Late-stage private companies: The new growth investing

Discover why the next wave of growth investing could be in the private market

Why the private market should not be ignored

In an era where innovation often scales behind closed doors, some of the most compelling opportunities for growth-oriented investors may no longer be confined to the public market. The traditional boundary between public and private capital markets has grown increasingly porous, reshaping the investment landscape in the process. Once viewed as a stepping stone toward a public listing, the private market has matured into a dynamic arena where companies not only incubate but thrive — often at valuations and operational scales once reserved for their public counterparts.

This evolution presents investors with a timely and powerful proposition: gain access to private companies that are larger, more established, and more diverse than ever before — all before they ring the opening bell. As companies delay IPOs in favor of the strategic and operational flexibility afforded by private capital, the late-stage private market has emerged as fertile ground for both innovation and investment returns. Whether it’s category-defining leaders in artificial intelligence (AI), fintech, or space technology, some of the most transformative growth stories of our time are unfolding away from the public market spotlight.

This report explores why late-stage private companies deserve a permanent seat at the table in institutional and sophisticated individual portfolios. We examine their performance characteristics, the shifting structural forces enabling private growth, and the rising accessibility of private market participation. The message is clear: the private market is no longer a precursor to value — it is increasingly where value is created.

Performance potential

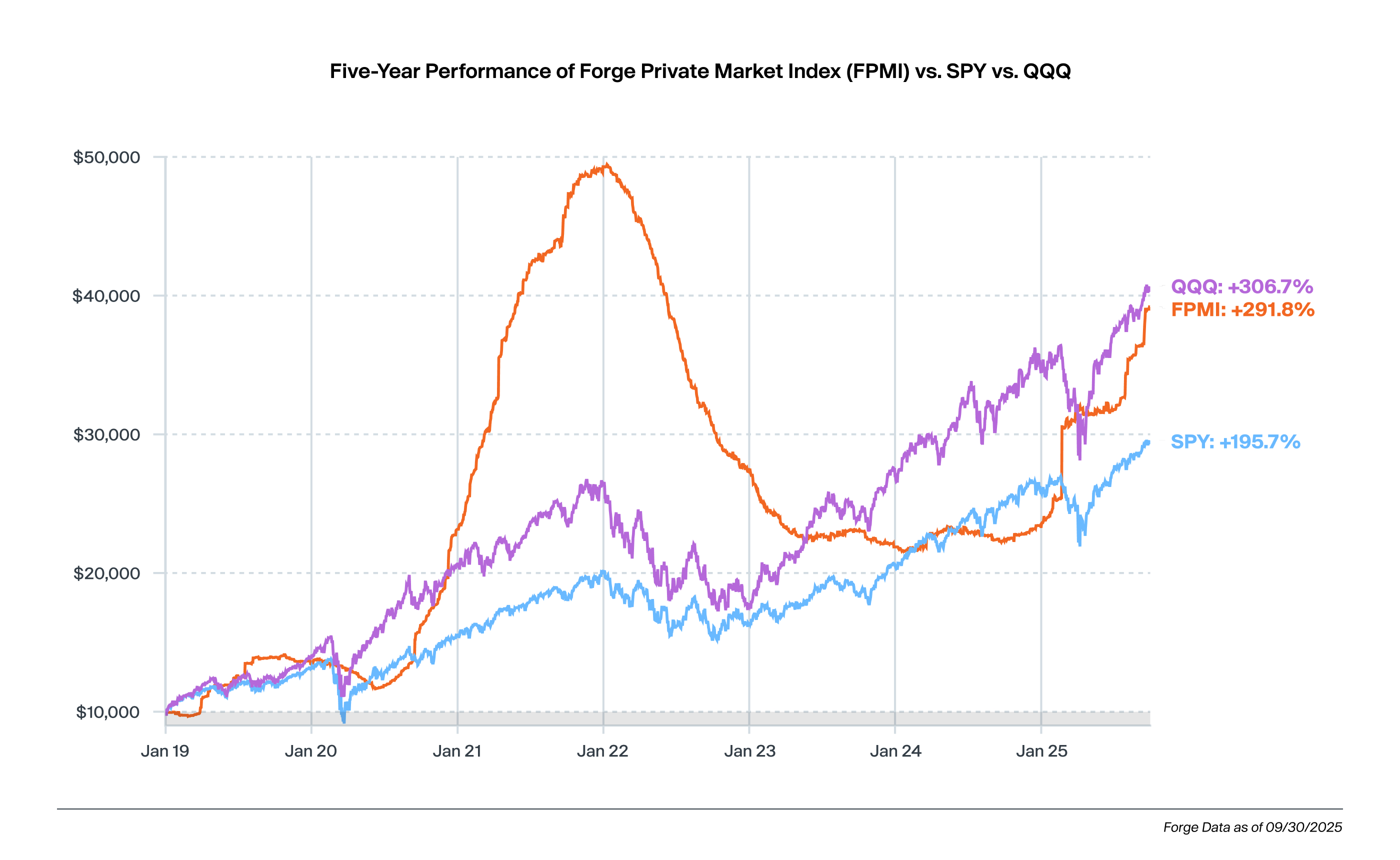

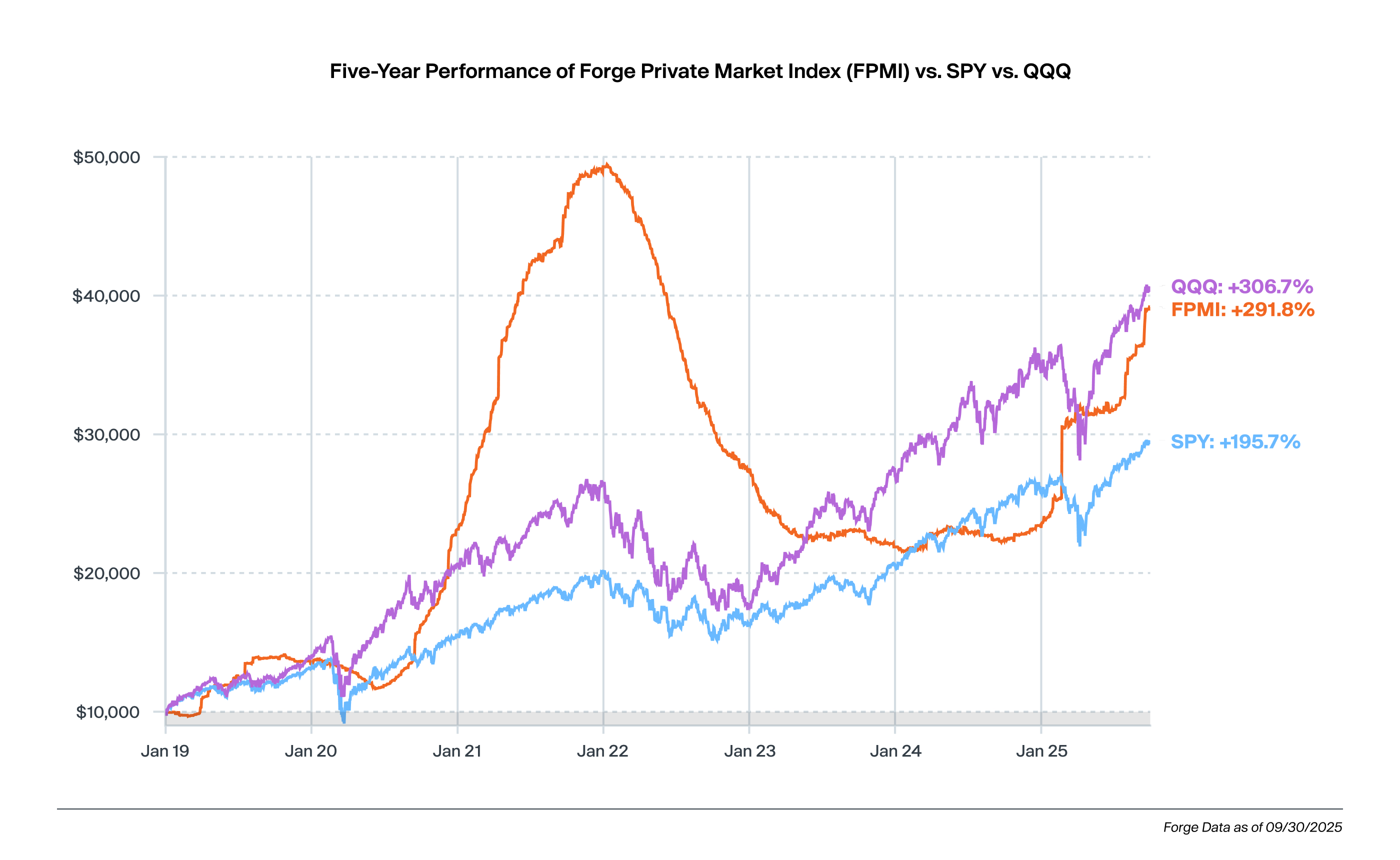

While the private market is not necessarily a substitute for the Nasdaq-100 given the market cap disparity,1 it can complement it and potentially enable greater returns prior to a public listing. Over the past five years, the broad-based Forge Private Market Index (FPMI) has shown competitive performance with major U.S. indices such as the Nasdaq-100 and S&P 500, and even displayed some diversification characteristics during different market cycles. In this context, investing in a portfolio of private companies may benefit an investor’s overall diversification strategy.

| YTD | L12M | L3Y | L5Y | Since Inception | |

|---|---|---|---|---|---|

| FPMI | 68.0% | 75.6% | 8.6% | 19.3% | 22.4% |

| SPY | 15.1% | 19.0% | 24.9% | 16.3% | 17.4% |

| QQQ | 18.4% | 26.0% | 32.0% | 17.1% | 23.1% |

Source: Forge Data as of 09/30/2025

FPMI inception date: 01/01/2019

Returns may continue to shift to private investors

With the private market showing it is competitive with the public market on return opportunities, the opportunity for investors to potentially earn outsized returns prior to an IPO is increasing. Given what the market has signaled recently, no longer do investors have to find a company that is valued in the tens of millions of dollars and hold it until it hopefully goes public at a valuation in the hundreds of millions of dollars. Companies are now staying private with valuations in the billions or even hundreds of billions of dollars.2

