- New Q2 data from Forge shows issuers trading at an average 6% discount to their last fundraising round 1

- Sell-side interest remains elevated on Forge marketplace as investors shift focus to decacorns

- The private market is providing critical liquidity as the IPO pipeline dries up

All eyes continue to be on private market valuations as new firms including Klarna and Stripe provide fresh insight on current market conditions.

In March, it was Instacart down 38%. This month, Swedish fintech company Klarna raised new financing at a $6.7 billion valuation, down 85% from the $46 billion valuation it secured just thirteen months ago. And just last week, Stripe cut its internal valuation by 28%.

These reductions grab headlines, but are they high-profile outliers or leading indicators of more discounts to come?

In this month’s Private Market Update, Forge publishes new data showing that private stocks continued to trade at lower prices in Q2 – but are doing so at a modest discount to a company’s last stated valuation. We believe both primary and secondary data seem to suggest a flight to quality – those names that can still raise primary funding in this environment, and those names that still continue to attract secondary interest are likely to have differentiators or fundamentals that give investors confidence despite the current market conditions.

A bigger potential concern for employee shareholders and investors in private companies may not be valuations but the ability to sell altogether. After all - it’s one thing when the value of your stock goes down. It’s another to be locked up, unable to sell with no liquidity in sight.

Barron’s recently reported that over 300 companies are currently holding off on an IPO due to deteriorating market conditions, and canceled SPACs are everywhere. This means shareholders must anxiously wait for their opportunity to gain liquidity – and it’s not clear that public markets will become more favorable to new listings any time soon.

Employees shouldn’t have to wait for a public exit to take something off the table. A recent Bloomberg report points out how private markets like Forge offer liquidity solutions that “aid recruitment and retention, and ensure wage earners don’t have their entire net worth riding on a single illiquid asset.”

As the IPO backlog continues to grow, the private market may be an attractive solution for pre-IPO companies to provide their employees with the liquidity they need – and a clever means for investors to buy stock at potentially attractive prices.

Private market data show companies beginning to be valued at a discount to last primary fundraising round

Private companies tend to update their valuations when they raise new primary rounds of financing, which then results in updated prices per share for such companies. These are useful data points in the overall valuation landscape, but can be further supplemented by secondary market data which reflects real-time trading of private company stocks.

To gain additional insight, investors can use Forge Data to analyze a company’s last secondary trade price compared to its last primary fundraising round price per share.

