Forge is thrilled to unveil the latest enhancements to Forge Intelligence, the desktop tool that investors can use to access Forge Data. Today, Forge is announcing the release of a company Watchlist feature and Mutual Fund Mark visualizations, providing a more tailored experience for investors through a deepened set of analytics to better analyze the private market.

Watchlist: Monitor and track your personally curated list of private companies

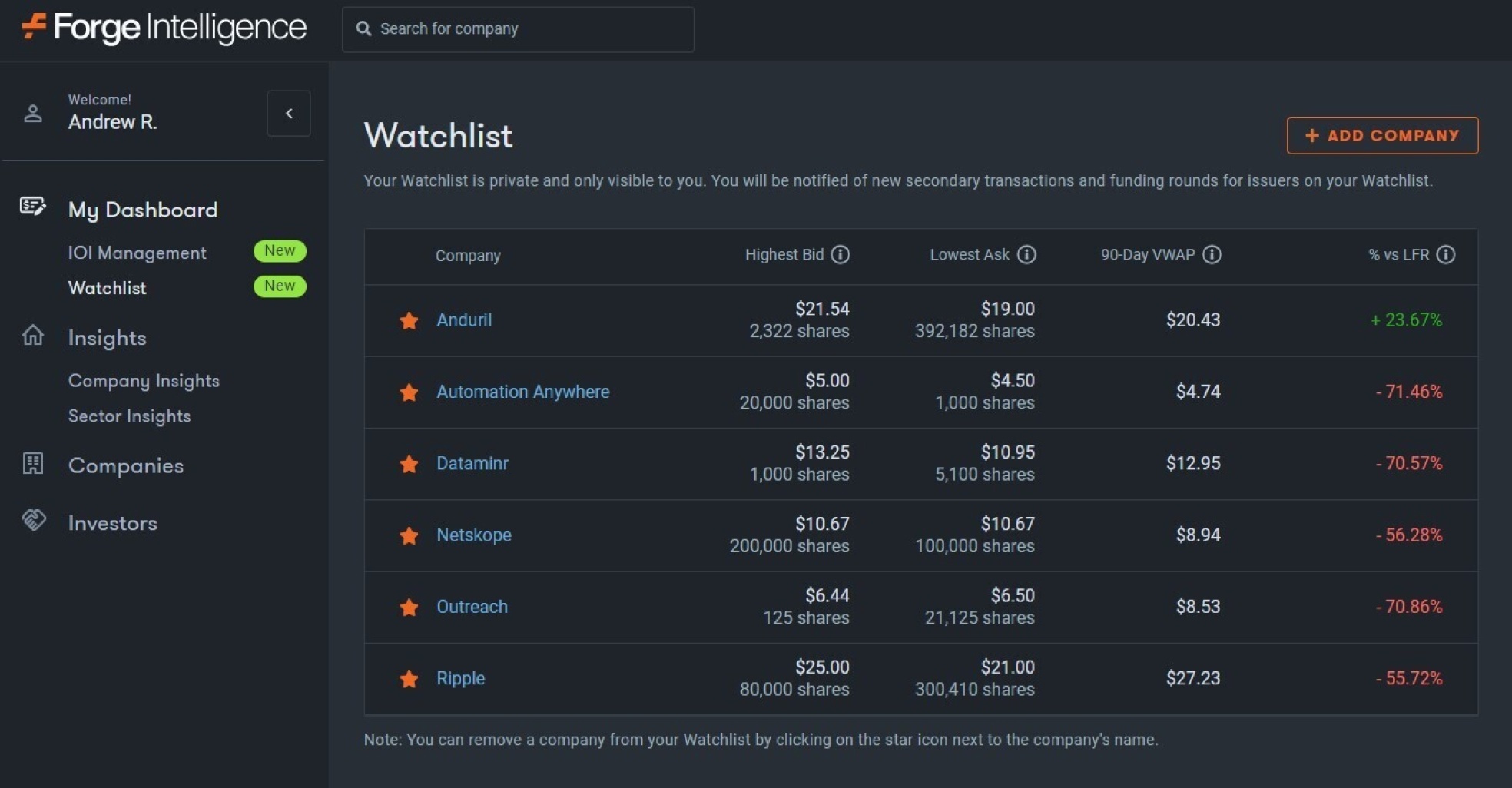

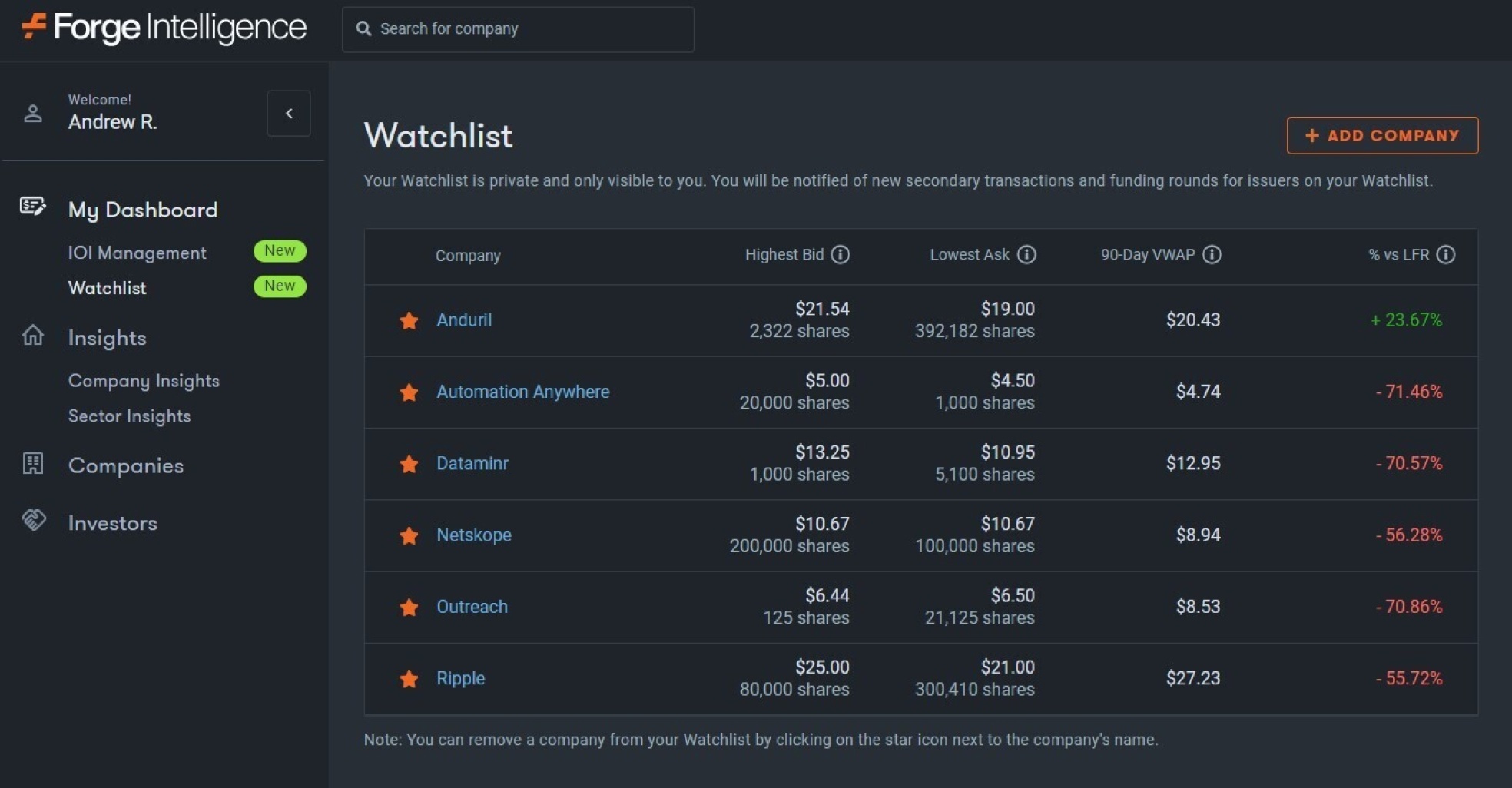

With the Watchlist feature, investors can monitor specific companies and their relevant pricing information, such as the bid/ask spread, 90-Day Volume-Weighted Average Price (VWAP), and the premium/discount to last funding round. Investors can view their tailored companies of note—whether they are potential prospects, portfolio companies, or competitors—with the relevant proprietary data from Forge.

Up-to-date pricing metrics

The Watchlist feature presents investors with real-time pricing metrics alongside each company. These metrics include the highest bid, lowest ask, the 90-Day VWAP, and the price change as compared to the most recent funding round. This consolidated view helps investors to understand the market sentiment surrounding their chosen set of companies.

Instant email alerts keep you informed

Investors can set up email alerts that keep them connected to the pricing changes of the companies on their Watchlist. The notifications can alert investors to any new secondary transactions or funding rounds, enabling them to respond promptly to developments that could impact key investments and trading decisions.

Explore the Watchlist feature today and take advantage of its capabilities to enhance the Forge Intelligence experience.

