The private market’s infatuation with FinTech

FinTech powers our increasingly borderless, cashless and efficient world. As FinTech investing became an increasingly important part of an average investor’s portfolio over the past 5 years, capital flowed heavily into both public and private companies in the sector. Public FinTech companies like PayPal and Upstart saw their stock prices soar in recent years, while private companies such as BlockFi and Opensea were still able to raise large funding rounds at notable valuation step-ups the first half of 2022 even as the broader markets started to turn.

But after the turn of 2022, the sector’s performance is now more in line with the broader market. Block, Coinbase, and Affirm all had notable contractions in the public market while Klarna, Stripe, and others cut valuations on the private side.

To take a closer look at how FinTech performed in the private market, we use Forge Data to explore bid/ask pricing metrics via Indications of Interest (IOIs) on Forge’s trading platform. The IOI dataset enables investors to view real-time private market sentiment and pricing indications by aggregating data points across buyers and sellers on the Forge platform.

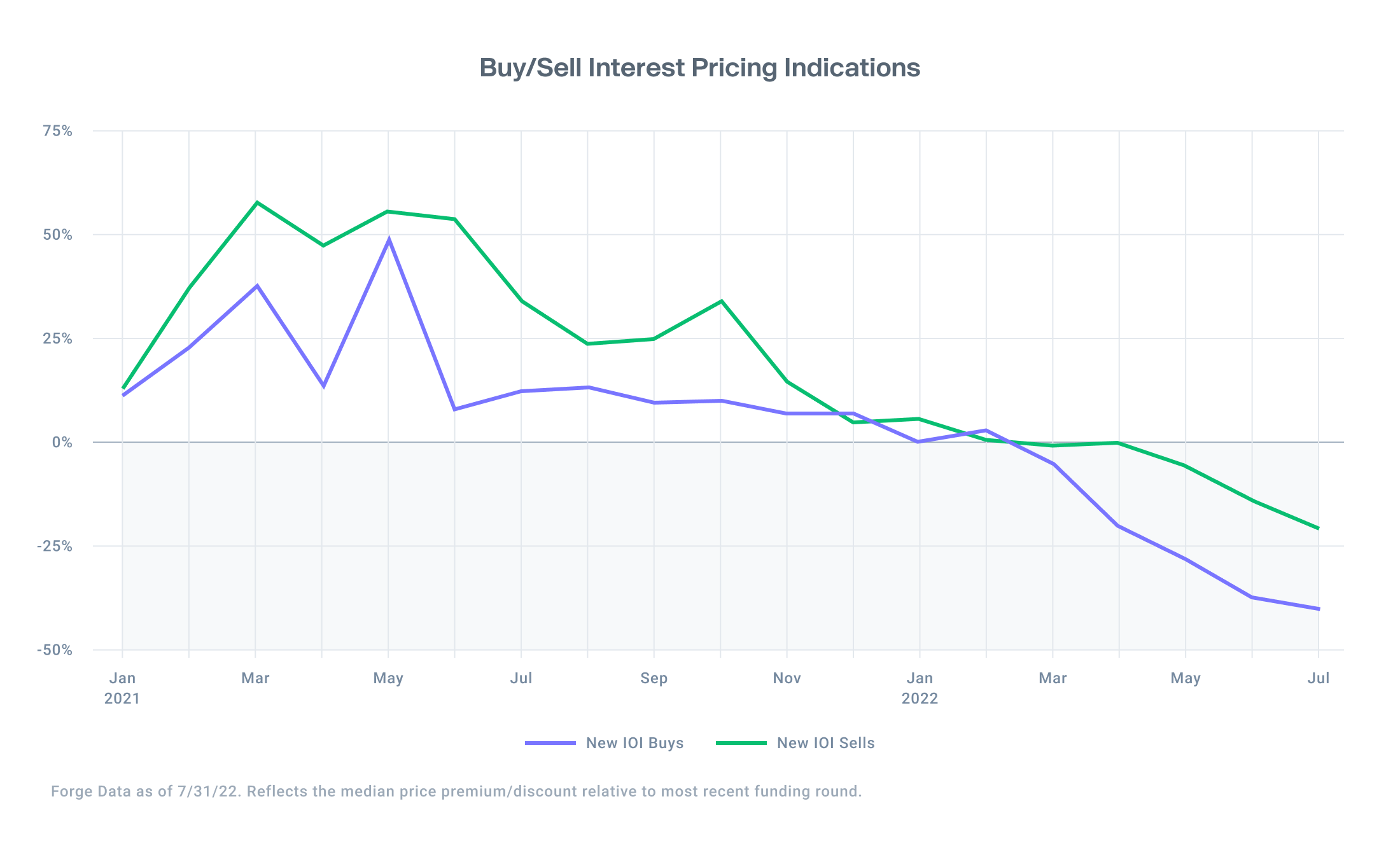

The shift in market sentiment across the board

Looking across all new IOIs submitted on Forge marketplace in Q2, both bid and ask prices dropped below previous primary funding round marks. These prices stand in contrast to those observed in 2021, where both bids and asks were at a premium relative to the last funding round.

It is also worth noting that the recent trend indicates a sharper and more pronounced drop in bid prices – which we believe suggests that buyers are more aggressive in adjusting their price expectations in the current environment.