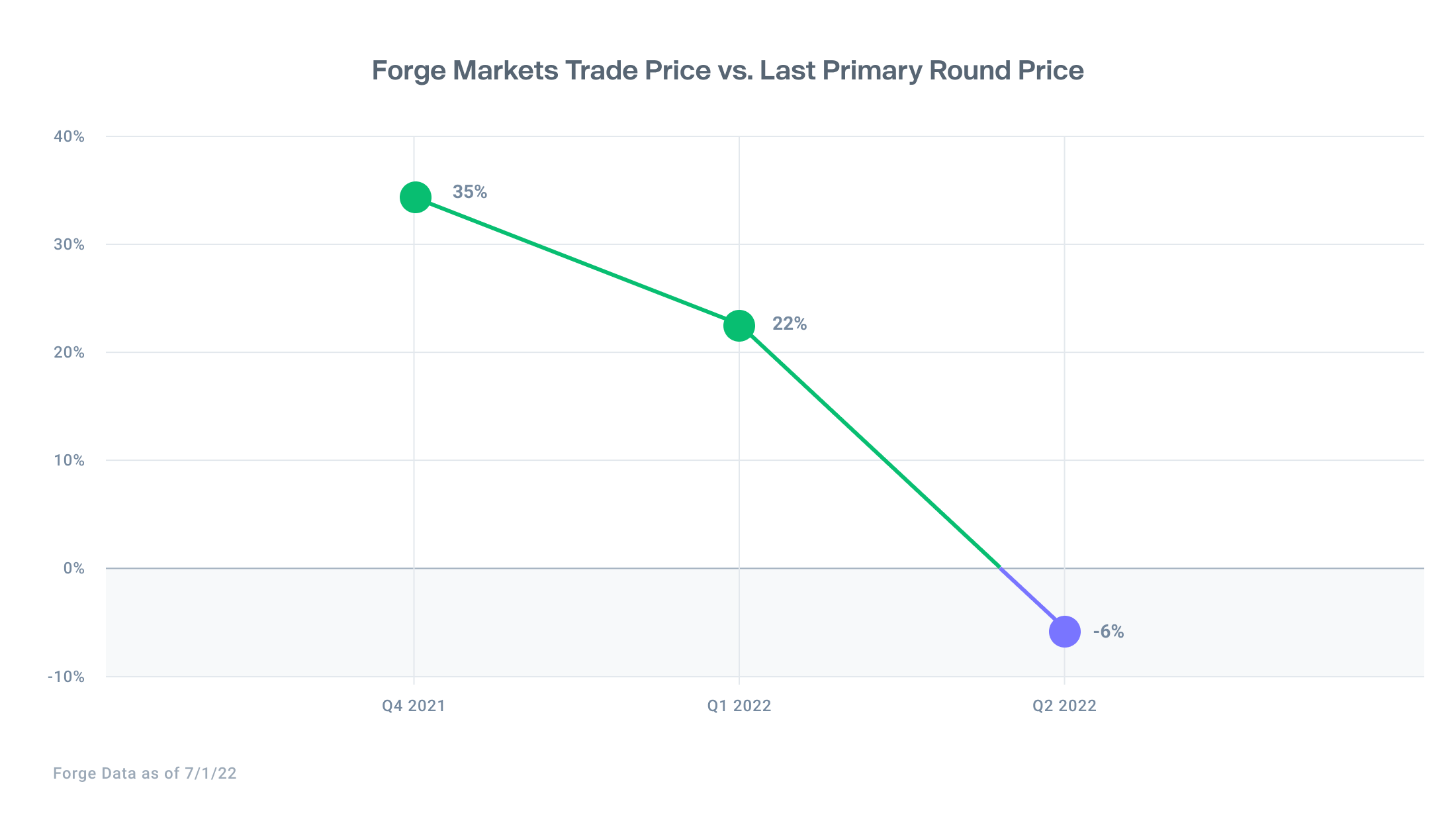

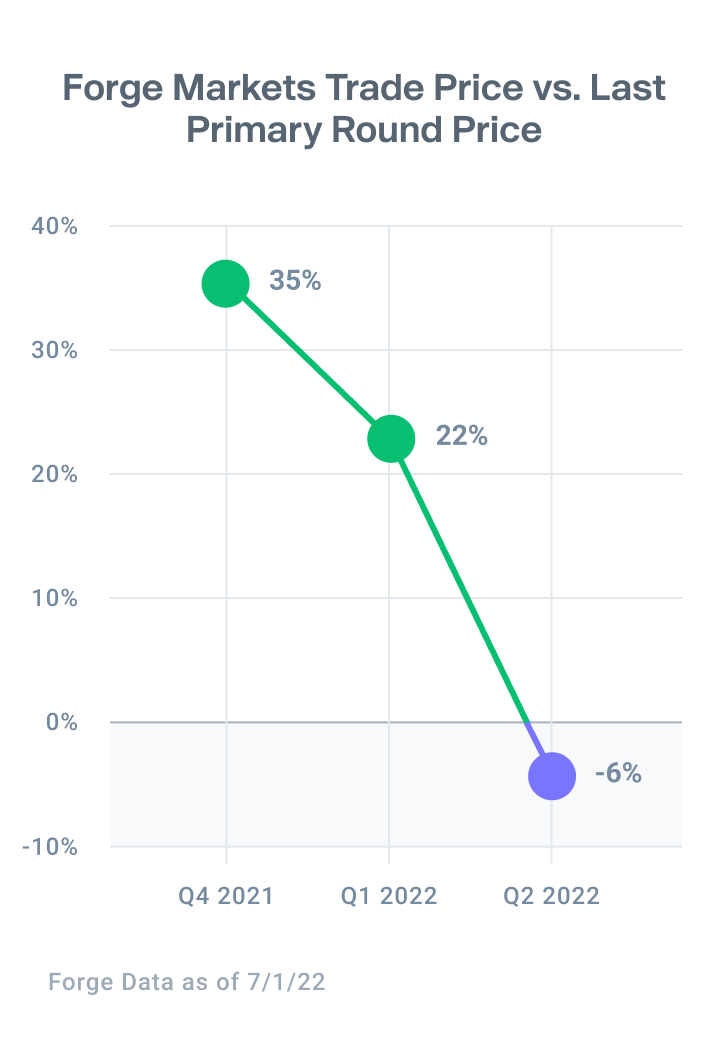

It took a while, but after consistently trading at a premium to a company’s last primary round, in Q2 Forge saw issuers now trading at an average 6% discount to their last fundraising round as buyers and sellers continue to engage in real-time price discovery.2

Companies were more likely to trade at a discount if they raised money recently, while companies were more likely to trade at a premium if their last fundraising round was some time ago. Since public market sentiment tends to lead the private market, it remains to be seen whether there will be further downward pressure in secondary prices.

