Private Market Update December 2024

IPO outlook for 2025 gets a boost from ServiceTitan amid an expanding pipeline

In what could be perceived as a bellwether for what's to come, ServiceTitan (NASDAQ: TTAN) went public Dec. 12th, gripping an investing public starved for venture-backed IPOs. The Glendale, California-based CRM software company is one of the few and most notable technology companies to go public in a down year for IPOs. In fact, the number of technology IPOs has remained under the pre-2021 median for the last three years, according to Goldman Sachs data2.

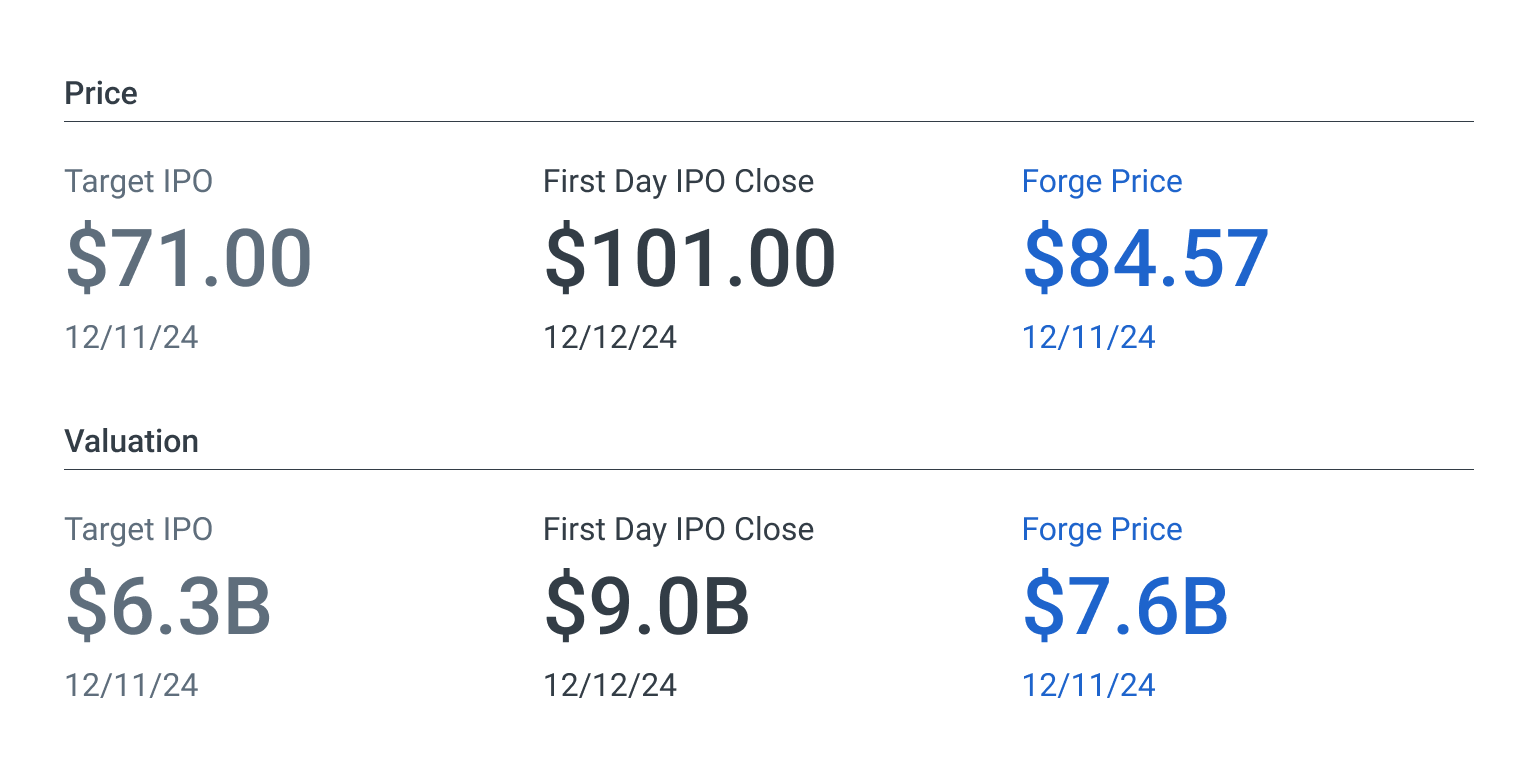

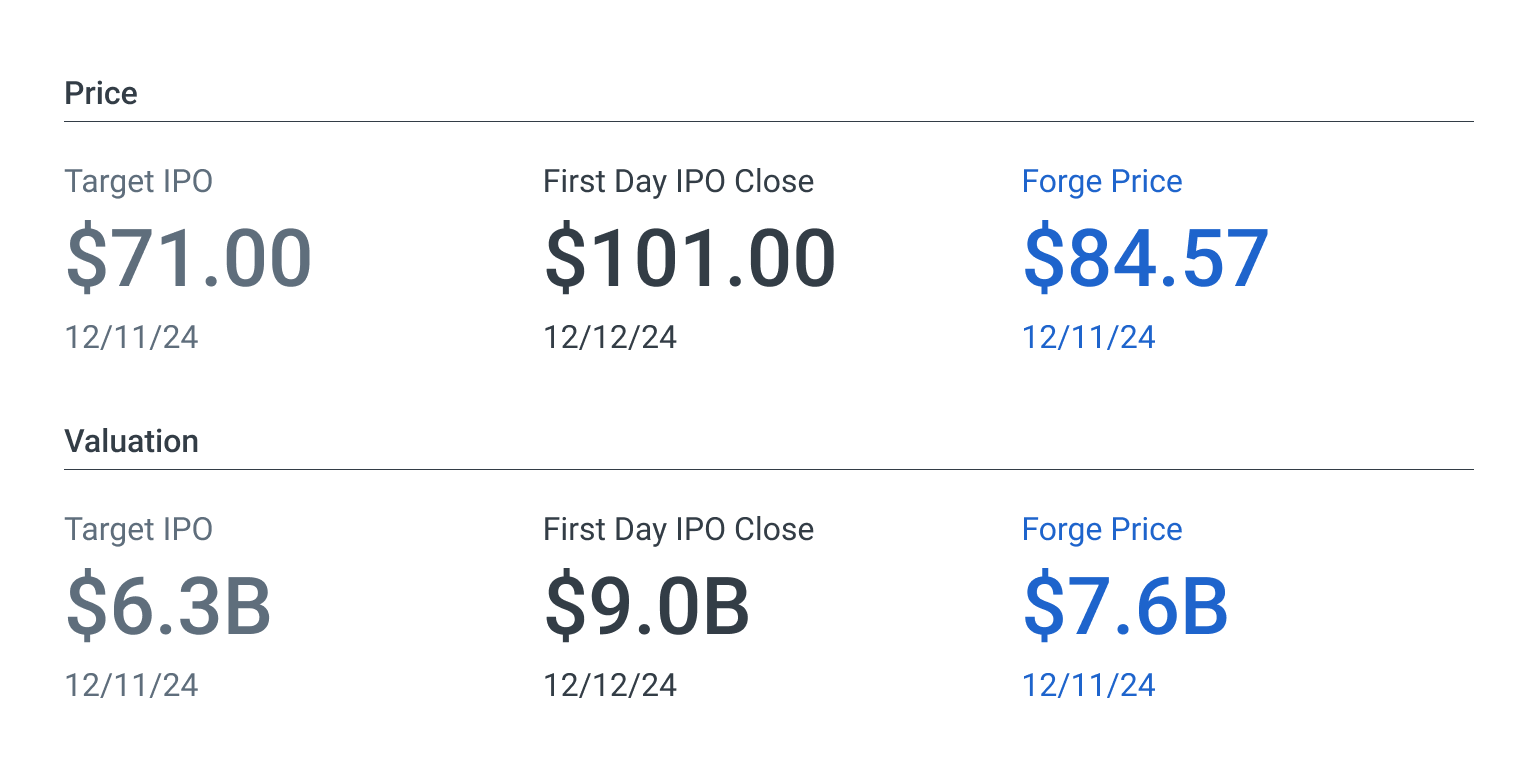

The last Forge Price for ServiceTitan prior to its public debut was $84.57, at an implied valuation of $7.6 billion. ServiceTitan debuted at $71 per share and traded up on its first day, closing at $101.

While pricing an IPO can often times be more of an art than a science, Forge Price, our proprietary pricing model for approximately 200 private growth stocks, indicated a higher price for Service Titan than its target IPO price. The successful exit also contributed positively to the cap-weighted Forge Accuidity Private Market Index, as Service Titan is a constituent amongst 60 high growth private companies held in the index.

