- February/March trade prices down on average just under 20% from Q4 2021

- Buyers/sellers seem to be aligning toward price discovery

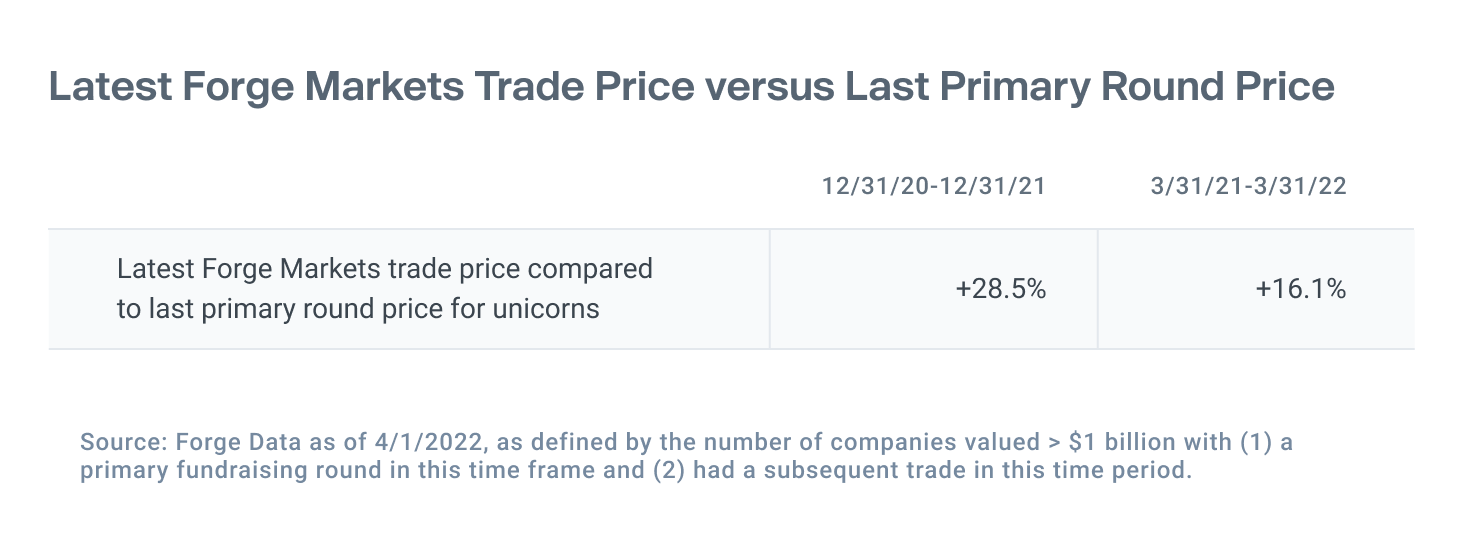

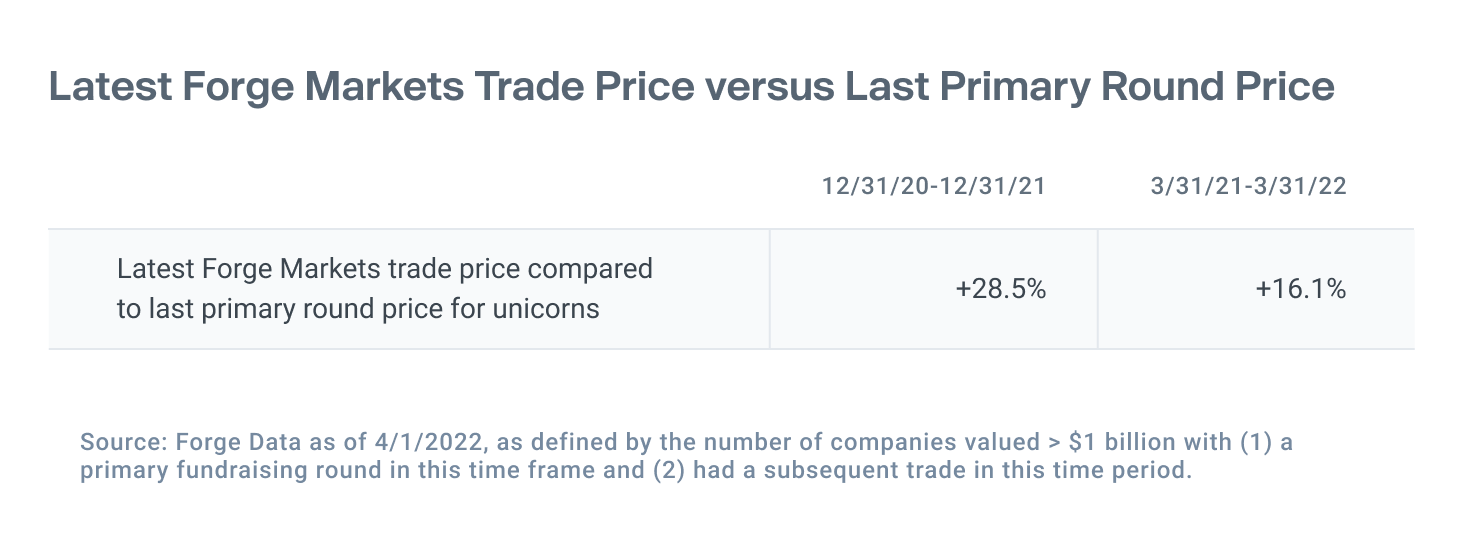

- 12-month pricing still shows a premium to the last primary fundraising round valuation

A recent high-profile valuation reduction by venture-backed delivery startup Instacart has investors taking a hard look at whether their portfolios are due for a price correction. Is Instacart’s bold move a trend, or was this an isolated case?

