- Bids and trade prices converge in Q3

- Companies raising primary funds at a compressed premium as investors seek more favorable terms

- Unicorns being minted faster than 2020 levels, reflecting the significant capital that remains available to startups

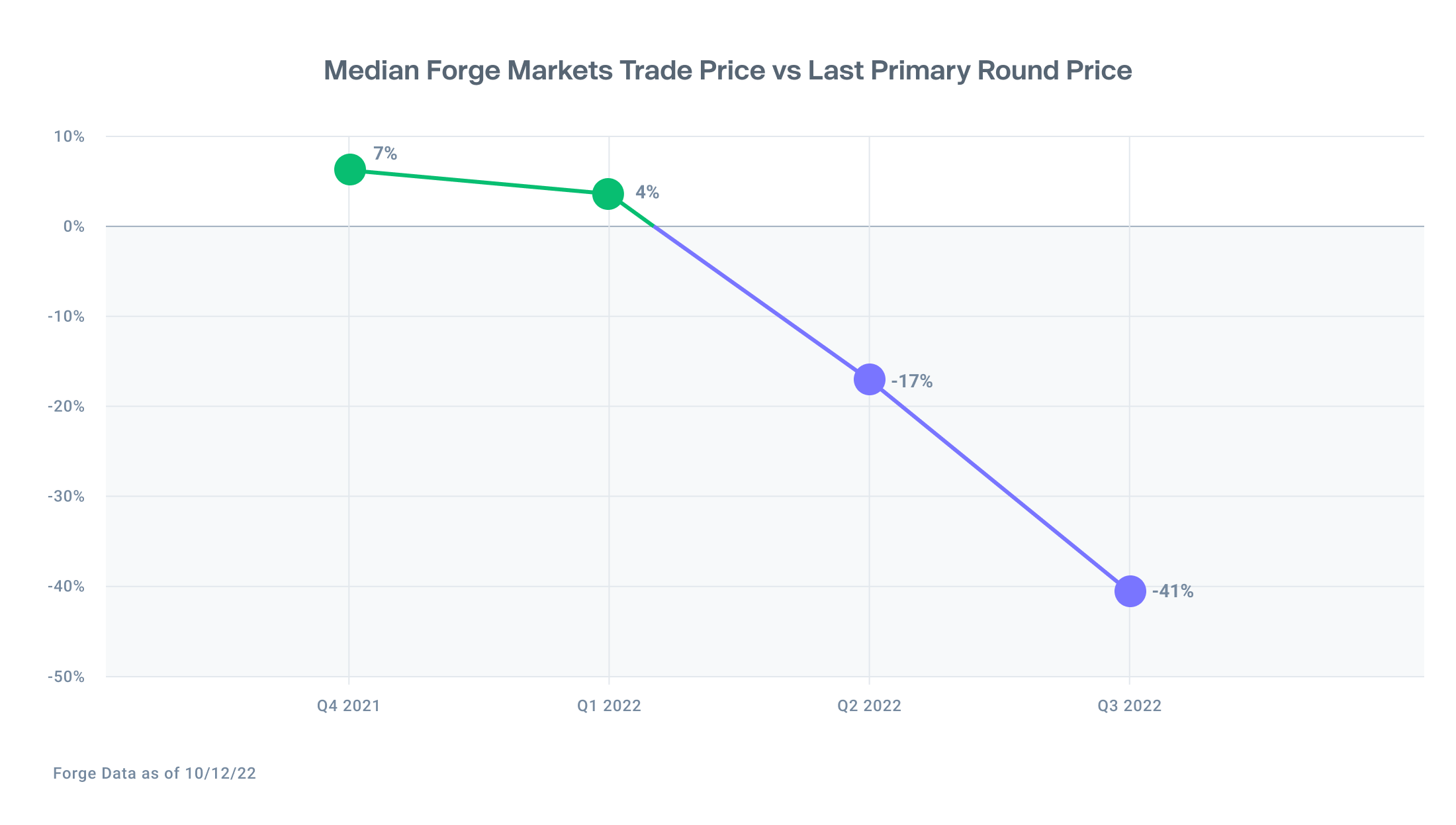

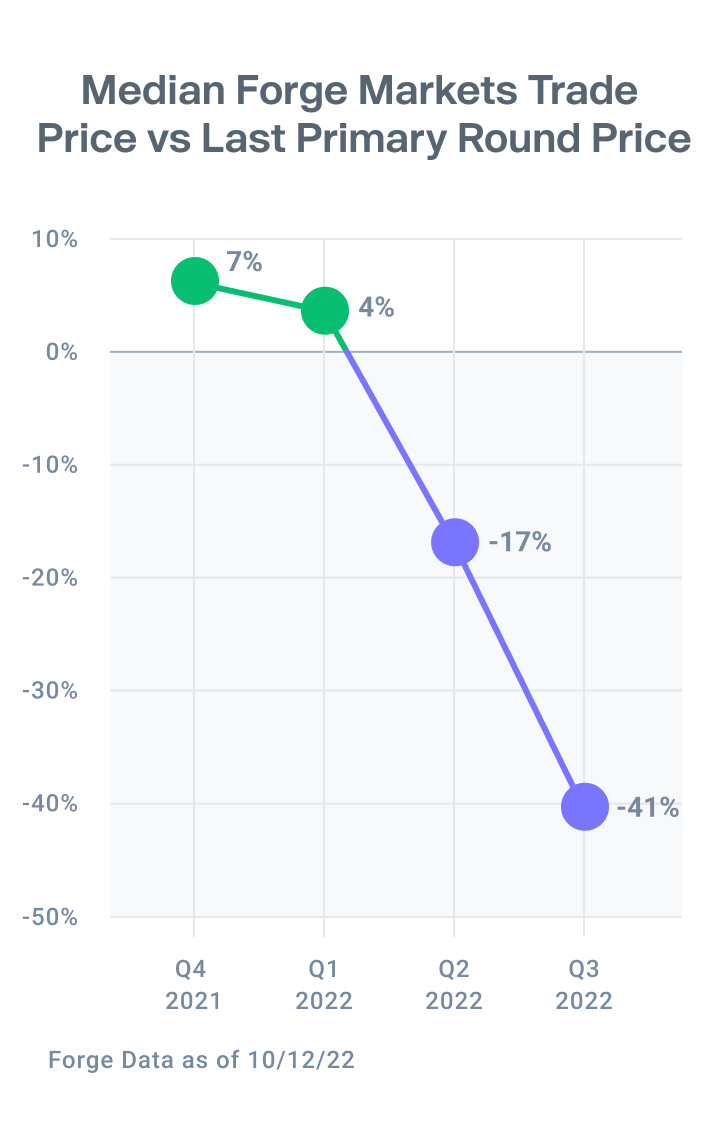

With recession seemingly on the tips of everyone’s tongues, private market investors continue to take a measured approach in the pre-IPO market. Q3 is in the rearview mirror, and Forge Data shows private market shares are now trading at a median 41% discount to their last primary round valuations.1

The primary fundraising environment looks similar, as global venture funding fell 53% year over year in Q3 and 33% quarter over quarter. 2

But that doesn’t mean the sky is falling. For example, the global new unicorn (private companies valued at $1 billion or more) count hit 37 in Q3 2022, matching its pace from Q2 2020 and ahead of the 23 that were minted in Q1 2020.3 Year to date, 2022 has minted more global unicorns (281) than all of 2020 (189). 4

Investors shouldn’t expect a repeat of the post-pandemic elevator ascent anytime soon, but fears of a rollercoaster ride down might not be warranted either. Like in public markets, some private companies may have taken a haircut as part of a larger pullback, rather than basing valuation reductions purely on fundamentals, creating an opportunity for investors seeking discounts.

