Discover the value of your shares

Unicorn liquidity has arrived

Join the new generation of people and institutions buying and selling private company shares.

What is the Forge Price™ shown above?

All ticker data above updated as of: 7/17/25

Investors

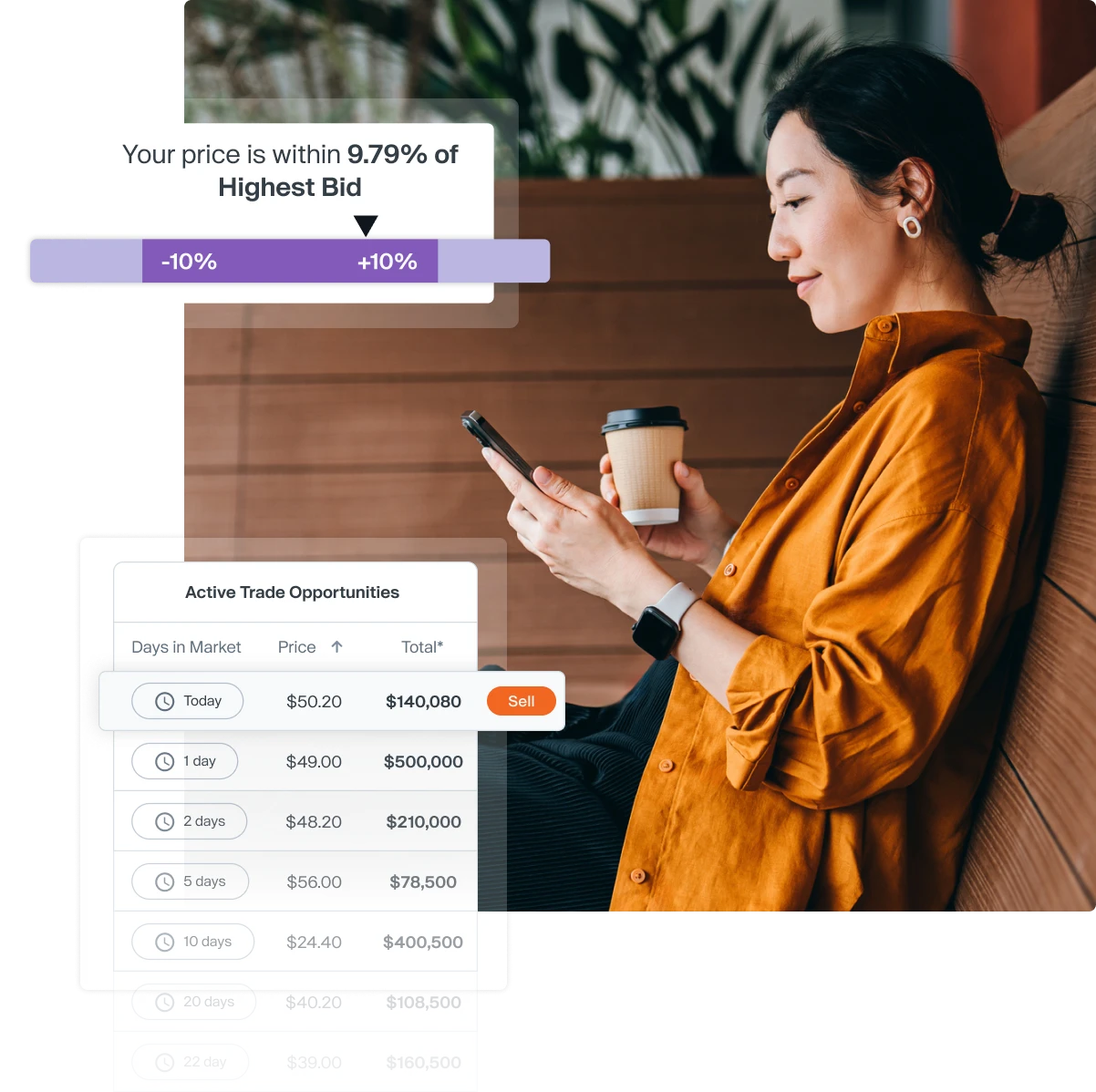

Join a leading private marketplace

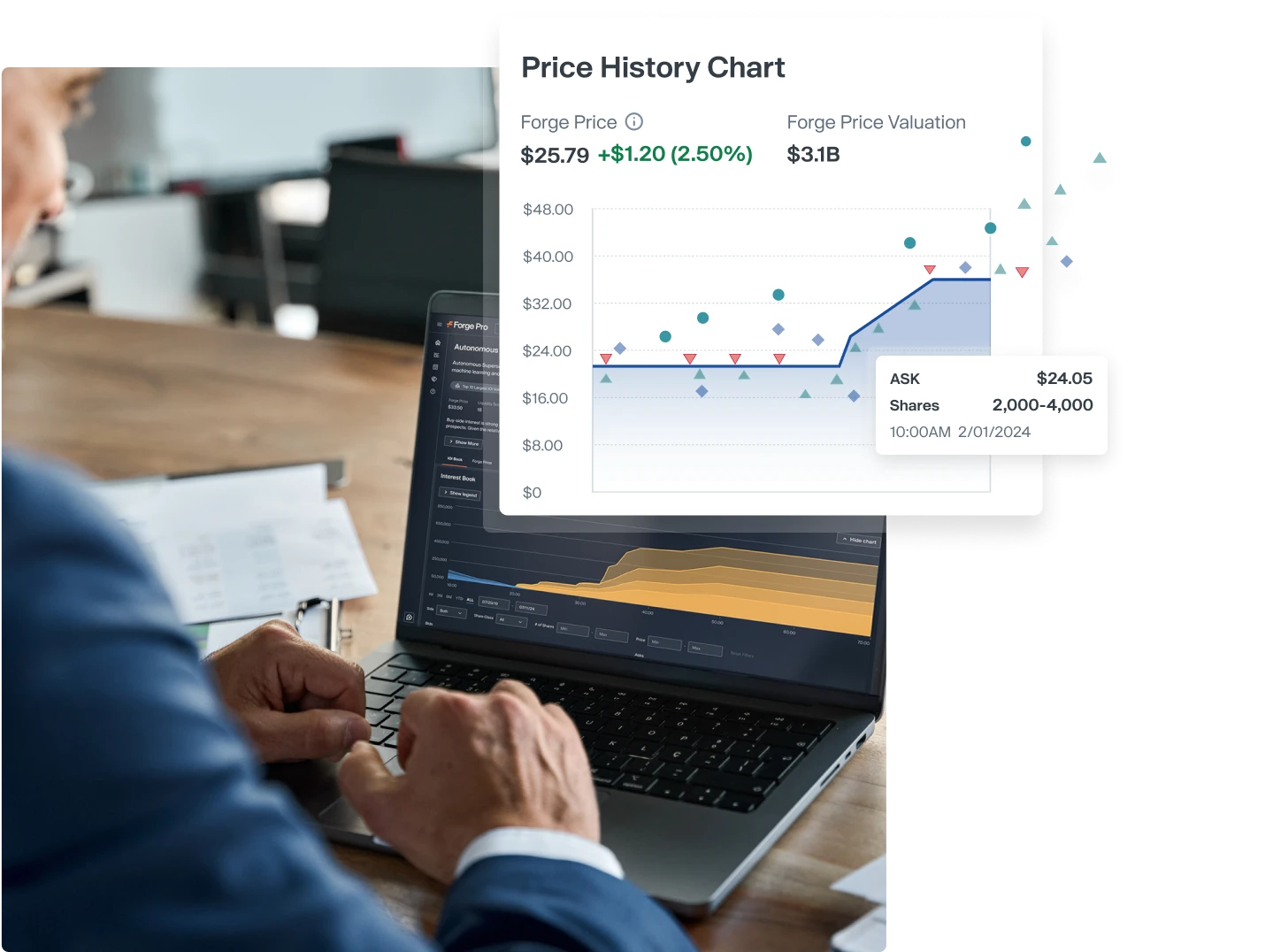

Get actionable views of share prices and valuations

Leverage indices and benchmarks to decide when to invest

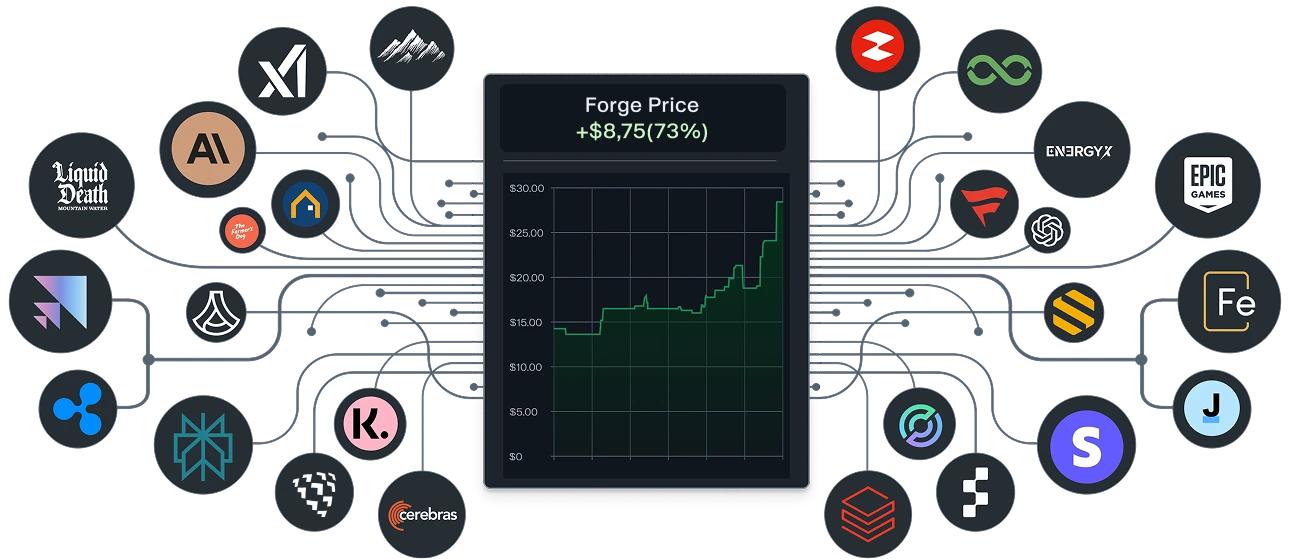

Discover opportunities in world-changing companies

LFR Post-Money Valuation

$739.96MM

$739.96MM

$40.72+$0.58 (1.44%)

LFR Post-Money Valuation

$50B

$50B

$59.00+$2.91 (5.19%)

