- According to Forge Data, quarter-over-quarter data shows reduction in private market trade prices

- Private companies continue to trade at valuation premium to last primary financing round

- Sell-side inventory on Forge platform at record high, but sectors showing reasonable balance between bids and asks

We often write about how the line is blurring between public and private markets. Both markets are feeling the effects of inflation, rising interest rates, and geopolitical events, as investors chart a new course forward in a rapidly changing economic environment.

While publicly company technology stocks have been among the hardest hit in the recent market drawdown, new data from Forge shows that private company technology stocks have done a slightly better job of retaining their value over the last two quarters.

Investors are searching every corner of the market to find ways to deploy capital to seek growth. Increasingly, the private market offers some key advantages over public markets that have more investors sitting up and taking notice.

Early Access to Value Creation: As companies stay private longer, it’s increasingly possible that a company develops most of its value for investors before it ever lists on a public exchange.

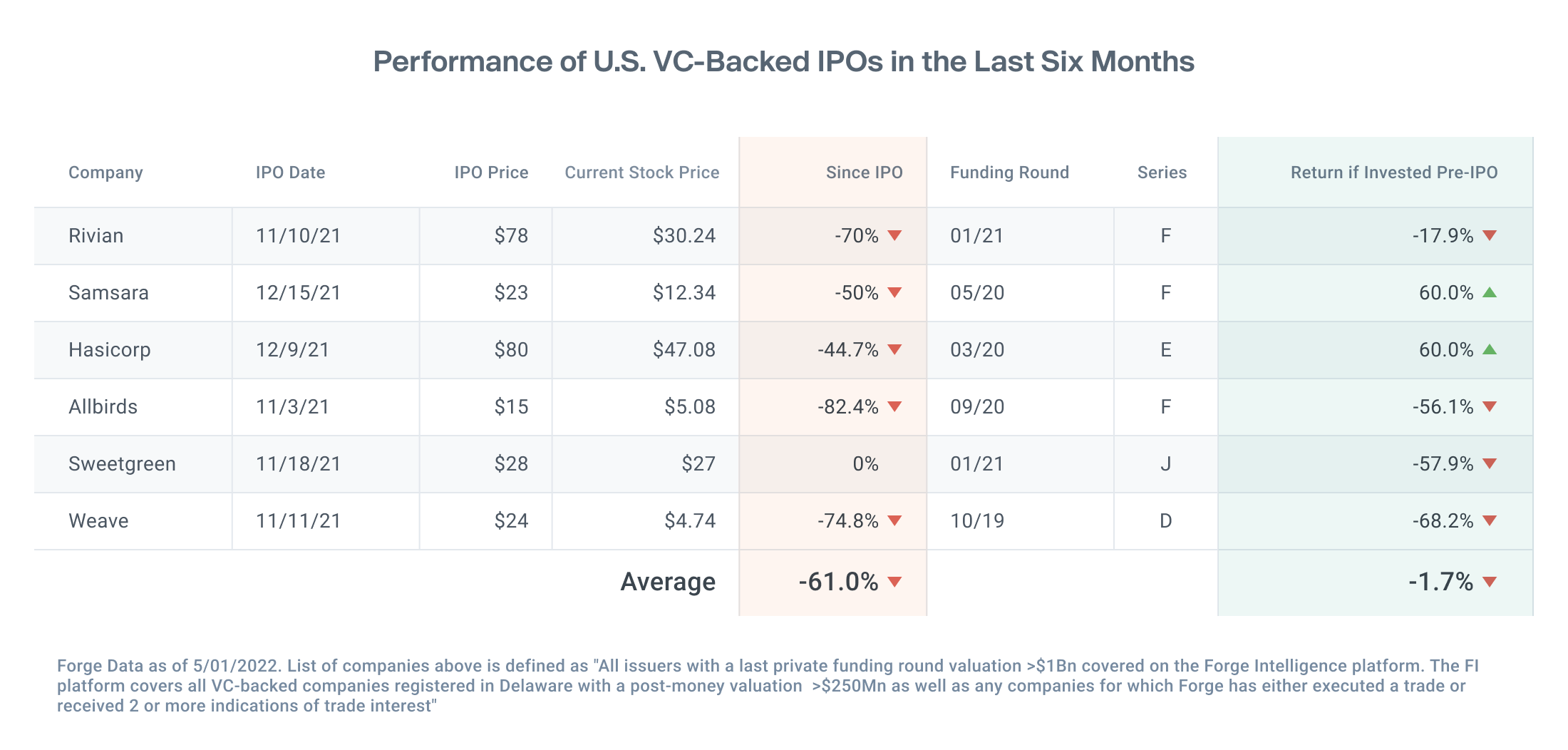

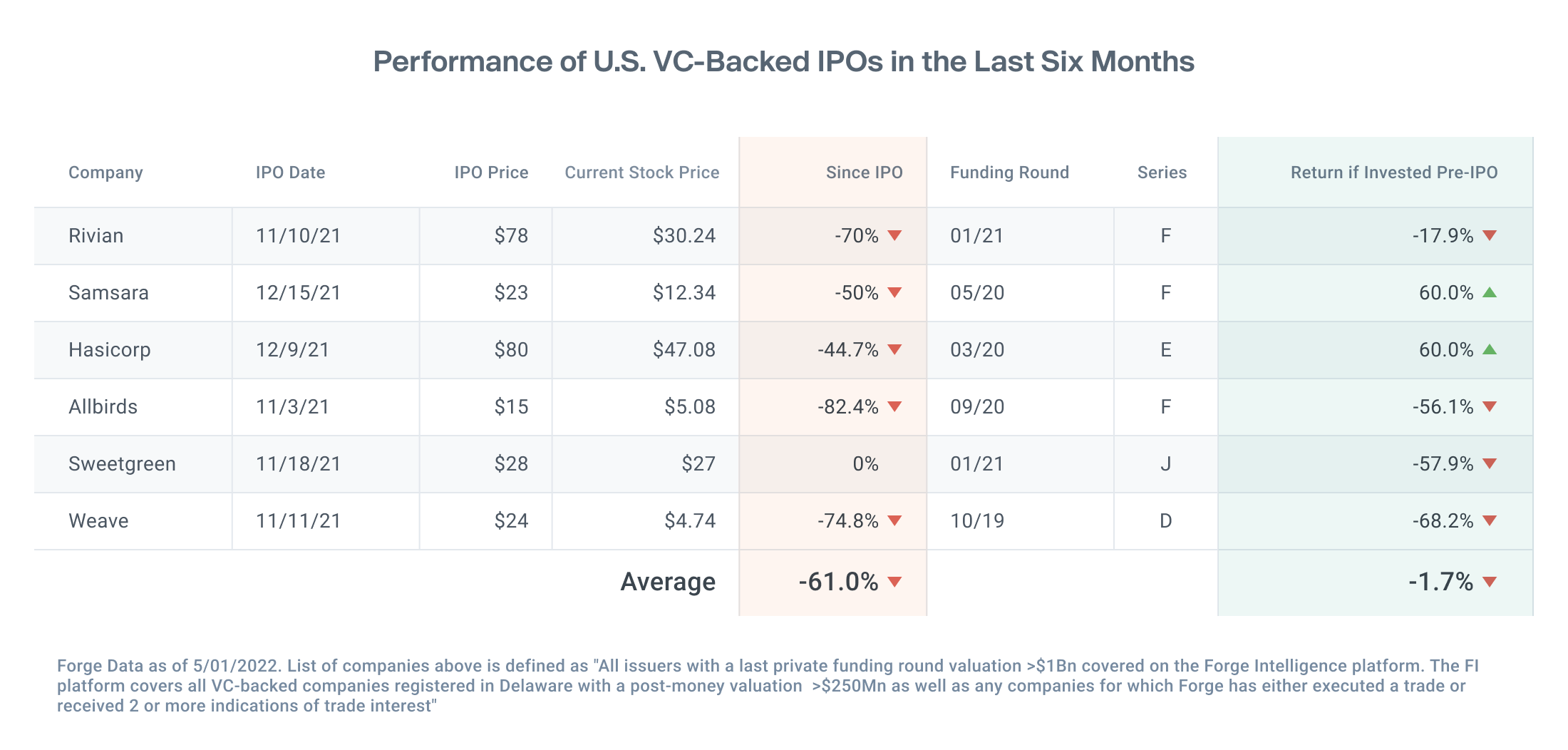

Pre-IPO Returns Remain Promising: Private companies remain strong potential value creation vehicles. A recent Forge analysis of 2021 IPOs shows that investors who participated in early financing rounds tend to show positive returns on their investments even despite the current public market drawdown. 1

Benefits of Less Frequent Trading: The private market lacks much of the intra-day volatility of the public market, potentially creating a use case for investors to deploy growth-seeking capital without the pressures of public market price fluctuations.

Institutional investors are increasingly paying attention. A recent study from Oliver Wyman and Morgan Stanley estimates that private market funds will total approximately $13 trillion in assets under management by 2025. New research from State Street also affirms this view, estimating that asset managers and asset owners are planning to increase their allocation to private assets in the next three to five years. While many of these investors focus on “traditional” private assets like private equity, private credit, and infrastructure, at Forge we believe private stock is on its way to taking its place alongside these commonly accepted alternative assets.

What is one thing holding back growth of private assets according to State Street? A lack of “timely and accurate quantitative data for investors.” 2 Forge aims to help investors increase their comfort level with the private markets through Forge Data, our Private Market Updates, and our commitment to transparency in the private markets.

With that, let’s dive into this month’s report.

