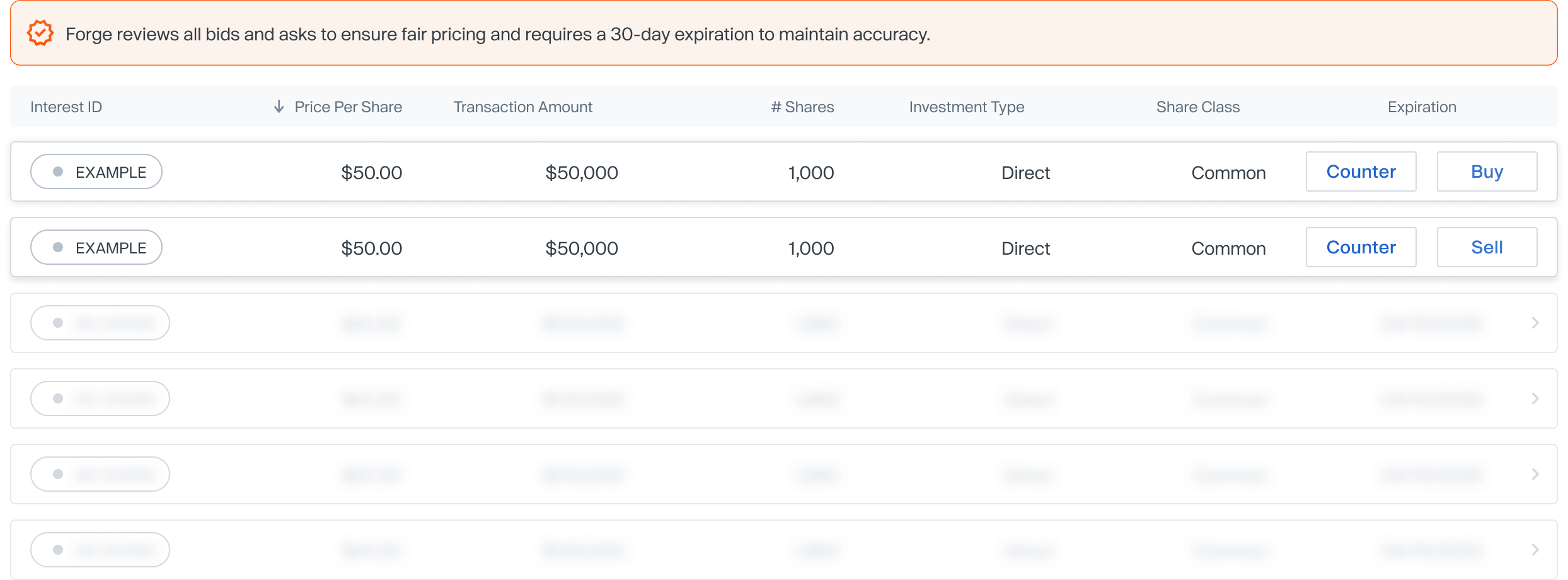

- Market activity indicates the level of activity for a company based on recent IOIs, secondary transactions, and pending transactions.

- Post-Money Valuation represents the estimated valuation based on company-submitted Certificates of Incorporations (COIs).

- Last Known Valuation represents a valuation gathered from non-COI, publicly available sources including company press releases or multiple concurring news articles.

- Actively traded companies are companies with a high market activity with the highest post-money valuation in the same sector.

‘Stock Price’ or other private company metrics (‘PC Data’) may rely on a very limited number of trade and/or IOI inputs in their calculation. PC Data is prepared and disseminated solely for informational purposes. While Forge has obtained information from sources it believes to be reliable, Forge does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives. Forge does not guarantee the accuracy, completeness, timeliness, or availability of PC Data, and are not responsible for any errors or omissions, regardless of the cause, or any results obtained from the use of PC Data. PC Data is derived from the performance and pricing of secondary activity on the Forge platform and other private market trading platforms. PC Data is not intended to, and does not necessarily, represent the market price of any securities (I.e., the price at which you could buy or sell such securities). Reference to company names does not imply any affiliation between Forge and that company, any endorsement or sponsorship by Forge of any company or vice versa, or any partnership, joint venture or other commercial relationship between Forge and any company. Rights with respect to any company marks referred to herein are owned by the company.

The news articles displayed on this page may be curated using artificial intelligence (AI) technology, which selects relevant content from a list of trusted web sources. While we strive for accuracy and reliability, the inclusion of an article does not imply endorsement or verification of its content. This communication is for informational purposes only. Investors should conduct their own research and consult a financial professional before making investment decisions.

Investing in private company securities is not suitable for all investors, is highly speculative, is high risk, and investors should be prepared to withstand a total loss of their investment. Private company securities are highly illiquid and there is no guarantee that a market will develop for such securities. Each investment carries its own risks, and investors should conduct their own due diligence regarding the investment, including obtaining independent professional advice. Past performance is not indicative of future results. This is not a recommendation, offer, solicitation of an offer, or advice to buy or sell securities by Forge, nor an offer of brokerage services in any jurisdiction where Forge is not permitted to offer brokerage services. Brokerage products and services are offered by Forge Securities LLC, a registered broker-dealer and member FINRA/SIPC. Please see other important disclaimers, disclosures and restrictions you acknowledge by using this website and to which you are subject.