The cryptocurrency industry is no stranger to ups and downs, controversy, and pivots. One company that exemplifies these dynamics is Abra, a business that started as more of a traditional, retail-oriented crypto wallet and exchange,4 but which has since reinvented itself as a crypto financial services company for the institutional and high-net-worth investor market.5

This shift occurred amidst a series of legal battles, such as with the Texas State Securities Board alleging in 2023 that Abra and its founder Bill Barhydt committed securities fraud, which prompted Abra to suspend its U.S. retail business.6

Then, in 2024, Abra reached an agreement with 25 state financial regulators, including Texas, that involved repaying $82 million to customers, due to Abra operating without proper licensing. This agreement also included Barhydt being barred for five years from involvement in any money transmitter or money services business in those states.7

Abra ran into controversy again in 2025, when it paused international operations—including withdrawals—for its Abra Earn crypto yield service, though Barhydt indicated on social media that this was an issue for a small number of clients using Abra's legacy services.8

Now, the focus seems to be on building out the institutional/high-net-worth business, which included Abra creating Abra Capital Management as an SEC-registered investment advisor (RIA) in 2024.9 The company promotes its use of separately managed accounts (SMAs) to segregate client funds, and it offers services like custody, yield, and lending to wealth managers who want to offer their own clients more access to crypto.10

Amidst all these developments, Abra hasn't necessarily received as much investor attention as other venture-backed crypto companies, such as ones like Kraken or Blockchain.com, which are eyeing IPOs in 2026.11,12 Abra's last primary funding round came in 2021, when it raised around $55 million for a Series C that valued the company at about $340 million.13

While its current valuation remains unclear, especially given the change in business model, Abra’s recent strategic shift has drawn attention from some market observers.

For now, interested accredited investors may be able to buy private market shares of Abra, and retail investors may be able to gain indirect exposure to Abra pre-IPO through other assets.

Abra: Company background

Abra was founded in 2014, initially as a crypto money transfer app before transitioning into more of a full-fledged crypto investment platform.14 The company has since pivoted away from retail, billing itself as "a global platform for digital asset prime services and wealth management."15

Abra was founded by Bill Barhydt, currently the company's CEO, whose previous experience includes working at Goldman Sachs and founding another financial startup, Boom Financial, a mobile banking service.16

Abra stock and funding history

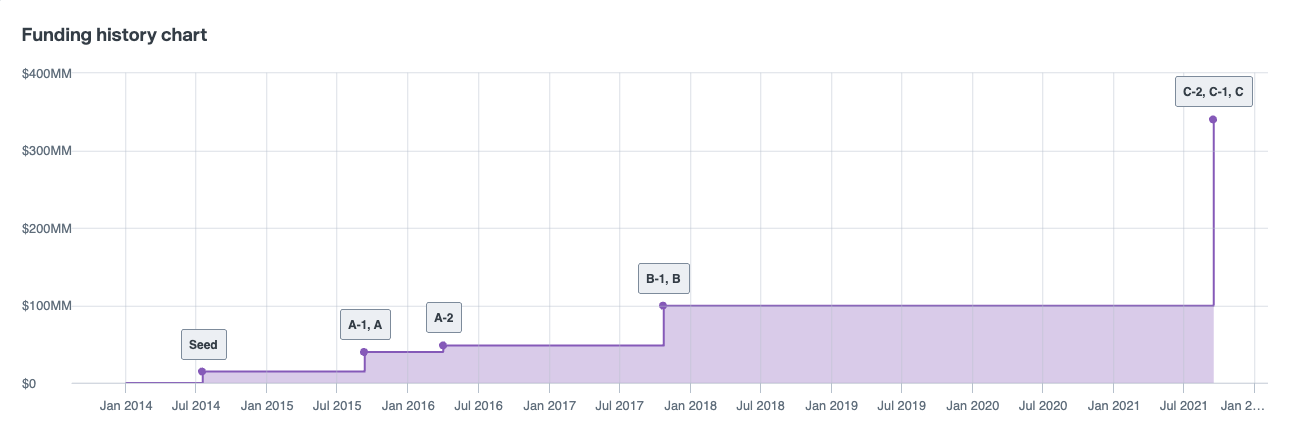

Abra has raised nearly $100 million total. Its first funding round came in July 2014, when its $2.22 million seed raise valued the company at $14.83 million, with a stock price of $0.89. This round included investors such as RRE Ventures, Mesa Ventures, and Future Perfect Ventures.17

In September 2015, Abra's Series A raised almost $13 million from Arbor Ventures, RRE Ventures, and First Round Capital, bringing the company's valuation up to about $40 million, with a stock price of $2.08.18

Less than a year later, in March 2016, its Series A-2 raised almost $6 million more from undisclosed investors, bumping up the valuation to about $48.5 million and the stock price to $2.11.19

In October 2017, the Abra Series B raised over $20 million from investors such as Foxconn Technology Group, Silver8 Capital, and Amex Ventures. This brought Abra's valuation to nearly $100 million, with a stock price of $3.44.20

Abra's most recent primary funding round came in September 2021, when it raised around $55 million from investors such as IGNIA, Blockchain Capital, and Kingsway Capital. This brought Abra's valuation to about $340 million, with a stock price as high as $7 per share (parts of the Series C included a lower stock price).21

At this time, Abra's Forge Price is unknown. Check back here or create an account with Forge for more updates.

