The Great Reset - Forge Investment Outlook

This quarter, Forge released the first installment of the Forge Investment Outlook, a brand new compendium of in-depth private market analytics built specifically for institutional investors.

This is a critical time for a deeper dive into private market analytics. Private markets are in the midst of a great reset, with companies on Forge marketplace trading at a –5% discount to their second-to-last funding round. In other words, the price discovery process has effectively reset private company prices to where they were before the most recent valuation upcycle.

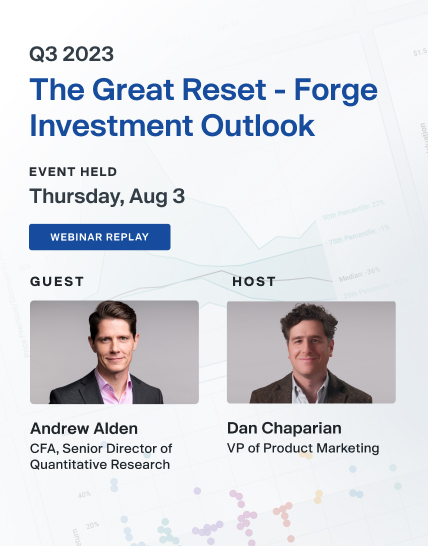

To go deeper into the state of the market and this new set of analytics, investors are invited to join Andrew Alden, CFA, Senior Director of Quantitative Research at Forge for a walkthrough of this new, in-depth report for institutions and professional investors.

Topics covered:

Private market performance vs. public equities – is the market leading or lagging?

Primary fundraising – new analysis on shifts in dollar volume and the length of time between funding rounds.

Secondary market activity – current trade premiums/discounts to last rounds and ROFR activity.

Andrew Alden, CFA, serves as Senior Director of Quantitative Research at Forge Global where he leads a research team focused on the private market. Prior to this role, Andrew launched Semantiqa, an investment management firm, which focused on the public-market growth equities space. Andrew has also held researcher positions at WeatherStorm Capital and Lattice Strategies (now Hartford Funds) where he led equities investment strategy development, including index development which was utilized to launch ETFs tracking those indices. Collectively his strategies are embedded in 7 systematic factor-based ETFs with assets in excess of $3Bn.

Dan Chaparian is VP of Product Marketing at Forge where he oversees the go-to-market strategy of the company’s services and offerings. Before joining Forge, Dan spent three years at BlackRock with the iShares ETF products. At Uber, Dan led Uber Eats for Business in addition to serving as their Global Product Marketing Lead for Uber for Business where he drove the go-to-market strategy for global product launches. At Apple, Dan managed the company's iAd product marketing strategy and execution for mobile display advertising, audience targeting, first-party data, and closed-loop attribution products.

Transcript

Thanks for joining today's webinar. My name is Dan Chaparian, VP of Product marketing at Forge. And I want to thank you for taking the time to join us for today's institutional webinar, which is an overview of Forges new compendium of private market insights called the Forge Investment Outlook. At Forge, we are committed to providing investors with the insights and the data and the tools that they need to gain better access and transparency into the private market.

The Forge Investment Outlook is designed for those institutional investors who seek as much data and insight as possible as they look to integrate private assets into their portfolios. The Forge Investment Outlook is available for download today on Forge global dot com. And we've also included a link to download the report in the chat box of today's webinar. And by the way, if you have questions, feel free to just put them in the chat box as well over the course of today's conversation. Now, let's dive into it.

I'm really excited for today's conversation, and also really excited to bring in Andrew Alden, who is a CFA and is a senior director of quantitative analysis here at Forge global. And Andrew is the lead author of the Forge Investment Outlook. So, Andrew, why don't we start with an overview of the private market as a whole? How should investors think about the private market performance relative to other asset classes like public growth, equities, or public tech stocks?

I know this might seem like a relatively straightforward question, but historically, I think we know that there has been a lack of benchmarking tools in the private market compared to other asset classes. So, what are your thoughts on this?

Yes, thanks, Dan. Perhaps the most direct place I like to go to understand performance in this space is the Forge Private Market Index. It was created to directly address the lack of good benchmarks in the space and also to give people a place to look to see how performance in the secondary market is moving.

