The war for the large language model (LLM) throne is shifting toward a new public market battlefield.5

Anthropic, the Claude chatbot maker, is reportedly gearing up for an IPO that could happen as soon as 2026, according to the Financial Times (FT).4 That could mean Anthropic leapfrogs its archrival OpenAI, the organization behind ChatGPT. While ChatGPT launched a few months before Claude,5 Anthropic might end up going public first.

No definitive dates have been set, but Anthropic has reportedly hired the law firm Wilson Sonsini to help prepare for an IPO, and it also has had preliminary talks with investment banks. While a 2026 IPO could be feasible, according to one insider, another told the FT that such a quick timeline is unlikely.6

At the same time, Anthropic is also in the midst of a massive funding round that could value the company at $300-$350 billion, with $15 billion already committed to this round from Microsoft and Nvidia.7

Meanwhile, OpenAI recently completed a corporate restructuring that streamlines the relationship between the non-profit foundation that OpenAI started as and the for-profit arm that is now a public benefit corporation. That could pave the way for an IPO in late 2026 or in 2027, at a valuation of up to $1 trillion, which could be one of the biggest IPOs ever, according to Reuters.8

However, shortly after the Reuters report in late October 2025, OpenAI's CFO said at a Wall Street Journal conference that an IPO isn't in the cards right now, as it could distract from the focus on scaling.9

As a result, Anthropic may proceed with an IPO ahead of OpenAI, though the timing for both companies remains subject to change.

Anthropic: Company background

Anthropic was founded in 2021 by siblings Dario and Daniela Amodei, who both came from OpenAI. Dario was the VP of Research at OpenAI, and Daniela was the VP of Safety & Policy.10 Anthropic has also recruited other ex-OpenAI staff, such as OpenAI co-founder John Schulman.11

The company is a public benefit corporation, with a mission to safely develop AI for humanity's long-term benefit.12 In addition to developing Claude, Anthropic is also an AI research and safety company.

An LLM arms race

While ChatGPT is still the most popular AI chatbot,13 there are several companies with similar offerings, creating stiff competition to win over customers. In addition to Anthropic's Claude, some other top competitors include Google's Gemini, Meta's Llama, Perplexity's Sonar, and xAI's Grok. Amidst the competition, these companies frequently release new, more powerful models.

Yet running these models can be very expensive, due to costs associated with areas such as data center usage and the acquisition or leasing of AI chips for training and inference. These resource requirements may create capital pressures for companies working to advance large language models.

Access to public-market financing through an IPO can provide companies like Anthropic with a way to raise additional funding for ongoing development. In that context, if Anthropic were to go public before OpenAI, it would simply represent an earlier opportunity for the company to access those public-market resources, without implying any performance advantage.

That said, other rivals like Google already have access to public market financing and the advantages that come from its stature. Fortunately for Anthropic, this isn't exclusively a cash race. The ability of these AI companies to create better models also depends on factors like the technical capabilities of staff, R&D processes, and acquisitions.

In other words, the way Anthropic and other AI companies operate in the coming years will affect the quality of their products, which will ultimately affect which LLMs customers favor and how model makers monetize their offerings. It's possible that some of the current LLM leaders will shrink or disappear altogether, similar to what happened to many startups in the dot-com era, while others rake in revenue from subscriptions and perhaps new AI income streams like advertising.

Anthropic's approach to stay relevant amidst the competition has been to focus more on B2B sales rather than the mass market angle of OpenAI.14 Anthropic has also been more conservative with its spending. While it lost around $5.6 billion in 2024,15 the company expects it will achieve $70 billion in revenue and $17 billion in positive free cash flow by 2028.16 Meanwhile, OpenAI projects it will lose $74 billion in 2028 but will turn a profit by 2030.17

Still, Anthropic and other LLM creators typically have a long way to go to meet their financial goals, and there's no telling if their projections will materialize. Anthropic is on track for $9 billion in annualized revenue by the end of 2025,18 which is a fast jump from crossing a $5 billion run rate in August 2025,19 but that's still a far cry from the $70 billion goal for 2028.

Anthropic stock price history

As of 12/23/2025

Anthropic's Forge Price is $270 as of mid-December 2025, which is about a 381% increase over the past year. During that period, Anthropic's implied valuation soared around $200 billion to its current level of about $350 billion.20 And if Anthropic's reported funding round goes through at a valuation of $300 billion or more, that could raise its stock price further.

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions, andindications of interest (IOIs) on Forge.

