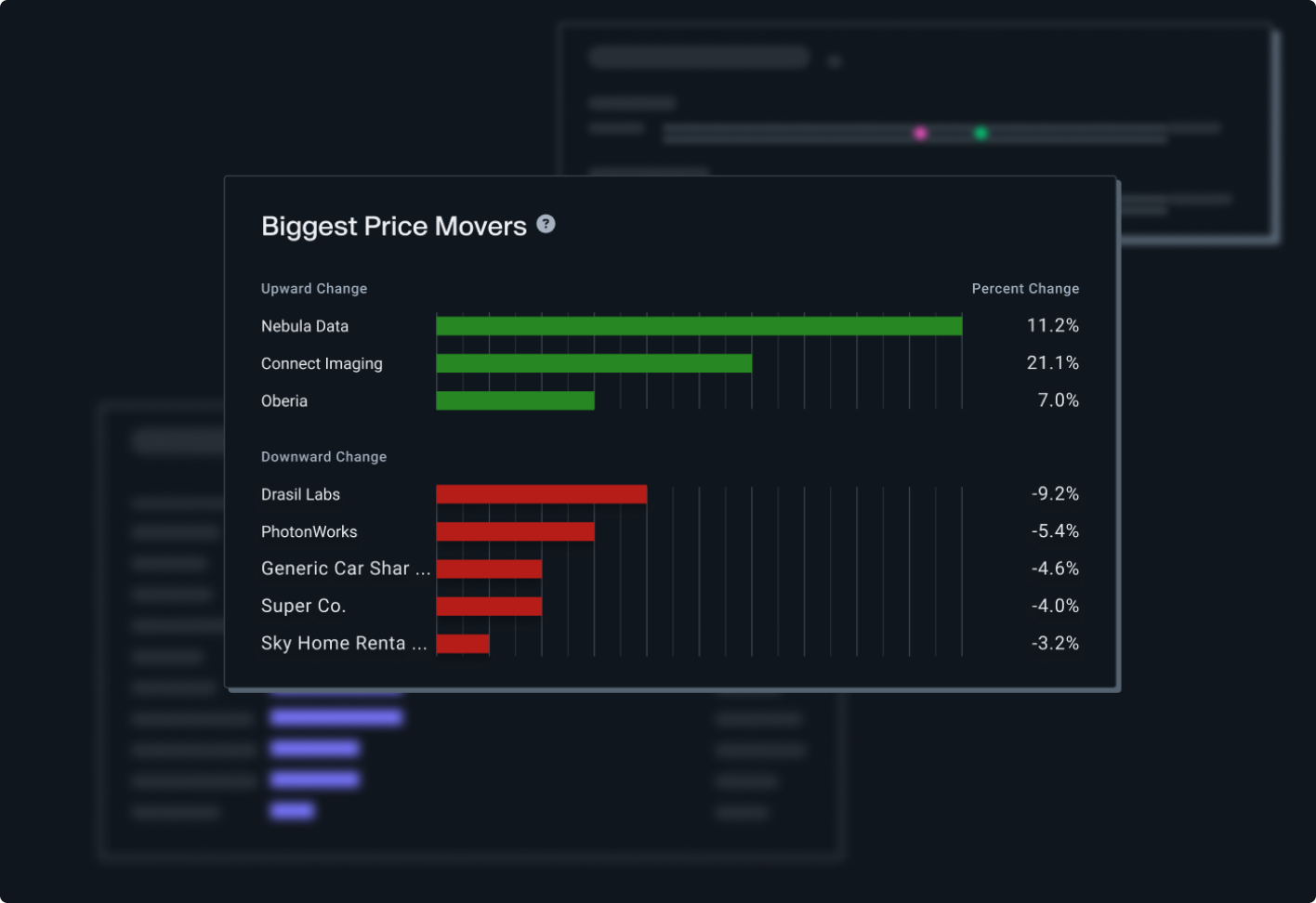

After a wild bout in April, both the private and public markets returned to their fighting rhythm in May. Specifically, the private market continued its upward swing throughout the month, while the public market extended its strong performance that began in late April. And, while tariff whiplash continues to dominate media headlines, broader market activity appeared to suggest that investors may have moved past April's tariff shock wave.

