Private Market Update July 2025

AI companies have taken pole position in the private market grand prix

Over the past few weeks, the private market has experienced a resurgence fueled by stronger investor confidence and rising exit activity. Indeed, the IPO landscape is buzzing once again: more than 174 companies have crossed the public finish line in the first half of 2025, raising over $31 billion — marking the strongest showing since the 2021 bull run — while high-profile tech companies such as CoreWeave, Circle, Chime, Figma and Gemini have either gone public or filed for listing.1 Behind the scenes, a pit lane full of potential IPO contenders are revving their engines, eager to tap public liquidity. Together, these developments suggest a private market that's not just back on track — but racing ahead with momentum.2

In this race, private artificial Intelligence (AI) companies have taken pole position. From precision-engineered AI models to lightning-fast infrastructure upgrades, the AI ecosystem is operating at full throttle. This month, Forge charts the track between AI’s public market titans — Microsoft, Google, Meta and others — and private market pacesetters like OpenAI, Anthropic, Perplexity and xAI. This update further contrasts the performance of the AIQ ETF and public Mag7 against Forge’s AI thematic basket, revealing who’s leading the pack and who is playing catch up.

The message in Forge’s July 2025 Private Market Update is clear: the AI sector continues to experience rapid growth, attracting significant investments in both the public and private markets. However, for those looking to truly carpe diem, private AI company investments offer a potential strategy for investors looking to access some of the most innovative and fastest growing companies.

Private AI company investments maintained their strong pace in June

Against a backdrop of ongoing tariff whiplash,3 geopolitical uncertainty and macroeconomic twists and turns,4 the enduring strong performance of private AI companies should not be understated.5

| Broad Market Performance | L1M | QTD | L3M | YTD | L12M |

|---|---|---|---|---|---|

| Forge Private Market Index | 0.51% | -0.86% | -0.86% | 35.89% | 37.63% |

| Forge Accuidity Private Market Index | 16.56% | 26.64% | 26.64% | 38.68% | 47.46% |