Overall, new data from the Forge Data platform shows private market prices over the 12-month period of March 31, 2021 through March 31, 2022 continued to demonstrate a premium to the last primary fundraising round valuation, though that premium did compress in Q1 2022 compared to all of 2021.1

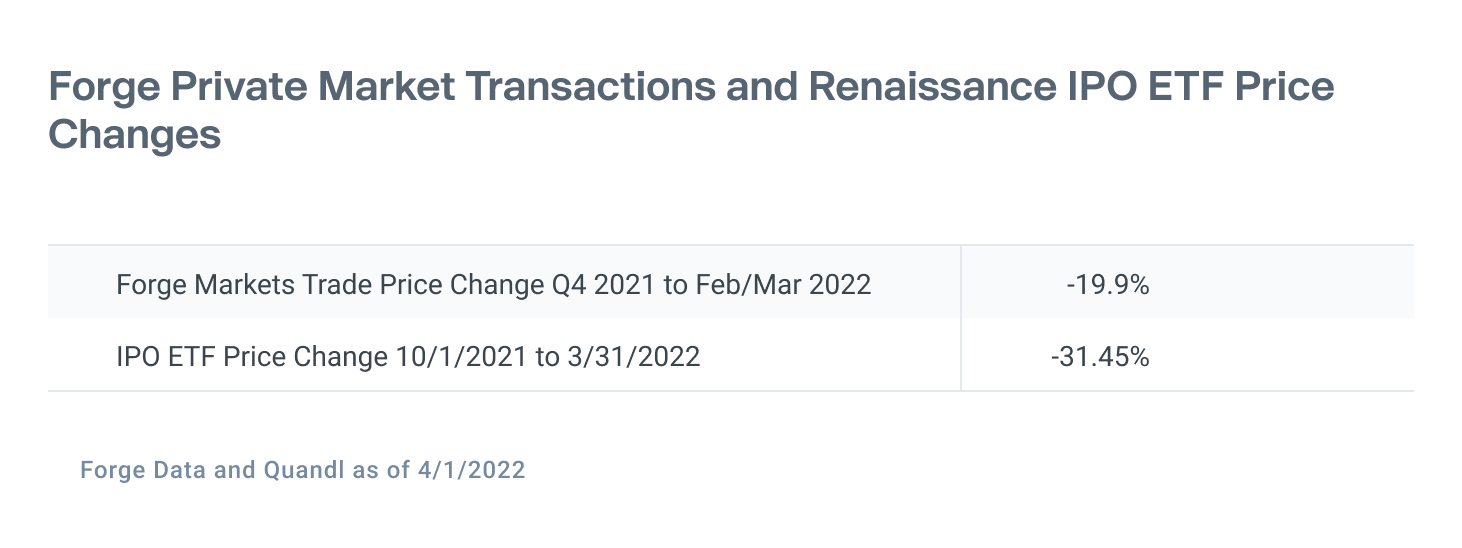

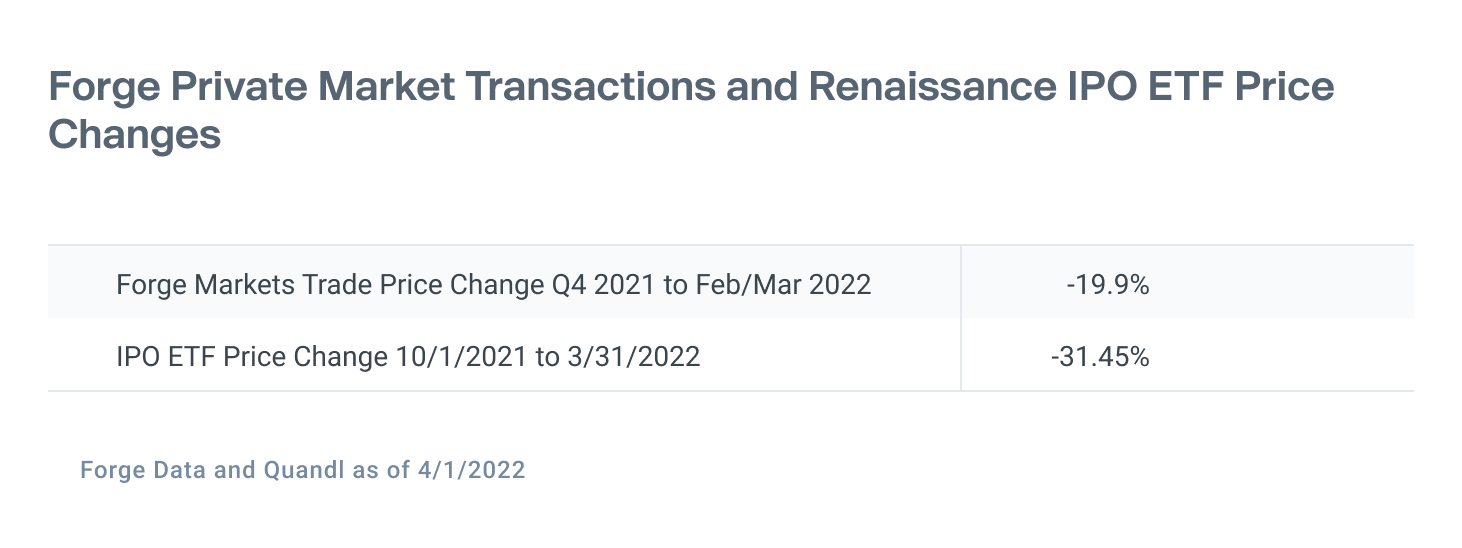

While the private market showed signs of softening in Q1 2022, pricing changes remained less dramatic than in the overall public market for the high-growth tech segment. The average price of completed trades on the Forge Markets platform was down on average 19.9% in February and March versus Q4 of 2021.2

