After several years of speculation, communications app Discord, which primarily serves the gaming industry, appears to have taken a concrete step toward going public, with Reuters reporting that the company confidentially filed for a U.S. IPO on January 6, 2026.5

In March 2025, Bloomberg reported that Discord engaged Goldman Sachs and JPMorgan Chase for an IPO that could happen as soon as this year, although the specific plans are somewhat up in the air.6

In April 2025, Discord announced that co-founder Jason Citron was stepping down but would remain on the board and as an advisor to the new CEO, Humam Sakhnini, former vice chairman at Activision Blizzard.7 This change added to the IPO buzz, given Sakhnini’s experience at Activision Blizzard, a public company, where he managed a multi-billion-dollar portfolio of gaming franchises, including Call of Duty, World of Warcraft, and Candy Crush.8

However, this isn't the first time Discord has made executive hires that fueled IPO speculation. In 2021, Discord brought on its first CFO, Tomasz Marcinkowski, who previously helped take Pinterest public. Granted, that move was reportedly one of the first steps toward an IPO, but former CEO Citron said around that time that he wasn't thinking about going public.9

Shortly thereafter, though, Discord ended talks about a potential sale to Microsoft for at least $10 billion, with Discord reportedly focusing on an IPO that could come sometime later on instead.10

The following year, in 2022, Discord reportedly explored going public via a direct listing,11 although that did not come to fruition. In 2024, speculation picked up again when former CEO Citron told Bloomberg that the company would probably go public at some point.12

Now, Reuters reporting on Bloomberg’s January 6, 2026 scoop suggests Discord has moved beyond speculation by submitting a confidential IPO filing, even if key details remain under wraps.13

Discord: Company background

Discord was launched in 2015 by co-founders Jason Citron and Stanislav Vishnevskiy, but its roots stretch back to 2012. Citron previously started a video game studio that Vishnevskly soon joined, but they decided to create Discord due to frustration over available options for talking to other gamers while playing online. So, they took some of the voice chat, text chat, and forum features from a game they previously launched (Fates Forever) to create Discord.14

The company is based in San Francisco and says it has over 200 million monthly active users.15 While it's gone through some pivots over the years, it has returned to primarily serving the gaming community,16 with features such as text, voice, and video chat on mobile, desktop, and through some gaming consoles.

A social network for gaming

While there are many other apps that can be used to communicate with friends and interact with new people online, Discord has found widespread success while focusing on a more distinct community — gamers.

That's not to say that gaming is a small industry by any means; in fact, gaming generates nearly $200 billion in revenue annually, which is more than the music and movie industries combined.17 Still, Discord's focus on gamers is narrower than some other social networks like Facebook, Instagram, and TikTok, which are mass market platforms.

Discord also differs from other social networks in the sense that it's more about direct communication among groups in private spaces, called servers,18 rather than the more open sharing of content for others to discover on other social networks.

That said, Discord does have discovery features where users can find new communities, but that still largely involves joining groups in which you can then engage in chats, more like you're in a text message thread or WhatsApp group, rather than browsing someone's TikTok feed.

This communication focus also means that Discord has some overlap with videoconferencing platforms like Zoom, but instead of being a general-purpose tool used for specific meeting times, Discord is structured as more of an open-ended conversation tool for specific communities, and it can involve asynchronous conversations too. In that sense, Discord also resembles some other community-focused apps like Slack or Telegram, but Discord is more specifically built to support communication between gamers, such as by enabling live streaming while chatting.

However, Discord is not exclusively for gamers. Anyone who wants to chat with other like-minded folks might start a Discord server, such as students in a study group, or an influencer who wants to create a space for fans to chat with them and each other. Businesses might also use Discord, such as if a conference host wants to facilitate conversations among attendees within the app.

Although Discord tried to expand to wider audiences like these after the app really took off during the pandemic,19 it decided in 2024 to return to focus primarily on the gaming community.20

Still, Discord remains widely popular and the company has been finding some success in monetizing its user base. The latest revenue data from 2023 shows that the platform grew its revenue to $575 million, up from $135 million in 2020. Most of Discord's revenue comes from its subscription service, Discord Nitro, which offers premium features such as a larger emoji library, allowing for large file uploads, and more.21

However, Discord's valuation has stumbled since the pandemic, as we'll examine more below. So, it remains to be seen how prospective IPO investors might buy into Discord's potential to further monetize the platform and how that might affect its valuation if/when it goes public.