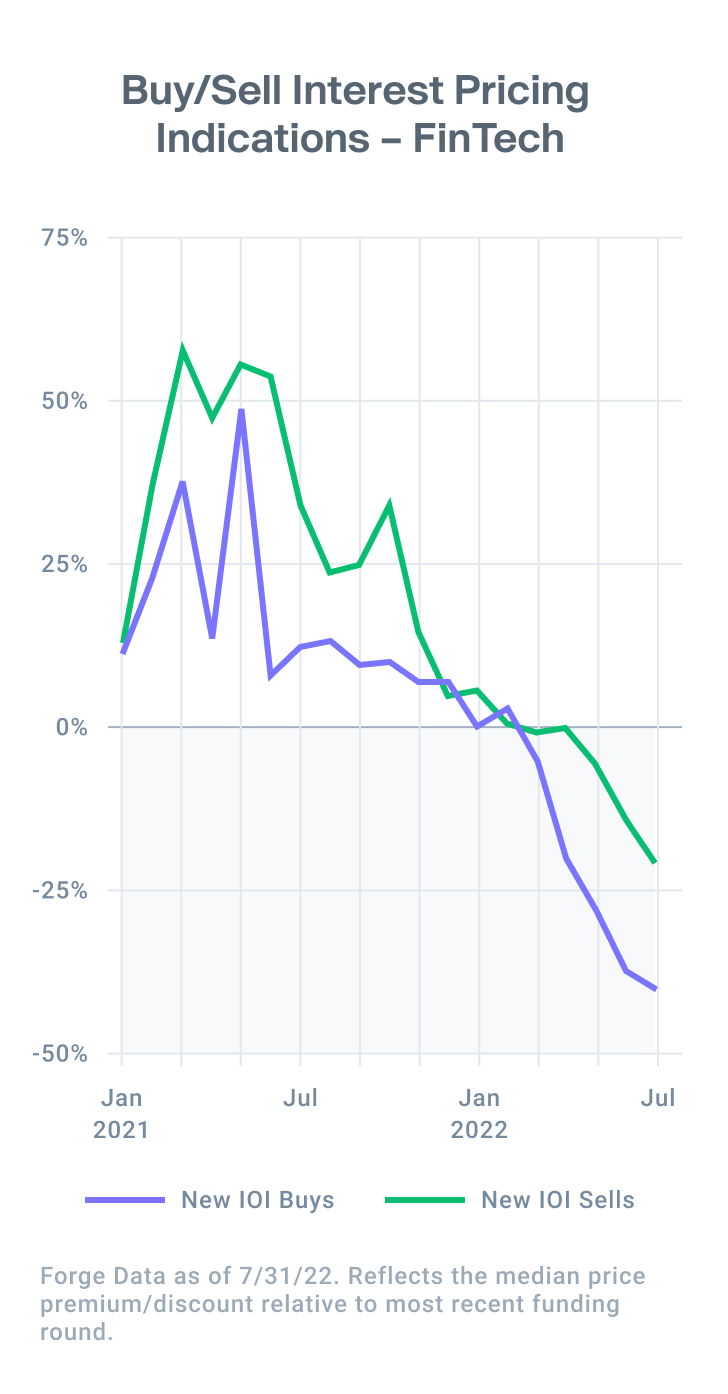

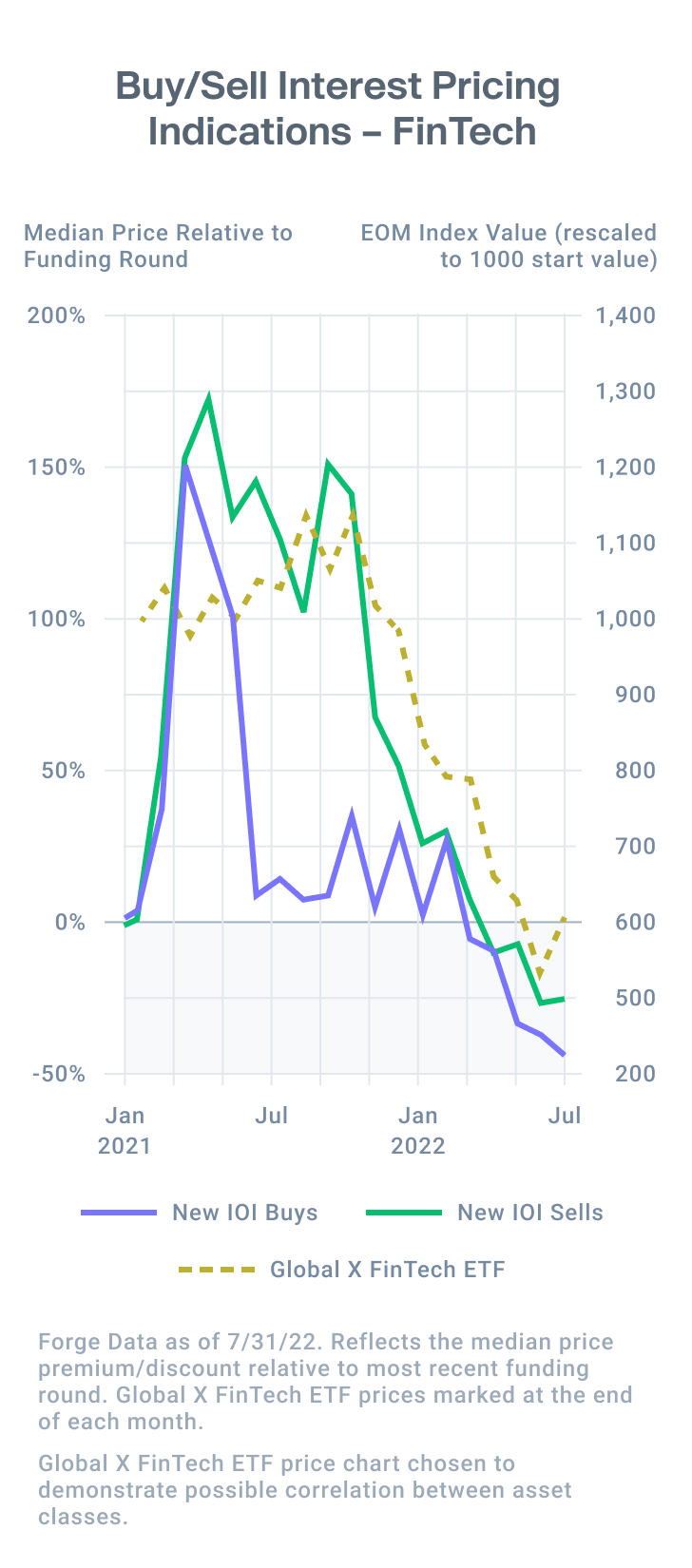

A closer look at the FinTech sector

In early 2021, bid and ask prices within the FinTech sector skyrocketed. In March 2021, bids and asks were aligned at 150% premium to last primary round. Said a different way, both buyers and sellers were willing to transact in FinTech names at prices that were 150% greater than the valuation at which companies last raised primary capital.

Although the sharp fall in bids by mid-2021 was a preview of things to come, ask prices remained highly elevated. By June 2021, bids stood only 10% above the previous funding round, while asks remained at an average of 146% premium. Ask prices finally started to come down in late 2021 to better align with buyer expectations.

