Investors eye 2023’s next wave of unicorns as valuations reset and rate of losses slow

- Private market companies end 2022 down 50%, but rate of losses slows in Q4

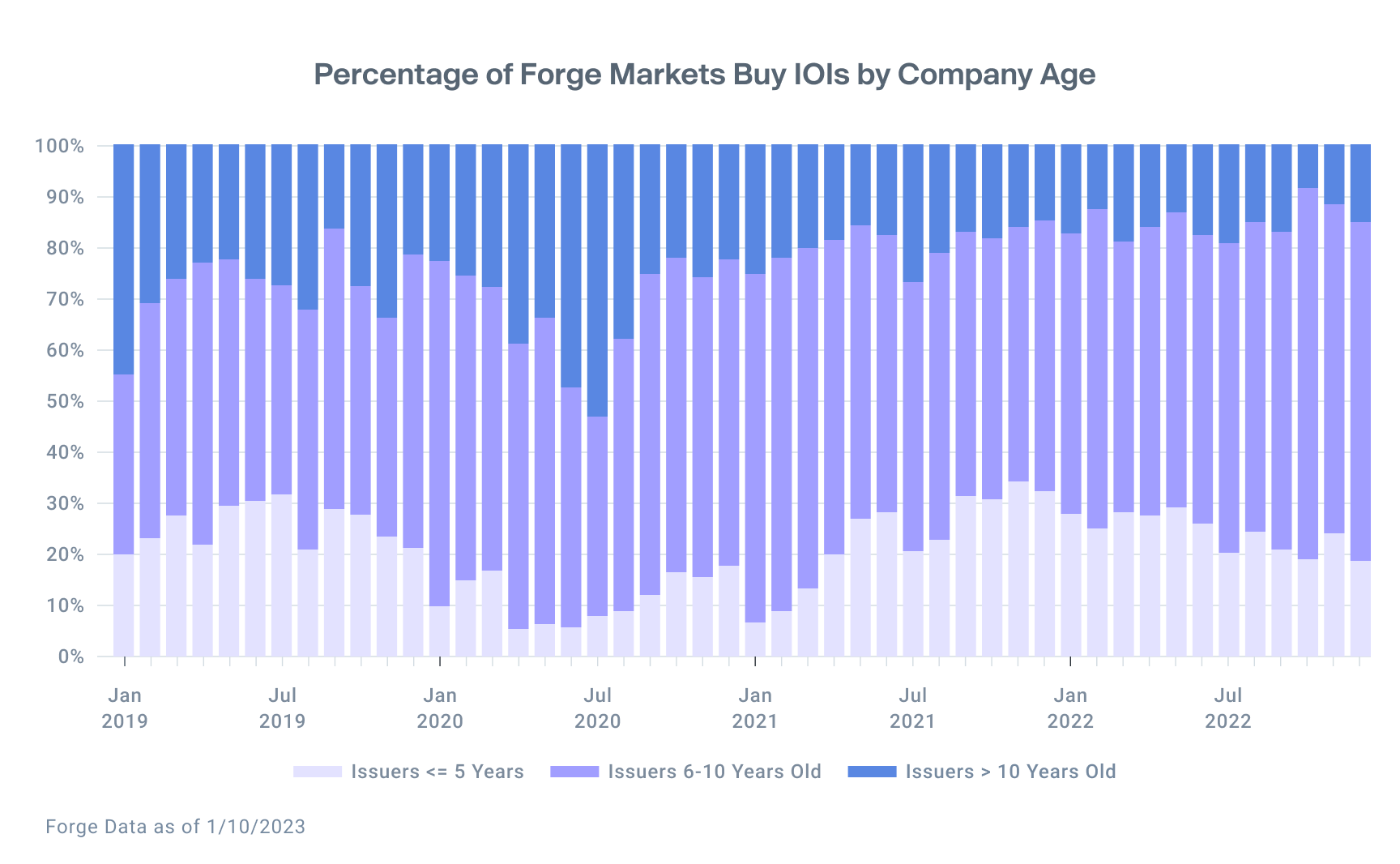

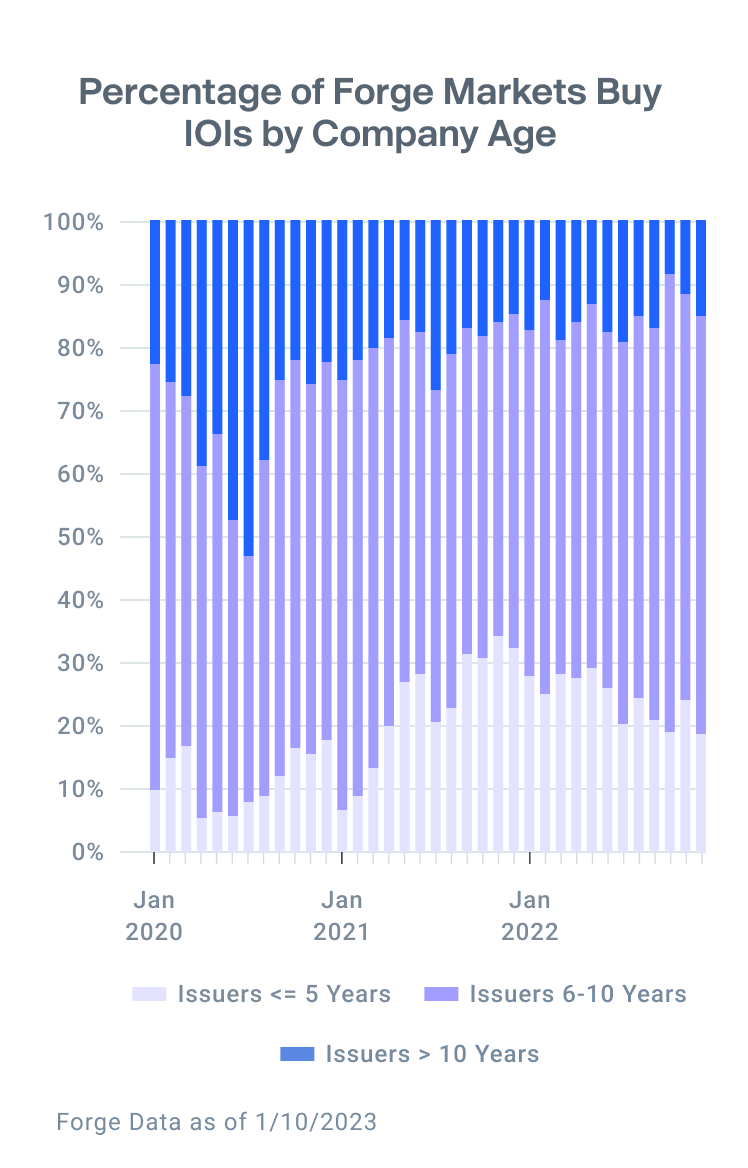

- Investors show preference for shares in slightly younger companies

- Companies weigh lower valuations versus “dirty term sheets”

After a rip-roaring 2021, financial markets took a step back in 2022 – with the tech sector taking it particularly hard. But a new year often coincides with newfound optimism, and in 2023 there’s reason to believe that this hope is grounded in promising data, not just wishful thinking.

For one, it’s important to look back at 2022 with proper context. To be sure, both private and public markets largely fell backward. But in many cases, that was a reaction to an ebullient 2021. In comparison to pre-Covid years, 2022 wasn’t so bad.

Take M&A activity, for example.

Global deal volume fell in 2022 by 37%, the sharpest percentage decline since 2001, reports the Wall Street Journal, based on Refinitiv data.1 Yet 2022 was still approximately level with pre-pandemic numbers. Plus, deal advisers project an uptick in 2023, though it’s unclear when exactly that will happen, the article adds.

