- Unicorns are emerging at a proportionally faster pace in Europe than in the United States

- Late-stage concentration may lead investors to seek secondary market opportunities

- A weak IPO market could fuel European private market trading

Overview of the European Private Market

As Silicon Valley charts a path forward through the post-COVID economic environment, Europe is emerging as a hot region for high-growth startups.

That’s not to say that the U.S. VC market is fizzling by any means, but the trendline points across the pond. Increasingly, European tech startups are growing into $1 billion+ businesses – or “Eurocorns” – and they’re doing so at a faster rate than their U.S. counterparts.

Year to date, Europe has minted 41 new unicorns, which is 58% of last year’s total. The United States has minted 159, which is 45% of last year’s total.1 In other words, the gap between the regions may be narrowing.

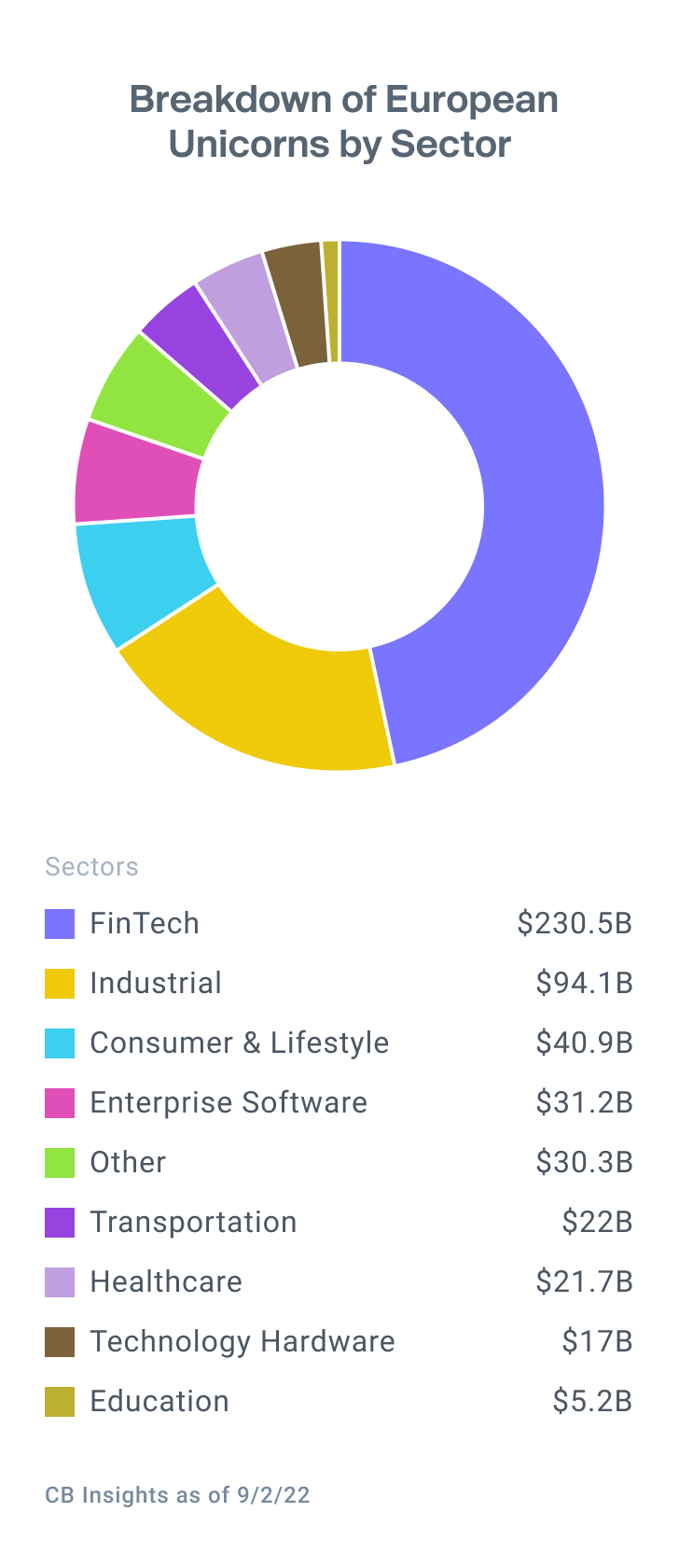

On the whole, the overall population of Eurocorns exceeds $350 billion2, and more are likely to come given that European venture capitalists are sitting on over $20 billion of dry powder.

That’s not to say that private companies in Europe aren't facing equally challenging economic headwinds as those in the United States. Issues like high inflation, tightening monetary policy, and the effects of the Russia-Ukraine war are notably acute in the region, with a particular impact on energy prices.

But while global venture funding tumbled in the second quarter, Europe only saw a 13% quarter-over-quarter decrease, compared with a 25% decline in both the United States and Asia, according to CB Insights.3

Only 29 IPOs occurred in Europe in Q2 2022, down from 142 in Q2 2021, according to PwC, and the pipeline for public debuts is likely to remain delayed for some time.4

Until then, we could see more companies and investors turning to private markets in search of liquidity – and Forge’s expansion into Europe offers the potential to broaden private market access for investors, shareholders, and companies.