Mutual fund marks: New insights to understand data from the world’s largest mutual funds

SEC-registered mutual funds are required to submit public reports that contain their per-share fair market value of the component companies, and the Forge Intelligence platform captures and tracks these implied prices in a new visualization tool. With Forge’s Mutual Fund Mark visualization feature, investors can extract data and insights based on these fund disclosures.

Compare different pricing trends

With this visualized graphic of Mutual Fund Marks, investors can view and compare pricing trends between mutual fund marks and key pricing datasets, like transactions on secondary marketplaces, funding rounds, and private and public comparables.

Navigate fund families

Investors can filter and compare marks across different fund families within the tool. Dive deeper into the specifics by accessing fund-level details, giving you a granular perspective on how different funds value specific private companies.

Unveil historical insights quarter-by-quarter

The Mutual Fund Mark visualization tool offers an aggregated view of historical marks quarter-over-quarter. This historical data lets investors uncover key summary-level metrics and trends that can help guide investment strategies and overall market outlook.

With Forge Intelligence, investors get access to private company pricing and analytics, enabling them to more effectively identify investment opportunities, seek potential excess returns, and manage potential risk.

Forge Intelligence is an interactive web-based application, built atop Forge Data, that contextualizes private markets with data, analytics, insights, and tools. Subscribers get a detailed view of pricing, third-party valuations, and reference data on late-stage venture-backed private companies that can help them make informed investment decisions.