Now that you know it is possible to sell your private company shares before an IPO, there are a few things to think about before selling.

1. Your company’s guidelines on selling their shares

Before you start learning how to sell stock, be sure to check company guidelines first. Like all public and private companies, your employer may have specific guidelines around selling company stock. As a private company, your company could require you to hold shares for a certain amount of time before selling them, while other companies don’t allow secondary transactions at all.

Some organizations also reserve the right of first refusal (ROFR), where they have the option to buy the shares from you or substitute a buyer of their choice instead of the buyer you lined up. If you work with a private market brokerage firm, they may be able to tell you if your company has allowed others to sell their shares in their market.

2. The tax implications of the sale

If you decide to sell stock, you’ll also need to take into account the tax liability this transaction could trigger. You may be able to save more on taxes if you’re strategic about when to sell employee stock.

Say you exercise your stock options, only to turn around and sell them to another investor within a year. In this case, you’d be liable for ordinary income tax on your gains. But if you held onto these private company shares for at least 12 months, you may pay a lower rate with the long-term capital gain tax.

As with all important financial decisions, though, it’s prudent to talk things through with a financial advisor or tax professional before making a decision. And this brings us to our next point…

3. The timing of the transaction

Other than getting professional tax advice and investment advice, you’ll also want to determine whether you’d benefit more from selling private company stock now, or from holding onto stock that may increase or decrease in value over time.

Think about why you want to sell your shares in the first place. Do you want to reinvest the cash in reliable public stocks or other high-growth startups? Make a down payment on a new house? Pay off your student loans?

If it’s an immediate need, it may make more sense to liquidate some or all of your shares now. But if you don’t have an immediate need and you believe their value may go up over time, you may want to hold off on doing any secondary transaction until then.

You could also perform a private analysis of whether selling shares or holding onto them would be more beneficial for you.

4. Making your decision

It’s okay to slow down and think things through. All investment decisions carry some degree of risk, so it’s important that you make one you’re comfortable with.

Don’t worry, you’ll usually have enough time to devise a plan — buyback events like tender offers are generally announced in advance with specific windows for you to sell your private shares at asset price, while transactions with private investors or on the secondary markets are initiated by you.

Make sure you understand the potential advantages and disadvantages of the decision you make, how your decision will affect your personal finances, the sale price, as well as the terms of the sale if you find a buyer.

How Forge can help shareholders sell private company stock with ease

If you list your shares on Forge, we act as your broker in the transaction. Sellers are able to leverage our company’s resources and expertise to find the right buyer, ultimately helping them turn their shares into the cash needed to fund their next big purchase or investment.

Forge has built a network of over 142,000 accredited and institutional investors who are interested in buying private stock of promising companies. And if there’s a buyer, our licensed Private Market Specialists, Operations, Legal and Compliance teams handle all the legal and regulatory requirements and work with your company to close the transaction.