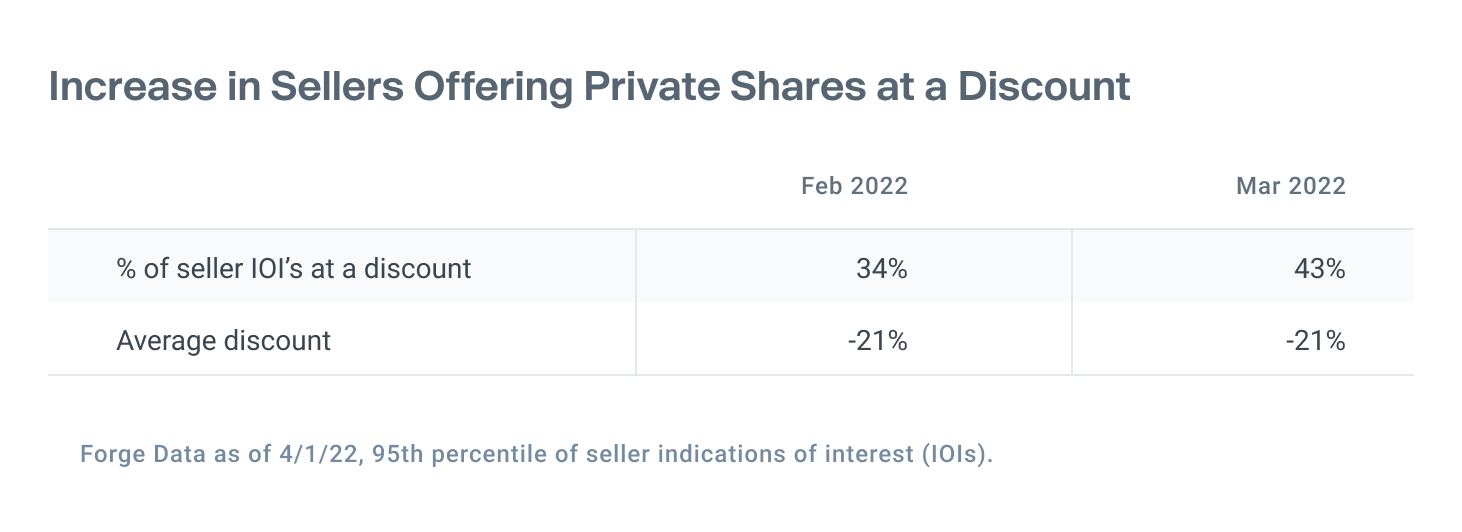

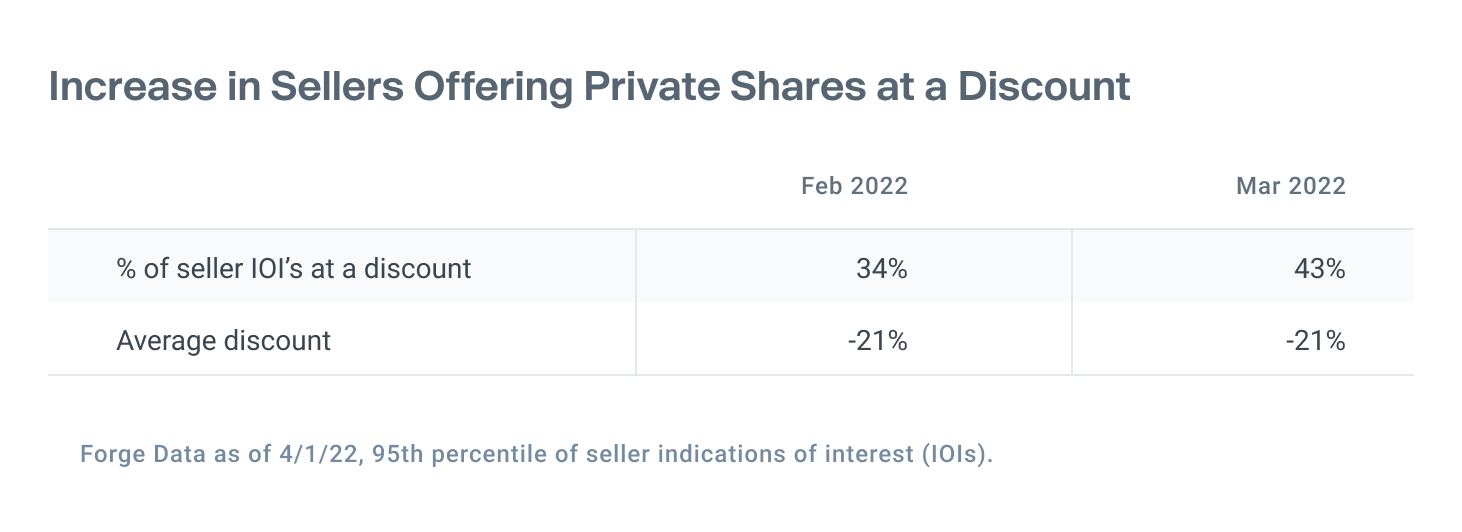

As employees and shareholders of private unicorn companies saw exit timelines delayed due to the challenging IPO/SPAC environment, their willingness to list shares at a discount increased.3

“Even as more sellers are willing to offer their private stock at a discount and as more buyers seek discounts to the last round, our data doesn’t show the steep drop in trade prices that would justify a 40% reduction across the board,” said Charlie Grimes, Managing Director and Head of Capital Markets at Forge.

