Article

July 7, 2025

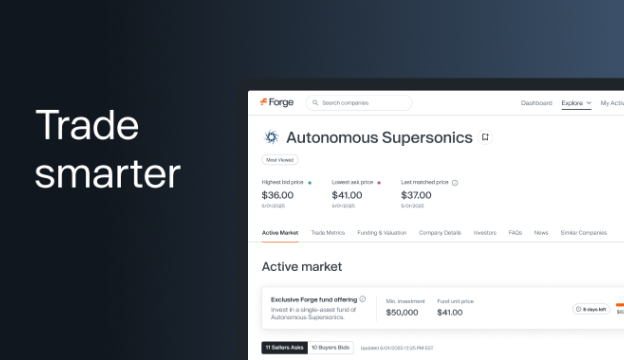

A common theme that unites companies listed on Forge Global that had the largest Q2 funding rounds in 2025 is AI integration. These five private companies offer products and services in industries including defense, manufacturing, enterprise software and technology, and each one has either integrated AI capabilities into existing offerings or built its business model around AI innovation. Collectively, these companies raised over $5.4 billion in Q2 2025.