At the same time, some private companies are enjoying continued success securing primary funding and considering exits. Many of these standouts fall into sectors like payments and analytics. For example, SQL database provider SingleStore reached unicorn status this summer, and it continued this success by announcing the close of its Series F-2 round in October, completing $146 million in financing.5 In July, it was reported that SingleStore has its sights set on going public.6

TripActions, a corporate travel and expense management company, has had a string of successes following its turn toward fintech.7 The company recently announced a Series G post-money valuation of $9.2 billion.8 Business Insider reports that TripActions also confidentially filed for an IPO.9

Aside from IPOs, Adobe’s $20 billion acquisition of Figma also shows that large exits remain viable, even if less prevalent right now.10

Altogether, these developments indicate that while caution remains warranted, private market investors may have reason for optimism. Rather than relying on blind faith, investors should leverage as much data as possible to spot the diamonds in the rough.

Some private market shares that are trading at steep discounts from their last funding rounds could be value buys at current levels, for instance. These companies may wait to fundraise until broader market conditions improve so they can try to avoid down rounds.

To take advantage of these situations, it helps to be able to analyze comparable private market valuations, including historical ones that could indicate fair market value for current startups. Just this week, Forge Data released a Private Market Comparables feature allowing investors to do just this.

And while exits might be limited right now, the private market remains vibrant with hundreds of companies available for investment. Understanding the depth of private market liquidity can help investors weigh whether to stay on the sidelines or consider new opportunities.

