While generative AI can create a limerick in the style of Shakespeare or an image of a cat on Mars, most businesses and investors aren't focused on these quirky applications of the technology. Instead, they want to see down-to-Earth ways that AI can improve operational efficiency to cut costs, generate sales ideas to grow revenue, improve compliance reporting, and other clear business benefits.

One company that's been riding the AI wave, while rooted in practical applications like the aforementioned, is Databricks.

Yet rather than offering AI analytics tools, Databricks more so provides the foundation for organizations to store, manage, and assess their data, including by building, testing, and deploying AI models within the software.

Thanks largely to AI demand, Databricks has seen over 50% year-over-year growth and crossed $4 billion in revenue run-rate in Q2 2025. The company also reached positive free cash flow over the past year.3

Amidst this growth, Databricks has raised huge funding rounds, including its Series K in September 2025, which raised $1.13 billion at a $100 billion valuation.4 It also raised over $10 billion for its Series J at the end of 2024, funding investment in building out AI capabilities, along with providing liquidity to current and former employees.5

With employees having some liquidity pathways, many investors are interested in buying Databricks shares pre-IPO. While most pre-IPO investing is limited to accredited investors, retail investors may also be able to gain some exposure to Databricks.

Here, we'll take a closer look at how to invest in Databricks stock pre-IPO.

Databricks: Company background

Databricks, based in San Francisco, started in 2013 with a platform built on top of Apache Spark, with the goal of making it easier and faster to analyze Big Data. Most of the company's seven co-founders have backgrounds as the original architects of Apache Spark, along with pioneering the lakehouse architecture that Databricks is known for, which combines elements of data lakes and data warehouses.6

Today, the company has expanded its focus to also include more unified areas of data management and analytics, such as by offering data storage solutions and making it accessible for users to develop and run AI models within the platform.7

Early investors included Andreessen Horowitz, which led its Series A, followed by others such as New Enterprise Associates, Australia Future Fund, In-Q-Tel, and Sinewave Ventures. Later, large asset managers such as T. Rowe Price and Morgan Stanley joined in, along with tech companies such as Microsoft, Amazon Web Services, and Nvidia, and other major investors like Ontario Teachers' Pension Plan.8

Databricks has also made some notable acquisitions in recent years, including buying MosaicML in 2023 to help expand generative AI access,9 as well as buying data management company Tabular in 2024, in a move that seemingly preempted rival Snowflake from acquiring that business.10

Databricks stock and funding history

Databricks has had 11 primary funding rounds, starting with its Series A in 2013, raising $14 million at a price per share of $0.26. The round, led by Andreessen Horowitz, valued Databricks at $48.68 million.11

In 2014, its stock price more than quadrupled to $1.12, in a Series B led by New Enterprise Associates.12 That round raised around $34 million at a valuation of around $250 million.13

In 2016, the Databricks Series C took the stock price to $1.97,14 with the round again led by New Enterprise Associates,15 followed by a Series D led by Andreessen Horowitz in 2017 that brought the stock price to $2.79,16 implying a valuation of nearly $1 billion.17

In 2019, Databricks' stock price more than doubled to $7.10,18 with this Series E round again led by Andreessen Horowitz but also including investors such as Microsoft and Coatue Management.19 Later that year, the company's stock price again more than doubled to $14.32 with a Series F,20 once more led by Andreessen Horowitz but also bringing in large asset managers such as BlackRock, T. Rowe Price, and Tiger Global Management.21

The company then took a huge leap forward by raising over $1 billion for its Series G in 2021, led by Franklin Templeton,22 valuing Databricks at $28 billion and a $59.12 stock price.23 Later that year, the Databricks Series H raised $1.63 billion, bringing the stock price to $73.4824 in a round led by Morgan Stanley's Counterpoint Global.25

In 2023, Databricks raised nearly $685 million for its Series I, and while the valuation climbed to over $43 billion, the Databricks stock price stayed almost the same at $73.50.26

Lastly, Databricks' most recent round, its Series J, has not officially closed, but the company says it is oversubscribed27 and will raise around $10 billion at a stock price of $92.50, implying approximately a $62 billion valuation.28

How to buy Databricks stock

Since Databricks has decided to remain a private company for now, stock is relatively limited, though accredited investors may be able to access pre-IPO shares through a secondary marketplace such as Forge.

