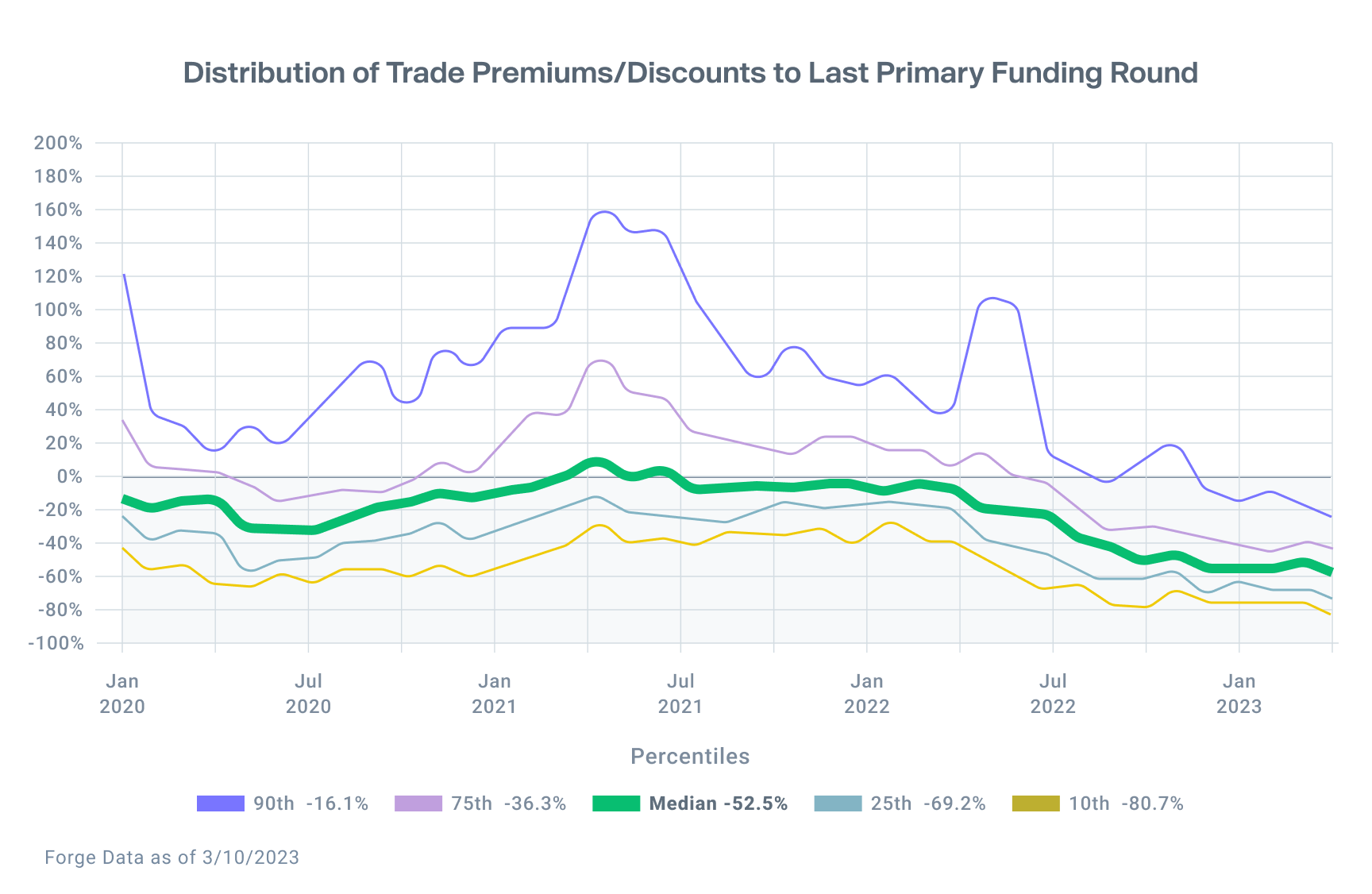

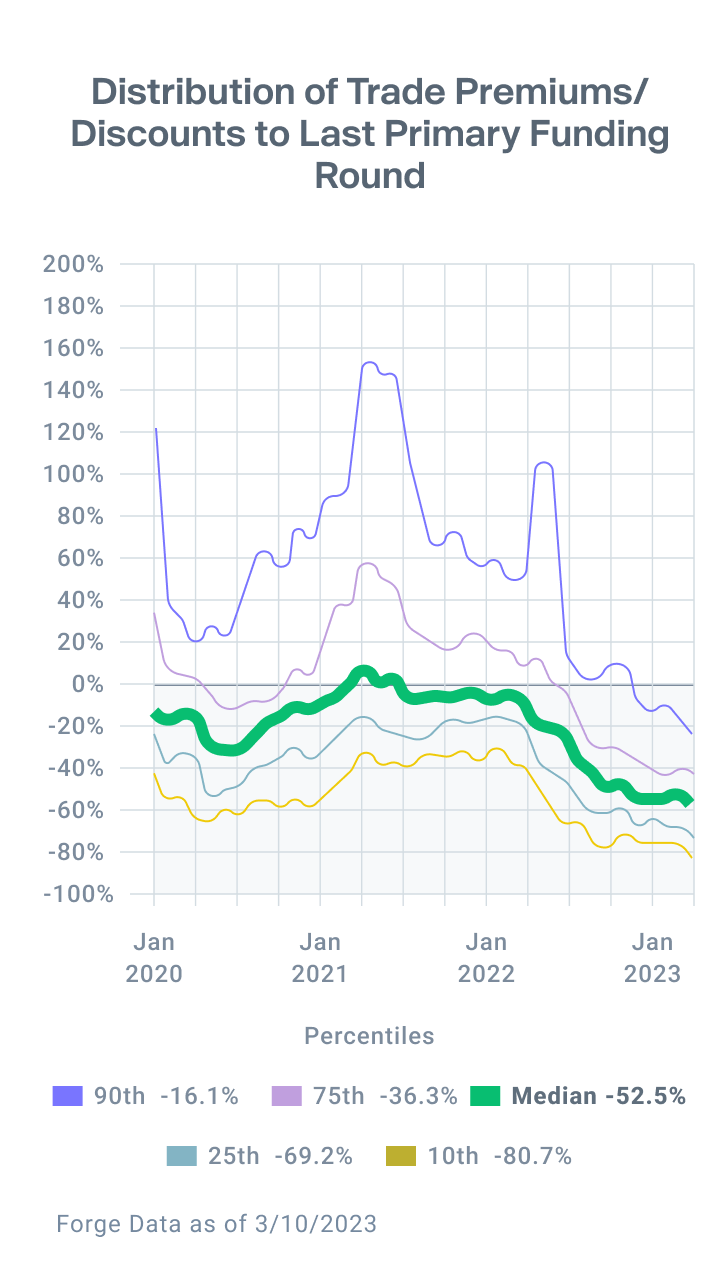

- Companies in the top 10% of premiums/discounts trading at -16.1% discount to last primary round valuation

