Private Market Glossary

What does Volume-Weighted Average Price (VWAP)?

A volume-weighted average price (VWAP) is a measure of the average price of an asset based on trading volume over a given period. In public markets, VWAP is used to measure the average price of a stock over the course of a trading day, but it could also be used to measure the average price over any period of time. Investors might use a VWAP indicator to try to inform whether they’re getting a good price.

A better understanding of a VWAP

A VWAP is the calculation of a security’s average price weighted by the number of units purchased, i.e., volume.

If an investor only looked at the average price of a stock over the past hour, for example, that might be higher than the average price for the hour before that. However, the higher price might have occurred on relatively low volume, which could indicate that the security may not have as much support at that price point.

To calculate a VWAP, an investor would take the sum of the price of each securities trade, times volume per order, divided by the total volume over a given period.

For simplicity’s sake, suppose an investor bought 100 shares at $100 and another investor bought 200 shares at $110. The regular average of these prices would be $105, but when weighted by volume, it works out as follows:

(100 x $100 = $10,000) + (200 x $110 = $22,000) = $32,000

÷ 300 (the total number of shares)

= $106.67

Investors have different theories of how to use a VWAP indicator, such as some institutional investors trying to use VWAP to place orders without moving the price of the security too much.

If an investor wants to sell a large block of shares, for example, that could cause the stock price to drop. So, the investor might split their order into smaller ones and try to sell when the trading price of that stock is slightly above or right around VWAP.

Others, however, such as some retail investors, might use VWAP as an indicator of where a stock is heading, such as with some thinking that a stock trading above VWAP is bullish.

What role does VWAP play in the private market?

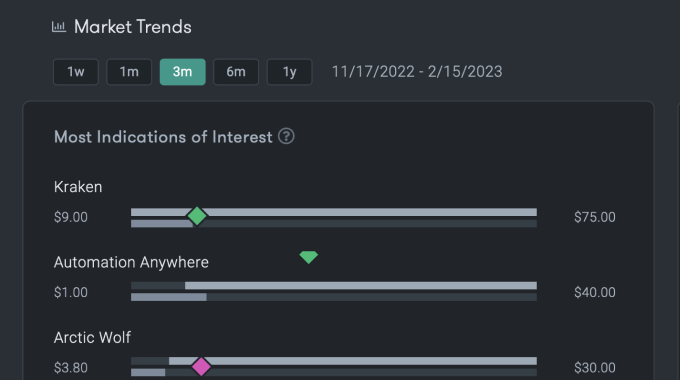

While VWAP is often used as an indicator for public equity trading, some private market investors might also use VWAP when trading private market stocks, if it is available. Especially when a private company stock has significant trading volume on a secondary marketplace like Forge, then VWAP might similarly be used to help inform investors.

That said, VWAP is one of many indicators that investors might consider. For private market companies, other data like valuation history and trajectories of similar companies might be preferred indicators, depending on the investor.