2025 has been a strong year for crypto in several ways. In the U.S., for example, the regulatory environment has shifted toward a more crypto-friendly stance,5 and several crypto-related companies such as eToro, Circle, Bullish, and Gemini have gone public this year.6

Crypto investing has also become more common, albeit still relatively niche, now owned by 17% of U.S. investors vs. 2% in 2018.7

That growth has occurred amidst lower barriers to access, such as with more crypto ETFs coming to market this year.8 Crypto trading apps like eToro, Gemini, and already publicly traded ones like Coinbase are also competing to pull in more investors.

Kraken is another prominent crypto exchange trying to draw in both retail and institutional investors. While it's been raising significant funding this year, it has not announced any plans to join competitors in the public market.

Instead, co-CEO Arjun Sethi said at a recent Yahoo Finance event that "We have enough capital on our balance sheet today as a private company, and we don’t want to race to the door as quickly as possible."9

Still, interested investors don't necessarily have to wait for Kraken to IPO. Accredited investors may be able to buy private market shares of Kraken through Forge, and retail investors may be able to get similar or indirect exposure through other types of assets.

Here, we'll take a closer look at how to invest in Kraken stock pre-IPO.

Kraken: Company background

Kraken, one of the oldest crypto exchanges,10 was founded in 2011 and launched in 2013 in San Francisco by Jesse Powell, Thanh Luu and Michael Gronager.11 Shortly before founding Kraken, Powell volunteered to help MtGox — what was then the largest Bitcoin exchange — recover from a hack. He then started Kraken with the idea of building a more secure exchange, trying to correct where MtGox went wrong.12

Kraken was the first centralized platform to launch Ethereum's Ether (ETH) token trading in 2015, and in 2020 it became the first digital asset company to receive a federal and state-recognized bank charter for its digital asset custody services.13

Today, Kraken is available in over 190 countries and allows for trading of 569 crypto assets. It has also started to expand into areas such as U.S. stock trading.14

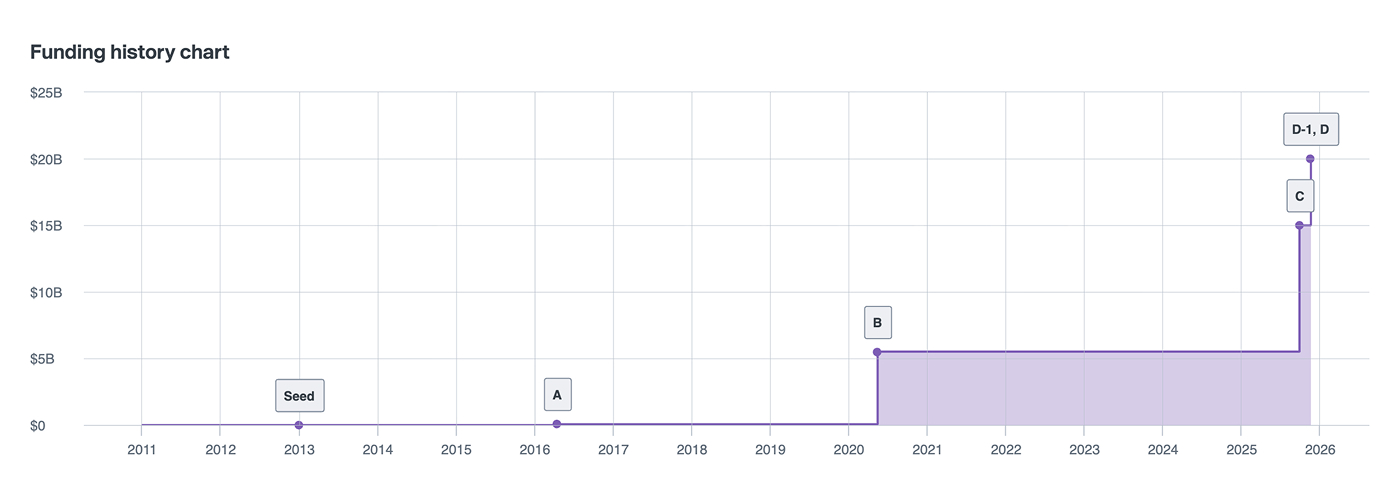

For most of Kraken's history, it has taken on limited outside funding until this year. It started with just a $200,000 seed round in 2013 that valued the company at $2 million, implying a stock price of $0.03.15

The Kraken Series A came in 2016, raising a little over $12 million at a valuation of around $67 million and a stock price of $0.17. In 2020, Kraken took a big step forward with its Series B, raising $52.5 million at a valuation of around $5.5 billion, bringing its stock price up to $19.84.16

About five years later, in September 2025, Kraken raised by far its largest round, taking in $500 million for its Series C at a $15 billion valuation and a stock price of $48.82.17 Bloomberg also reported in September that Kraken is in talks to raise another $200-$300 million at a $20 billion valuation.18

However, Kraken's Forge Price of $41.79 is currently a little lower than the stock price from its last primary funding round.19

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions, and indications of interest (IOIs) on Forge.

Some of Kraken's investors include Tribe Capital, Blockchain Capital, Digital Currency Group, and Hummingbird Ventures.20

How to buy Kraken stock

Until it potentially goes through an IPO, Kraken's stock is not for sale to the general public. However, accredited investors may be able to buy Kraken stock through Forge's next-generation marketplace for private market trades, subject to availability.