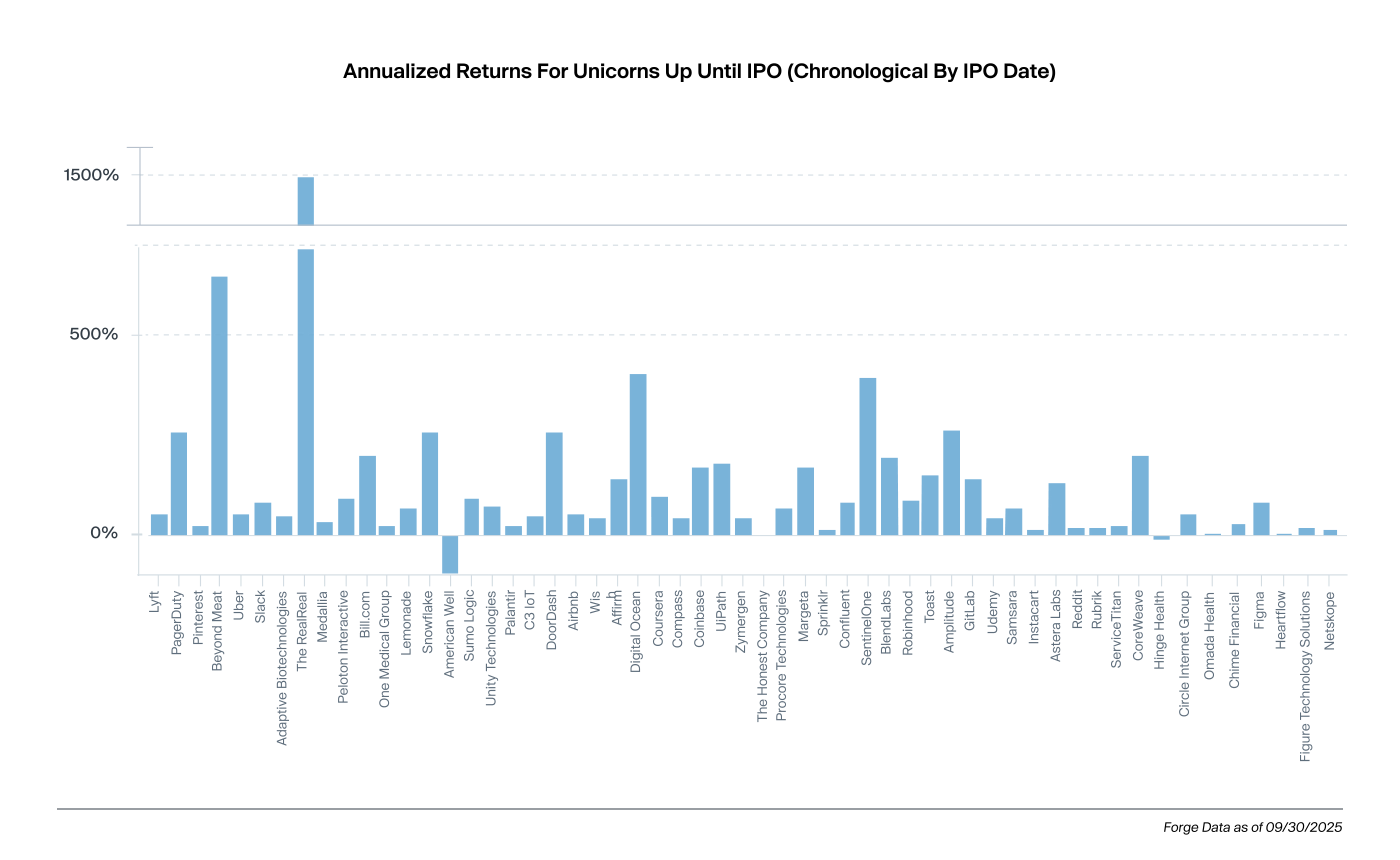

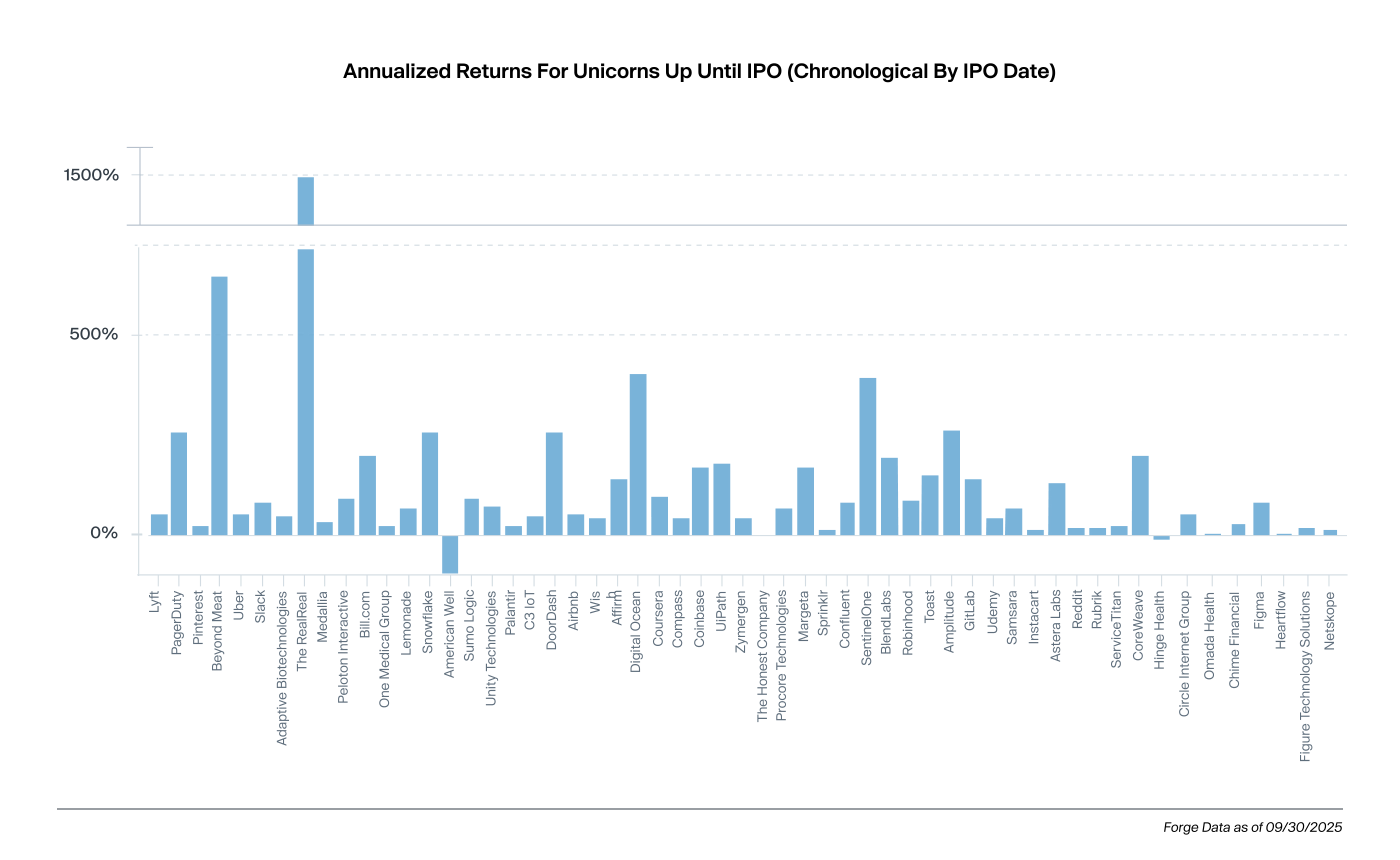

A private market investor can gain access to shares of a company when it becomes a unicorn—a private company that is valued over $1 billion—and hold those shares until the IPO or look for opportunities to get liquidity earlier. This substantially changes the risk dynamic of investing in late-stage companies. Reviewing companies that have gone public since 2019 indicates the amount of growth that can potentially take place once a company becomes a unicorn, but before the company goes public. The median annual appreciation for this group of companies from when they become a unicorn until IPO is 65.7%.