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions on Forge.

How to buy Abra stock

Unless it conducts an IPO in the future, Abra's stock is not for sale to the general public. However, accredited investors may be able to buy Abra stock through Forge's next-generation marketplace for private market trades, subject to availability.

For indirect exposure, investors could also explore opportunities to gain exposure by buying private market shares in other types of crypto companies, crypto trading platforms Blockchain.com or Uphold.

Forge's technology and relationships helps facilitate the trading of private company shares in companies like Abra, along with other private market crypto companies.

Who can invest in Abra pre-IPO?

Investment in a non-public company like Abra is typically limited to accredited investors, due to U.S. regulations that generally restrict the offer and sale of private company securities to such investors.

Some accredited investors, such as VC funds and other institutional investors, may be able to invest in Abra if selected to participate in primary funding rounds or strategic investment partnerships. For smaller, individual accredited investors, buying Abra stock through a private stock marketplace like Forge may be an option, subject to the availability of shares.

Where to buy pre-IPO Abra stock

Although pre-IPO Abra stock is not for sale to the general public, accredited investors may be able to find shares for sale through a private marketplace such as Forge for private market trading.

Through Forge, you can typically access a private market company's Forge Price, which provides real-time transparency by synthesizing data from various sources, including secondary market transactions, recent funding rounds and active bids and asks on Forge.

These contextual pricing insights seek to help private market investors determine whether to accept or negotiate an existing ask, or see if they want to create a new bid for Abra shares. That said, Abra's Forge Price is not available at this time, but that could change if investor interest picks up.

Potential indirect exposure to Abra for non-accredited investors

As a private company for now, direct pre-IPO investment in Abra is typically limited to accredited investors. However, there are publicly available investment options that may provide exposure to broader trends in the crypto space, which could, in turn, impact companies like Abra.

Some examples include:

1. Publicly traded Crypto exchanges

Public companies operating in the digital asset exchange space—such as Coinbase, eToro, and Gemini—may offer some industry-related exposure. While these companies provide more of a retail focus than Abra, they have varying degrees of emphasis on the corporate/institutional market too, which might provide more correlation with Abra. Still, performance may vary significantly between firms, due to differing strategies, market positions, and financial conditions.

2. Cryptocurrencies and crypto-related funds

Investing directly in cryptocurrencies, such as Bitcoin, Ether, or Solana, could also be an option for retail investors. Similarly, investors may be able to invest in crypto-focused ETFs, such as those tracking the price of Bitcoin. These assets can reflect overall sentiment and activity within the crypto markets, though they are not directly linked to Abra's performance. Still, there can be overlap, as increases in crypto market activity may benefit the broader market for crypto-related services, but crypto investments carry unique risks and are highly volatile.

3. Broader financial sector investments

While not quite the same as investing in crypto or crypto companies, making broader financial sector investments could still provide indirect exposure to Abra. For example, investors might buy stock in traditional publicly traded financial services firms that are starting to partner with crypto companies or offer related digital asset services, or they might allocate to diversified financial ETFs.

Note, however, that market-wide factors—like macroeconomic trends or increased interest in alternative assets—may influence both traditional financial services and crypto-related companies differently.

How to analyze Abra stock

Private companies generally do not face the same disclosure requirements as public companies, which typically makes analyzing private market stocks more challenging, especially for companies like Abra that share limited financial details.

This analysis can be particularly difficult given Abra's pivot from retail to institutional too, as there's less history to draw from.

Still, Abra publishes some headline numbers on its website, like stating it has $484 million in AUM as of September 30, 2025.22

Investors might use this type of data to compare Abra to other types of crypto or broader companies. Funding data can also provide some insights, although Abra's lack of primary funding rounds since 2021 provides limitations. Still, investors might compare what they can find on Abra to similar private companies listed on Forge's private stock marketplace, as well as how it stacks up against public market crypto and financial services companies.

Still, even when looking at what financial information is available for Abra, private market stocks are generally more opaque than public market ones. So, analyzing Abra stock, along with the valuations of other private market companies, can be highly subjective.

Get started investing in Abra on Forge

If you're interested in investing in Abra before a potential IPO and shares become available, you can open a free Forge account to explore one of the most established marketplaces for private company securities.

Once your account is active and your accreditation is verified, you may gain access to real-time private market data, context-rich insights and a platform built for self-directed investors.

Not sure where to begin? Start with our buyer’s guide to investing in private market shares. And if questions come up along the way, Forge’s experienced specialists are available to support you.