Bids and trade prices converge in Q3

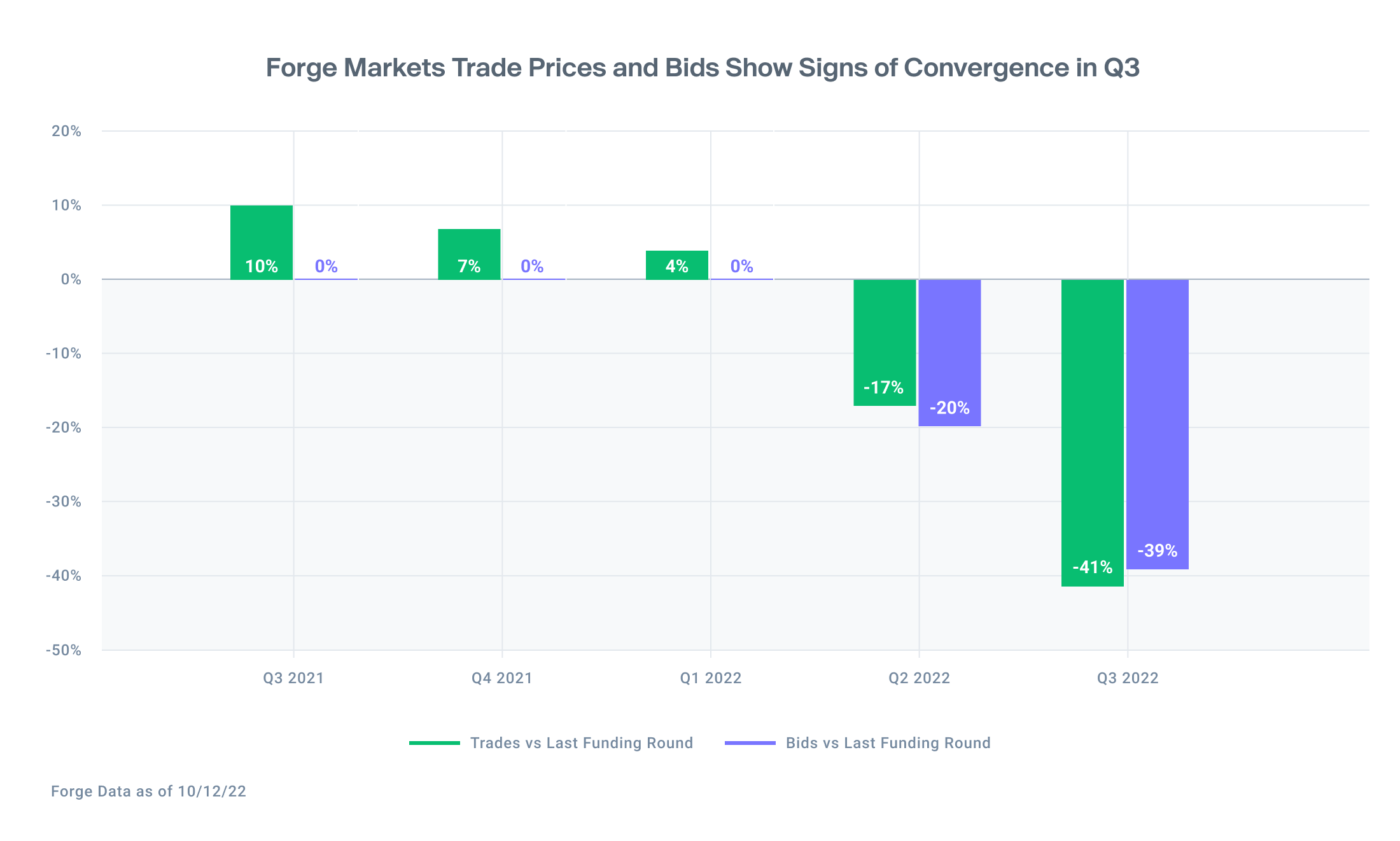

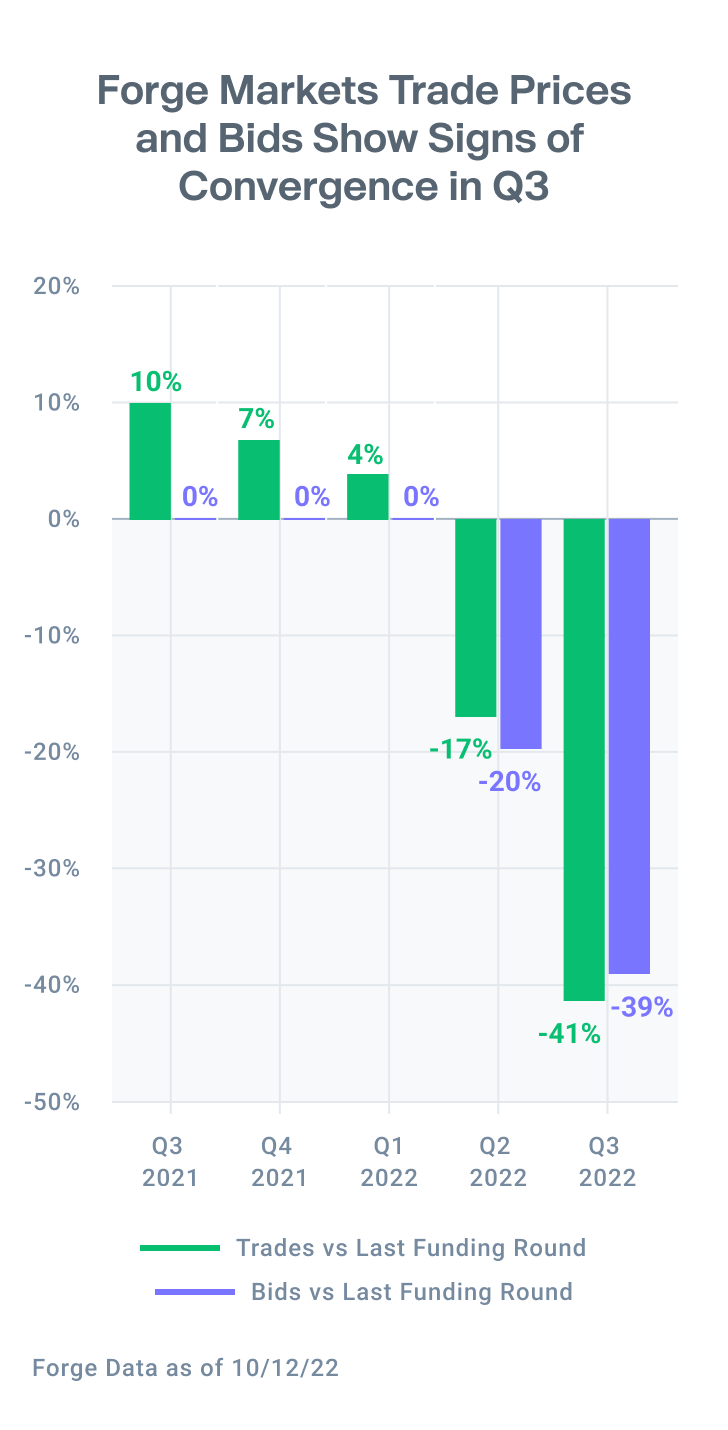

When it comes to the art and science of private company valuation, market participants generally want to have a sense for where the overall secondary market is valuing common stock vs. the last funding round’s price. Over the past year, as macro factors deteriorated, bids have increasingly been seen as a leading indicator – and trade prices needed to catch up.

In Q3, trades and bid prices converged – with bids coming in at a 39% discount to a company’s last funding round, and trades landing at a 41% discount.11 This differs from the bid-ask spread, which looks at the difference in prices at which sellers want to sell, and buyers want to buy.

And as noted above, in Q3 the median trade price on Forge Markets showed a 41% discount to a company’s last fundraising round.12

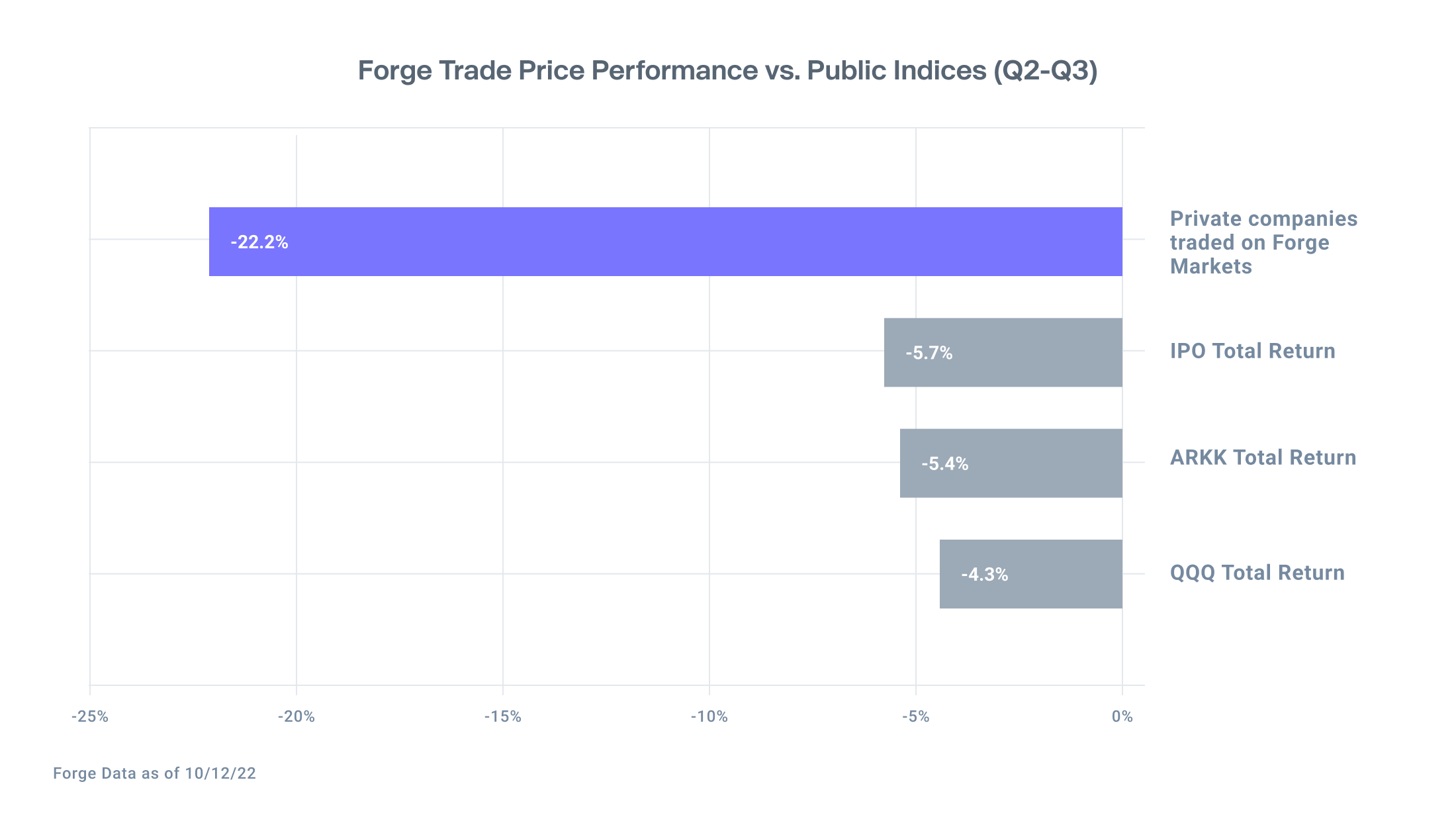

Private Market lags Public Market by approximately one quarter

On average, prices fell 22.2% when comparing the price of companies that traded on Forge Markets in both Q2 2022 and Q3 2022. Meanwhile, public tech indices slowed their pace of losses in Q3, with the NASDAQ falling -4.3%, the IPO ETF falling -5.67%, and the widely watched ARKK ETF falling -5.39%.13

