Disclosures

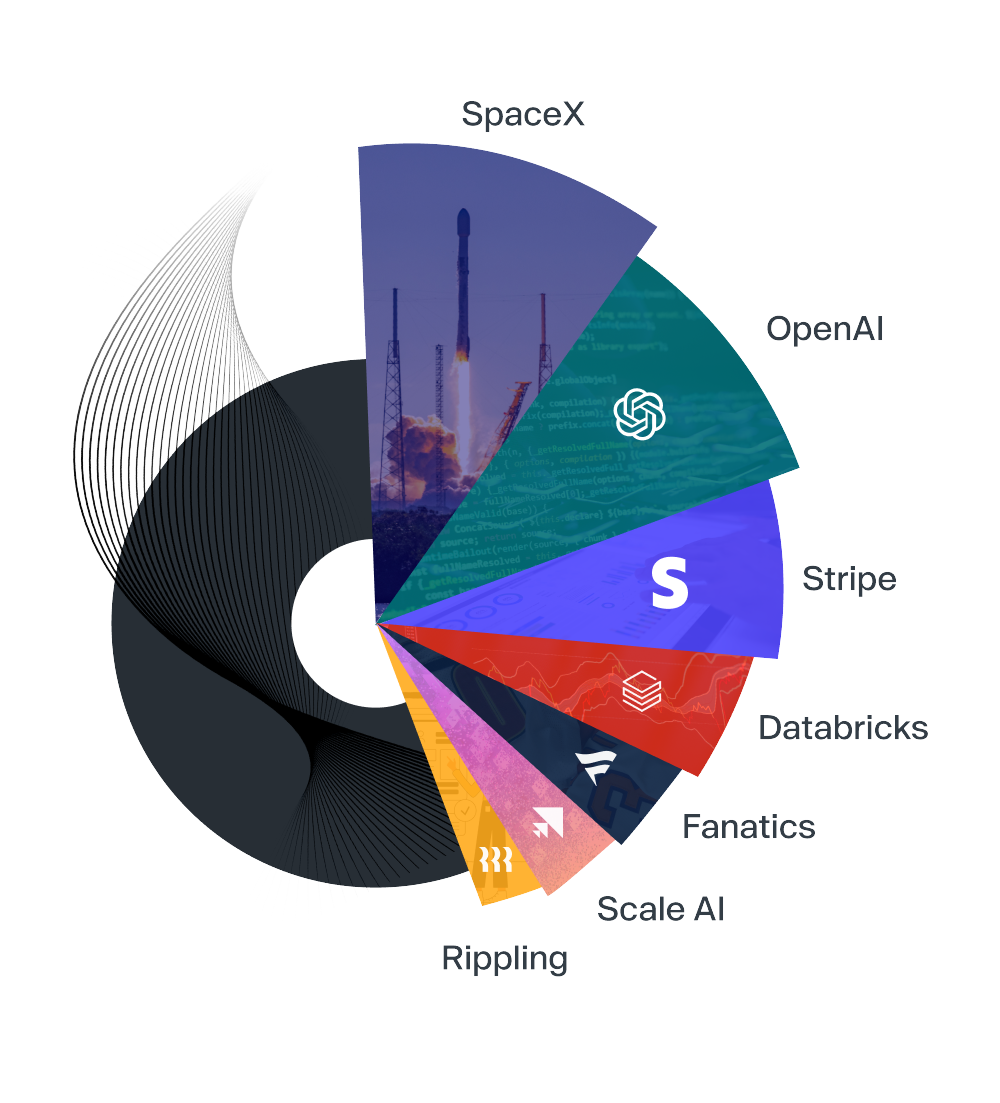

Criteria for companies to be included in the Private Magnificent 7 include a minimum implied valuation of $10B, secondary market liquidity, brand awareness, and relative price performance.

All trademarks, logos and/or names are the property of their respective owners. All such names, logos, and trademarks shown are for identification purposes only. Use of these names and trademarks do not imply any affiliation or endorsement.

All rights reserved by Forge Global Holdings, Inc (“FGHI”), and its affiliates, Forge Global, Inc (“Forge”), Forge Securities LLC (“FSEC”), Forge Global Advisors LLC (“FGA”), Forge Data LLC (“Forge Data”). Investing in private company securities is not suitable for all investors, is highly speculative, is high risk, and you should be prepared to withstand a total loss of your investment. Private company securities are highly illiquid and there is no guarantee that a market will develop for such securities. Each investment carries its own risks, and you should conduct your own due diligence regarding the investment, including obtaining independent professional advice. Past performance is not indicative of future results. This is not a recommendation, offer, solicitation of an offer, or advice to buy or sell securities by “FSEC” or any of its affiliates, nor an offer of brokerage services in any jurisdiction where FSEC is not permitted to offer brokerage services. Registered representatives of FSEC do not (1) advise any party on the merits of a particular transaction; (2) assist in the determination of fair value of any security; or (3) provide legal, tax, or transactional advisory services. Securities and investments are offered only to customers of FSEC, a registered broker-dealer and member FINRA & SIPC. Securities referenced in this article may be offered by FSEC, and certain Forge affiliates may act as principals in such transactions. See Forge and its affiliates’ Disclosure Library for additional disclosures (Disclaimers & Disclosures and Form CRS) for additional disclosures.

Forge Price™ is calculated and disseminated by Forge Data. All rights reserved. Forge Price™ is designed to reflect the up-to-date price performance of venture-backed, late-stage companies. Forge Price™ is determined based on a proprietary model incorporating the pricing inputs from primary founding round information and secondary market transactions, including indications of interest (IOIs). Secondary market transactions are sourced from Forge Securities LLC (an affiliate of Forge Data), a leading market platform, and data collected from other private market trading platforms. The Forge Price™ is a mark of Forge Data. The Forge Price™ is solely for informational purposes and is based upon information from sources believed to be reliable, however Forge Data makes no assurance as to the accuracy or reliability of this data. Forge Data is not an investment adviser and makes no representation regarding the advisability of investing in any asset or asset class. The Forge Price™ may rely on a very limited number of trade and/or IOI inputs in its calculation. Neither reference to company names, nor calculation of Forge Price™ for a particular company(ies) implies any affiliation between Forge or its affiliates and any company, any endorsement or sponsorship of Forge or its affiliates by any company or vice versa, or any partnership, joint venture or other commercial relationship between Forge or its affiliates and any company. Rights with respect to any company marks referred to herein are, as between Forge and its affiliates and such company, owned by the company.

To learn more about the Forge Private Market Index, please visit Forge Private Market Index Disclaimers & Acknowledgments where you can access comprehensive information and detailed terms and conditions.

To learn more about the Forge Accuidity Private Market Index, please visit Forge Accuidity Private Market Index where you can access comprehensive information and detailed terms and conditions.