- Investors signal improved buy sentiment across an expanded investment opportunity set

- Activity and interest level – from both sellers and buyers – ticks up

- IPO pipeline’s spigot sputters to life

After a year full of recessionary fears and market turmoil, the start of 2023 showed that there are reasons for optimism grounded in data, not just wishful thinking.

Let’s start with monetary policy, which has been influencing what’s been happening in financial markets, labor markets and more.

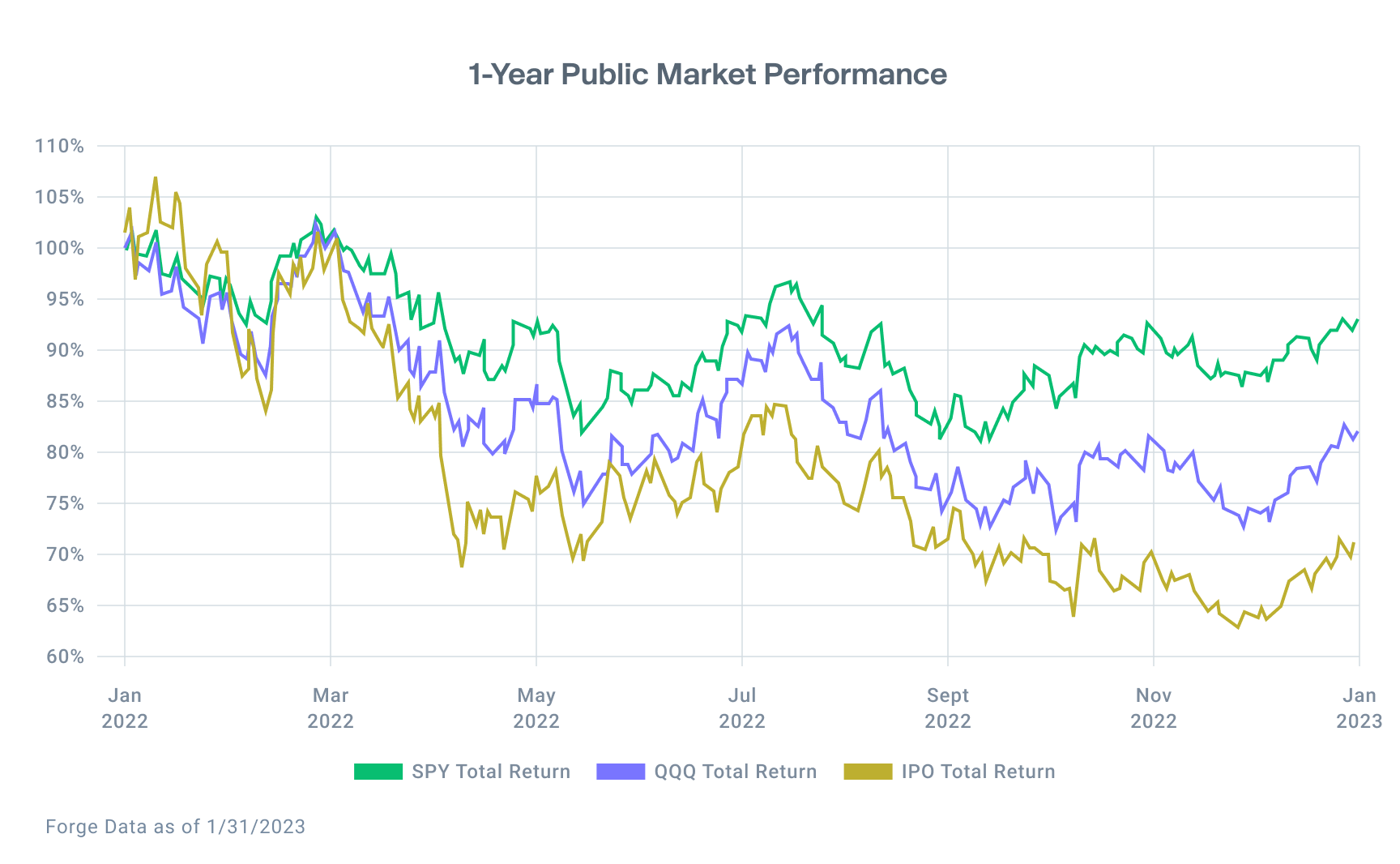

Over the course of 2022, the Fed initiated the fastest tightening in decades, going from a target range of 0-0.25% to 4.25-4.50% by the end of the year. Along the way, the goal of a “soft landing” — where inflation gets under control without causing a recession — often seemed like a pipe dream.