Forge Data through 06/30/25

| Thematic Performances | L1M | QTD | L3M | YTD | L12M |

| Forge AI thematic basket | 5.82% | 13.50% | 13.50% | 63.10% | 132.40% |

| SPY | 5.14% | 10.78% | 10.78% | 6.05% | 14.94% |

| QQQ | 6.38% | 17.77% | 17.77% | 8.18% | 15.78% |

Forge Data through 06/30/25

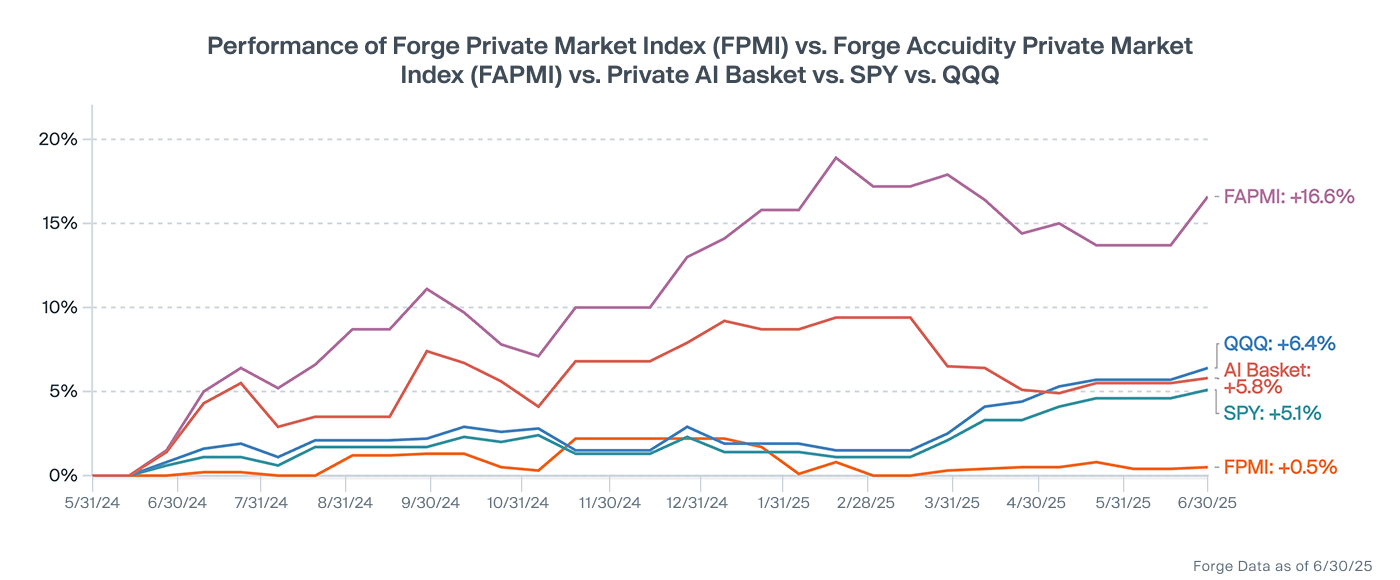

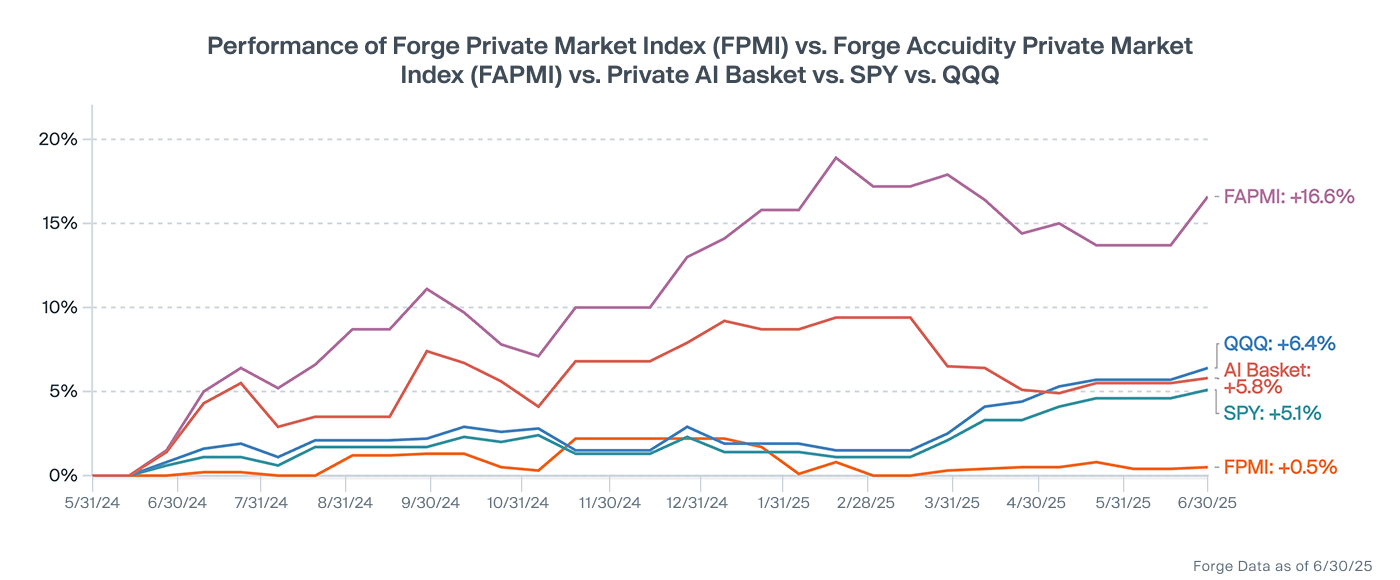

In June 2025, the Forge AI thematic basket returned 5.8% compared to 5.1% for SPY and 6.4% for QQQ. Looking at the previous six- and 12-month periods reveals a gap in investor demand between the tech-heavy, but limited AI exposure QQQ, mostly legacy company SPY and the Forge AI thematic basket. Major contributors to the Forge AI thematic basket performance during June 2025 include Meta’s $14.3 billion investment6 in Scale AI at a $29 billion valuation and CoreWeave – whose spectacular run as a newly minted public company bested 46.5% in June 2025, following a 170% gain in May 2025.7

The broader private market gave a recently reinvigorated public market a run for its money last month. While the public market rebounded strongly in June 2025, with major indices closing at all-time highs,8 the Forge Accuidity Private Market Index (FAPMI) returned 16.6% during June. The equal-weighted Forge Private Market Index (FPMI) remained quieter in June, returning 0.5%.

The Forge AI thematic basket appears poised to win the long race

When one takes a longer view of the private market grand prix, it becomes clearer that the year-to-date (YTD) performance of the Forge AI thematic basket9 has outperformed its public market counterparts in 2025, as illustrated in the chart below. Thus, making the basket’s returns an attractive proposition for potential investors.