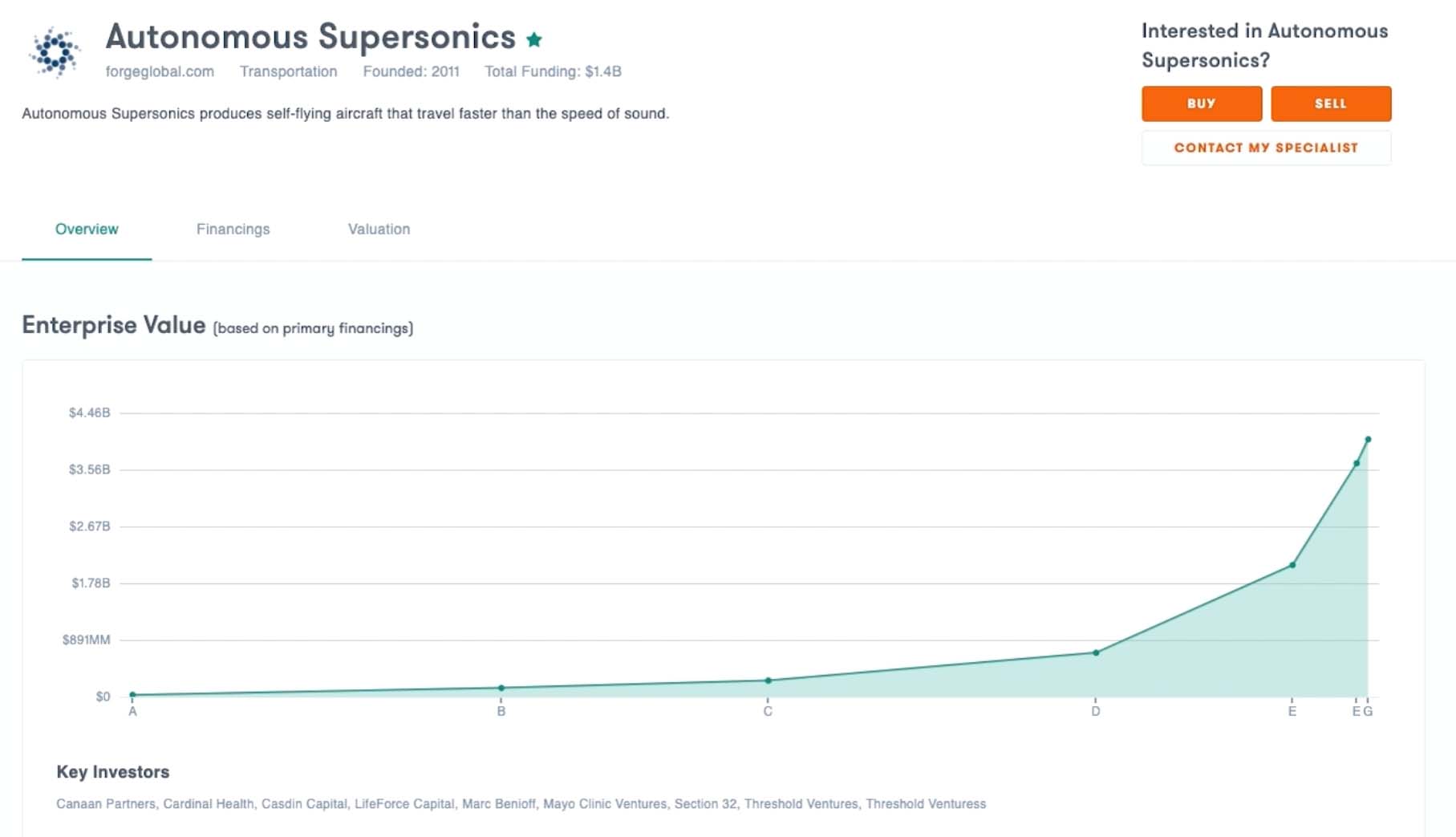

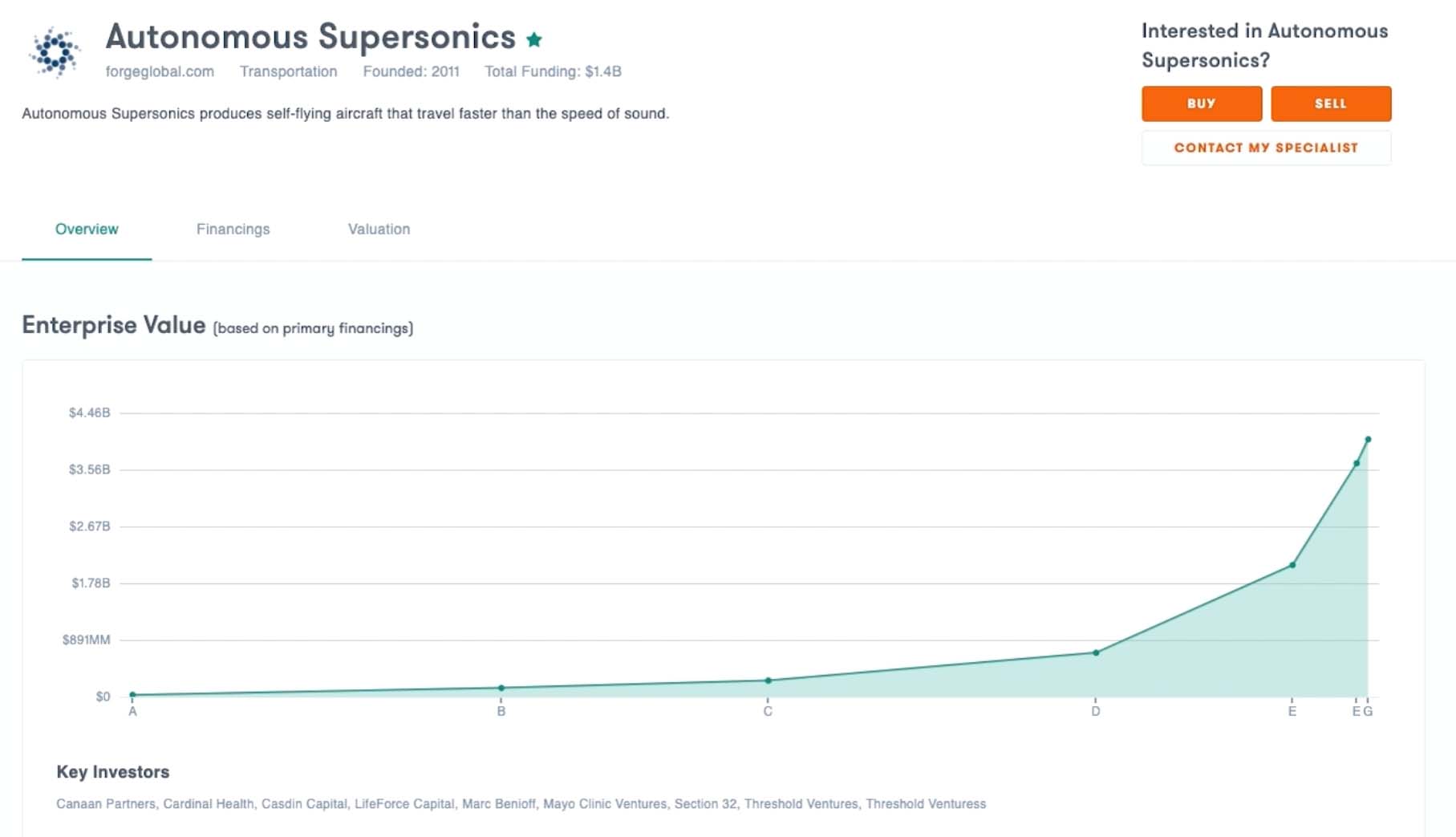

With the Forge trading platform, you can also track the valuation of your company as it raises capital and research other exciting private companies to invest in. Combined with the knowledge and expertise of our Private Market Specialists, this means that an existing shareholder who wants to start selling company shares privately can take advantage of a wealth of insight, as they sell their individual stocks.

With the resources and knowledge available to you through Forge, learning how to sell private stock can be easier than ever before. To begin the process, create a free account on our trading platform today to see how much your shares could be worth.