Historically, there has been a lack of benchmarks. I've seen people using public equity benchmarks, such as Nasdaq 100 or the Russell 2000. I've also seen people using private equities manager returns provided by people like Cambridge to proxy performance in this space. But both of those are materially different and do not show the performance of private secondary market trading activities. And the Forge Private Market Index exclusively uses private market price data, and reflects the price movement of 75 of the most liquid names in the space.

As such, the Forge Private Market Index is always a place I go to first to understand the performance on our platform and in this space. To answer your initial question, the Forge Private Market Index is down -17% for the year through June 30th. And this has been in contrast with the public markets, which as you well know are up about 40% for the year through June. And that's led by mega cap tech stocks. Here, this chart shows the full history of the index.

So, you can see how the Private Market Index has performed since the index inception at the start of 2019. You can also contrast it with some commonly used public market indices. You can see the dramatic outperformance of the Private Market Index in the 2019 to 2021 period. And then also the bear market that began in 2022. One thing I also find very interesting about this chart is the apparent lead/lag relationship between public equity market and this space.

What we see in the 2020 and 2021 period is the strong rally started first in the public markets before dramatically taking off a quarter or two later in the private market. Meanwhile, at the tail end of 2021, the drawdown seemed to hit the public and private markets at nearly the same time. So, what I'm watching most intently now is this performance dispersion between the public and private markets in 2023. Year to date, the public market is leading dramatically, and it'll be really interesting to see if the private market will follow.

Related to the index, another chart that I like looking at is this one. Showing the performance of the underlying Forge Private Market Index constituents in green, gray, and red bars overlaid with the transparent bar chart of the Nasdaq 100 ETF quarterly performance represented by triple Q. Green shows the percentage of index companies that had positive performance in each quarter, while red reflects the percentage of index companies with negative performance in the quarter. And gray is flat.

To me, this chart helps us better get under the hood of the Index and see if they're potentially any indications of a turning point in the market. As you can see, when NASDAQ was posting a lot of positive quarters, that sentiment does appear to have permeated private markets, leading to a higher percentage of companies trading up in our space. Turning to recent months, you can see that we're getting an increasing share of companies with positive returns, even though the aggregate index performance has yet to turn positive this year.

So, this is one place I look to perhaps get an early indication of turning points in the market.

Thanks, Andrew. That's a great overview of the private market performance overall. And it's especially interesting to see that sort of an understand that sort of lead/lag relationship between public markets and private markets like you're describing. And that can also be seen in the Forge Private Market Index, which is on forgelobal.com. Also, great to see that increasing share of companies in the Private Market Index that are being priced up so far throughout this year.

So. let's talk a little bit about where we are right now. It seems like we're sort of in this period where public exits are still few and far between. But one really large component of private markets is, of course, primary fundraising. What are you observing in the primary fundraising markets right now? In terms of funding activities, specifically for those mid and late-stage companies that are covered by Forge.

You know, Dan, that's a really interesting question.

Everyone talks about less easy access to capital now and everyone knows intuitively that we came out of a really frothy period and things have materially changed. But where are we now and what are we really seeing in our data? This is what we sought to answer and what we are putting together in the next couple of charts. This bar chart in green, gray, and red, counts the number of primary funding rounds in each quarter that we're up flat or down. And overlaid in the line chart is the total dollars raised in the periods.

There's a few things I find interesting here. One, you can see just how active the primary market was in 2020 and 2021 relative to the subsequent years. Two, you can also see that while funding is down materially in 2022 and 2023, it's not entirely dried up. Companies are still raising. And three, as we'd intuitively expect, down and flat rounds are increasing as a percentage of total rounds. More companies are having to raise capital at less attractive terms.

That is a fact. But number four, the majority of companies are still raising an up round. This says that the majority of companies raising new primary rounds are doing it from a position of strength. Those raising from a position of weakness are increasing, but they're still in the minority. And this leads to the next chart that I find really interesting, which corroborates this story. This chart shows, for each company raising a new round, on average, how many months it's been since their prior funding round.

