Private Market Glossary

What is a private company?

A private company is generally a business that is privately owned, as opposed to offering some of its equity for sale to the general public (in contrast with a narrower set of investors deemed eligible based on meeting certain regulatory requirements) in a registered offering. A public company has shares that can generally be bought or sold by anyone. Private companies tend to have more control around stock ownership, and sales of their stock must be conducted pursuant to an exemption from registration with the SEC.

Public companies generally have to disclose more information, such as financial performance, than a private company does based on applicable laws and regulations.

Or, as the SEC explains, a company might not have public reporting requirements but in select cases might trade on smaller public markets. That said, most people in the finance world separate private and public companies based on whether or not company shares can be traded by the general public.

A better understanding of a private company

Private companies are privately traded (if they are traded at all), in that you can’t find shares of these companies trading on a public stock exchange like the New York Stock Exchange or Nasdaq. Instead, the issuer sells shares to private investors, such as private equity or venture capital (VC) funds, and perhaps grants shares to employees. Some of these shares might then be sold to accredited investors on a private marketplace.

Ownership typically remains more limited and controlled by the private company. The private company could retain the right of first refusal, where the company would have the contractual right to buy back shares that shareholders (including employees) are looking to sell.

Technically, the U.S. Securities and Exchange Commission (SEC) defines a public company as a business that has public reporting requirements. While that generally goes hand in hand with having publicly traded stock—e.g., a company registers with the SEC to then conduct an initial public offering (IPO)—it’s possible that a company could avoid listing on a stock exchange but still have public reporting obligations, due to factors such as size and stock ownership circumstances. Private companies have some limited reporting requirements, for instance, around when they effect financing and are required to file a “Form D” with the SEC.

What role does a private company play in the private market?

If the private market is generally considered to consist of private company securities, then private companies compose the private market. Private market investors like VC funds, for example, might participate in a fundraising round for a unicorn company (a private company with a valuation of at least $1 billion), which would give them equity in that private company. Then, if that company goes public, the company would move from the private market to the public market. And the VC fund could sell the equity it acquired to the general public via the stock exchange that the startup listed on. The VC fund may also have had the opportunity to sell the shares before the company went public, for instance, through a private marketplace.

What are some examples of private companies?

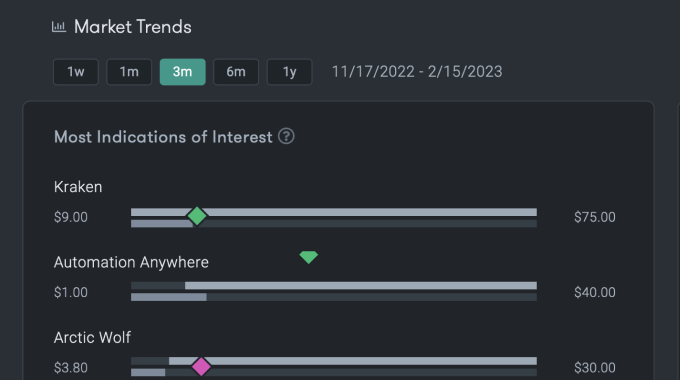

Some examples of well-known private companies include*:

- Helion Energy: A company developing a fusion generator founded in 2013.

- Miso Robotics: A robotics company for restaurants founded in 2016.

- Redwood Materials: A battery company that recycles lithium-ion batteries founded in 2017.

- Zipline: A manufacturer and operator of automated drone delivery service founded in 2011.

*The companies indicated are provided for illustrative purposes only and neither they nor their results or experiences are representative of any broader market, nor is inclusion of a company an endorsement of the company. They are purely examples to provide context and clarity.

Private companies on forgeglobal.com with the most page views in Q1 2023 as of March 2023.

That’s not to say these companies will always remain private. But unless/until these companies register with the SEC and start trading on a public stock exchange (if ever), they’ll generally remain private companies, barring circumstances like filing for bankruptcy or getting acquired by an existing public company.