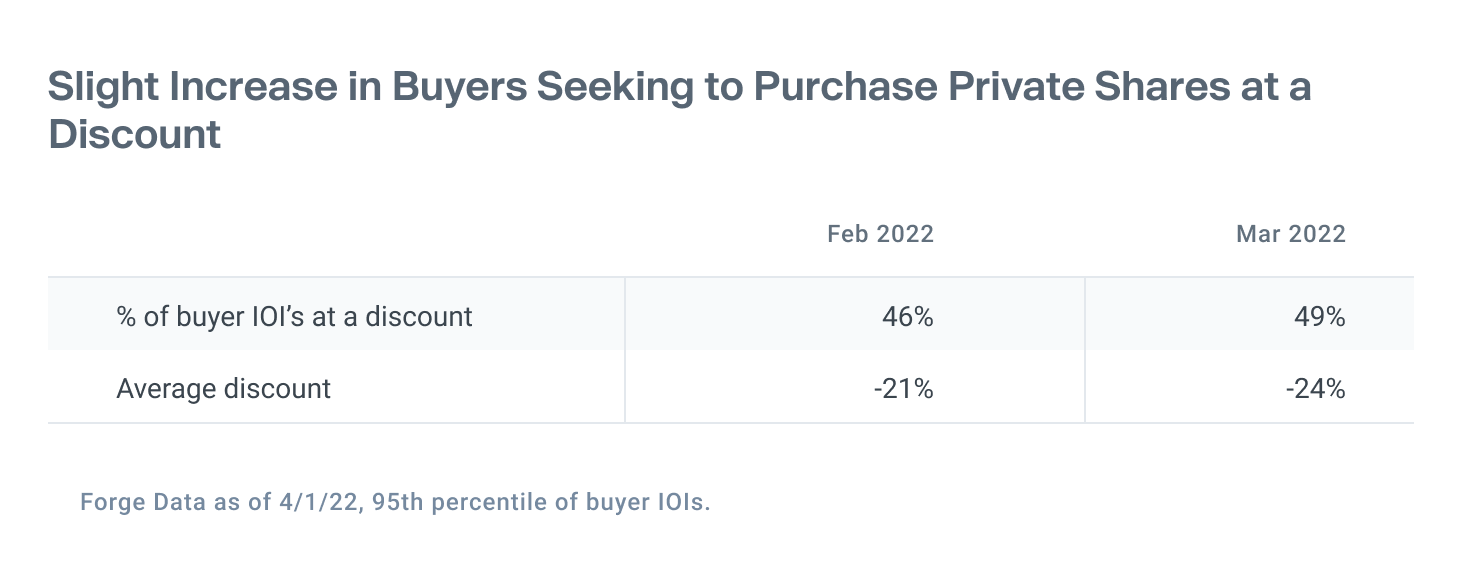

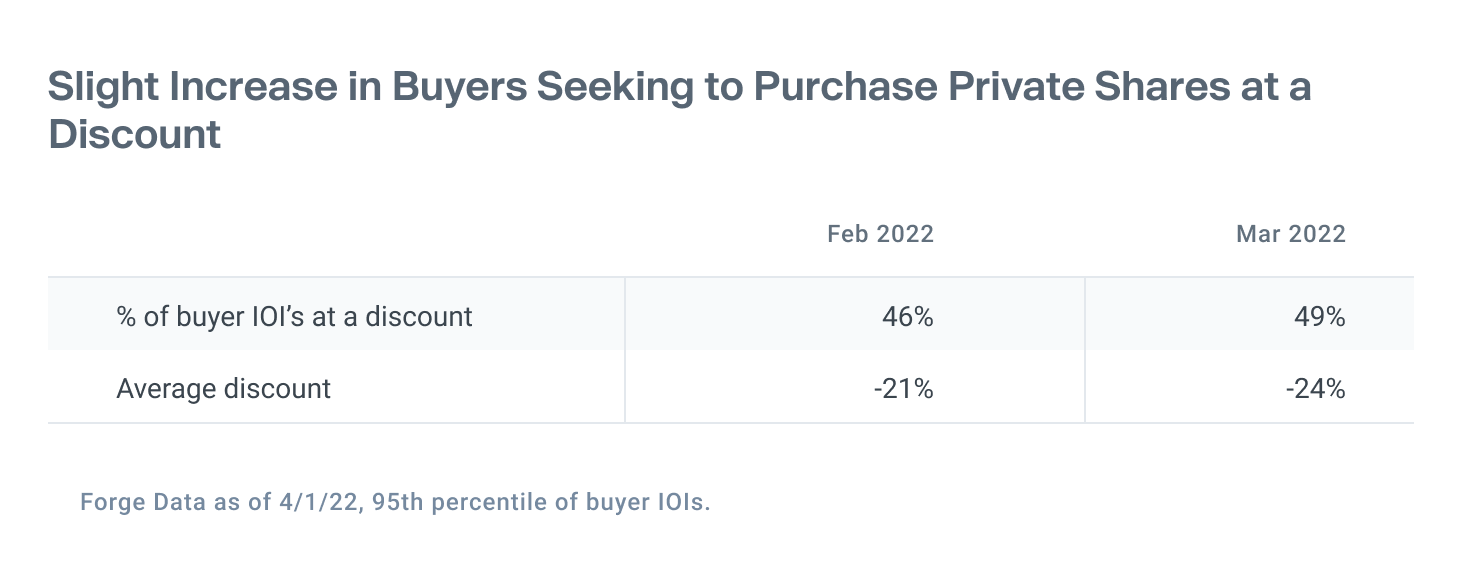

While the price discovery process between buyers and sellers was disrupted at the start of the year, February and March 2022 produced an increasing percentage of sellers willing to list stock at a discount to the last primary fundraising round. Notably, in March, the price discount buyers sought was more closely aligned to the discount sellers were offering, with buyers seeking on average discounts of 24% to the last round versus sellers posting shares at discounts on average of 21% to last round, suggesting that buyers and sellers were finding common ground.4

Private market valuations remain strong, but pull back in Q1 2022

To get a better understanding of how the private market really values a company today, investors using Forge Data can analyze a company’s last trade price compared to its last primary fundraising round price.

When looking at the companies with a last primary fundraising valuation of greater than $1 billion (aka “unicorns”) on the Forge Data platform who raised a primary funding round during the period of March 31, 2021 through March 31, 2022 and subsequently traded on Forge during this period, their most recent trade showed an average 16% gain to their primary funding round price.5

This is down from the 12-month period of December 31, 2020 through December 31, 2021. In this period, unicorns who raised a primary round and subsequently traded on Forge showed an average 28% gain from their most recent trade price to their primary funding round price.6

We believe this reaffirms some of the recent market softening, while reminding investors that the private market operates on a long-term timeframe.

It takes years for private companies to build technology, disrupt markets, and generate value. It's a well-worn investing adage, but time in the private market may be better than timing the private market.

