“The Little Engine that Could” is a timeless story of determination in the face of adversity that is often taught to children to emphasize the importance of perseverance and self-belief. Indeed, these are some of the qualities that allow startups to potentially become successful and challenge the status quo.

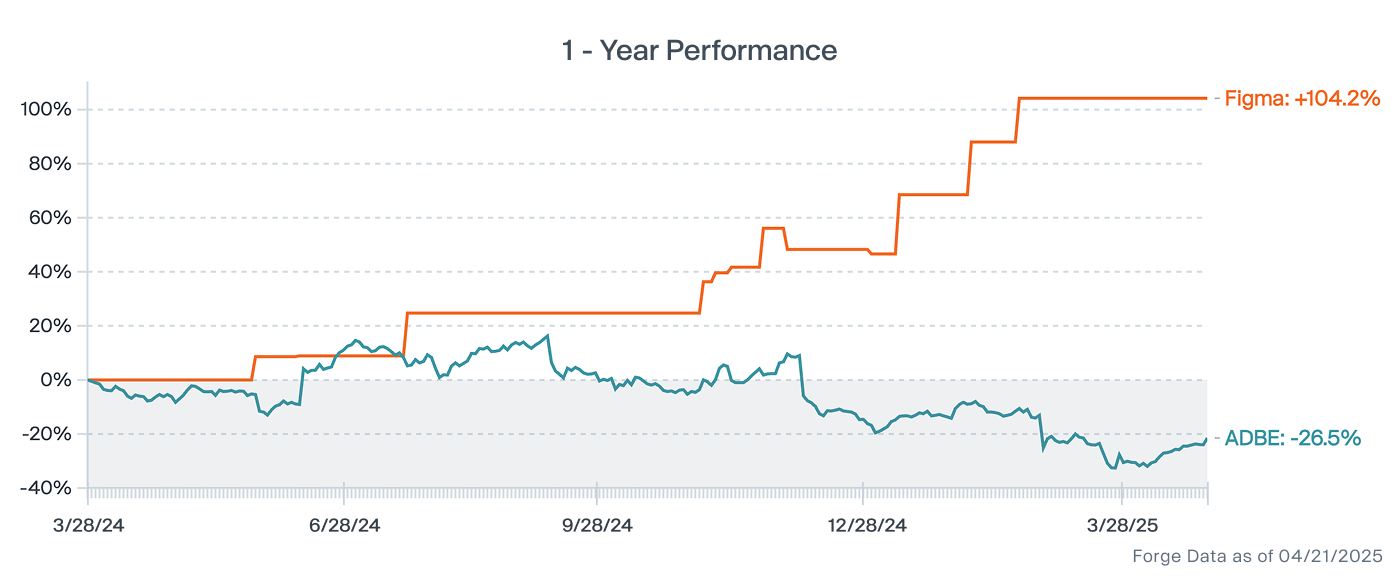

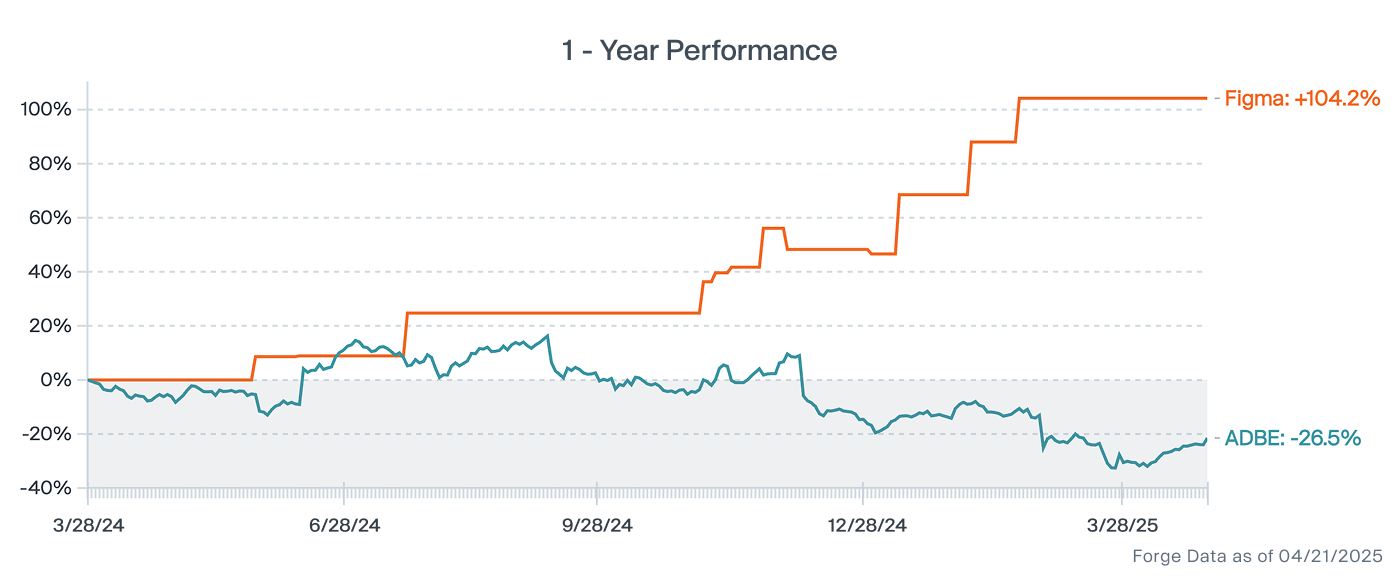

And, while it often takes time for a startup to truly establish a meaningful presence alongside a market leader, one of the ways to gain insight into the changing dynamics is through a share price chart comparison, where you can see how the stock of an emerging company might accelerate as the market leader’s stock falters.

