2025 proved to be a strong year for dealmaking in the crypto industry, and experts suggest that will continue this year, amidst more hospitable regulation and institutional demand.4

Last year, crypto-related companies like Bullish, Circle, eToro, Figure, and Gemini all conducted IPOs,5 while crypto VC deal volume nearly doubled from 2024 levels to reach $19.7 billion. Deal count did drop in 2025, but that had to do with VCs focusing on later-stage rounds as some of these crypto companies prepped for IPOs, according to Pitchbook.6

One late-stage private crypto company that could be going public soon is Uphold.

While the multi-asset trading platform has not disclosed an S-1 filing or given many details about an upcoming IPO, its CEO said on a BeInCrypto podcast last fall that Uphold “is at an advanced stage” of the process for going public, with a target of Q3 2026.7

Uphold: Company background

Uphold was founded in New York in 20138 by Halsey Minor, an entrepreneur who previously started CNET.9

The company initially began as a Bitcoin storage platform called Bitreserve. In 2015, the company rebranded as Uphold, and in the years since, it has expanded its offerings to become more of a multi-asset trading and financial services platform, such as by supporting precious metals trading and many fiat currencies, though it's still largely centered around crypto.10

Competing in the crypto crowd

Since expanding from just providing Bitcoin storage, Uphold now operates in over 140 countries across more than 300 fiat and crypto currencies.11 Plus, Uphold has recently been adding crypto services beyond trading, like lending and borrowing,12 along with products including a USD account with above-average interest rates (subject to market conditions and terms.)13

Yet Uphold faces competition from many other crypto platforms, such as centralized crypto exchanges like Coinbase, Gemini, and Kraken, decentralized exchanges like PancakeSwap and UniSwap, brokerages like Robinhood and eToro that enable crypto trading, and hybrid platforms like Crypto.com and Blockchain.com, to name a few.