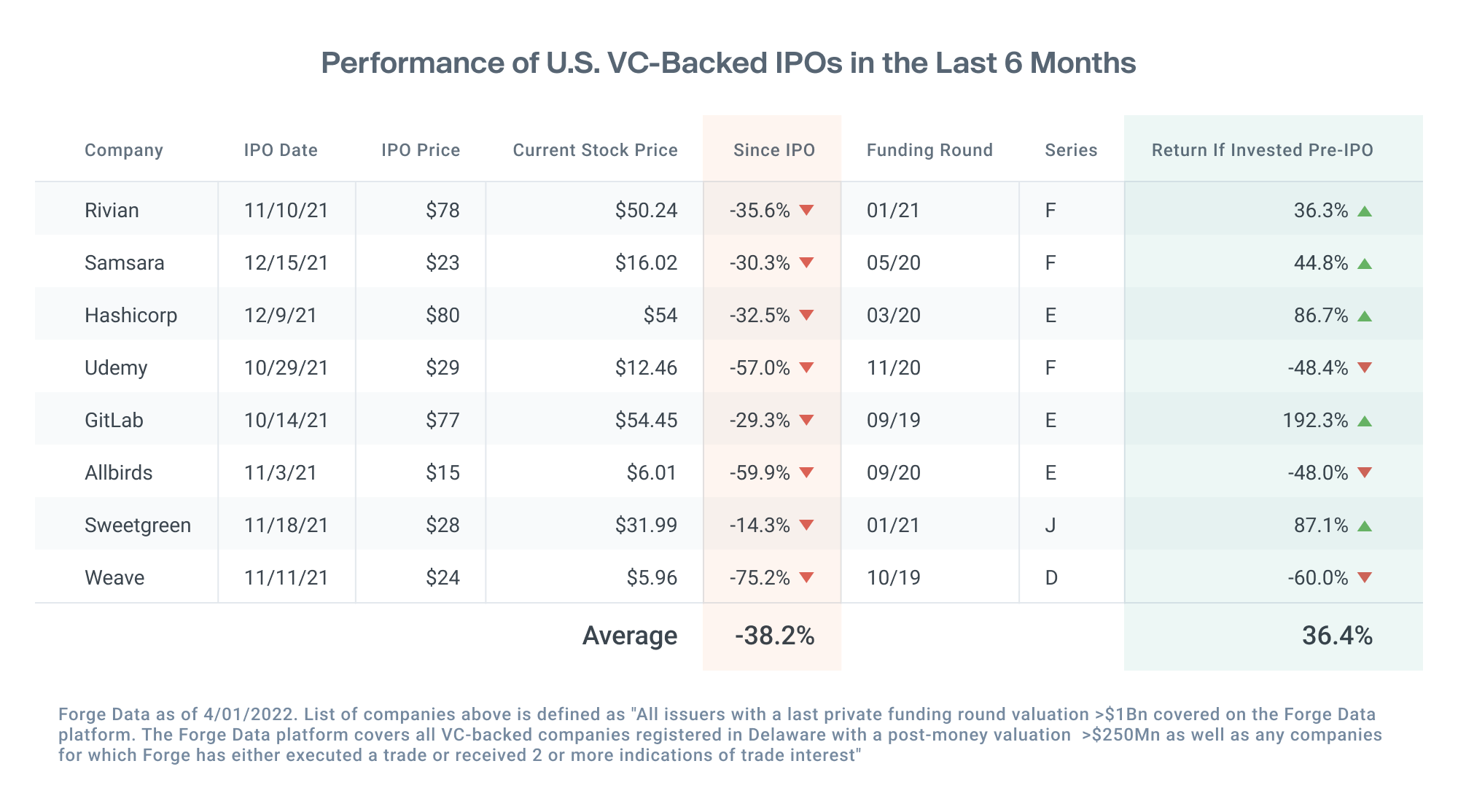

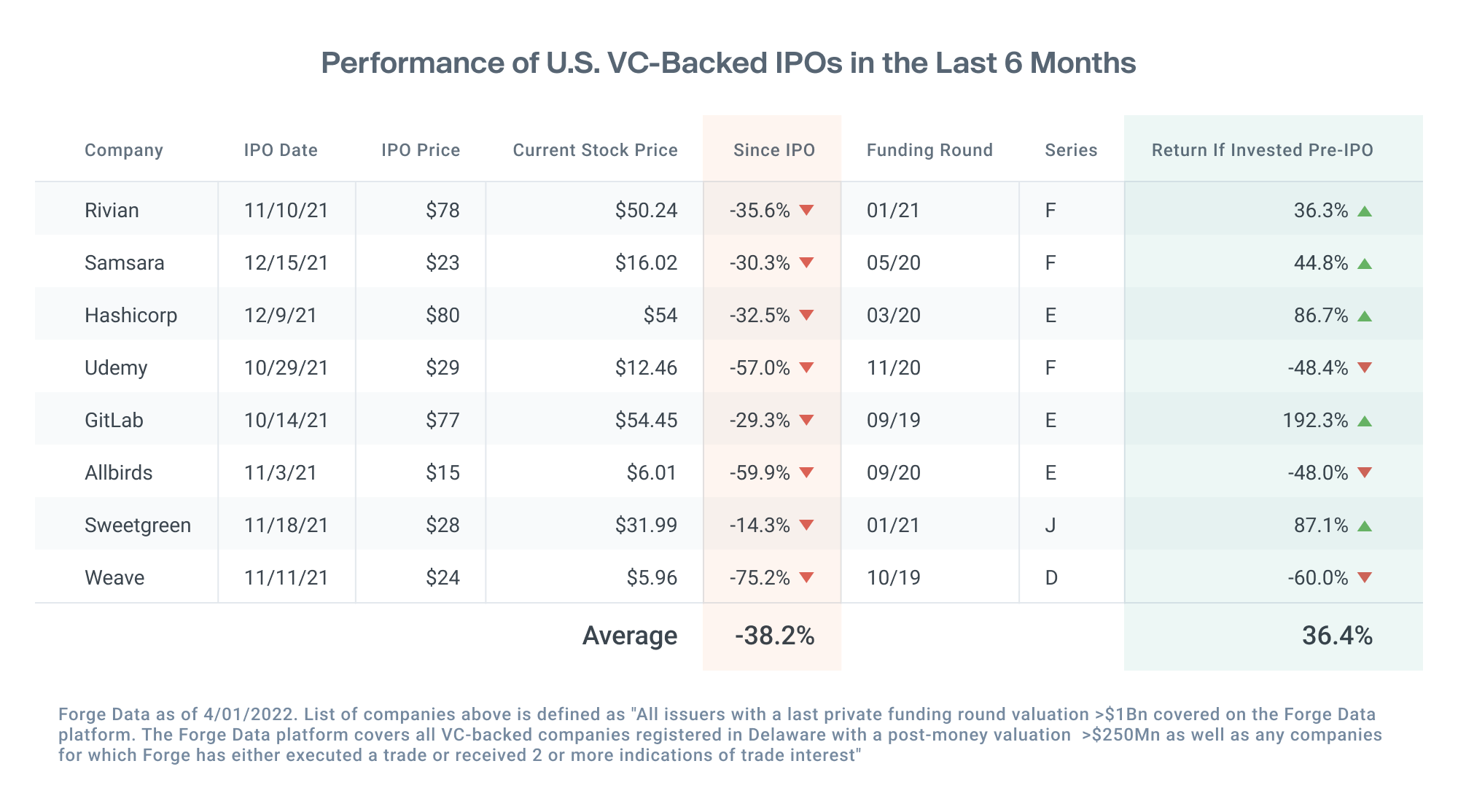

Meanwhile, the public market has not been kind to those companies who made it through the IPO window in the last six months. Conversely, returns were positive for investors who invested at the last private market round price in these same companies. Today’s late-stage private companies are surely aware of how their peers have performed on the public stage, which may delay IPO plans even further – which we believe creates a greater need for private market liquidity.

