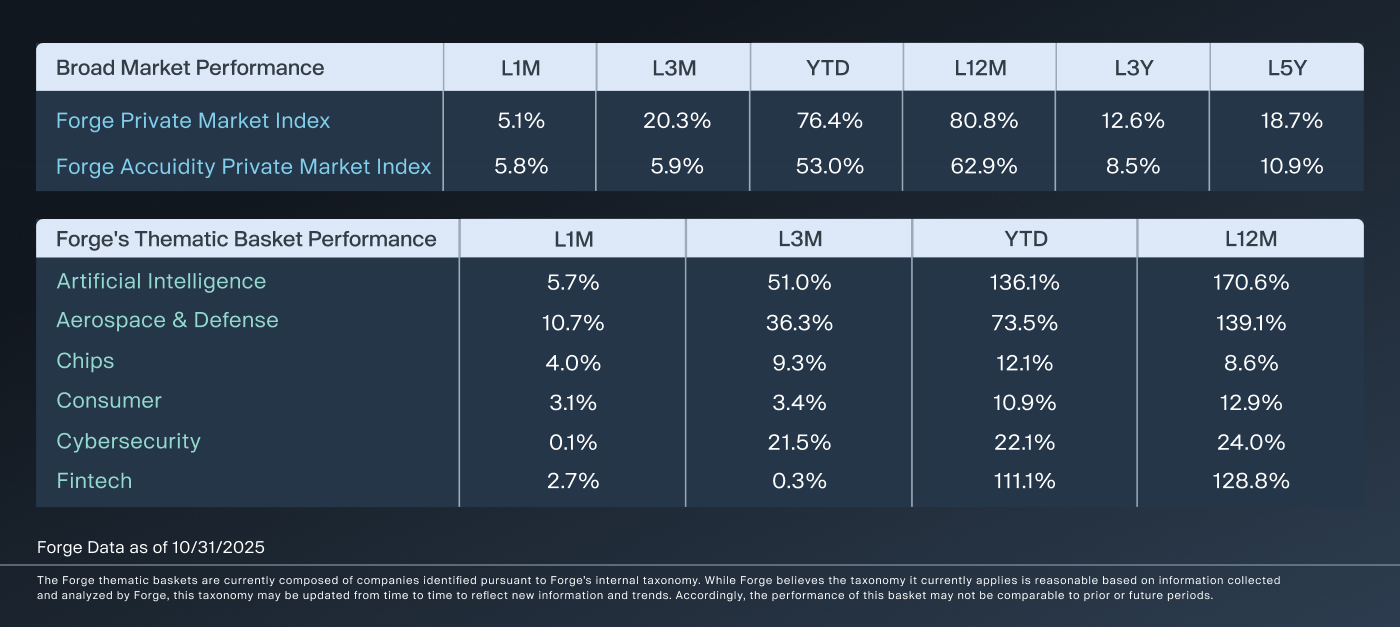

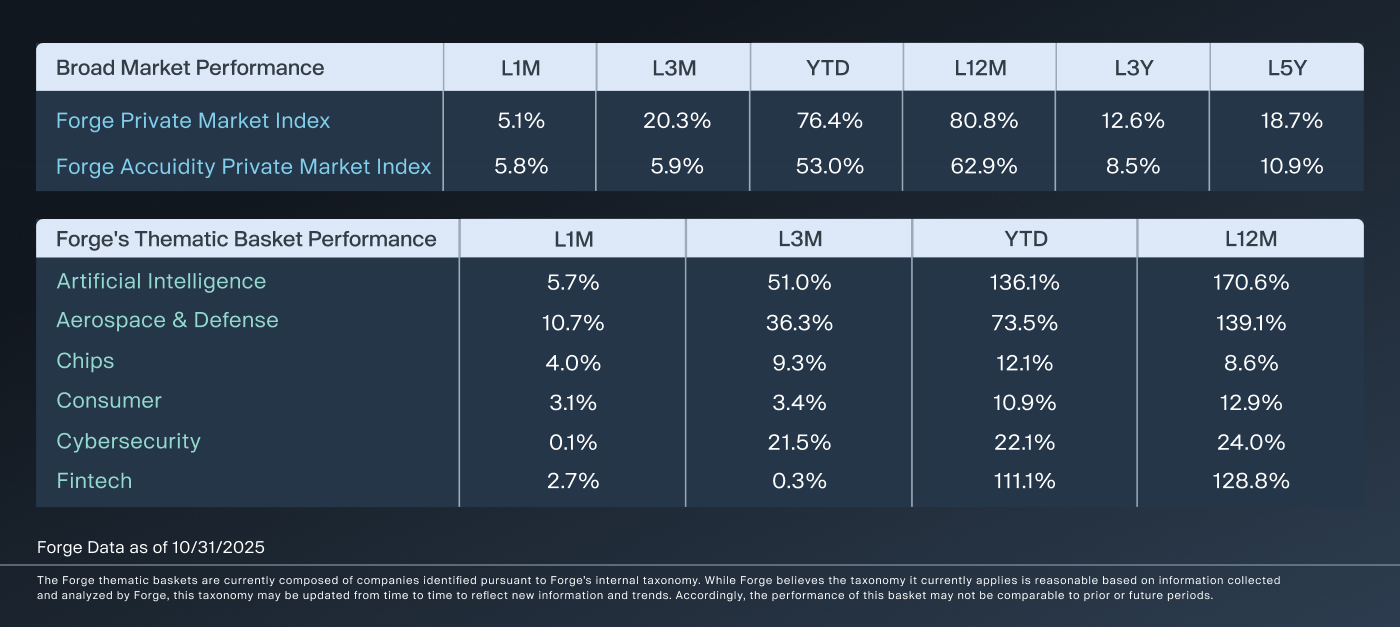

Both Forge private market indices produced solid gains during the month of October.

- The Forge Private Market Index (FPMI), ended October at +5.1%

- The Forge Accuidity Private Market Index (FAPMI) ended the same month at +5.8%

FPMI and FAPMI are broad-based indices for benchmarking and tracking, respectively, that reflect the health and performance of the private market as a whole. FPMI reflects the up-to-date performance and pricing activity of venture-backed, late-stage companies that are actively traded on the Forge marketplace. FAPMI was developed for the Accuidity Megacorn Fund to track, and is comprised of 60 privately held, late-stage venture-backed US companies.

Aerospace & Defense and AI led the private market higher

Following up its leading performance in September, the Forge Aerospace & Defense thematic basket (+10.7%) led the month of October as well. In a distance second place was the AI basket (+5.7%). Companies that drove positive performance:

- Anduril upheld its title of “most coveted stock in the private markets”1 with a 25.2% increase during October. Shares saw demand but the Forge PriceTM increase was not fueled by a specific catalyst

- Similar to Anduril, Anthropic (+25.2%) saw solid appreciation in its Forge PriceTM, but was not fueled by a particular piece of news