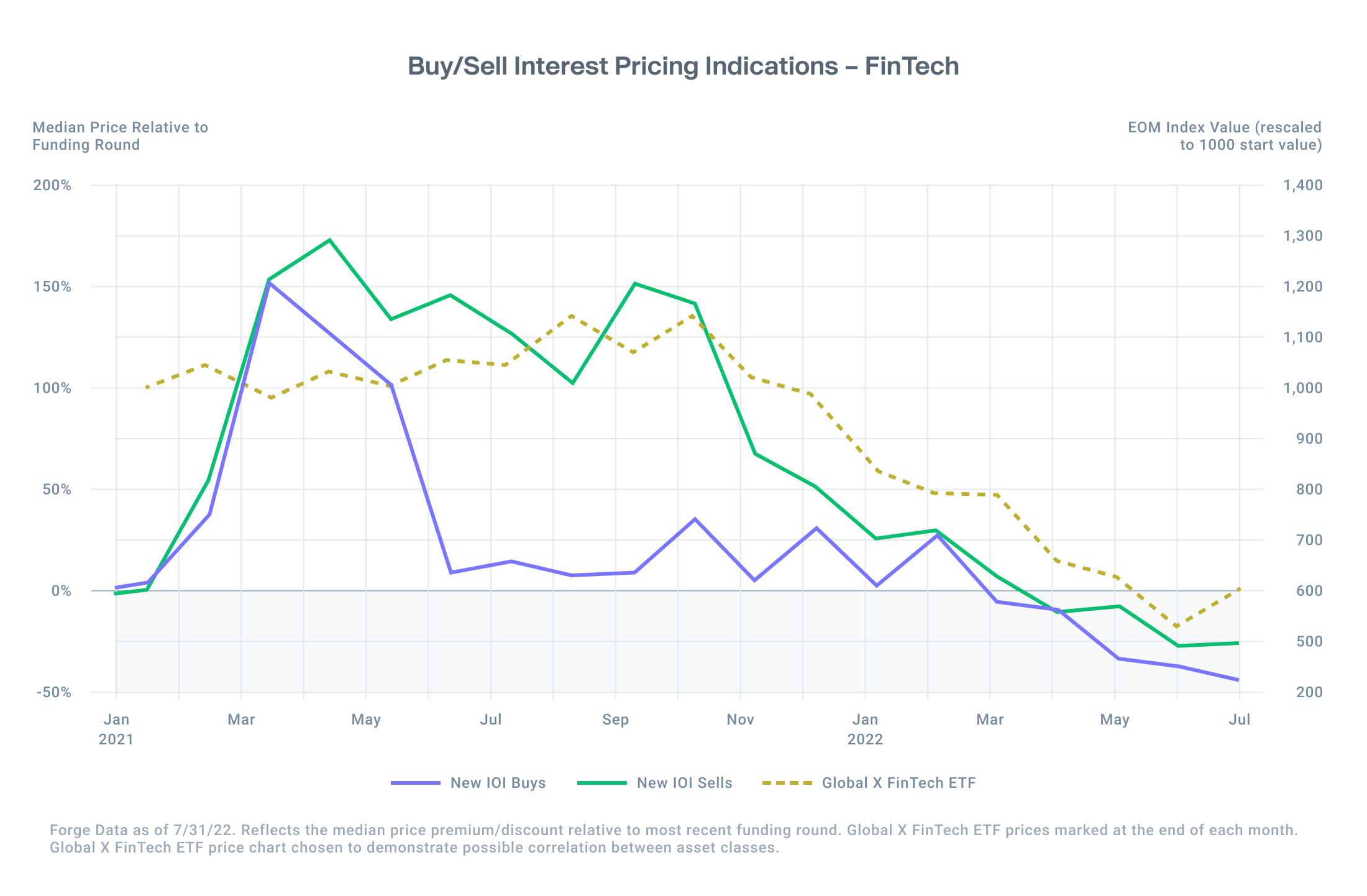

While there is generally a lag between public and private prices, indicators such as IOIs are often timelier in reflecting market sentiments and facilitating faster price discovery. We can see that in the relationship between the performance of FINX (Global X FinTech ETF) and the IOI trend of the private companies tracked by the Forge FinTech sector.