Three noteworthy AI investment vehicles

Investors looking to ride the AI investment wave now have multiple vehicles to choose from—public and private. Here’s how three of the top AI-related investment paths are faring in 2025:

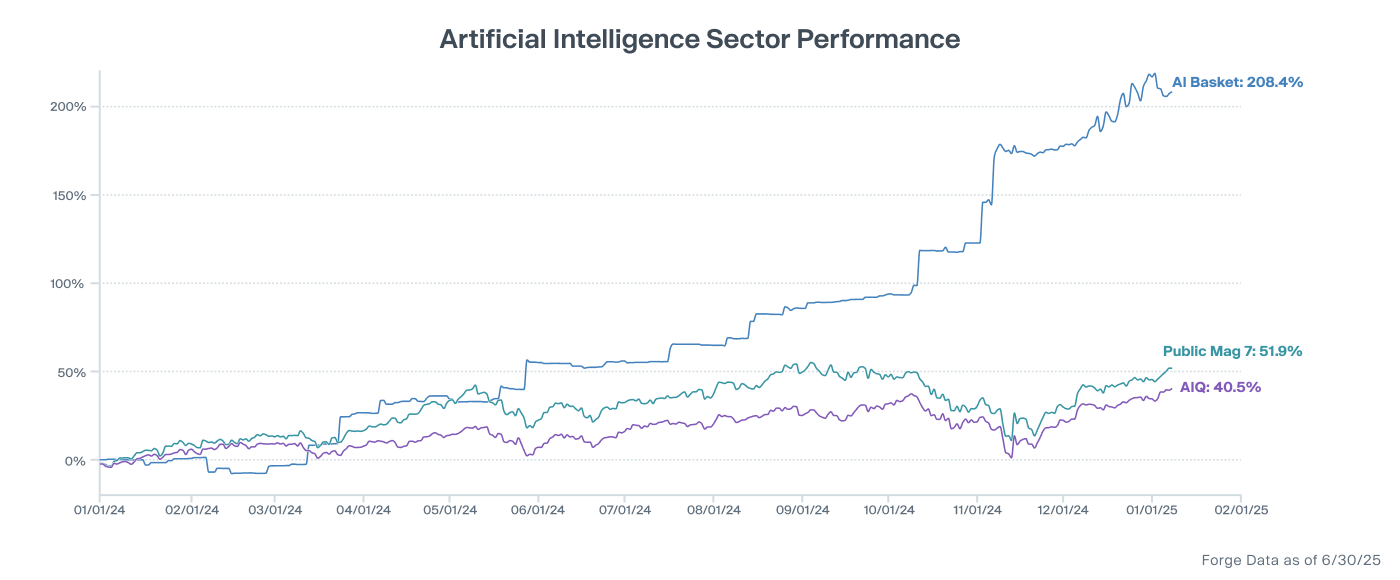

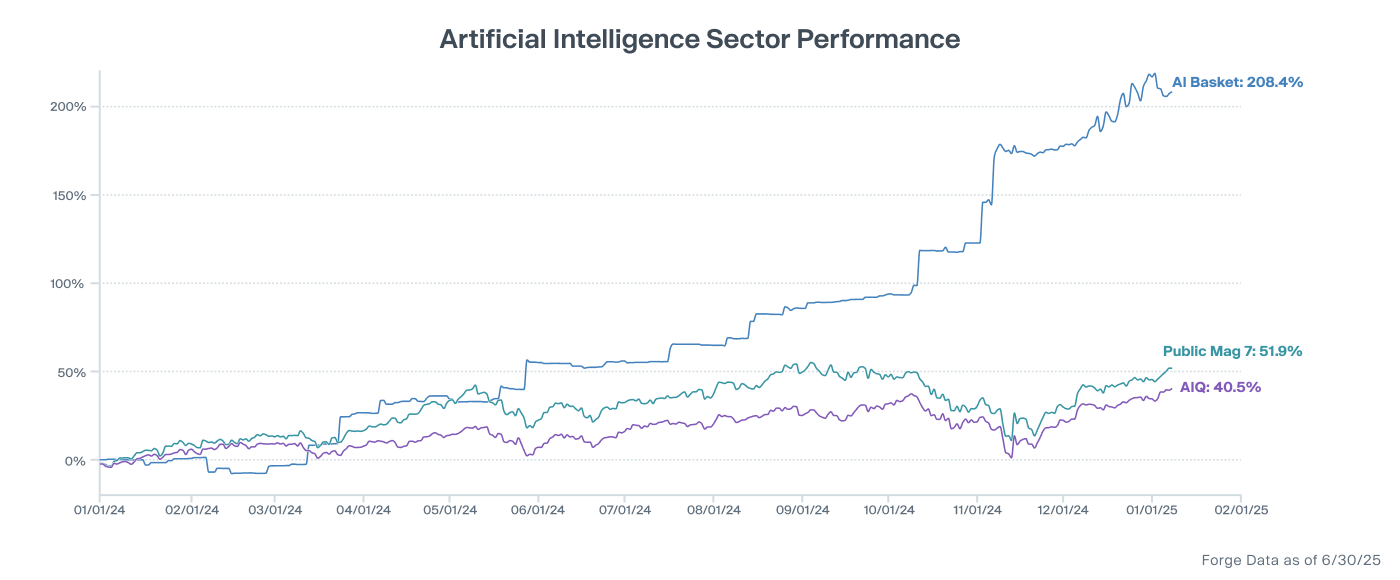

AIQ ETF (public market)

The Global X Artificial Intelligence & Technology Exchange-Traded Fund (AIQ ETF) invests at least 80% of its total assets in the securities of an underlying index that is designed to track the performance of companies involved in the development and utilization of AI and big data. It’s a clean, efficient way to invest in leading public players like Palantir and Nvidia, which are not necessarily AI ‘pure plays,’ but AI industry influencers, nonetheless. This ETF has had decent acceleration in 2025— +13.2% YTD10— but its performance still falls far behind the Forge AI thematic basket, as highlighted in the chart below.

Mag7 (public market)

The public Mag7 stocks are a group of seven large, influential technology companies that have significantly impacted the stock market, particularly in recent years. These companies are: Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), Nvidia (NVDA) and Tesla (TSLA). They are often highlighted for their strong performance, innovation and market capitalization, which can heavily influence major stock indexes. Although they’re well-known public market investments, their YTD performance — +2.5% YTD11 — also falls far behind the Forge AI thematic basket.

Forge AI thematic basket (private market)

This basket of private AI companies includes top-tier AI companies like OpenAI, Anthropic, Perplexity, Scale AI and others that the above-mentioned public vehicles do not include. The YTD performance of the basket — +63.1% YTD — is illuminating, while noting that, despite its incredible performance this year, private company investments can potentially be riskier and more volatile. The clear takeaway here is that the Forge AI thematic basket has significantly outperformed its public market counterparts this year.