Private Market Trade Prices Drag Down Valuation Premiums

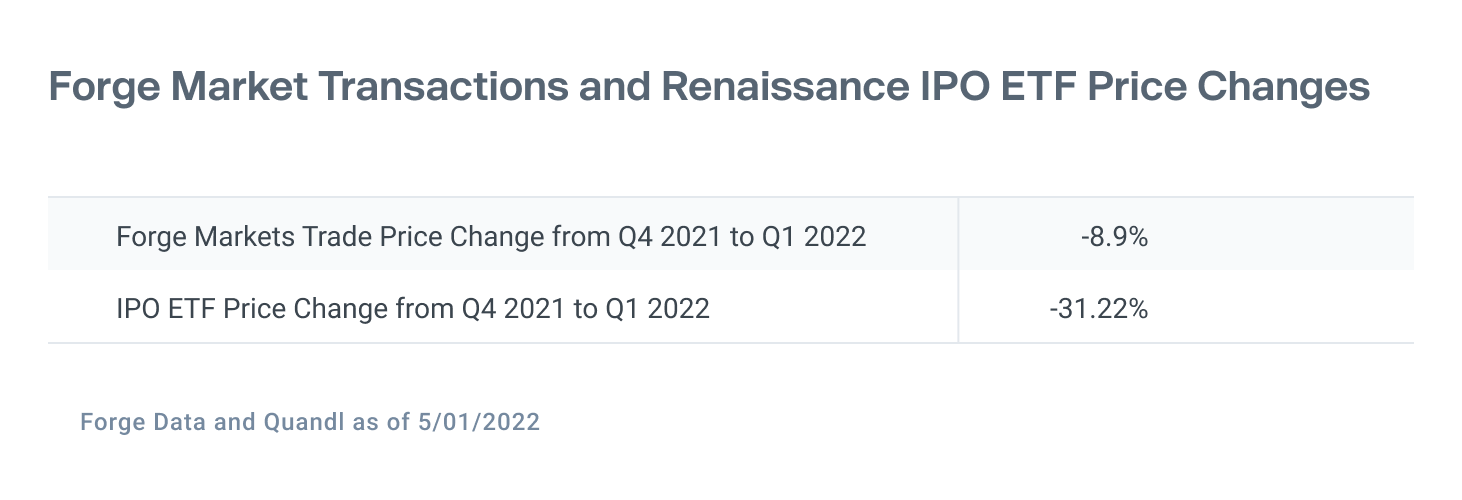

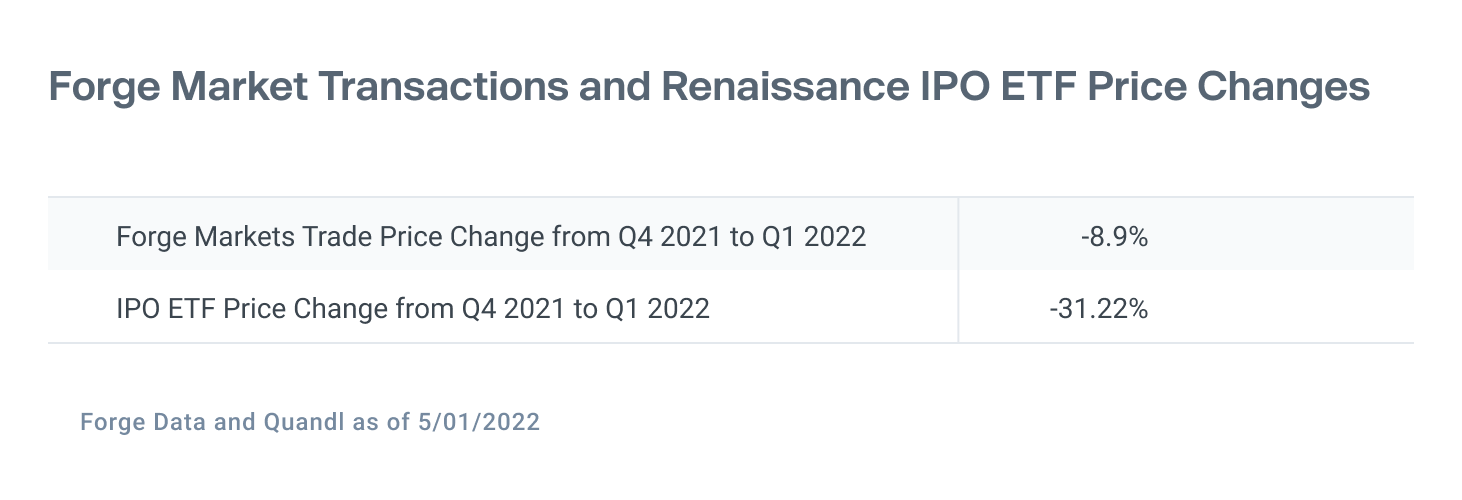

Volatility began to set into the public market in late Q4 2021 and accelerated in Q1 2022. Forge saw an 8.9% decline in prices of private companies that traded on the Forge Markets platform from Q4 2021 to Q1 2022. 3 In contrast, the Renaissance IPO ETF lost roughly 31% over the same time period. 4

