What is a secondary marketplace for private company shares?

When you think of private company shares, or stock in pre-IPO startups, your mind probably jumps to areas like VC funding rounds and stock options. When private companies issue new shares through these channels, the participants engage in what’s known as a primary market or marketplace. But that’s not the only way private company shares change hands.

What is a secondary market?

A secondary marketplace is where trades of existing shares take place. Rather than a company creating new shares and selling them for the first time to buyers, the secondary marketplace participant buys and sells stock that’s already held by an existing employee or investor.

So, when you think of the stock market, you’re probably thinking of the secondary market. Stock exchanges like the New York Stock Exchange and Nasdaq are secondary marketplaces for publicly traded companies.

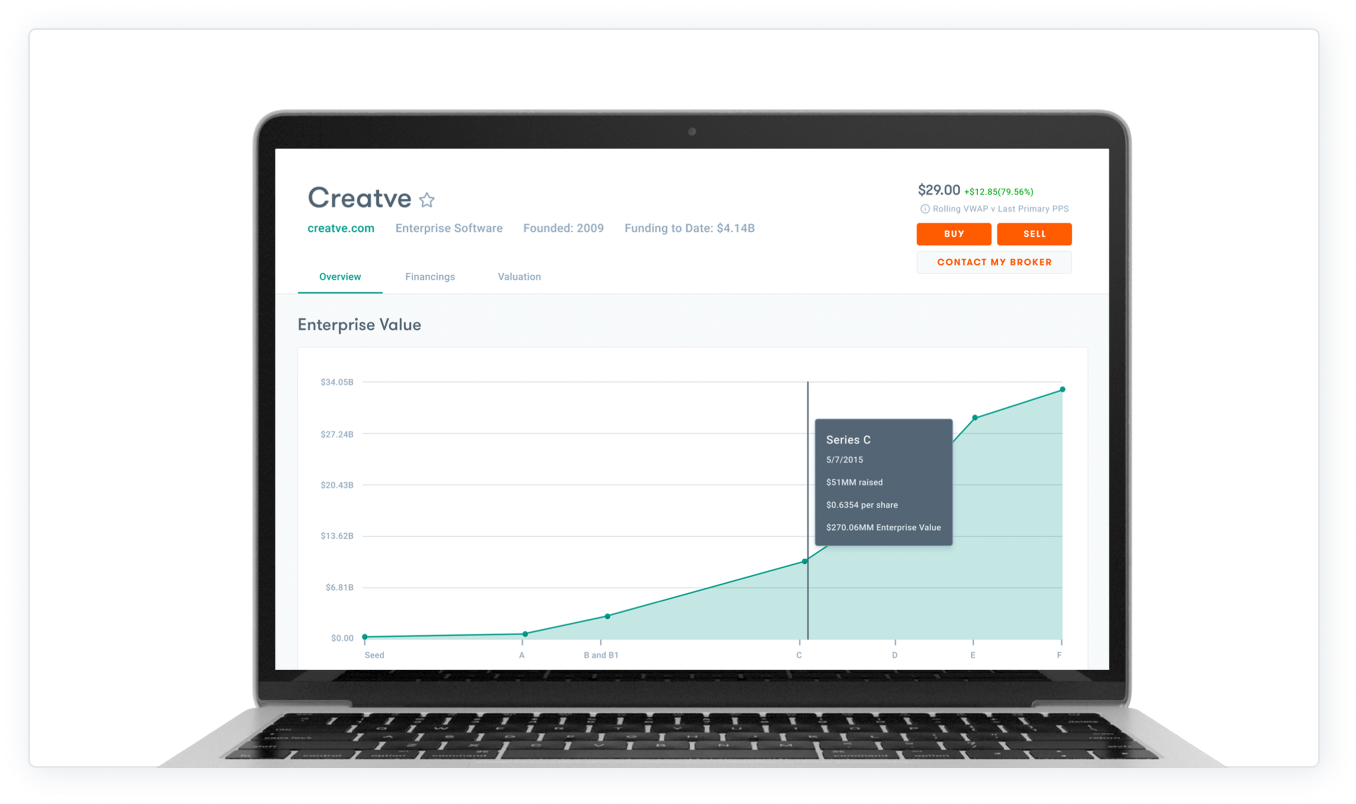

For private companies, secondary marketplaces like Forge exist for pre-IPO investing. What was once more limited to the domain of institutional investors like private equity funds has now opened up to a broader pool of participants. Through a secondary marketplace, investors and startup employees can buy and sell securities with relative ease.

