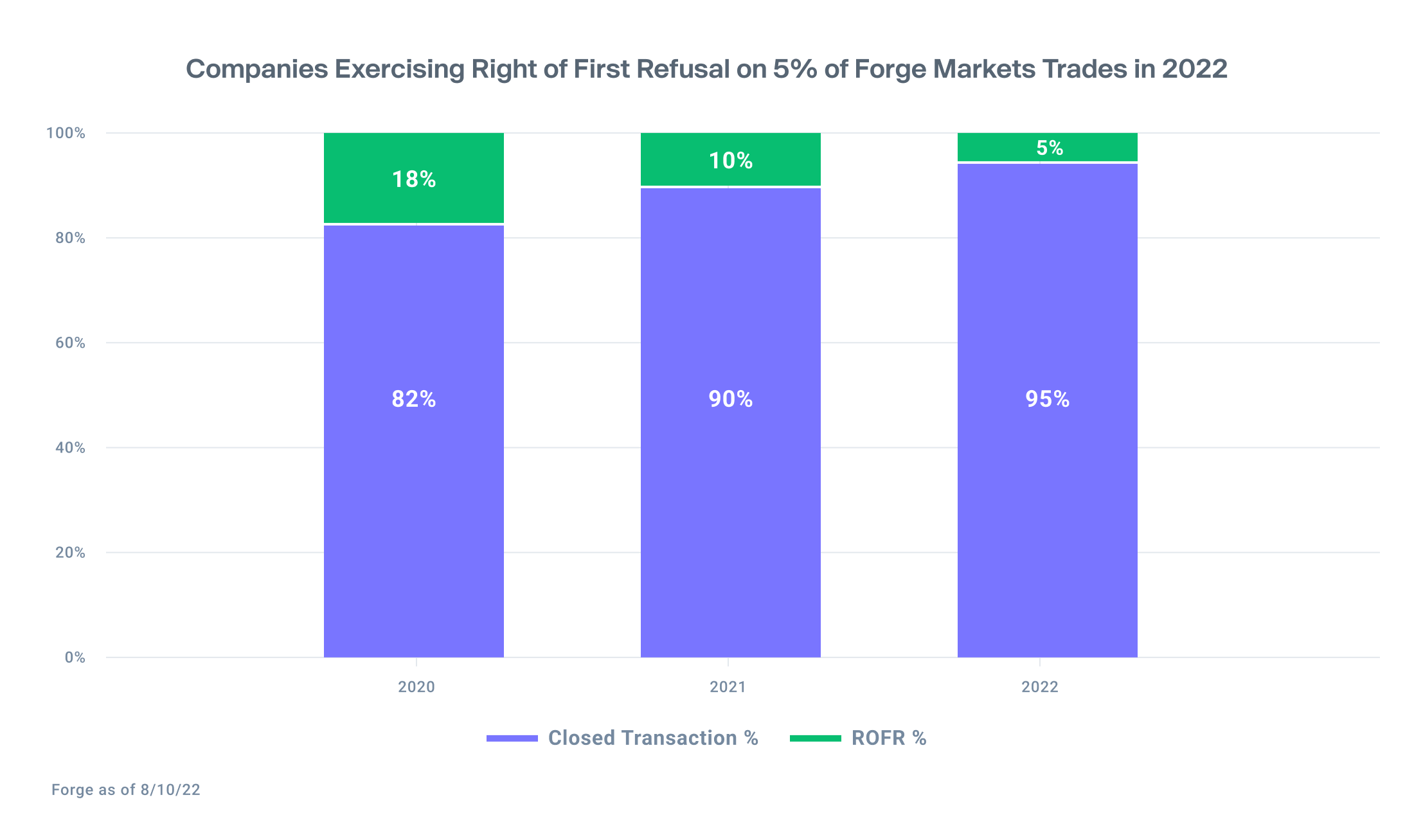

- Companies exercising right of first refusal at lower rate

- Private market sellers tend to be a broad range of employees, not just executives