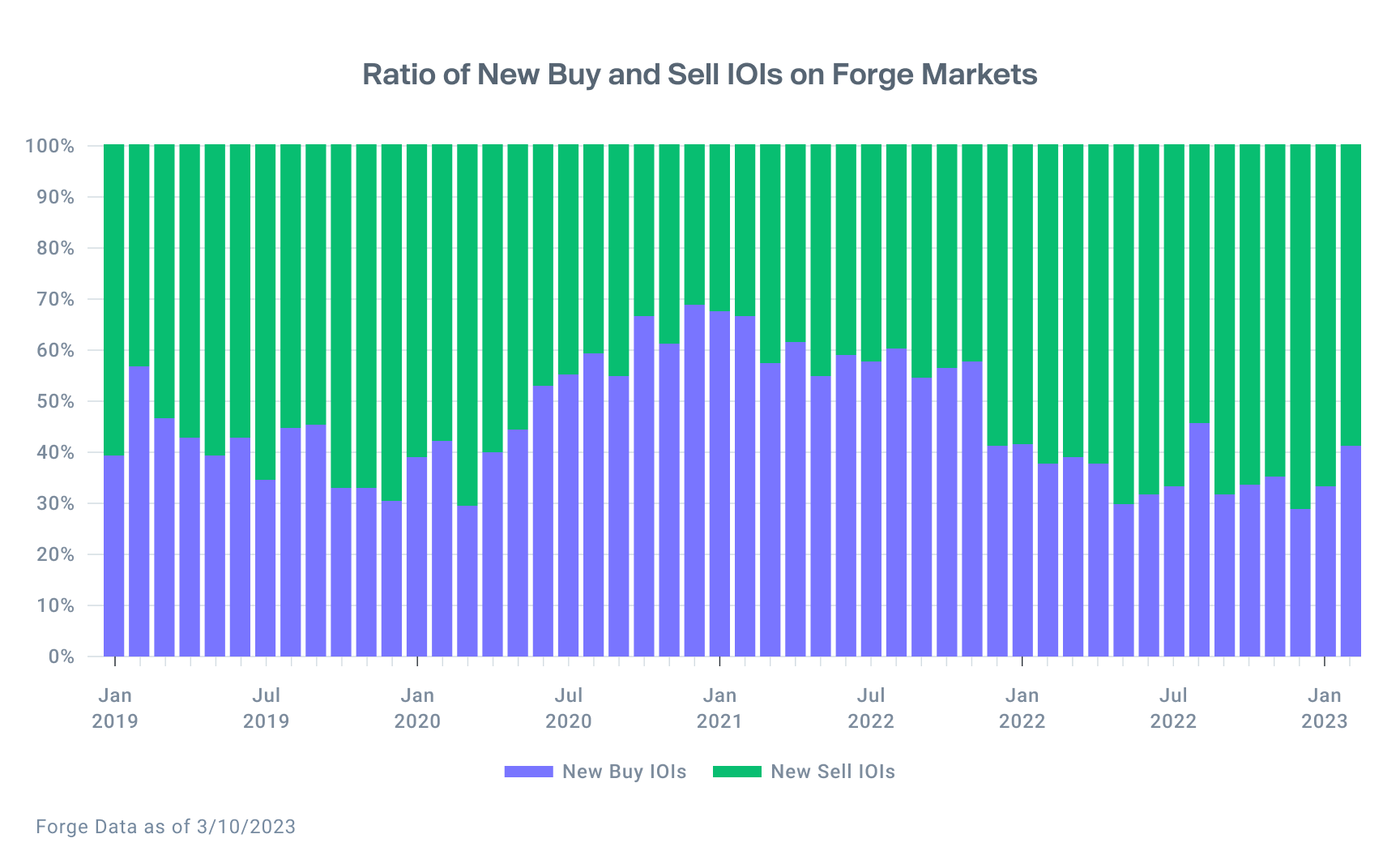

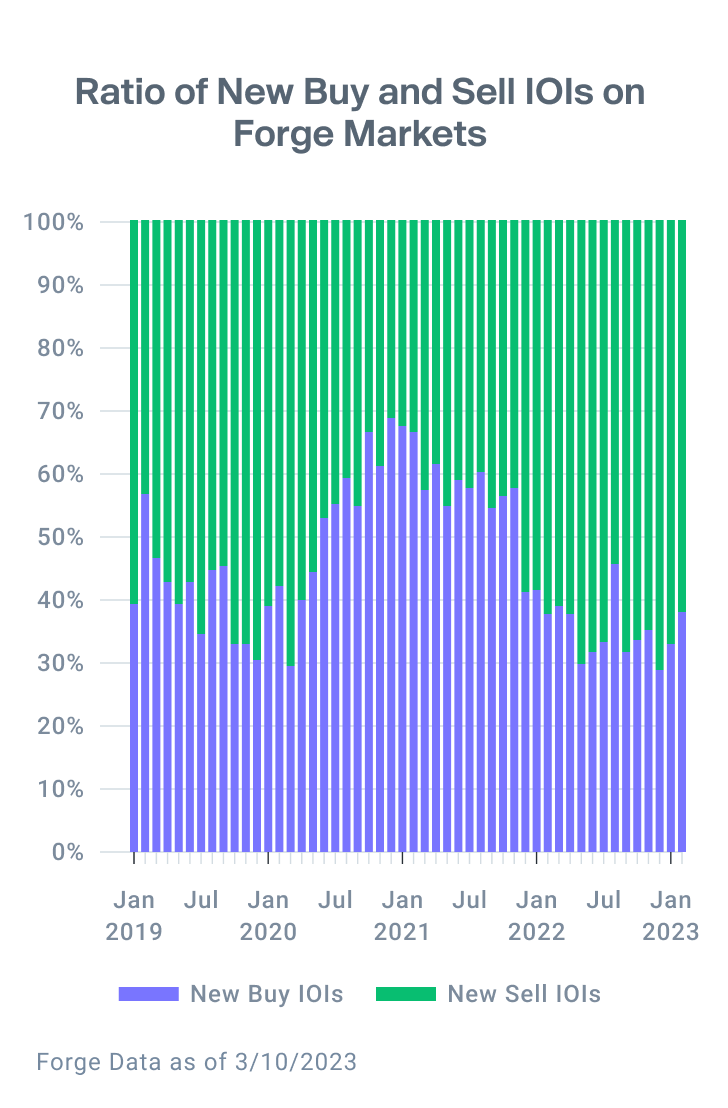

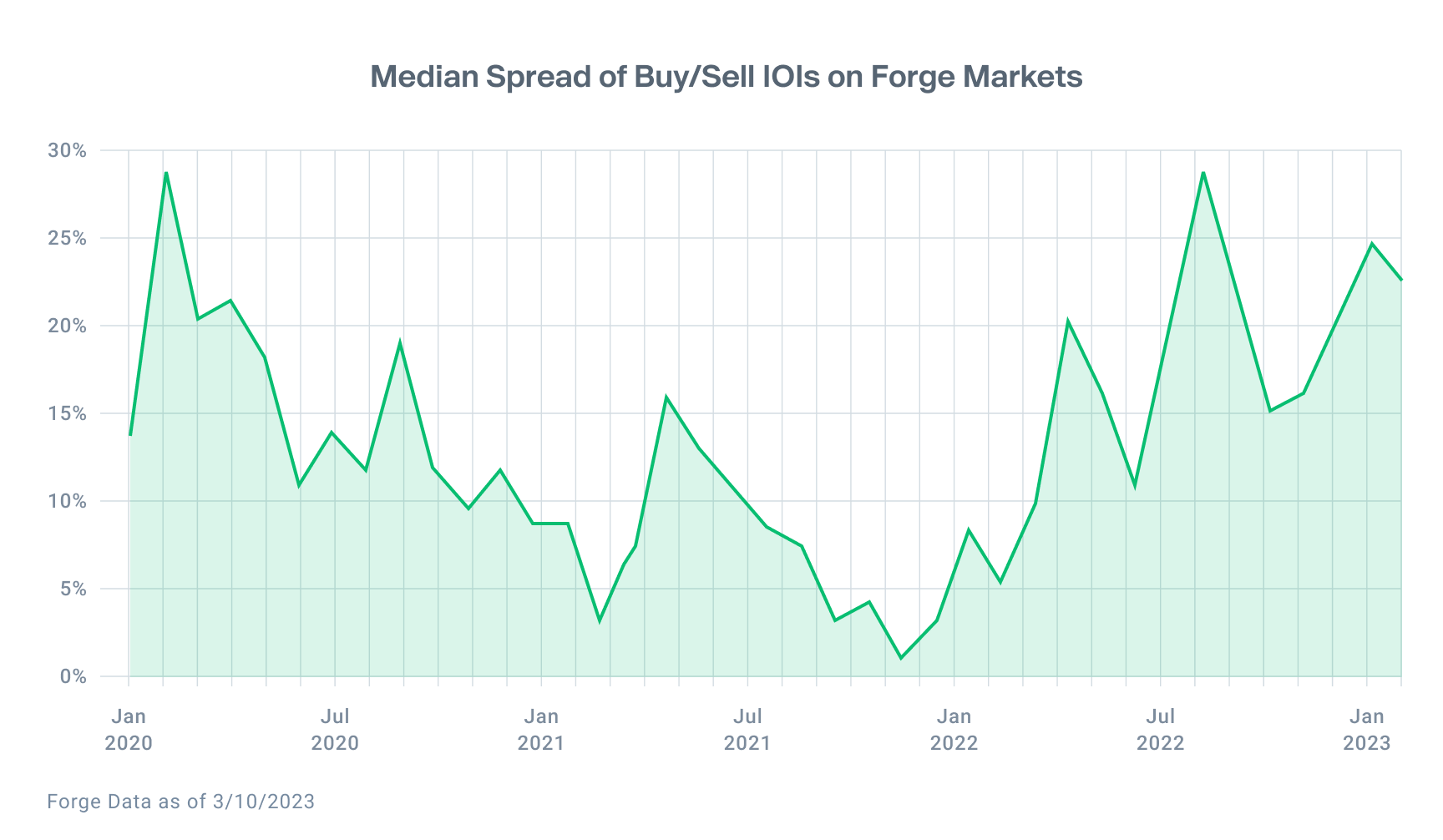

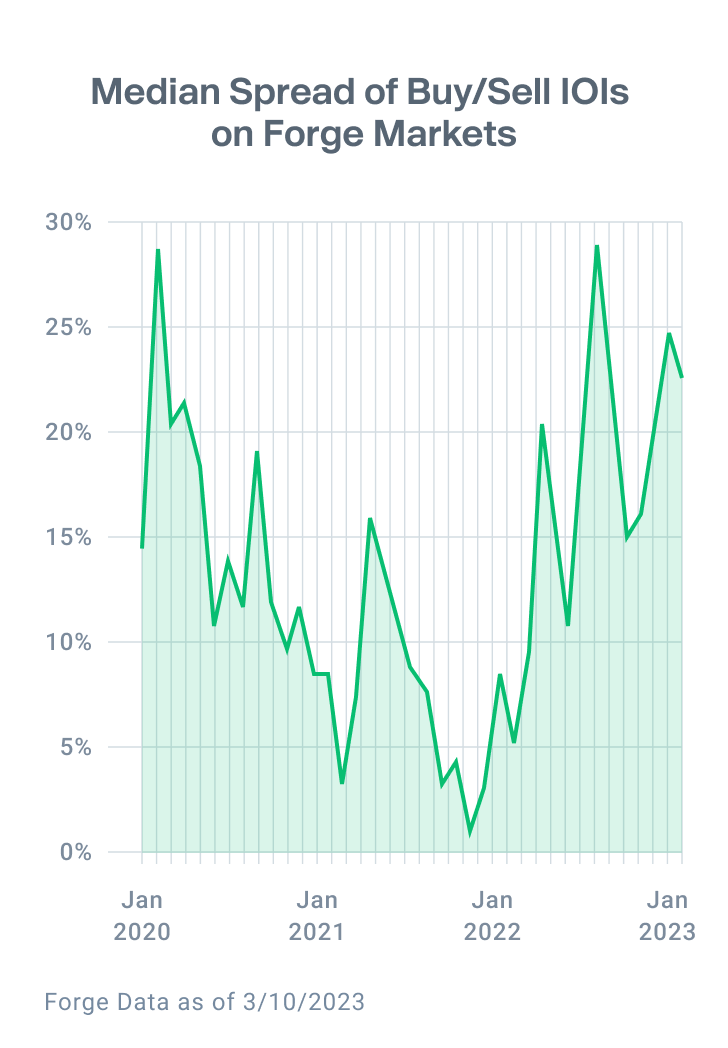

- Buy-side interest rises to 42% of IOIs, median buy-sell spread falls slightly

- Buyers, sellers will be navigating SVB fallout going forward

Private market participants are understandably concerned about the closure of Silicon Valley Bank and the resulting impact on the financial sector and technology companies more broadly. While the extent of the fallout still remains to be seen, SVB’s collapse and related bank troubles may inject more caution into the private market. To shore up markets, the U.S. Department of the Treasury announced that SVB depositors would have access to all of their money, and depositors at Signature Bank, which was also shut down by regulators, would similarly be made whole.

And while stocks of publicly traded banks generally suffered on the first trading day (Monday, March 13, 2023) after this type of announcement, the overall stock market held up better. The S&P 500 traded in the green most of the day before closing down 0.15%, while the Nasdaq gained 0.45%. Tuesday saw the SPDR S&P Regional Banking ETF bounce back 2%, but Wednesday brought a return to the broader market drawdown driven by European banking concerns.

As Forge’s private market participants navigate continued volatility, trends indicate that investors in February were interested in a broader array of pre-IPO companies. Buy-side indications of interest (IOIs) grew in both January and February 2023, and investors placed bids in 114% more companies from December to February. Also in February, 25% of buy-side IOIs came in private companies that previously had no open buy IOIs.1

February data shows divergence in private company performance

Like the public market, the private market is comprised of a diverse group of companies of different sizes, sectors, and at different stages in their lifecycle. In the private market, investors may be able to access companies that are working on promising technologies but may also still invest heavily for growth, alongside those with product-market fit and economics that may foreshadow a public listing.

