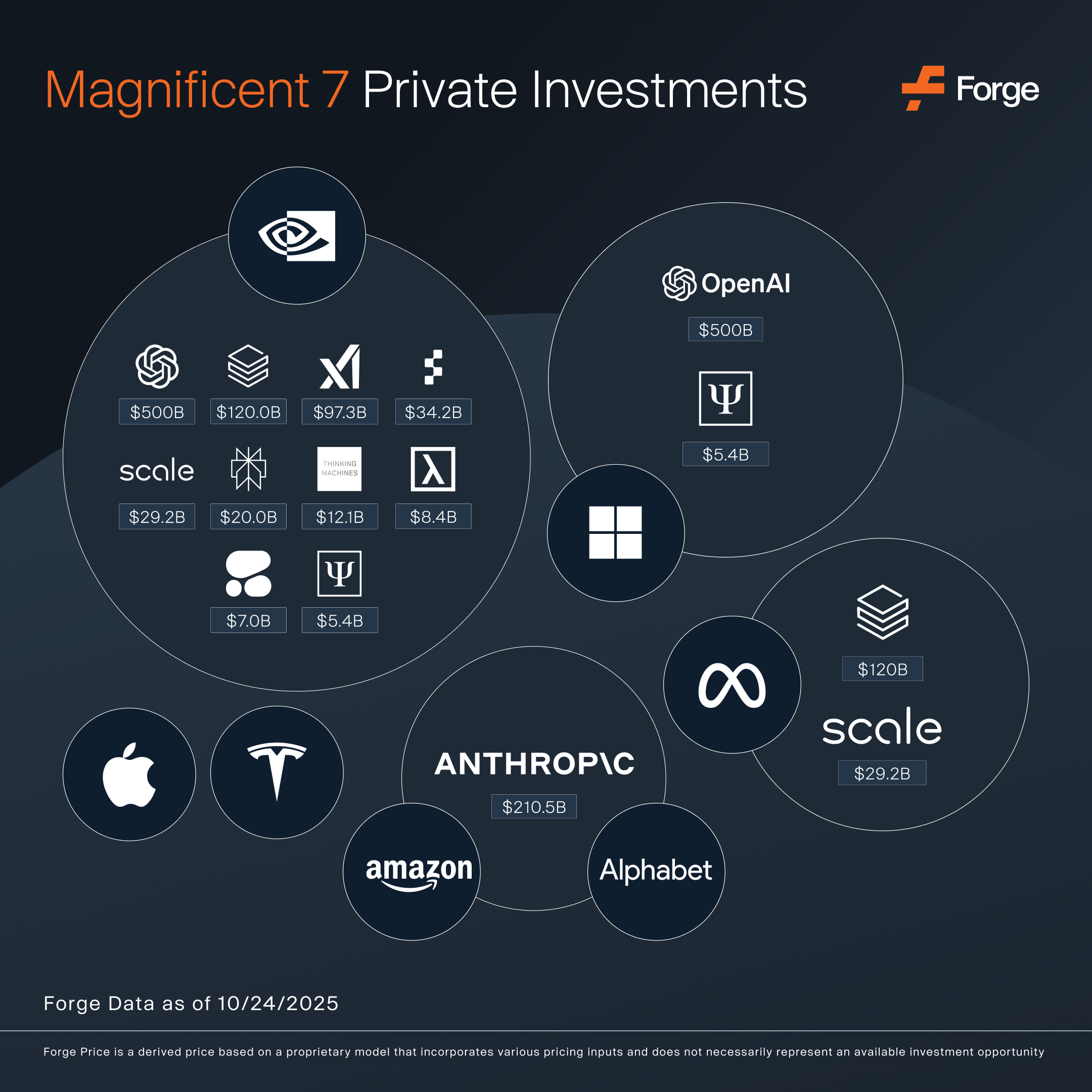

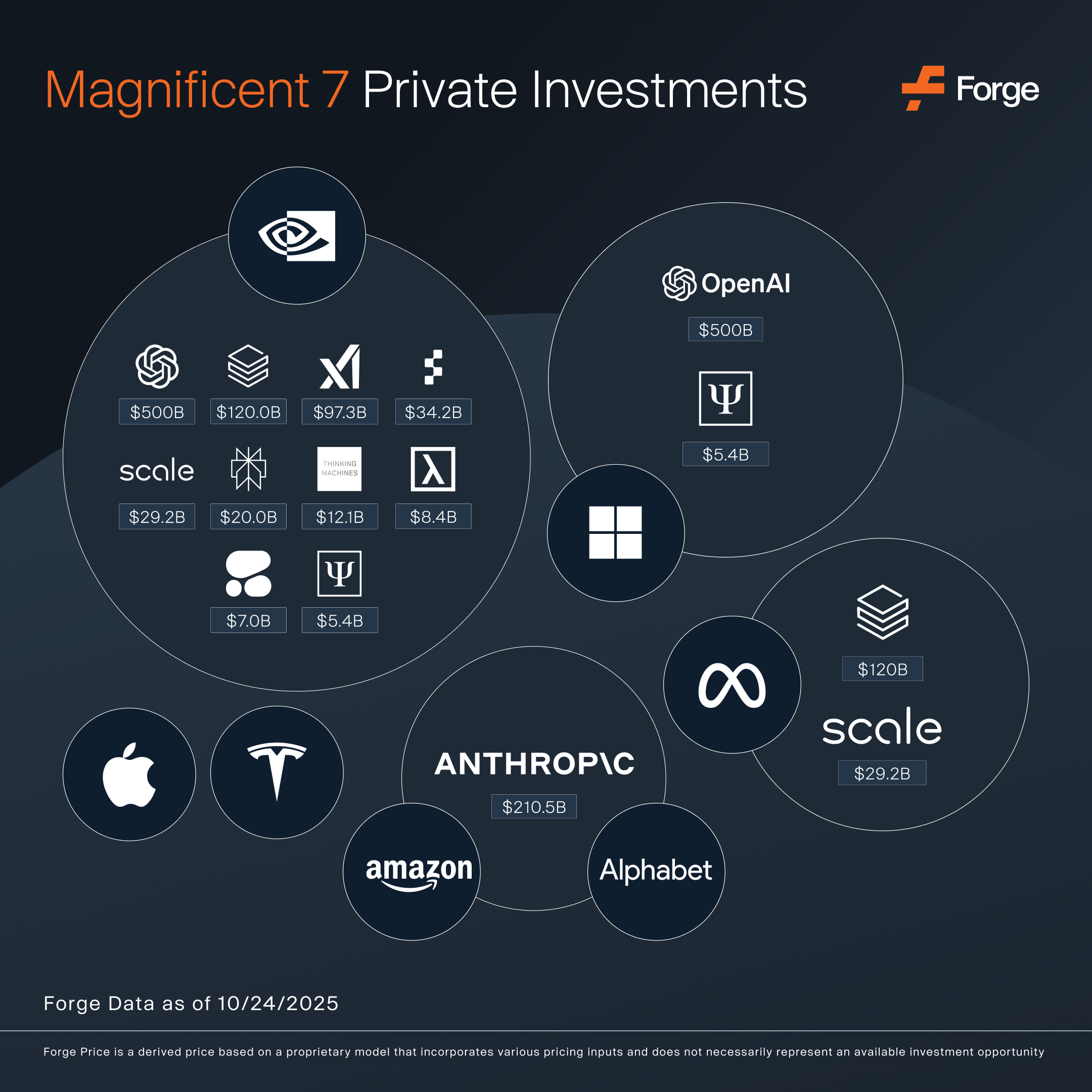

The public "Magnificent 7" (Mag 7) draw significant attention, and rightly so. These seven U.S. technology giants collectively represent over $20 trillion in market value.1 But beyond analyzing their public market performance, it's equally instructive to look at how these companies deploy capital from their balance sheets. As companies stay private longer and reach unprecedented valuations, the need for capital to support innovation grows, and one important source is the Mag 7 themselves.

These investments take various forms, including corporate venture capital (CVC), direct balance sheet investments, and technology infrastructure support (e.g., cloud computing credits). A close look at their portfolios reveals diverse strategic approaches. While some Mag 7 firms avoid private company investments altogether, others operate at a pace rivaling traditional venture capital firms.

NVIDIA

Among the Mag 7, NVIDIA is the most prolific private market investor. Through its CVC arm, NVentures, NVIDIA has backed dozens of startups that reinforce its position at the center of AI infrastructure. Historically a relatively quiet investor, NVIDIA has ramped up its activity significantly in recent years. Notable examples include a high-profile, multi-year $100 billion commitment to OpenAI2 and a controversial investment in xAI, which defied OpenAI's preference that its backers not fund competitors.3

Microsoft

Microsoft arguably triggered the current wave of AI investment with its 2019 investment in OpenAI. Its cumulative stake through 2023 entitles it to 49% of OpenAI’s future profits.4 While widely regarded as a shrewd investment, the partnership has been strained by debates over intellectual property sharing and the perception that Microsoft received overly favorable terms.5

Meta

