No exit for unicorns? A conversation on private company valuations as the IPO market crawls.

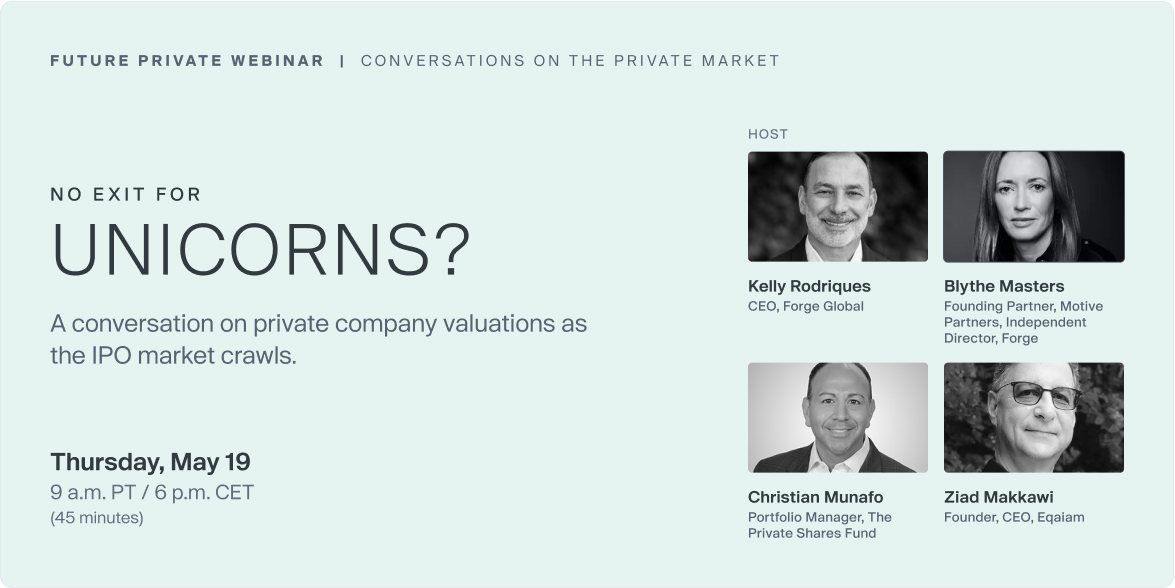

In the latest Future Private webinar held on May 19th, Forge CEO Kelly Rodriques hosted Blythe Masters, Founding Partner, Motive Partners, for an exclusive one-on-one conversation on the latest private market trends. Then, Kelly turned to two veteran fund managers to get insights on how they look at navigating the current market and investment opportunities for their respective portfolios. Christian Munafo, Chief Investment Officer of The Private Shares Fund and Ziad Makkawi, CEO of EQUIAM, together have decades investing early in private growth companies to build fund portfolios.

Key Takeaways

Companies that will best weather the current market downturn include those positioned at the confluence of megatrends, and with disciplined operators

M&A expected to accelerate

Only the most experienced, diligent SPAC sponsors will be successful going forward

But as the exit window remains shut, companies will increasingly need alternative capital and liquidity solutions

Webinar Transcript

Hello. Welcome, everybody. Welcome, everyone, to another “Future Private” from Forge. Today, we're exploring the exit environment for private high growth companies. First up, we'll talk to Blythe Masters, a Founding Partner at Motive Partners and a Forge board member, about the state of the exit market for unicorns, what characterizes the companies and sectors that will best weather the current volatility, and how institutional investors should be thinking about growth.

Then we'll have a conversation with two investors, Christian Munafo of the Private Shares Fund and Ziad Makkawi of EQUIAM, on how current public market volatility is affecting valuations in the private market, the impact of that volatility on private market investing, and what fund managers are doing to navigate the current environment. Before we jump in one quick plug, you can find insights from and subscribe to our monthly Private Market update at our website forge.com.

So let's get started. I'm here with Blythe Masters. So, Blythe, we're seeing public market volatility now bleed into the private markets. You're on the front lines of a number of trends that are shaping the future, whether it's financial technology or other disruptive trends. What characterizes the companies or sectors? Who will best weather the current environment? Who stands to come out stronger? Hey, Kelly, good to see you again.

A very timely question, obviously front of mine for so many people at present, and it's a challenging question to answer, but I think it boils down probably to essentially two things. Firstly is where you're positioned as a company and secondly, how you're able to operate. And they're both equally important.