Overall, prices of private market names are down 44.1% YTD for companies that traded on Forge Markets in Q4 2021 and Q3 2022.14

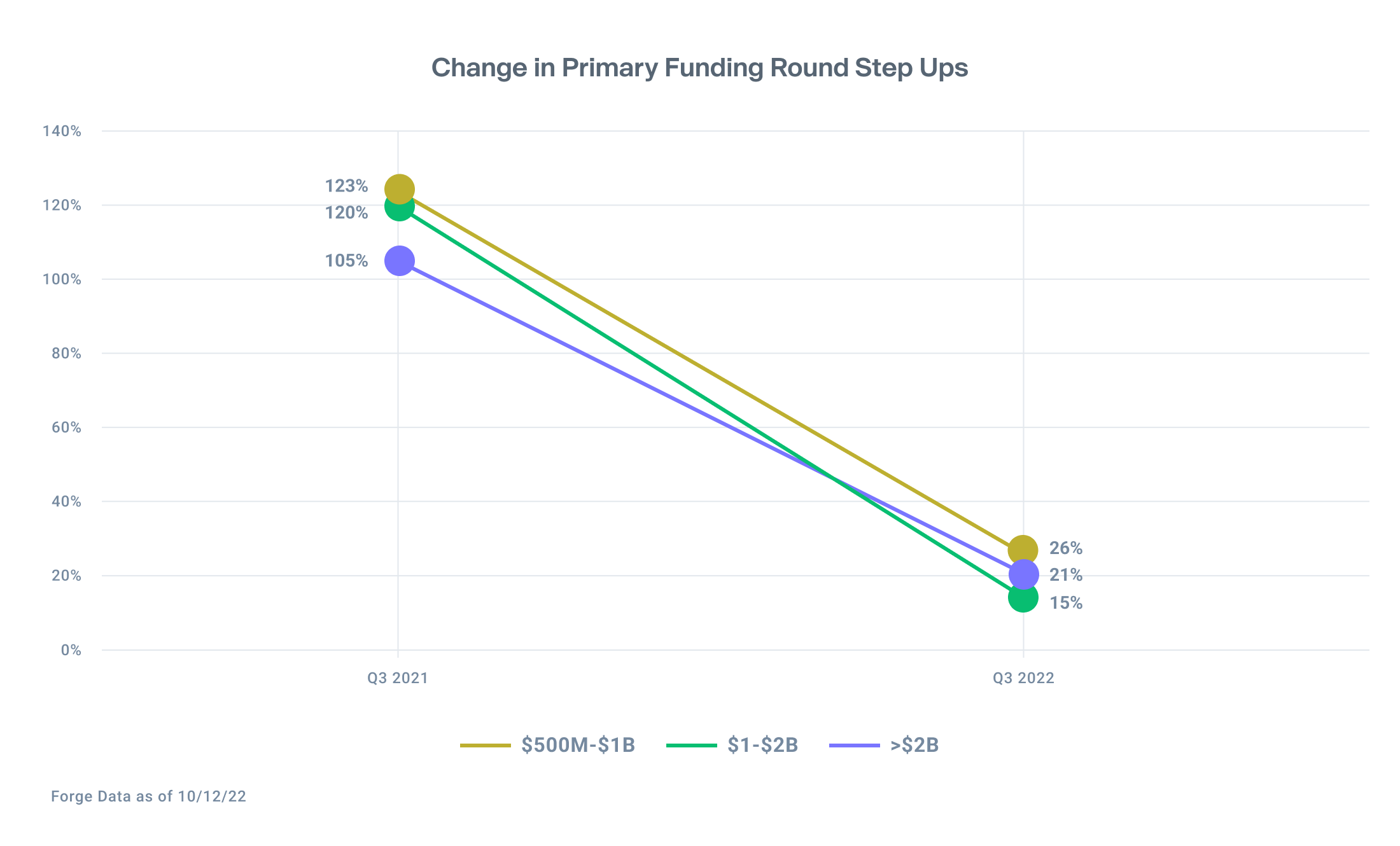

UpRINOs emerge as funding terms favor investors

Companies are still able to raise capital at a premium to last round valuations, but that premium has been highly compressed, landing between 15-26% in Q3.15

There’s more to these numbers, as The Information points out. Many companies have raised up-rounds on paper, including Acorns, Tonal and Jokr, but are doing so at incredibly favorable terms to investors rather than employees. To earn that bump in valuation, companies are including 2-3X liquidation preferences and warrants to buy more stock at a later date. This has led to another word being added to the startup lexicon: “Up Round In Name Only” or UpRINO.