In June 2025, Meta made headlines with a $14.3 billion investment in Scale AI, acquiring a 49% stake. The size of the deal raised eyebrows, but so was the perceived intent. Observers viewed it as a mechanism to acquire top AI talent while sidestepping regulatory scrutiny.6 The outlook for this investment became murkier shortly after, as Scale AI began to lose major customers.7

Alphabet

Alphabet, despite developing its own AI,8 seemingly responded to Microsoft’s OpenAI deal with a strategic investment in Anthropic, the second-largest LLM company. The initial investment came in February 2023, suggesting a hedge against losing ground in the foundational AI race.9

Amazon

Amazon, often viewed as trailing its peers in AI,10 took a similar path to Alphabet by investing in Anthropic beginning in September 2023. This investment not only offers exposure to frontier model development but also generates significant demand for Amazon’s AWS cloud business.11

Apple and Tesla

Notably, both Apple and Tesla have abstained from investing in private startups to date. While Apple has remained acquisitive,12 it has not yet ventured into direct startup investing, and Tesla has shown little interest in such activity.

While public market narratives often oscillate between viewing the Mag 7 as untouchable monopolies13 or vulnerable incumbents,14 their investment behavior suggests a more nuanced picture. By placing strategic bets on the next wave of technology, these companies are potentially looking to guard against obsolescence. In doing so, they remind us that much of today’s breakthrough technology—and some of the most innovative companies—are still private.

For investors interested in buying stock of these private companies, while they remain private, should read Forge’s buyer’s guide to investing in private market shares. However, if you’re ready to start trading, you can create an account today to buy and sell shares.