What we see here is that the time between rounds has increased from lows in 2021, where companies on average were raising capital only a year after their prior round, to highs of a little over one and a half years, on average between rounds and currently trending up. To me, this hints that companies probably raised capital a bit more opportunistically in 2021 when valuations in multiples were strong. And probably helps explain why we have yet to see a large number of companies raising capital under tighter conditions, doing those down and flat rounds.

These companies, on average, just had done a round or two shortly before the current market downturn and so they probably still have cash. And therefore, I think this suggests companies are still waiting for attractive terms, have enough cash for now and are seeking to grow into their valuations if they can before they need to raise again. Companies on average do not appear desperate.

Got it. Thanks, Andrew. So, companies are waiting longer to raise money, and we're starting to see some down rounds creep in. It's good to know.

And also, that's an important call out on the data that you're discussing, which focuses on those companies that are covered on the Forge platform, specifically. So, Andrew, why don't we switch gears a little bit and talk about price comparisons? So, you know, just like any asset class, it's really hard to time the market in the private markets. And it's also quite difficult for private market investors to form a view on how relatively expensive or relatively cheap, private market companies or private market stocks might be, which is a process that's really common with public stocks.

So what data are we publishing in the Forge Investment Outlook on pricing trends of private companies, and specifically ,maybe related to the premiums and discounts that these private companies are currently trading at relative to their primary fundraising valuations?

Thanks, Dan. I love this question. And we've been doing a lot of thinking about how best to assess fair valuations. One chart that I really like, which addresses this, and you've seen this before for a couple of months now in the Forge Private Market Update,

is this chart showing the distribution of premium/discounts to last funding round on companies traded in each month? This chart breaks down the range of trade premium/discounts so you can see how more expensive companies are trading as well as how cheaper companies or an average or median company have traded. So, for example, what we see right now is that the median trade premium/discount is currently -52%. So, that's a discount. But what I think is so helpful about this chart is that we're showing the distribution of these premium/discounts.

Some raised around recently, while others may not have raised for several years, some face stronger or weaker macro conditions as well. But this chart helps investors benchmark whether the price they might be considering buying or selling a position is fair or not. For example, if someone is considering selling shares in a company at a 5% premium right now, that would be somewhere in the top 10% of all premium/discounts right now.

So, as you consider buying or selling shares in a company, you can think through the unique specifics of that company and use this chart to get a better sense of where that company should probably be trading relative to the others.

Thanks, Andrew. It's particularly helpful to see how premiums and discounts are changing over time and through different market cycles as it relates to private market trading. So, let's talk a little bit more about where these valuations to today. It seems like many private companies are still trading at relatively deep discounts as you just explained.

They're trading at around a 52% median discount to their last primary fundraising round. Forge global CEO, Kelly Rodriques has been commenting recently that these discounts represent something of a “Great Reset” of private company valuations. Now, as a result of the secondary market transactions that take place on the Forge platform, Forge has a unique vantage point on pricing relative to current valuations and maybe even relative to previous round valuations.

So, can you tell us more about what the data is saying here?

Yes, I'd be happy to. One chart we put together recently to help us understand where we are right now is the following in which we plot the median trade premium/discounts relative to the last funding round as well as to the second to last funding round. In hindsight, we all know that the last round for many companies done in 2020 or 2021 was done in another era of cheaper money and higher valuations. Therefore, maybe it's helpful to see how prices compared to a period prior to that.

Very interestingly, from about 2022 onwards, we're seeing trade premium/discounts to the second to last round to be close to flat to those rounds. And currently at -5%. This tells us that from a premium/discount standpoint, the current market has mostly wiped out the prices received in the last primary round. It also hints perhaps the prices are normalizing. Premium/discounts to the second to last round have been more stable for 9 months or so. And perhaps this is a helpful reference point to consider - measuring prices relative to a funding round done in a less frothy time than the last round.

Andrew, let's move on from valuations a little bit and talk about one of the more idiosyncratic elements of the private market, which is the presence of the right of first refusal or ROFR. Essentially, when a private company shareholder looks to sell their stock to a third-party buyer, the company typically retains a right of first refusal for a set period of time, around 30 days, to step in and buy the stock back at the price, negotiated by the buyer and the seller.

