Private Market Update April 2025

The IPO market hit crosswinds in late-March as public market volatility intensified

March weather, at the tail end of winter, is known for starting stormy before becoming mild as spring arrives; hence, the saying “in like a lion, out like a lamb.” For March 2025 in particular, the macro-economic environment reversed this paradigm, as what seemed like ideal conditions for upward momentum in the private market early in the month, quickly turned volatile at the end of the month. While private market performance held up compared to the public market, the IPO market was hobbled. The arrival of controversial U.S. tariffs also gave investors cause for concern about how this will all play out.

Taking a look back at March

At the outset of March, IPO filings gained steam, and the AI fundraising bonanza continued. There were several public IPO filings which suggested optimism that the dormant IPO market would awaken. Riding February’s momentum, companies raised new funding rounds in March at attractive valuations.

The Forge Private Market Index (FPMI) and Forge Accuidity Private Market Index (FAPMI) have proven resilient when compared to the SPY ETF, which closely tracks the performance of the S&P 500. During March 2025, the FPMI outperformed the SPY by 10.8%, while the FAPMI outperformed the SPY by 6.1%.

| L1M | L3M | L12M | |

|---|---|---|---|

| FPMI | 4.92% | 37.08% | 39.98% |

| FAPMI | 0.27% | 9.51% | 24.16% |

| SPY | -5.86% | -4.55% | 8.30% |

Forge Data through 3/31/25

The chart below further highlights that the private market held up through the early-April storm.

The first high-profile company to publicly file an S-1 this year was artificial intelligence (AI) infrastructure provider CoreWeave1 [NASDAQ: CRWV]. This was soon followed by other decacorns, private companies valued over $10 billion, like Swedish buy-now-pay-later company Klarna,2 and event ticket reseller StubHub.3

Sprinkled in with this news were large funding rounds at step-up valuations. Anthropic raised $3.5 billion at a $61.5 billion valuation4 as it further positioned itself in the AI arms race. Autonomous drone provider Shield AI, gathered $240 million at a $5.3 billion valuation5 and fintech Mercury raised $300 million at a $3.5 billion valuation.6

The culminating event for the month was CoreWeave bravely moving forward with its IPO on March 28th with potential tariffs looming on the horizon. To pull-off its IPO, CoreWeave ended up cutting its pricing from a range of $47-$55 per share to $40 per share and reduced the amount raised to $1.5 billion from an initially reported $4 billion.7

With CoreWeave’s wobbly public offering and the formal announcement of U.S. tariffs on April 2nd,8 the IPO window has been decidedly shut in the near-term and multiple companies delayed their IPOs. There are a range of reasons for companies to go public in a suboptimal environment or instead choose to delay an IPO until conditions improve.

Limited options for raising capital

Despite trying to pick the right time, there are some companies that may have to go public, even if market conditions are not ideal. CoreWeave’s endeavor fit this bill since it wasn’t a typical venture-backed company and was saddled with $8 billion of debt at the time of its IPO.9 Many companies have stayed afloat through the downturn of the last three years even as venture funding remained scarce. But those whose growth relies on massive infrastructure investment may have run the already stingy spigots dry in the private market, leaving them no choice but to turn to the public market to leverage debt at more acceptable rates.10 Few late-stage private companies will face the infrastructure costs and debt burden of CoreWeave however, which offers many companies more flexibility to wait for public market conditions to improve.

Readily available private capital for AI companies

Other companies, however, have ready access to capital in the private market. For example, AI unicorns are some of the most sought-after companies right now. With so much investor demand, it’s easy to understand why companies like OpenAI, Anthropic and Perplexity choose to stay private – there is abundant private capital on favorable terms.

In fact, primary funding in AI companies has constituted over 60% of total funding in mid-and late-stage, VC-backed companies, since Q4 2024. Forge defines mid- and late-stage based on a set of rules incorporating funding rounds, money raised, implied valuation and company age. AI companies have shown that they can scale quickly and generate meaningful revenue and fast growth rates, as they pursue large addressable markets. Companies with these characteristics are hitting the sweet spot of private market investors. If the demand for AI companies continues on its current trajectory, there is little incentive for these companies to be in a rush to IPO and face the scrutiny of the public market.

Additional capital not needed

Lastly, there is another category of companies that may be well-positioned to go public, but are not in a rush to do so because they have built sustainable business models. Companies such as Klarna, StubHub and Chime quickly delayed their IPO pursuits after the public market fallout from the April 2nd U.S. tariff announcement. Companies with this financial profile can time their public offerings to optimize their valuation/pricing, increase receptivity from new investors and maximize proceeds for employees and existing investors. With the Great Reset having potentially affected some private investors’ world view, it wouldn’t be surprising if non-AI private companies potentially choose this path.

