Who can buy pre-IPO stocks?

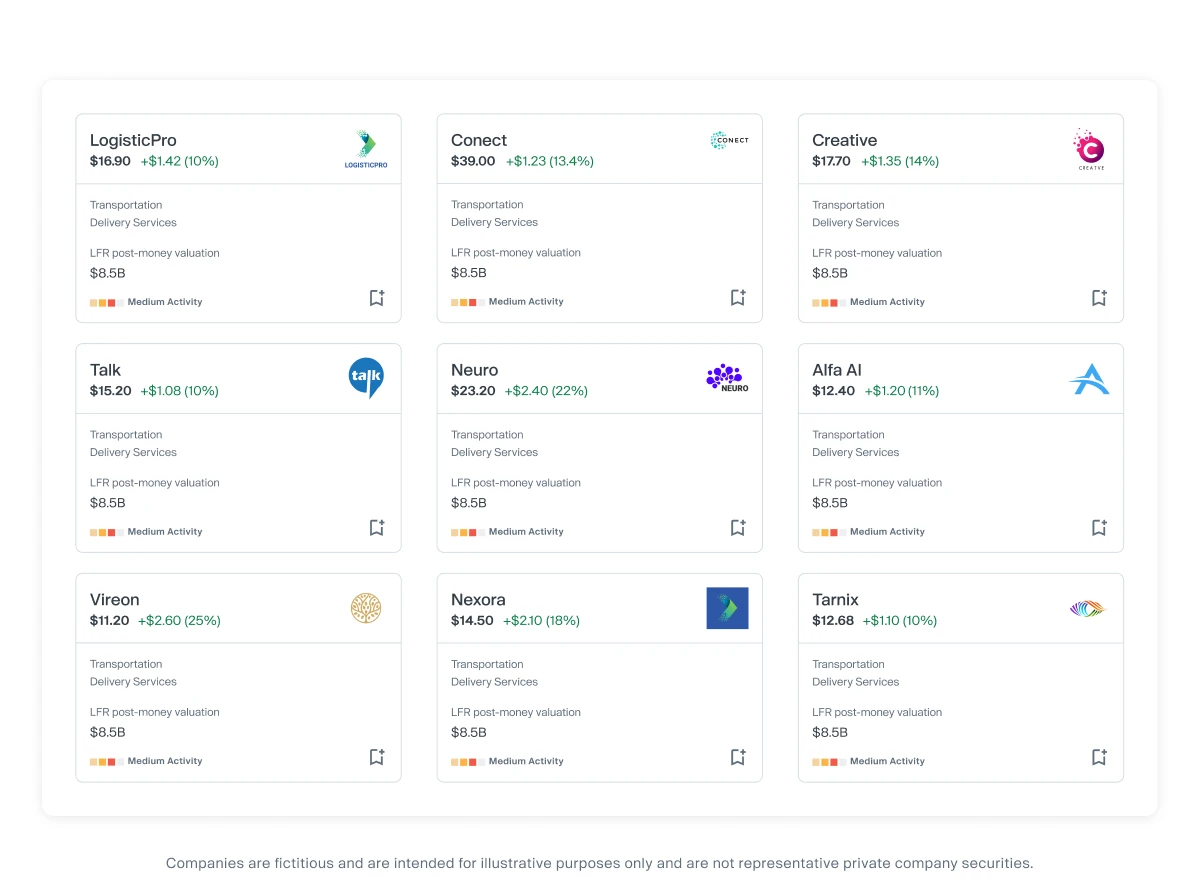

Accreditation is the first step in accessing the pre-IPO companies found on Forge. Once qualified, you can tap into valuable insights and opportunities to buy pre-IPO shares.

Possess earned income over $200,000 (or $300,000 with a spouse or partner) for the past two years.

Reasonably expect to maintain the same income in the current year.

Or, possess a net worth of at least $1 million, excluding their primary residence.

Or, hold in good standing a FINRA Series 7, 65 or 82 license.