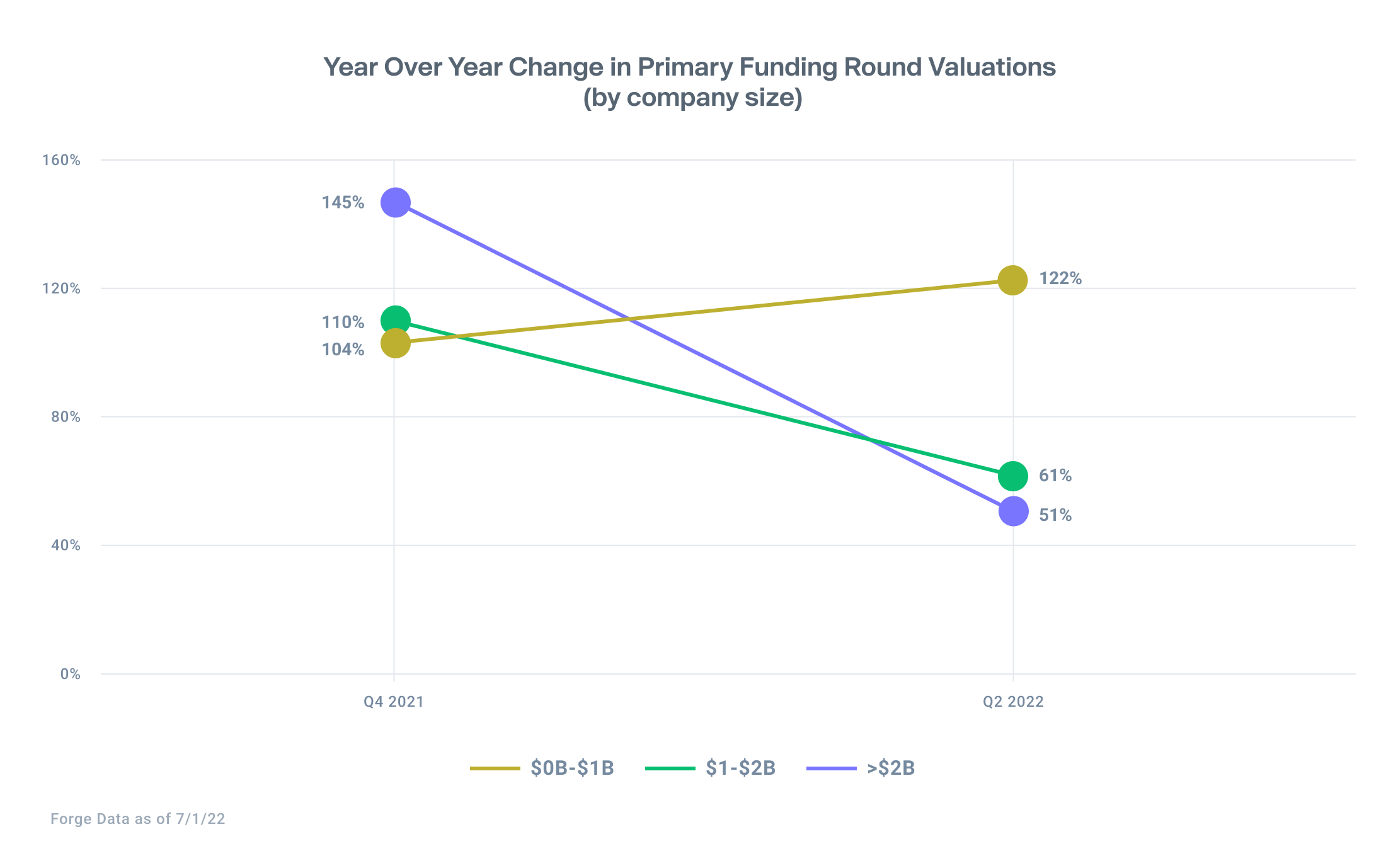

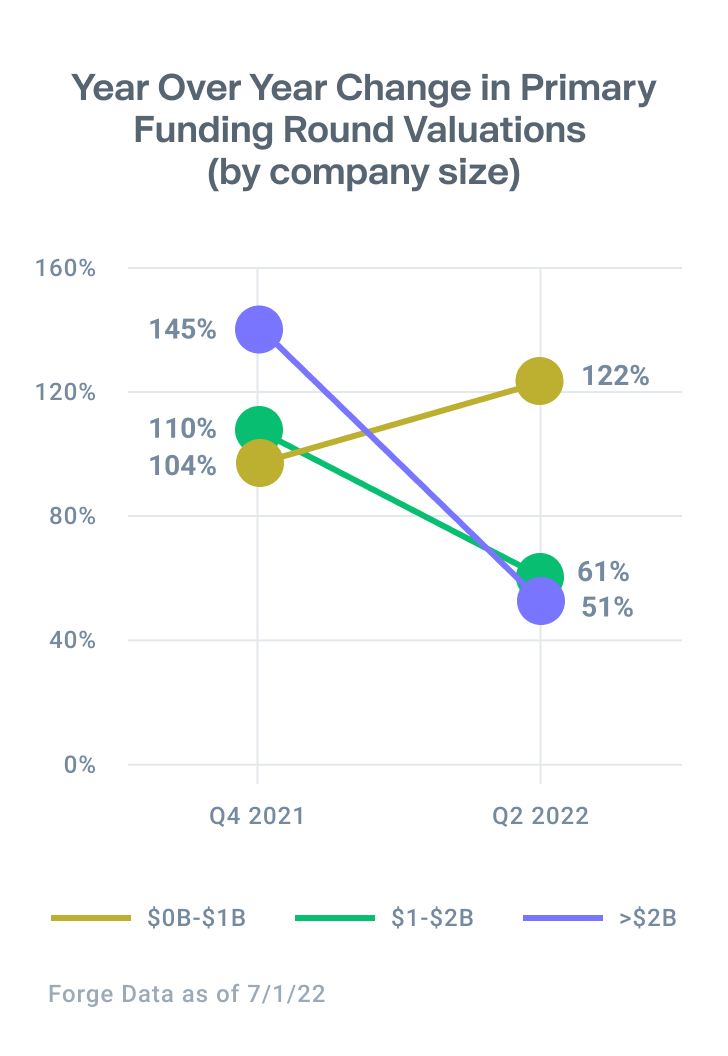

In the primary market, companies are still able to raise capital at a premium to last round valuations. However, the average premium for larger companies is now smaller compared to the same time last year. At the same time, those companies that might be forced to raise primary funding at lower valuations may still be waiting it out, hoping to delay until market conditions improve.