Go public: what’s the rush?

The transition from being a private company to a public one is nicely showcased by CoreWeave’s Forge Price and public price on a single, continuous chart. Since going public, CoreWeave’s stock has fluctuated wildly between a $36 low the day after its debut, to over $60 and back down again as macro-economic factors like the tariffs induced market turmoil.11 If companies do have a choice about staying private, as Klarna, Chime and StubHub have indicated, anticipating a more stable market environment may be a key motivation.

Waiting for the full impact of tariffs

While the final form and impact of tariffs has yet to be seen, there will possibly be a high-level impact on the private market, as well as specific sectors. At a sector level, companies that rely on internationally sourced semiconductor chips will likely be impacted by higher costs due to tariffs, as well as consumer companies that sell clothing, shoes or other discretionary items manufactured in Asia. Software or fintech companies, which don’t rely on physical goods, may not be directly impacted by tariffs initially, but any sustained economic slowdown will likely impact the customers of these businesses, too.

Looking at the data and trends during March, the private market remained steadfast in the face of public market volatility. With private company information typically updated on a quarterly basis, conventional wisdom suggests we may not see any effects for three to six months;12 but, for now, it remains business as usual in the private market.

Buy-side indication of interest activity decreased

March produced buy-side indication of interest (IOI) activity that continued to trail down; however, it still remains at elevated levels. Much like the public market, this data tends not to move in one direction as increases give way to decreases, but overall, the trend continues to be positive since the lows of Q3 2022.

Unique issuers ticked lower, but were still within recent range

Unique issuers with sell IOIs decreased in March 2025 compared to February 2025. Overall, the data has not shown any dramatic highs or lows in the past few years.