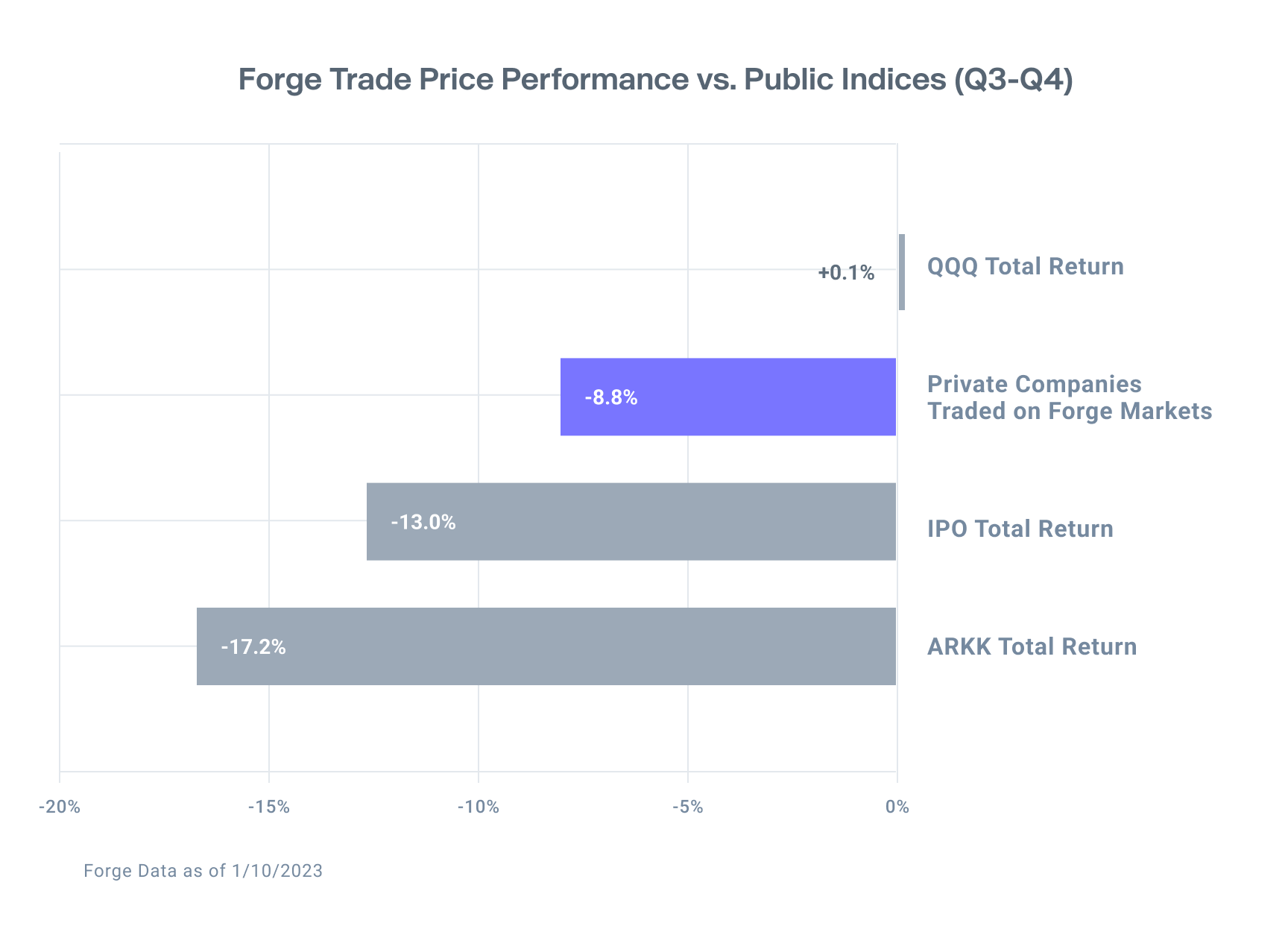

Meanwhile, Forge data shows that price declines may be leveling out. To be fair, companies trading on Forge marketplace still experienced an 8.8% decline from Q3 to Q4 2022. But that’s much less than the 22.2% drop from Q2 to Q3. 2

So, as this period of valuation resetting potentially winds down, what’s next?