| Investment Vehicle | Some of the Top Companies | YTD Performance |

|---|---|---|

| AIQ ETF (public market) | Nvidia, Adobe, Palantir | 13.2% |

| Mag7 (public market) | Apple, MSFT, Tesla, Meta | 2.5% |

| Forge AI thematic basket (private market) | OpenAI, Anthropic, xAI | 63.1% |

Forge Data through 06/30/25

| Artificial Intelligence Index | L1M | QTD | YTD | L12M | ITD |

|---|---|---|---|---|---|

| AIQ ETF (public market) | 5.82% | 13.50% | 63.10% | 132.40% | 208.42% |

| Mag7 (public market) | 8.53% | 20.23% | 13.20% | 22.79% | 40.47% |

| Forge AI thematic basket (private market) | 7.43% | 20.34% | 2.50% | 15.08% | 51.88% |

Forge Data through 06/30/25

Taking a pit stop: AI company fundraising fervor

In the first half of 2025, venture capital (VC) investment in private AI companies surged to new heights, driven by a race to secure early stakes in the next generation of foundational models, infrastructure tools and agentic platforms.12 Investors deployed capital at a noteworthy pace, targeting emerging companies that demonstrate not only technical breakthroughs but also commercial traction across enterprise, developer and consumer markets.

From generative AI leaders like OpenAI, Anthropic, and Cohere to infrastructure players such as Scale AI and Together AI, funding rounds have routinely reached the hundreds of millions—often at multi-billion-dollar valuations. This influx of capital underscores a perceived belief among investors that AI remains one of the most disruptive and lucrative frontiers in the private market today. In fact, over seven AI companies raised more than $100 million in Q2 2025,13 including Scale AI, SandboxAQ, Anysphere, Glean, as well as others.

