The private market reached a new milestone this month, and it didn’t take a funding round to get there. To paraphrase Justin Timberlake's take on Sean Parker from the Social Network, “A billion dollars isn’t cool. You know what’s cool? A trillion dollars.”

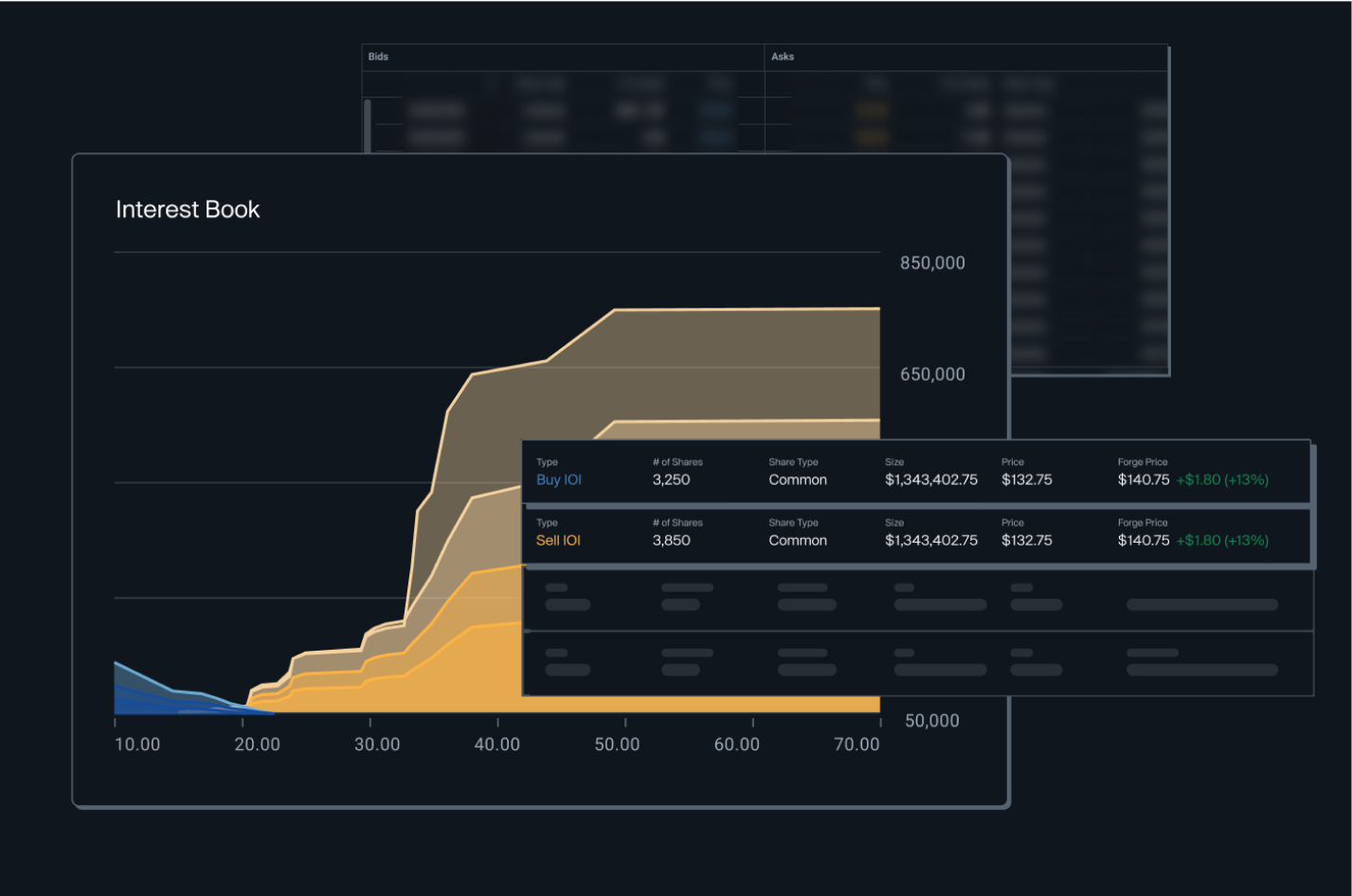

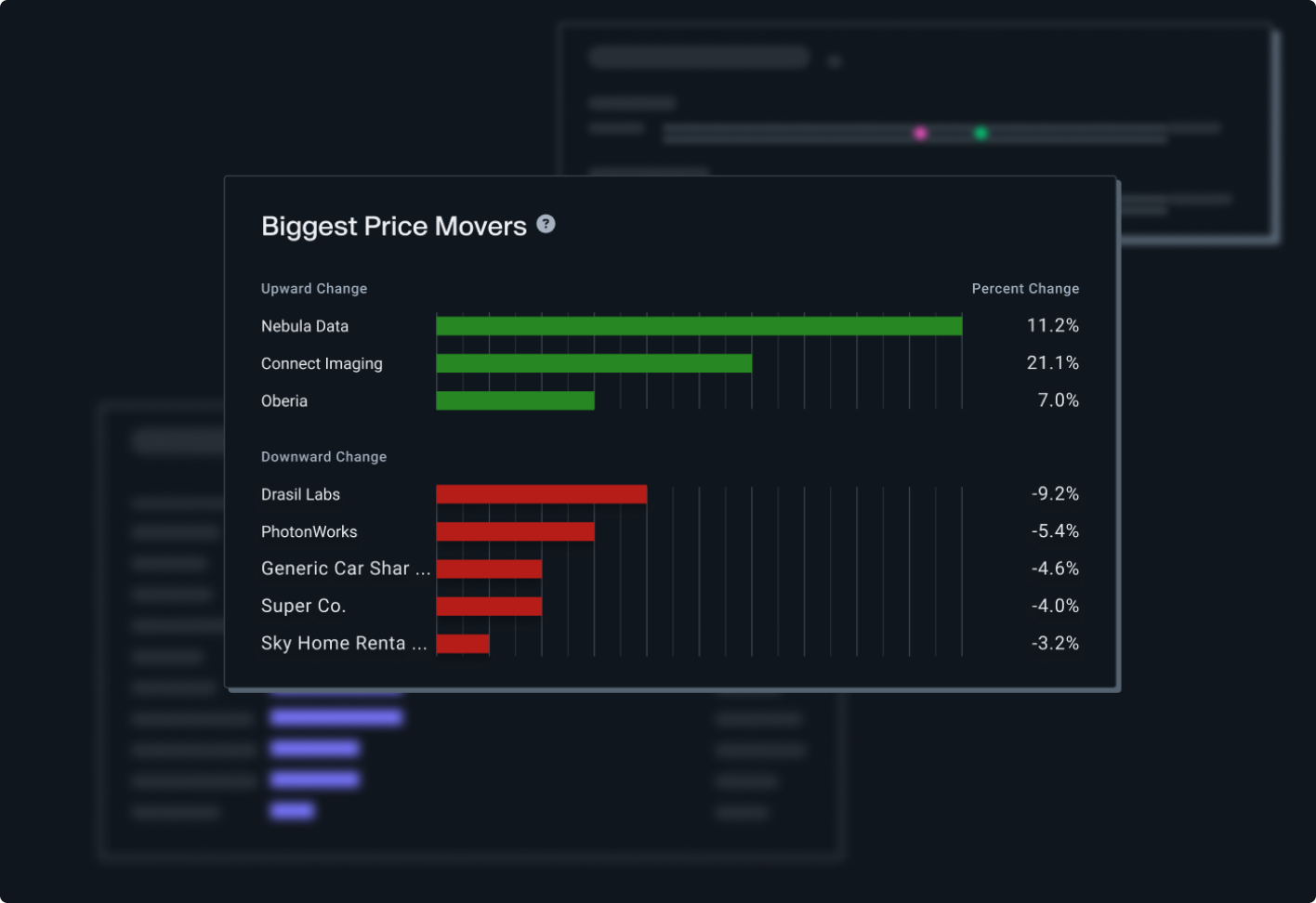

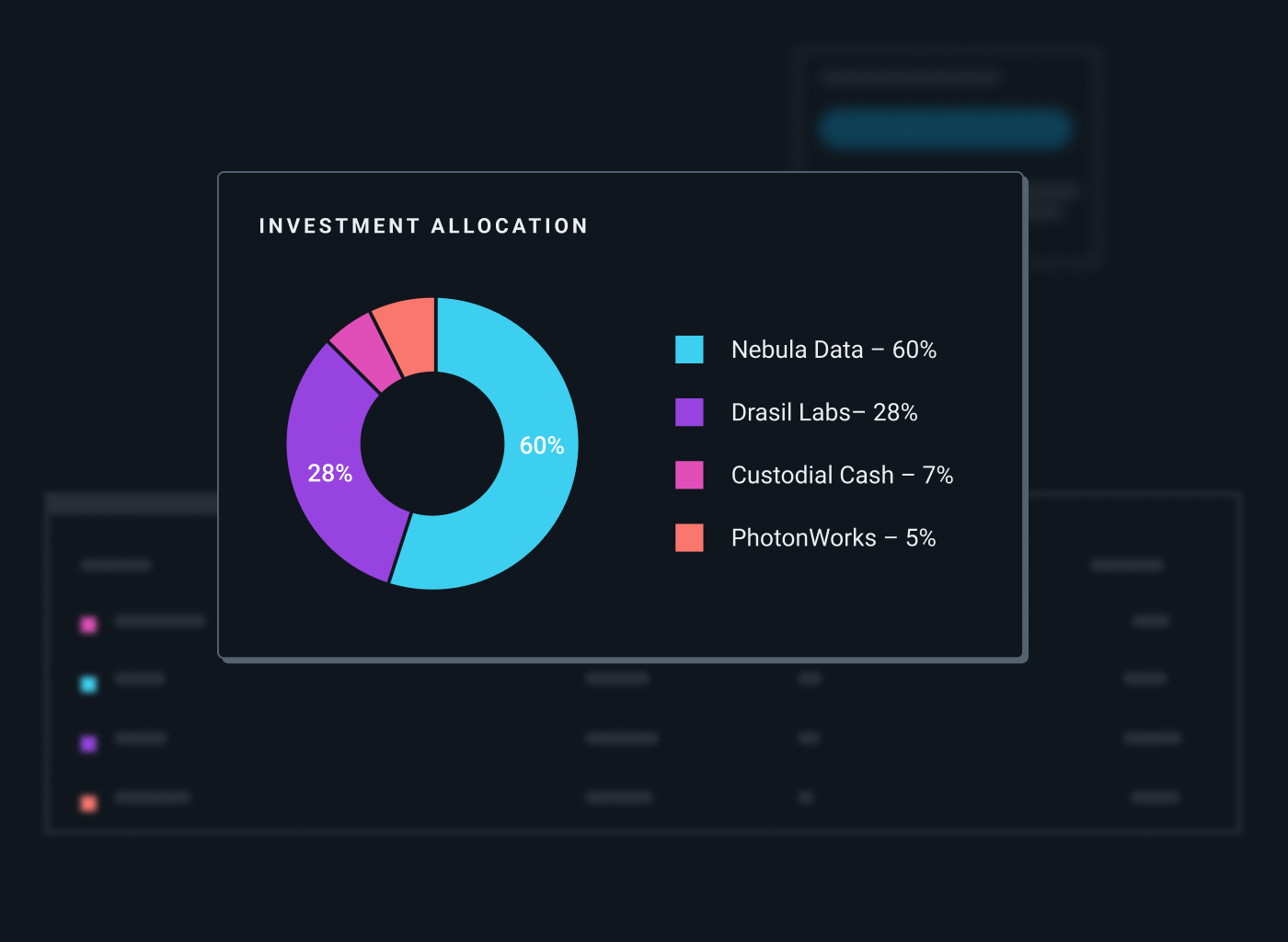

Forge provides venture capital firms with the ability to generate liquidity and seek new private company investment opportunities through industry-leading technology, pricing data, and our team of Private Market Specialists.