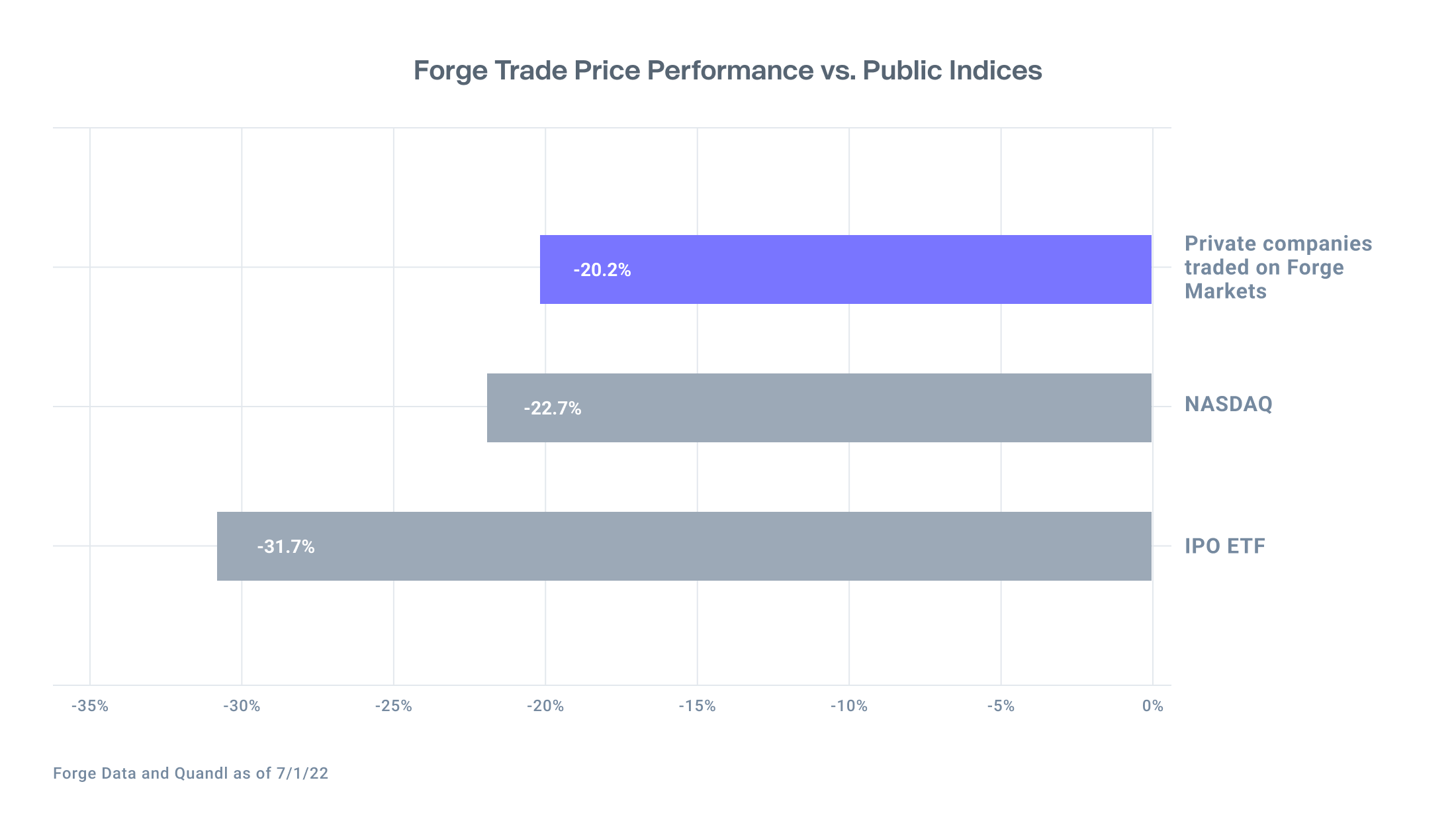

Real-time secondary trade prices down 20.2% in Q2

On average, prices fell 20.2% when comparing the price of companies that traded on Forge marketplace in Q1 2022 and subsequently traded in Q2 2022.3

Public tech indices made similar moves during the same period, with the NASDAQ falling 22.7% and the IPO ETF falling 31.7% through the end of Q2.4