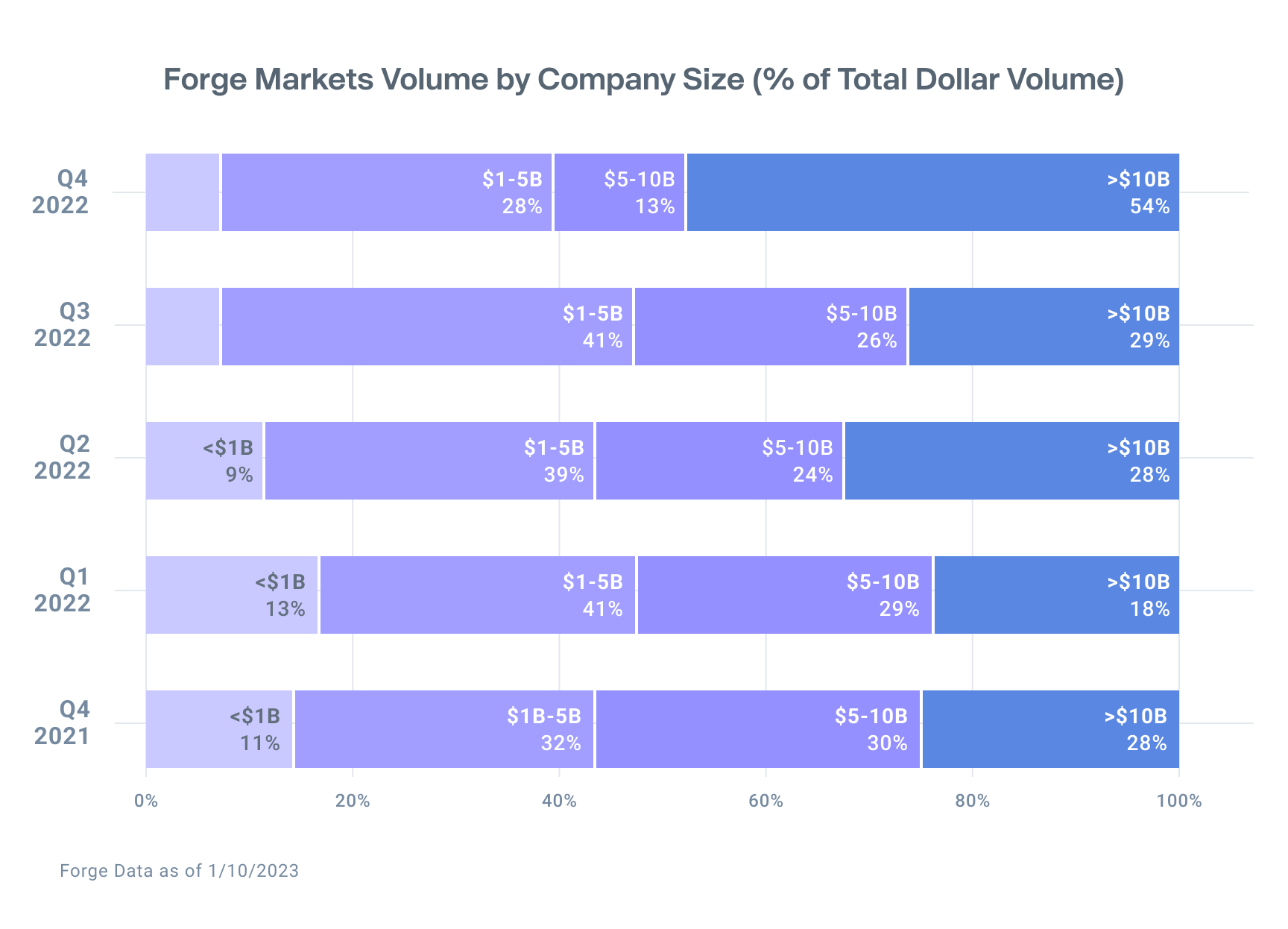

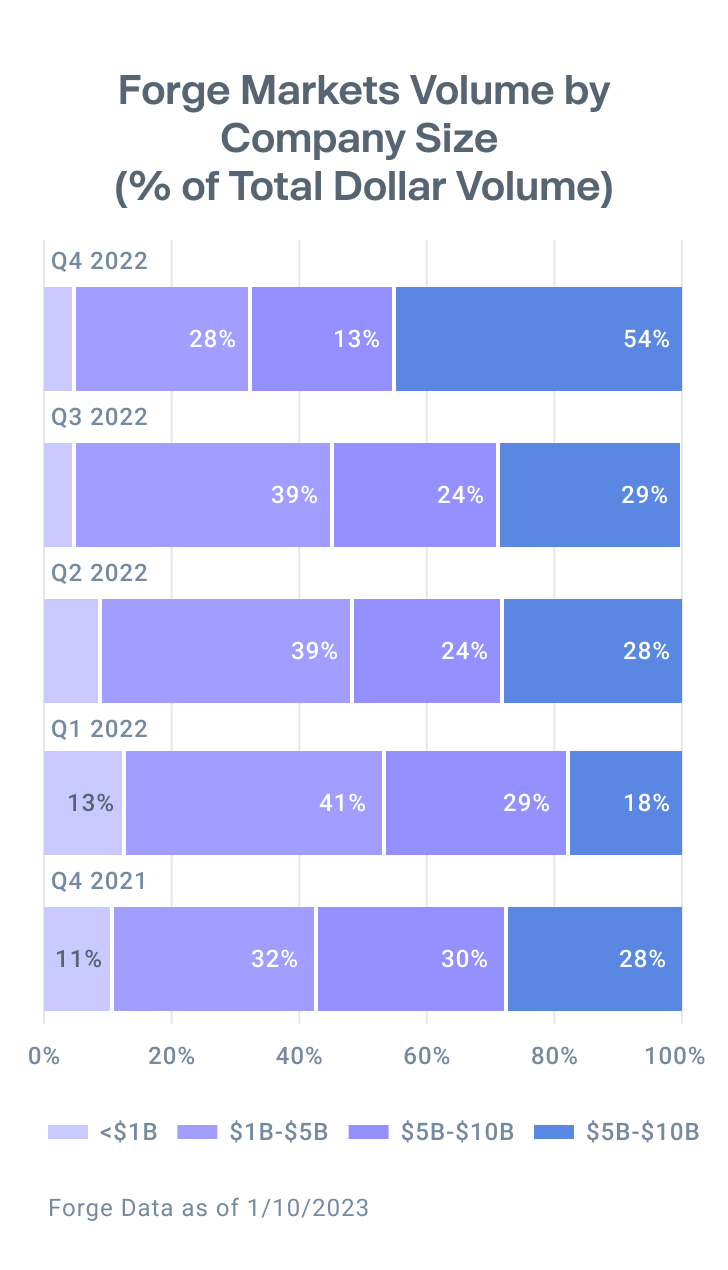

Recent trends show that younger, bigger private companies (think less than 10 years old, greater than $10 billion valuation) are getting the most investor attention. Additionally, esoteric deal terms are making their way back into many venture deals as investors grapple with the market reset. 3

One name that exemplifies this trend is OpenAI, which is generating buzz from both the private market investment world and the general public based on its introduction of ChatGPT, which enables AI-generated art and writing.

The New York Times reports that OpenAI is in talks to more than double its valuation from 2021, reaching around $29 billion. 4 But a closer look at the deal terms indicates that OpenAI and its lead investor, Microsoft, arranged a “highly unusual deal structure” – not just a simple equity stake.

Of course, not every company will experience this type of boom, but at least the overall picture could be better as we progress through 2023. The most recent U.S. inflation figures, for example, show signs of improvement. 5 If that means the Fed slows down on interest rate hikes, that could buoy private markets.

Much is left to play out, but in many ways, the new year is off to a good start.

Investors shift focus to younger companies

Over the last two years, investors have increasingly shifted their preferences to younger companies. At various points throughout 2020, approximately 40-50% of investor interest was directed at companies that had been operating privately for 10+ years. In recent months, that percentage has dipped to an all-time low of 8%, meaning 92% of investor interest is directed at companies operating privately for less than 10 years.

There may be two reasons for this trend. First, 2020 and 2021 were two of the biggest years for IPOs since the 90s, which means many companies trading on the private market exited, leaving younger companies to soak up private investments. 6

Second, 2022 saw many older companies on the IPO doorstep, such as Stripe and Instacart, lower their valuations in light of shifting investor appetites for risk assets and dour macroeconomic conditions. In contrast, younger companies may have been insulated from this trend with less likelihood for inflated valuations and high burn rates. This may allow investors to more confidently deploy capital, while still offering upside potential.

While investors are showing a preference for slightly younger companies, Q4 showed a sizable move into larger companies with over 50% of investor dollars going into companies valued over $10 billion. This suggests that the sweet spot for companies in the current market are those valued greater than $10 billion with 6-10 years of tenure, which includes companies like Discord, Databricks, Chime, and Airtable.