Gap narrows between private and public market prices in Q1

While public market stock trades settle in two days, private market trades may take longer to close due to their complexity. This creates a lag in pricing data as closed transactions reflect previously agreed-upon prices. Over time, we believe this lag will tighten as the private market matures and Forge innovates through new trading technology to speed up the process.

In the private market, prices have fallen –19.9% for companies that traded on the Forge Markets platform in both Q4 2021 and Feb/March 2022.7 Meanwhile, public market prices for the high growth technology segment were less volatile in March, falling slightly more than 3%.8

Buyers and sellers nearing equilibrium at discounts to previous primary fundraising rounds

Sellers on the Forge platform tend to be employee shareholders. With so much of their personal wealth tied up in their companies, it may take them some time to digest what’s happening and adjust their expectations before deciding to sell at lower prices.

In March, we saw an increase in the number of sellers offering their stock at a discount to the last fundraising round, suggesting this sentiment has taken hold with sellers.

Buyers tend to be accredited individual or institutional investors. With less emotion and more of a professional focus, they priced this in one month earlier.

With 43% of sellers offering stock at an average 21% discount to last fundraising round, and 49% of buyers seeking to buy stock at an average 24% discount to last fundraising round, the market may be reaching a new level of equilibrium.9

Sellers outnumber buyers reflecting public market sentiment and presenting potentially attractive entry points for buyers

