Private Market Update February 2025

The private market swells with an optimistic IPO pipeline

After several years of muted private market returns and IPO activity, 2025 got off to a positive start, and that momentum may continue as the IPO pipeline swells.

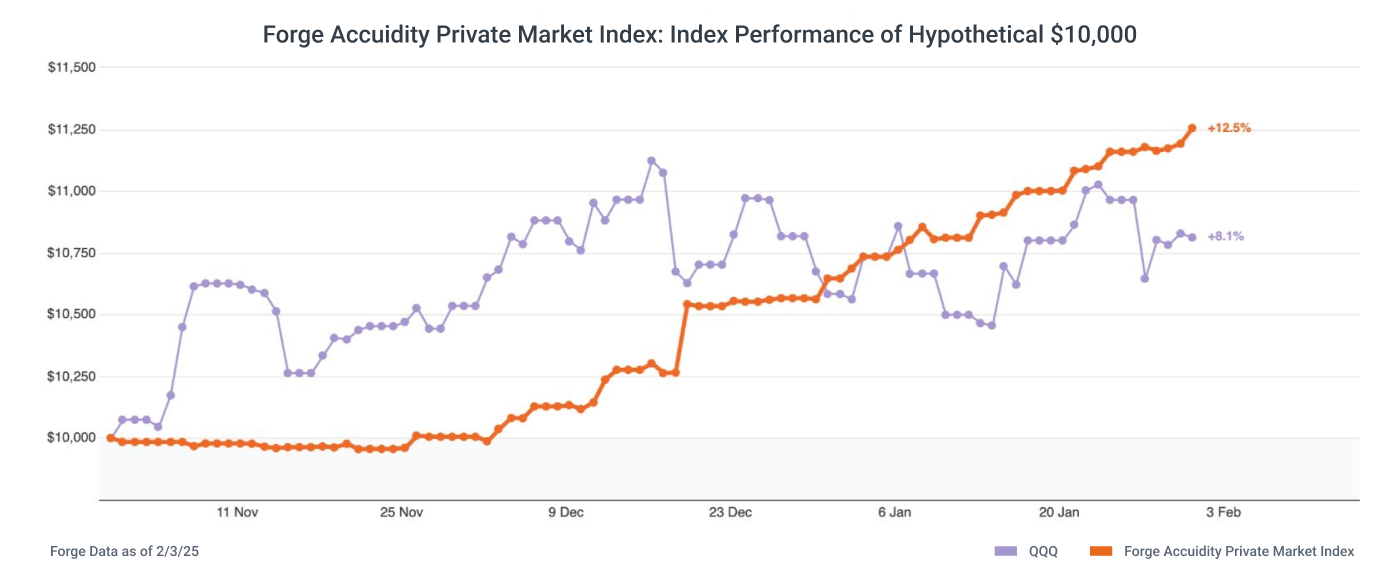

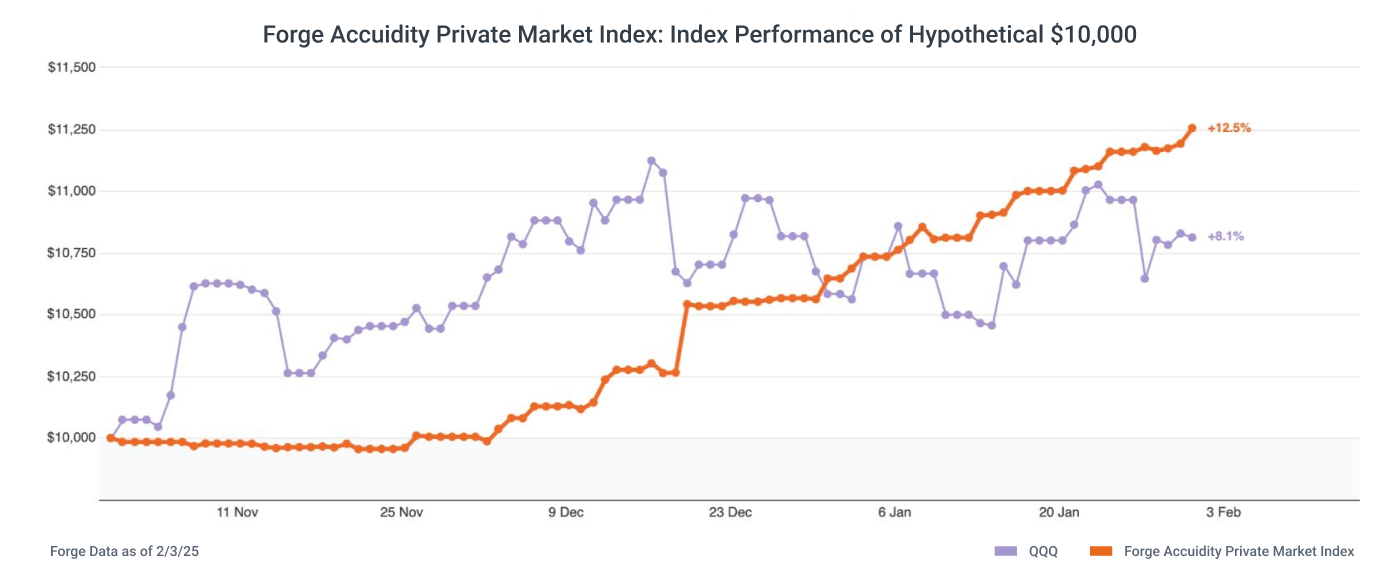

The Forge Private Market Index gained 8.6% in January and is up 11.3% over the last three months, outpacing major indexes like QQQ and SPY, even amid strong public market performance.2