Rate of decline slows as Private Market waves goodbye to 2022

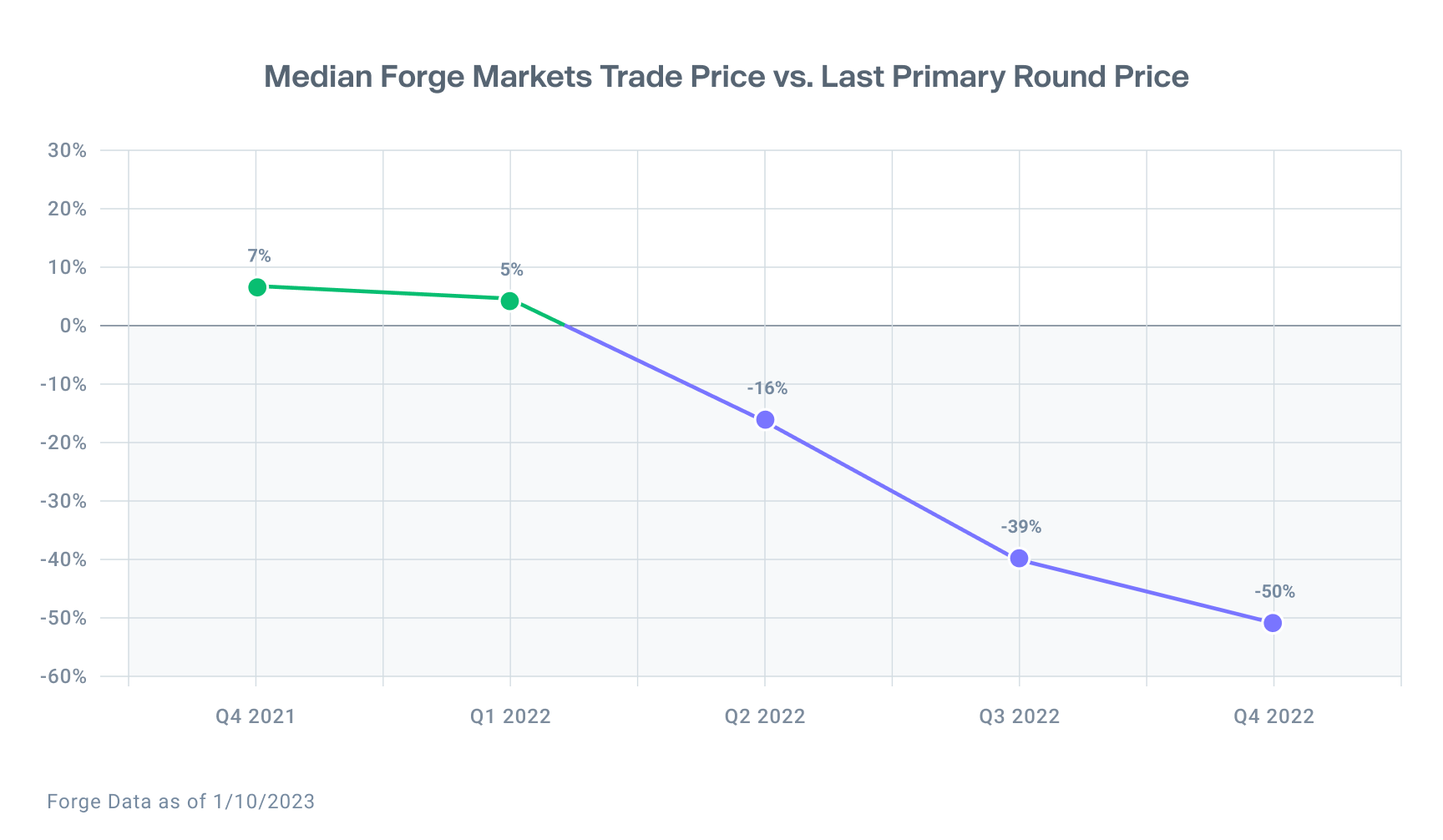

In Q4, the median trade price on Forge marketplace showed a 50% discount to a company’s last fundraising round. Notably, the rate of decline during the Q3 2022 – Q4 2022 period slowed versus the Q1 2022 – Q2 2022 and Q2 2022 – Q3 2022 periods.

On average, prices fell -8.8% when comparing the price of companies that traded on Forge marketplace in both Q3 2022 and Q4 2022 – a slowing rate of decline from the Q2-Q3 drop of –22.2%.

Public tech indices had varying performance depending on the composition of the index. The NASDAQ budged upward 0.1%, the IPO ETF fell -13%, but the widely watched ARKK ETF struggled across the finish line, falling -17.2%.

Overall, prices of private market names fell -50.9% for companies that traded on Forge marketplace in Q4 2021 and Q4 2022

Down rounds or dirty term sheets?