So the winners are going to be companies who are manifestations of playing upon, benefiting from the kind of mega trends that are going to survive the near term dislocation in markets and reestablishment of valuation expectations and all the other stuff that's going on. There are some phenomena that will evaporate in this market environment, but there are others that are going to carry on.

In fact, in many cases, could be accelerated by some of the pain that many people are experiencing. So, for example, in the world of fintech and capital markets and wealth technology, just to provide an example, the trends I would have in the back of my mind would be the ongoing digitization and electronification of asset classes that began decades ago in public equities, but has moved since through credit, foreign exchange, and is now, of course, courtesy of Forge being brought to private markets.

That's a trend that is about efficiency, security, logic, ease of processing, focusing on value adds diminishing time spent on other things. That's a trend that will only get accelerated in the current environment. Another is the ongoing democratization of finance. So the growth of the individually motivated and self-directed investor, the opening of asset classes that were previously the domain of only institutional players to individuals.

Again, that's a phenomenon that is going to be with us forever. The growth of private capital markets, the growth of platform businesses that enable other people to do their business at lower cost, greater efficiency, and themselves generate opportunities to monetize data to provide analytics that have value. These are all examples of trends that are here to stay and could accelerate when times get tough.

People will still make use of these types of businesses and businesses well positioned in terms of where they sit. Visa, Visa's trends will survive and will prevail and be differentiated. The second answer to the question is how do you operate? Clearly, anyone running companies with it, public or private in this environment, but certainly private needs to be focusing very intently on what they do. Focus. With focus comes discipline, thinking about cost control.

What are the right economics for your product? Does your product have defensible unit economics, a clear path to profitability, or ideally, present profitability? Focus on talent, culture, the war for Talent somebody said to me sarcastically the other day, the war for talent is over and talent is won. Operators that aren't focusing on their people, especially in this environment, are going to lose out.

So it's where you sit and it's how you operate that is going to differentiate the winners from the losers.

Thank you. So let's talk about the IPO window. There's a lot of discussion going on here at Forge. We work closely with hundreds of companies on private market liquidity strategies, trading, and other programs. The topic of today's webinar and topic on every CEO's mind is the IPO window. It seems pretty closed right now. We have a lot of issuers on this call today.

How can private companies, looking at the late exit timelines, best prepare? Which should they be doing right now? Well, you should never underestimate the importance of luck in business, obviously, although I think actually you that over time, if you demonstrate the operating disciplines I talked about in response to your first question, you tend to make your own luck.

People that have had that approach during the good times are probably finding themselves with a decent amount of cash on their balance sheet right now that others who were flying a little closer to the edge of the envelope may not have on hand. And obviously those that were prepared are in a better position than those that were not.

Obviously, if your trajectory was for a public markets exit and that window is now closed, you need to be thinking both about alternative sources of liquidity and how you operate in that environment without the public market source of liquidity that you had perhaps been planning on from the point of view of early stakeholders, so early investors looking for an exit or liquidity and in particular employees.

If companies are staying private for longer, it's not five years anymore. It may not even be ten. It could be 15 years or forever. You have to find a mechanism for recognizing that employees largely or some cases predominantly exclusively paid in the form of stock or options need an alternative source of liquidity, and it's a public market option is closing, you'd be thinking about alternatives to that. So it's not a coincidence you asked me this question, Kelly.

You're good at what you do, and you are leading the witness directly to the point of forge, which obviously is where I'm going. I'm a big supporter of the story of Forge, and what you do is provide companies in this predicament with the kind of liquidity that they need when they can't access the private market. The other thing I would say, speaking of the private equity professional as well as an early-stage investor, there is a surprising amount of dry powder left in the private markets.

Allocations to privates have gone up. Obviously, with the recent public market sell off, the private markets look like more of a safe haven than they did even before. And funds with the vintage year 2022 are probably going to be some of the highest appointment funds of all time. So good companies with the kind of operating discipline I talked about earlier in the right spaces are absolutely, as we speak, in a very real way, tapping into available capacity in the private markets.

And so whether it's through secondaries and Forge or through primaries and the dry pattern that's out there, there's an avenue, but it's for the good companies and others are going to really struggle well.

So let me direct this towards a non self-interested question, and that's M&A. I was recently talking to analysts the other day that speculated that the current environment could produce a period of accelerated M&A activity, which stands to reason in some ways, given a closed IPO window, what's your view on the current market and M&A activity?

There is no doubt that this environment is going to drive a consolidation wave in many sectors, actually, that will be driven by the need to solidify market positioning, cut costs, and extract synergies, and for stronger companies to absorb their weaker competitors.