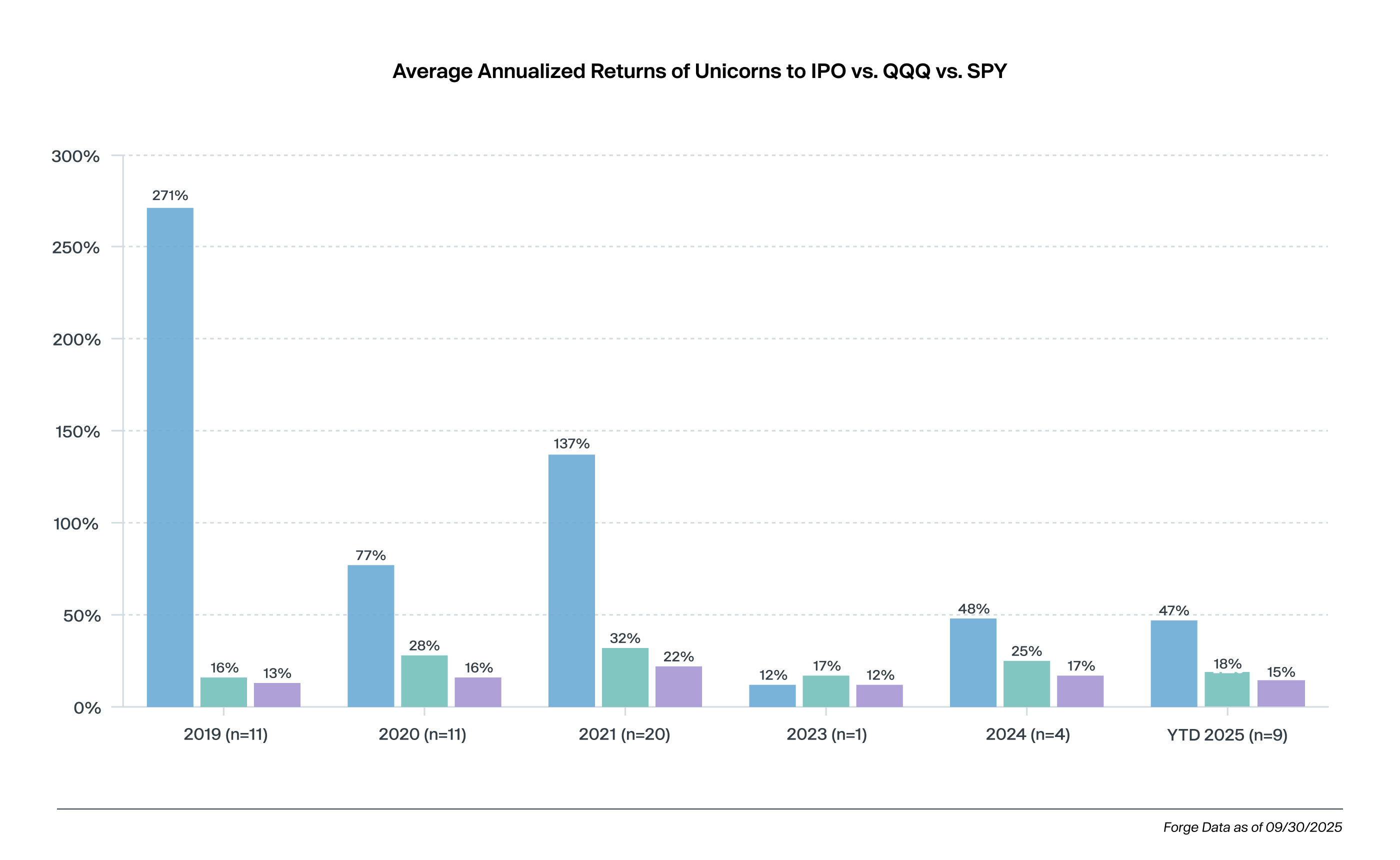

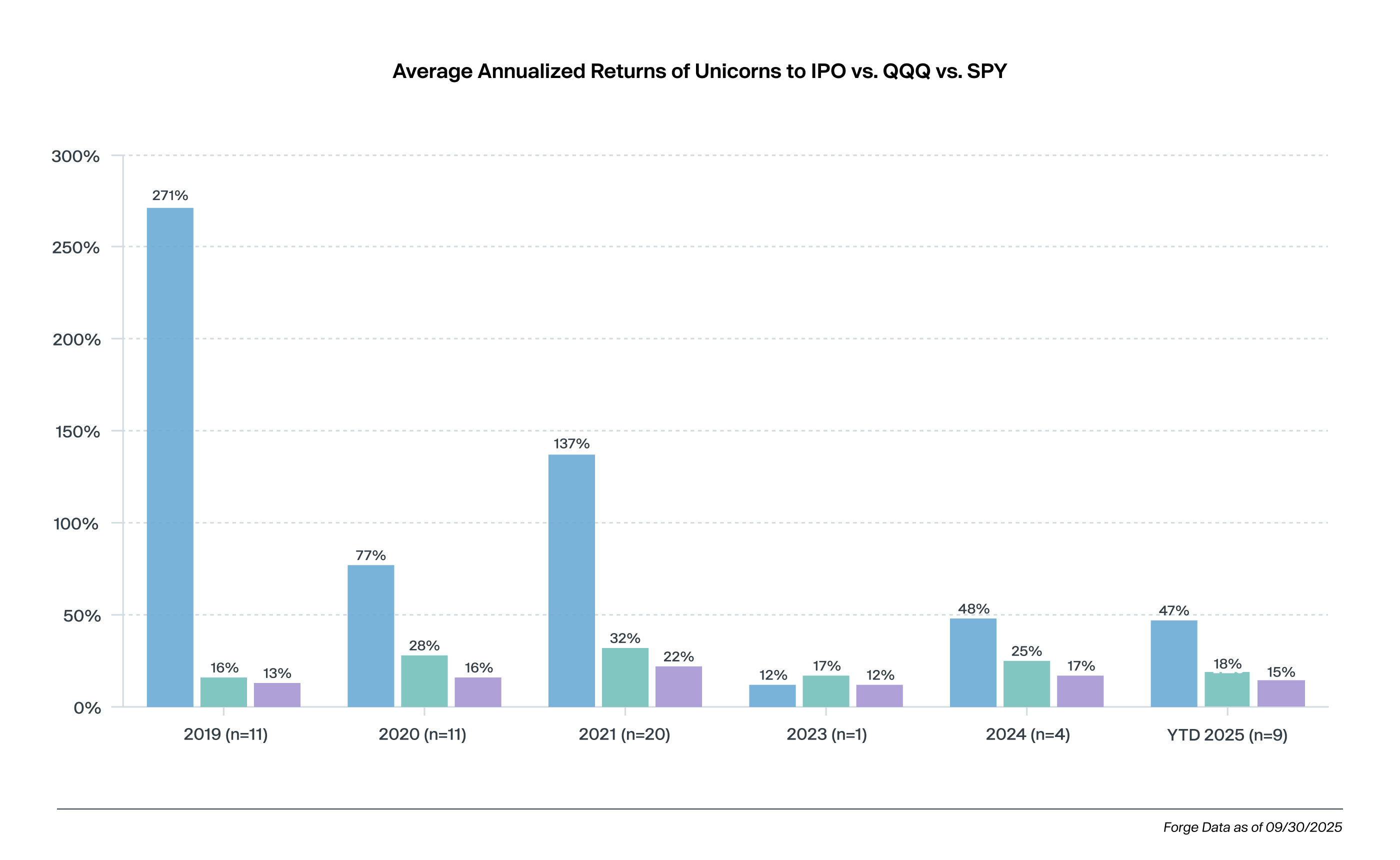

Analyzing each company that became a unicorn and subsequently went public from 2019 to 2025 (56 total) reveals that, compared to public market indices over the same time period, unicorns that went on to IPO generated returns in excess of the public market in four of the five years. The year that unicorns underperformed, 2023, contained only one IPO that year, Instacart, which is not enough statistically significant data to draw a conclusion. Previously, though, going public was thought to be the best way to realize a company’s full potential value. However, the dynamics of today’s private market may be changing that rationale.

Pure-play innovation that’s often only available in the private market

Not only has the private market shown that its performance is outpacing the public market at times, but by not investing in private companies, investors may be missing exposure to companies with growth potential in their portfolios. This becomes even more pronounced when you consider companies that specialize in AI, as an example.

While there are a number of public companies that will benefit directly from AI, many of them have other slower growth business lines that offset a company’s AI-related returns. Magnificent 7 companies like Alphabet, Meta and Microsoft all have significant AI initiatives, but also have software, advertising or social media business lines that comprise a more significant portion of each company’s business model. Conversely, many of the highest valuation private AI companies are still largely focused on AI, while investors should still appreciate the risk of investing in a non-diversified company. For example:

- Anthropic: Anthropic is an AI safety and research company founded in 2021 that focuses on building reliable, steerable systems. The company develops advanced AI models under the Claude™ brand and prioritizes aligning AI behavior with human intentions to ensure safe and ethical use of its technologies. The company recently raised capital at a $183 billion valuation.3

- xAI: xAI was founded by Elon Musk in 2023 and is shorthand for "eXplainable AI.” xAI’s mission is to understand the true nature of the universe using AI. xAI develops advanced AI models and acquired one of Musk’s other ventures, X (formerly Twitter), in March 2025.4 The acquisition valued the combined company at $113 billion.

- Scale AI: Scale AI is a data infrastructure company founded in 2016 that provides high-quality training data for AI applications. It helps organizations build and deploy AI models by offering data labeling, annotation, and management services across areas like computer vision, natural language processing, and autonomous systems. Meta recently acquired 49% of the company for $14.3 billion, valuing Scale AI at $29 billion.5

- Perplexity: Perplexity is an AI-powered search and answer engine founded in 2022. It combines large language models with real-time web data to provide accurate, up-to-date answers and citations for user queries. The company last raised capital at a $20 billion valuation.6

Today’s private companies do not resemble yesterday’s

The private market is not just fledgling companies.

What results from the evolving maturity of the private market is a collection of companies that are often larger, more established, and more diverse than investors might expect. In years past, being a private company was just a pit stop on a founder’s journey to creating a larger and more sustainable enterprise.