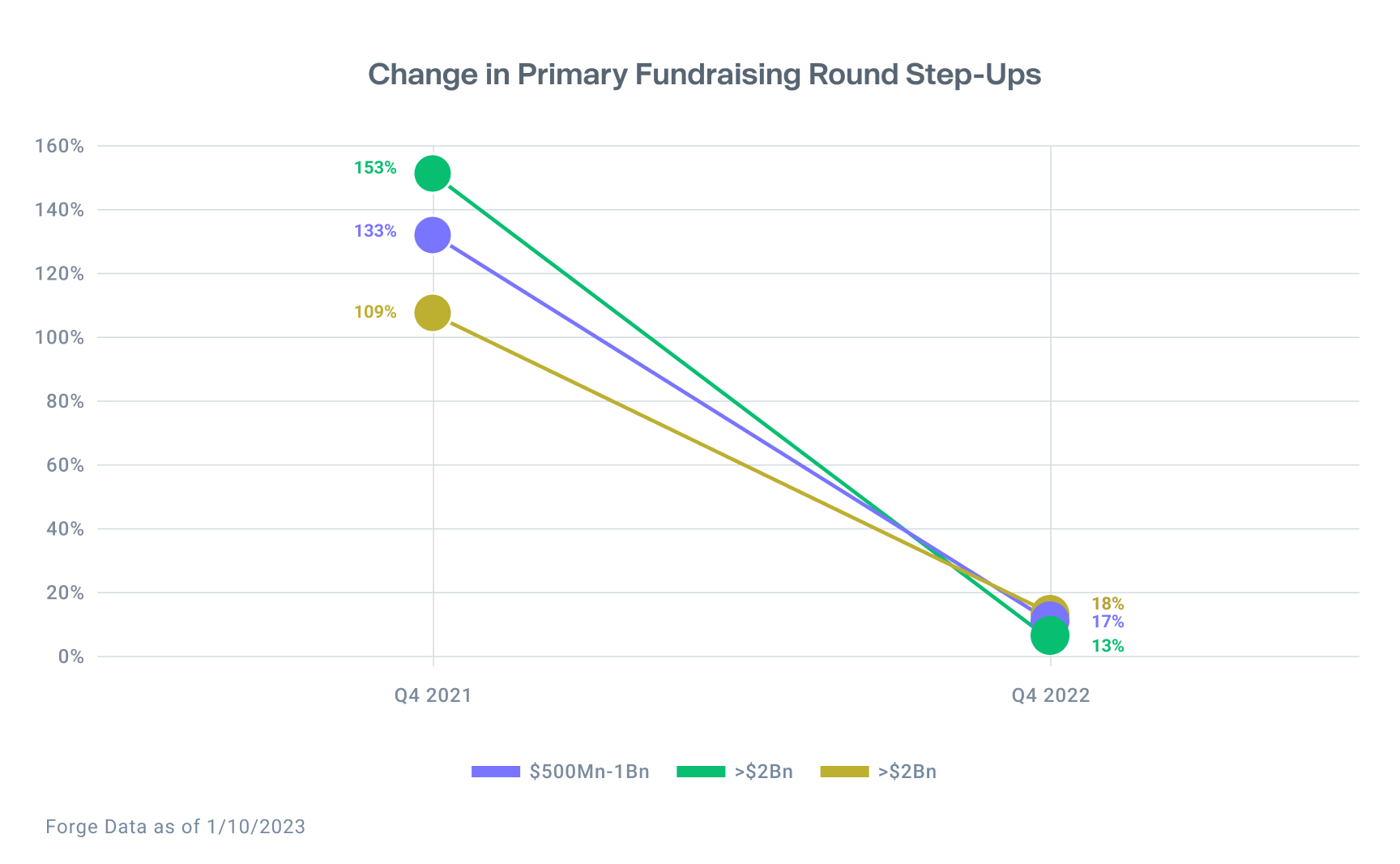

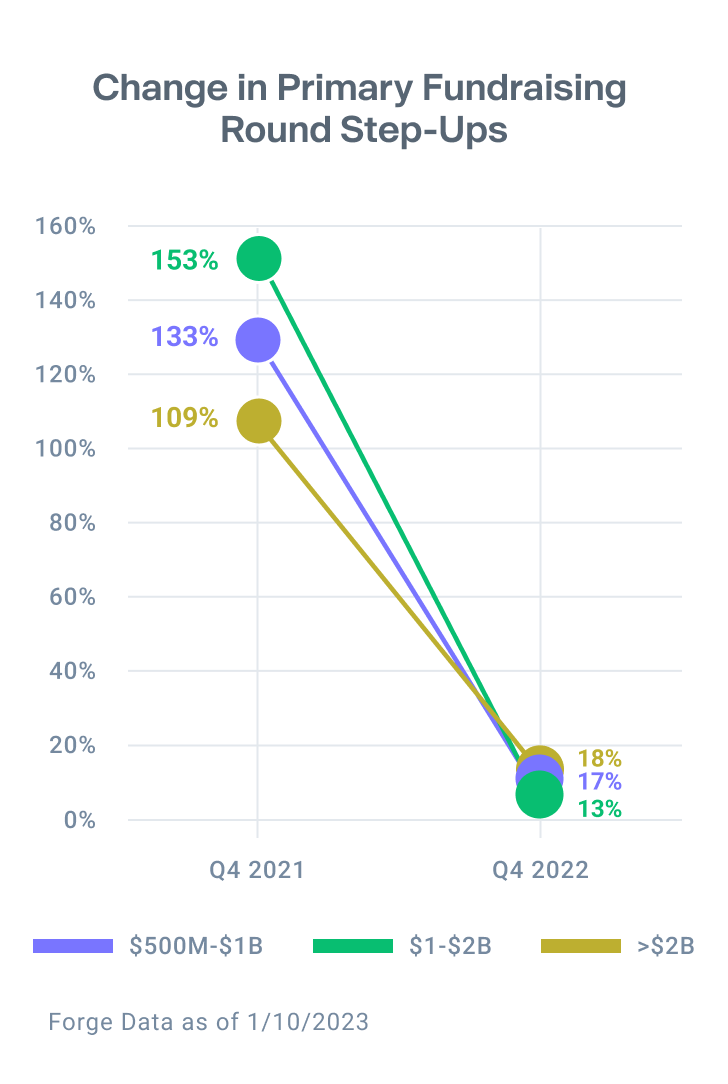

In Q4 2022, only five companies covered by Forge Data valued at greater than $2 billion raised money, with an average valuation increase of approximately 18%.

In the current market, headline valuations do not necessarily tell the full story. As investor Janelle Teng of Bessemer Venture Partners points out, private companies facing challenging fundraising conditions may find themselves choosing between lower valuations and “dirty” term sheets. Neither choice is ideal for companies, but Teng predicts “less stigma will be associated with markdowns” as the risks of rounds with high valuations but exotic deal terms become more apparent.

Mutual Fund Managers Mark down private holdings – Is valuation reset upon us?

