Neuralink gets FDA approval to test its brain device on humans

The medical device company Neuralink, co-founded in 2016 by Elon Musk, is seeking to remedy challenging medical conditions such as Parkinson’s disease, epilepsy, spinal cord injuries, and even blindness.

Neuralink’s ambitions are finally about to be put to the test. On May 25, the company announced – in a tweet – that it has received approval from the Food and Drug Administration to conduct its first human clinical study, putting the company one step closer to the marketplace. The news “represents an important first step that will one day allow our technology to help many people,” the company wrote on Twitter. “Recruitment is not yet open for our clinical trial.”

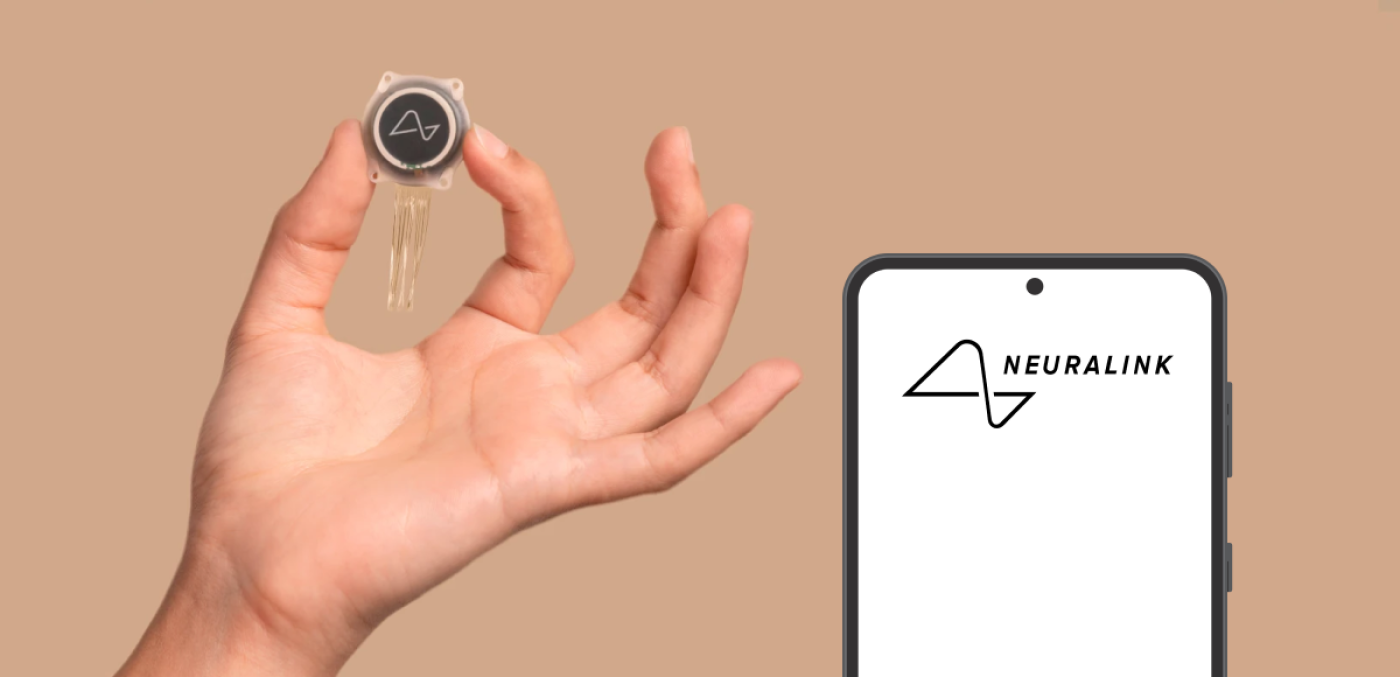

Neuralink’s main device is a coin-sized unit called “The Link.” It’s implanted within a small disk-shaped cutout in the skull using a precision surgical robot. The robot splices a thousand threads from the The Link to certain neurons in the brain. Each thread is a fraction of the width of a human hair. Neuralink has said the device could enable precise control of prosthetic limbs, giving amputees natural motor skills and improving treatment for conditions such as Parkinson’s disease, epilepsy and spinal cord injuries.

The Fremont, Calif.-based company was last valued at $2.15 billion as of July 2021 and has received funding from Google Ventures, Peter Thiel’s Founders Fund, and OpenAI CEO Sam Altman, among other venture capitalists.

Instacart launches a search tool powered by ChatGPT

Rarely a week goes by without news that another tech-forward company has found a way to utilize OpenAI’s chatbot, ChatGPT.

The latest on the list is Instacart, the nationwide online delivery service for groceries and other everyday items. Last week, the company launched “Ask Instacart,” an AI-powered search tool designed to assist with customers' grocery shopping questions. The goal, according to the company’s press release, is to save customers’ time while “inspiring their routine and helping them make food-related decisions by offering personalized recommendations throughout the shopping experience.”

The San Francisco-based company says “Ask Instacart” is directly embedded in the search bar in the Instacart app. It will provide customers with product recommendations that are intuitively organized, as well as additional information about food preparation, product attributes, dietary considerations, and more.

Founded in 2012, Instacart’s value has grown rapidly over the past decade as it attracted a slew of financial backers including Andreessen Horowitz, D1 Capital, Fidelity Investments and T. Rowe Price. As of February 2021, the company was valued at over $39 billion.

Lightmatter raises $154 million, triples valuation

Boston-based Lightmatter is emblematic of the unusual and innovative ways in which companies are finding technological niches to serve the fast-growing universe of artificial intelligence.

The company, which uses the power of light to aid in AI computing, announced last week that it raised $154 million as customers in need of faster, more energy efficient computing for AI work are buying its systems.

"We use light to link computer chips together and we also use light to do calculations for deep learning," Lightmatter co-founder and CEO Nick Harris said to Reuters. "The reason that we're getting these customers and data center scale deployments with our interconnect is that the generative AI boom is driving high-end chips like crazy." Google Ventures or GV, the venture capital investment arm of Alphabet, and Fidelity Management & Research Company were among the investors taking part in this latest round, the company said.

Though the company says that the latest funds tripled its valuation, it didn’t release a valuation figure. According to Crunchbase, Lightmatter has raised a total of $267 million over four rounds including the latest round announced last week.