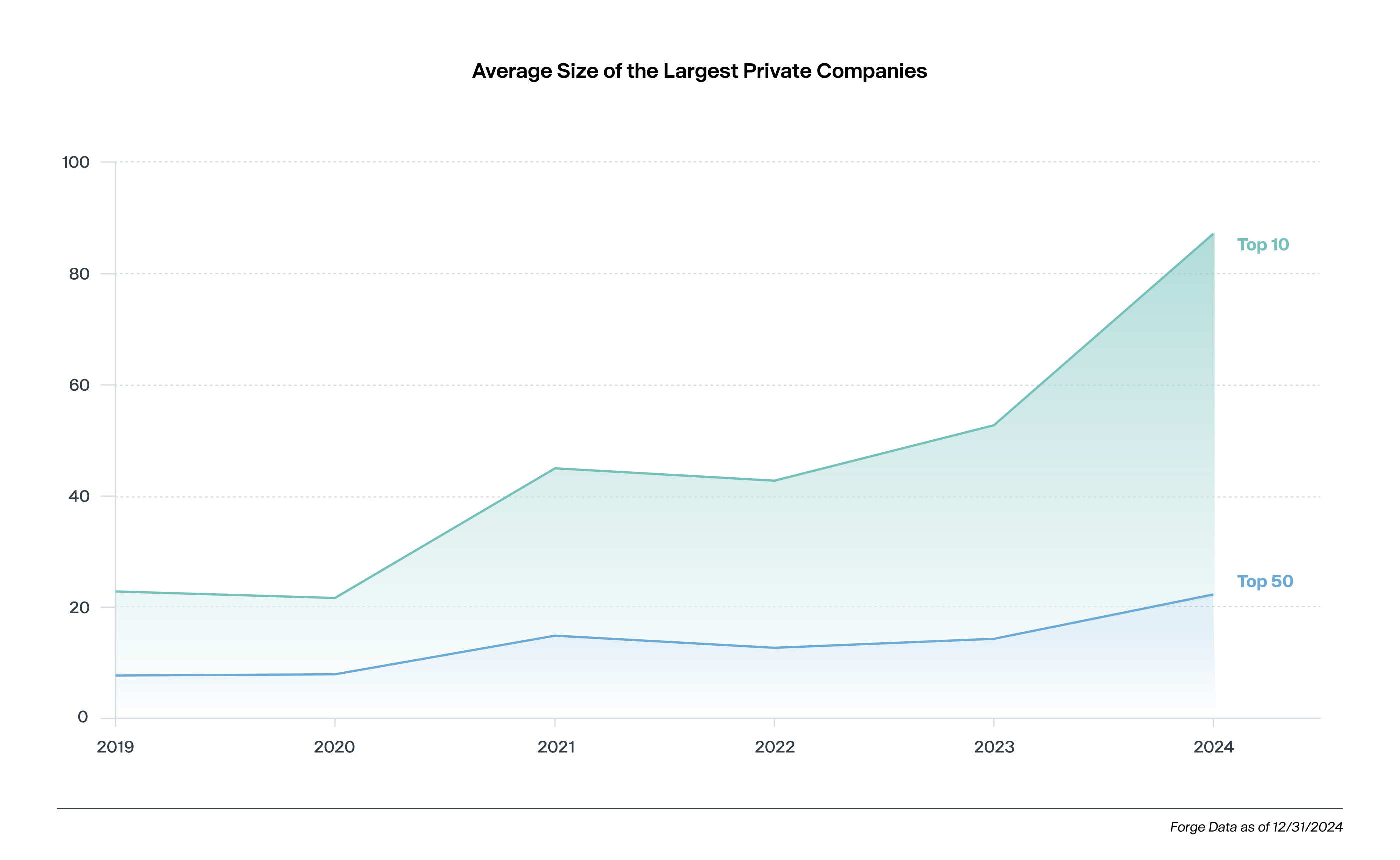

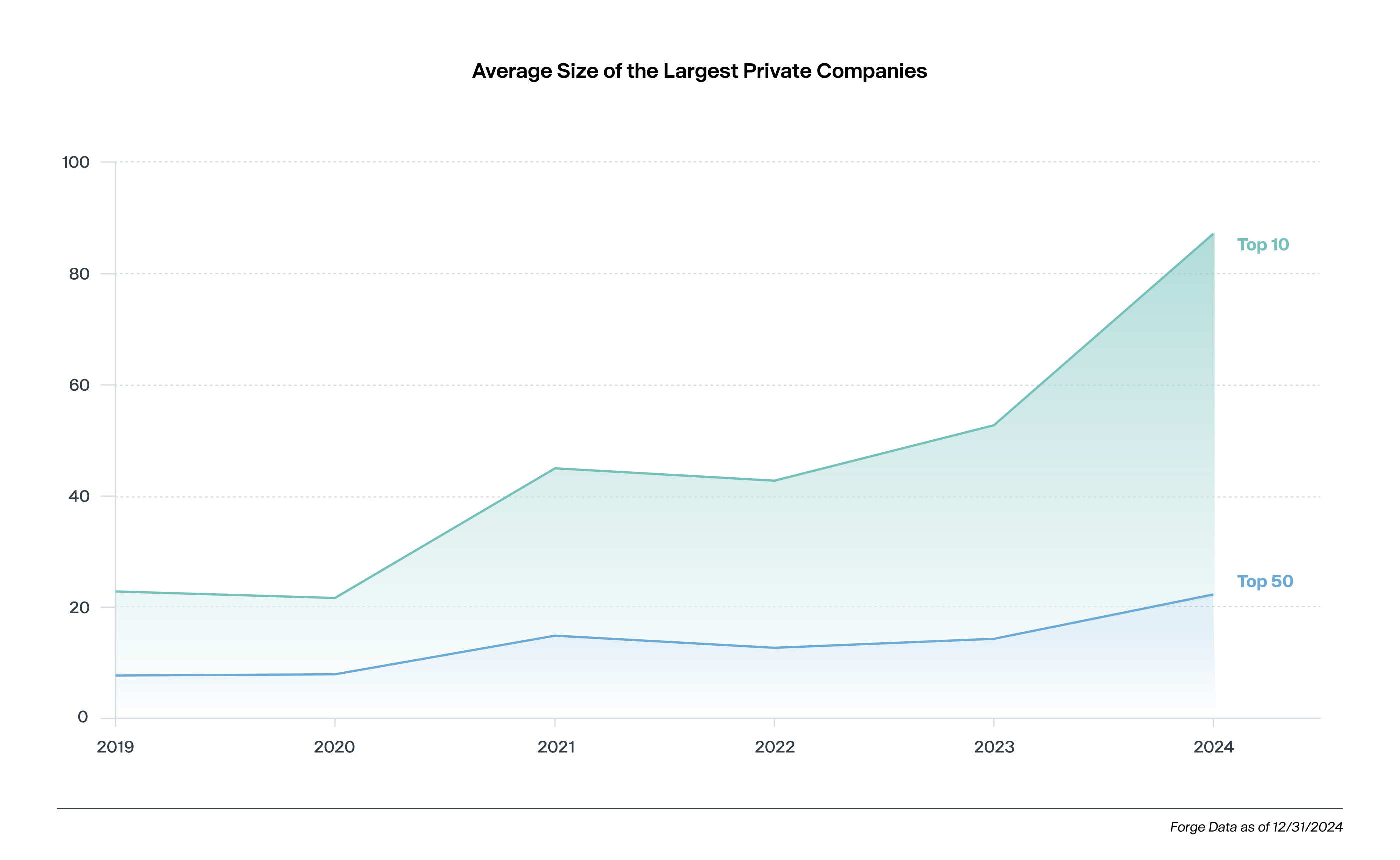

In today’s private market, being a private company may no longer be a stepping stone, but rather a longer-term stage of growth that is not necessarily dependent on an opportunity to become public. This potentially allows a company to grow and mature into an organization more akin to a public company from a valuation perspective. Analyzing the fifty largest private companies in terms of market capitalization and how their total valuation has changed over time shows that, on average, companies have gotten larger over a five-year period. Particularly when focusing on the ten largest companies, there has been an even more dramatic increase in market value—from an average valuation of $22.8 billion in 2019 to $87.2 billion in 2024. This compares favorably to an average market capitalization of companies in the S&P 500 of $105 billion.7