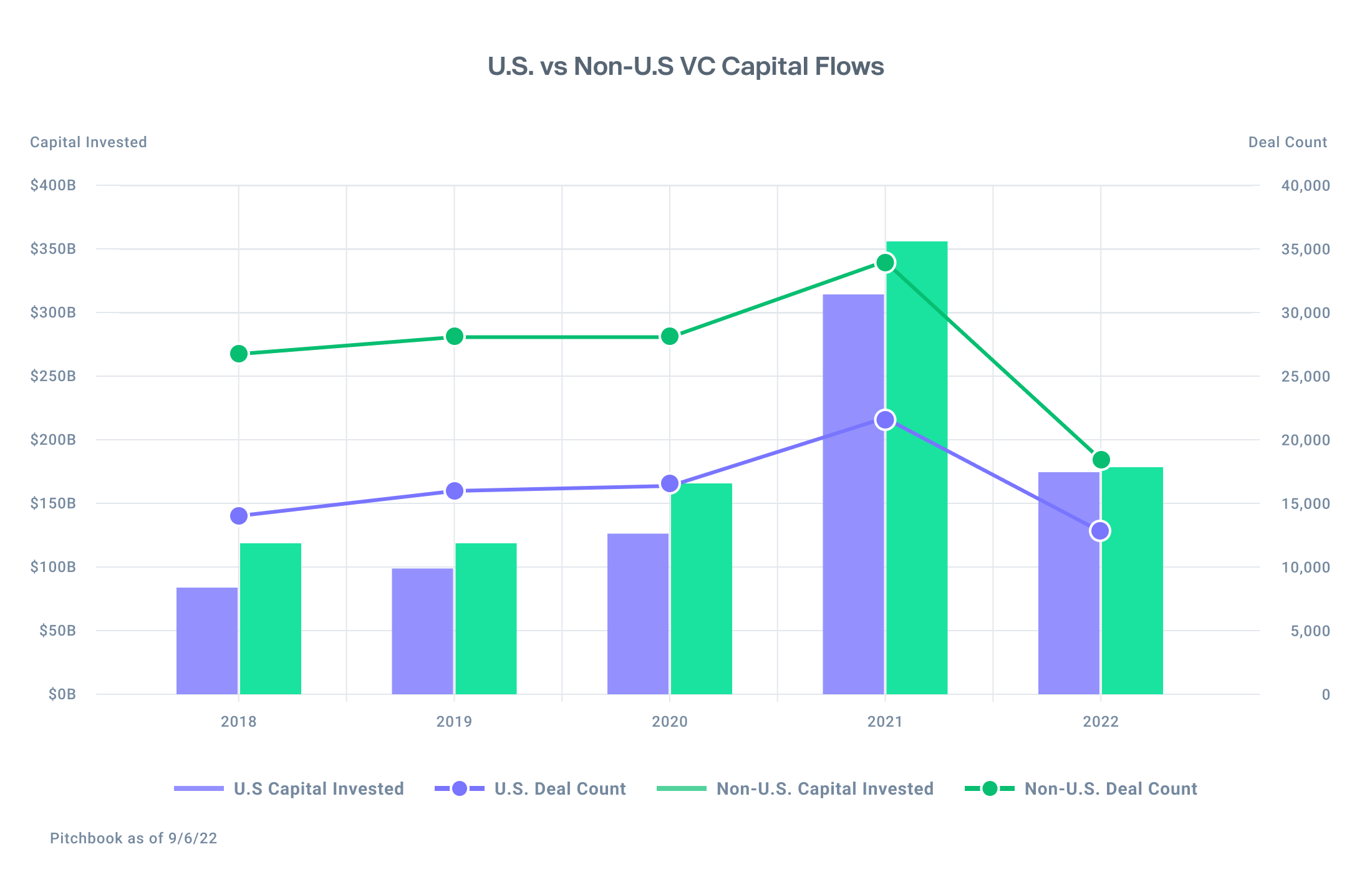

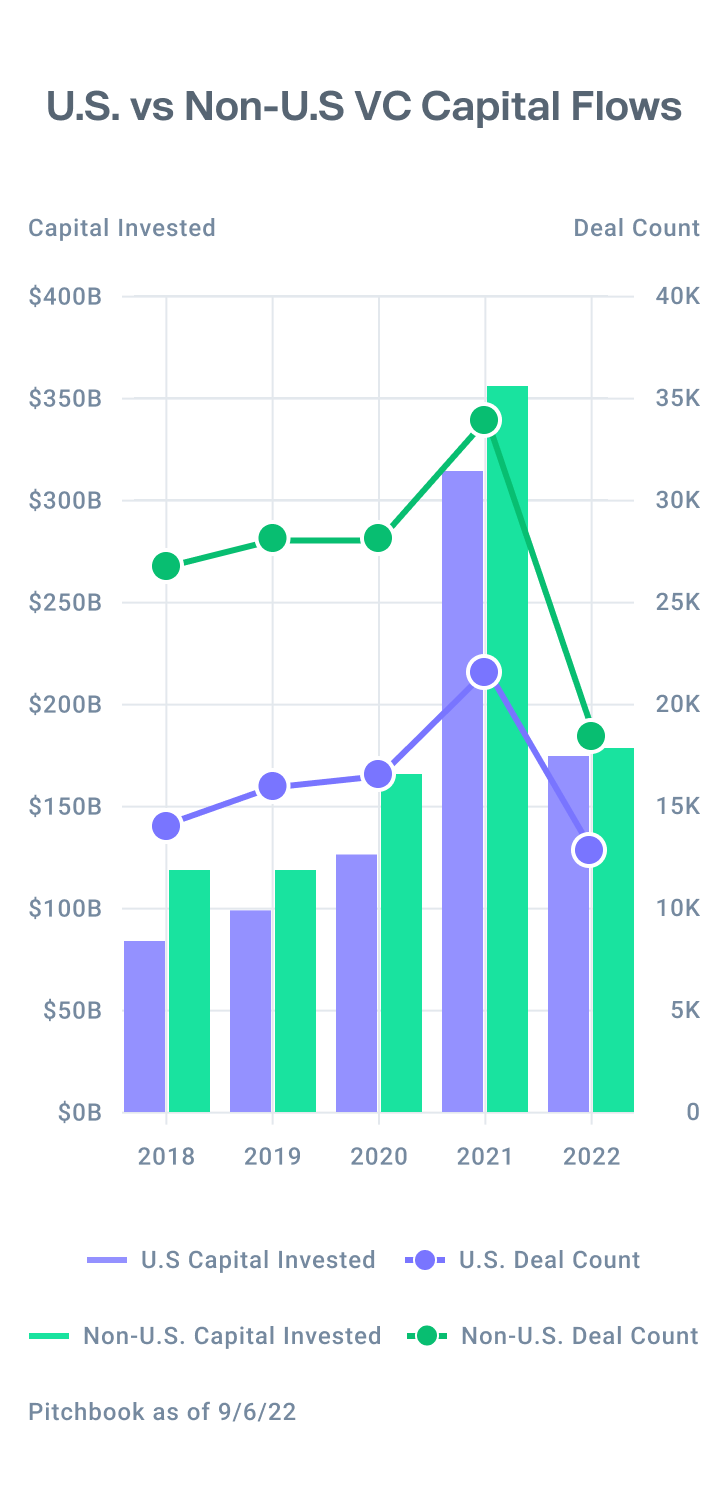

Venture capital is increasingly flowing into global regions, not just the United States

Since 2018, investors have poured $945 billion into tech companies outside of the United States compared to $797 billion into U.S. tech companies. And the number of deals is larger too, with roughly 1.5-2X the number of deals taking place outside the United States. For private market investors, this speaks to an increasing need to widen the aperture and look for investment opportunities elsewhere.