For this reason, it’s helpful to segment the private market to understand how different types of companies are performing. While the overall market remains down, companies in the top 10% of Forge premiums/discounts have seen their stock trade at somewhat more modest discounts (-16.1%) to their primary fundraising valuation. On the other hand, companies in the bottom 10% have seen much steeper discounts of -80.7%.2

Sally Mace, Principal at Forge Securities, discussed this trend in a recent webinar, noting that “a lot of investors (on Forge’s platform) [are] looking primarily above all at the quality of the businesses that they're investing in. Investors [are] looking at each company on a case-by-case basis and not applying any sort of broad discount to an entire sector or asset class.”

Sellers may see discounts when they seek to sell their stock on the private market. Especially in light of the recent banking crisis, risk assets remain discounted across the board and startup equity is no exception.

One important nuance when valuing private companies is the recency of pricing data. The stalwart for private company valuation has historically been the price set during a primary fundraising round. But the turbulence of this recent market cycle has exposed the risks inherent when relying on valuations which may be outdated and inaccurate.

Investors may find it helpful to consider primary round data alongside the increasing number of other data points that can be used to value companies, like secondary trade prices, mutual fund marks, and bid/ask sentiment. Forge Intelligence maintains updated pricing data in the last three months for more than 290 companies inclusive of those metrics, so investors can get up-to-date insight into how companies are trending.

Buy-Side Interest Rises in February as Spreads Narrow Slightly

February saw a third consecutive monthly increase in buy-side activity, as buyer interest made up 42% of activity on Forge Markets.3 This suggests that more investors dipped their toes back in after the calendar turned.

The median spread between new buy/sell indications of interest fell slightly to 21%.4 Spreads do not need to reach zero in order for private market trades to match– but they remain elevated which typically indicates that buyers and sellers are still going through the price discovery process.