The Forge Private Market Index (FPMI) shows a similar trend

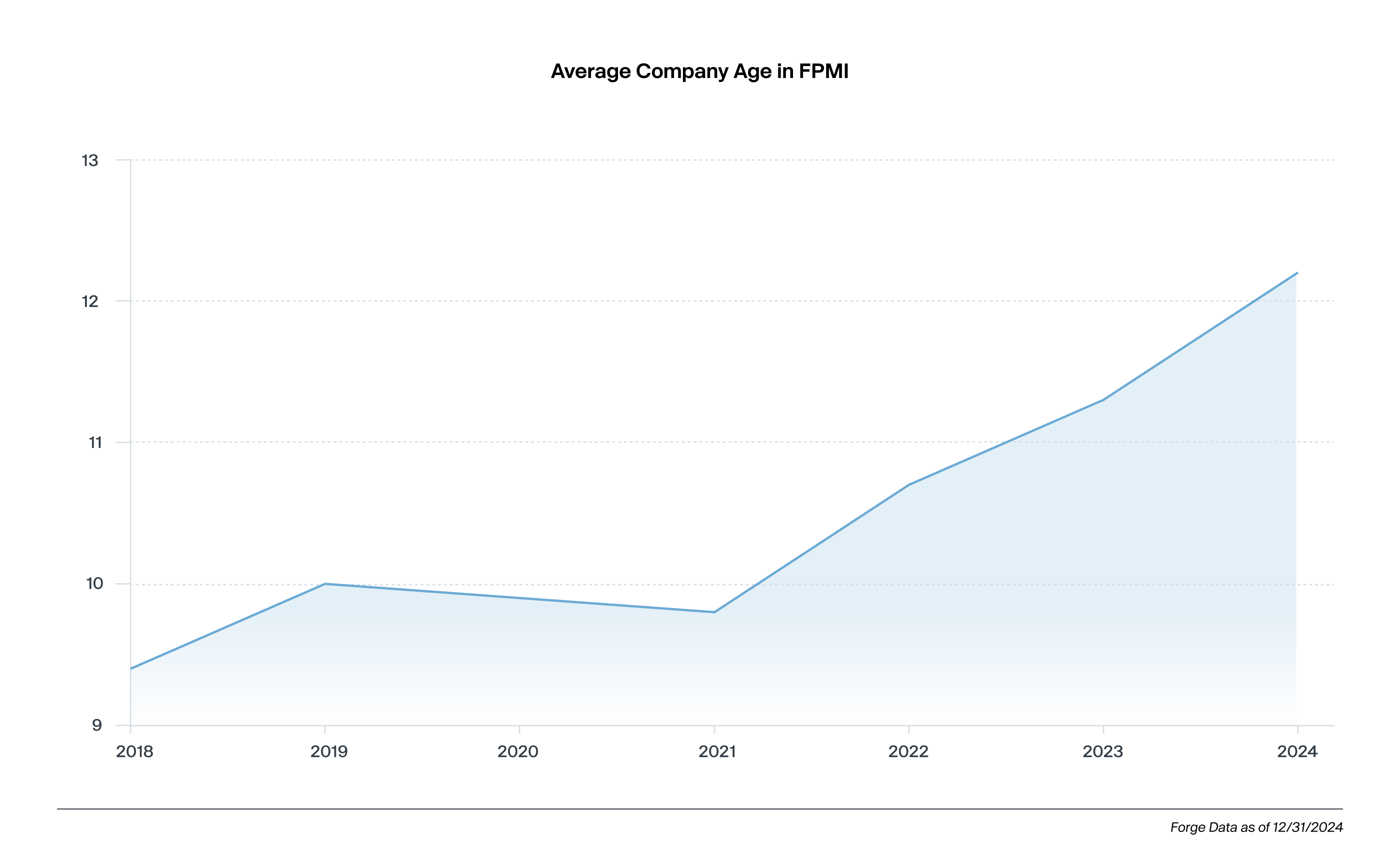

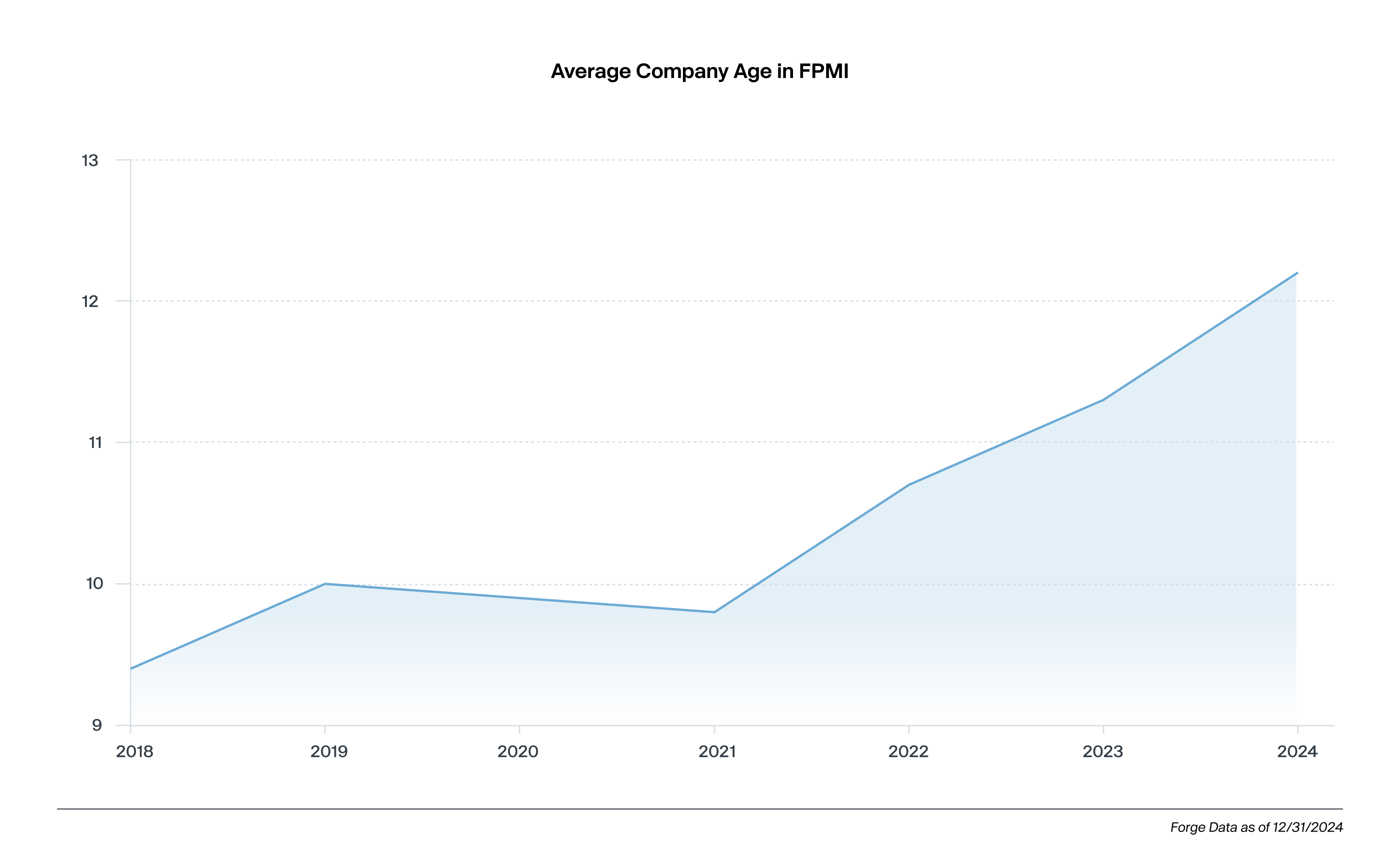

Data for the FPMI constituents tells a similar story. Index companies have seen a steady increase in age over the past five years. On average, FPMI companies were 9.4 years old in 2018 and stand at 12.2 years old in 2024.8

An overview of the top private companies

The current largest private companies by valuation have been in business for at least a decade and generate on average over $6 billion of revenue per year. They also cover diverse industries within technology like space travel, payments, military defense and AI. If public, many of these companies would have similar revenue or market capitalization characteristics to those in the S&P 500.9

- OpenAI (founded 2015): OpenAI is an AI research and deployment company with a mission to ensure that artificial general intelligence (AGI) benefits all of humanity. OpenAI develops cutting-edge AI technologies, including large language models (LLM) like ChatGPT. An upcoming employee share sale will value the company at approximately $500 billion.10 In 2024, the company reportedly had $3.7 billion in revenue.11

- SpaceX (founded 2002): SpaceX is a space travel company founded by Elon Musk with a mission to reduce space transportation costs and enable the colonization of Mars. SpaceX designs, manufactures, and launches advanced rockets and spacecraft. A recent share sale valued the company at $400 billion.12 In 2025, the company is projected to generate $15.5 billion of revenue from rocket launches and Starlink™.13

- Databricks (founded 2013): Databricks is a cloud-based data and AI platform founded by the creators of open-source analytics software Apache Spark. It provides tools for data engineering, machine learning, and analytics, enabling organizations to unify their data, analytics, and AI workloads. An August 2025 funding round valued the company at over $100 billion.14 The company reportedly generated $2.7 billion in revenue in 2024.

- Stripe (founded 2010): Stripe is a fintech company that provides payment processing software and APIs for businesses of all sizes. Stripe’s technology enables companies to accept online payments, manage revenue, and handle financial operations. A February 2025 tender offer valued the company at $106.7 billion.15 The company reportedly generated $5.1 billion in revenue in 2024.16