Uphold stock price history

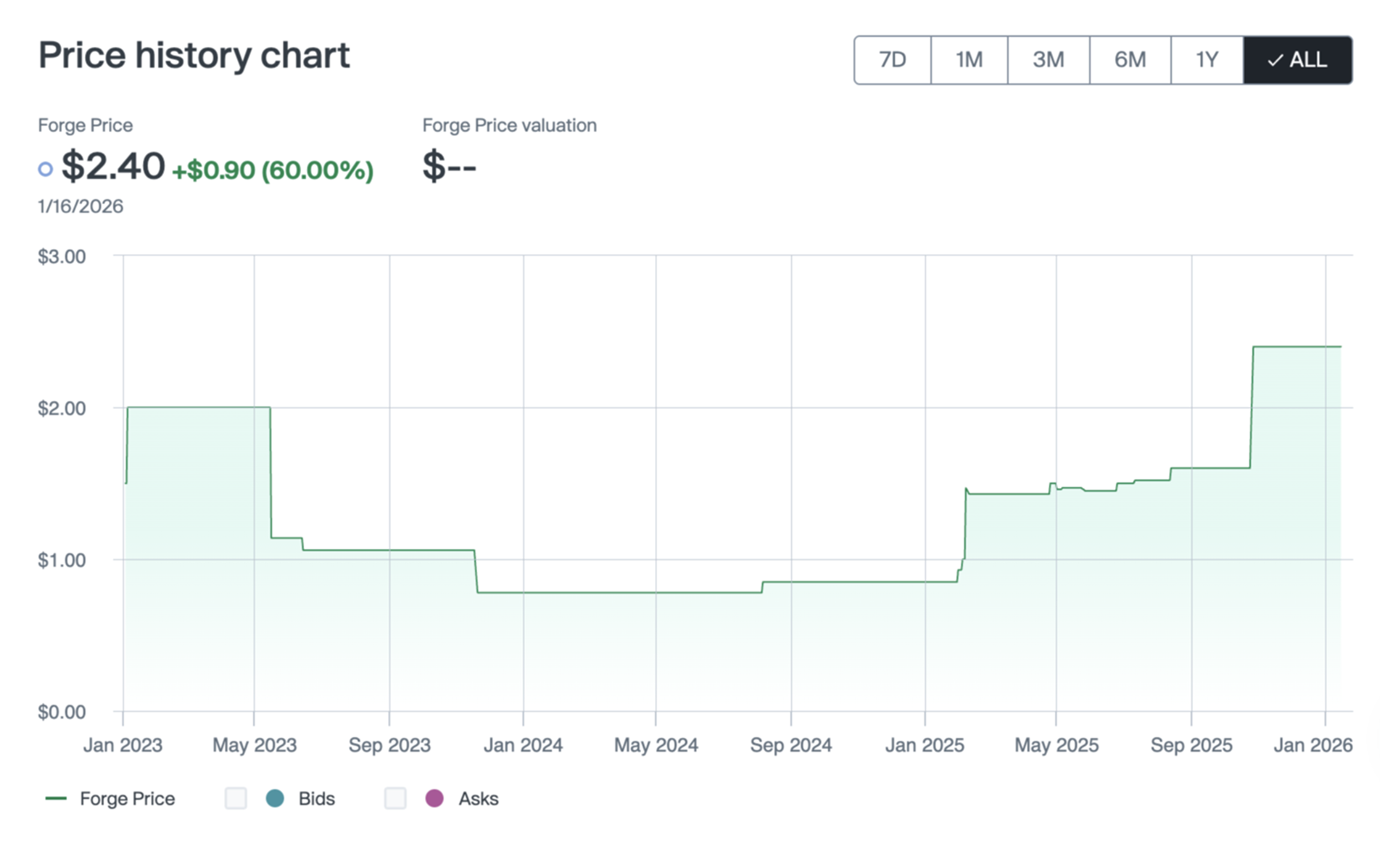

Uphold's Forge Price is $2.40 as of mid-January 2026, up from a recent low of $0.78 in mid-2024.14

Forge Data as of 1/16/2026

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions on Forge.

Uphold funding history and private market valuation

Currently, Uphold has limited available data on its funding history and private market valuation. In 2018, Uphold announced a $57.5 million investment from Greg Kidd, who was formerly Ripple's chief risk officer and a Federal Reserve senior analyst.15

Past that, however, Forge does not have funding history or private market valuation data available at this time.

Check back here or create a free account with Forge for potentially more updates on Uphold's funding and valuation information.

Looking ahead

Although Uphold has not announced specific IPO plans, previous comments do indicate that going public later this year is the goal.16

Check back here or take a look at Forge’s upcoming IPO calendar to stay in the loop about a potential Uphold IPO and other pending public offerings.

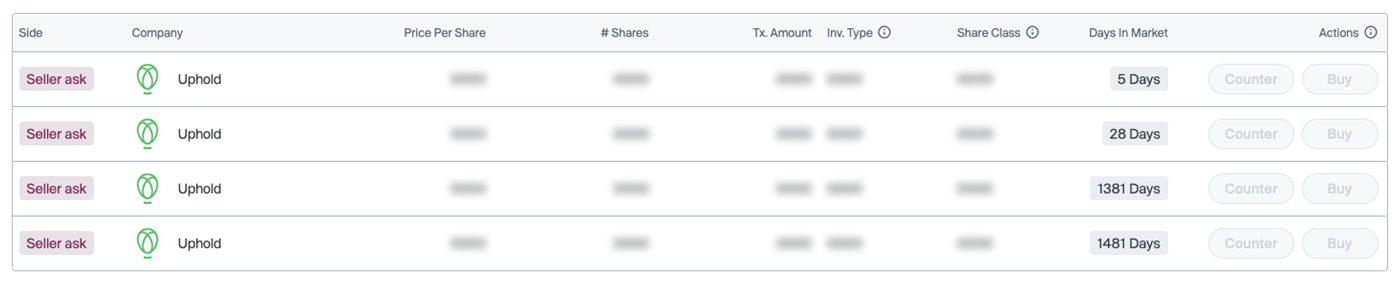

For now, as it remains a private company, if you want to invest in Uphold pre-IPO if/when shares become available, create an account with Forge marketplace to access our deep marketplace of private market securities.

After you create a free account, you may be able to express interest in transacting in Uphold shares other startups (subject to share availability and applicable transfer restrictions).

Image displayed reflects sample of active opportunities available on Forge marketplace as of 1/16/2026. Actual securities or bid/ask volume may vary at any time. Listed bids/asks are non-binding.

Forge seeks to provide tools and data services designed to increase transparency in the private market, and as a publicly traded company, it operates within a regulated environment that allows investors to explore private market access.