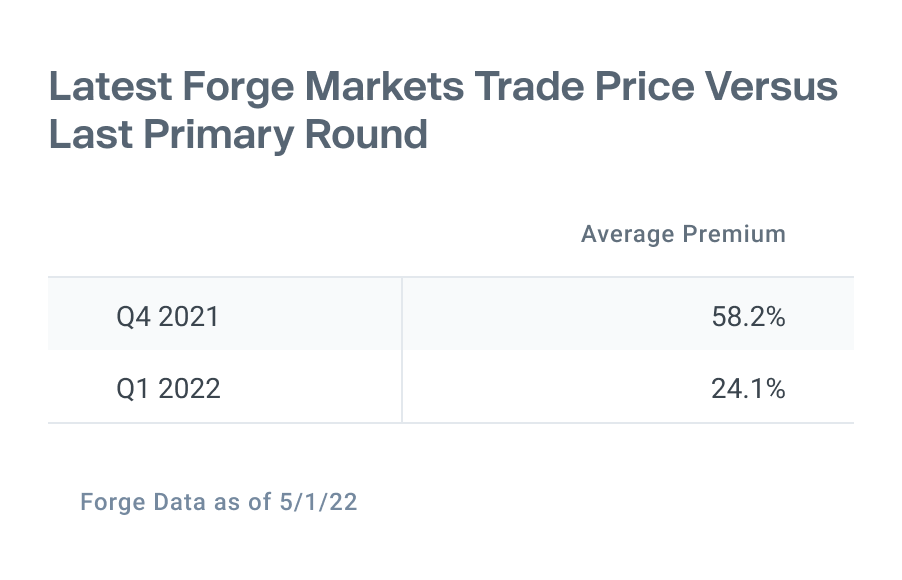

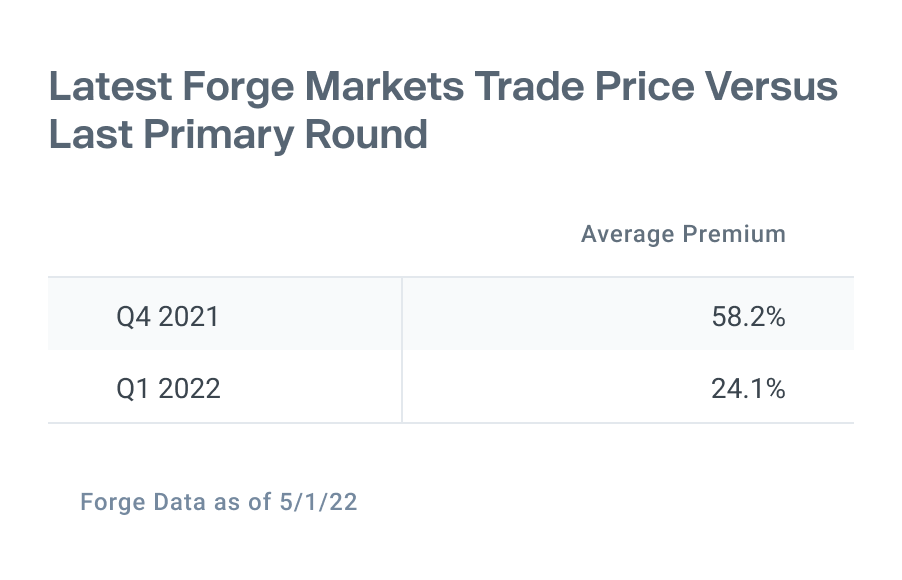

Last month, spurred by the news that Instacart was reducing its valuation by 40%, we began looking at how private companies’ current trade prices compare to their last primary funding round share prices. Valuations are a critical metric in the private market, as companies, investors, and employee shareholders all use it as a quick measure of their company’s growth.

Many companies in the private market continue to trade at a premium to their last primary fundraising round valuation. However, over Q1 2022, that has declined from a 58.2% premium from last round to a 24.1% premium, indicating that broader market conditions are likely weighing on how investors value companies today. 5