Primary vs. secondary markets: what’s the difference?

A primary market refers to a market where securities are created or offered for the first time.

The most common example of a primary offering is when a startup creates and offers preferred stock as part of a financing round. An Initial Public Offering (IPO) is another classic example of a primary market offering which occurs much later in a company’s life cycle. In that process, the private company creates and sells stock to institutional investors to become a public company. These investors, who are typically investment banks, then sell those common shares on a secondary market, like the New York Stock Exchange or NASDAQ.

Secondary market examples

Examples of secondary markets are Stock Exchanges (NASDAQ, London Stock Exchange), Over-the-Counter (OTC like foreign currency exchanges), auction, and dealer markets.

How does a secondary marketplace for private company shares work?

Now that you're familiar with the secondary market meaning, let's learn how it works. A secondary marketplace for private company shares works similarly to public markets, in the sense that buyers and sellers can come together via the secondary marketplace to trade private company stock. A secondary marketplace for private company shares facilitates the matching of buyers and sellers interested in transacting their shares.

For example, after an employee vests stock options in a startup, they might decide to sell some of their shares pre-IPO. That way, they can get some cash now and diversify, rather than waiting for the possibility of the company going public or getting acquired. By selling through a secondary marketplace, they can get matched with an investor who’s interested in buying pre-IPO stocks.

Why do buyers and sellers use a secondary marketplace?

Secondary marketplaces help facilitate trades between buyers and sellers. Think of the public stock market. It’s become incredibly fast and easy to open a brokerage app and trade stocks almost instantly via these secondary marketplaces, as opposed to finding a specific secondary buyer or seller on your own and then dealing with all the transfer logistics.

While private secondary marketplaces generally aren’t as fast and straightforward as public ones, they’re still arguably much easier to use than conducting a secondary transaction on your own.

If you want to buy shares of a hot new startup, would you rather:

Contact employees at that company to see if anyone wants to sell their shares and then deal with the logistics of trading private shares yourself.

Or, go through a secondary marketplace that finds a seller for you — perhaps one they already have lined up based on previously expressed interest— and handles the heavy lifting, like getting the startup to approve the secondary transaction.

As you can see, the centralization of a secondary marketplace generally makes trading easier.

A brief history of private company secondary marketplaces

There are a few different private company secondary marketplaces that you may have heard about. One is SharesPost, founded in 2009, which merged with Forge, completing its integration in 2021.1

Another private company secondary marketplace is Nasdaq Private Market, which acquired another secondary marketplace platform, SecondMarket, in 2015.2

Other platforms for conducting secondary market transactions also exist, and new ones could crop up as investors look for ways to trade private equity without necessarily going through a traditional financial institution.

Are secondary marketplaces for private company shares regulated?

Generally, secondary marketplaces for private company shares are regulated entities, somewhat like how stock exchanges are regulated.

In many cases, private secondary marketplaces are broker-dealers registered with the Securities and Exchange Commission (SEC) and are members of FINRA/SIPC. The Forge marketplace entity, Forge Securities, is a regulated broker-dealer.

Can anyone buy or sell private company shares in a secondary marketplace?

To buy private company shares in a secondary market, you generally have to be an accredited investor. That means you have to meet certain financial or professional requirements as set by the SEC such as having individual income over $200,000, or joint income of over $300,000 (with spouse or partner), in each of the prior two years, and reasonably expects the same for the current year, or a net worth of over $1 million, excluding primary residence, among other ways to meet accredited investor requirements.

To sell private company shares, however, you don’t have to be an accredited investor. However, private companies might have their own restrictions on whether you can sell pre-IPO shares, which most commonly include a company right of first refusal (ROFR) over any proposed sales.

Do you need a secondary marketplace or broker to trade private company shares?

While you don’t legally need a secondary marketplace or broker to trade private company shares, going through a centralized platform can streamline the process. You might have a hard time finding a buyer or seller on your own, let alone dealing with issues like compliance that come with this asset class.

Want to learn more about buying secondary investments and buying or selling private company shares? Visit our secondary marketplace Forge Markets.