But so far, so good. That’s not to say it was an easy year to get through, and recessionary concerns certainly haven’t disappeared. However, public indices across equity and fixed income markets demonstrated some renewed optimism in the last half of 2022 and into January of 2023. And in February 2023, the Fed slowed its pace, raising rates by 25 basis points, compared with several 75 bps hikes in 2022.

Meanwhile, despite some big-name layoffs, particularly in tech, the overall employment picture remains strong.

As Reuters reports, “The strong January job gains of half a million new positions coupled with moderating wage growth has increased hopes for a ‘soft landing’ as the Fed continues with interest rate increases but the labor market powers ahead, Federal Reserve Gov. Lisa Cook said.”1

Stock markets have joined the labor market by also having strong gains so far in 2023. In January, the S&P 500 gained 6.18%,2 while the majority-tech-weighted Nasdaq-100 jumped 10.6%, its largest January gain since 2001.3 Both are still down year-over-year, but the January gains could be signs of a positive 2023.

Meanwhile, the private market showed some signs of life in a few leading indicators.

In January, new bids from investors on Forge demonstrated –39% discount to last primary round compared to bids at the end of Q4 which averaged a –50.5% discount. And investors placed bids in twice as many private companies in January as they did in December, demonstrating an improved buy sentiment across a larger investment opportunity set.

In particular, Next Wave unicorns — which Forge considers to be companies that are less than 10 years old and valued at $1 billion or greater – continue to draw investor interest. And some of those Next Wave companies have recently announced positive news. Just one example: HR platform Deel, recently announced it hit a $12 billion valuation (based on its most recent funding round in May) and has ambitious plans for 2023.4

But that’s not to say that older private companies are locked out. Some big names like Stripe could soon find liquidity via private markets. While Stripe is considering an IPO, the company is also exploring a private market transaction that would let employees sell shares, as The Information reports.5

And Stripe isn’t the only one. In January, a record number of issuers had shares listed for sale through Forge. And several companies, including CAVA and Mineralys Therapeutics Inc. signaled they’ll pursue an IPO this year, a sign that the frozen IPO tap has at least begun a slow thaw. While these signs are budding sprouts of optimism, it will take many more announcements – and sustained stabilization of the economy, among other factors -- to wrench the IPO pipeline spigot open and get private company exits flowing again.

Until then, private company employers are feeling the pressure to help shareholders access liquidity as they continue to delay exits.6 However, this growing acceptance among unicorns and other high-growth technology companies beyond Stripe and SpaceX to pursue liquidity programs to retain critical employees may mean more investment opportunities for private market participants.

Overall, while we’re still early in the year, and the memories of a tumultuous 2022 still linger in our recent memories, there are glimmers of hope that 2023 could be different if market conditions stabilize or improve.

