The underlying trend of mega-cap tech companies propelling the stock market forward has continued over the past several years first as FANG, followed by FAANG, and then culminating in the moniker the “Magnificent 7.”

Even with some recent stumbles1, in the last 12 months, this group (the “Public Magnificent 7”) – Alphabet (Google), Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla – has delivered returns nearly double those of the S&P 500 overall, which includes those Public Magnificent 7 gains.2

But the public market isn't the only place where a small group of companies accounts for an outsized impact. Forge has identified The Private Magnificent 7, a group of seven companies which has grown larger and delivered outsized performance compared to other private, venture-backed tech unicorns3. These outperformers rank among the private market’s most capitalized, resilient, and well-known private companies powering the innovation economy today.

While there are 568 unicorns in the United States, the seven companies in the Magnificent 7 account for 25% of total valuations. The performance of this group – which includes SpaceX, OpenAI, Stripe, Databricks, Fanatics, Scale AI, and Rippling – far outpaces the majority of private market companies.4

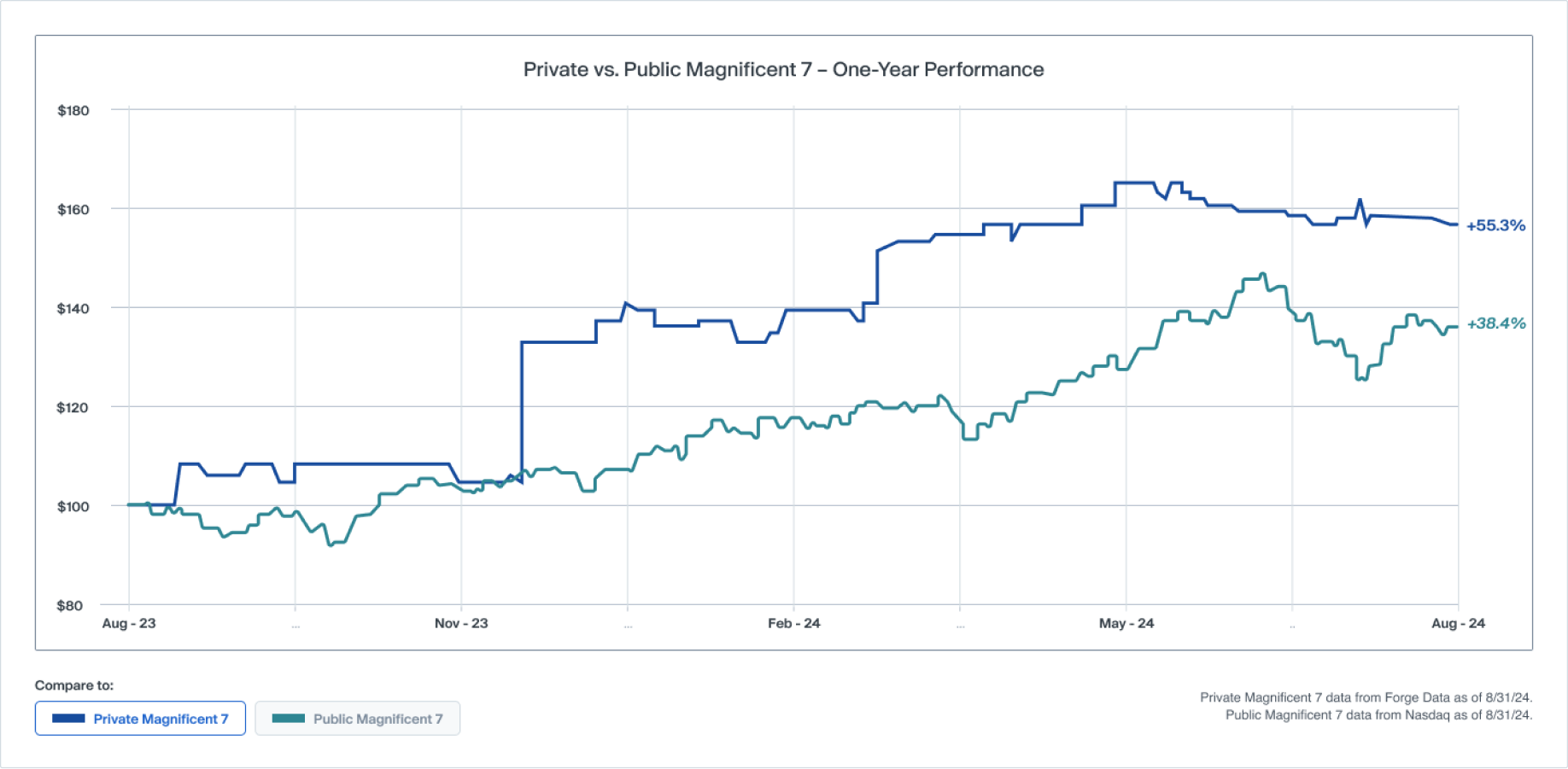

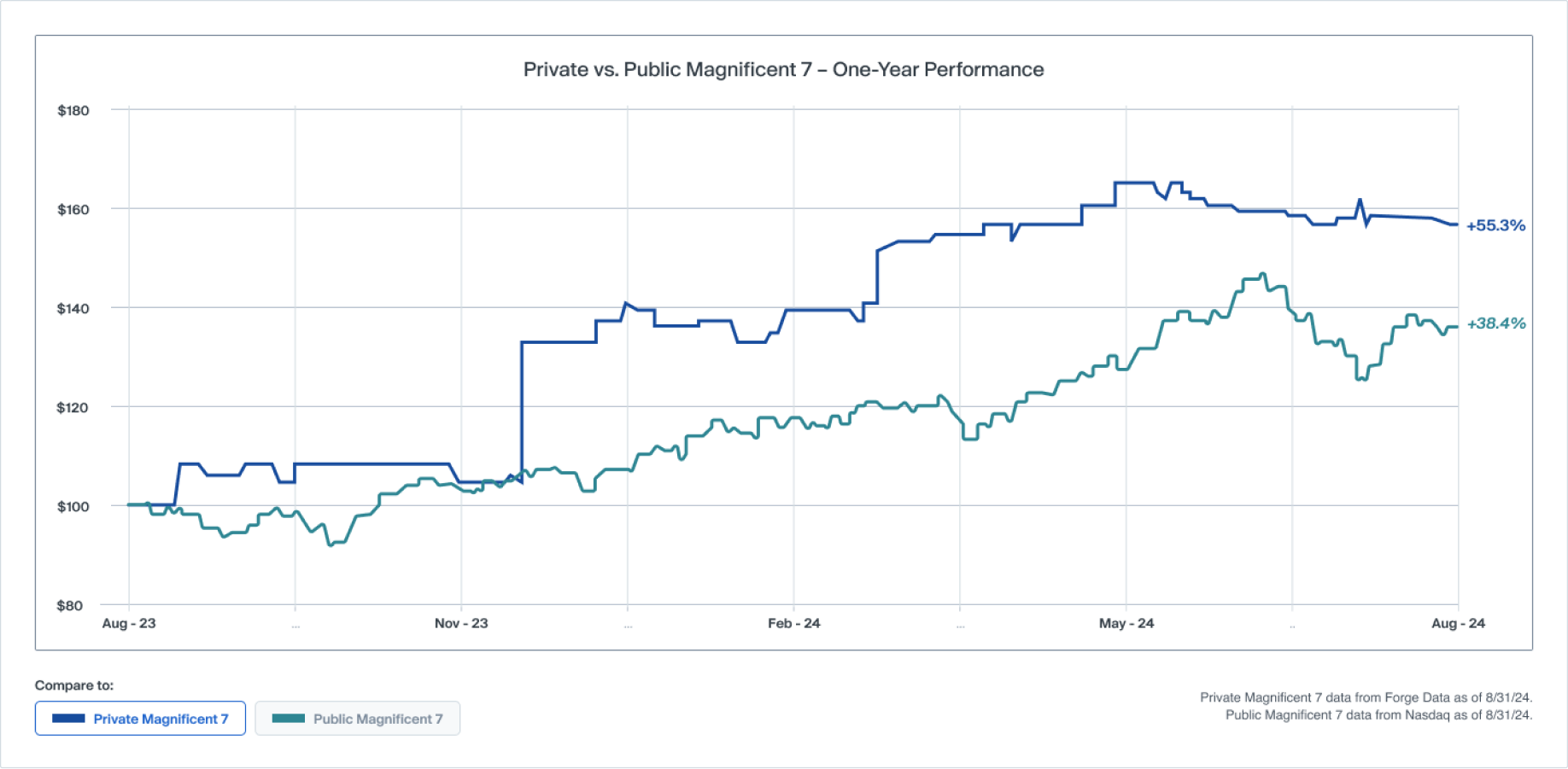

The Private Magnificent 7 returned 55.3% during the 12-month period through August 2024, while the Public Magnificent 7 rose 38.4% during this period.5

This group of private companies remained resilient throughout the most recent market cycle even as valuations for most private companies plummeted from 2021 peaks. Forge data shows the median discount to last funding round for private companies bottomed out at -63% in September of 2023.