It's very clear that those that were riding the tide, that raised all boats without real focus on operating discipline, financial metrics, and so on, are likely to, in some cases, fail. In other cases, have to capitulate and combine forces. And also there may well be mergers of great equals, just great companies that look better together, that have real synergies, that may not even be competitive.

You'll see horizontal integration, you'll see vertical integration. I think there are many avenues that can be back where consolidation and M and A puts together a story that sings and resonates more strongly with investors, whether ultimately that puts the company back on the path to a public exit or Milly just ensures that you have a great story to tell to private investors.

Either way, I think the opportunity for those that are well positioned going into this challenging environment is going to be very significant. And indeed, we're already seeing some of that across our world of fintech.

Great. So this is a question that I'm sure you're getting. I know I am. I recently spoke at another conference as CEO of the entity formerly known as Motive Capital Corp.

You helped take Forge public through a SPAC, and my last presentation was on the last SPAC standing, which was a funny, ironic twist to just the current market environment. Can SPACs be successful in the current environment going forward, and what will it take?

I mean, there are a lot of things to be said on this topic.

First of all, the prospect of going or being public for those that weren't positioned ahead of this storm to pull that off in the way that Forge did right now is unattractive and the markets aren't particularly receptive. So whether it's Stack or IPO, many companies will simply elect not to go in that direction.

But for those for whom the public market remains a viable option, specs remain and will be in the future a realistic alternative to the IPO when the market conditions are right for either or both of those two avenues. I think a lot of what's been going on in the SPAC market, as distinct from what's been going on in the broader market is the realization that the space became saturated.

It was populated by many sponsors who really didn't have professional credentials. It was populated by many companies that probably could not have made it public by any more conventional route. They're just companies that really didn't stand up to the kind of scrutiny process that an IPO would have put them through. The SEC has made it very clear they take a dim view of all of that.

Their recent round of proposals, from our point of view, actually, frankly, really codifies presuming the proposals in some form become the rule. It really codifies what we consider to be best practice. In fact, if you look at a lot of the processes that we went through in making the decision to combine forces with Forge and take you public via our back vehicle, a lot of things that are in the current SEC proposals were in fact, things that we voluntarily have done, ranging from fairness, opinions, and a lot of due diligence, as you know, through which you came through with flying colors.

But that was a disciplined process. I think what you're seeing is that there will be significant differentiation both in terms of the companies that make it public virus back Avenue and in terms of the sponsors. The end of the day, a sponsor in this market has to put their money where their mouth is in motive case. And the reason why we were able to give you transaction certainty was that we back our specs with large forward purchase agreements that are commitments to buy the stock from our private equity funds.

That guaranteed an avenue by which the company could go public. And it's also to do with the sponsor caliber themselves. So track record network, a stable of portfolio companies that bring synergies, in-house technology, innovation capabilities, and in-house operating capabilities.

I think these are all features that the CEO of a company considering going public using a partner vehicle like a SPAC, it is increasingly going to have to seek for a year ago, as you well know, or more, it was all about price and only about price. And at the end of the day, many of those combinations that were won on the basis of who was willing to bid the highest price at all cost, because really all they were in it for was the sponsor, promote and then were planning to walk away.

Those are deals that are breaking today, and companies that have been distracted, that have had the best of intentions, are regressing that choice. But it's at the end of the day, they made the mistake of considering the price at IPO entry as or rather listing entry as the destination in its own right. In fact, it's not as you know perfectly well, this is a milestone, an important one, on a much longer journey.

And you need to leave value on the table for the public market investors as well, and be able to demonstrate that in a sustained way once you are a public company. So I think this is sorting out the sheep from the goats, both in terms of the companies and in terms of the sponsors and the SPAC structure, which has been here for a lot longer than most people realize, will stay for a lot longer than most people are currently predicting.

Well, Blythe, thank you so much for joining us today on Future Private. It's a pleasure.

And we're going to go ahead in this next segment and talk to two investors, fund managers who, with access to our data and private company shares, are building innovative funds and portfolios. Christian Munafo from the Private Shares Fund and Zia Makkawi from EQUIAM. So let's start with Christian. Christian, can you tell us about the Private Shares Fund? What do you do and how does it work?

Sure. Hi, Kelly.