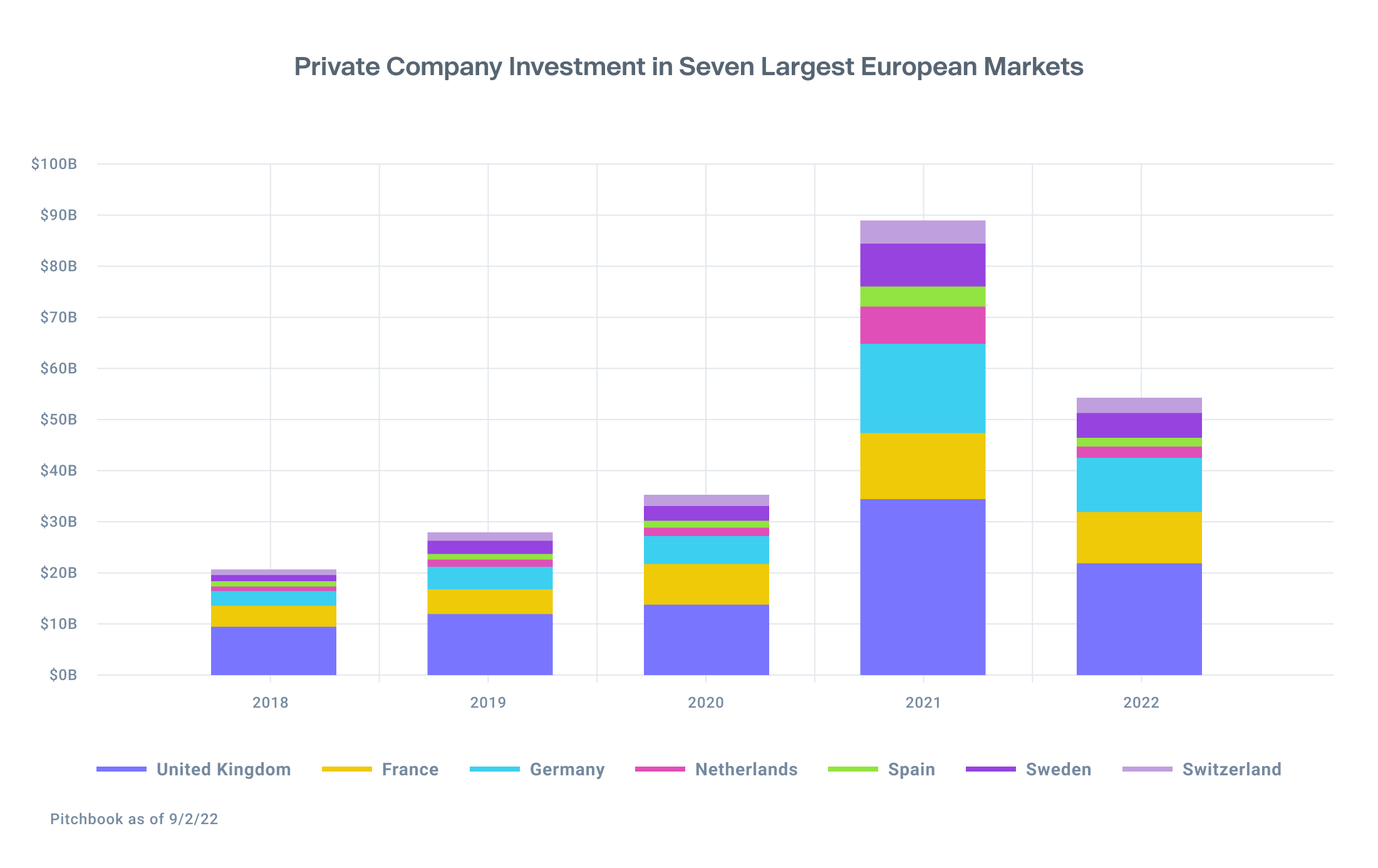

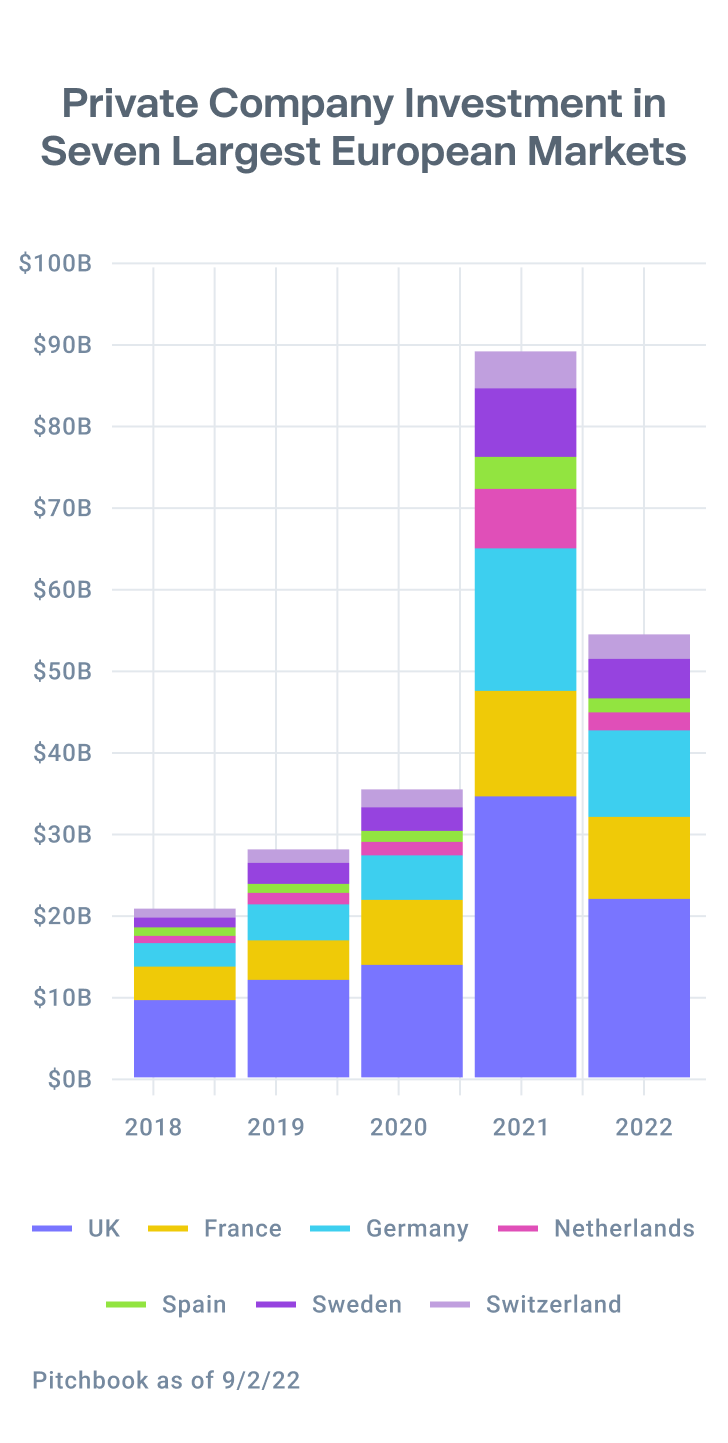

Europe’s private market has seen significant growth in recent years

As with many other sectors, 2021 brought tremendous growth to Europe’s private market with a staggering $89 billion invested into startups in seven of Europe’s biggest markets. Despite challenging economic conditions in the Eurozone due to inflation and its ongoing energy crisis, 2022 is already ahead of 2020’s pace – with $54 billion spread across a wide array of sectors thus far.

Secondary market offers European investors a new path forward

Late stages, large checks. According to PitchBook, late-stage venture capital comprised 50% of all European private fundraising in 2017 – and that proportion grew to nearly 70% in 2021 and 2022.5

Only a small number of investors can write large enough checks to participate in late-stage rounds, and thereby take part in their potential appreciation.