If the company waves that right, the seller can proceed to sell that stock to the buyer at the negotiated price. And Forge tracks this metric very closely as a result of all the trading that takes place on our platform. Now, we have access to pretty unique data here to help illustrate the state of private markets through the lens of how often rights of first refusal are being exercised. So, what is this data telling us about the market right now?

I love this question.

For a few months now, there's been talk internally here at Forge and externally as well. That we're seeing a pickup in the number of companies ROFRing trades. So, I was very interested to dive into this data a little bit deeper. And sure enough, what we're seeing is a significant uptick in the percentage of companies which are ROFRing trades in Q1. And just a quick side note on why Q1 and why there's no Q2 data here. It's because settlement takes time. So, a lot of the Q2 trades are still in the midst of the settlement process.

And we won't have the complete ROFR picture on those until sometime in Q3. So, in this Q1 period, it's trades executed in Q1, but settling in Q1 or into Q2. So, what does all this mean? More than anything, I think it means insiders believe there's value at current prices. And this could be for a couple of reasons. The company could be trading cheaply relative to the opportunities the insider is seeing, or it could be that they know of upcoming plans to unlock shareholder value.

Such as an exit or new funding round at a more attractive terms. And they want to buy shares ahead of that event. So, ROFRs are often seen by investors as a bullish indicator on a company. Does this mean a company is inherently cheap relative to others in the market? No, not necessarily. We actually looked at that as well. Although it's not presented in this report, companies that ROFR are not doing it at materially cheaper prices than other companies are trading at. They're most often doing it at the going fair market price is just that insiders are seeing value at that price.

Thanks, Andrew. Besides right of first refusal data, another data point that Forge aggregates and shares back out with investors is what's known as mutual fund marks or the valuations that institutional investors are putting on the private companies that they hold in their portfolios. Now, since many of these mutual funds are managed by some of the world's largest institutions, their insight and their valuations can be used as a key component in understanding how the private market is doing today.

So, what are these mutual fund marks telling us about how the market overall is performing?

Good question. This was actually something we looked at recently. And I think the findings are especially thought provoking. In this chart, we show the quarterly median trade premium/discount on companies against the median premium/discount at which mutual fund managers are marking their positions. In 2020 and 2021, they priced very similar to each other. But in 2022, trade prices fell faster and further than mutual fund marks.

What I find especially intriguing here is that there's two possible interpretations. Number one, perhaps mutual fund managers haven't marked down enough. Anecdotally, we often think of them as being slower to Mark positions up and then perhaps slower to mark them down as well. But two, and conversely, this chart could also suggest that perhaps private markets have overreacted and oversold. Since mutual fund managers see financial statements and have a better sense for the intrinsic value of the company, perhaps their valuation is more appropriate than those trading in the secondary market, who often do not have the same visibility into the company.

Of course, naturally, it's possible that both are partially true. Maybe some mutual fund marks need to come down more and maybe some secondary market names have oversold as well. This is especially intriguing to consider against the backdrop of public markets, where 2023 tech performance is suggesting that the market probably did oversell there some in 2022. And we've not yet seen that rebound in the private markets.

Great. So, let's end on a fitting note, which is IPOs.

People obviously pay a lot of attention to IPOs. And the pace of the IPO market and the private market tend to be pretty closely tied together. When companies are going public, that suggests improved market dynamics, which tend to trickle down into the private secondary markets. So, as we know, the IPO pipeline was pretty active in 2021. And it obviously slowed down considerably in 2022 as inflation and interest rate hikes all set in. So, how has 2023 gone so far?

And what do you see in the second half of the year?

That's certainly something a lot of people are talking about right now. We recently put together a chart to show various exit activities and help show us where we're at and how that looks in the context of the last few years. Overall, what we see is low, but steady activity levels in 2022 and 2023. IPO and SPAC activity came down considerably from 2021, which we all already know. But we continue to see steady M&A in each quarter.