Forge Sell-Side Liquidity Reaches Record Numbers

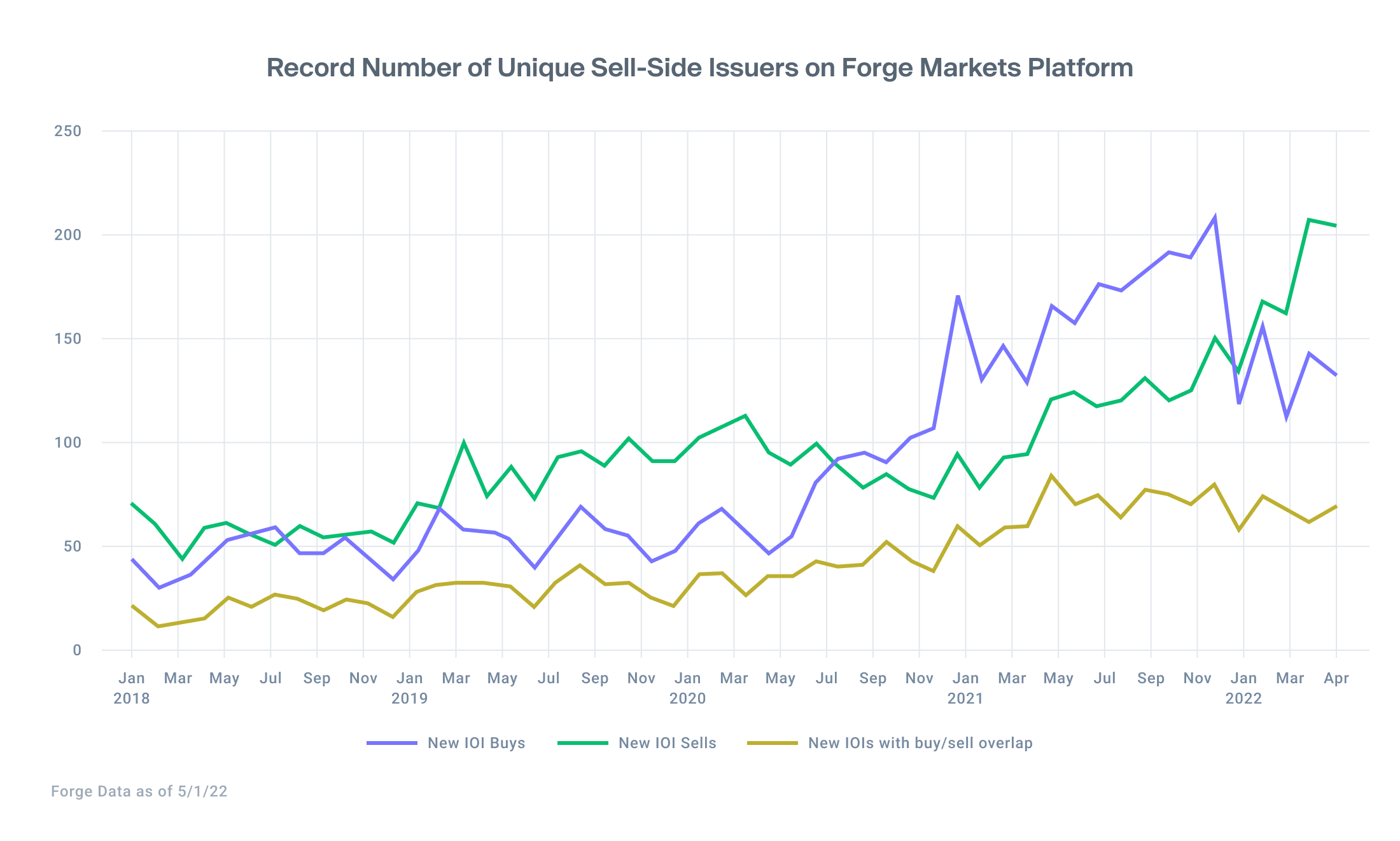

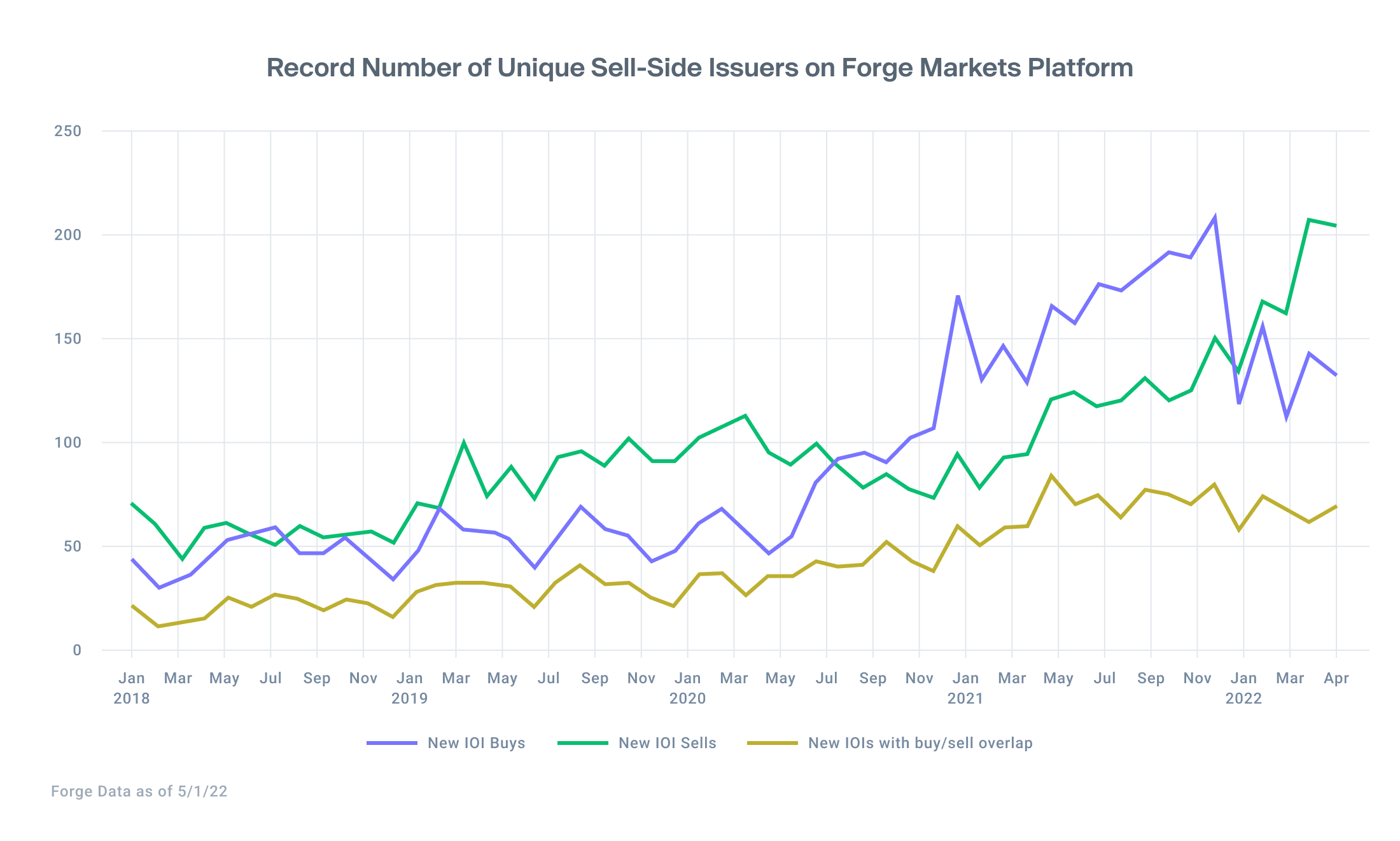

Investors seeking long-term growth in the innovation economy may look to the private market for new opportunities given public market volatility. Upon doing so, they’ll find a near-record number of companies with sell-side indications of interest (IOIs).

In March and April 2022, Forge Markets saw the highest number of unique sell-side IOIs on the platform, meaning individual companies for whom sellers offered shares. There’s currently a widening dispersion between the expectations of sellers and buyers, creating an opportunity for savvy investors who can pick winners.