Nice to be with you. Yeah. So the Private Shares Fund is a 1940 act closed and interval fund that we created roughly a decade ago with the primary objective to democratize access to the late stage venture and growth segment of the private market. So what do we mean by that? Historically, this is an area of the market that's been reserved for large institutional great investors, pensions, endowments, family offices, things like that.

We wanted to essentially level the playing field and so investors can get access to our strategy with as little as a $2,500 commitment. There's also what we think are pretty attractive efficiencies with our fund structure. So, for example, it doesn't require subscription documents, so you can buy it with a ticker. There's no K ones. So from a tax perspective, it's more efficient. With 1099 reporting, we do not charge carry incentive.

So there's not multiple layers of economics. It's simply a management fee plus some expense cap. There's a redemption feature. So up to 5% of our fund can be redeemed on a quarterly basis. And there's multiple layers of protection as an SEC registered fund, including an independent board of trustees. So one, the fund structure is quite unique. We currently have close to a billion dollars under AUM.

And then what we do is we focus on companies in this segment of the market that are typically generating at least 50 million in revenue, often well in excess of that. We like to see growth rates 40 50% plus, but not growth at all costs. So if they're not profitable, we'd like to see a near term path to profitability. And we execute the strategy through secondaries. So buying existing securities from, whether it's early investors or founders or employees. We also participate in new rounds of financing.

And what's so important about all investors being able to access this segment of the market is that over the last couple of decades, as these companies stay private for longer, they're growing into much larger market caps in the private market. And so by the time they go public, as you just heard from Blythe, not all companies provide for immediate Alpha generation for public market investors. And so we're trying to provide clients who like technology, they like innovation.

We like to give them an opportunity to access those types of companies before they've made it into the public market. We have a couple of decades of experience across our management team and really know how to navigate not just figuring out the right companies and the right VCs to work with, but also the capital structures of these vehicles.

Great. Thank you. So, yeah, tell us about EQUIAM.

Sure. Thanks, Kelly, for having me on the Webinar.

In a nutshell, EQUIAM is a systematic, data driven investor in the growth and late-stage private tech space. We've developed over the last four years a set of proprietary algorithms and models that sift through millions of data points. We look at over 120,000 companies. We put that through basically our models, to come up with a short list of companies using over 90 different metrics.

So it's really applying systematic strategies to what is really the private markets. We are offering this to both accredited investors and institutional investors, and our portfolios are designed to deliver top quartile returns. And I'm happy to say that actually we've been quite successful at doing that since we started.

We collect data from about 16 different sources in both the public and private domains, in addition to transaction data that we get proprietary transaction data that we get from forge and the Forge data products. And we've had that partnership for the last four years. We access these companies again through secondary markets and increasingly through primary markets. And we look at this space of systematic as one of the biggest kind of growth opportunities in the VC space.

Our approach is really risk focused. We're nimble because of what we do. We're flexible in terms of our execution. A systematic approach allows us to be faster, faster deployment, faster identifying of targets, continuous monitoring of our portfolios using the transactional data in the market. It allows us basically to have Fund Live, which is half what a traditional VC would be. So four to six years instead of like eight to twelve years.

Awesome. Thank you. Thank you both. So I'm going to start with a big question. I'm going to insert some data into this question.

Public tech markets have experienced steep declines since Q Four of last year. The IPO ETF was down 31% at the end of Q One, and we started to see some declines start to influence private market valuations too. Instacart took a 40% cut in valuation ahead of filing confidentially for an IPO last week. Our data from our Forge’s Private Market Update showed that private market valuations have held up better than the public market so far.

But here's a few data points. Many companies in the private market continue to trade at a premium to their last primary fundraising round valuation. Over the last quarter, that premium has declined from 58% from the last round to 24%. Now that's a premium over the last round, indicating that the broader market conditions are weighing on how investors value companies today.

Now on our data, Forge saw about a 9% decrease decline in prices of private companies that traded on Forge markets from Q Four to Q One. What's more, the number of sellers willing to offer shares at a discount continues to trend up to 46% in April.

But even more pronounced is the number of buyers who are interested in discounts 64% in April, which shows a continued dislocation in the buy and sell expectations in the private market. So for you, Ziad, I guess the big question is what are you seeing in the market in terms of valuation? How are current market conditions affecting the EQUIAM portfolio?

So maybe starting with the second part of the question, both are kind of fun one and fun two performances have held up very nicely, so we're quite pleased with that. We are feeling good about those portfolios and excited about the attractive levels that we're seeing now in the market for next month. So opportunities in terms of entry levels, in terms of what we're seeing in the market and valuations, there is no doubt that we're seeing a huge reset.