With this recent surge, the Forge Accuidity Private Market Index (FAPMI) has outperformed the QQQ for the period noted in the chart below for the first time since its peak in 2021. The Accuidity Capital Management Megacorn Fund is the first fund of its kind that tracks the FAPMI by aggregating the performance of a diversified group of 60 late-stage private market companies underlying the FAPMI.

One of the primary drivers of this growth is the strong demand for private artificial intelligence (AI) company shares. A private AI basket of seven companies Forge tracks has been sharply climbing, growing 58.3% in value from mid-2024 through the first five weeks of 2025. This trounced the performance of the SPY index (that tracks the S&P 500), which gained 12.1% over this period,3 setting an enthusiastic tone for private market AI investments in early 2025.

Following a relative drought in recent years, 2024 saw an uptick with 176 U.S. IPOs, up from 127 and 90 in the preceding years. Still, that's far below the high-water mark of 416 in 2021.4

However, several signs point to the IPO market returning as 2025 progresses. In January, there were 13 IPO filings of $100 million or more in planned raises, which was the highest monthly total of filings of this size in three years.5

IPO filings include cybersecurity software firm, SailPoint, which filed to go public6 about two and a half years after it was taken private by Thoma Bravo,7 with the company now seeking a valuation of up to $11.5 billion. This compares to its take-private price of $6.9 billion.8

Other large private cybersecurity companies such as Snyk,9 Wiz10 and Cato Networks11 are also all on IPO watch in 2025, though filings have not been made yet.

Swedish buy now-pay-later fintech giant Klarna12 is readying for its IPO on the U.S. markets, with an eye on an April listing.

Several major AI and AI-related companies could also IPO this year if conditions remain rosy, including CoreWeave13 and Databricks.14

Cerebras is another hot AI company that could make its public market debut in 2025, after delaying its 2024 plans.15 The AI chipmaker often draws comparisons to Nvidia, one of the most successful public market stocks in 202416 and a strong February 2025 rebounder in the wake of product launches by Chinese AI rival DeepSeek. Cerebras could ultimately be one of several private market companies looking to cash in on the comparable success of their public market counterparts.

Crypto is another sector that's been booming lately, where private companies like Kraken17 could look to take advantage of the public investment tide that companies such as Coinbase have raked in. Coinbase’s stock is up around 125% over the past year.18

Ripple is another crypto-related company on IPO watch, potentially making its public debut as soon as late-2025.19 While Ripple's XRP cryptocurrency is not a publicly traded stock, XRP is open to the public through platforms like Coinbase and Robinhood, and has gained about 360% in the past year.20 XRP ETFs could also soon be publicly available, potentially propelling this private company to new heights.21

Collectively, there’s a lot of potential public market juice that private companies could look to squeeze. And, if more companies flow through the IPO pipeline, and the macro environment improves with lower interest rates, that could further support improved private market valuations.

Still, given the current geopolitical tumult, it’s important to not draw too many conclusions with existing data, as events continue to unfold at a rapid clip. While the private market may have entered 2025 running full speed, a fair amount remains to be seen in terms of how the rest of the year will play out.

Buy-Side IOIs Hit All-Time High

Underpinning the private market surge in January was an all-time high in the number of buy-side indications of interest (IOIs) on Forge, which jumped about 25% in the month. The previous high came at the end of 2020. Note, however, that the distribution of buy and sell IOIs became slightly more balanced in January, due to strong activity on both the buy and sell sides.

Influx of Unique Issuers

The number of unique issuers with sell IOIs ticked up in January, helping to fuel liquidity amidst strong buy-side demand. While there was similar sell-side demand during softer periods, throughout 2022 and 2023, the difference now seems to be that sellers are often cashing in on buy-side fervor, rather than trying to unload underperforming assets.

Spreads Stay Relatively Tight

Amidst all the activity from both the buy side and sell side, median spreads remained below their long-term average. While there was a slight uptick from last month, that type of variance is common. Zooming out shows a more consistent trend of spreads being relatively tight recently, in the ballpark of where they were in 2020-2021.

Trade Premiums Climb, Especially at the Top

Strong private market demand helped lift average trade premiums in January. While the median still remains in discount territory at -24% below last primary round, that's up from -36% the previous month. The biggest difference, however, can be seen among the top names. Those in the 90th percentile traded at a 60% premium to their last primary funding rounds on average, compared with a 34% premium last month.