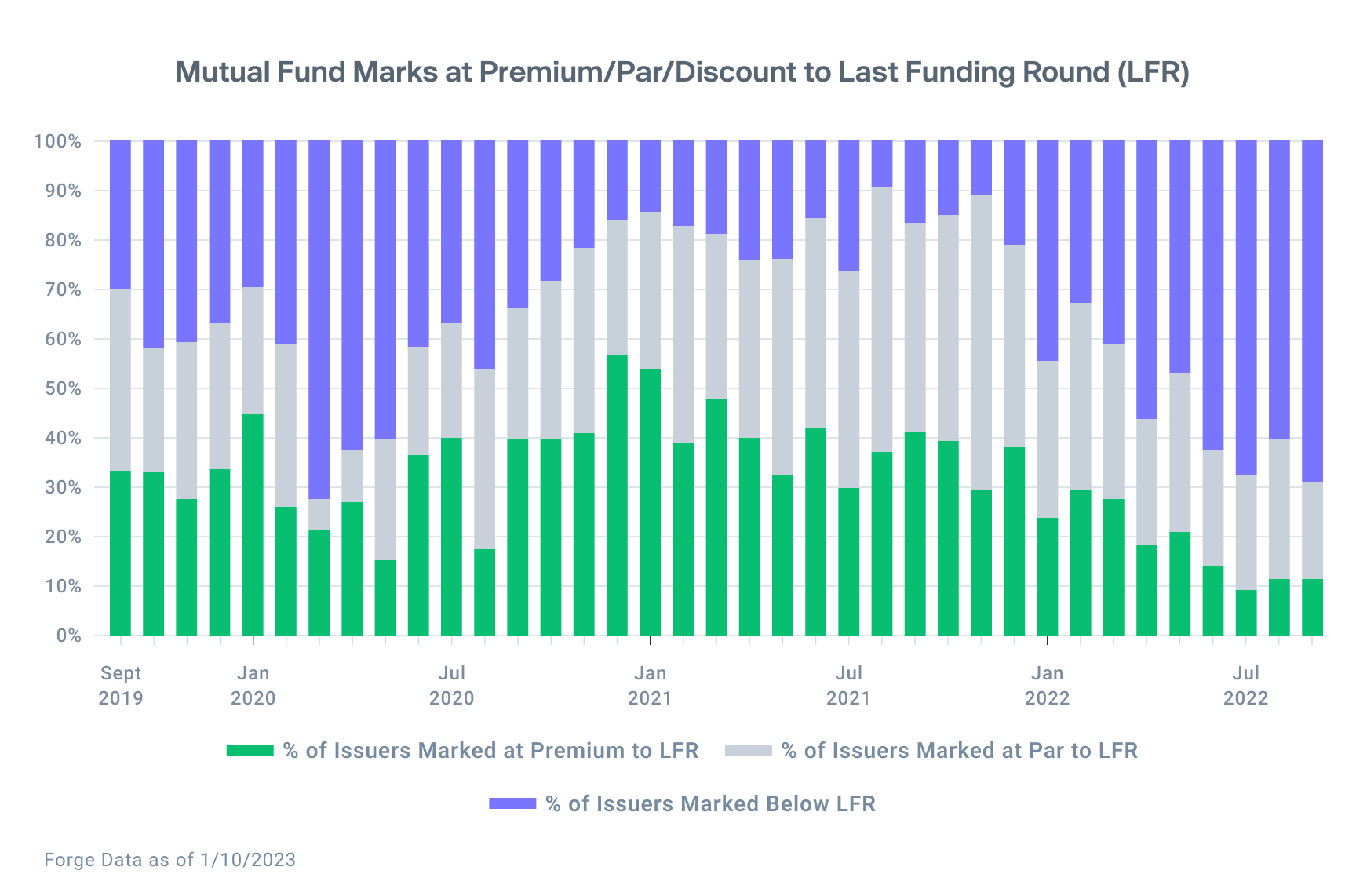

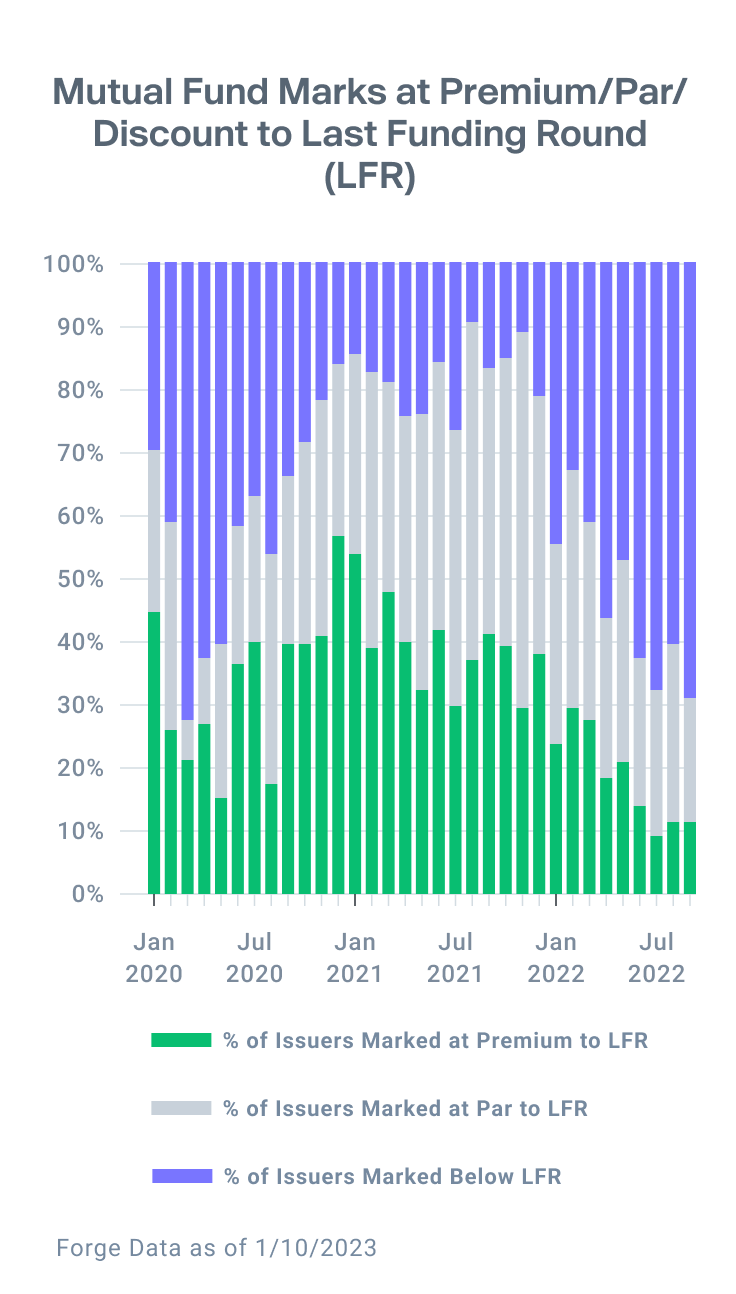

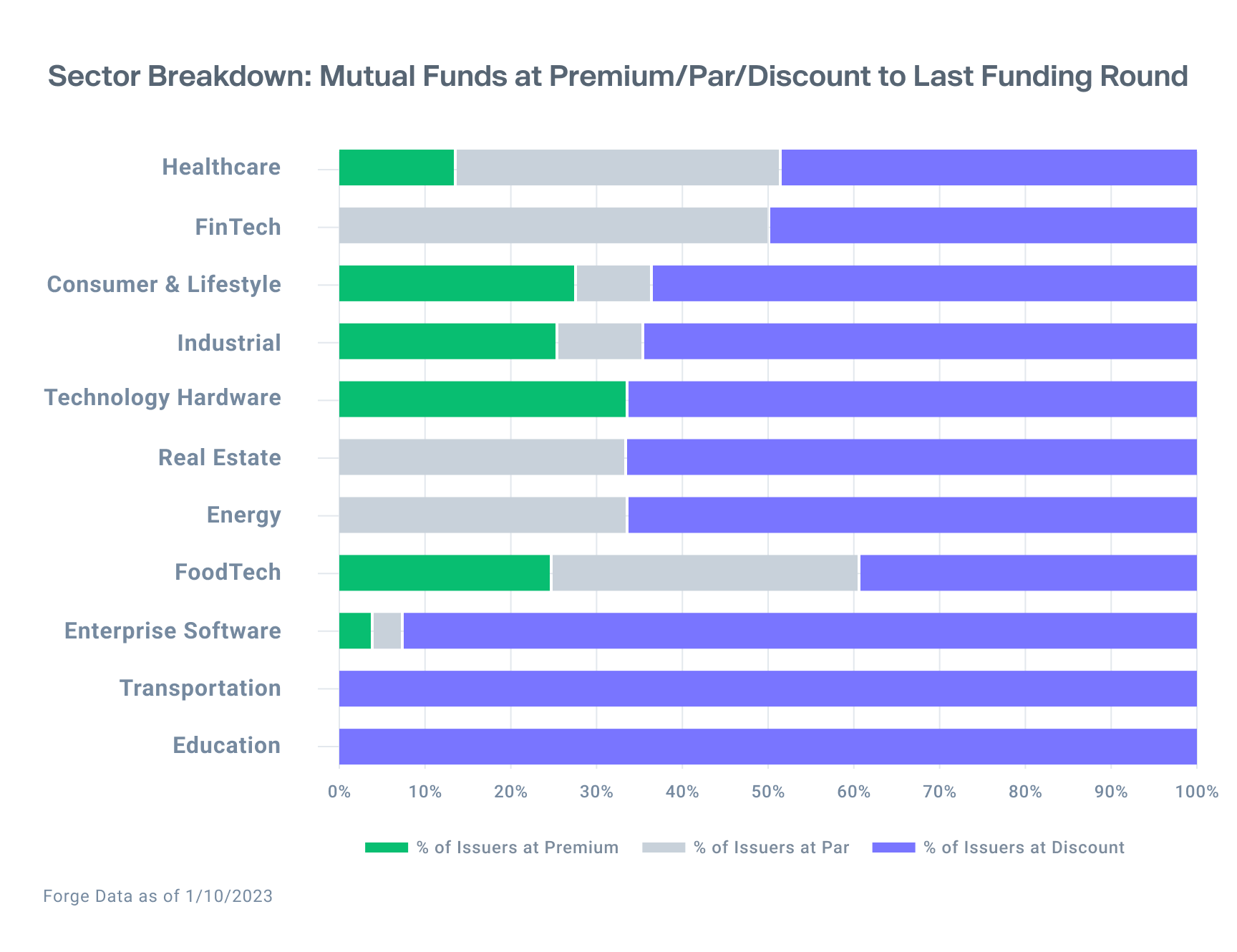

Forge Data maintains a dataset of mutual fund marks, which allows investors to analyze how some of the largest institutional investors are pricing their private company holdings. Forge offers this data at the mutual fund and company level, but an aggregated view shows that markups have all but disappeared from the current market.

As Janelle Teng noted in her blog, this may be the result of an “increasing recognition that many of these valuation resets represent a correction of 2021’s peak frenzy mispricing and overhang, rather than a reflection of core business performance.” 7

Forge Data also allows investors to drill down into specific segments of mutual fund marks to show which sectors are still holding on to valuation premiums. Healthcare and Enterprise Software are the two largest sectors, and each has a small number of companies commanding premiums from their investors such as Tempus, Somatus, Checkr, and Arctic Wolf. Meanwhile, the companies that make up the fintech sector, such as Stripe, Klarna, and Plaid, have seen their premiums erased during this year’s drawdown.