Forge's technology and relationships facilitate the trade of private company shares in companies like Kraken, along with other private market crypto-related companies.

For example, Blockchain.com is another unicorn that provides similar crypto investing services, albeit arguably with more of a focus on its self-custody wallet offering, though this is a product Kraken offers too.

Uphold is another crypto investing platform, and while perhaps not as popular as exchanges like Kraken or Blockchain.com, it seeks to provide additional investing capabilities, such as offering precious metals trading alongside crypto.

Investors interested in buying private crypto companies might also review Abra, which arguably has a more distinct focus on the institutional/high-net-worth investor market than Kraken. Abra also aims to bring a wider breadth of digital asset services beyond trading, such as providing crypto-related lending and advisory services.

So, those interested in buying Kraken stock could look at these other types of private companies if they want some exposure to the crypto market but can't find Kraken shares or want to diversify.

Who can invest in Kraken pre-IPO?

Typically, investment in Kraken pre-IPO is limited to accredited investors. This is due to U.S. regulations that generally limit private companies when offering securities for sale, rather than having to do with any crypto-related regulations.

Some accredited investors, such as VC funds and other institutional investors, may be able to invest in Kraken if selected to participate in primary funding rounds or strategic investment partnerships. Another route, which may be more practical for smaller but still accredited individual investors, is to potentially look at buying Kraken stock through a private stock marketplace like Forge, subject to availability.

Where to buy pre-IPO Kraken stock

While pre-IPO Kraken stock is not available to the general public, accredited investors may be able to find shares for sale through Forge's marketplace for private market trading.

Through Forge, you can access Kraken's Forge Price, which provides real-time transparency by synthesizing data from various sources, including secondary market transactions, recent funding rounds and active bids and asks on Forge. These contextual pricing insights seek to help private market investors determine whether to accept or negotiate an existing ask, or see if they would want to create a new bid for Kraken shares.

Overall bull market and strong economy could correspond with banks and investment managers seeing more revenue and profit, which could help their stock prices. Meanwhile, the same conditions that cause investors to put money into traditional assets like stocks could also increase flows toward alternative assets like crypto, thereby possibly helping Kraken's stock.

Potential indirect exposure to Kraken for non-accredited investors

Kraken is currently a private company, and as such, direct pre-IPO investment is typically limited to accredited investors. However, there are publicly available investment options that may provide exposure to broader trends in the crypto space, which could, in turn, impact companies like Kraken.

1. Publicly traded crypto exchanges

Public companies operating in the digital asset exchange space—such as Coinbase—may offer some industry-related exposure. While these companies compete in the same ecosystem as Kraken, performance may vary significantly between firms due to differing strategies, market positions, and financial conditions.

1. Cryptocurrencies and crypto-related funds

Some investors may consider investing in cryptocurrencies directly (e.g., Bitcoin, Ether, or Solana), or in crypto-focused ETFs. These assets can reflect overall sentiment and activity within the crypto markets, though they are not directly linked to Kraken’s performance. Increases in market activity may benefit many exchanges, but crypto investments carry unique risks and are highly volatile.

2. Broader financial sector investments

Investing in traditional financial services firms or diversified financial ETFs may offer exposure to firms that intersect with digital asset markets, albeit indirectly. Market-wide factors—like macroeconomic trends or increased interest in alternative assets—may influence both traditional financial services and crypto-related companies differently.

How to analyze Kraken stock

Analyzing private companies can be difficult, as they do not have to share as many financial details — if any — compared to public companies. However, Kraken does disclose a relatively significant amount of financial data that could help investors analyze Kraken stock.

For example, Kraken's most recent data from Q3 2025 shows $648 million in revenue, net of trading costs, which is a 50% gain from the previous quarter and a 114% year-over-year increase. Its adjusted EBIDTA for the quarter was $178.6 million, which is 124% more than Q2 and a significant reversal from its -$6.8 million loss a year ago.21

So, investors could take data like this and compare it to financial metrics of publicly traded companies like Coinbase to try to determine a fair valuation for Kraken. Granted, differences such as the liquidity of private and public companies can affect valuations, but this data could still enable more fundamental analysis.

Similarly, investors might compare Kraken data, including private market trading activity and funding, to similar private companies by exploring Forge's private stock marketplace.

In addition to looking at real-world market signals informing Kraken's current Forge Price, investors can discover other available investments and review market interest signals in real time. Seeing how other crypto and fintech companies are trading on Forge could help determine what seems like a fair valuation for Kraken.

Still, even with Kraken disclosing some financials, private market stocks are generally more opaque than public ones. Even with real-time pricing insights on Forge, there can be more subjectivity involved in analyzing Kraken stock, along with valuations of other private market companies.

Get started investing in Kraken on Forge

If you want to invest in Kraken pre-IPO if/when shares become available, create an account with Forge Markets to access our next-generation marketplace of private market shares.

When you create a free account, and based on your level of accreditation, you can potentially buy and sell private market shares in Kraken and other startups.

Forge aims to bring greater transparency to an otherwise opaque private market, and as a publicly traded company, it operates within a regulated environment that allows investors to explore private market access.