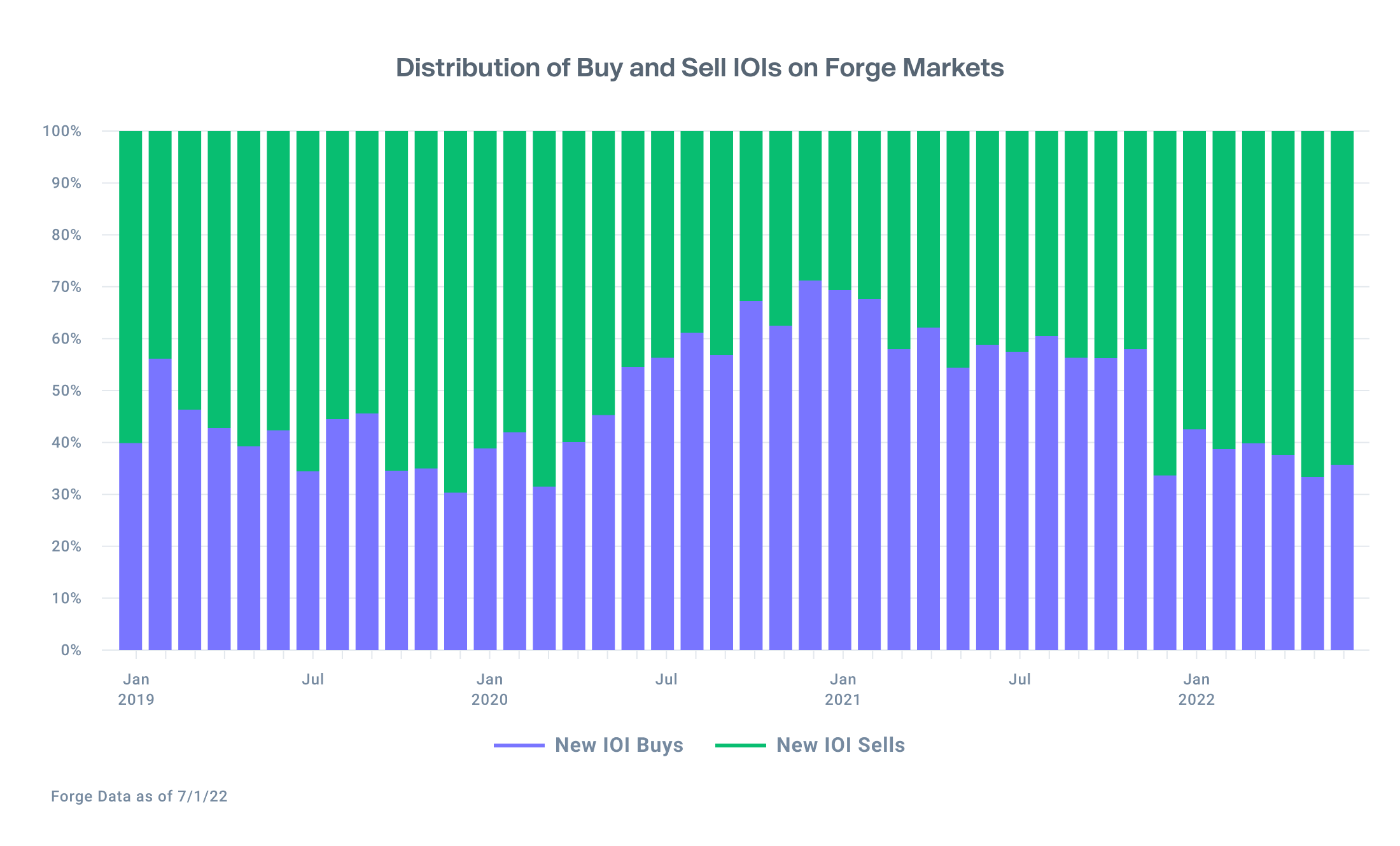

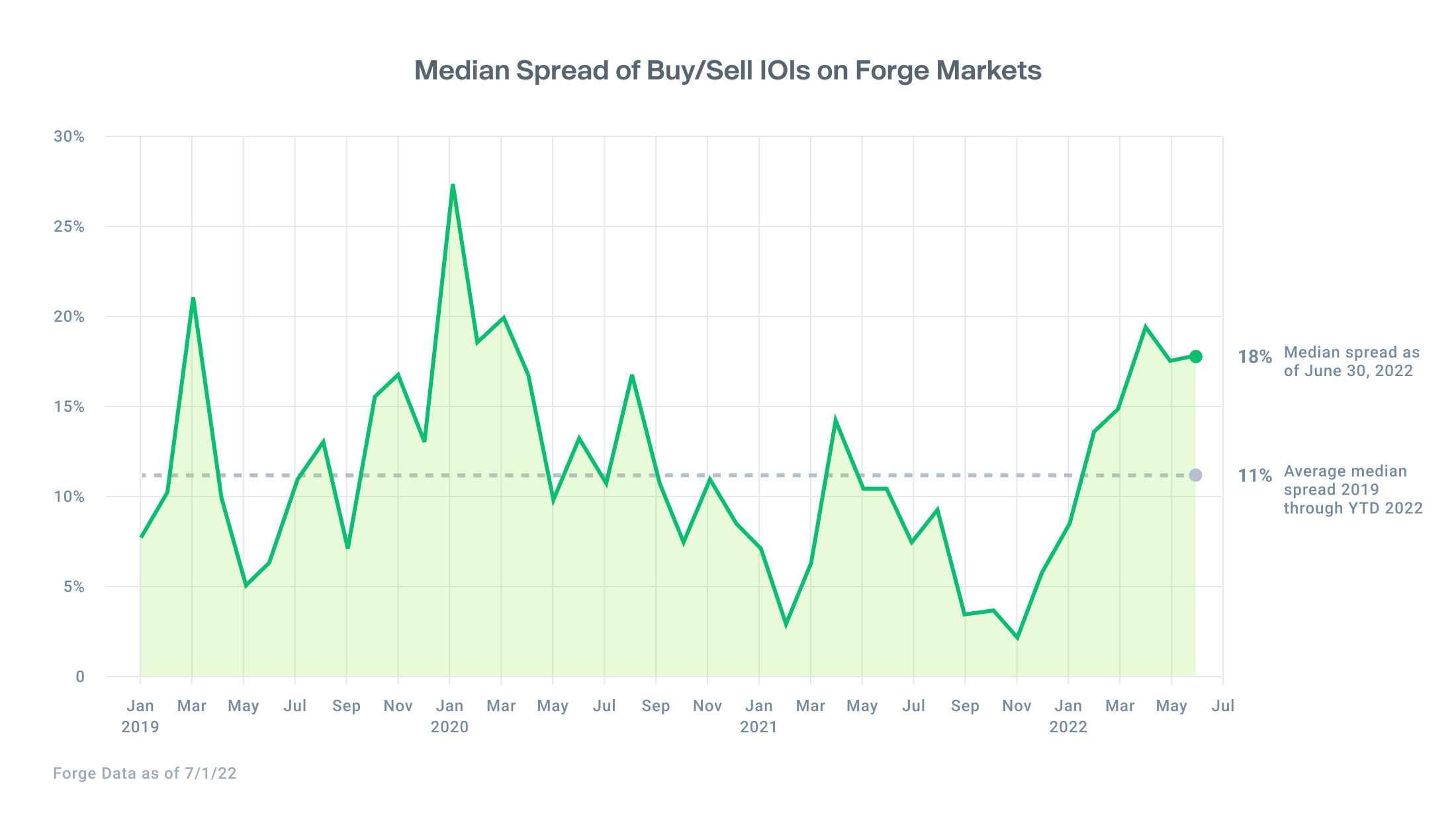

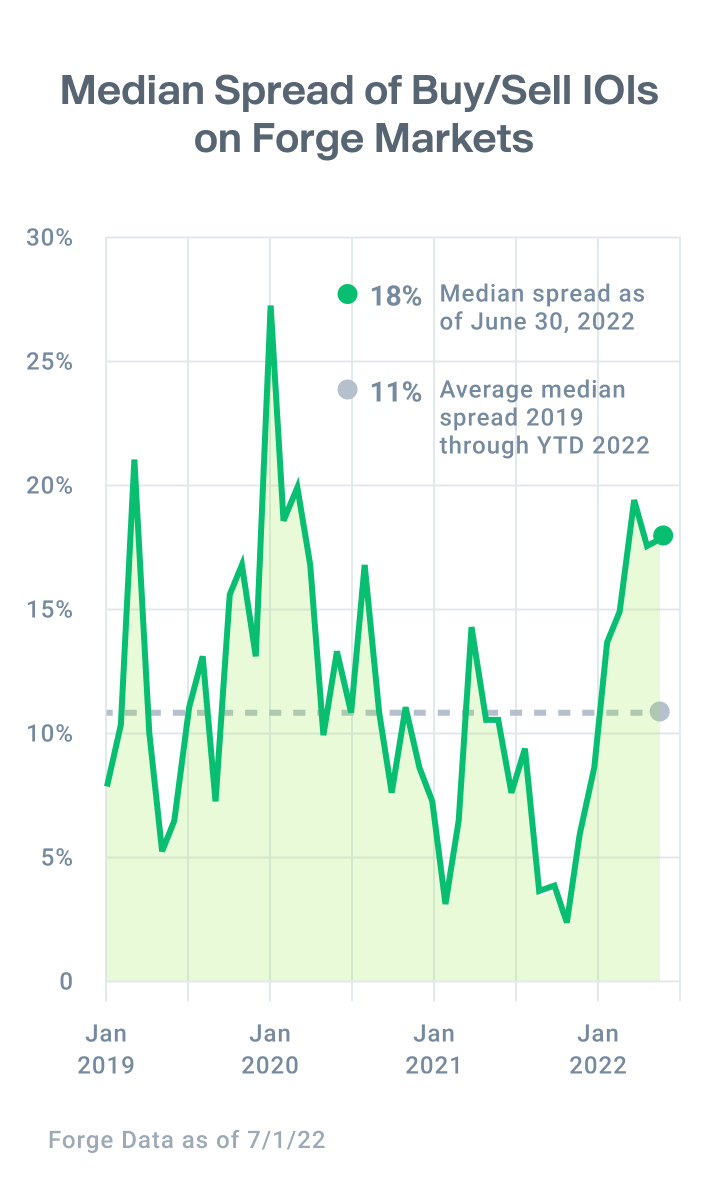

Indications of interest remain elevated on the sell-side, with median buy/sell spread at 18%

As has been consistent since the beginning of the year, sell interest remains elevated on the Forge platform. The ratio of sell-side IOIs to buy-side IOIs remains roughly consistent with sell-side interest taking up roughly 60% of the mix.5