And as with all resets, the baby gets thrown out with the bathwater. Good companies get treated the same way as bad companies. And I think that's where we're seeing a lot of opportunities right now in being able to discern between the good ones and the bad ones. I think Light Mist made the point, which is we're seeing a bifurcation right now, greater discernment and being able to identify what are the companies that are going to make it.

So this has all been brought about, really, by, you know, we've had inflation fed tightening wars in Ukraine, pandemics. I mean, all of these things finally kind of broke the camel's back of high valuations and taking our queue from the public markets. You're right. I mean, we've seen 50, 60, 70% declines in prices. And it's important to know that these declines not really come just because the companies all of a sudden started underperforming.

It's literally a reset of multiples, whereas multiples were like in the 40s now in the single digits. And this has come about by not only it's not like in 2008 or 2009 where you actually had a major shock, an event that caused a credit bubble to burst. This is more kind of the fear of what's going to come. The companies are many of them are still doing well. And the byproduct of all of this is that valuations have contracted substantially.

So much is being discussed about the contagion between the public and private. And this is certainly something that we look at extremely carefully and trying to figure out how that transmission mechanism is taking place. On the one hand, some companies shouldn't be severely punished. On others, one of the questions was Instacart. Are there more Instacarts? And certainly there are. And you have to be able to find out what's what.

So room for error for fund managers is going to be substantially decreased. And the ability of fund managers to pick the winners and avoid the landmines is going to become increasingly important. And so then you have to say, well, what do you use? Which managers are going to be who has the best kind of landmine detecting technology?

And we think that basically the whole kind of systematic, data driven approach is the way to go because it allows you to look at a much bigger funnel, live almost, and to constantly be dynamically managing your portfolio. So we flipped basically from a seller's market to a buyer's market. And with that comes both kind of volatility, but also great opportunities.

Awesome. So for Christian, you've been at this for a while.

I guess we're curious about what questions are you getting from investors in your fund right now? What do they want to know? What do you tell them? And do they think the sky is falling?

Yeah, it depends on the day, right? Yeah. Look, I think we don't think the sky is falling. We don't think the world is ending. And I think you're hearing a similar perspective today. Look, it's clearly a challenging time. I think some are going to experience more pain than others.

And we are getting lots of questions from our clients about what should we expect about evaluations. What should we expect about the exit environment? Are you able to take advantage of these dislocations? We have a fund that is priced every single day, unlike most private funds that price every quarter. We are reflecting the current environment every day. Now. We also have companies that are raising capital at higher valuations year to date. We've had a number of them, so it's balanced.

So what we try to do, Kelly, is we try to basically understand that we're all human. We understand reasons for people wanting to panic, but we just try to educate our clients and we try to share our perspectives. So this is an oversimplification of our view. But as I was saying, you're essentially going to see a bifurcation of higher caliber companies and lower caliber companies. And it's not that the higher caliber companies are not going to face challenges, because they certainly will.

But the reality is you're going to be fine. They may reduce their burn rates to extend their runway, which could result in slowing their growth, which is relative because most companies that we look at are growing 500% a year. So if you pull that growth down at 25% to 50%, it's all relative. That's still pretty good by most traditional standards. And as we said, we are seeing up rounds right now. I think they're not going to happen at the same frequency.

I think it's going to take longer for these rounds to get raised. There will likely be less over subscription, the multiples will be lower. I think the smartest companies from doing this for a while, they're going to avoid pricing altogether. They're going to basically say, hey, investors, look, we've grown a lot since our last round, but we understand the environment. So we're going to open up our last round. We're going to do an extension of the prior round. We're going to issue a convertible note with some sweeteners.

We just have a fundamental disagreement on pricing and so let's not over engineer or overthink it. That narrative is something that the stronger companies can coach and they'll likely push their exits out, as you heard from Blight. And as a long term investor, we're a long term investor. We want to see exits in two to four years. But if it takes longer, but it takes longer, we don't want companies to force liquidity. The weaker companies are the ones that are either going to simply raise down rounds, get acquired, or go away.

And that may sound harsh, but it's healthy for any ecosystem. We had a lot of nontraditional investors vacationing in our markets in recent years, but the vacation is over. The ability to make quick, unrealized returns is over for a lot of these groups. And they drove up a lot of the pricing and now it's coming down. But also, Zia said that also creates a dislocation where sophisticated, more patient buyers who know the right VCs, they know what a diligence this market.