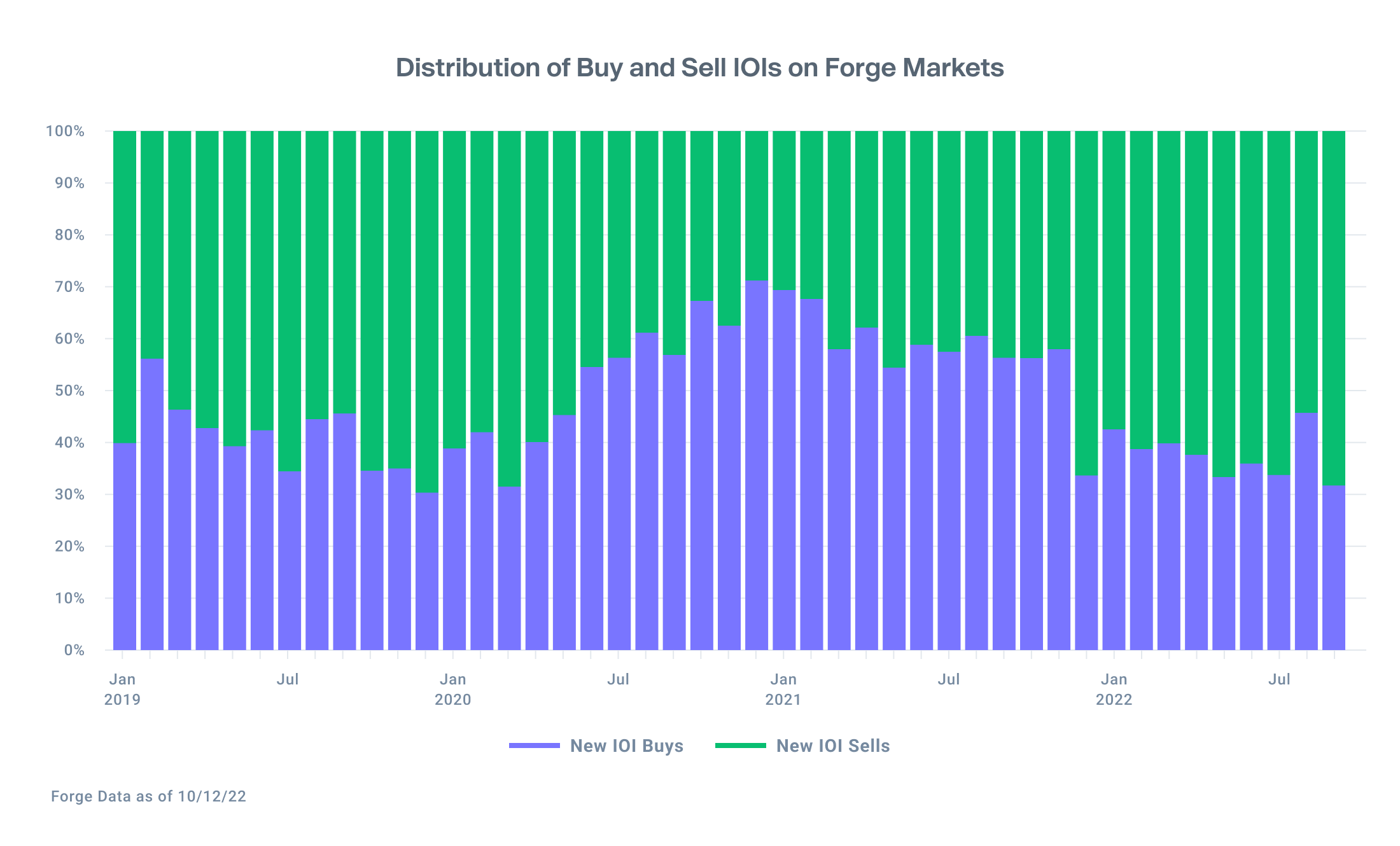

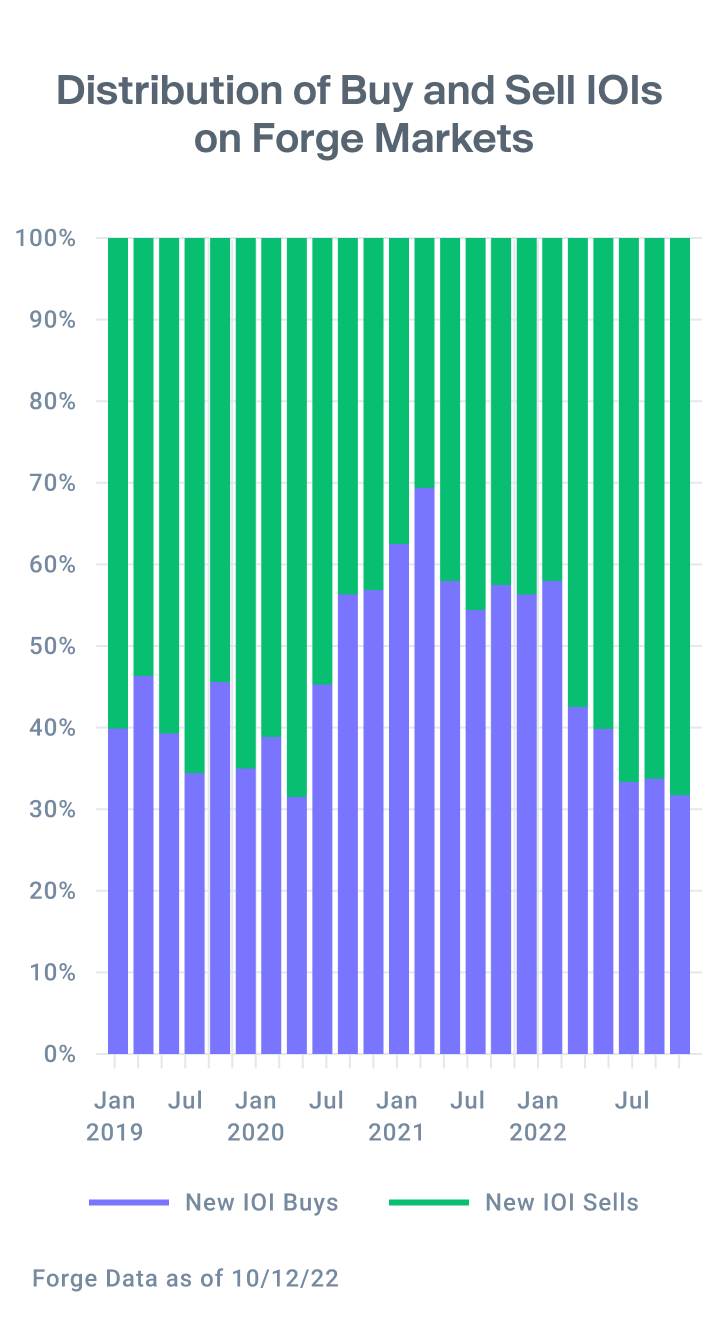

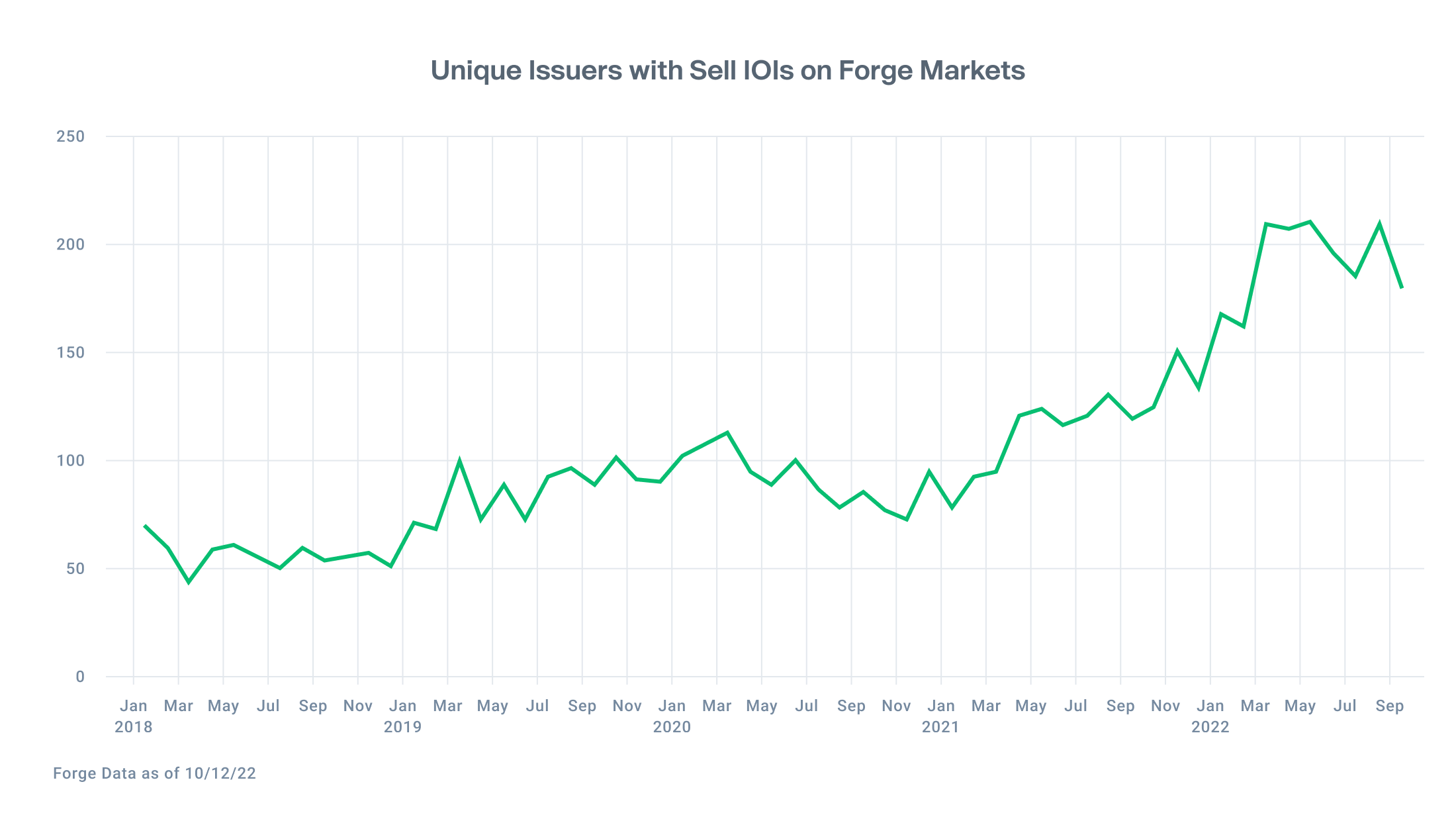

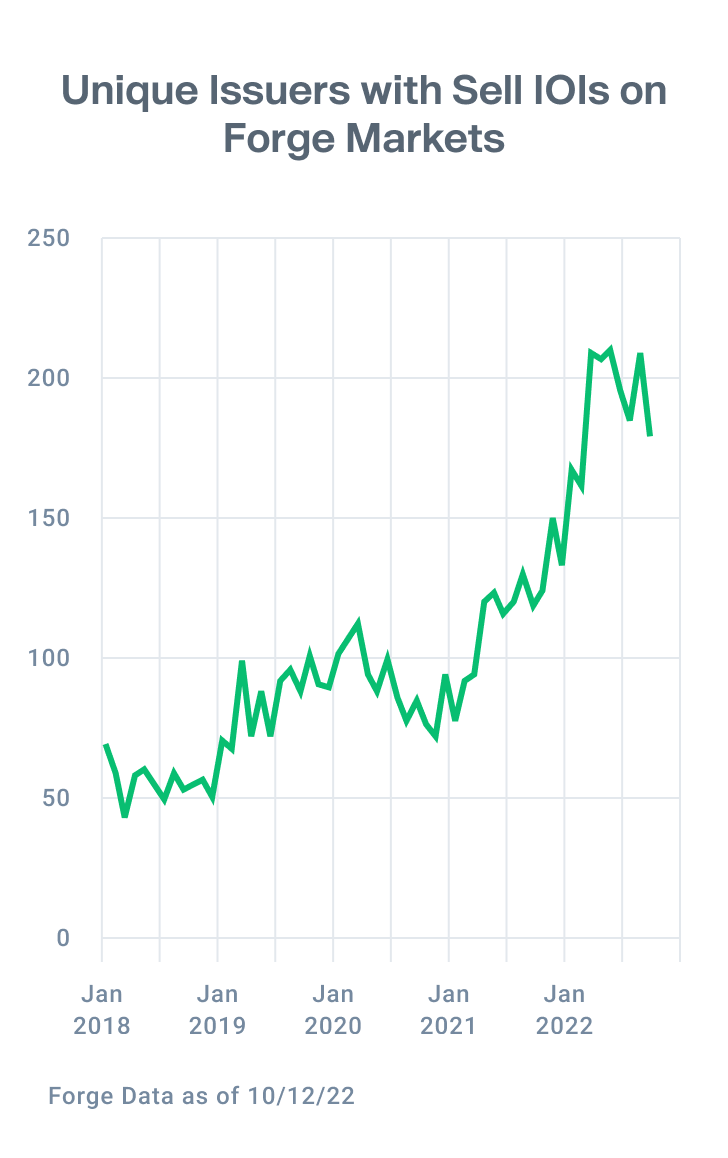

Buyers Market persists as Sell-Side IOIs and issuers remain elevated

IOIs remain skewed to the sell-side, though August showed signs of parity as the public market showed brief signs of improvement. It’s another reminder that IOIs are one of the more directional leading indicators in the private market. By the end of Q3, Forge continues to see a historically elevated number of sellers arriving to the platform, looking for liquidity even at steep discounts.