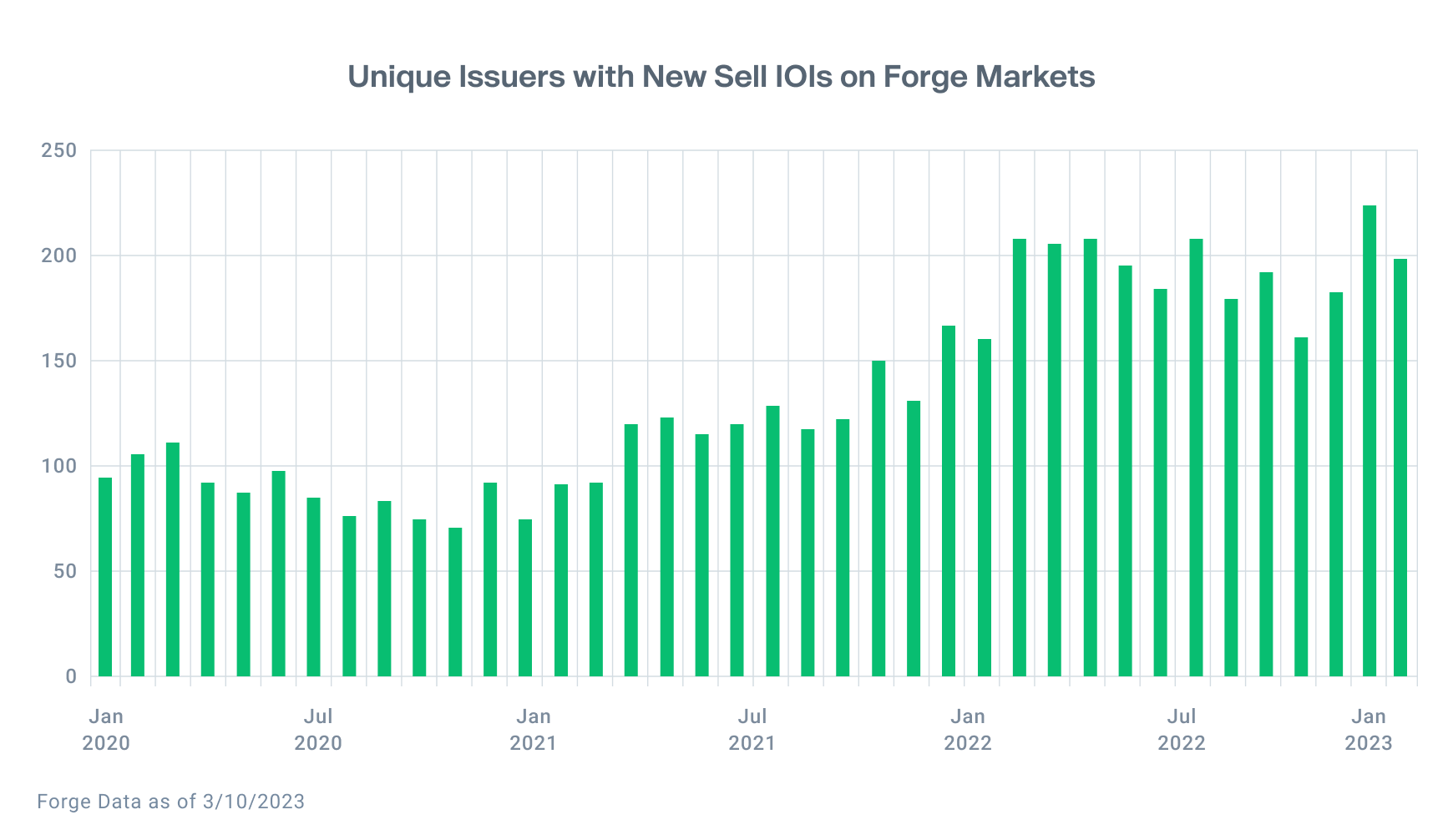

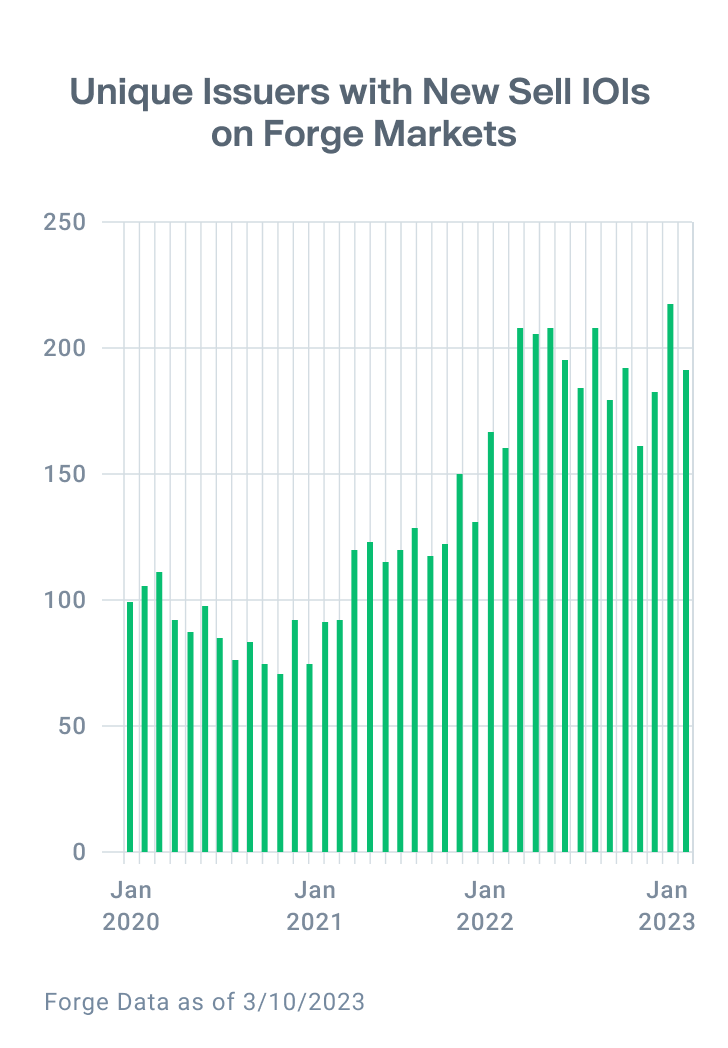

Finally, the number of issuers with new sell IOIs fell slightly in February, with 191 unique issuers having sell-side interest this month.5