They could really take advantage and secure attractive entry points. And history tells us that vintages during high periods of volatility and macro uncertainty, those tend to generate outperformance on a relative basis in subsequent years. So it really just requires that long term view, the education, to understand public and private market private market dynamics. And then the last thing I'll say, Kelly, is that there's been a lot of negative media.

Our beloved media is quite good at that, right. It sells papers and it sells clicks about some very well known firms that I will not name. What a lot of folks need to understand is that a lot of these groups invested in some really good companies in the private market. Part of the problem is that they decided to hold the companies once the shares became freely tradable. So a lot of private market investors like us, once shares go public and come off lock up, we don't get paid by our clients to take public market risk.

So we're going to get out of those positions in a fairly quick manner. Some of these investors decided to ride their shares further, and they're paying the price for that. But I just think it requires perspective rather than just reading the headlines.

Thank you. I was going to add one thing that I've observed, too, just from the vantage point of Forge, when I've looked at the history of valuations and people challenging names.

And I look at some of the growth rates of these late-stage companies, whether it's 40, 50, 80%, if somebody's challenging evaluation multiples and you just wait six months, nine months, these companies are growing into sort of the next phase of valuation. And I think we're in a period right now that even if this takes three or four quarters, there are a lot of great companies that we continue to see perform both in growth and in terms of really attractive, huge TAM markets.

So on that note, I'm going to ask you a follow up, Christian. In 2015, there were three and a half unicorns minted a month. On average. Last year, there were 50 unicorns minted a month. And even amid a volatile market, 35 new unicorns were minted in April of this year, which is down from April 52 in the historic year.

But it's still ahead of historic averages, about triple the number that were created in April of 2020. So from your perspective, what's the impact of current market volatility in terms of the unicorn universe?

I think there's roughly 1000 or over 1000 right now. That may be 1001, 5000 hundred according to the latest data we have. Right. We'll see if that number holds. Right. Due to the current environment. So there are going to be some down rounds, I mean, to throw some more numbers at you.

When our fund was launched in 2014, there were only a few dozen. And when I left investment banking in 2005 to try my hand in venture and secondaries, there were none. So the market has just grown wildly. If you're going to have some that fall off that list, you're going to have new ones that make it on. They're going to make it on primarily because they're staying private longer. They're growing into larger businesses. The average company in our portfolio, we think 20 years ago, would have already been public right back then in the companies went public roughly four years from inception.

Today it's twelve years, but they're going public at market caps that are five times larger. So it's all relative, right? You're growing into larger companies in a private market, and so you'll see larger valuations. Some of them are irrational. Some of them are rational. Our focus is kind of away from whether or not it's our company. For us, it's more about the company itself in the sector and the cap table. So what does this company do? What kind of traction have they demonstrated for their customers?

What's the product or service they provide? Can they actually generate good margins on those products and services? Do they have good retention? So customers are coming back and ideally buying more on their low churn rates, small numbers of customers going away. Can they generate value based on the cost that they're paying to acquire those customers? You hear kind of LTV to CAC ratios. Is there a good governance structure in place? Right. Do investors around the table have more capital to protect them?

So whether or not it's a unicorn, for us, it's more about what are we looking at and then making sure you don't overpay. And then the overpaying gets to the capital structure. And while we agree you're going to see a tremendous amount of secondaries, having done this for a while, you're also going to see a lot of wide bid/ask spreads because your sellers are getting less price sensitive. Your buyers are getting more price sensitive.

And as a sophisticated buyer, we frankly do not have as much interest in lower stack common or even early preferred securities in markets like this unless there is a really compelling reason to do so and a clean cap structure to do so. These create lots of buying opportunities. But you also need to be careful what you're buying, because if you buy the wrong paper at the wrong price, even if it's a good company, you can be pretty disappointed with the outcome.

Thank you. I've got one more question for Ziad, and then I've got some questions that are rolling in that I want to get to. So Ziad in two minutes or less. Would love to hear you talk about the role of private market data and how you navigate the current environment, give us some insights there, and then we'll go to the group for questions.

Sure. So really data, as I mentioned before, is really the lifeblood of what we do.

And we've spent the better part of four years collecting, cleansing, and making over 10 million data points fit for purpose, for our proprietary models and algorithms. And again, just very few firms have been focused on that. And we've been getting quite a bit of data from forge and the transactional data from what you guys are doing. And most investors remain unaware of the availability of this data. That's what I find surprising. People say, can you really do what you're doing?