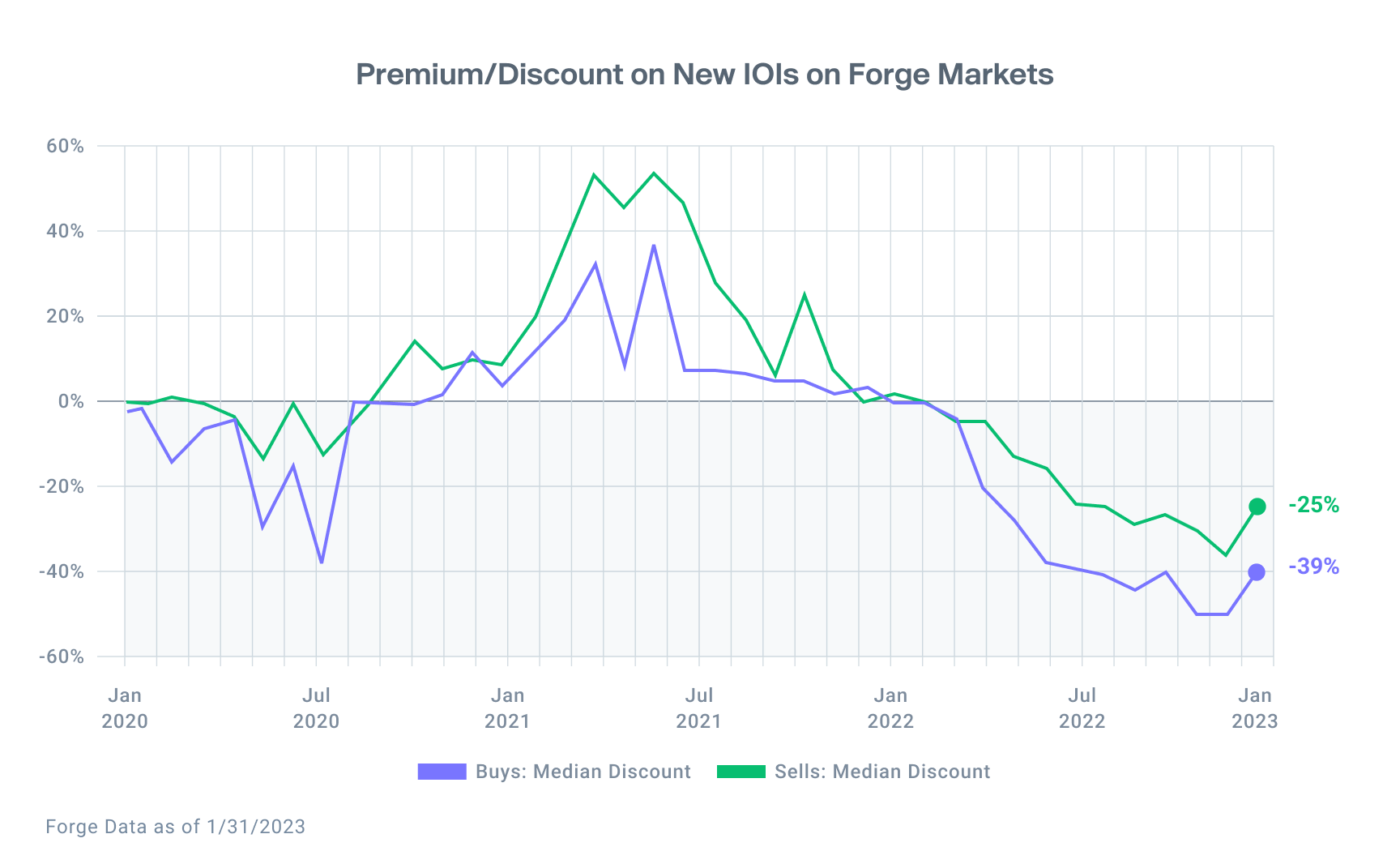

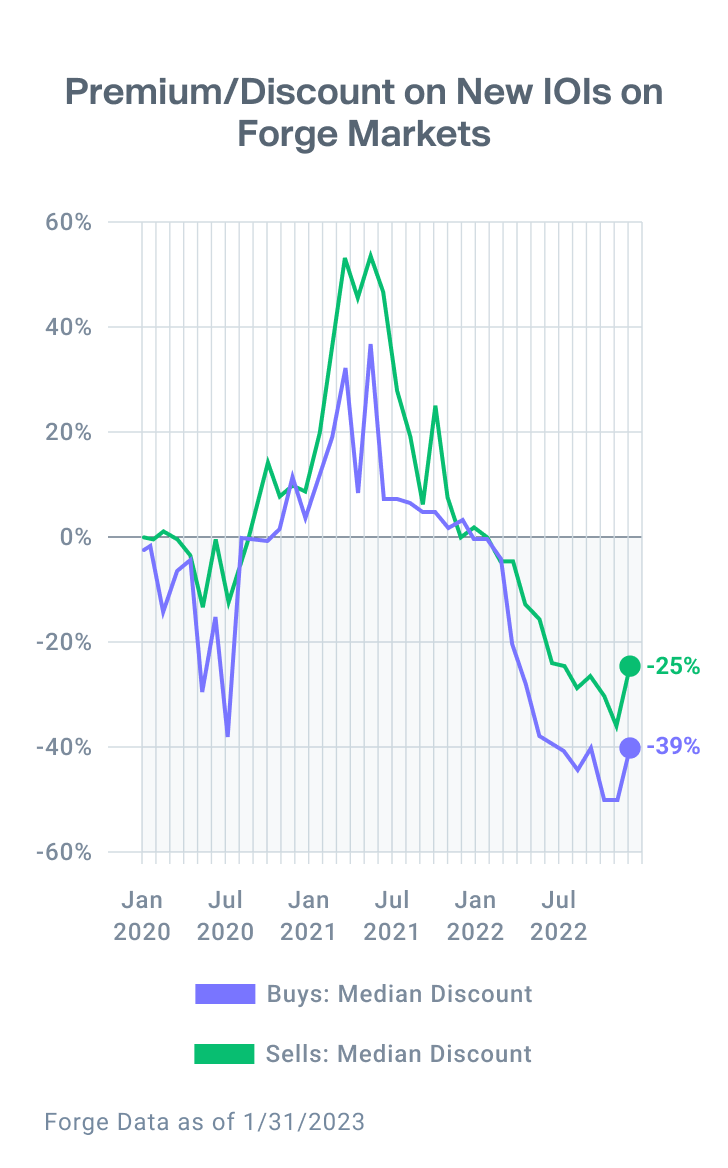

Pricing sentiment on private companies ticks upward

Both buy and sell side indications of interest on the Forge platform tallied the highest average prices since August and September 2022 respectively. While bid and ask prices moved in the same direction in January, bid premiums jumped more than 11% in January, which is the largest single-month change since the stark decline of 17% in April 2022. The velocity of the change signals a change of sentiment and optimism in the private market.