Waiting for an IPO is missing the point

Companies are staying private longer

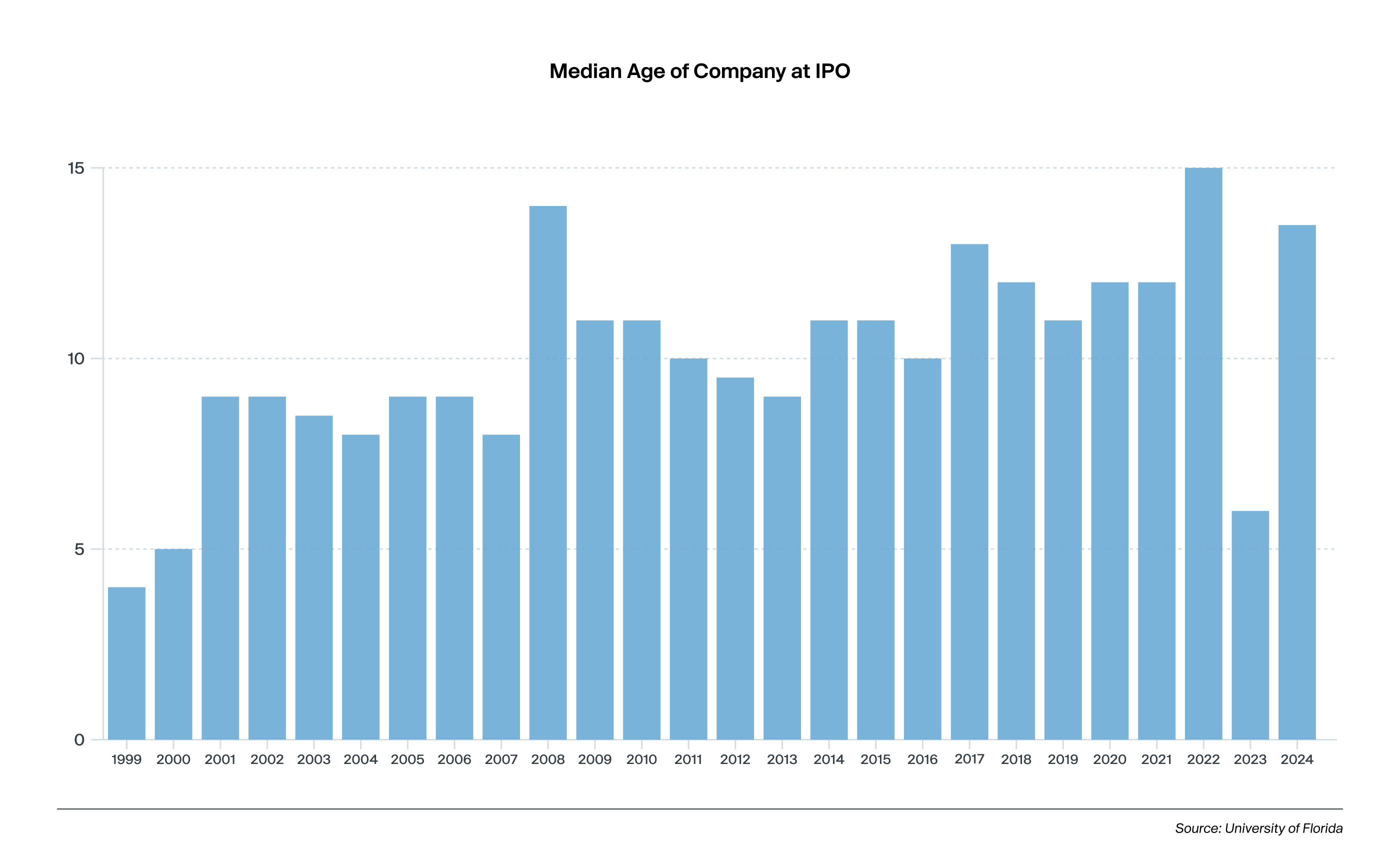

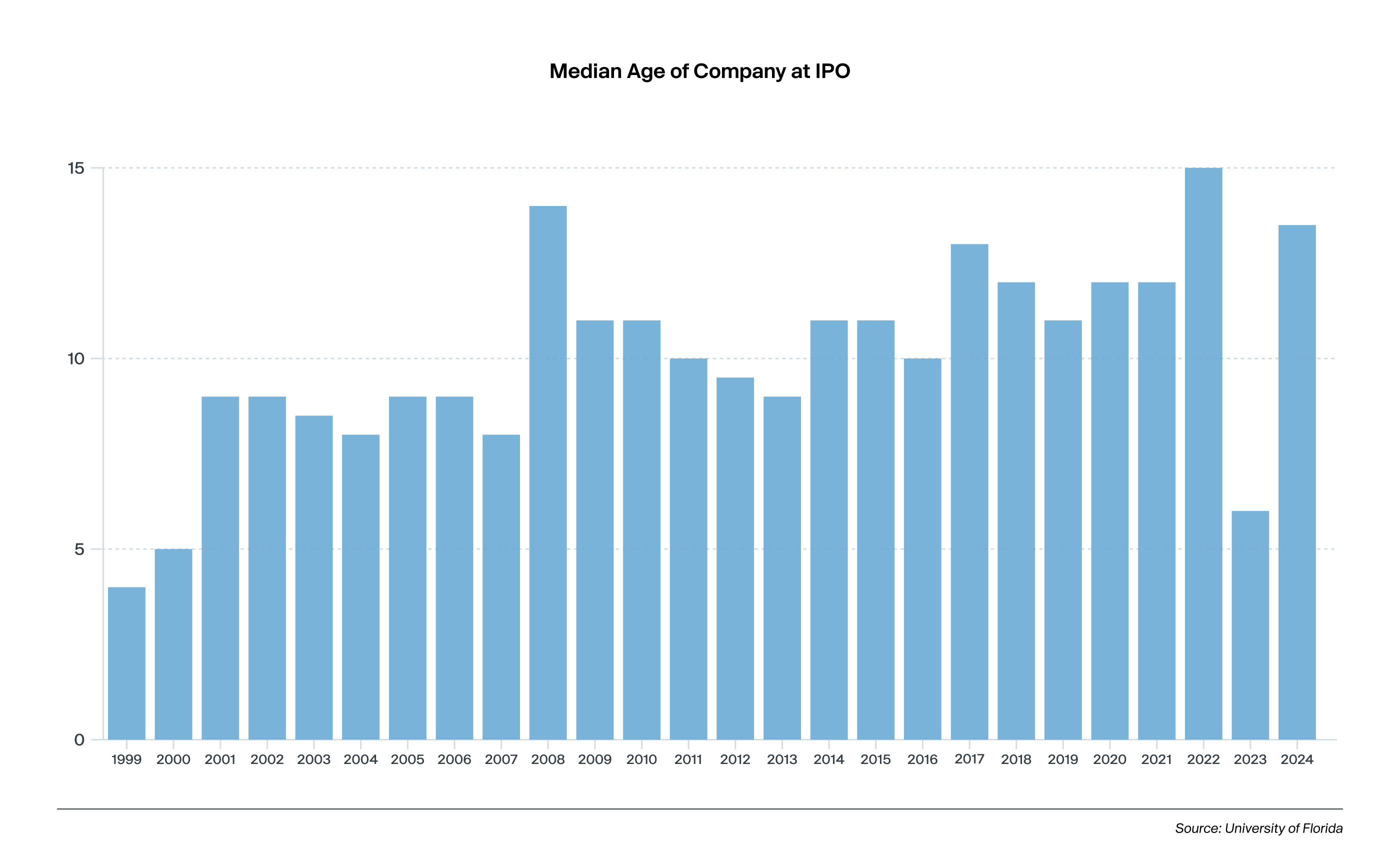

The increased valuations and scale of private companies is borne out by the trend of companies staying private longer. In 2024, the median age of a company launching an IPO was 13.5 years, which grew from a median age of just 4 years in 1999.17

This trend also leads to an increased opportunity set for investors, as private companies that have achieved unicorn status are similar to public companies in terms of stock valuation and revenue scale.

Running a public company may be less attractive

Being a public company comes with many challenges, which may be a factor in companies choosing to stay private longer. There are increased legal, operational, and other costs that result from regulatory compliance requirements of being a public company.18 Being public also exposes a company to different investor demands—such as shorter-term expectations (i.e., “making the quarter” and focusing on stock price fluctuations)—and offers less autonomy to management than remaining private.

Capital is available from more than the traditional private sources

The rise of non-traditional private investors willing to invest in private companies has enabled companies to stay private longer. With increased attention from growth equity funds, crossover funds, mutual funds, sovereign wealth funds, and corporate venture capital programs,19 private companies can now raise hundreds of millions or even billions of dollars20 when needed, without rushing into an IPO decision. The growth in capital raised by mid- to late-stage companies—from $15.7 billion in 2016 to $114.4 billion so far in 2025 (over $152 billion annualized)—reinforces that there are now larger and more numerous pools of capital actively investing in private companies.

Recommended IPO criteria sets a high bar

Additionally, the suggested financial and valuation criteria compiled from Forge institutional clients for a company to offer their shares in an IPO have only become more difficult to achieve as investors have recalibrated expectations post-2021. IPOs can be a competitive process, and successful IPOs generally have demonstrated financial returns before they are considered an attractive offering by the public markets. These returns can include having multiple product or service offerings, revenue scale, attractive growth characteristics, and a minimum market capitalization.

Feedback provided by a sampling of Forge’s institutional investor clients during 2025 indicates the preferred characteristics for a VC-backed company seeking to offer their shares in an IPO in the United States on a major exchange include:

- Annual revenue greater than $300 million

- Multiple products or services that generate material revenue

- Revenue growth of at least 20% year over year

- Potential public market capitalization of at least $2 billion

These criteria point to scale and the demonstrated success of the business model. Meeting them also allows a company to attract attention through sell-side analyst coverage, which can help generate broader investor awareness. Conversely, companies that do not meet these benchmarks may struggle to build a stable institutional investor base and can face stagnant or declining share prices.