The Private Magnificent 7 has an aggregate valuation of about $473 billion based on Forge Price through the end of August, according to Forge data.6

While, overall private market performance has been subdued throughout the most recent market cycle, there could be room to run for the Private Magnificent 7 relative to their public peers, which are 30 times larger in a size as a group. If valuations have now settled down to more attractive levels, especially with interest rates potentially falling soon, then inflows to the private market could mean that these large, high-performing unicorns benefit the most, similar to how the public market Magnificent 7 benefited in part from large overall inflows into the stock market.7

Recent news about the underlying companies within the Private Magnificent 7 doesn’t necessarily point to imminent plans to go public. The Information reported that Stripe is planning a new tender offer to buy back employee shares, financed entirely from its own money, suggesting strong cash flow at Stripe.8

Meanwhile, OpenAI continues its meteoric growth, with The Wall Street Journal reporting in late August that the company is in talks with investors such as Thrive Capital and Microsoft to raise several billion dollars, at a valuation exceeding $100 billion.9

That's not to say that the Private Magnificent 7 is immune from downturns and risk. Fanatics, for example, has experienced recent performance declines10. However, its resilience through the Great Reset, raising up-rounds in both 2021 and late 2022, demonstrated the company continued to swim upstream even as many others in the consumer sector, as well as in the rest of the market, sank deeper during the downturn. And even with recent declines, its Forge Price11 implied valuation is still hovering near 2021 levels.

There are industry veterans who believe companies in the Private Magnificent 7 have room to run. Venture capitalist Tim Draper, speaking to an audience of institutional investors at the Carmo Private Markets California Meeting this month, predicted that we could see the emergence of the first private company valued at $1 trillion in the next decade. “It could be SpaceX,” he said, noting that he’s an investor in the company.

Four companies were added to the IPO pipeline in August, all in the Healthcare sector. BioAge, Bicara Therapeutics, Ceribell, and MBX Biosciences all filed their S-1s with the SEC and represent over $1.2 billion in market value based on their last funding round valuations12. For those companies that have signaled an IPO is on their radar, OpenAI is said to be in talks to raise a new round that would value the company above $100 billion, according to The Wall Street Journal 13 and Ripple made news for again saying it would seek an IPO outside of the United States.14

The Forge Private Market Index (“FPMI”) posted a 3% decline over the past three months. Exabeam’s acquisition15 and rotation off the FPMI, weighed negatively on the index in the period. The FPMI is up 2.4% year-to-date.

While the summer has remained demure from an activity perspective, median discounts to the last primary funding round of companies that trade on Forge rose sharply to -8% in August. This is the highest median discount recorded since early 2022. Companies in the top 90th percentile averaged 81% premium to their last round while companies in the 75th percentile posted a 2-year high 19% premium to their last funding round. These premiums were largely influenced by demand in AI company shares as well as in shares of companies in the industrial and energy sectors on the Forge platform.

The bid/ask spread returned to below the median after a spike in July, coming in at 8.3%, and more in line with the general trend over the past 1.5 years.

Unique issuers with sell IOIs dropped in August as the summer slowdown extended into its second month.

*The term “institutional” is used broadly to refer to sophisticated, professional investors, and does not refer to an “institutional account” as defined under FINRA Rule 4512(c).

Legal Notices and Disclosures

© 2024 Forge Global, Inc. and its affiliates. All rights reserved. Investing in private company securities is not suitable for all investors, is highly speculative, is high risk, and you should be prepared to withstand a total loss of your investment. Private company securities are highly illiquid and there is no guarantee that a market will develop for such securities. Each investment carries its own risks, and you should conduct your own due diligence regarding the investment, including obtaining independent professional advice. Past performance is not indicative of future results.

This is not a recommendation, offer, solicitation of an offer, or advice to buy or sell securities by Forge Securities LLC (“Forge Securities”) or any of its affiliates, nor an offer of brokerage services in any jurisdiction where Forge Securities is not permitted to offer brokerage services. Registered representatives of Forge Securities do not (1) advise any party on the merits of a particular transaction; (2) assist in the determination of fair value of any security; or (3) provide legal, tax, or transactional advisory services. Securities and investments are offered only to customers of Forge Securities, a registered broker-dealer and member FINRA & SIPC. Securities referenced in this article may be offered by Forge Securities, and certain Forge affiliates may act as principals in such transactions. See Forge Global, Inc. and its affiliates’ Disclosure Library (Disclaimers & Disclosures and Form CRS) for additional disclosures.