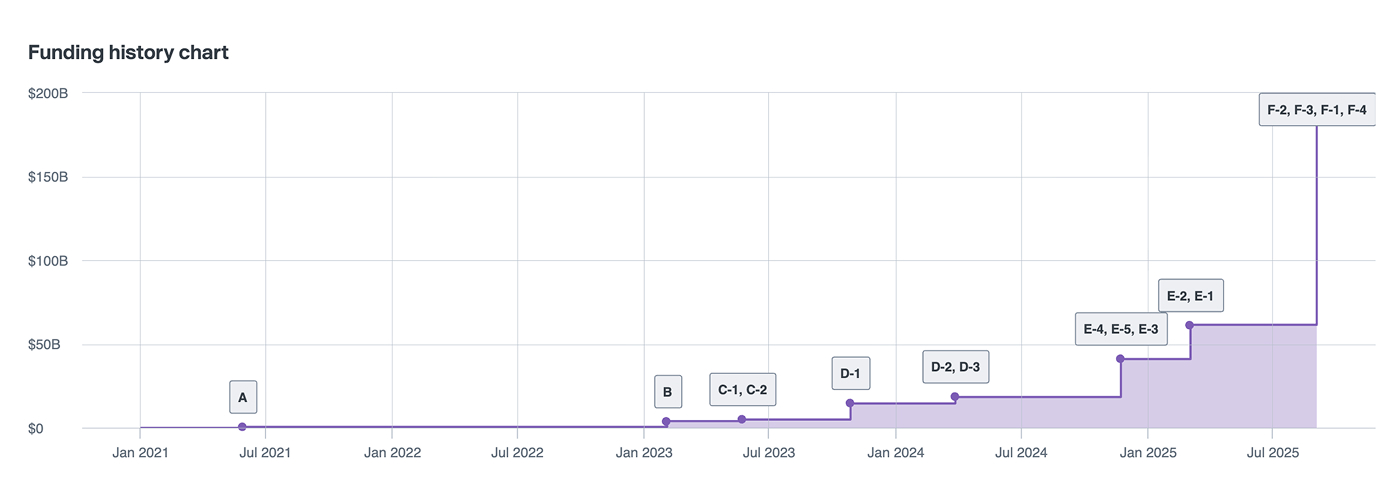

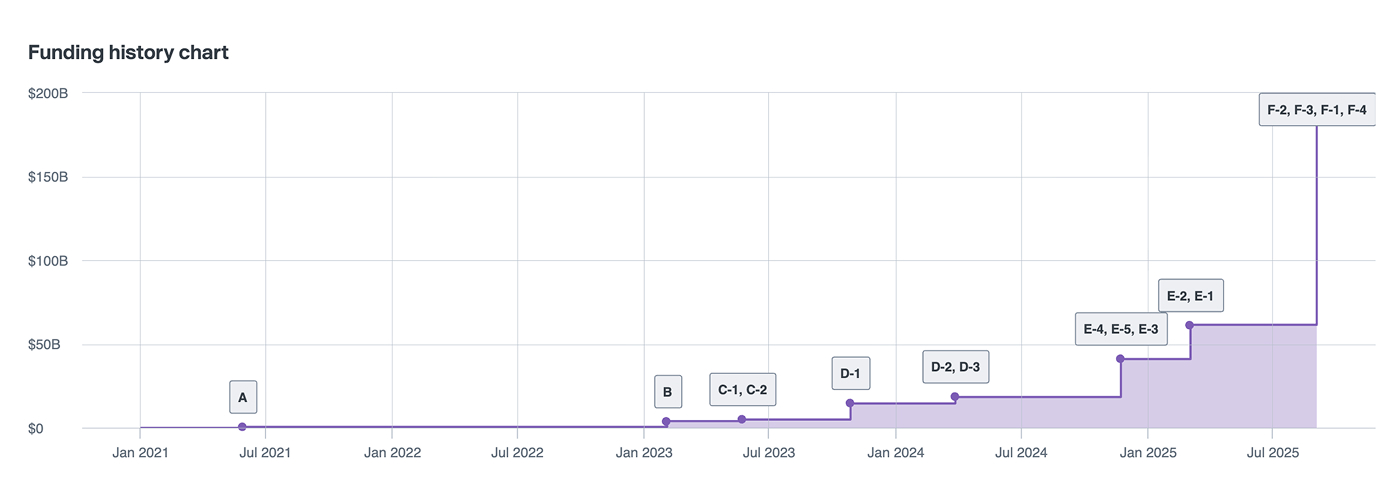

Anthropic funding history and private market valuation

The growth of AI has coincided with massive capital inflows. Since its first primary funding round in 2021 through its most recent Series F in September 2025, Anthropic has raised over $23 billion.21

Initially, the Anthropic Series A in May 2021 raised around $125 million at approximately a $623 million valuation. This funding round included investment from several high-profile individuals such as Jaan Tallinn, James McClave, Dustin Moskovitz, and Eric Schmidt, as well as the Center for Emerging Risk Research.22

In February 2023, Anthropic took a big leap forward, raising nearly $1 billion for its Series B at a valuation north of $4 billion. This round also included investment from several individuals such as Sam Bankman-Fried, Caroline Ellison, and Nishad Singh.23

A few months later, in May 2023, a two-part Series C brought Anthropic's valuation to around $5 billion, with several institutional investors joining in, such as Google, Salesforce Ventures, Sound Ventures, and Zoom Ventures.24 By October that same year, with Claude having launched just a few months earlier in March, Google invested in Anthropic again at nearly a $15 billion valuation.25

Then, in early 2024, Amazon invested in Anthropic too, first in March at an $18.4 billion valuation, and then again in November at over a $41 billion valuation.26

Anthropic's valuation kept rapidly climbing in early 2025, when it raised about $4.5 billion at a $61.5 billion valuation from institutional investors such as Lightspeed Venture Partners, Bessemer Venture Partners, Cisco Investments, and Fidelity. Half a year later in September 2025, a multi-part Series F from investors such as ICONIQ Capital, BlackRock, Blackstone, and Coatue Management raised around $13 billion and roughly tripled Anthropic's valuation to $183 billion.27

As mentioned, Anthropic is now working on a funding round that could bring its valuation above $300 billion.28

Funding history as of 12/23/2025

Looking ahead

Although Anthropic has not announced specific IPO plans, the company's reported engagement with Wilson Sonsini, which has significant tech IPO experience, is a notable step forward. Next steps could include publicly reported engagement with specific underwriters or the eventual filing of an S-1, should the company decide to move forward with an IPO.

Check back here or take a look at Forge’s upcoming IPO calendar to stay in the loop about the Anthropic IPO and other pending public offerings.

For now, as it remains private, interested investors can learn more abouthow to invest in Anthropic pre-IPO. Those looking to buy shares of Anthropic, or other AI startups, should also read Forge’s buyer’s guide to investing in private market shares.

Finally, if you’re ready to get started, you can create an account today.