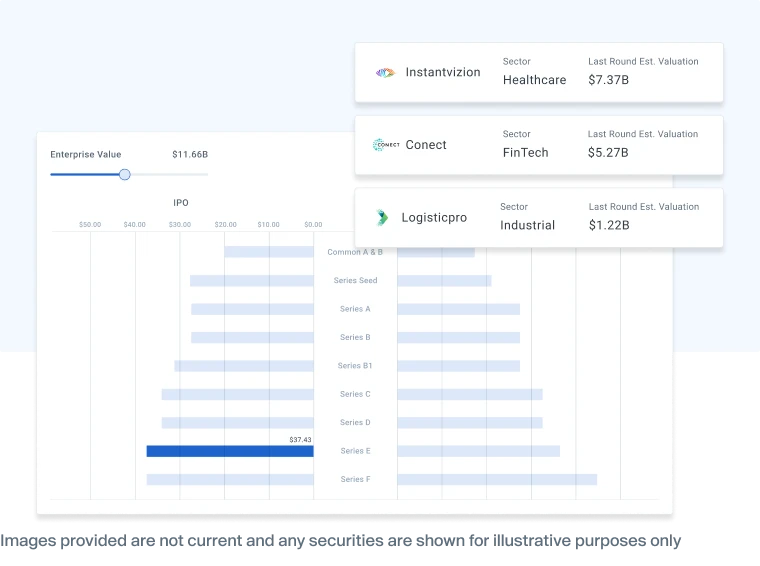

Companies

Companies above are listed in alphabetical order.

Around the world, thousands of private companies have created technologies that have changed the way we live and work. As today's startups pursue the moonshots of tomorrow, access to private capital fuels their journeys. Forge’s private stock trading platform provides accredited investors with access to this multi-trillion dollar asset class.

The private market represents potential opportunities for investors and shareholders alike. In a market where timing can be important, Forge is an avenue to potentially achieve diversification, outsized returns and liquidity.

Accredited individuals that meet specific net worth or income requirements are invited to access Forge’s private stock market. Create a free account to connect with a Private Market Specialist to determine qualification.

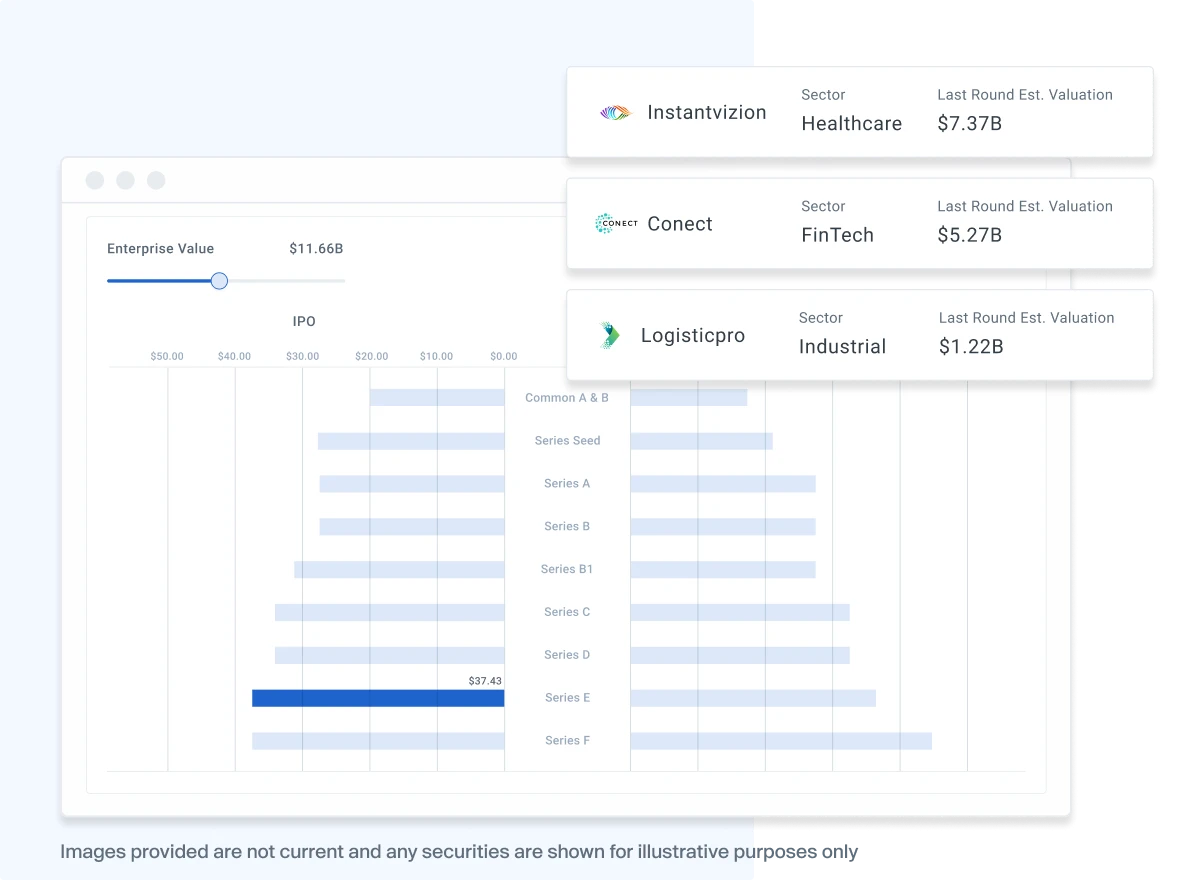

A data-driven, market-based approach provides accurate and timely pricing information that’s vital for investors, shareholders and institutions.