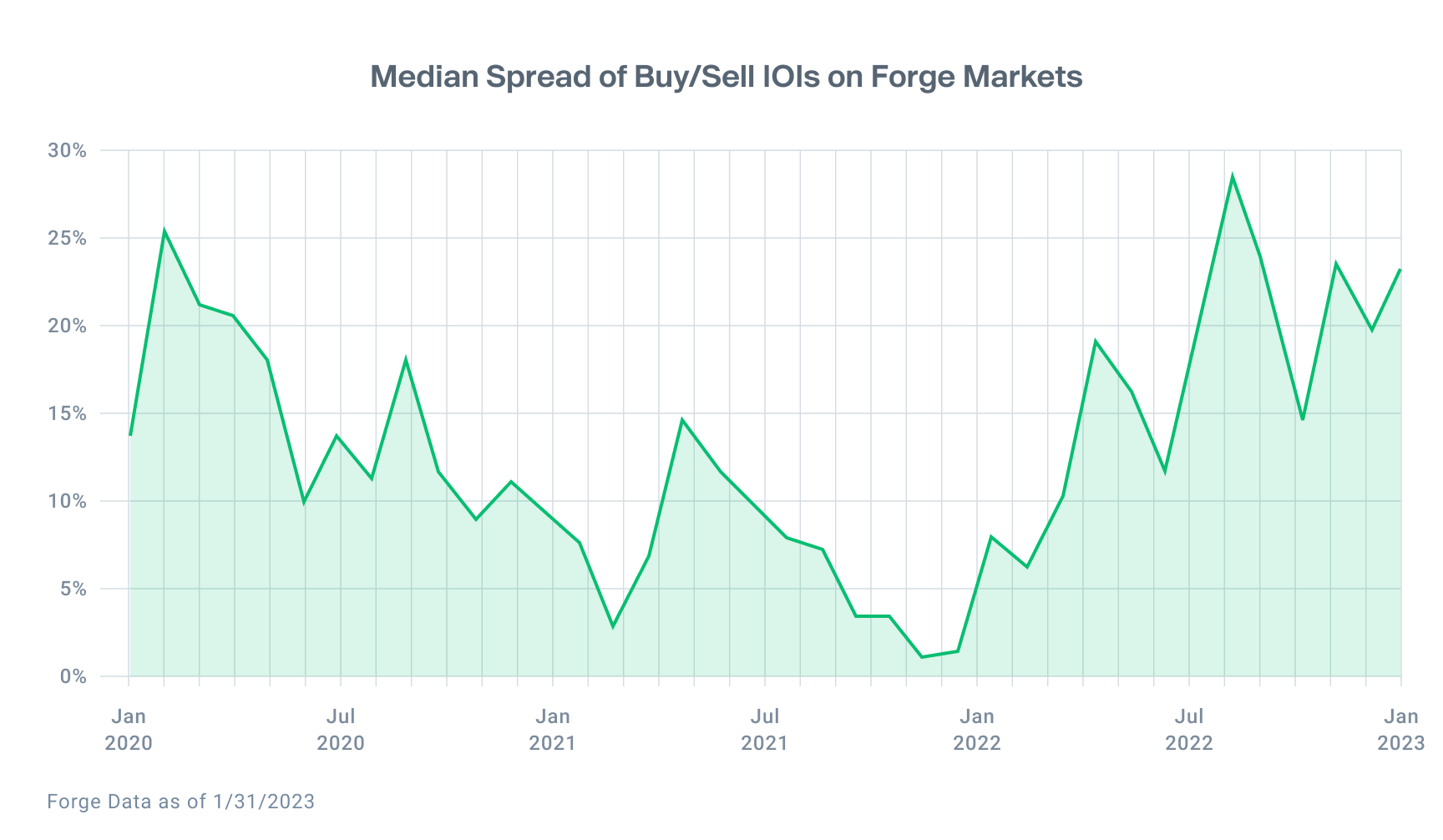

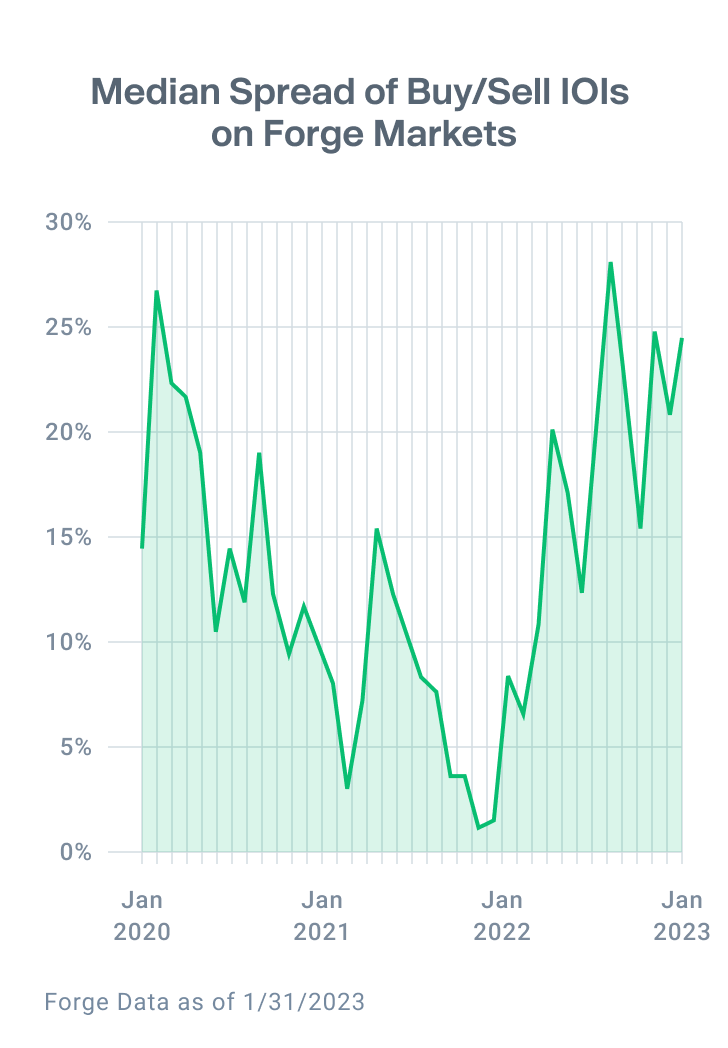

Bid-Ask spread remains high as prices adjust upward

Based on Forge’s data, both bids and asks had significant price changes but moved synchronically, resulting in an elevated bid/ask spread on IOIs. It's common to see asks (the price indications sellers want for their shares) lag bids (the price indications investors want to pay for shares) during a downturn, however while historic data show the trend reverses when market conditions improve, the past is not always a predictor of the future.