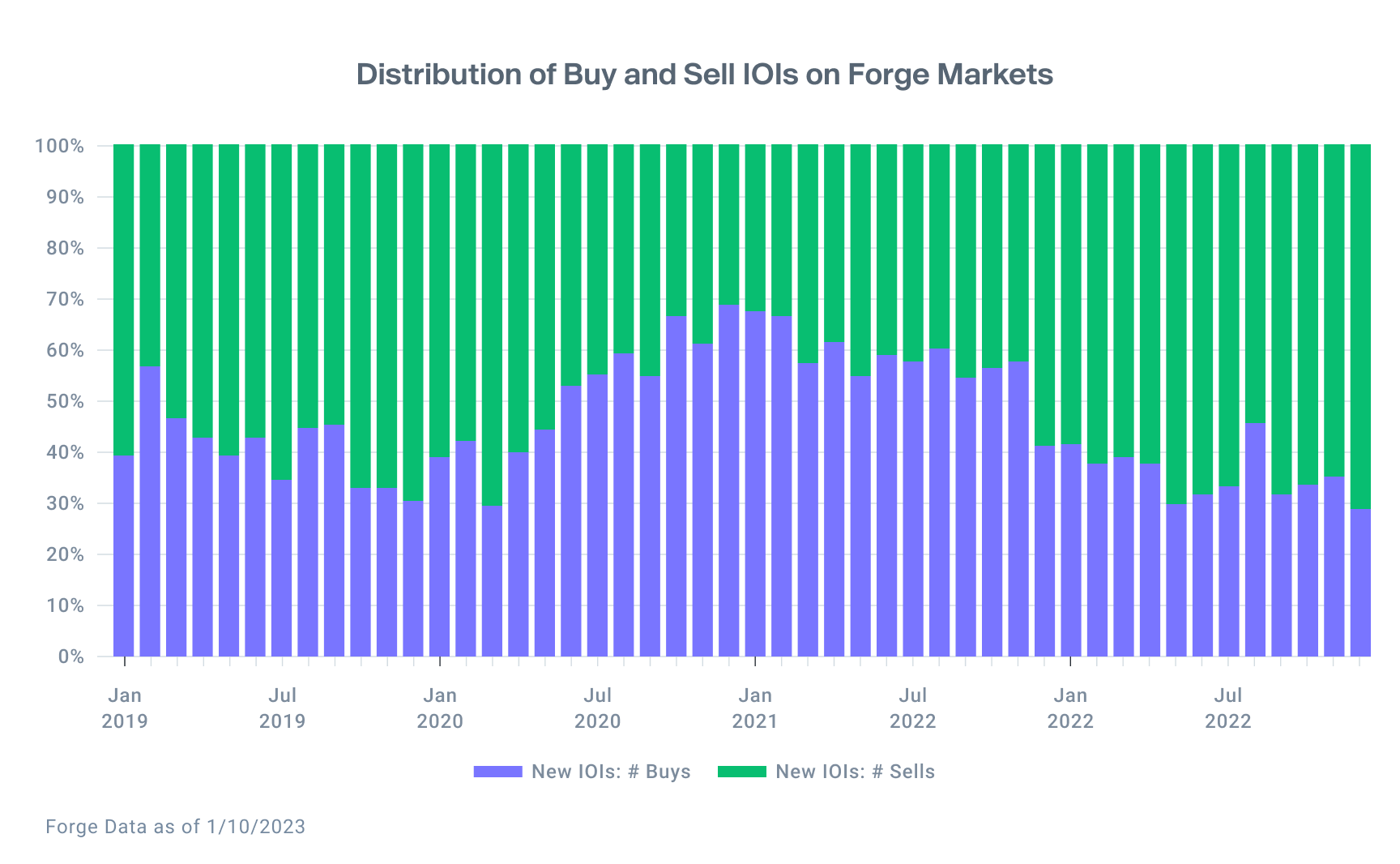

Sell-Side continues to lead Private Market as investors search for opportunities

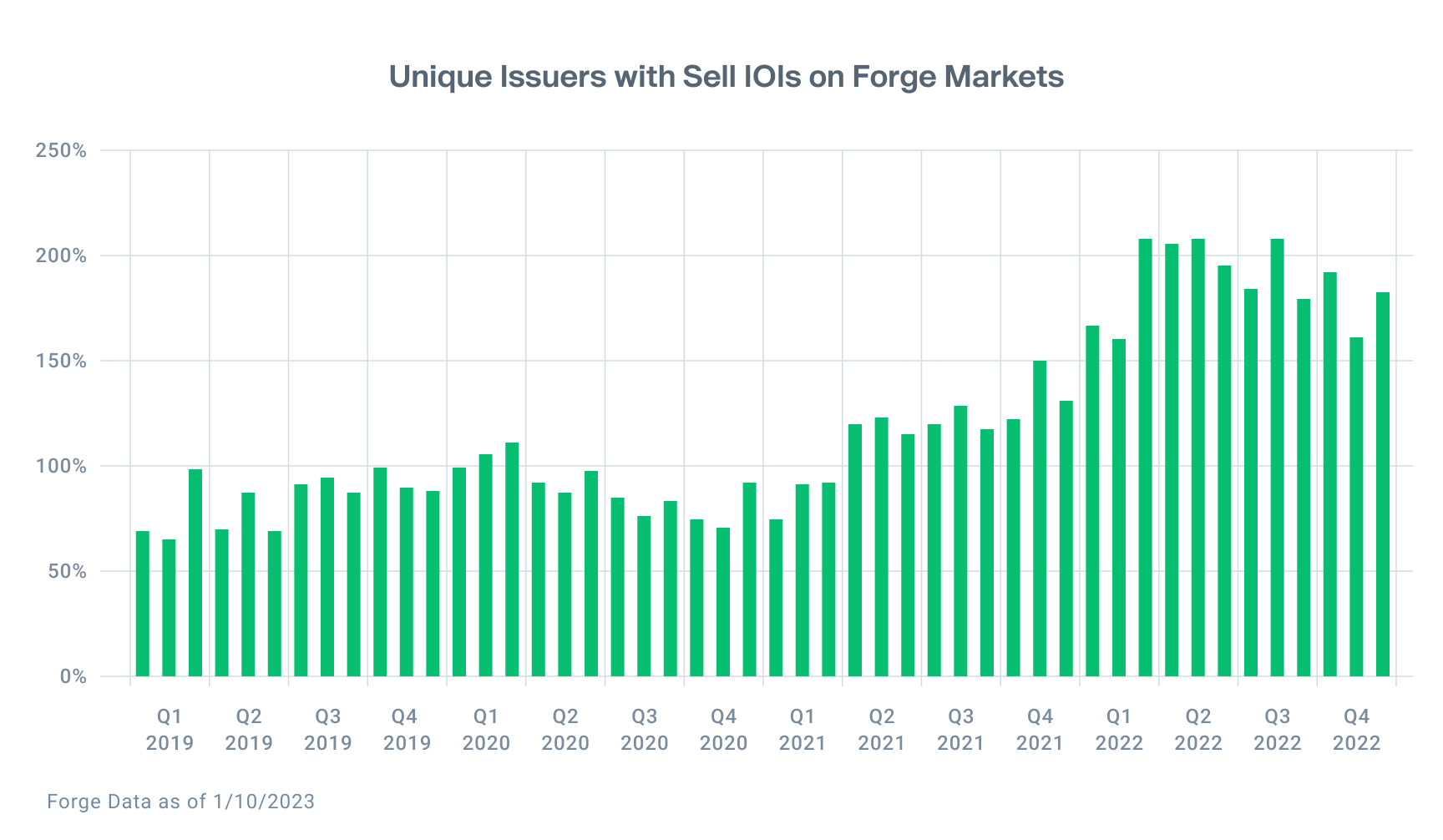

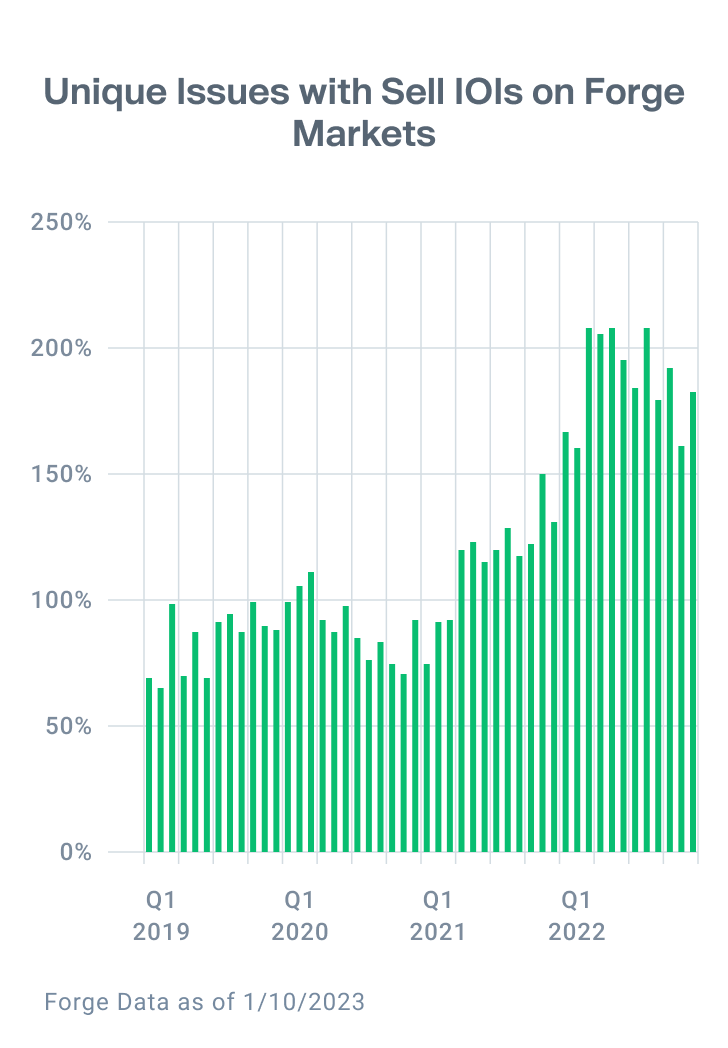

The market remains skewed to the sell-side, with nearly 70% of indications of interest (IOIs) coming from shareholders – typically employees of private companies or early investors. This trend has remained consistent throughout the year, and market participants are watching closely to see if interest shifts to the buy side as macroeconomic factors like inflation show signs of improvement and there is a potential line of sight into the Federal Reserve pausing rate hikes.