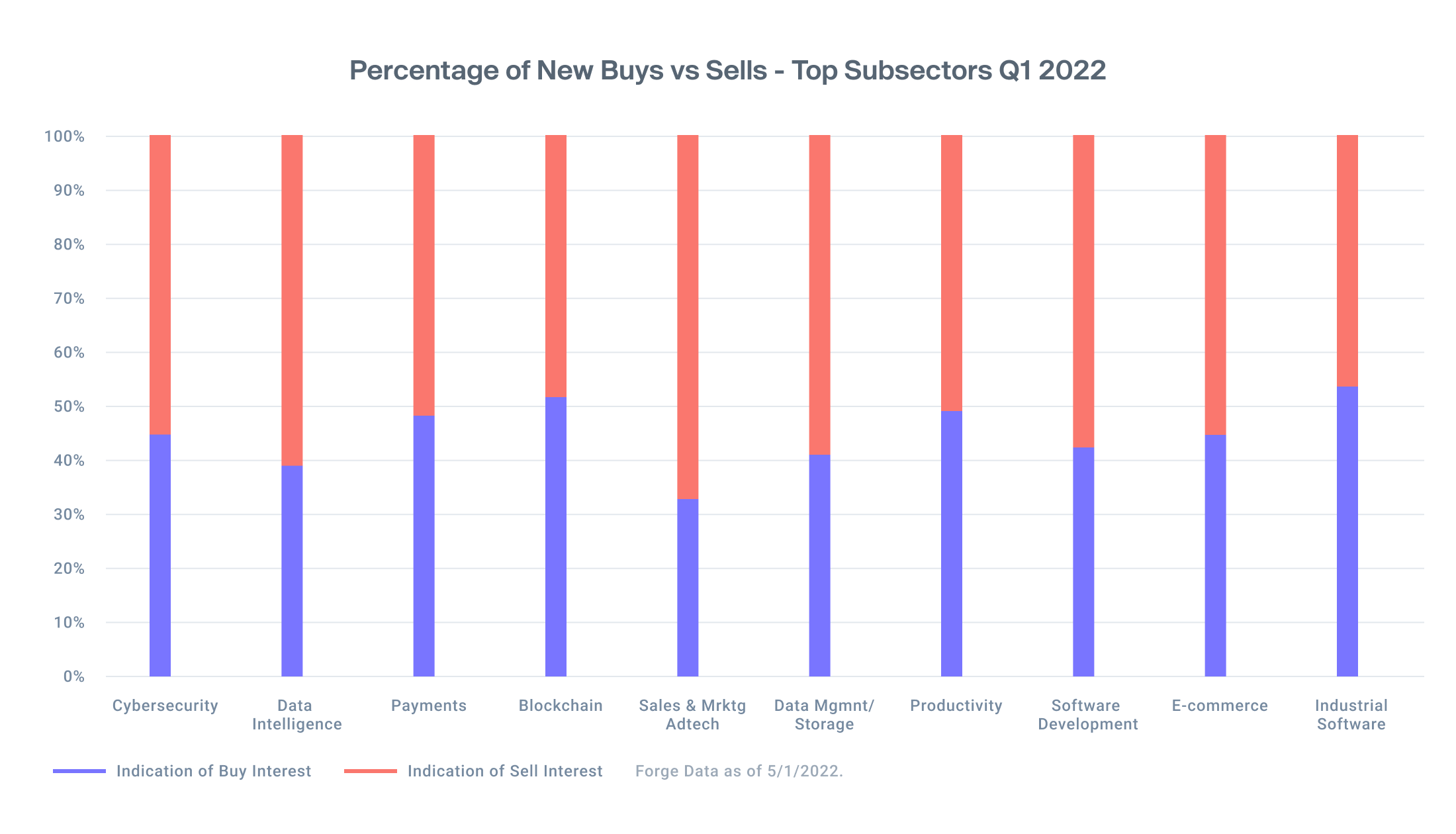

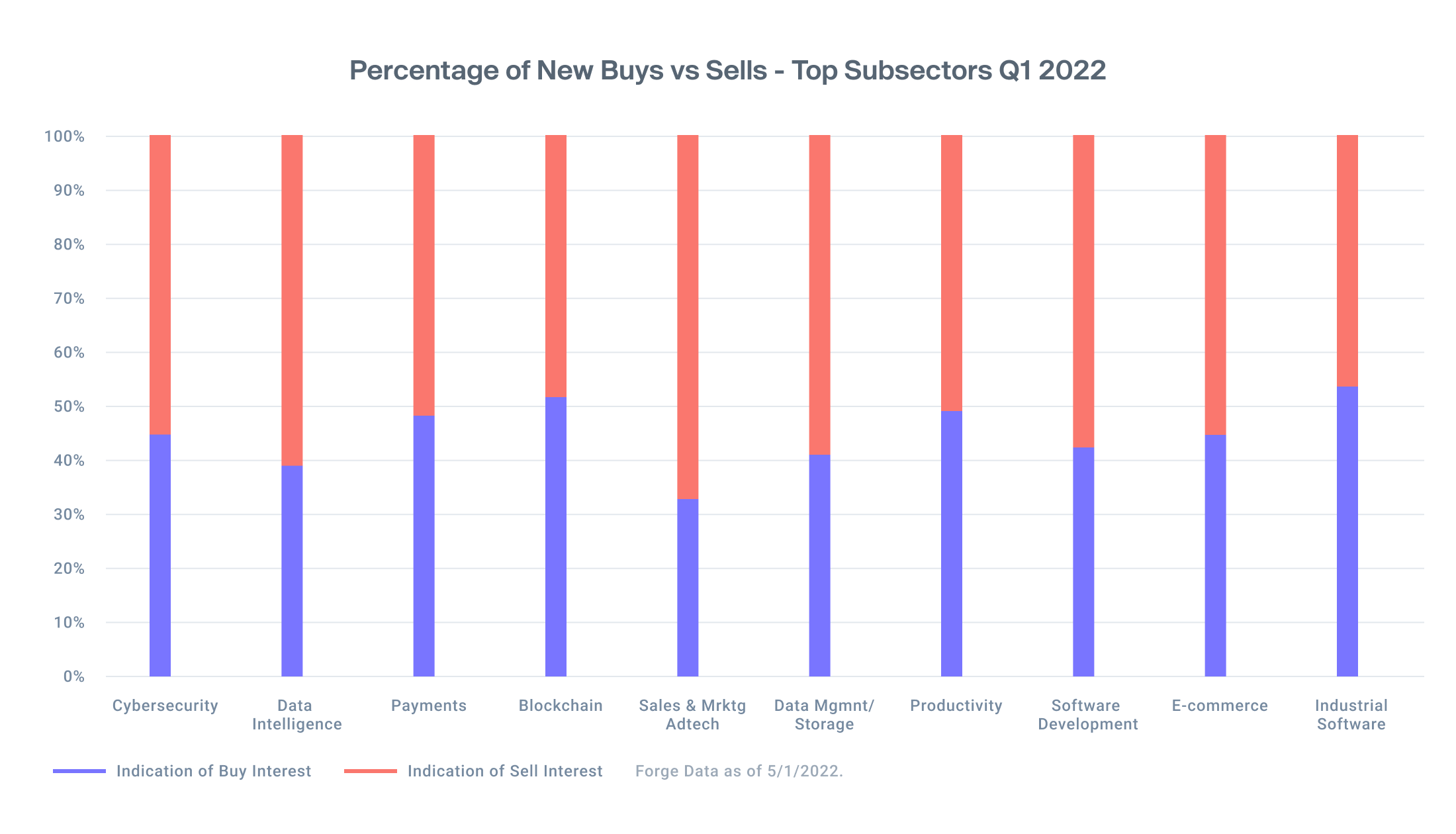

Going deeper, the aggregate ratio of sell-side demand to buy-side demand looks similar when looking at the most active sectors on the Forge platform. Sellers outweigh buyers, as noted above, but most sectors show a reasonable balance between the two sides.