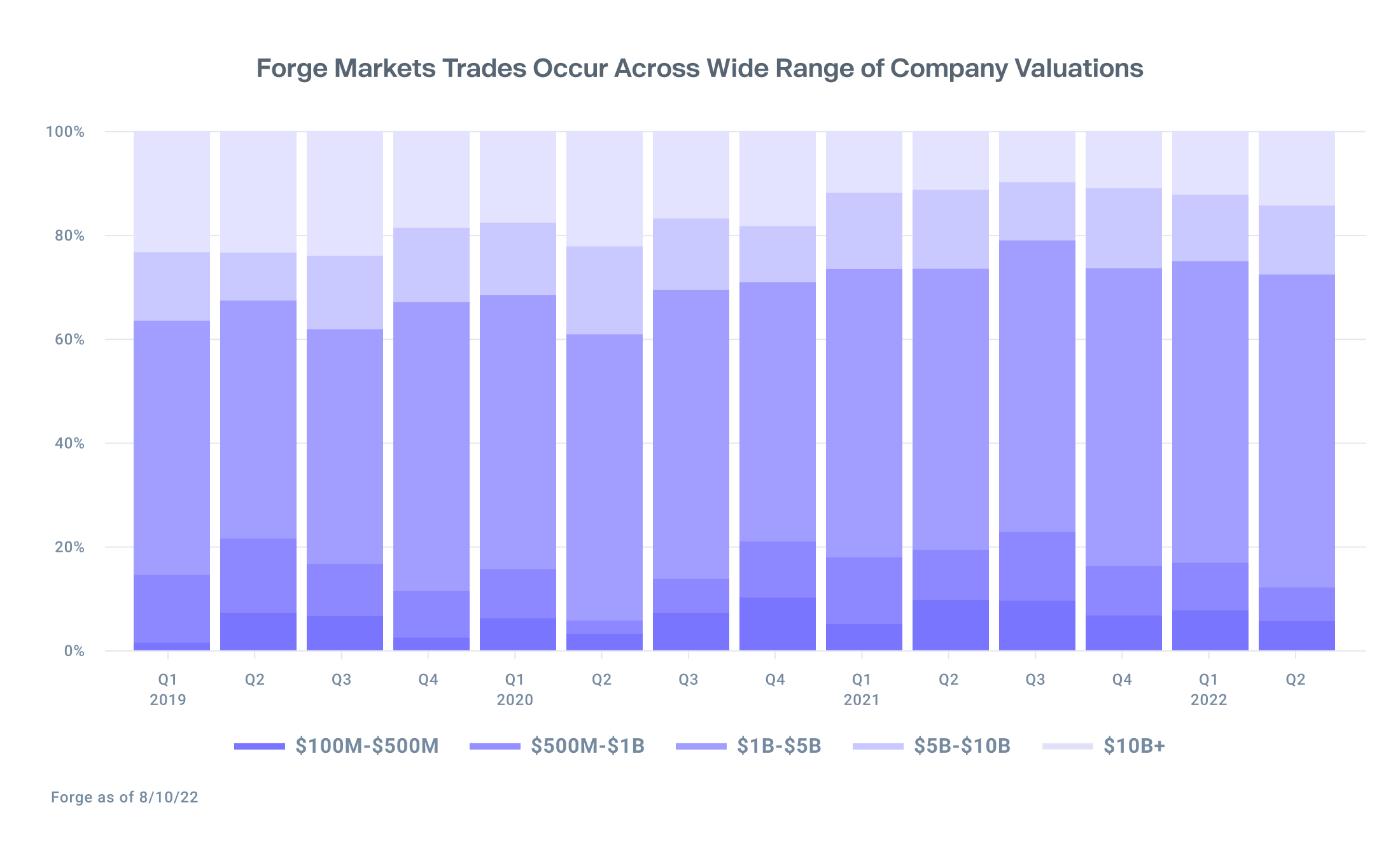

- Trades are occurring across a wide spectrum of company valuations

Public market investors breathed a sigh of relief in recent weeks, as stocks moved in a slightly more positive direction thanks to better-than-expected earnings from mega-cap technology stocks and improving inflation data. Despite the Federal Reserve’s rate hike, public market indices – including the tech heavy NASDAQ – have regained some of this year’s losses.

