Private Market Glossary

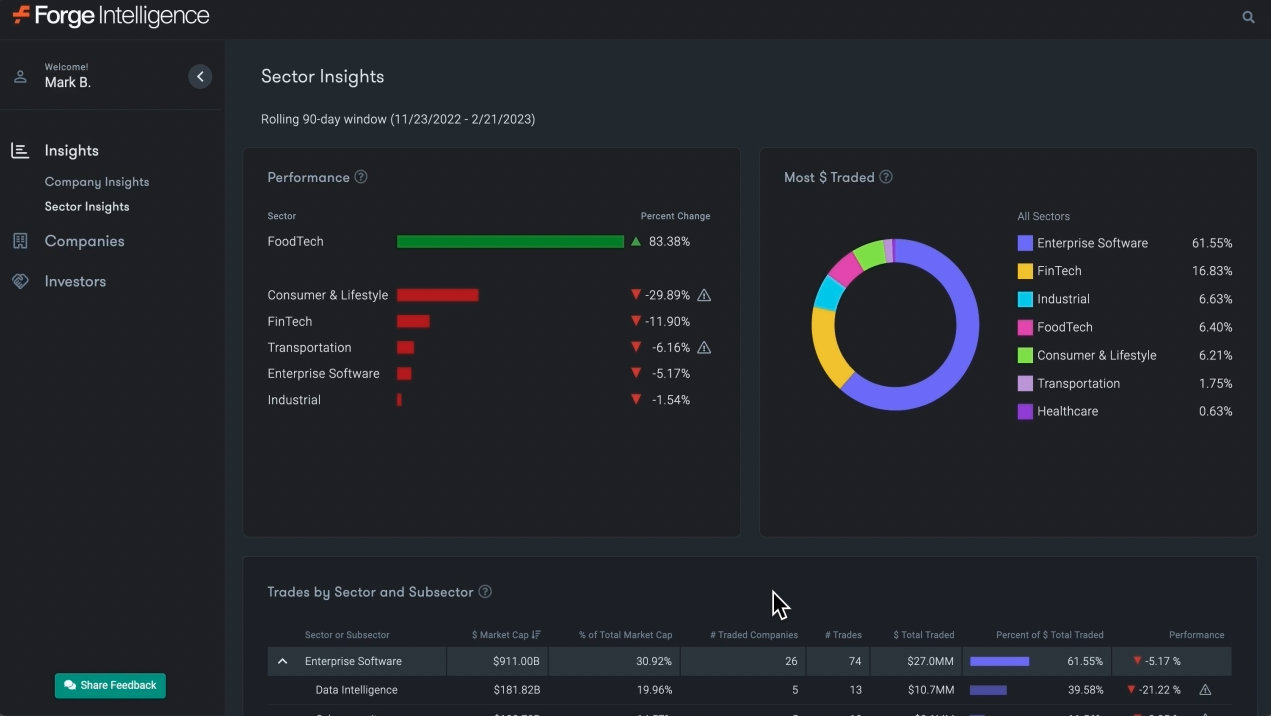

What does bid-ask mean in stocks?

Bid-ask, often referred to as the bid-ask spread, means the range between the highest price at which an investor is willing to purchase a security (the bid) and the lowest price at which a holder is willing to sell that security (the ask).

A better understanding of bid-ask

A bid-ask spread shows the difference between prices at that buyers and sellers are willing to trade securities. The bid price will typically be lower than the ask price. For a trade to occur in the public market, it must happen at the bid, the ask, or somewhere in between those two prices.

If there’s a wide bid-ask spread, that can indicate that there’s not a lot of liquidity and/or that investors disagree on price. A tight spread indicates that a stock generally has higher liquidity and there is greater alignment on price. Although these are general indications, there may be additional factors impacting the spread of a given security.

What role does bid-ask play in the private market?

Bid-ask spreads play a similar role in the private market to the one they do in the public market. While the bid and ask prices aren’t as transparent in the private market, these prices generally show what investors are willing to pay and what sellers are asking for a specific private company stock.

In unstable or volatile private market conditions, the bid-ask spread might widen, indicating that there’s disagreement about what private company securities should trade at.

But if the bid-ask spreads are tight, that is an indication that private market buyers and sellers are in more alignment, which might result in more liquidity.

Given the lack of widespread price disclosure of private market stock trades, private market bid-ask spreads can be several percentage points, if not double digits, apart. In contrast, in the public market, bid-ask spreads might be, say, only a couple of cents apart owing to the greater price transparency of the public market, and the role played by market-makers.

What is an example of bid-ask spread?

Suppose a stock’s highest bid is entered at $49.99 and its lowest ask is entered at $50.01, the bid-ask spread is $0.02. The stock may trade somewhere at the bid, the ask, or somewhere between the bid-ask spread.