M&A and AI company investments by enterprise tech players

Major tech players like Google, Nvidia, Cisco and Salesforce are racing to gain an edge in AI through strategic acquisitions.14 In 2024, Salesforce acquired Tenyx to bolster its autonomous agent development,15 while Cisco’s purchase of Splunk expanded its data analytics and cybersecurity footprint.16 Nvidia’s investment in Hugging Face signaled a deeper commitment to open-source AI infrastructure17 and Google’s $2.7 billion investment in Character.AI (executed via a rare reverse acquihire)18 underscored the growing importance of conversational AI. As AI innovation becomes a defining force across industries, acquisitions are emerging as a primary strategy for public tech giants looking to accelerate product innovation, lock in talent and outpace rivals.

>More recently, in June 2025, Meta made headlines with its historic $14.3 billion investment for 49% of Scale AI — a private AI company known for providing high‑quality, annotated data powering industry-leading AI models.19 This landmark deal not only setup Meta with a reliable pipeline of expertly labeled datasets — critical for refining its Llama series and advancing toward artificial general intelligence (AGI),20 but also strategically brings Scale AI’s co‑founder and CEO, Alexandr Wang, into Meta’s newly formed Superintelligence Lab. With Wang at the helm and Scale AI’s infrastructure at its disposal, Meta is addressing two persistent challenges — access to elite talent and the quality of training data — positioning itself to close the gap with AI frontrunners like OpenAI and Google.21

Given the magnitude of the investment and its dual focus on data and leadership, this move stands as one of Meta’s boldest external maneuvers yet in its quest to redefine the frontier of AI and further highlights just how attractive private AI company investments are — to individual investors and public tech titans alike.

June buy-side interest continued moving higher

Shifting gears and following a rebound in May 2025 activity, June buy-side interest as a percentage of overall interest again moved up, going from 62% to 64%.22 After hitting a trough in October 2022, the proportion of buy-side indications of interest (IOIs) relative to total IOIs exhibited a steady upward trend, reverting toward the distribution levels observed in the 2020–2021 period.