But even though the temperature has cooled slightly in the public market, private market investors continue navigating very murky market conditions. Their investors, such as Sequoia and Y Combinator have been sounding alarms for months, warning them about shifting economic conditions, and encouraging them to reduce burn, tighten balance sheets, and focus on profitability.

Employees often bear the brunt of these shifts. By some estimates, there have been nearly 70,000 employees laid off from technology companies globally this year 1. And for employees at private companies who are often compensated in stock, many have seen the value of their stock drop for the first time in their careers. In July 2022, the average share price of an issuer trading on Forge Markets traded at an approximate 28.6% discount to a company’s primary fundraising round. 2

For private companies, the competition for talent is real. They’re competing with public behemoths such as Google, Apple, and Tesla to hire great people – and private companies are less likely to reach their ambitious growth aspirations without the best talent.

As a result, more and more private companies are finding a middle ground, creating pathways for employees to sell stock throughout their tenure. For example, a private company may implement a policy that allows its employees to sell 25% of their vested stock once they hit their two year anniversary. This rewards employees for their hard work while keeping them incentivized for the future.

Forge expects this to accelerate given the dried-up IPO and SPAC landscape, which has delayed liquidity events for unicorn companies.

Companies are increasingly allowing their employees to find buyers for their stock

The trend of companies permitting their employees to find buyers for their stock in the private market is clearly seen in the decline in private companies exercising their right of first refusal (ROFR) on a stock sale. When a private company shareholder seeks to sell stock to a third-party buyer, the company typically retains a right of first refusal for a set period (e.g. 30 days) to buy the stock back at the price negotiated by the seller and buyer. If the company waives this right, the seller can proceed to sell the stock to the buyer at the negotiated price. Thus far in 2022, companies have executed their ROFR on just 5% of completed trades. 3

A broad range of employees seek liquidity from a broad range of companies

A common assumption about the private market is that trades tend to be concentrated in the largest companies, including “decacorns” (companies valued at least $10 billion). While these companies contribute a significant amount of private market activity, the majority of trades occur in companies valued less than $5 billion. 4