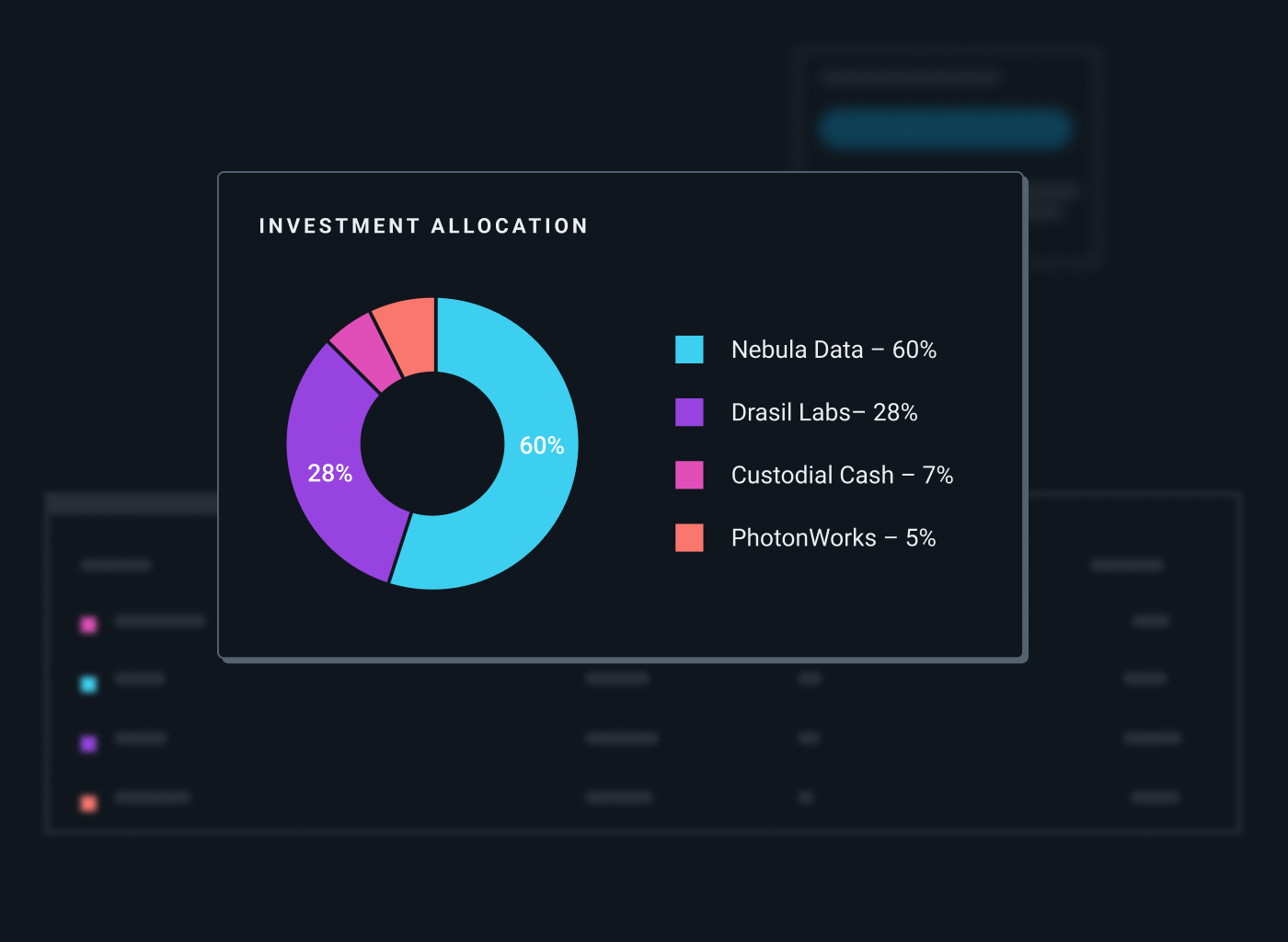

Forge provides venture capital firms with the ability to generate liquidity and seek new private company investment opportunities through industry-leading technology, pricing data, and our team of Private Market Specialists.