And truth be told, it's not always as easy to find the data, and sometimes it's expensive to get it, but it is there and it's very important to plug in. So in the beginning you have the data, but the data is not enough. You need to transform the data into insights and information and back test all of that so that you can generate buying or selling signals. So the learning and compounding knowledge that a systematic approach provides is really what's valuable.

The data is there, but what do you do with it? Over the past seven years and you guys have touched upon that we've had a 10x increase in the number of unicorns transaction volumes have gone up by 200x to $150,000,000,000. The market cap of the universe that we operate in has gone from 400 billion to 4.2 trillion today. So all of this data exhaust is something that we kind of focus on to kind of generate a better way of investing.

And we expect that this is going to continue. There's more and more data providers, there's more and more people who are providing us with alternative data sources. So I cannot over emphasize how critical. And we've seen this in the public domain. Right. I mean, when the whole quant strategy movement, the Rentex the Bridgewaters, the AQRs of the world and the hedge funds obviously started getting into this, it was a data story. And we have a data stories now, and we're going to see this really have a big impact on the whole space.

Okay. Thank you. So listen, I'm going to jump to some of the Q and A now. I want to remind everybody you can submit questions to Q and A function. A lot are coming through. I'd ask that Ziad, you and Christian trying to keep your answers to a minute or less. We can get to some of these. The first one for Christian is have companies accepted the fact that the last valuations may no longer be sustainable? Christian?

Yeah, not all of them.

And some of them won't have to, frankly, because they are strong enough and there's so much demand. We have companies literally this week that have been reforcasting up dramatically for the year. You heard from Blythe, some of these companies are going to thrive. As crazy as that sounds, in this environment, you're going to have companies that are going to actually be seeding the forecast they expected. And while the multiples may have come down, companies like that are going to have a fairly strong degree of negotiating leverage.

So I don't think all companies are in that position. Most are not. Not all companies have yet accepted their fate. We think in due time they will. And I think frankly, Kelly, as Ziad was saying, I think the data product that Forge has really provides a lens not just to buyers and sellers, but also the issuers to give them a reality check on where the market thinks their company's worth. Markets are very intelligent, whether it's public or private.

And I think the data product that you guys have, which we've been using for a while, is incredibly valuable, as is, quite frankly, the efficiency with which a lot of the digitization for just done of what is traditionally an analog transaction process between buyers and sellers is also equally important, quite frankly, in my view, as the data product. Thank you.

Moving on to the SAS segment, this relates to the large segment of private markets, which is software as a service.

The question is, looking at growth over the last several years in the SAS market, is there now a pivot towards profitability? Are people really focused more on that or is that an overreaction? And I'll hand that over to Ziad.

Certainly, we've seen probably the biggest contraction in multiples in the SAS sector, dropping from the single digits, even low single digits.

And that's clearly a sign that kind of the over exuberance that we saw in the market before in terms of allowing this. They're going to grow into their valuations argument being completely reversed, which is now absolutely less tolerance for companies that show no signs of switching to profitability or at least having a pathway to profitability that's visible. And that cuts across all the sectors. It's not just SaaS models, although south is where you have kind of the biggest amount of volatility.

Thank you. Going back to Christian, are there sectors that are weathering the environment better across the spectrum of companies that you look at, Christian?

Yes. We cover our current portfolio as exposure to over 20 different sectors, ranging from the space economy to fintech, cybersecurity, agricultural tech, food tech, supply chain, health care. So we've got a lot of exposure.

I think the supply chain and the agricultural tech and food tech areas are actually holding up quite well. Cybersecurity, while some of the multiples have come down, they're also holding up quite well, especially if they have differentiation. And I would just say also, Kelly, that having done this for a while, we were modeling in multiple compression and growth compression in the second quarter of last year.

Because when you have companies trading at these historic highs, sophisticated investor knows that that Sunshine doesn't last forever. So I think a lot of investors that are worth their salt have already been pricing in multiple compression for some time. That may have led disciplined investors not to do deals in certain situations which we can now do at better entry points. But in aggregate I'd say those are areas we're seeing hold up pretty well right now.

Okay. So we got time for one more. Ziad in under a minute.

M&A expectations increasing. I asked Blythe about this. If you assume M&A expectations are increasing, do you expect more risk in buying common shares?

I think that first of all, I totally agree that we're going to see a big increase in MNA activity especially since a lot of the larger corporations are sitting on a ton of cash. So that's kind of the first thing and whether that's going to translate.