Databricks' most recent funding round is meant in part to provide liquidity to employees, so in some sense that could reduce instances of current or former employees selling shares within a private marketplace. However, if there's enough demand for Databricks pre-IPO stock through private marketplaces, it's possible that Databricks decides to let employees cash out that way, while using more of the Series J funding for internal investment in areas like AI development.

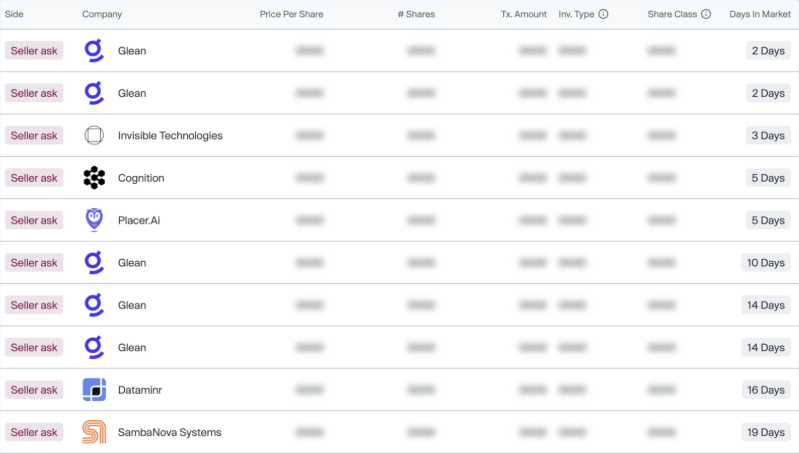

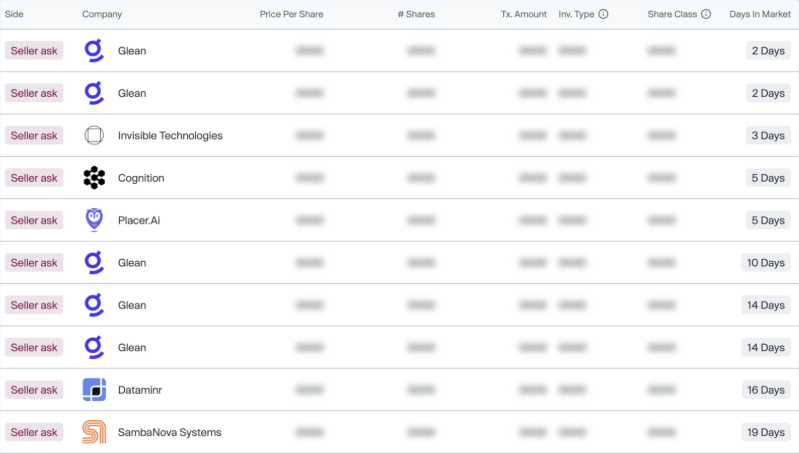

Interested investors might also look at other related private companies that could have shares available on a private marketplace like Forge.

For example, SambaNova Systems provides a holistic AI platform across hardware, software, and AI models, which could be somewhat complementary to Databricks' business. Another popular AI unicorn is Dataminr, which focuses on risk detection. While it doesn't exactly have a ton of direct overlap with Databricks, there could be some competition in terms of whether companies want to buy Dataminr's system vs. build their own tools via Databricks.

Investors also might consider SandboxAQ, which uses large quantitative models (LQMs) instead of LLMs to try to tackle problems in scientific contexts like healthcare and cybersecurity. So, there could be some competition in terms of companies using LLMs via Databricks or SandboxAQ's LQMs.

DataRobot is another popular AI platform offering more of an off-the-shelf solution for running predictive models, whereas Databricks is generally more customizable and flexible. Lastly, shares of a company like ThoughtSpot, an AI-powered business intelligence tool with a similar buy-versus-build dynamic to Databricks, may appeal to investors seeking exposure to that segment.