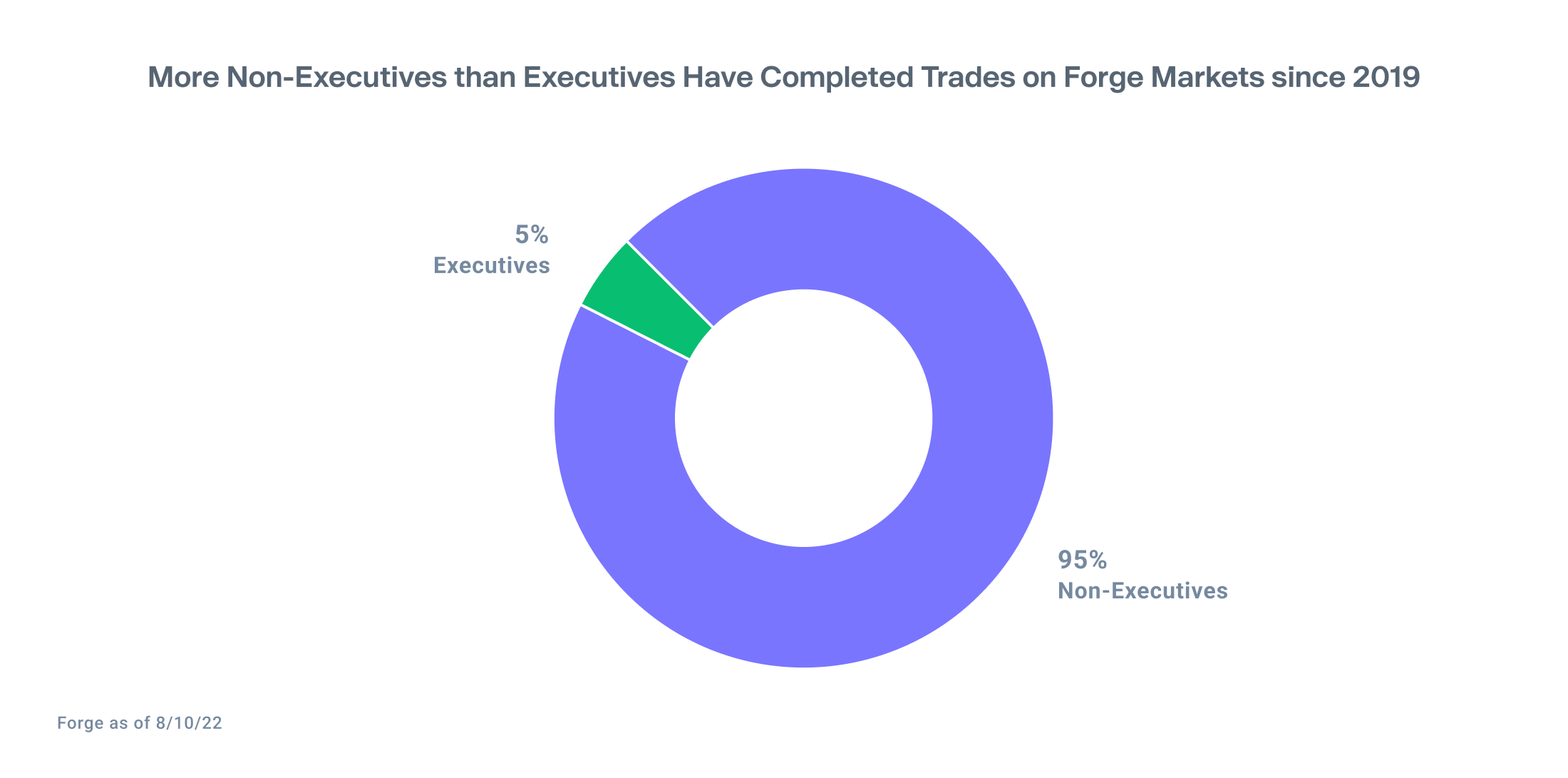

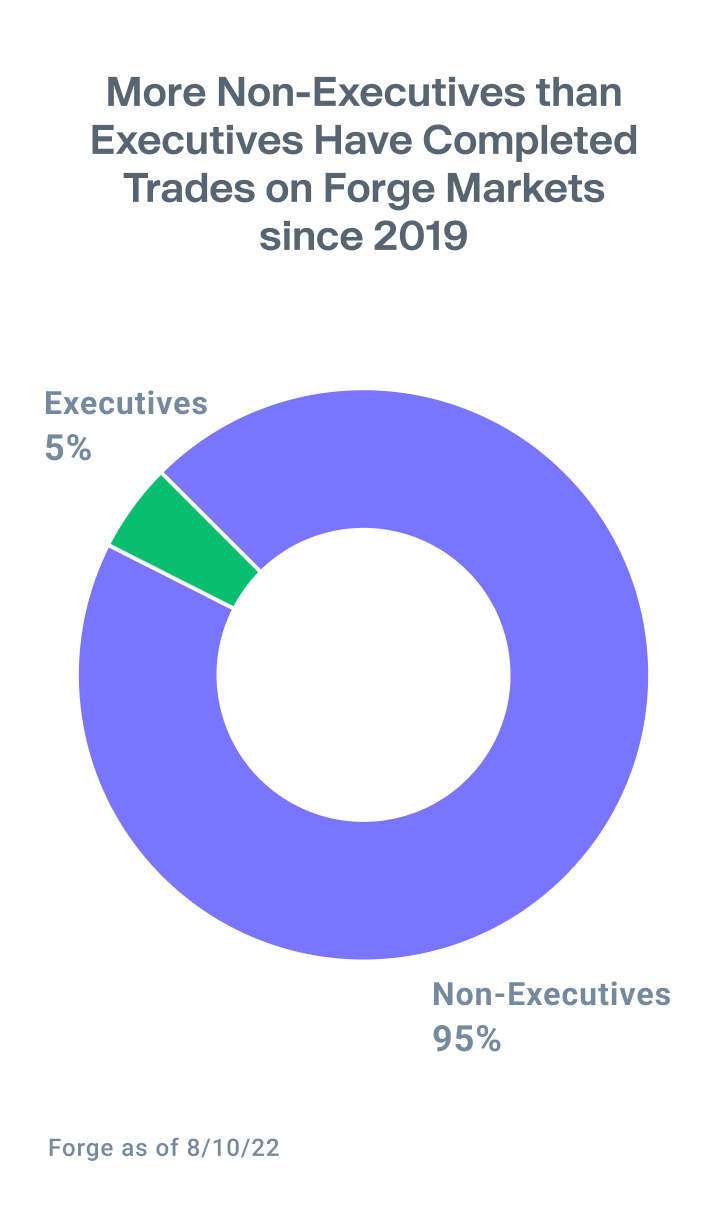

What’s more, the large majority of trades completed on Forge Markets since 2019 came from non-executive sellers versus executive. This suggests that a wide range of employees are seeking to sell stock in the private market, not just the highest levels of management.