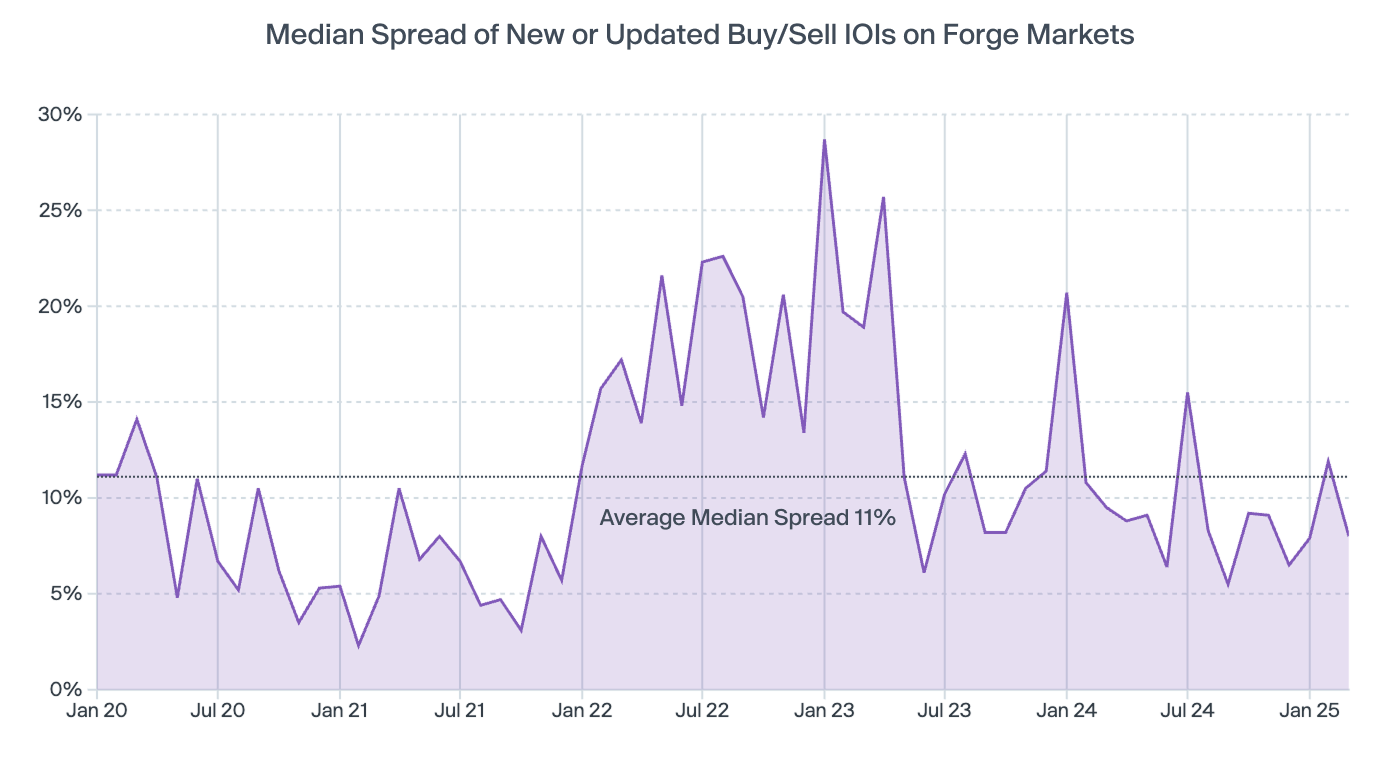

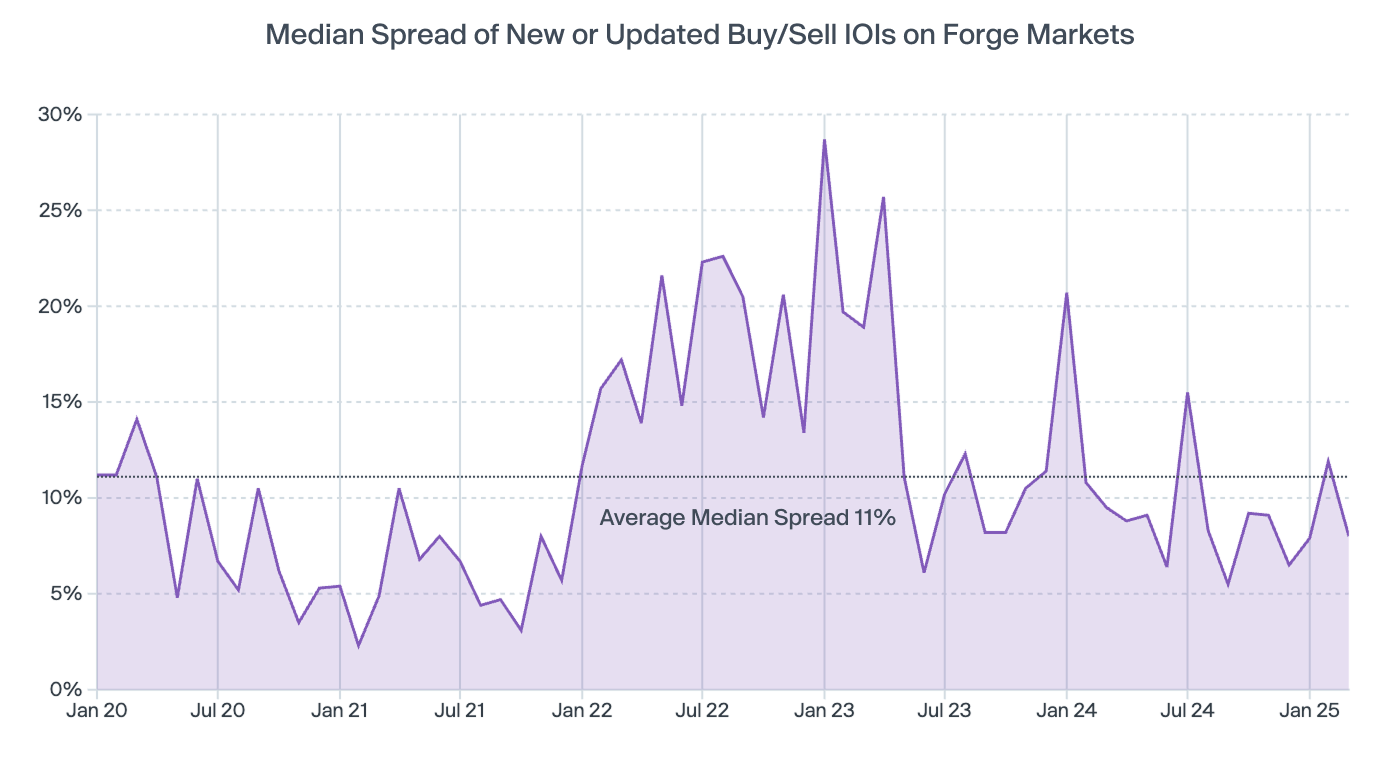

The median spreads continue to narrow

After a spike in February 2025 to almost 12%, which is above the average level of 11%, the bid-ask spread narrowed in March to 8%. The overall trend with the median bid/ask spread continues to trend downward since reaching a peak in January 2023. This should represent a healthy market, as buyers and sellers have similar expectations, which is conducive to completing trades.

Trade premiums moved higher across the board

Trade premium/discounts to last funding round rose for all percentiles in March, 2025. This was particularly apparent in the lower percentiles, which, in many cases, exceeded recent highs. Higher percentiles saw increases over February 2025, as well, but not to the same extent. The 90th percentile in particular is still below January 2025.