Forge Price™ is calculated and disseminated by Forge Data LLC (“Forge Data”). All rights reserved. Forge Price™ is designed to reflect the up-to-date price performance of venture-backed, late-stage companies. Forge Price™ is determined based on a proprietary model incorporating the pricing inputs from primary founding round information and secondary market transactions, including indications of interest (IOIs).

Secondary market transactions are sourced from Forge Securities, a leading market platform, and data collected from other private market trading platforms. The Forge Price™ is a mark of Forge Data. The Forge Price™ is solely for informational purposes and is based upon information from sources believed to be reliable, however Forge Data makes no assurance as to the accuracy or reliability of this data. Forge Data is not an investment adviser and makes no representation regarding the advisability of investing in any asset or asset class. Private company securities are highly illiquid, and the Forge Price™ may rely on a very limited number of trade and/or IOI inputs in its calculation. Brokerage products and services are offered by Forge Securities, a registered broker-dealer and member FINRA/SIPC.

Neither reference to company names, nor calculation of Forge Price™ for a particular company(ies) implies any affiliation between Forge or its affiliates and any company, any endorsement or sponsorship of Forge or its affiliates by any company or vice versa, or any partnership, joint venture or other commercial relationship between Forge or its affiliates and any company. Rights with respect to any company marks referred to herein are, as between Forge and its affiliates and such company, owned by the company.

The information contained herein is based on currently available information, and Forge undertakes no obligation to update any of such information or to reflect new information or the occurrence of unanticipated events, except as required by law. While Forge believes such information forms a reasonable basis for the contents of this Private Market Update, such information may be limited or incomplete, and this content should not be read to indicate that Forge has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. This Private Market Update contains trademarks, service marks, trade names and copyrights of Forge and may contain those of other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products is not intended to, and does not imply, a relationship with Forge or any of its respective affiliates, or an endorsement or sponsorship by or of Forge or such affiliates. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Private Market Update may be listed without the TM, SM, (c) or (R) symbols, but Forge will assert, to the fullest extent under applicable law, the right of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. The performance of the Forge Private Market Index with respect to the growth of $10,000 shown herein does not represent the performance of any actual investment, as you cannot invest in the index, but rather reflects the hypothetical growth of a $10,000 investment in a basket of securities based on the index. Additionally, the chart assumes reinvestment of dividends and capital gains in the constituent securities but does not reflect any fees or commissions that may be incurred in purchasing or selling such securities, which would lower the figures shown if included. Further, $10,000 may not be a sufficient amount to invest simultaneously in all securities contributing to the performance shown, which would further prevent an investor from matching the performance shown. The performance shown represents past performance, and past performance is not indicative of future results.

The Forge Private Market Index is calculated and disseminated by Forge Data and is a mark of Forge Data. All rights reserved. The Forge Private Market Index is solely for informational purposes and is based upon information from sources believed to be reliable. It is not possible to invest in the Forge Private Market Index, and Forge Data makes no assurance that any investment products based on or underlying the Forge Private Market Index will accurately track index performance or provide positive investment performance. Forge Data is not an investment adviser and makes no representation regarding the advisability of investing in any asset classes or investment vehicles. This is not a recommendation, offer, solicitation of an offer, or advice to buy or sell securities by Forge Securities LLC (“Forge Securities”) or any of its affiliates, nor an offer of brokerage services in any jurisdiction where Forge Securities is not permitted to offer brokerage services. Registered representatives of Forge Securities do not (1) advise any party on the merits of a particular transaction; (2) assist in the determination of fair value of any security; or (3) provide legal, tax, or transactional advisory services. Securities and investments are offered only to customers of Forge Securities, a registered broker-dealer and member FINRA & SIPC. Securities referenced in this article may be offered by Forge Securities, and certain Forge affiliates may act as principals in such transactions. See Forge Global, Inc. and its affiliates’ Disclosure Library (Disclaimers & Disclosures and Form CRS) for additional disclosures. Private company securities are highly illiquid, and the Forge Private Market Index may rely on a very limited number of trade and/or indication of interest inputs in its calculation. Brokerage products and services are offered by Forge Securities, a registered broker-dealer and member FINRA/SIPC. By downloading this content, you acknowledge that you have reviewed and are subject to the Forge Private Market Index disclaimers and disclosures which contains other important disclaimers, disclosures and restrictions related to the Forge Private Market Index. Additionally, if you are accessing this content away from forgeglobal.com, you acknowledge that you have reviewed and are subject to Forge’s Terms of Use with respect to use and distribution of information as if you were accessing this content on forgeglobal.com.