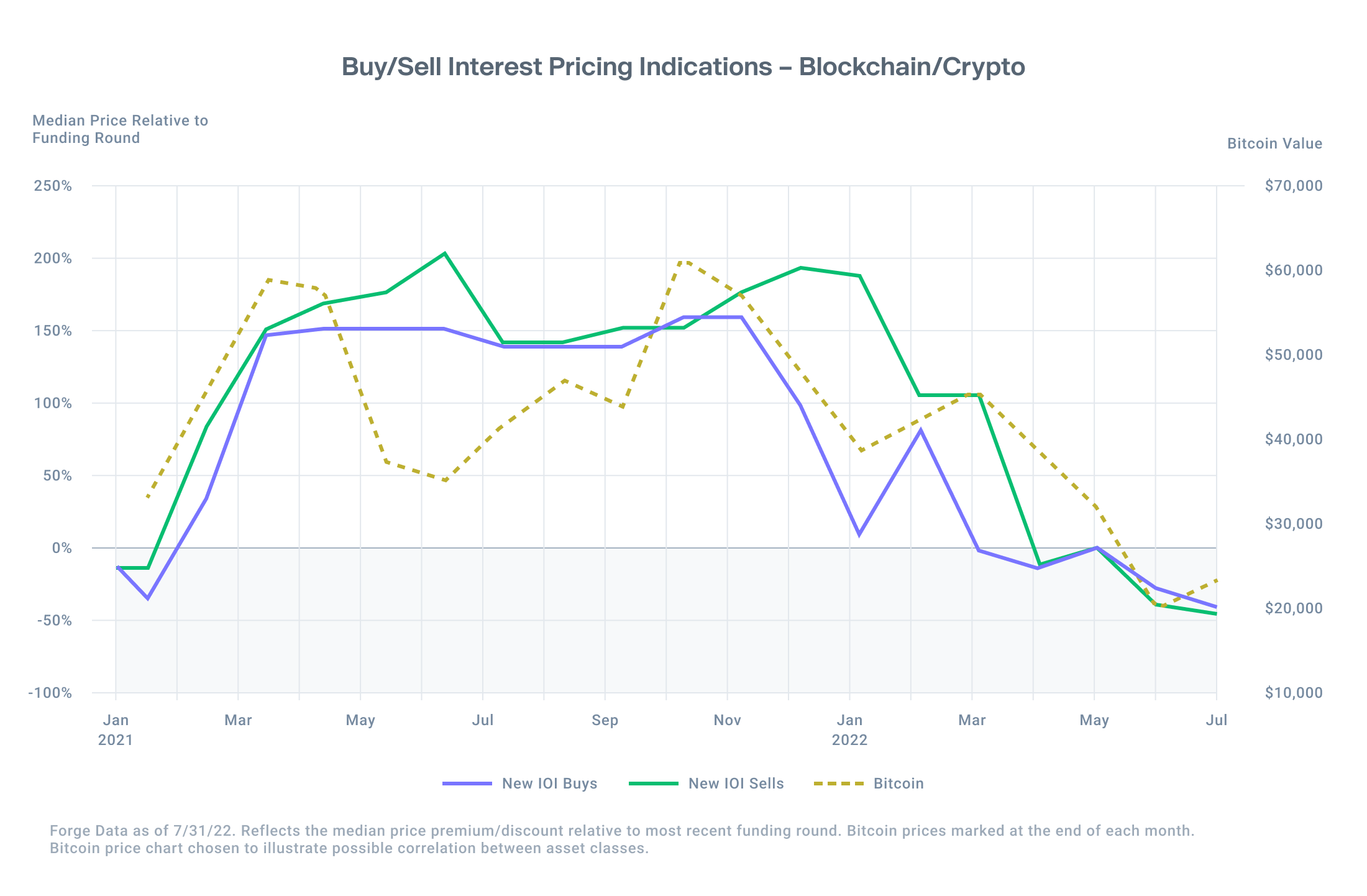

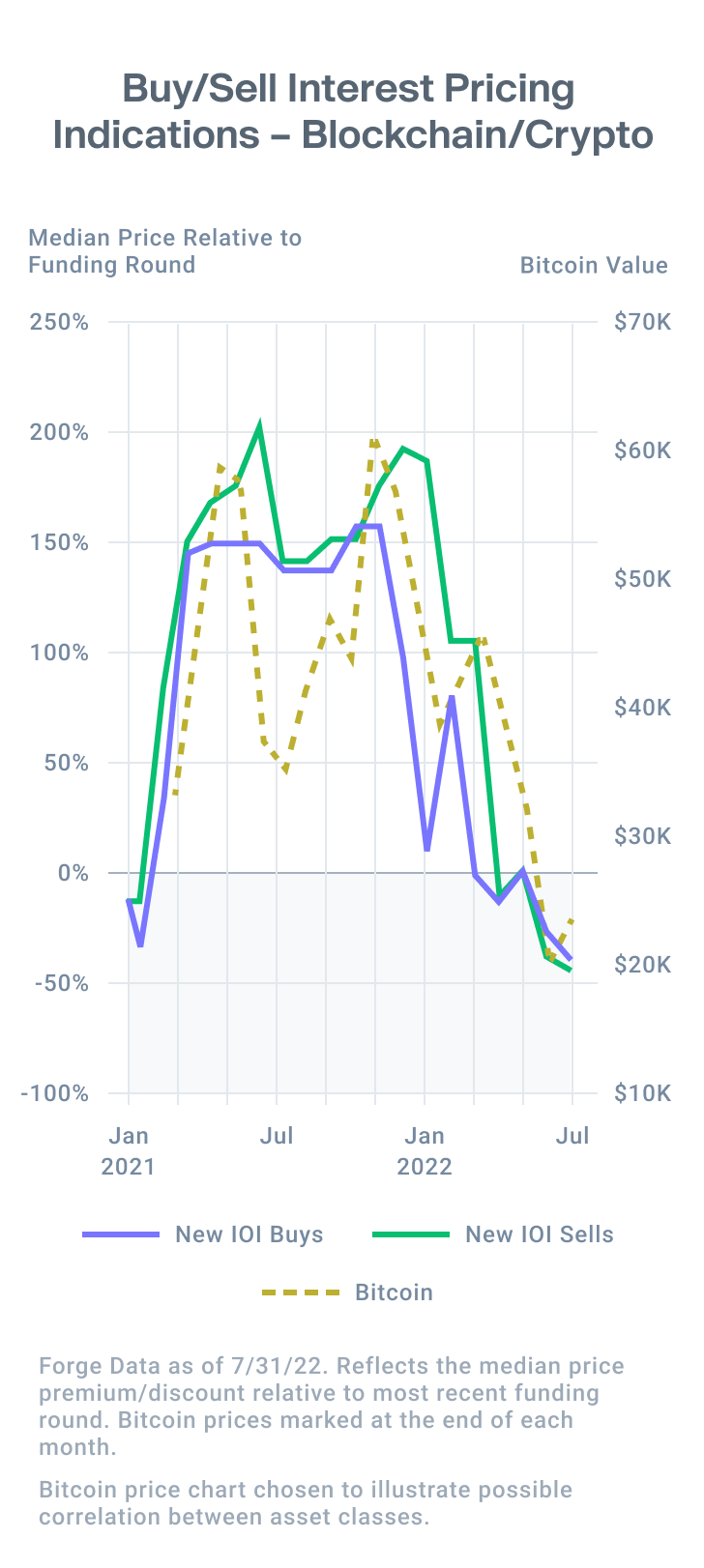

The Crypto Effect

Market sentiment for the FinTech sector peaked in early 2021, led by companies such as Kraken and ConsenSys. The trend reversed in late 2021, following the trendline of Bitcoin (BTC). Bids and asks both now sit roughly -45% below primary funding rounds.

Wrap up

FinTech companies are an important part of the innovation economy. They have attracted significant interest and capital from both public and private investors. But not all FinTech companies are created equal, as seen in the recent public market sell-off, where crypto and buy-now-pay-later names were sold off more than others in the cohort. We see the same trend in private fintech companies covered by Forge Data, with interest in the Payments and Blockchain/Crypto subsectors greater over the past 6 months than in others; and bid pricing holding up better in Personal Finance, as reflected by investor buy/sell interest on the trading platform.