Registered investors with a verified profile may also explore Forge’s active opportunities for companies similar to Databricks in the Data Intelligence sector.

Image displayed reflects sample of active opportunities available on Forge marketplace as of 1/7/2026. Actual securities or bid/ask volume may vary at any time. Listed bids/asks are non-binding.

Who can invest in Databricks pre-IPO?

As with any private company, investment in Databricks is generally limited to institutional investors or high-net-worth individuals who are invited to participate in the company's primary funding rounds. Accredited investors might also be able to find Databricks shares for sale on a secondary marketplace such as Forge, but that is contingent on existing shareholders choosing/being able to list their Databricks stock for sale.

That said, Databricks' intention to eventually go public means that more investors, not just accredited ones, will likely be able to invest in Databricks in the future, just not necessarily in the pre-IPO stage.

Where to buy pre-IPO Databricks stock

Accredited investors may be able to buy pre-IPO Databricks stock through a secondary marketplace such as Forge, subject to availability. Existing shareholders would need to decide to list their shares for sale on the marketplace in order for accredited investors to then buy Databricks pre-IPO shares, so availability may be limited or not be available at all.

Those who are interested in investing in Databricks pre-IPO may wish to create an account with Forge and speak with a Private Market Specialist to stay informed about whether Databricks shares become available through Forge.

Alternatives for unaccredited investors who want to buy Databricks stock

While retail investors may not be able to buy Databricks stock directly the way that accredited investors might, it's possible to still get some exposure to Databricks or similar companies through other publicly traded stocks and funds.

For example, the Fidelity Select Technology Portfolio mutual fund holds an allocation to Databricks stock from three different primary funding rounds. However, only about 0.1% of the mutual fund's assets are invested in Databricks, so this exposure is small.29

That said, this fund holds many other AI names, including some other private companies like CoreWeave and Anthropic, so if you have conviction in the broader space, you might invest in this or similar retail funds.

Many tech ETFs or mutual funds, including this Fidelity fund, also hold large allocations of Nvidia, Microsoft, and Amazon stock. Considering that these tech companies are also investors in Databricks, then you might decide to invest in these types of tech funds in order to potentially benefit from the same AI wave. Or, you might invest directly in companies like Nvidia, Microsoft, or Amazon, considering these are all publicly traded companies.

Still, that only provides partial exposure to Databricks. Another option is to invest in Databricks main competitor, Snowflake30, which is publicly traded. In some sense, this provides more comparable exposure to Databricks if you're trying to bet on a sector trend, but at the same time, it's possible that Snowflake's stock performance lags or leads Databricks' performance based on whether one takes market share from the other, or similar business issues develop.

How to analyze Databricks stock

Because private companies do not disclose their financials in the same way that public companies do, stock analysis can be more difficult for the average investor. Still, investors might use the information that is public, such as Databricks' projected $3 billion annual revenue run-rate for 2025, and see how its valuation multiple compares to similar private tech companies using Forge Data.

You can also consider Databricks' past growth and future potential to assess whether it's trading at what you consider to be a fair price compared to other private companies on Forge, though this method of analysis can be highly subjective.

Public company competitors such as Snowflake or Cloudera might also provide somewhat of a benchmark, but again, private company data is much more limited, so it's hard to say for sure how to value Databricks. Plus, investment in any private company typically carries additional risk compared to publicly traded companies, due to limited liquidity, so that risk arguably needs to be accounted for in the valuation.

Get started investing in Databricks on Forge

If you want to invest in Databricks pre-IPO if/when shares become available, create an account with Forge marketplace to access our deep marketplace of private market securities.

When you create a free account, you'll be connected with a Forge Private Market Specialist to determine your eligibility, and from there you can potentially buy and sell private market shares in Databricks and other startups.

Forge stands out for its transparency into what can otherwise be an opaque private market, and as a publicly traded company itself, Forge provides a regulated, proven way to invest in the private market.