Companies above are listed in alphabetical order.

A data-driven, market-based approach provides accurate and timely pricing information that’s vital for investors, shareholders and institutions.

As the first private stock trading platform to be listed on the New York Stock Exchange, Forge makes it possible to invest within a proven and regulated marketplace.

As the first private stock trading platform to be listed on the New York Stock Exchange, Forge makes it possible to invest within a proven and regulated marketplace.

Learn more about the private market on Forge. Explore the FAQs.

Private market investors include many parties, such as individual investors, venture capital funds, mutual funds, and more. To participate as a buyer in the U.S., the investor must be deemed an “accredited investor”, as defined by federal securities laws.

Qualifying as an accredited investor depends on meeting certain financial or professional thresholds, such as having income over $200,000 ($300,000 with spouse or partner) for the past two years, with a reasonable expectation to have the same in the current year.

Or, an individual can qualify as an accredited investor if they (alone or with a spouse/partner) have a net worth of at least $1 million, not counting their primary residence.

There are additional ways to qualify as an accredited investor. The above are just a couple of common examples.

While there is no legal requirement to use a broker to invest in private companies, many investors, especially individuals, may find that it’s easier to buy private company shares through a private marketplace like Forge Markets.

Doing so provides advantages, such as offering a centralized network of shareholder/sellers, compared with trying to source a seller with shares in your desired company on your own. Buyers can also benefit from Forge Markets’ experience with private company transfer processes, knowledge of applicable securities laws and transaction documents, and the ability to bring these elements together in a transaction.

On the other hand, one disadvantage of using a broker to buy private company shares is cost. Forge Markets, like most other brokers, charges a fee for their services. Working without a broker would save on these fees.

Valuing private company shares can be both an art and a science. Private companies generally don’t provide as much transparency to investors as public companies do, and you can’t see pricing from prior trades as easily as you can look at public company trade data.

That said, you can try to come up with a valuation based on information such as private market trading activity on a secondary marketplace like Forge, recent funding valuations, and valuation histories at comparable companies.

Forge has proprietary valuation insights, and your Forge Private Market Specialist can help you bring together all available information for your valuation assessments.

Pre-IPO investing refers to investing in a company before it goes public and sells its shares on a public stock exchange. Pre-IPO investing can be an attractive opportunity for investors who believe that a company is poised for growth and has the potential to generate significant returns. However, it can be a high-risk investment, as there is typically less information available about the company's financial performance and future prospects than there would be for a publicly traded company.

Investors who participate in pre-IPO investing often do so through private placements or secondary market platforms like Forge Markets that allow them to purchase shares in the company before it goes public. For more on pre-IPO investing, please refer to our blog – “What is Pre-IPO Investing?”

Forge provides transparent and flexible fees, as low as 0% in some instances. The Forge transaction fee for direct secondaries is typically 2-4%. The fee depends on several factors including transaction size, market dynamics, investment types, and customer lifetime transaction volume, among other considerations. For alternate investment structures, the fee can range higher than that of direct secondaries.

As a reminder, Forge does not charge a fee to create an account or to access our marketplace and join our global network of buyers and sellers. Unlike other secondary marketplaces with hidden platform fees or upfront subscription costs, Forge Securities only gets paid upon the completion of a successful transaction.

Our standard minimum for direct transactions is $100,000 USD; however, we accept Indications of Interest for notional amounts as low as $5,000. Note that opportunities for Indications of Interest with lower notional value are very limited and may only be available through a Forge Fund.

Investors may buy pre-IPO shares for several reasons, such as:

Rather than investing solely in publicly traded companies, which often means investing in mature companies and facing a lot of competition from other investors, buying pre-IPO shares can potentially mean getting an ownership stake in a company before there’s a crowd.

See our blog post on buying pre-IPO stocks for more information.

Forge provides a runway for employee shareholders to sell private stock. Learn more about unlocking liquidity on the private market.

Enhance investment strategies on the pre-IPO market using the platform with capacity to manage the multifaceted institutional investing process.

* “Trending Companies” listed above are not a recommendation, offer, solicitation of an offer, or advice to buy or sell securities by Forge Global, Inc. or any of its affiliates or subsidiaries, and are not based on any user’s particular financial situation or needs. Trending Companies are companies on the Forge Markets platform with the highest indications of interest during the time period noted next to the list.