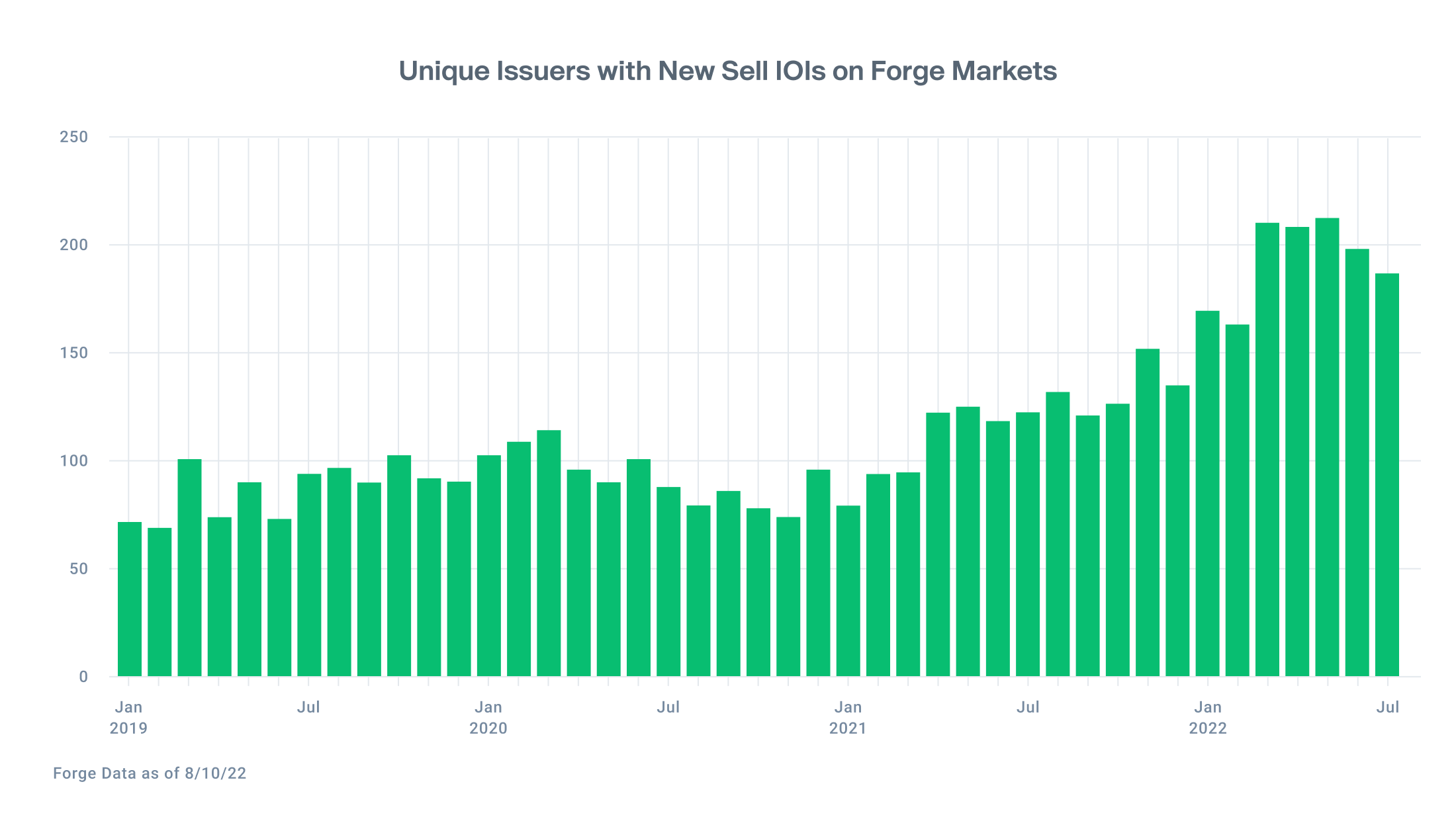

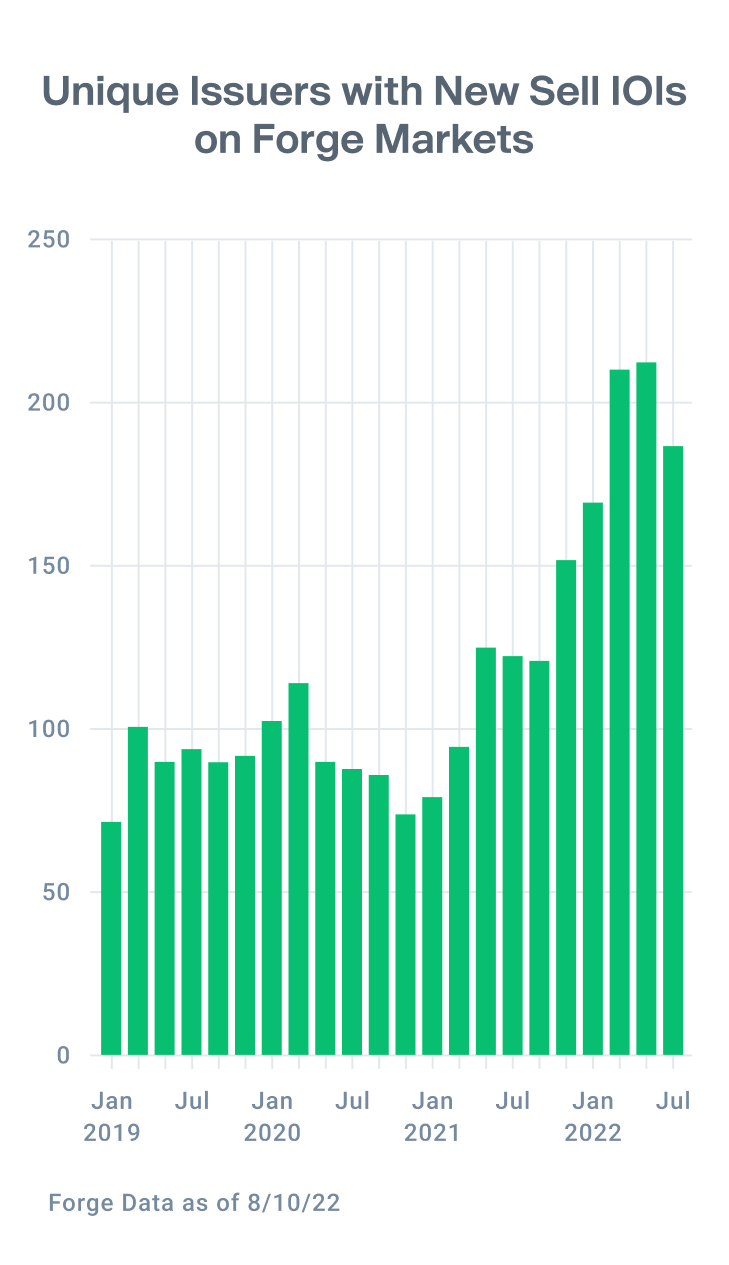

Sell interest remains elevated as a growing number of companies trade on the Forge Markets platform

Since inception, there has been steady growth in the number of companies traded on the Forge Markets platform, with approximately 500 unique names having transacted as of August 2022. 5 As noted in previous Private Market Updates, companies trading on Forge represent a diverse array of sectors and sizes – allowing investors to pursue growth and returns in a variety of different ways.