December saw an increase in the number of companies with unique sell indications of interest on Forge marketplace, but again – no change to the broader trend.

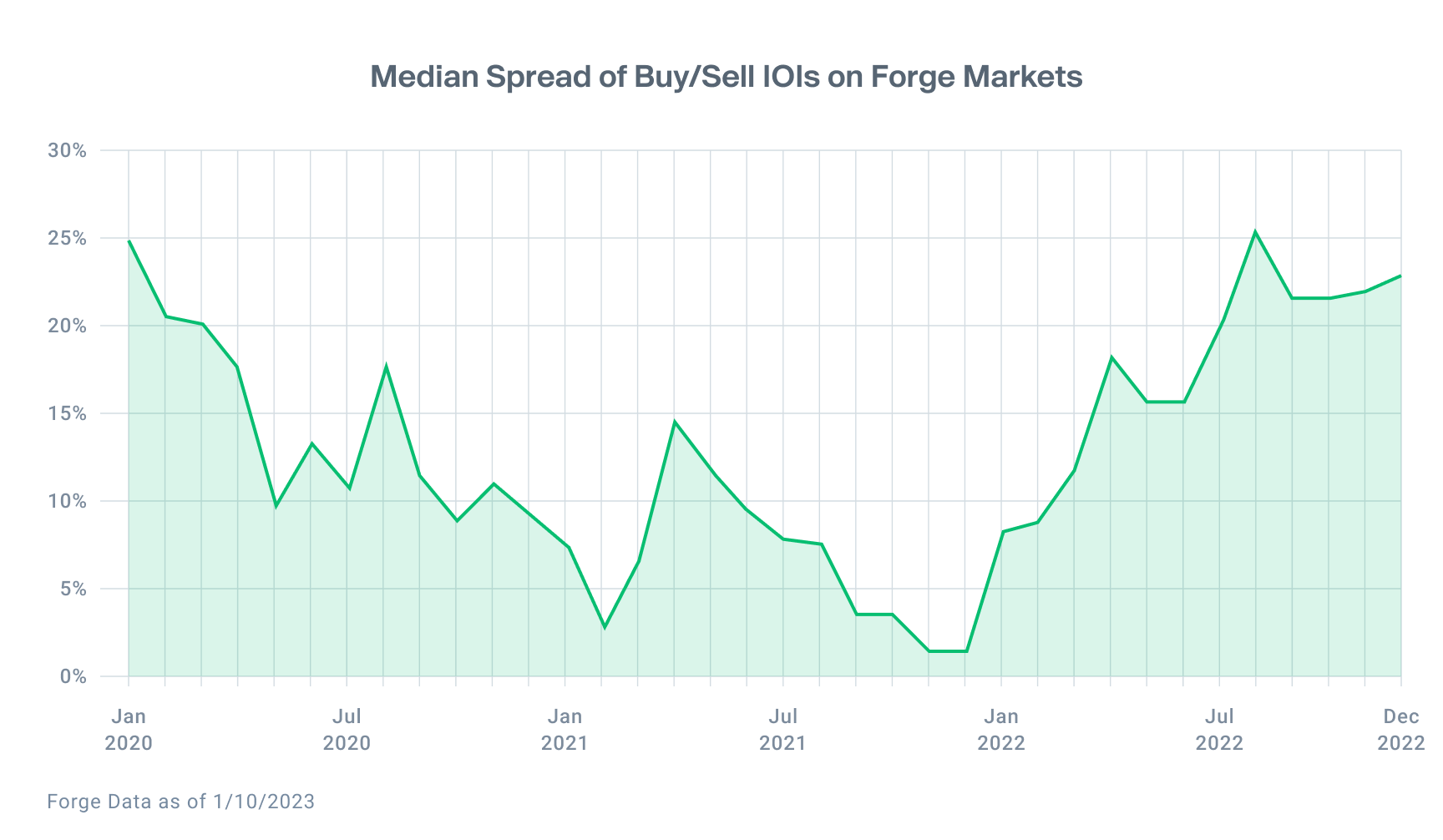

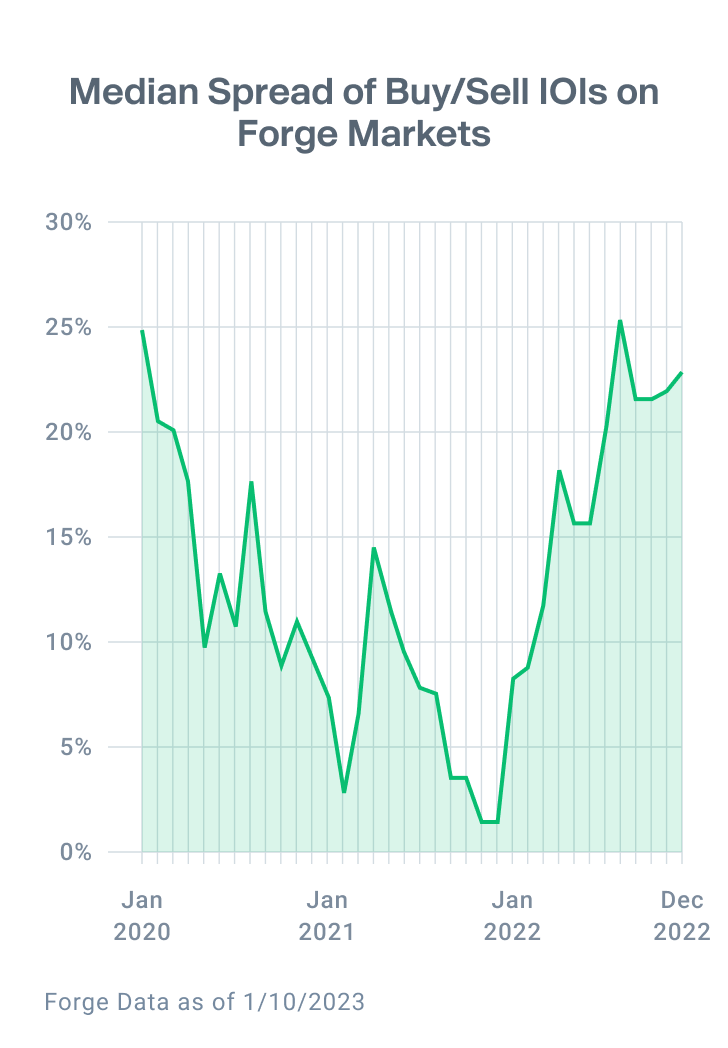

Bid-ask spreads remain elevated but have narrowed slightly from their all-time high of 25% in August.

Private market participants have reason for optimism as the calendar turns to 2023. Macroeconomic signals are flashing improvement, and a significant amount of the recent valuation frenzy has been flushed from the system. This is potentially a rare moment for private market investors to add shares of high-growth companies to their portfolio while prices are depressed. Forge will continue providing data to the private market community as the year unfolds – so please subscribe for future updates.