The Cybersecurity basket had trailing performance with -0.1% for October. Tanium’s -8.0% performance during October weighed the most on the basket.

Positive returns for both indices that also outpaced the public market

FAPMI edged out FPMI, but both outperformed QQQ (+4.8%) and SPY (+2.4%). FAPMI received positive contributions from the aforementioned Anduril, as well as Deel (+55.7%) and Vercel (+149.0%). SpaceX (-5.2%) was a modest detractor from FAPMI performance. FPMI saw gains from EquipmentShare (+69.8%) and Anduril but was held back by Kraken (-6.8%). These performances were driven by:

- Deel raised a $300M Series E at a $17.3B valuation with lead investors Ribbit Capital, Andreessen Horowitz, and Coatue Management.2 This represents a substantial step up from its 2022 Series D at a $12.1B valuation3

- Vercel raised $300M for its Series F round at a $9.3B valuation led by Accel and Singapore sovereign wealth fund GIC.4 Previously the company had been valued at $3.25B for its Series E round in 20245

- EquipmentShare shares received investor buying interest based upon increased speculation about a near-term IPO6

Overall, the private market had a strong performance in October despite concerns about the effects of the government shutdown.7 While the IPO market appears to be effectively closed until the government shutdown is over,8 private market investors appear undeterred.