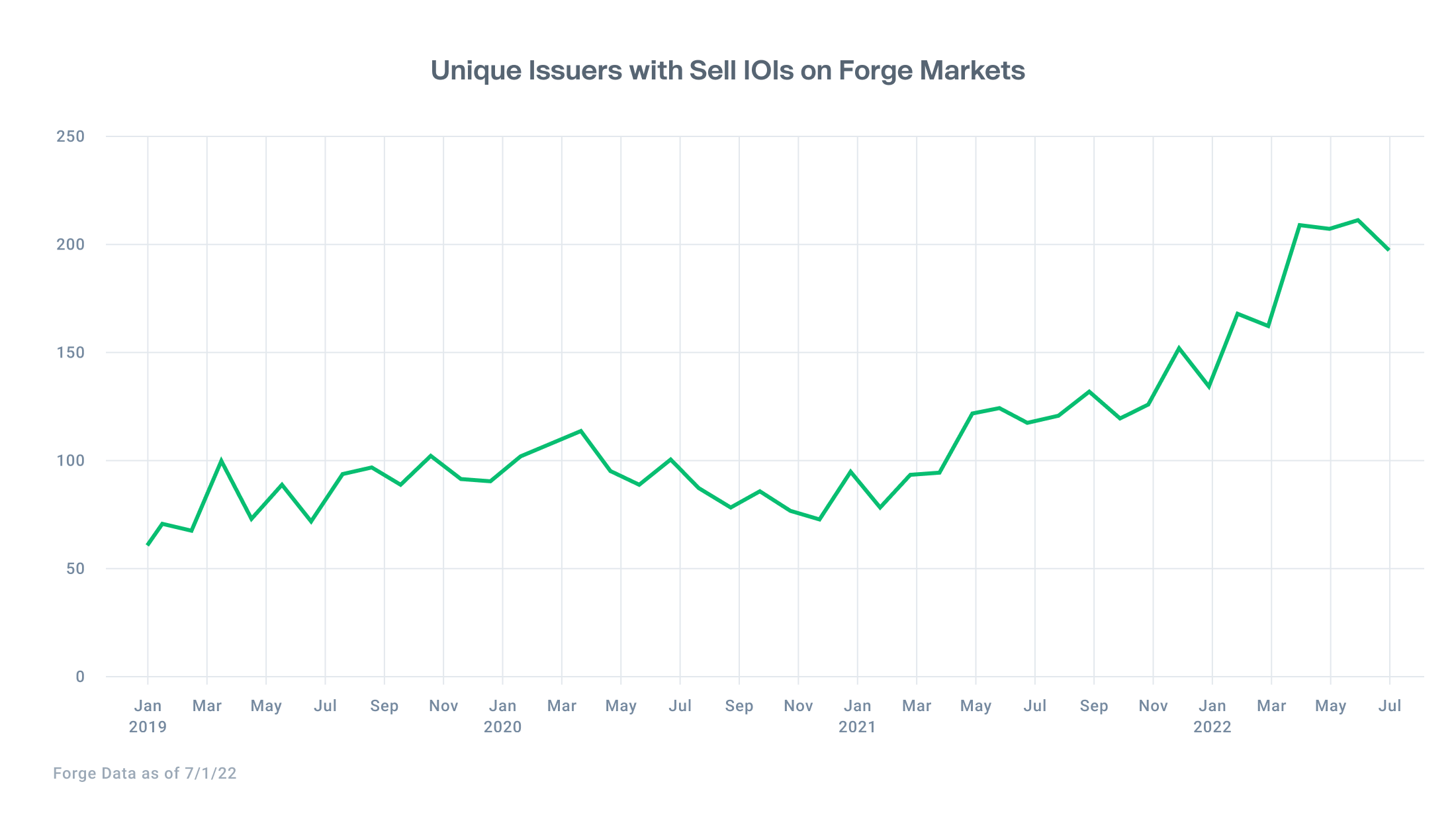

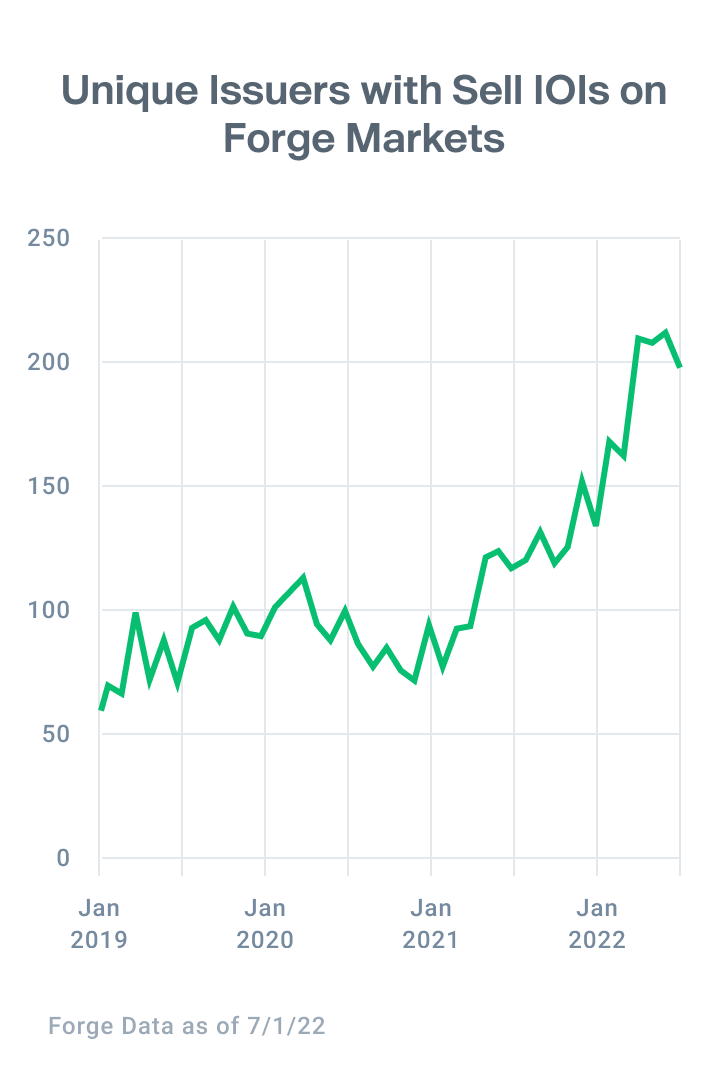

There are nearly 200 unique issuers with sell-side IOIs. While there was a slight decline in the number of unique issuers with buy-side interest, this potentially reflects seasonal summer trends in financial markets.6

Meanwhile, the median bid/ask spread is 18% as buyers and sellers digest current economic conditions in an effort to reach price discovery – though there has been some stabilization in the last month.7