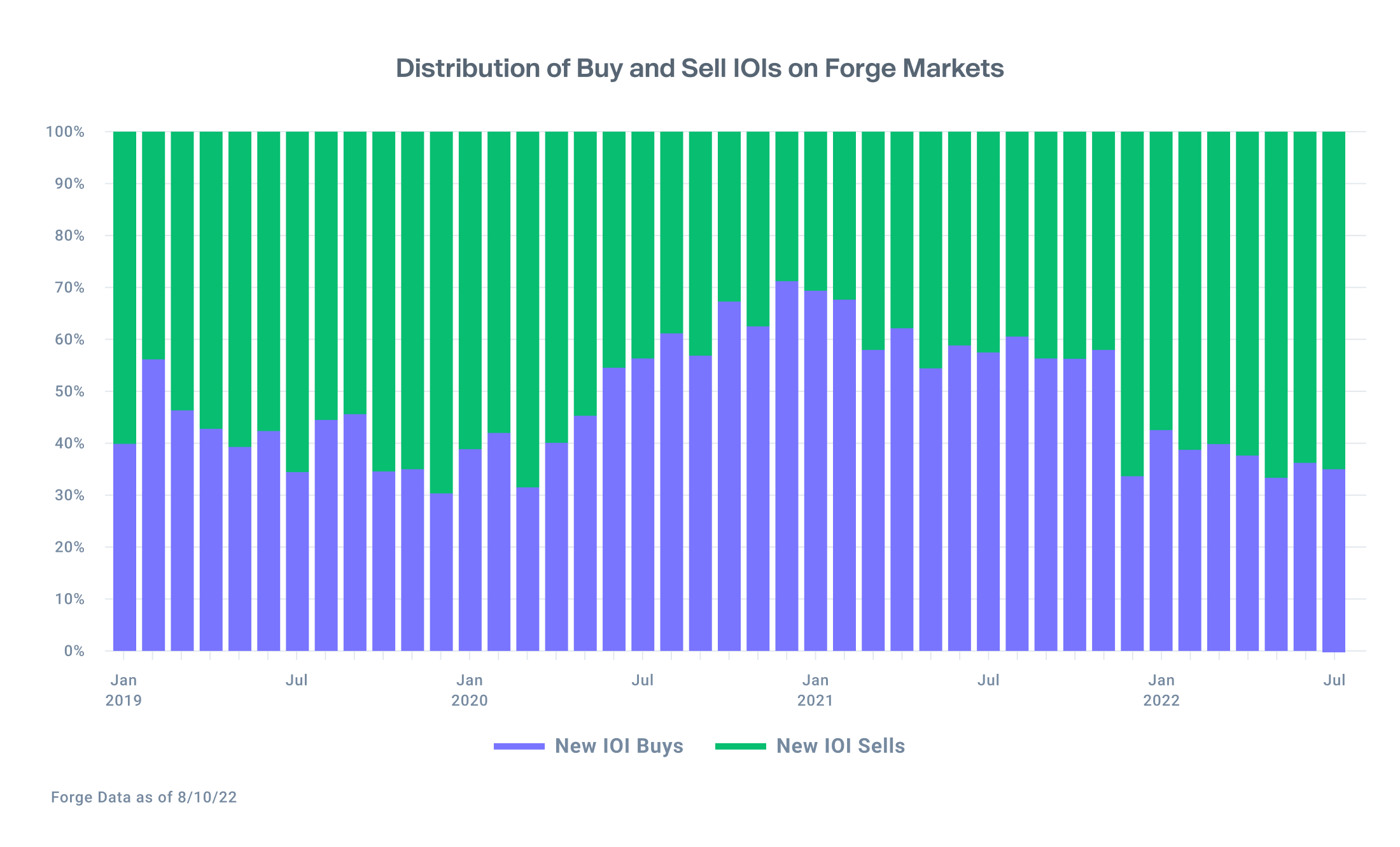

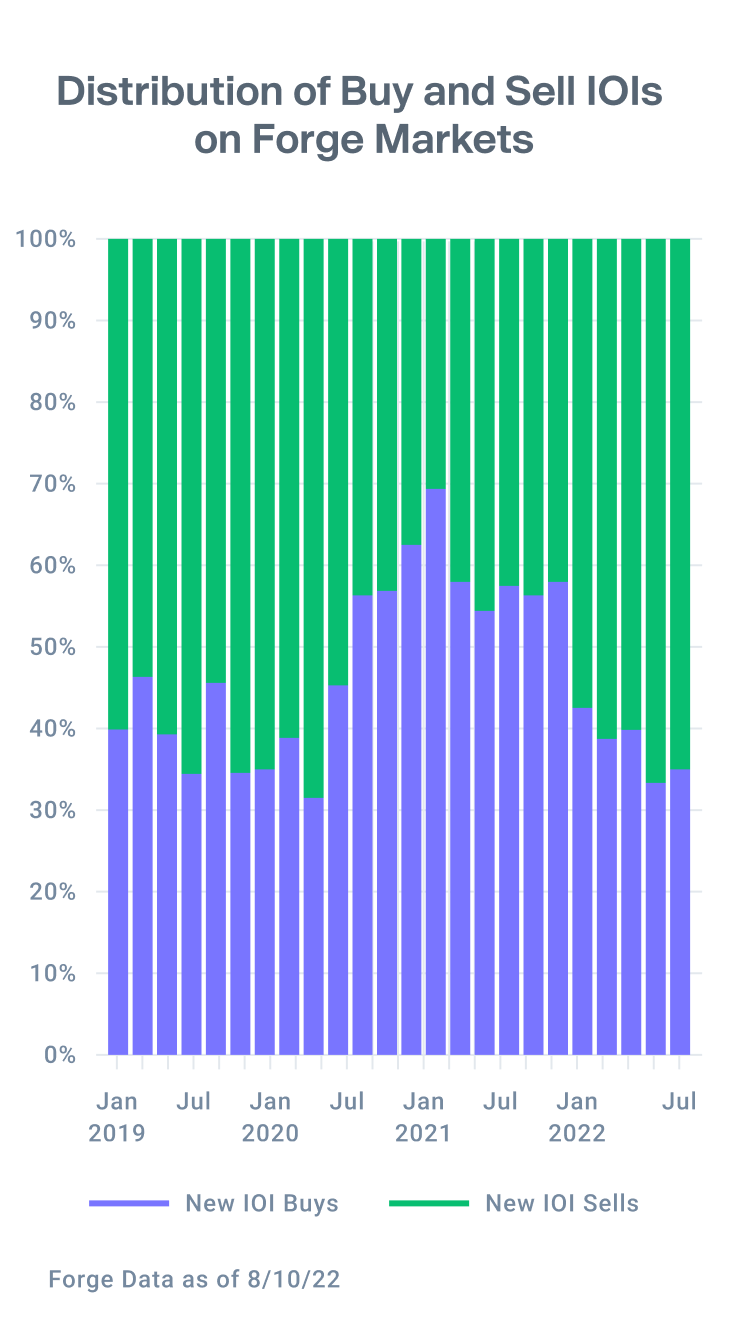

As for current market conditions, Forge remains near all-time highs for unique monthly sell-side indications of interest (IOIs). Nearly 200 companies have unique sell-side interest on the Forge Markets platform, providing investors with a wide range of opportunities to explore at potentially attractive prices given the recent market drawdown. 6

The private market continues to be a buyer’s market: sell-side interest remains elevated versus buy-side, consistent with the trend we’ve seen in recent months.

As the IPO and SPAC window remains closed, delaying liquidity for private company shareholders, and as prices on the private market fall to reflect the recalibration of the technology sector as a whole, there are more opportunities for investors with patient strategies to participate in unicorn growth. Forge’s technology and expertise, combined with the increasing trend of private companies enabling their employees to sell stock throughout their tenure, helps makes clear that a liquid private market is accessible for buyers, sellers, and companies.