And we are seeing hints of renewed energy in the IPO space. Cava's IPO last quarter at a near $5 billion valuation got people excited that IPOs can happen again. And there's some interesting IPOs in the pipeline potentially for the coming months. Klaviyo is a large one. They confidentially filed back in May. And then, of course, there's also, as there always is, rumors flying about which other companies may seek a public market exit soon too. But we'll see. We're always watching the IPO picture.

And I think the back half of 2023 will be really interesting.

Well, thanks so much for that IPO commentary. And thanks for walking us through all of the insights and analytics from this first edition of the Forge Investment Outlook. As a reminder, you can download the Forge Investment Outlook on Forge global dot com. We've placed the link in the chat box. So, if you haven't had a chance to download this report and take a look, I highly encourage you to do that. And if you've placed a question in the chat box, we will get back to you personally with an answer there.

I want to once again thank Andrew Alden for walking us through all of the analysis and taking the time to join today's webinar. And I encourage you to look out for future reports and analysis that are published on forgeglobal.com. In particular, the Forge Investment Outlook will be released on a quarterly basis going forward. So, stay tuned for that. Again, thanks so much for joining us. I hope you've enjoyed today's webinar and we're wishing you a pleasant rest of your summer.

Legal Notices and Disclosures

The opinions expressed are those of the speaker and are subject to change. There is no guarantee the stated results will occur.

The information and material presented in this video is provided for your informational purposes only and does not constitute an offer by Forge to sell, or a solicitation of an offer to buy any securities and may not be used or relied upon in connection with any offer or sale of securities. An offer or solicitation can be made only through the delivery of final offering document(s), purchase agreement(s), and other applicable documentation, and will be subject to the terms and conditions and risks delivered in such documents.

This article does not constitute an offer to provide investment advice or service. Registered representatives of Forge Securities do not (1) advise any member on the merits or prudence of a particular investment or transaction, or (2) assist in the determination of fair value of any security or investment, or (3) provide legal, tax, or transactional advisory services. Securities referenced in this article may be offered by Forge Securities, and certain Forge affiliates may act as principals in such transactions.

Investing In private company securities is not suitable for all Investors. An Investment In private company securities is highly speculative, involves a high degree of risk, and you should be prepared to withstand a total loss of your investment. Private company securities are also highly Illiquid and there Is no guarantee that a market will develop for such securities. Each Investment also carries Its own specific risks and Investors should conduct their own, Independent due diligence regarding the Investment, Including obtaining additional Information about the company, opinions, financial projections and legal or Investment advice. Accordingly, Investing In private company securities Is appropriate only for those Investors who can tolerate a high degree of risk and do not require a liquid Investment.

Past performance is not Indicative of future results.

Legal Notices and Disclosures

The opinions expressed are those of the speaker and are subject to change. There is no guarantee the stated results will occur.

The information and material presented in this video is provided for your informational purposes only and does not constitute an offer by Forge to sell, or a solicitation of an offer to buy any securities and may not be used or relied upon in connection with any offer or sale of securities. An offer or solicitation can be made only through the delivery of final offering document(s), purchase agreement(s), and other applicable documentation, and will be subject to the terms and conditions and risks delivered in such documents.

This article does not constitute an offer to provide investment advice or service. Registered representatives of Forge Securities do not (1) advise any member on the merits or prudence of a particular investment or transaction, or (2) assist in the determination of fair value of any security or investment, or (3) provide legal, tax, or transactional advisory services. Securities referenced in this article may be offered by Forge Securities, and certain Forge affiliates may act as principals in such transactions.

Investing In private company securities is not suitable for all Investors. An Investment In private company securities is highly speculative, involves a high degree of risk, and you should be prepared to withstand a total loss of your investment. Private company securities are also highly Illiquid and there Is no guarantee that a market will develop for such securities. Each Investment also carries Its own specific risks and Investors should conduct their own, Independent due diligence regarding the Investment, Including obtaining additional Information about the company, opinions, financial projections and legal or Investment advice. Accordingly, Investing In private company securities Is appropriate only for those Investors who can tolerate a high degree of risk and do not require a liquid Investment.

Past performance is not Indicative of future results.