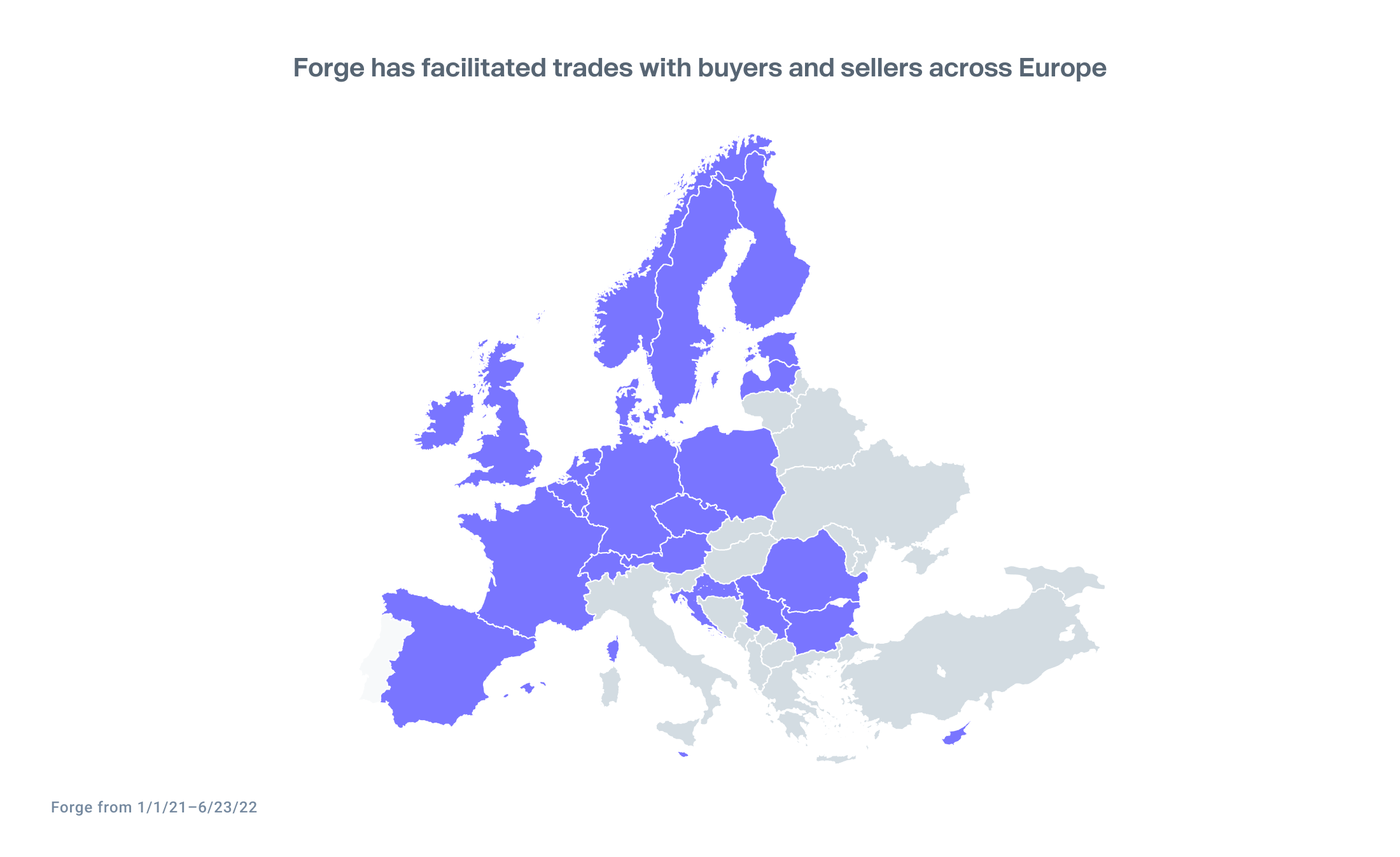

One outgrowth of this trend toward bigger European checks may be more investors seeking to buy shares of private companies in the secondary market. Since 2021, Forge has facilitated trades with buyers and sellers across Europe – and with expansion ahead, more investors may be able to participate.

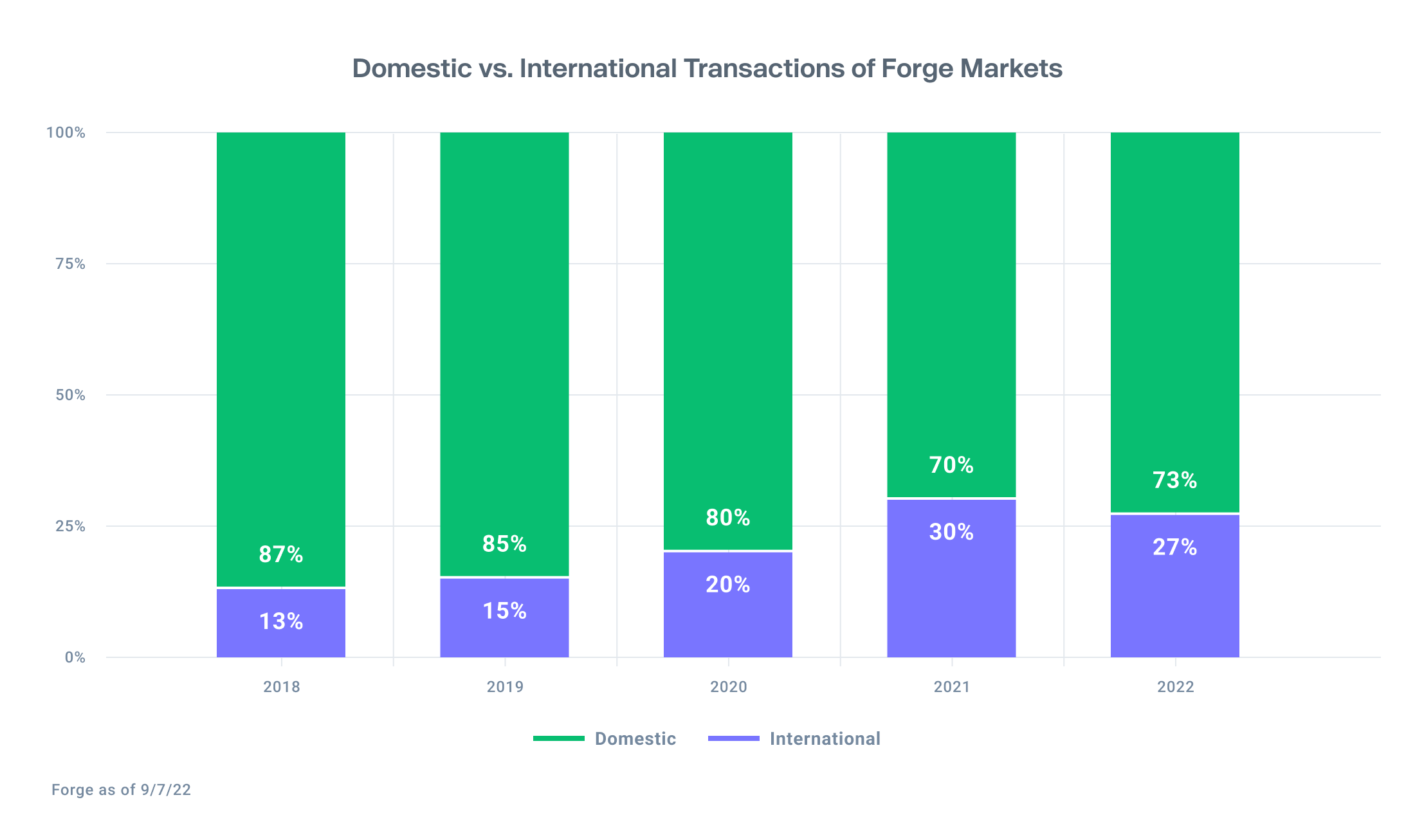

Meanwhile, the proportion of private market transactions on Forge with international buyers or sellers is steadily increasing, from 13% in 2018 to roughly 30% in the last two years.