In November, the equal-weighted Forge Private Market Index gained 0.7%.3 That's the second positive month in a row for the benchmark index, and while it still lags public market indexes, rising valuations among the top tier index names are contributing to positive performance.

Private Market Continues to Lag

Still, private markets have some catching up to do. The Forge Private Market Index has increased almost 5% from January 2024 to November 2024 compared to around 28% for the S&P 500. One encouraging sign, though, is that the Renaissance IPO ETF, which tracks companies that recently went public, has slightly outperformed the S&P 500 over the last 12 months (37.4% vs. 34.0%),4 signaling that recently private companies are benefitting from this year’s public market enthusiasm.

That enthusiasm for recent IPOs similarly showed up in November for private market startups, with a surge in new buy-side indications of interest (IOIs) on the Forge platform. For the month, buy IOIs trumped sell IOIs by approximately a 2:1 margin.

Trump Pump Rallies Markets as 2024 Draws to a Close

Part of that buyer enthusiasm has included Trump-related trades. Demand for Elon Musk-owned private companies such as xAI and SpaceX has been high since the election, given Musk's budding relationship with Trump and Musk's anticipated role in the new administration.5

President-elect Trump's expected embrace of cryptocurrency has also helped propel interest in some companies involved in digital assets, including Kraken (Forge Price +18.3%) and Ripple (Forge Price +10.3%) which have posted strong performance gains in November. Bitcoin itself has also been on a tear, gaining over 40% in November6 and nearly touching the $100,000 mark (for the price of one Bitcoin) in early December.7

Looking ahead, Trump's proposed pick for the SEC Chair, Paul Atkins, is expected to adopt a more crypto-friendly stance,8 and he's stated in the past that regulations have hindered the IPO market.9 So, in a Trump administration that has historically favored lighter regulation, that could help open up pathways for companies to go public and possibly help the private market catch up to benchmarks like the Renaissance IPO ETF.

Still, much remains to be seen around how Trump's policies may affect the economy, with many projections showing that rumored tariffs could increase inflation and hurt GDP.10 So, it's still too early to say whether this recent rally will continue into 2025 or if this is simply a case of short-term investor exuberance.

IPO Pipeline Grows Heading Into 2025

Many investors had high expectations that 2024 would see a strong rebound in IPOs, and while there has been an improvement — with 216 U.S. IPOs so far this year vs. 154 in 202311 — recovery of the IPO market has remained elusive.

However, with the election in the rearview mirror, a growing number of companies have made recent moves toward public listings, including eToro, which reportedly hired Goldman Sachs to lead its IPO earlier this month12.

Among these expected IPOs, some of the largest include crypto-related ones or other fintech companies, such as Chime, Klarna and Circle. These businesses could potentially benefit from a more relaxed regulatory environment under Trump. To that point, financial stocks have been one of the top assets tied to the so-called ‘Trump trade’ that many investors are making in anticipation of the next administration's actions.13

Bid/Ask Spreads Remain Choppy

Bid/ask spreads on Forge’s platform tend to fluctuate significantly from month-to-month as new companies with no prior secondary pricing indicators come online. In general however, spreads have trended downward since peaking in January 2023 and low spreads throughout 2024 have lowered the 2024 median average from more than 11% in 2023 to just over 9% as of the end of November. For November, the median bid/ask spread was 9.1%, just below the long-term median of 9.2% (January 2020 to November 2024). This metric indicates that there's relatively strong liquidity and price discovery happening, as opposed to the much higher spreads seen during leaner times like in 2022.

Median Trade Premiums Tick Up for Top Quartile

The distribution of trade premiums/discounts compared to last primary funding rounds was relatively flat in November for companies at the median, coming in at a -25% discount. However, much of this discount can be attributed to a split among top- and bottom-quartile performers. For the month, those in the 75th percentile ticked up to a 10% average trade premium, while those in the 90th percentile went up to a 53% average premium. In general, those toward the top have largely bounced back from the doldrums of 2022 and 2023, while those toward the bottom are still languishing.

More Issuers Jump in to Sell

Lastly, November saw an uptick in unique issuers with IOIs. Drawing conclusions from this data can be tricky, as sometimes more sellers come online as they want to exit due to market turbulence. However, the recent market strength and spike in buy-side IOIs could mean that sellers are now trying to capitalize on this demand.