Meanwhile, the number of issuers has remained roughly consistent with sell IOIs in between 180-200 distinct companies represented each month to the Forge platform since mid-Q1.16

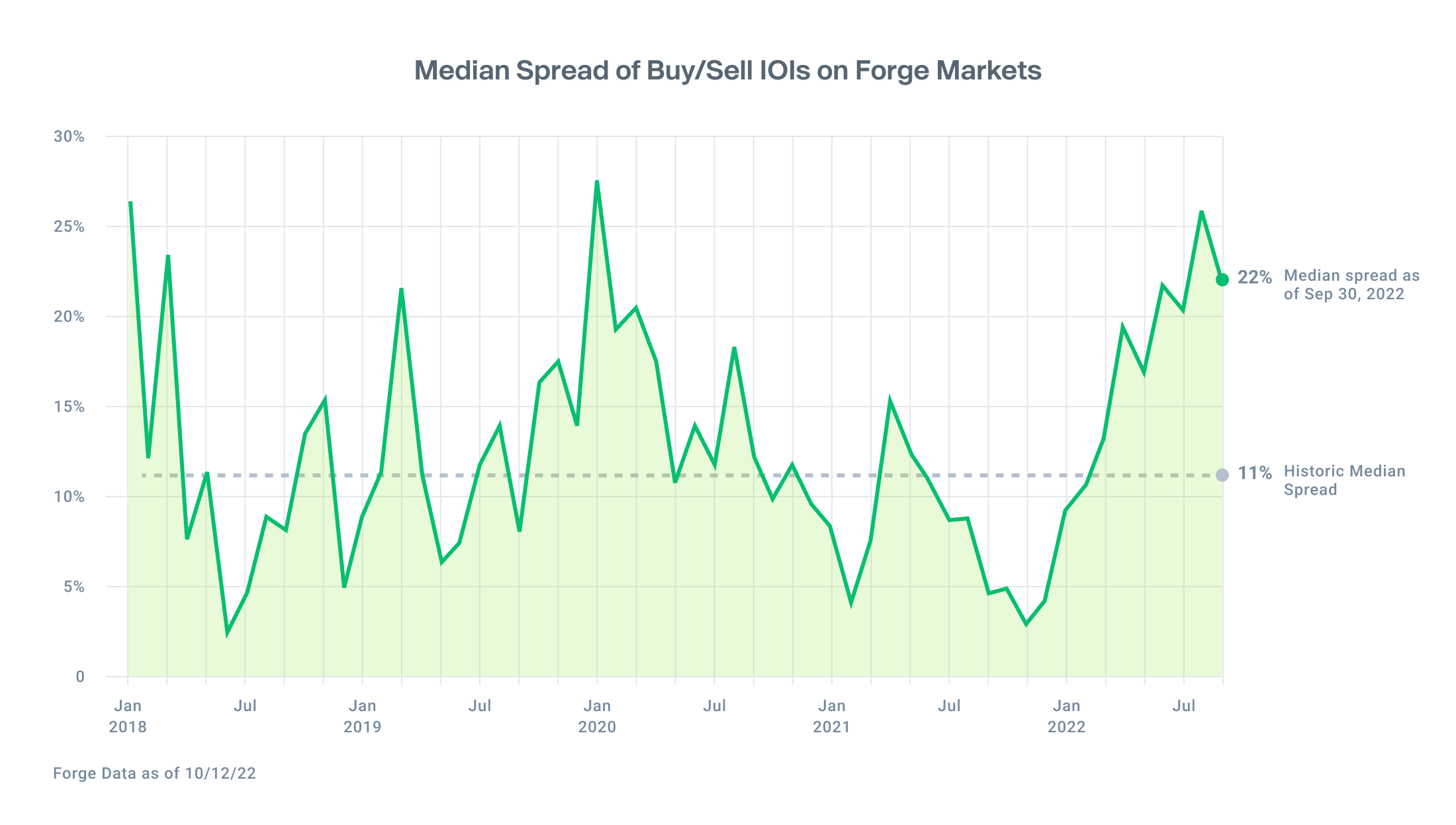

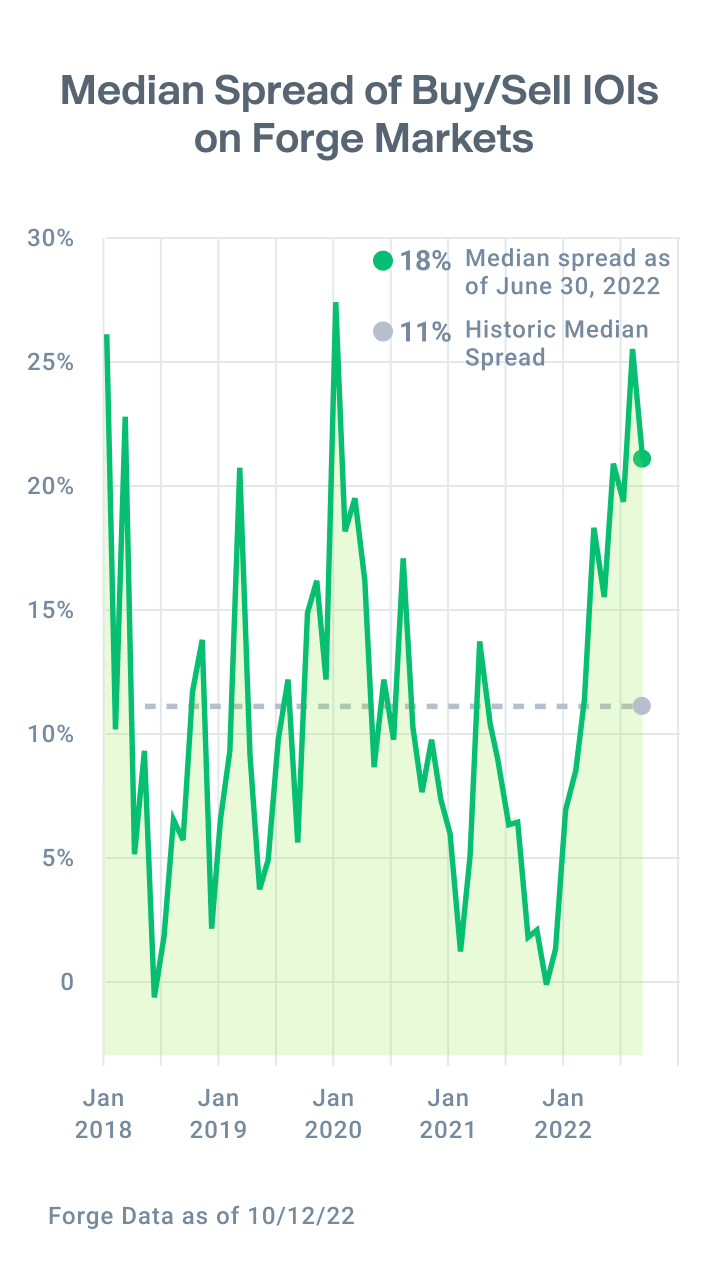

Bid-Ask spread peaks in August

Bid-ask spreads widened a bit from July, ending the quarter at just over 20% but down from a recent peak of over 25% in August.17 Since the market flipped from a seller’s market to a buyer’s market at the end of last year, there are clear indications that seller expectations are falling more in line with what investors are willing to pay in recent months. While it’s unclear if the spread will continue to narrow, the price at which trades are crossing (on average at more than 40% discount to last primary) is giving new sellers more insight into realistic pricing expectations.