So again, one of the things and Chris mentioned that earlier where you are on the cap table is now much more important when you are in a highly discerning environment. And so we should be seeing bigger spreads between common and preferred shares and more kind of visibility on that. So I think yes, definitely there will be a high degree of differentiation in there. Having said that, again, good companies are going to have no problems raising money.

There's a ton of dry powder in the whole system. But again, discernment and being able to identify good from bad companies has never been more critical than in the past.

Ok, well, thank you and thank you to our esteemed panelists. Thank you, Blythe. We hope to see you on the next future private look for a recap and a replay and of course, sign up to the Private Market Update at forge.com. Thanks, everybody.

Kelly has been Forge’s Chief Executive Officer since July 2018. Prior to Forge, Mr. Rodriques served as Chief Executive Officer of PENSCO Trust Company from March 2010 to September 2016.

Blythe joined Motive Partners in 2019 and is a Founding Partner. Blythe is also President of Motive Capital Corp II (NYSE: MTVC.U) and formerly held the position of CEO and Board member for Motive Capital Corp (NYSE: MOTV.U), the special purpose acquisition corporations sponsored by Motive’s funds, and is now a board director at Forge.

Christian has 21 years of experience in finance, with the last 16 years focused on secondary investments involving venture-backed and growth equity-oriented companies and funds.

Ziad is the Founder & CEO of San Francisco based EQUIAM, a systematic, data-driven venture capital manager disrupting the traditional VC investment model and democratizing access to the asset class. Ziad is a serial entrepreneur with a 30+ year track record building and running financial institutions across asset management, private equity, venture capital, and investment banking.

Legal Notices and Disclosures

The opinions expressed are those of the speaker and are subject to change. There is no guarantee the stated results will occur.

The information and material presented in this video is provided for your informational purposes only and does not constitute an offer by Forge to sell, or a solicitation of an offer to buy any securities and may not be used or relied upon in connection with any offer or sale of securities. An offer or solicitation can be made only through the delivery of final offering document(s), purchase agreement(s), and other applicable documentation, and will be subject to the terms and conditions and risks delivered in such documents.

This article does not constitute an offer to provide investment advice or service. Registered representatives of Forge Securities do not (1) advise any member on the merits or prudence of a particular investment or transaction, or (2) assist in the determination of fair value of any security or investment, or (3) provide legal, tax, or transactional advisory services. Securities referenced in this article may be offered by Forge Securities, and certain Forge affiliates may act as principals in such transactions.

Investing In private company securities is not suitable for all Investors. An Investment In private company securities is highly speculative, involves a high degree of risk, and you should be prepared to withstand a total loss of your investment. Private company securities are also highly Illiquid and there Is no guarantee that a market will develop for such securities. Each Investment also carries Its own specific risks and Investors should conduct their own, Independent due diligence regarding the Investment, Including obtaining additional Information about the company, opinions, financial projections and legal or Investment advice. Accordingly, Investing In private company securities Is appropriate only for those Investors who can tolerate a high degree of risk and do not require a liquid Investment.

Past performance is not Indicative of future results.

Previous Webinar Replays

Legal Notices and Disclosures

The opinions expressed are those of the speaker and are subject to change. There is no guarantee the stated results will occur.

The information and material presented in this video is provided for your informational purposes only and does not constitute an offer by Forge to sell, or a solicitation of an offer to buy any securities and may not be used or relied upon in connection with any offer or sale of securities. An offer or solicitation can be made only through the delivery of final offering document(s), purchase agreement(s), and other applicable documentation, and will be subject to the terms and conditions and risks delivered in such documents.

This article does not constitute an offer to provide investment advice or service. Registered representatives of Forge Securities do not (1) advise any member on the merits or prudence of a particular investment or transaction, or (2) assist in the determination of fair value of any security or investment, or (3) provide legal, tax, or transactional advisory services. Securities referenced in this article may be offered by Forge Securities, and certain Forge affiliates may act as principals in such transactions.

Investing In private company securities is not suitable for all Investors. An Investment In private company securities is highly speculative, involves a high degree of risk, and you should be prepared to withstand a total loss of your investment. Private company securities are also highly Illiquid and there Is no guarantee that a market will develop for such securities. Each Investment also carries Its own specific risks and Investors should conduct their own, Independent due diligence regarding the Investment, Including obtaining additional Information about the company, opinions, financial projections and legal or Investment advice. Accordingly, Investing In private company securities Is appropriate only for those Investors who can tolerate a high degree of risk and do not require a liquid Investment.

Past performance is not Indicative of future results.