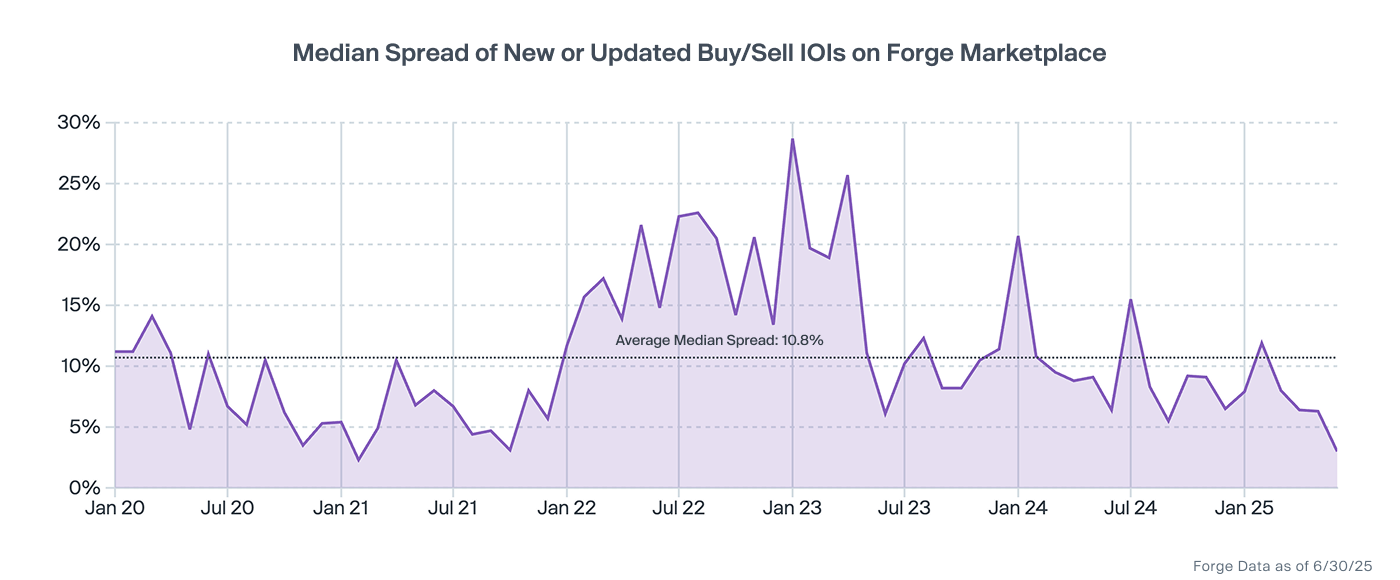

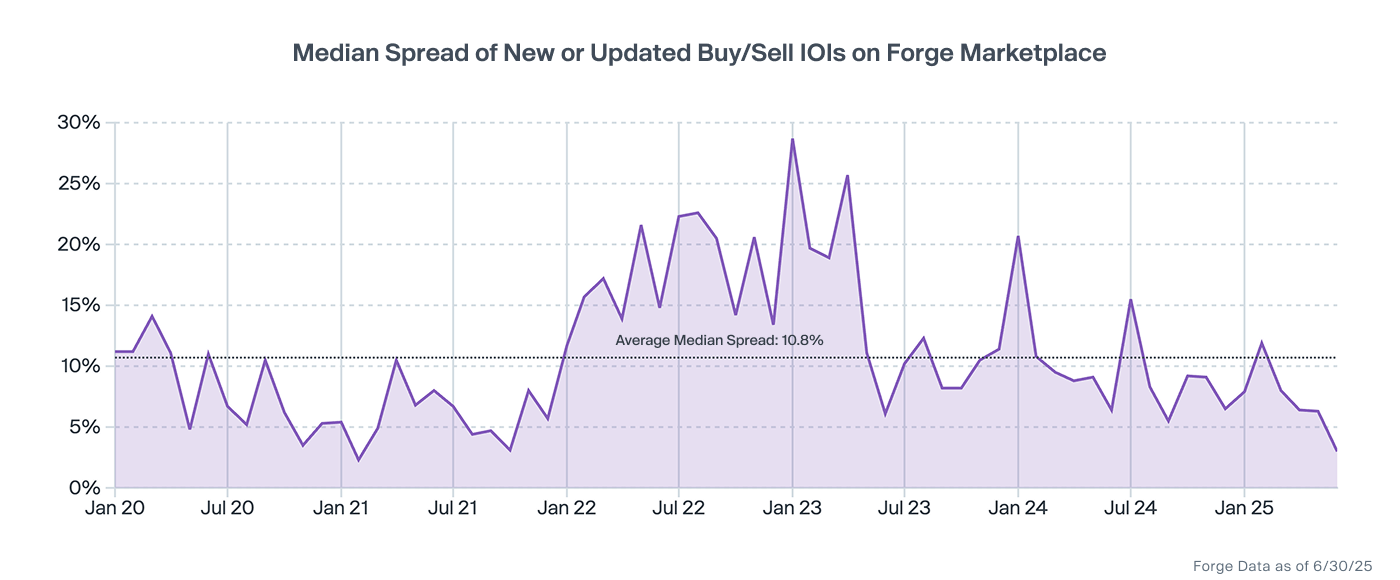

The bid/ask spread continued to compress in June

The median bid-ask spread continued to decline last month, reaching 3% in June 2025, down from 6.4% in May 2025 and the lowest level since February 2021. While this metric can fluctuate from quarter to quarter, it's more meaningful to focus on the longer-term trend. That said, narrower bid-ask spreads often signal a more active market with strong demand.

Secondary premiums/discounts mostly increased in June 2025

With the exception of the 75th percentile, secondary trade premiums/discounts to last funding rounds increased in June 2025 when compared to May 2025. The median discount decreased to -9% in June from -21% in May, while the 90th percentile premium increased to 57% from 36%.

The final lap: where opportunity lies

The celebratory checkered flag is waving in Forge’s July 2025 update, but for investors tracking AI company performance in the private market, the race is far from over. The data is clear, though: while the public market regained its footing last month, it’s the private market AI sector that’s lapping the field — delivering standout performance, attracting investment mega-rounds and commanding attention from public tech titans deploying billions to stay competitive.

From Meta’s headline-making $14.3 billion investment in Scale AI to the sustained momentum of Forge’s AI thematic basket, the story unfolding in 2025 is one of private market outperformance and strategic realignment. Investors are recognizing that some of the most compelling opportunities are no longer listed on major public exchanges — they’re emerging in private market portfolios, early-stage ventures and secondary transactions that give access to future industry leaders before they become household names.

In this new era of investing, where innovation cycles are shorter and AI development is moving at breakneck speed, alpha may not be found by following the crowd — but by charting a quicker path to opportunity through untraditional investment approaches. Forge’s marketplace gives qualified investors a differentiated view into this dynamic ecosystem, with access to curated thematic baskets, proprietary data insights and liquidity solutions to stay agile in the turns, while savvy AI investors are already accelerating into the next lap of private market investing.