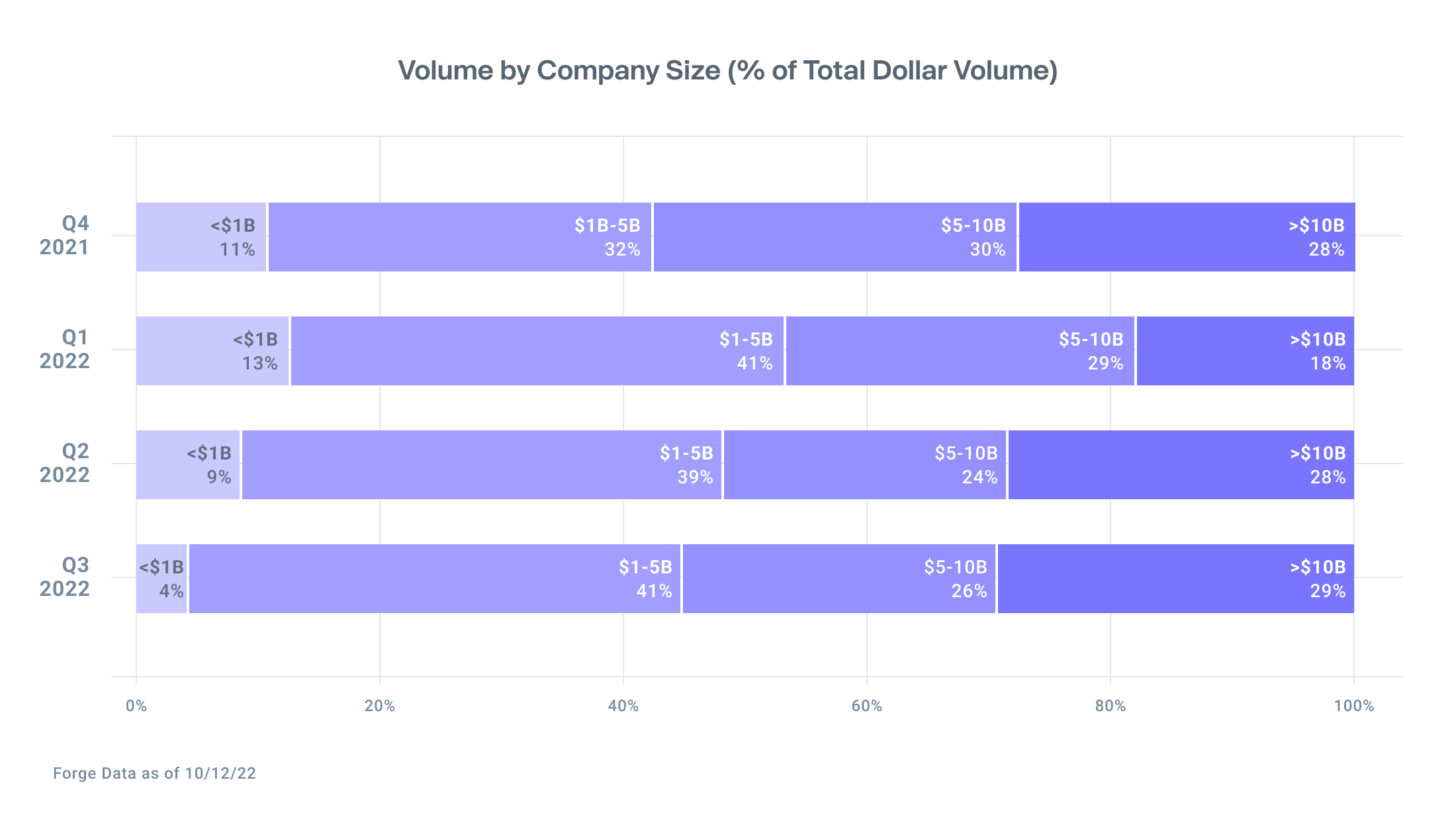

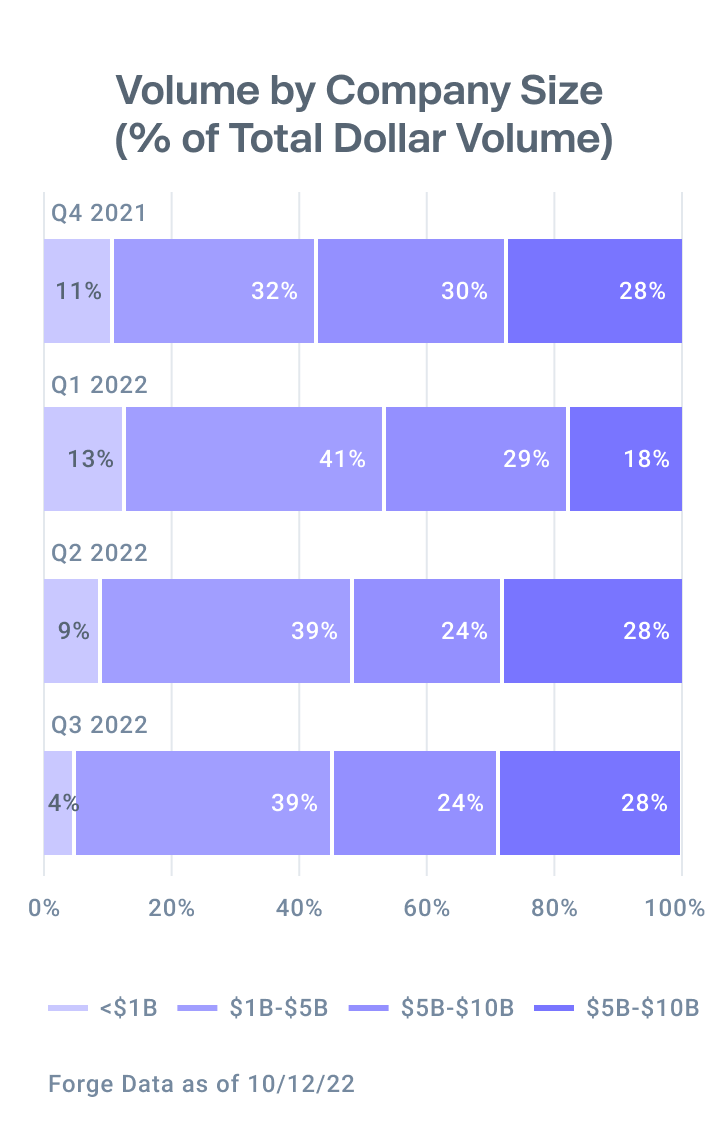

Investors focused on smaller unicorns

Investors remained broadly consistent in their investment bands, continuing to show a preference for companies with $1-5bn valuations which may suggest a continued search for growth – and a perception that companies at the top end of the valuation band have exhausted their upside.

Three quarters into the year, the private market has had additional time to absorb and price in the headwinds that have affected nearly every other corner of the broader economy. As buyers and sellers engage in ongoing price discovery, Forge will continue to provide the data and transparency necessary to help all market participants engage confidently in the private market.