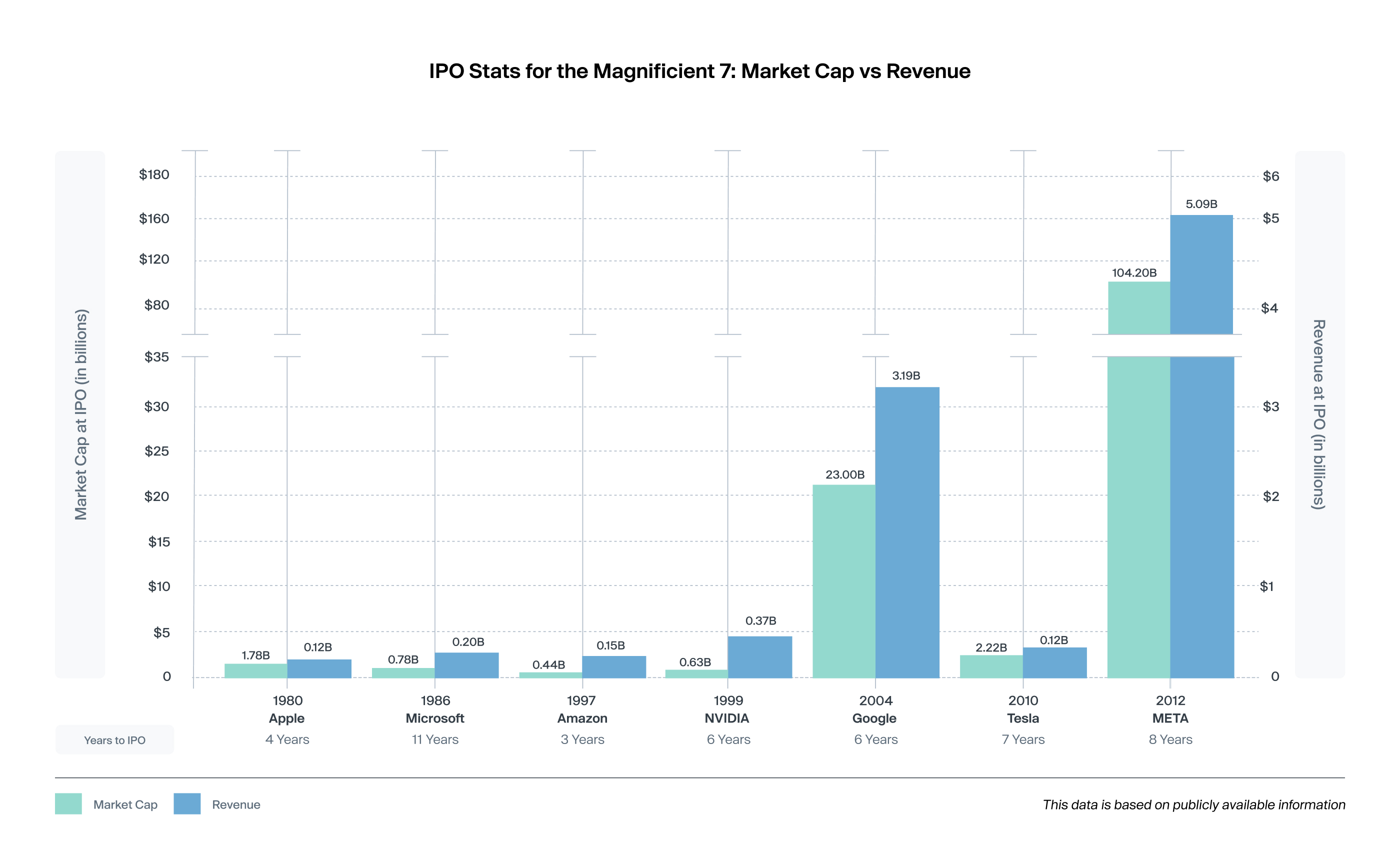

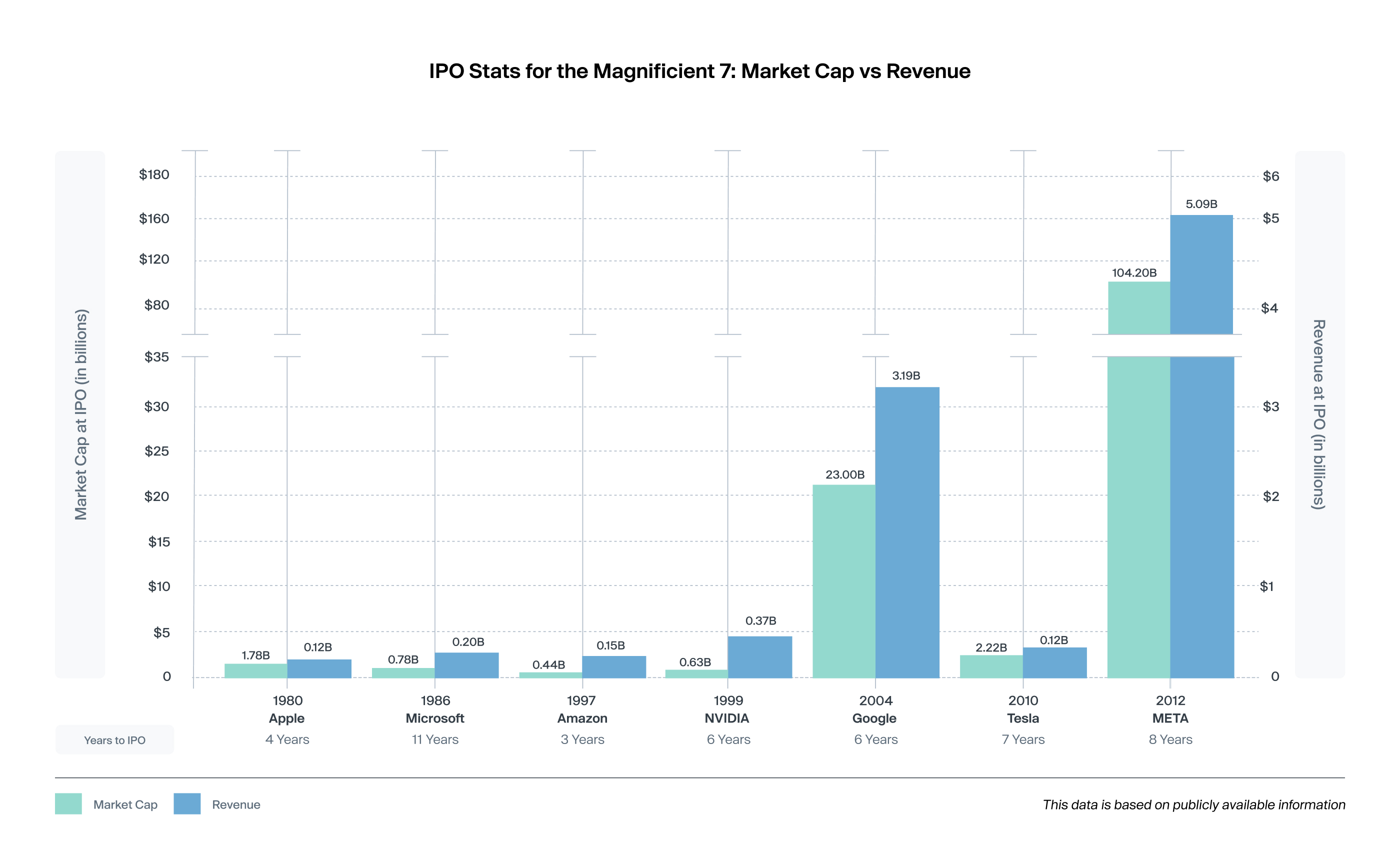

What IPOs used to look like

To understand how the private market has changed, examining the Magnificent 7 stocks at the time of their IPOs paints a revealing picture. When looking at the Magnificent 7 companies that went public before the 2000s, none of them were at or above the average age of companies going public in 2025, nor did any of them achieve all the previously mentioned thresholds. In fact, only Microsoft, at 11 years old,21 was near the age of the average company at IPO in 2024, while Amazon, at just 3 years since founding,22 was an immature company by today’s standards.

While this highlights the amount of value that the Magnificent 7 have created as public companies, in today’s market environment—where issuers are delaying IPOs—we believe more of that value appreciation would have benefited private investors. While they are generational companies, Meta and Google were unusual in having multibillion-dollar valuations at the time of their IPOs.

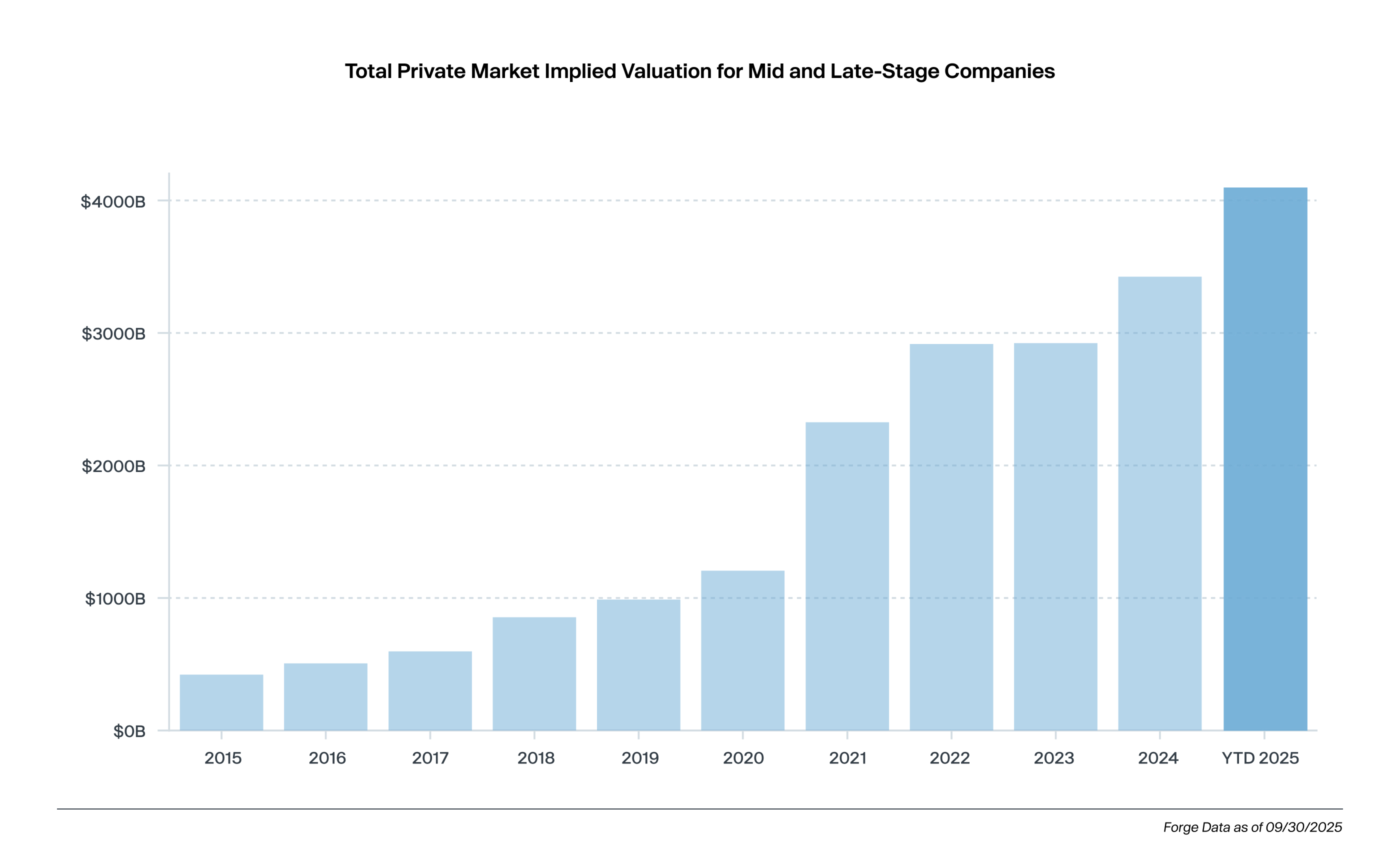

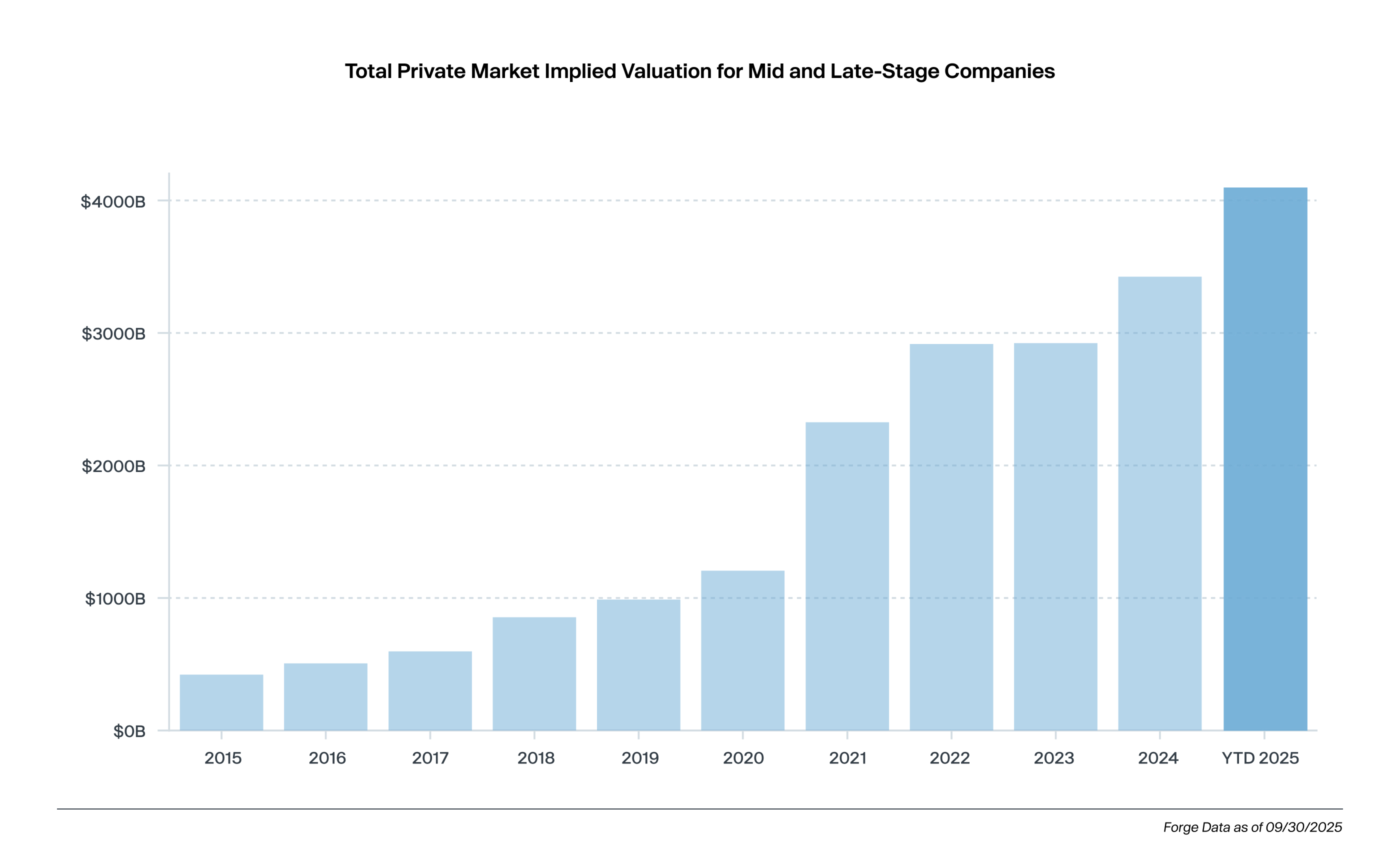

The private market continues to grow market share

Private market total value has grown relative to the public market

Companies staying private longer with increased financial scale have created a private market that has grown significantly in size and sophistication. The total valuation of mid- and late-stage private companies tracked by Forge has expanded rapidly over the past 10 years — from $421 billion in 2015 to over $4.1 trillion as of Q3 2025. When compared to the market capitalization of the S&P 500, the private market represented just 2.2% of the S&P 500 in 2015.23 As of Q3 2025, despite public market appreciation, the total value of the private market now stands at 7.8% of the S&P 500 — a 250% increase.

