The private market reached a new milestone this month, and it didn’t take a funding round to get there. To paraphrase Justin Timberlake's take on Sean Parker from the Social Network, “A billion dollars isn’t cool. You know what’s cool? A trillion dollars.”

Integrate Forge Data into your workflow

Web application

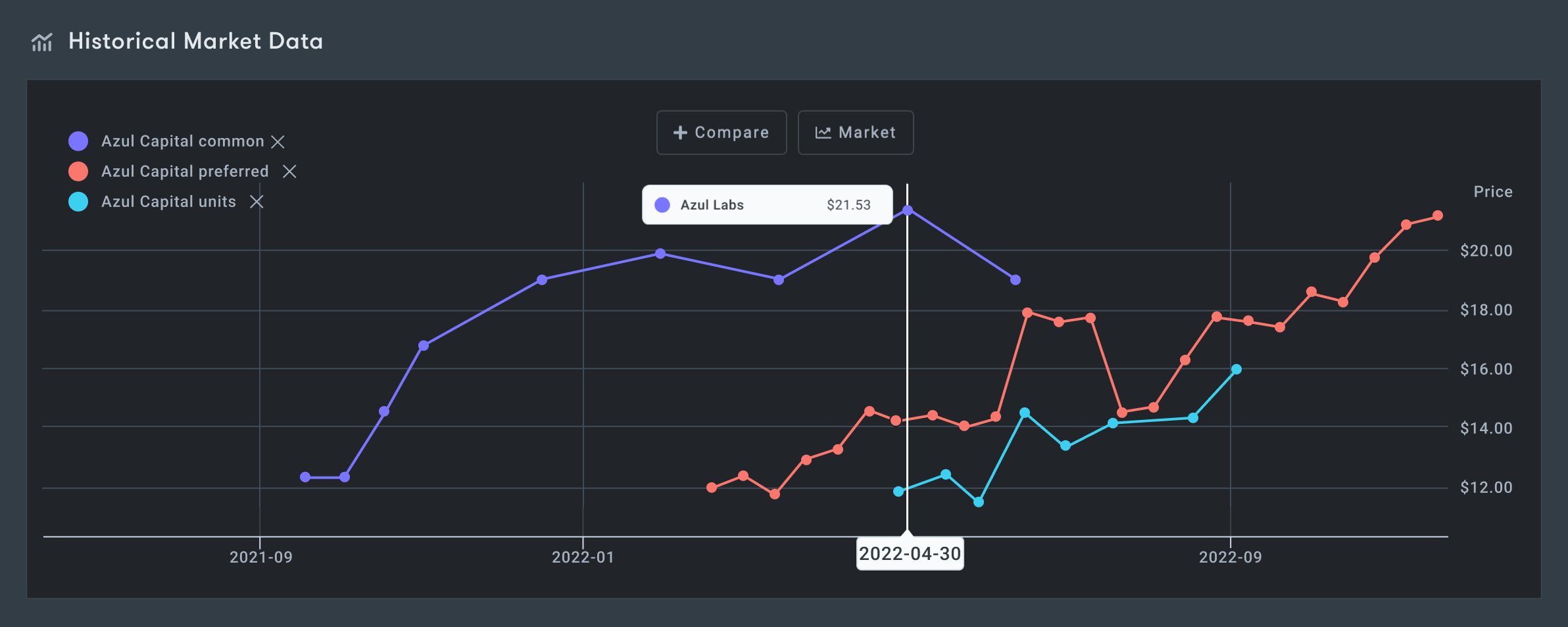

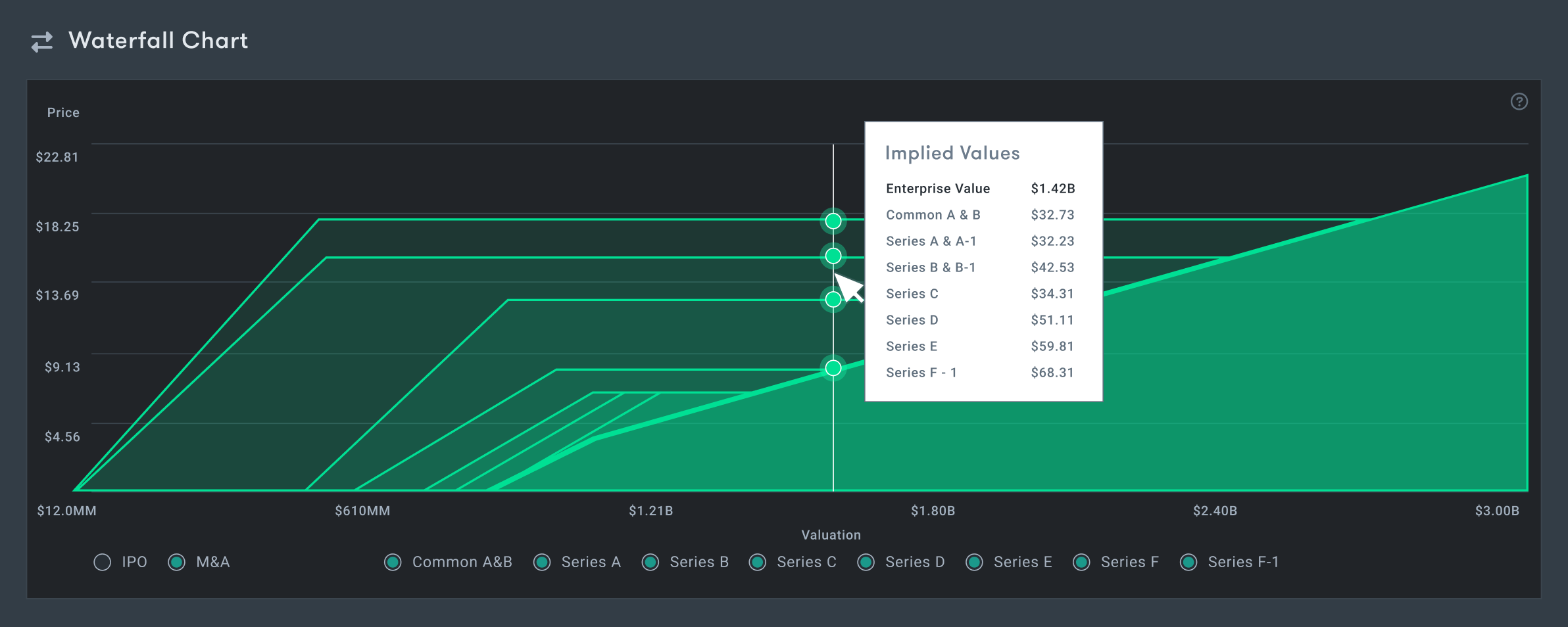

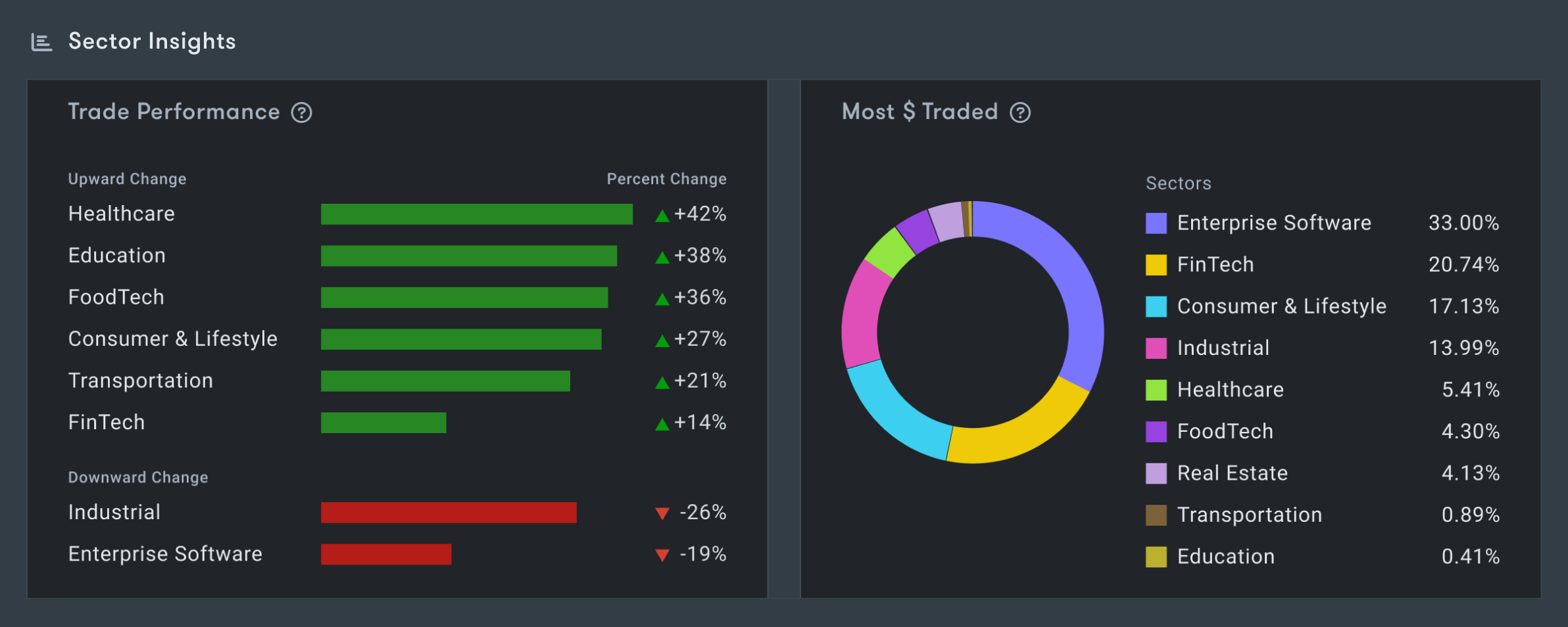

Forge Intelligence is an interactive web-based application that visualizes trading activity in the private market and provides investors with a detailed view into private market activity.

API

Investors and financial institutions can integrate the Forge Data API – with same-day trade pricing, indications of interest, valuations, and more – into their existing investment, portfolio management, and risk analysis tools.

File based

Forge Data is also available in a file-based format for investors and financial institutions seeking to integrate within their existing investment processes and systems.

Recency, accuracy, and innovation