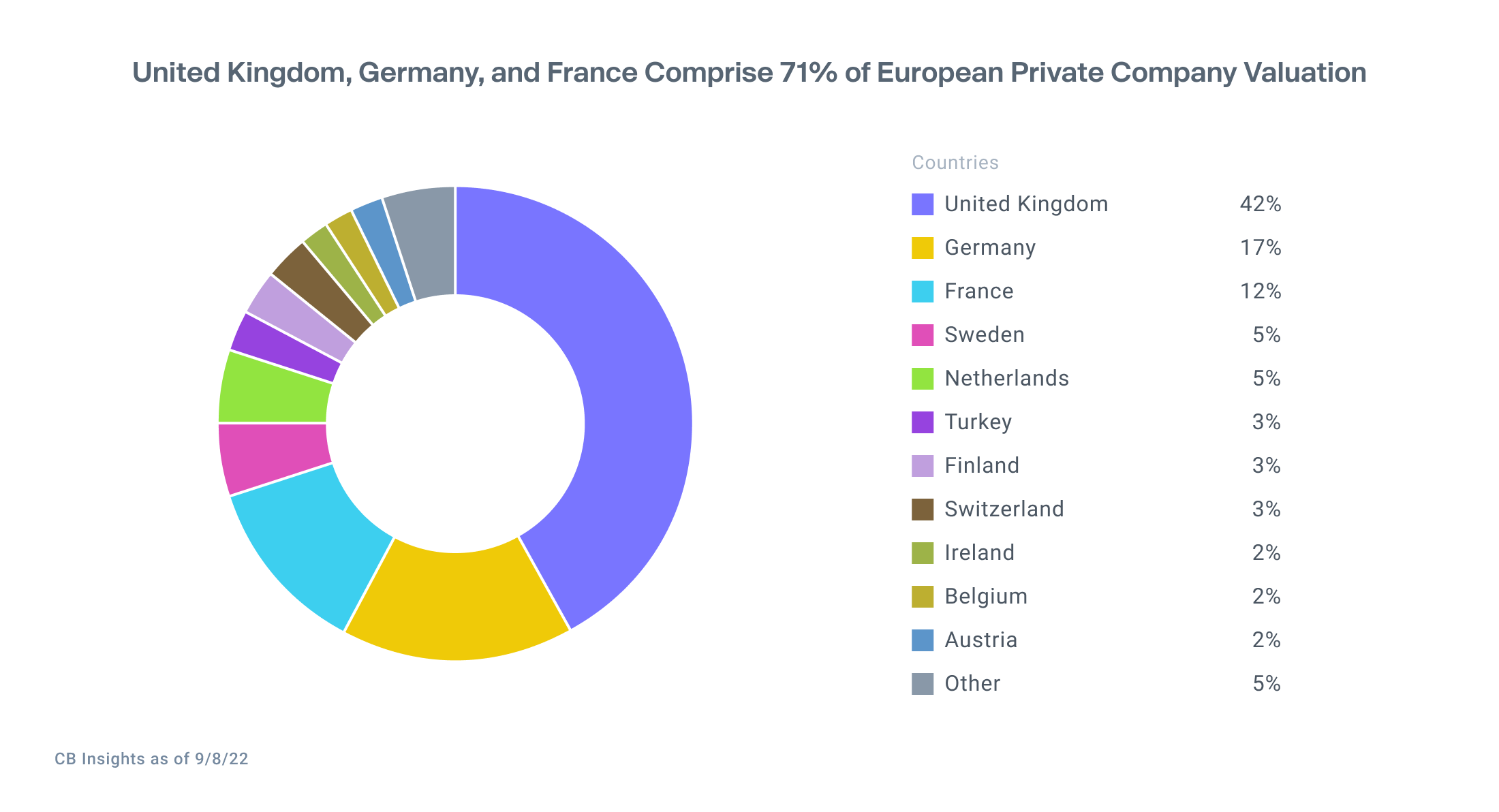

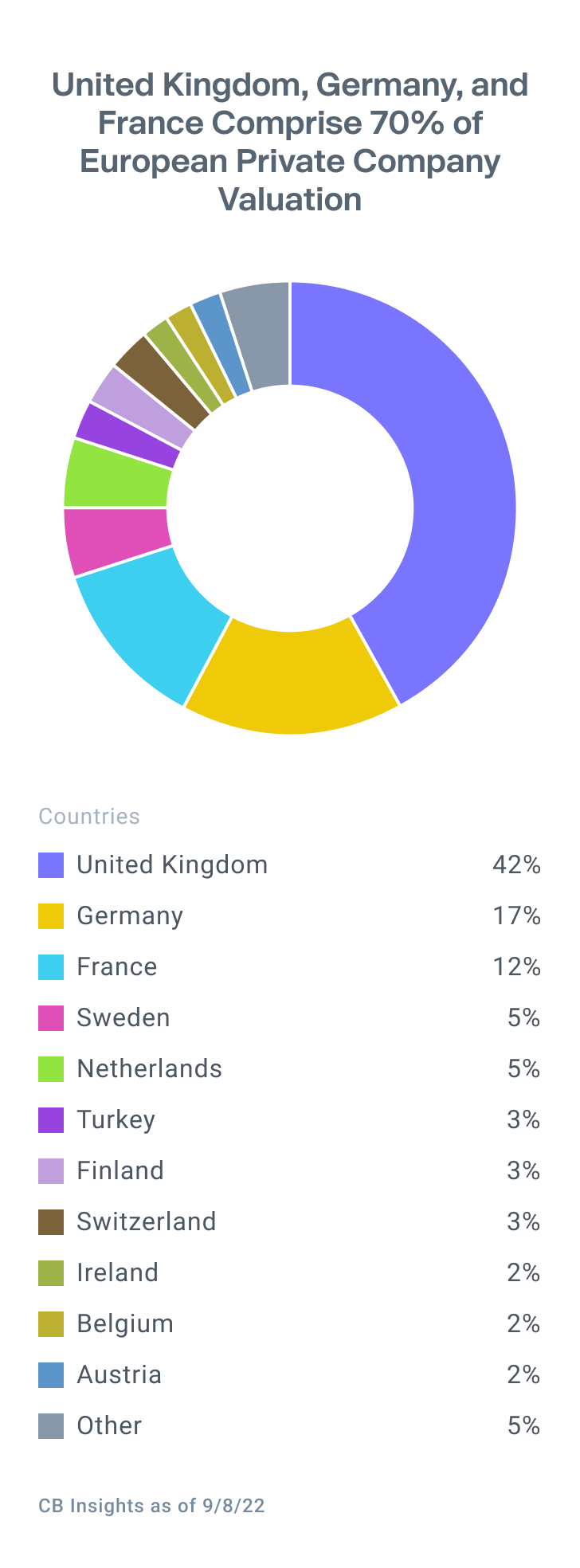

There are 153 Eurocorns – and the UK, Germany and France comprise 70%6

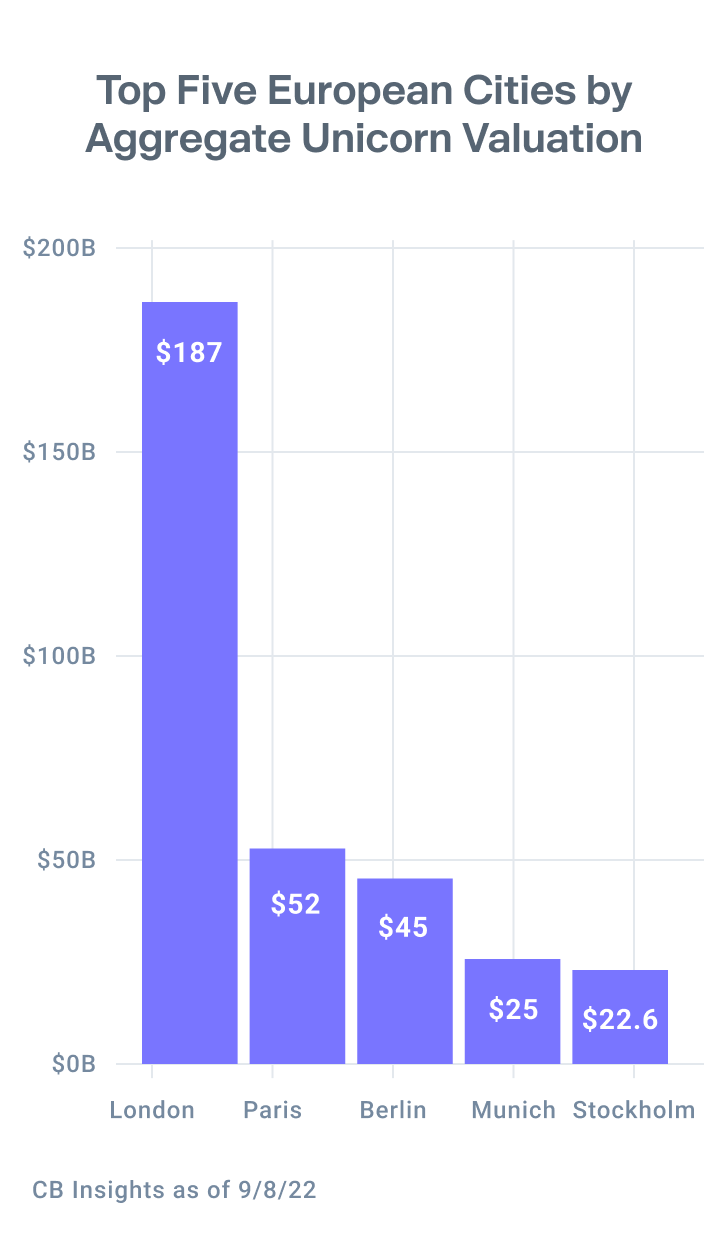

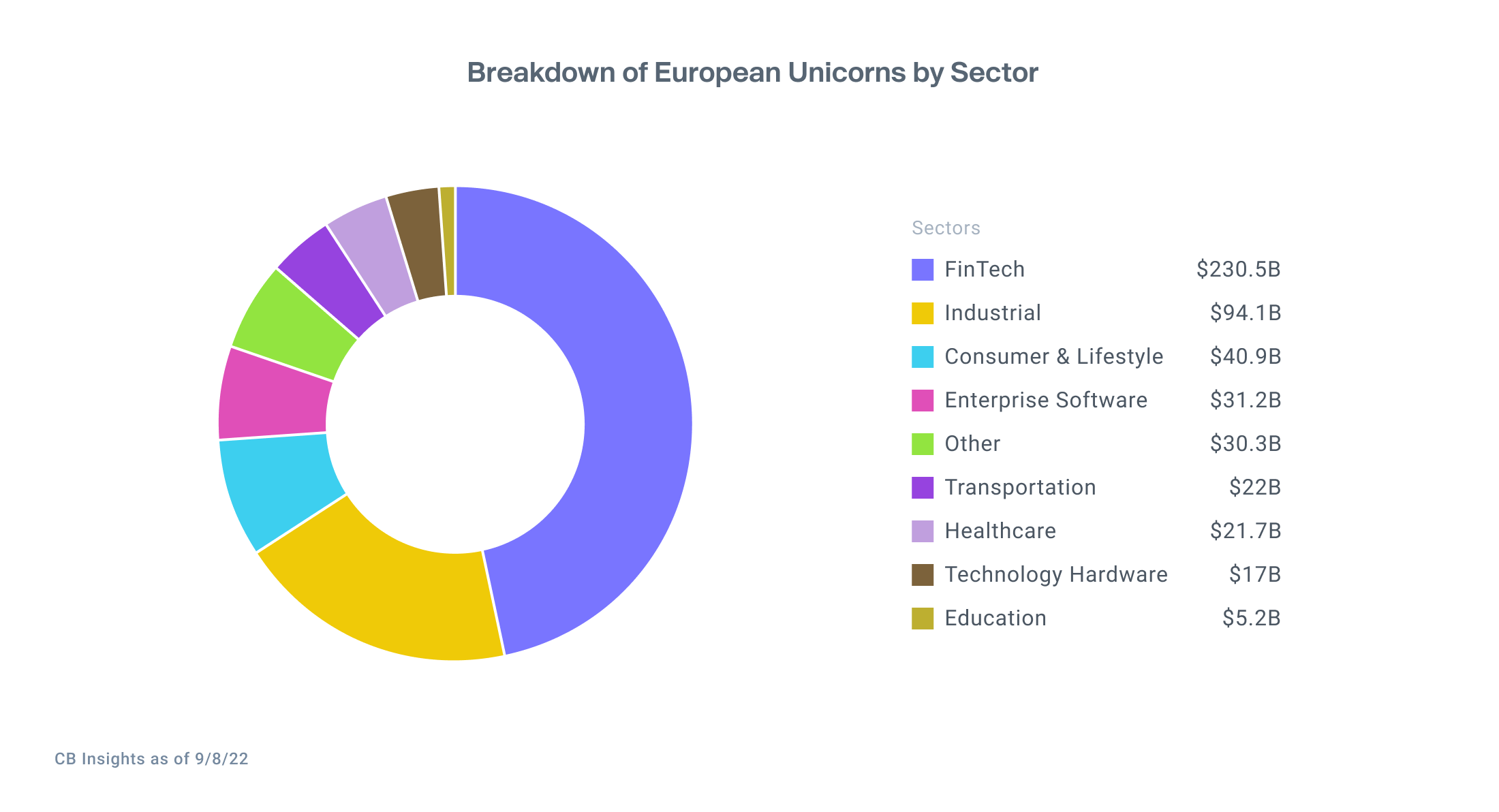

Roughly 10% of the world’s unicorns are located in Europe.7 Unsurprisingly, the United Kingdom, Germany, and France – and their capital cities of London, Paris, and Berlin – have the largest concentration of companies with billion-dollar valuations. With robust financial service and corporate sectors, it’s no surprise to see an abundance of fintech and SaaS companies atop this list.

But Europe’s broadening growth can also be seen through countries further afield, incubating startups that have morphed into global brands, like Sweden’s Klarna or Finland’s Oura.