Discord stock price history

Discord's Forge PriceTM is $265.27 as of October 2025, which is a 10% increase over the past year.22 However, Discord's Forge Price is down about 28% since the beginning of 2023, when it was priced at $370. Moreover, Discord's implied stock price from its last primary funding round in 2021 was $550.62, when it was valued at over $15 billion.

So, Discord's Forge Price has fallen by more than half since that last primary funding round, with the company's current Forge Price valuation at about $6.6 billion.23 That's more in line with Discord's stock price of $280.25 and a $7 billion valuation from its preceding funding round in 2020.24

Forge Data as of 1/15/2026

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions on Forge.

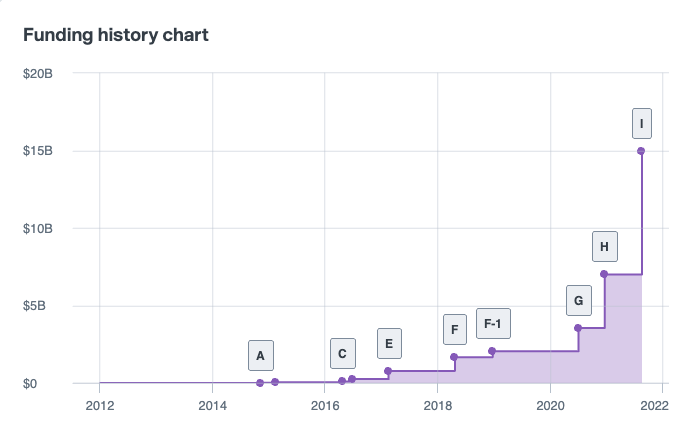

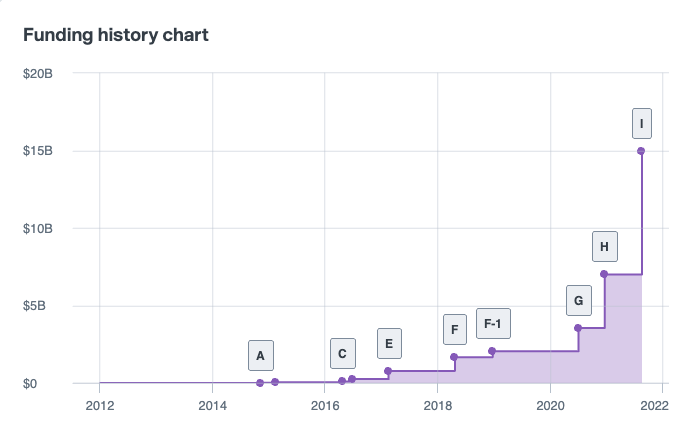

Discord funding history and private market valuation

Discord has raised just over $1 billion across 10 primary funding rounds.25

Forge Data as of 1/15/2026

Early funding came from a YouWeb incubator before Discord officially launched, when co-founder Citron ran the video game development studio Hammer & Chisel.26 While still a video game studio, the company also raised a second round from investors such as Benchmark Capital and gaming company Tencent.27 By 2016, about a year after Discord officially launched, the company raised over $20 million in a round led by Greylock Partners, valuing Discord at $260 million.28

The following year, Discord raised nearly $50 million and almost tripled its valuation to around $775 million, with investment from a mix of new and returning investors, including Benchmark Capital, Greylock Partners, Index Ventures, IVP, and Spark Capital.29

By 2018, Discord reached unicorn status, raising $50 million at a valuation above $1.6 billion valuation. Shortly thereafter, it raised another $150 million, crossing just over $2 billion in valuation, with the round led by Greenoaks Capital.30

In 2020, Discord raised two rounds, both bringing in around $100 million, first at a valuation of around $3.5 billion and then approximately doubling to $7 billion.

Discord's last primary funding round came in 2021, when it raised $500 million and more than doubled its valuation to $15.2 billion.31 That round was led by Dragoneer Investment Group.32

Looking ahead

While Discord has not publicly announced an IPO timetable—and its spokesperson told Bloomberg that the company’s focus remains on delivering the best possible experience for users and building a strong, sustainable business—investors will likely scrutinize Discord’s monetization and path to profitability as it approaches public-market scrutiny.33

Check back here or take a look at Forge’s upcoming IPO calendar to stay in the loop about the Discord IPO and other pending public offerings.

If you’re interested in investing in private companies like Discord, read more about pre-IPO investing or register for Forge Marketplace today to get started.