LFR Post-Money Valuation

$61.5B

$61.5B

--

LFR Post-Money Valuation

$36.71B

$36.71B

$234.34+$4.95 (2.16%)

LFR Post-Money Valuation

$46.08B

$46.08B

$112.75+$4.84 (4.49%)

LFR Post-Money Valuation

$62.04B

$62.04B

$9.59-$3.20 (-25.02%)

LFR Post-Money Valuation

$6B

$6B

$629.49+$138.58 (28.23%)

LFR Post-Money Valuation

$18B

$18B

LFR Post-Money Valuation

$12B

$12B

$24.16+$0.16 (0.67%)

LFR Post-Money Valuation

$2.81B

$2.81B

$44.84-$0.16 (-0.36%)

LFR Post-Money Valuation

$5.25B

$5.25B

LFR Post-Money Valuation

$3.5B

$3.5B

--

LFR Post-Money Valuation

--

--

--

LFR Post-Money Valuation

--

--

Most viewed companies as of July 18, 2025.

Read more about the Forge Price¹, Forge Price Change², Last Funding Round (LFR) Post-Money Valuation³ displayed above.

Forge Price

A new standard for private market pricing insight

Forge Price™ provides fast and frequent pricing updates on pre-IPO companies.

Dive deeper into private market trends

Forge tracks the pipeline of prospective IPOs to help private market investors stay informed of potential public market activity.

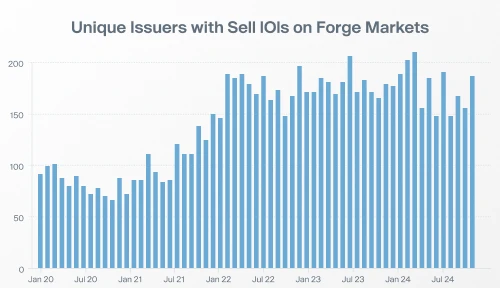

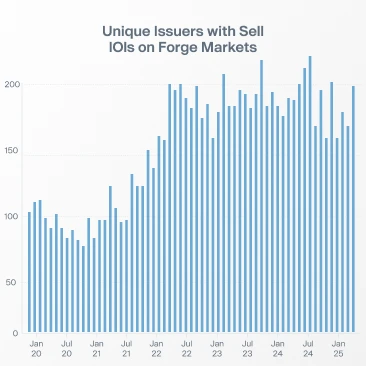

Access proprietary data, trends and insights that aren't available anywhere else.

Track 60 privately held, late-stage, venture-backed, U.S. companies.

Unlock exclusive access to high-growth private companies