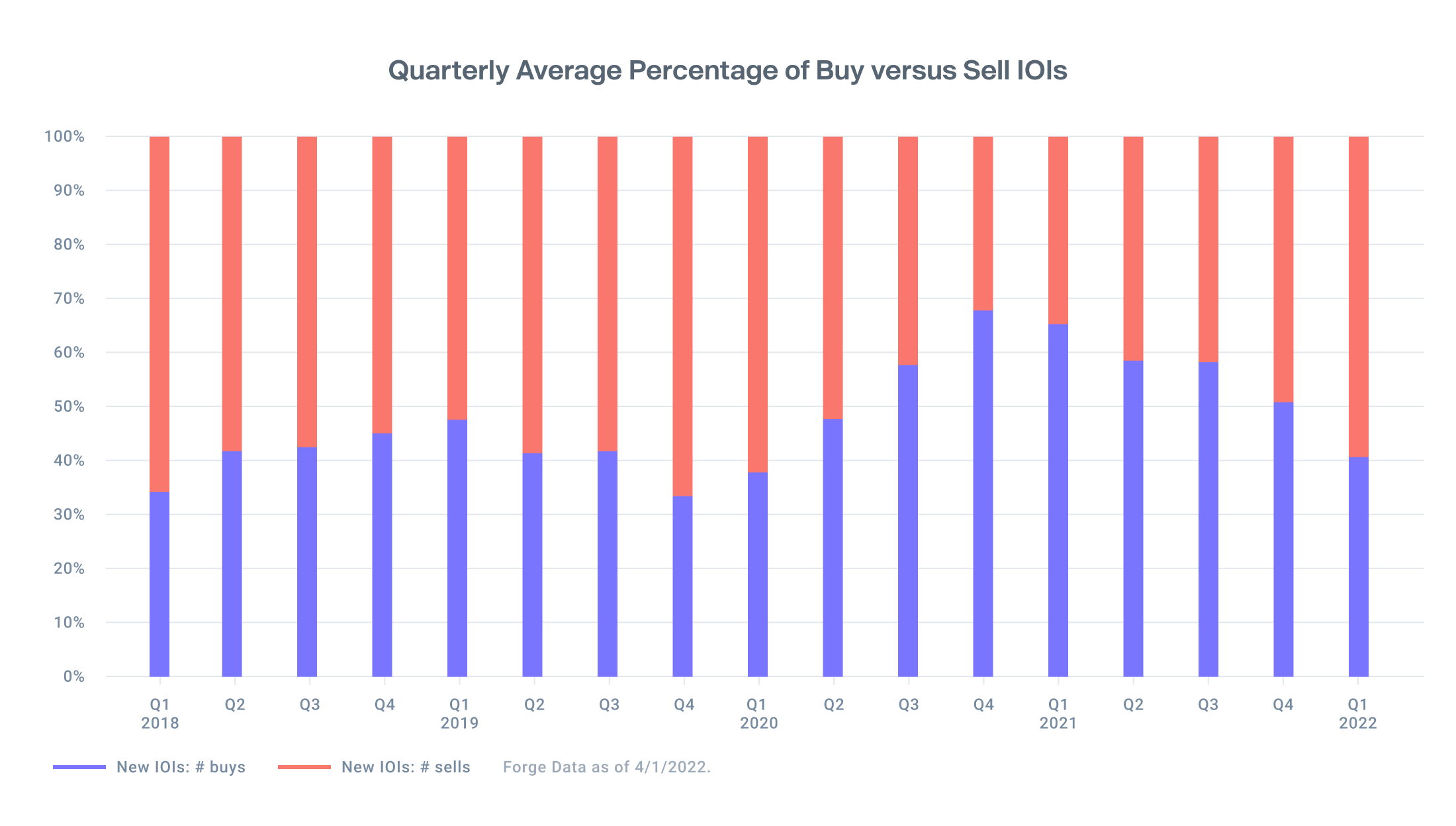

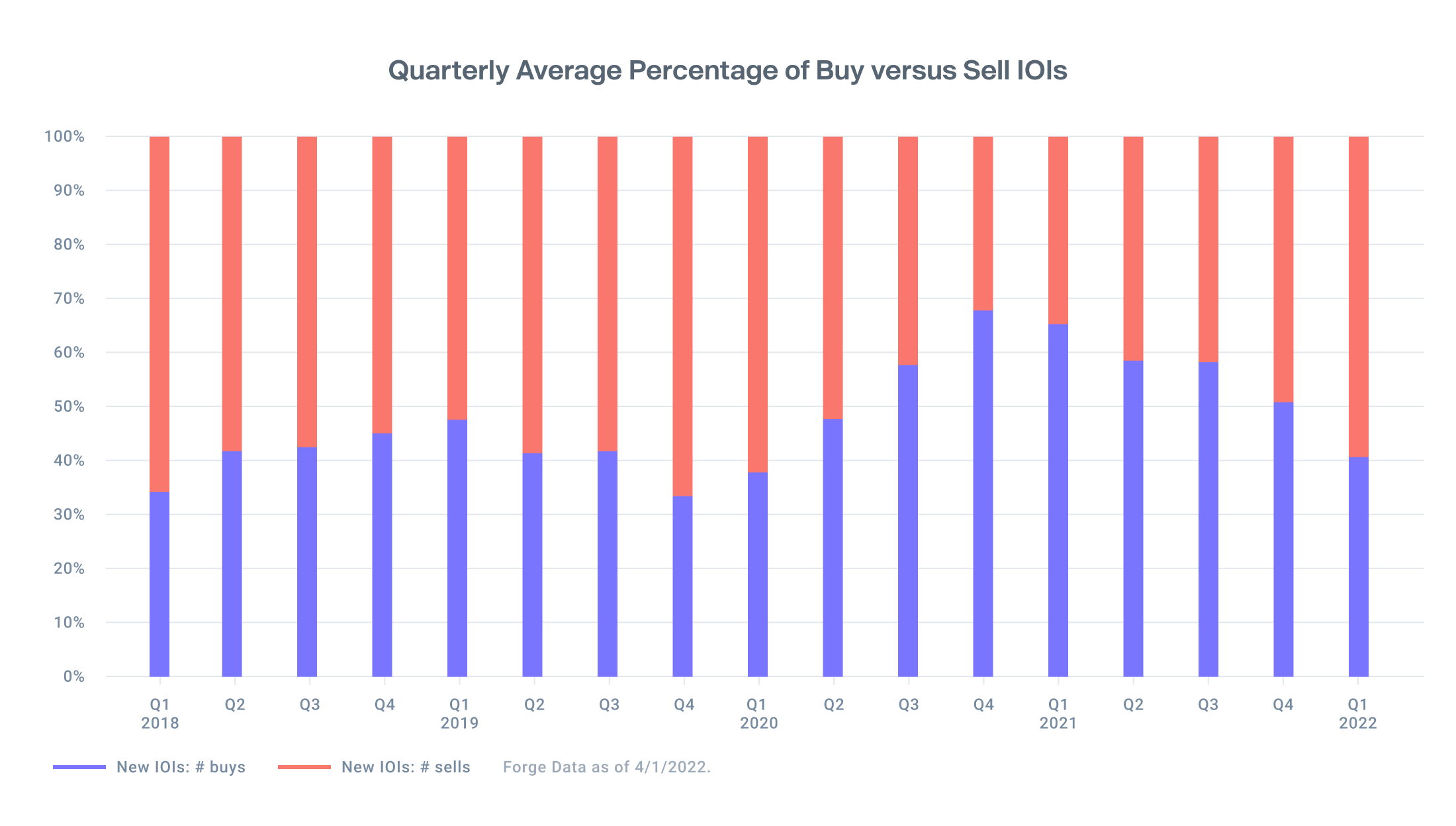

In Q1 2022, roughly 60% of indications of interest on the Forge platform in Q1 were from sellers and 40% were from buyers.10 While this is a notable change from the height of the COVID-19 pandemic in which buyers drastically outnumbered sellers, it more closely resembles trading periods in 2018 and 2019.

Forge Data shows broad market activity across sectors

As the private market broadens to include more companies in more sectors, more buyers and more sellers, this increased activity allows for even greater data and transparency to help investors participate.

To help investors make decisions, Forge offers a proprietary sector categorization that enables greater precision when analyzing private market companies. This data shows a broad distribution across different sectors, providing investors with additional detail as they research private market opportunities.

If 2021 was the year of the SPAC, we believe 2022 is the year that unicorns rethink their exit strategies. And in the private market, we believe valuations no longer need to be determined annually, or whenever a company raises money – they can be understood on a quarterly, monthly, or perhaps even daily basis.

As buyers, sellers, and companies make strategic decisions about the future, it’s our mission at Forge to provide this transparency and to enable more and more people to exercise ownership within the private market.