Thankfully, Forge and Yahoo Finance’s recently announced partnership helps deliver such comparisons by expanding access to private market data and enabling investors to easily plot Forge-tracked private company prices versus public ones.3

To kick off Forge’s public vs. private company comparison series, we're starting with Figma vs. Adobe, which highlights Figma’s enduring efforts to make its mark in the industry. Yet, this story almost never came to be, as Adobe, the industry stalwart, previously tried to acquire Figma, a growing startup, in a $20 billion deal that ultimately fell through at the end of 2023.4

But Figma has remained resilient, most recently with the company confidentially filing for an IPO, as reported in mid-April 2025.5 While it remains to be seen what the upcoming Figma IPO might look like exactly, we can chart Figma's path over the last few years to see that the company has been growing on a positive trajectory (see chart below).

Company backgrounds

Figma and Adobe are both design software companies, hence Adobe’s attempted acquisition of Figma. However, their backgrounds and current paths diverge in meaningful ways.

Adobe, one of the first companies to put Silicon Valley on the map,6 started in 1982 and made its mark in the 80s by releasing the PostScript programming language that essentially made printing from a computer the experience we know today, where you simply click a button and out comes the file as you intended.7

In 1987, Adobe started selling directly to consumers with the release of its Illustrator program, which remains a popular graphic design platform today.8 From there, the company expanded into several other areas of software through a series of acquisitions and developments, such as with platforms like Photoshop for image editing and InDesign for print layout design.9

However, it wasn't until 2017 that Adobe fully released its XD software, which is a UI/UX design platform that can be used to outline apps and websites.10 Adobe XD is the tool that directly competes with Figma's main functionality.

Figma started in 201211 but didn't publicly release its UI/UX design platform until 2016,12 so it didn't have much of a head start against Adobe XD.

Performance comparison

There’s nothing like looking back at a brewing rivalry and attempted acquisition story to see how the outcome unfolded, and Figma and Adobe definitely fit this bill. But to understand what happened since the two companies parted ways, it's important to compare what was happening before they drew closer.

Despite Adobe's size and history, Figma arguably became the more popular tool versus Adobe XD in short order. So, by 2020, Adobe started courting Figma but, ultimately, got rejected.13

In September 2022, however, Adobe started to win Figma over with a buyout offer for a whopping $20 billion.14 Yet as the process dragged on, it became clear that regulatory authorities — including the European Commission and the UK Competition and Markets Authority (CMA) — likely would not approve the acquisition.15 The anti-trust concerns were indicative that Figma had achieved a material level of market penetration against a much larger incumbent to raise red flags.

Amidst this attempted buyout, Adobe stopped selling XD as a standalone app in June 2023.16 While it still supports the app for existing customers for now, the company stopped investing in the program even after the Figma deal was called off in December 2023.17

So, in some sense, Adobe recognized Figma’s emerging prowess in the industry. However, that doesn't mean the rivalry is over. Both companies continue to expand offerings in areas besides UI/UX design, and Adobe is still a much larger company — Adobe has a $156.7 billion market cap vs. Figma's current estimated valuation of $17.84 billion.18

It's possible, for example, that Adobe may leverage its popular apps like Illustrator and Photoshop to provide more of the functionality that Figma offers. Or, Adobe might use its size to purchase another startup in the future that can compete with Figma.

Still, after the deal fell through, Figma received a hefty $1 billion termination fee19 for its trouble 20 and appears to have moved on independently, as reflected in the price chart comparison.

Specifically, since the schism was announced in mid-December 2023 through late April 2025, Adobe's publicly traded stock has been on a downtrend, returning -38% vs. a 44% gain on Figma’s Forge Price. Even if you only look at the returns through the end of 2024, before the recent public market downturn took off, Adobe saw a decline in its share price over 30% over that period, while Figma’s Forge Price gained nearly 5%.21 [Note: These figures reflect directional trends in the public / private market and are not guarantees of future performance or investment returns.]

Figma Forge Price™ and valuation history

Figma's Forge Price has risen recently, reflecting the company's growth since the Adobe deal was abandoned. As of late April 2025, Figma's Forge price is $37.99, implying a $17.84 billion valuation.22

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions, and indications of interest (IOIs) on Forge.

This Figma Forge Price and valuation showcases growth since the company's last primary funding round in 2021, when its $200 million Series E valued the company at $10 billion.23

While Figma was going to be acquired by Adobe for $20 billion, Figma reset its valuation to $10 billion when the two parted ways. However, the company has shown signs of recovery since then. In May 2024, Figma allowed investors, including current and former employees,24 to sell shares in a tender offer, led by investors such as Fidelity, which valued the company at $12.5 billion.25 Since then, Figma's Forge Price has been on an upward trend.

As Figma steps closer to a potential public debut, its trajectory underscores how quickly a rising company can alter market dynamics in a competitive industry. The termination of the Adobe acquisition may have once seemed like a missed opportunity, but today, it has given way to Figma charting its own path. With Figma’s Forge Price nearing the valuation Adobe once offered, the Figma vs. Adobe story serves as a compelling case study about how private market companies can potentially not only survive separation from legacy suitors, but thrive, too.