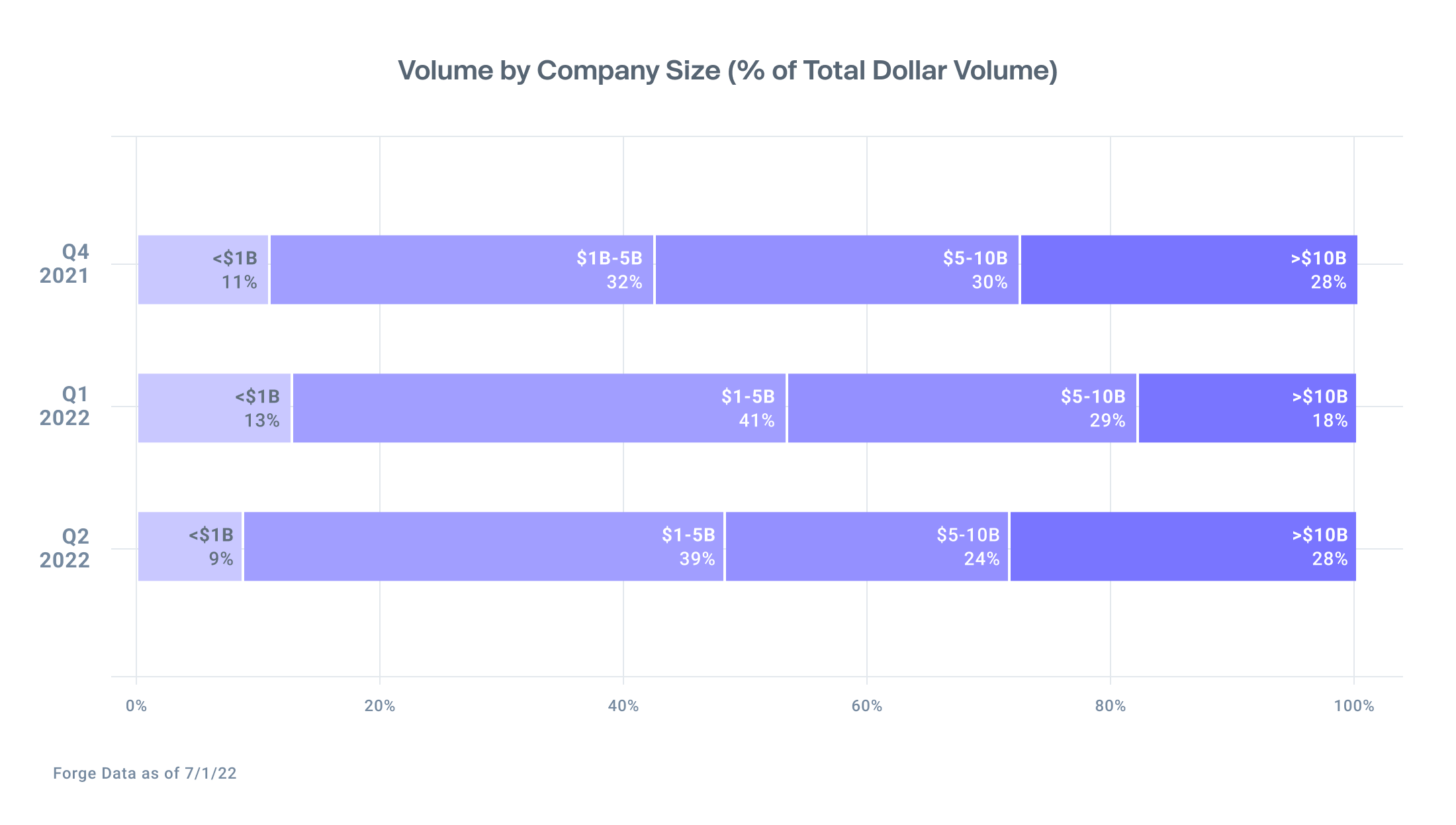

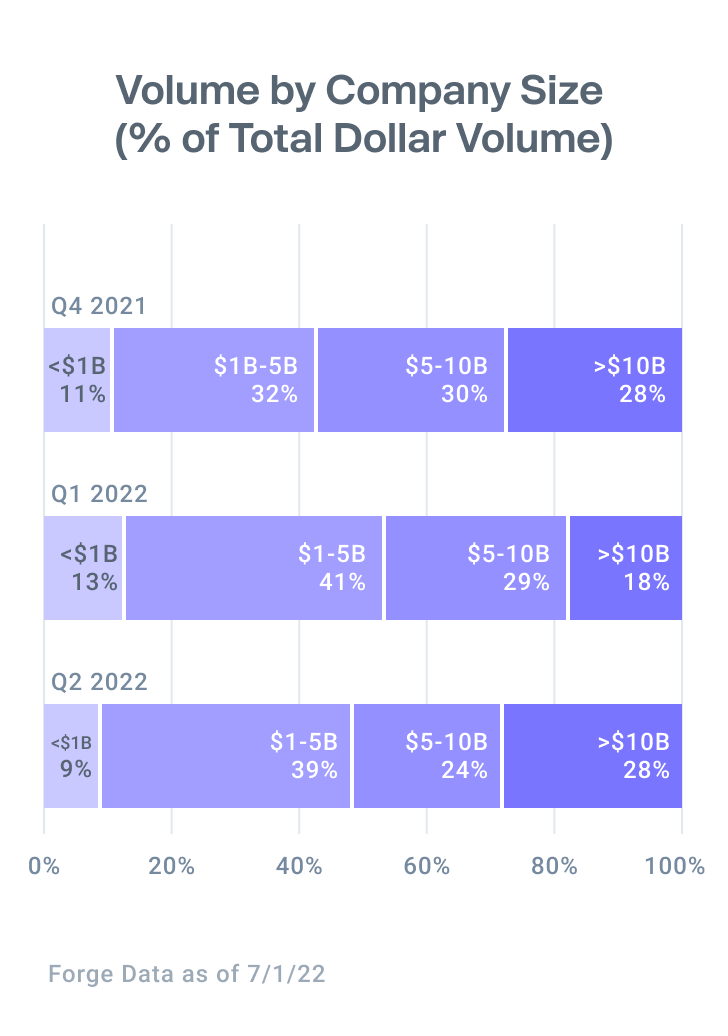

Investors increase focus to decacorns in Q2 2022

Last month, we introduced new data showing where investors were deploying capital in the secondary market, using primary round valuation as a benchmark. Updating this data to close out the quarter shows investors increased allocations to “decacorns” (or companies valued > $10 billion) in Q2 compared to Q1.

Since re-introducing the Private Market Update in February, we have published the first six months of public market returns from companies that were covered on the Forge Data platform when they were private. As proof of the dried-up IPO landscape, there have been no IPOs fitting this criterion in the last six months. As a result, we’ve removed that chart from this Private Market Update.

When will the IPO pipeline resume? It’s anyone’s guess. But issuers shouldn’t be forced to wait for inflation to subside and quantitative easing to return in order to provide liquidity to their employees, and investors shouldn’t cease the search for growth. The private market will continue striving to provide liquidity for all participants regardless of market conditions.