With so many unicorns minted in recent years, it’s possible that investors are still becoming familiar with this explosion of companies and are continuing to develop their investment thesis about the asset class, the sector, and the individual issuer itself. This may create opportunities for discerning investors to dig into these names that have excess supply and invest at potentially attractive prices.

Sellers Increasingly Offering Shares at a Discount but Holding Steady on Pricing

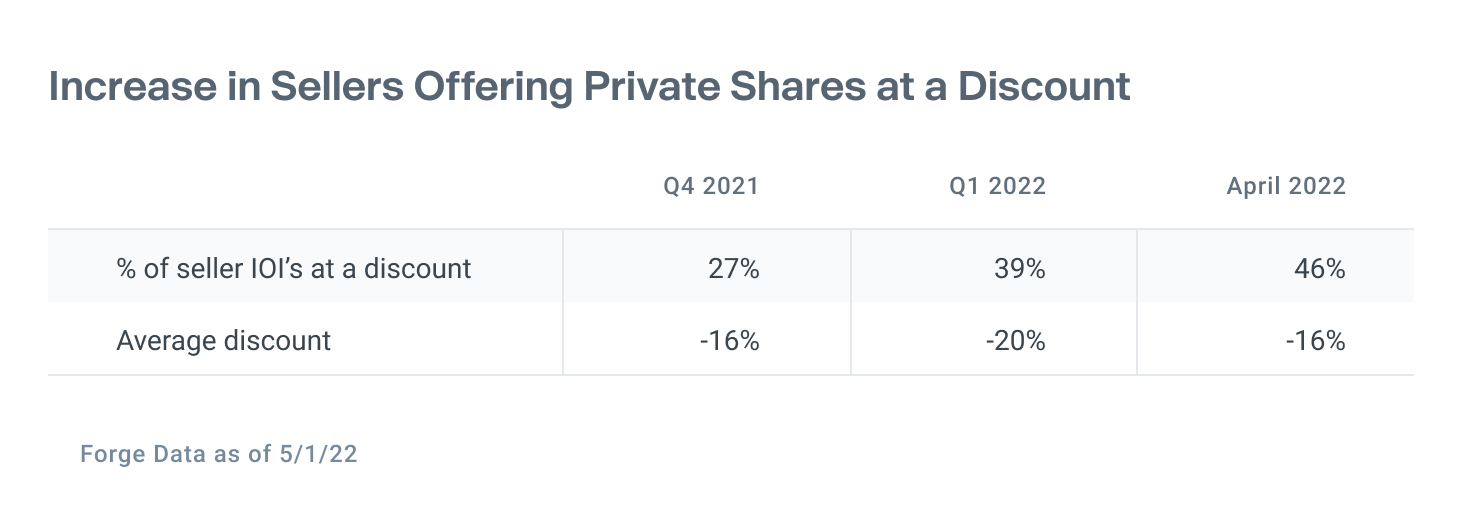

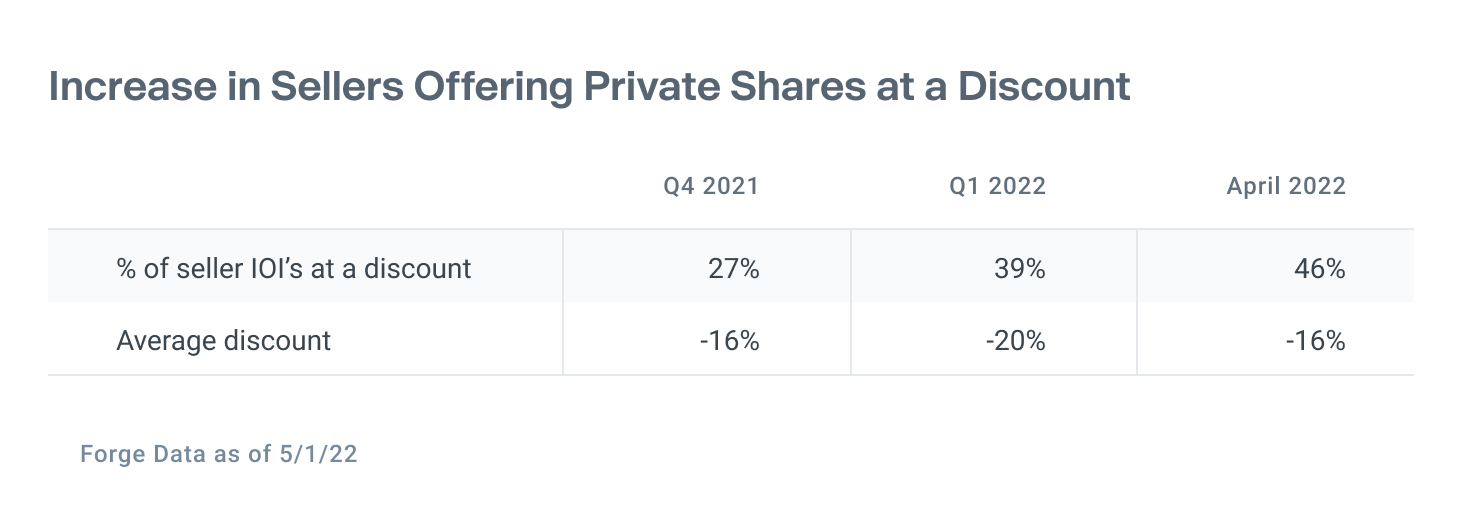

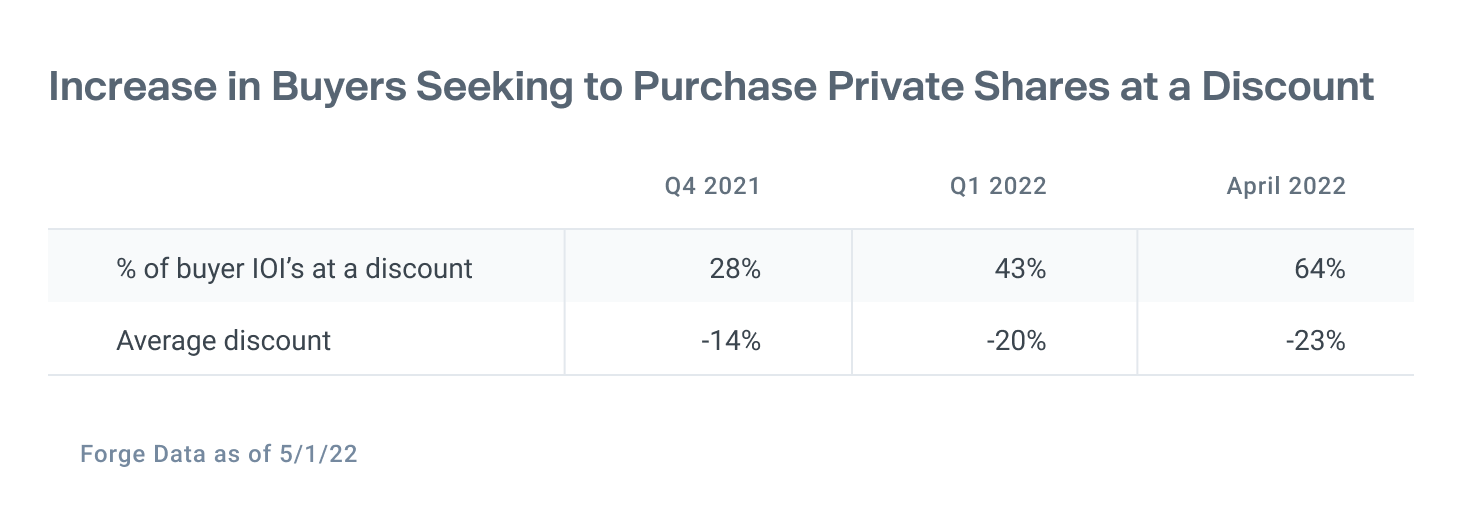

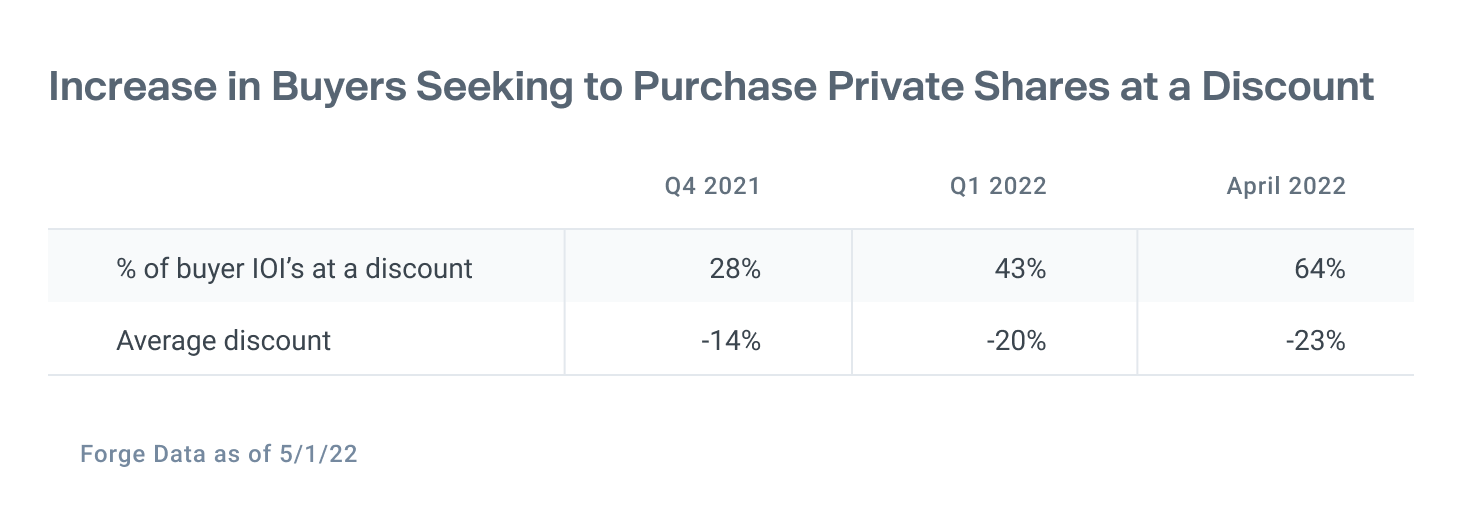

One measurement that we will continue to look at monthly is the percentage of buyers and sellers seeking to transact at a discount or a premium to a company’s last fundraising round.

For April 2022, we saw a steep increase in the percentage of buyers seeking private shares at a discount, though the discount only ticked up slightly compared to Q1 2022. More sellers are offering shares at a discount as well, but their pricing expectations have not caught up with the rest of the market.

No Exit for Unicorns?

With the data suggesting the IPO window is closed, more companies may turn to the private market for liquidity solutions for their employees and early investors. Returns have turned slightly negative for the small basket of companies who went public in the last 6 months, but the dispersion remains wide between investors who got in at the last private market price and those who invested at IPO.

It's a new moment in the private market, with record levels of supply, investors charting a new course forward amidst the broader market correction, and the IPO window seemingly closing. There are lots of questions. What does a narrower exit environment mean for today’s private companies? If private company valuations compress on a level with their public company counterparts, does this present an opportunity for institutional players and strategic investors?

To dive deeper into these topics and more, join our live webinar on Thursday at 9AM PST / 12PM EST. Forge CEO Kelly Rodriques will sit down with Blythe Masters (Founding Partner of Motive Partners), and then lead a discussion with Christian Munafo (CIO, The Private Shares Fund) and Ziad Makkawi (Founder and CEO, EQUIAM) on these topics and many more.