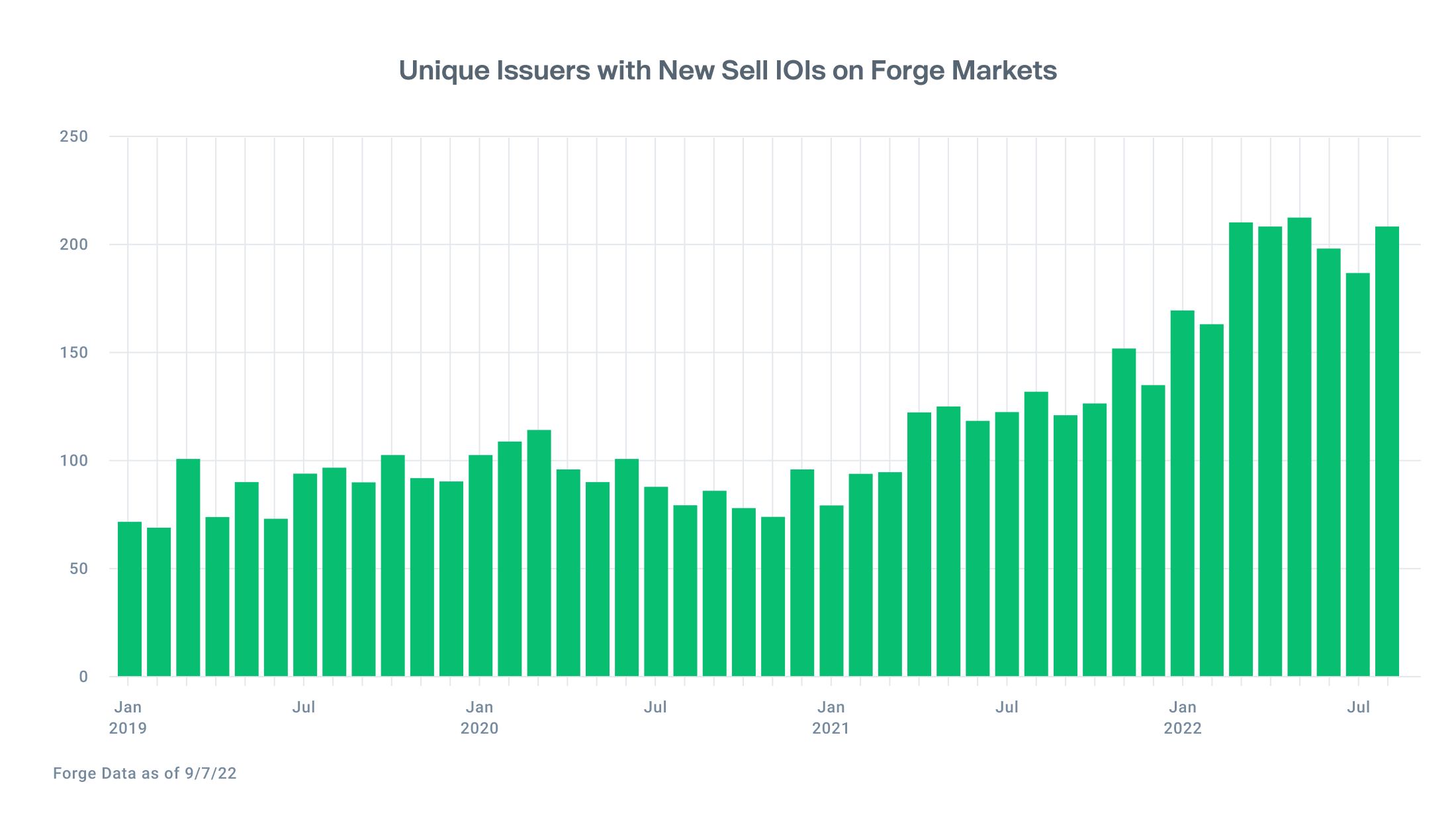

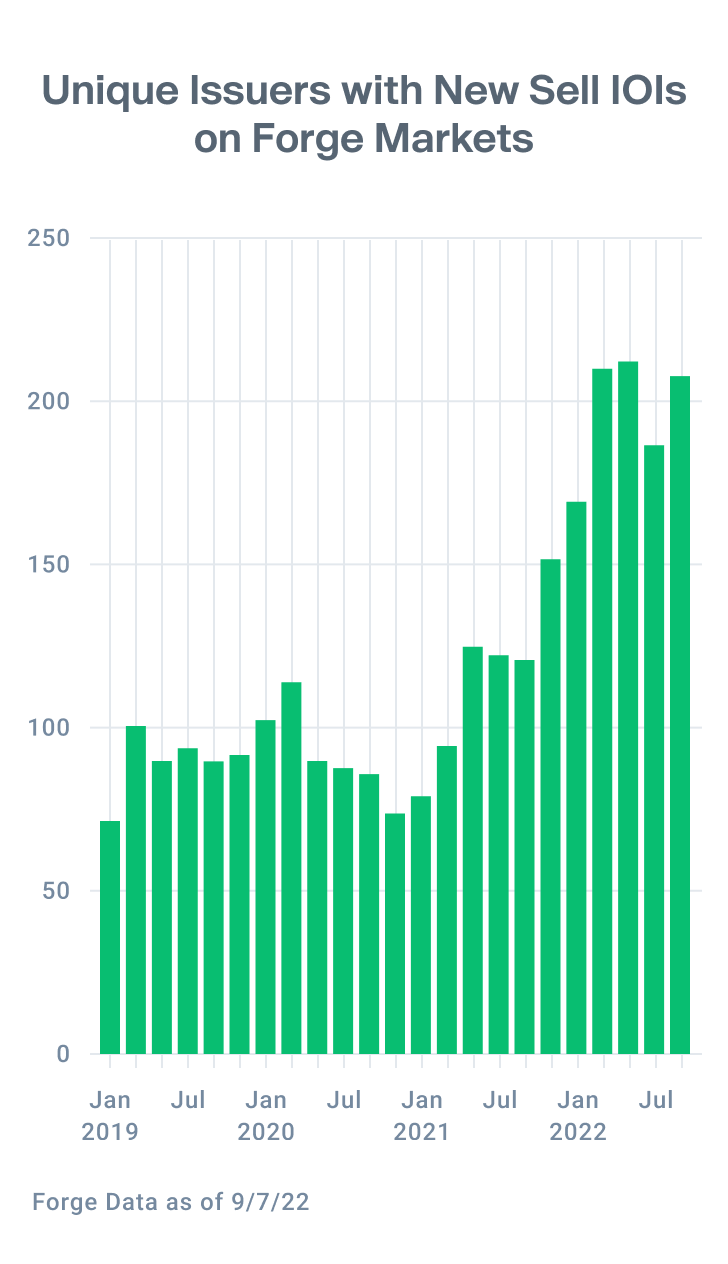

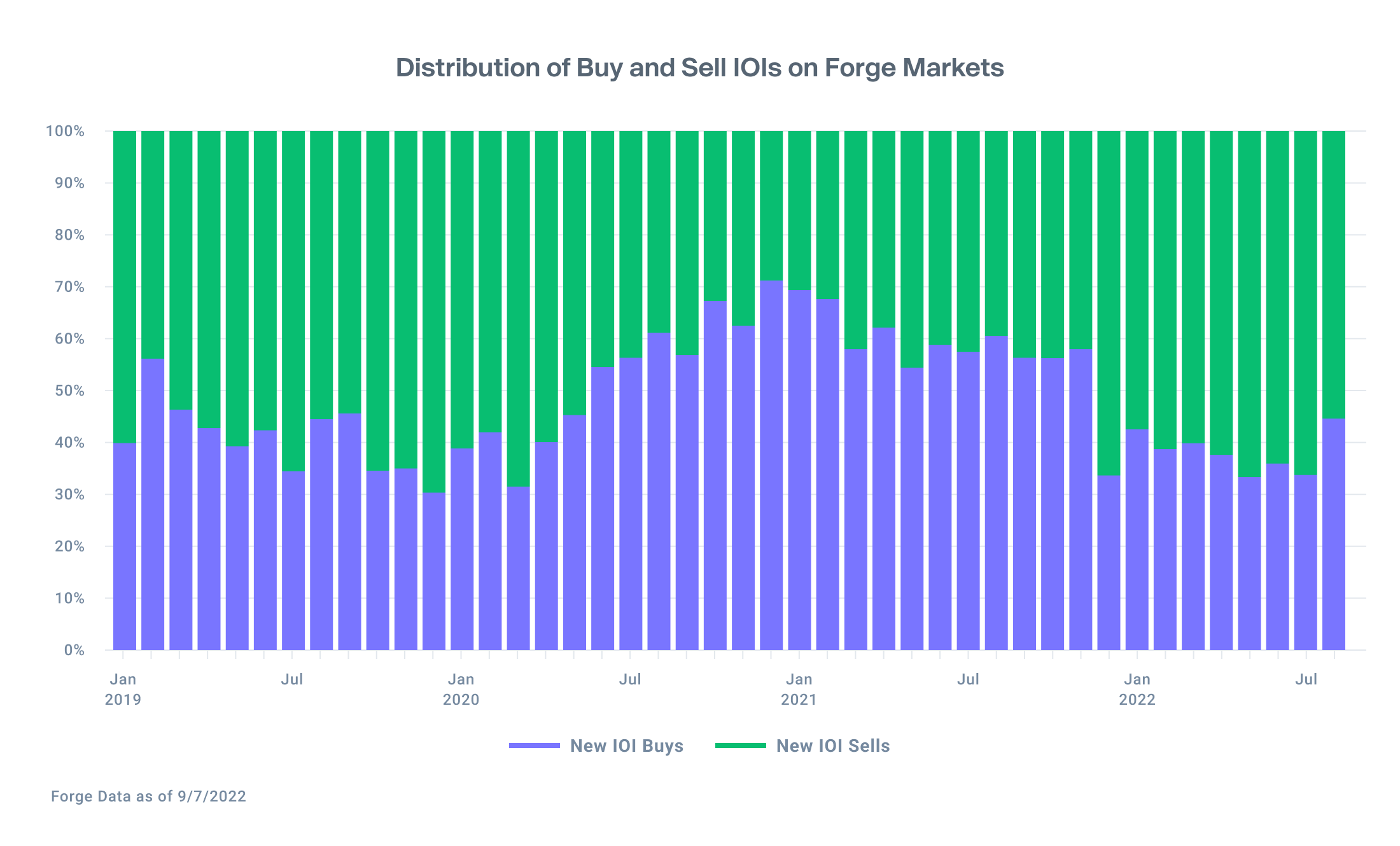

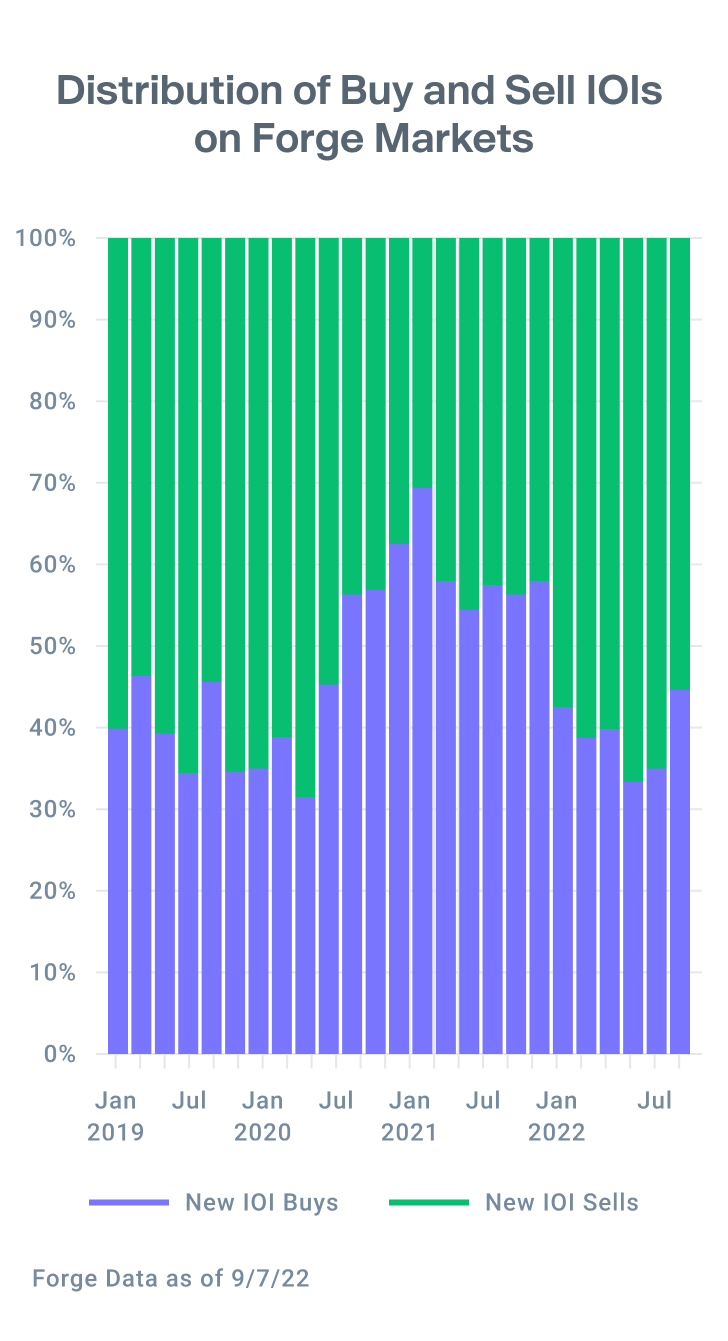

Slight uptick in Forge Markets buy-side interest potentially reflects improving investor sentiment

While Forge Europe aims to accelerate private market growth and innovation for a broader set of geographies, buyers and sellers continue to actively participate in today’s crop of unicorns. In August, the number of unique issuers with new sell indications of interest on Forge Markets exceeded 200 companies once again after a slight decline in July. At the same time, buy-side interest rose to nearly 45% on the Forge Markets platform in August 2022, compared to 35% in July. These readings may be the result of investors digesting steadily improving inflation data plus a slightly less volatile public market environment in recent months.

The private market continues evolving, and with more regions coming online the opportunity for investors, shareholders, and companies grows as well. To dive deeper into the growing European unicorn universe, we invite you to join our live webinar on Wednesday September 14, 2022 at 9AM PDT / 12PM EDT / 6PM CET. Blythe Masters (Founding Partner, Motive Partners and Independent Director, Forge) will lead a discussion with Kelly Rodriques (CEO, Forge) and Christoph Hansmeyer (Managing Director, Deutsche Börse Group and Independent Director, Forge).