Secondary trading liquidity shows strong growth

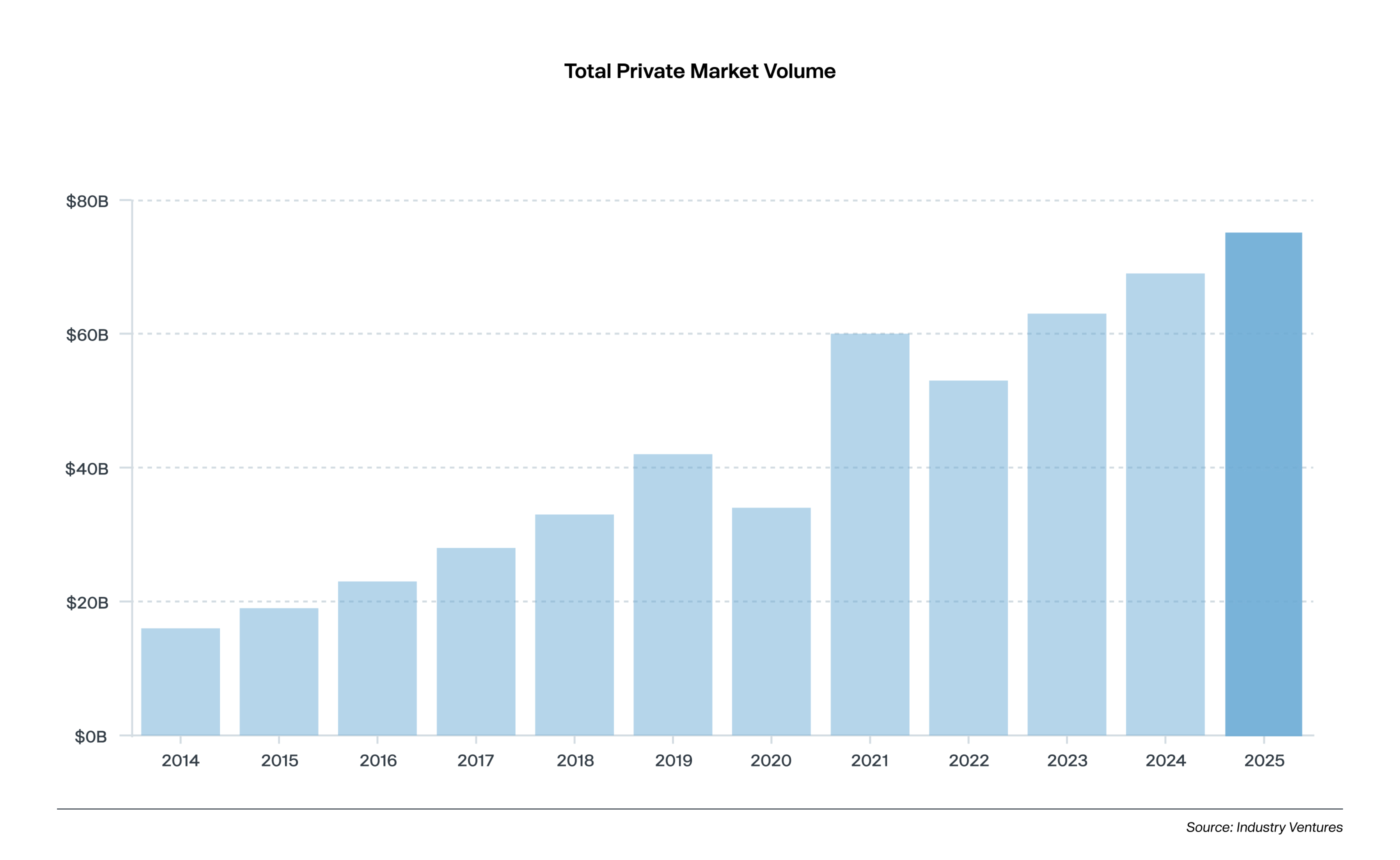

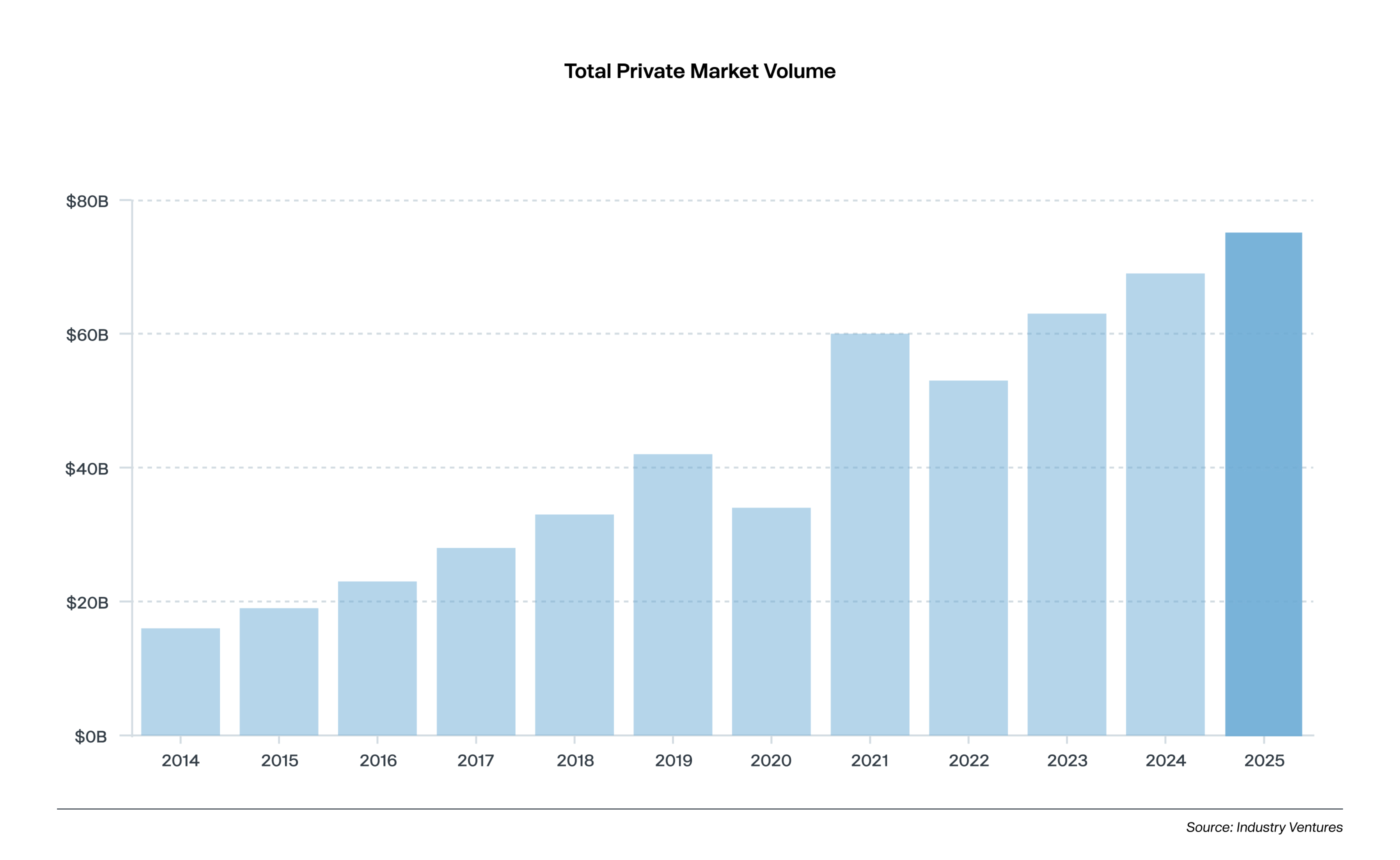

In addition to growth in size, the private market has seen expanding liquidity as well. Focusing on venture capital direct secondaries—an area where many secondary platforms specialize—there has been notable trading volume growth over the past twelve years despite a prolonged downturn from 2022 to 2023. This highlights the volume and depth that the secondary market has achieved over the past decade, with an almost 4x increase in liquidity.24

There are unique risks associated with private investing

Like any investment, investing in private companies carries risks. Some of these, such as the potential loss of capital, are familiar to public market investors, while others are unique to the private market.

Limits on liquidity and timing

Public market investors can buy or sell shares at any time and for any reason. Private shares, however, do not offer this flexibility. An investor’s potential inability to sell shares at a desired time—whether due to lack of demand or holding restrictions—is known as “illiquidity.” This means patience is required for those investing in private markets. In addition, private companies have more discretion than public companies and can choose not to approve share sales, limit who participates in a tender offer, and restrict how much investors can sell.

Private investments can mask volatility

Private companies may have infrequent share transactions and often lack a transparent or continuously updated market price. As a result, there is no assurance that private investments are priced daily—or even weekly. Some companies may only update their valuations quarterly or annually.

Buyer uncertainty on purchases

Even when a seller finds a buyer—either directly or through a secondary platform—the private company may intervene through a right of first refusal (ROFR). This allows the company to purchase the shares itself or assign that right to another investor, typically within a 30-day period. While the seller still receives the same price, the possibility of a company exercising its ROFR can dampen external buyer interest.

Information rights

Private companies also control how much information is released to shareholders. Unless an investor is specifically granted information rights, private companies have fewer obligations to disclose detailed financial and operational data compared to public companies. Greater transparency benefits investors by providing access to valuation, financial, and operational insights. Disclosure practices vary widely—from offering no information, to selective reporting for certain investors, to publicly available updates.

Again, it’s no longer necessary to wait for an IPO

The line separating late-stage private companies from public market growth companies has blurred. Today’s private firms are more mature, larger, and—thanks to secondaries, tender offers, and a growing number of non-traditional investors—often enjoy greater liquidity opportunities than ever before. While returns are never guaranteed, for growth-oriented portfolios this means the private market has evolved into a meaningful space where potential returns can be generated well before an IPO, if one happens at all.

Ignoring late-stage private companies may limit access to key opportunities. First, investors may miss exposure to transformative themes—such as artificial intelligence—whose pure-play leaders remain private. Second, they may forgo the gains achieved by unicorns that have dramatically increased in value while remaining private. Third, they could miss out on diversification benefits: broad-based private market indices have shown return patterns that do not move in lockstep with the S&P 500 or Nasdaq-100, particularly across shifting market regimes.

For growth investors, allocating exclusively to public equities may mean overlooking the next wave of potential opportunities. Including a measured allocation to late-stage private companies can enhance portfolio diversification, capture early growth, and position investors for exposure to category-defining leaders. In short, late-stage private companies have become too big—and too important—to ignore.

To download the report, click here.