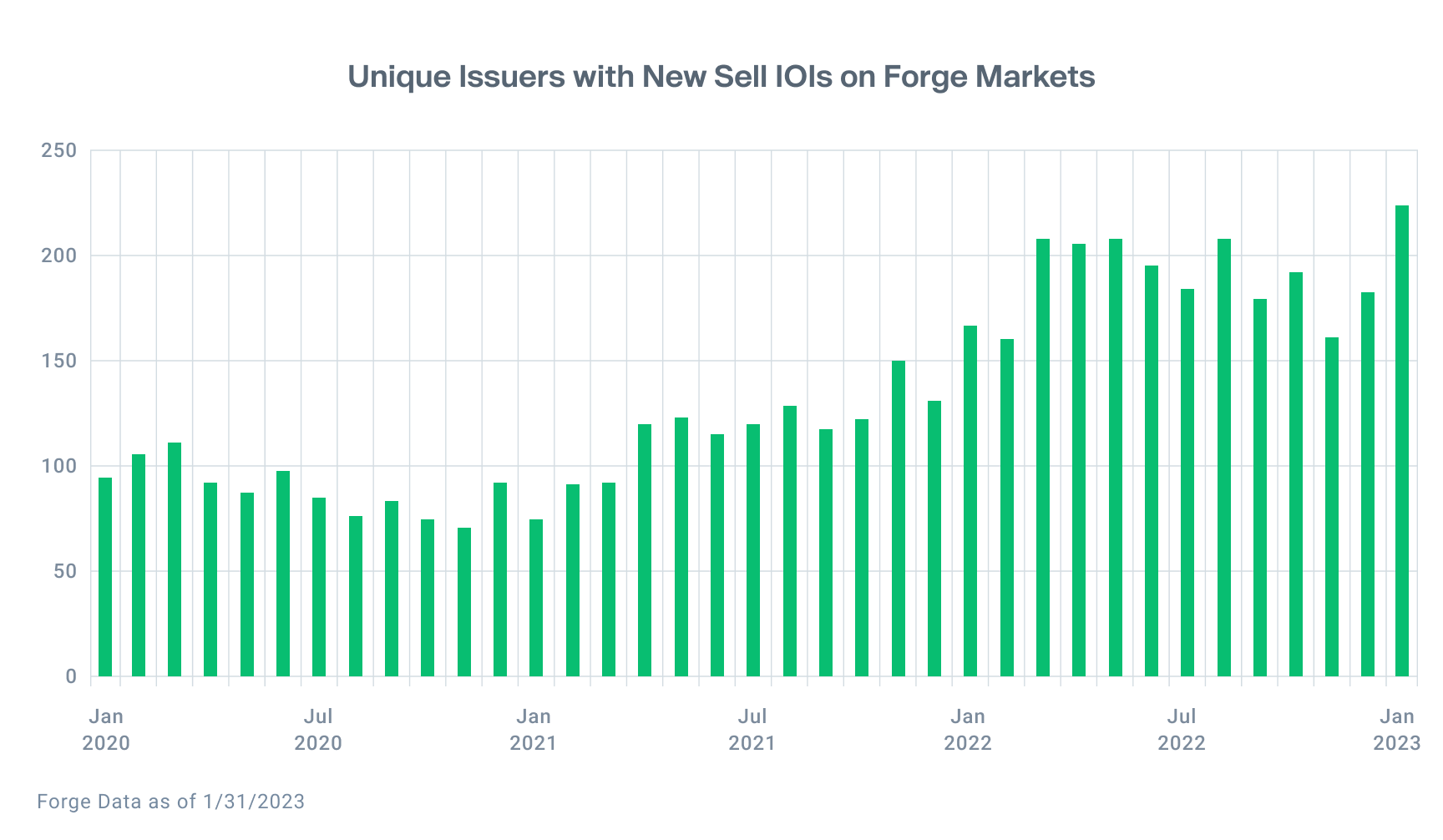

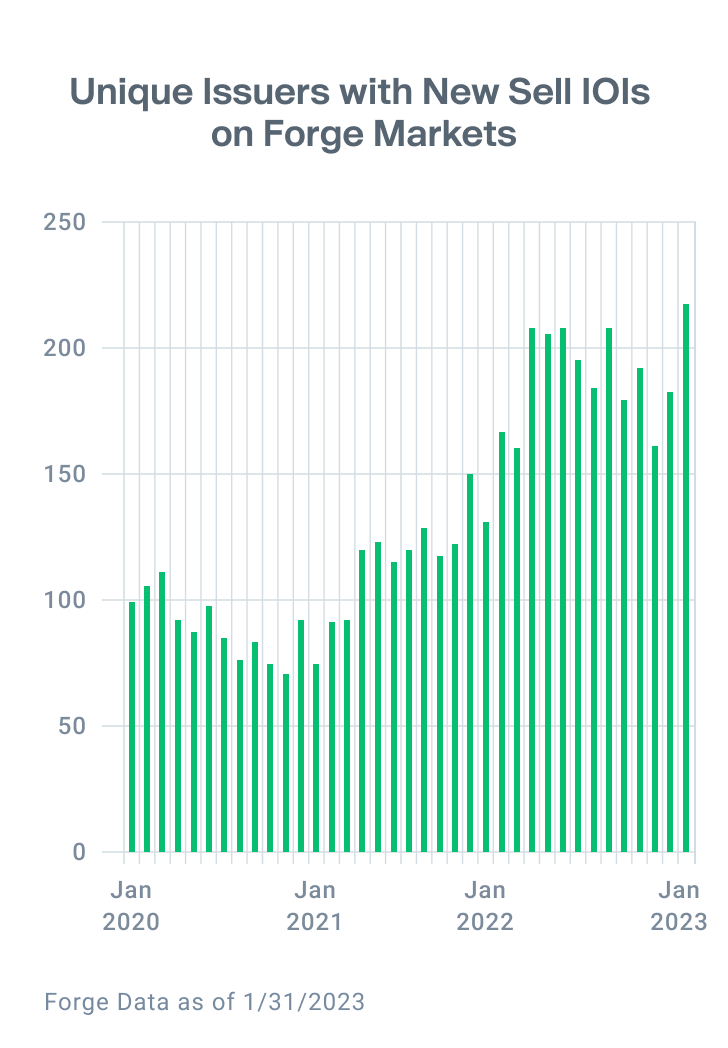

Unique companies with Sell-Side inventory sets new record

In January, Forge saw unique issuers with new sell IOIs reach a new record, up to 218 investable issuers. The uptick in sell-side inventory is representative of the building demand for liquidity among private company shareholders after a full-year of little IPO activity, delayed exits and an unclear 2023 IPO outlook. But seller indicators were not the only noticeable shift, as unique issuers with new buy IOIs doubled from December to January, climbing to the highest levels since August 2022 according to activity on the Forge platform.

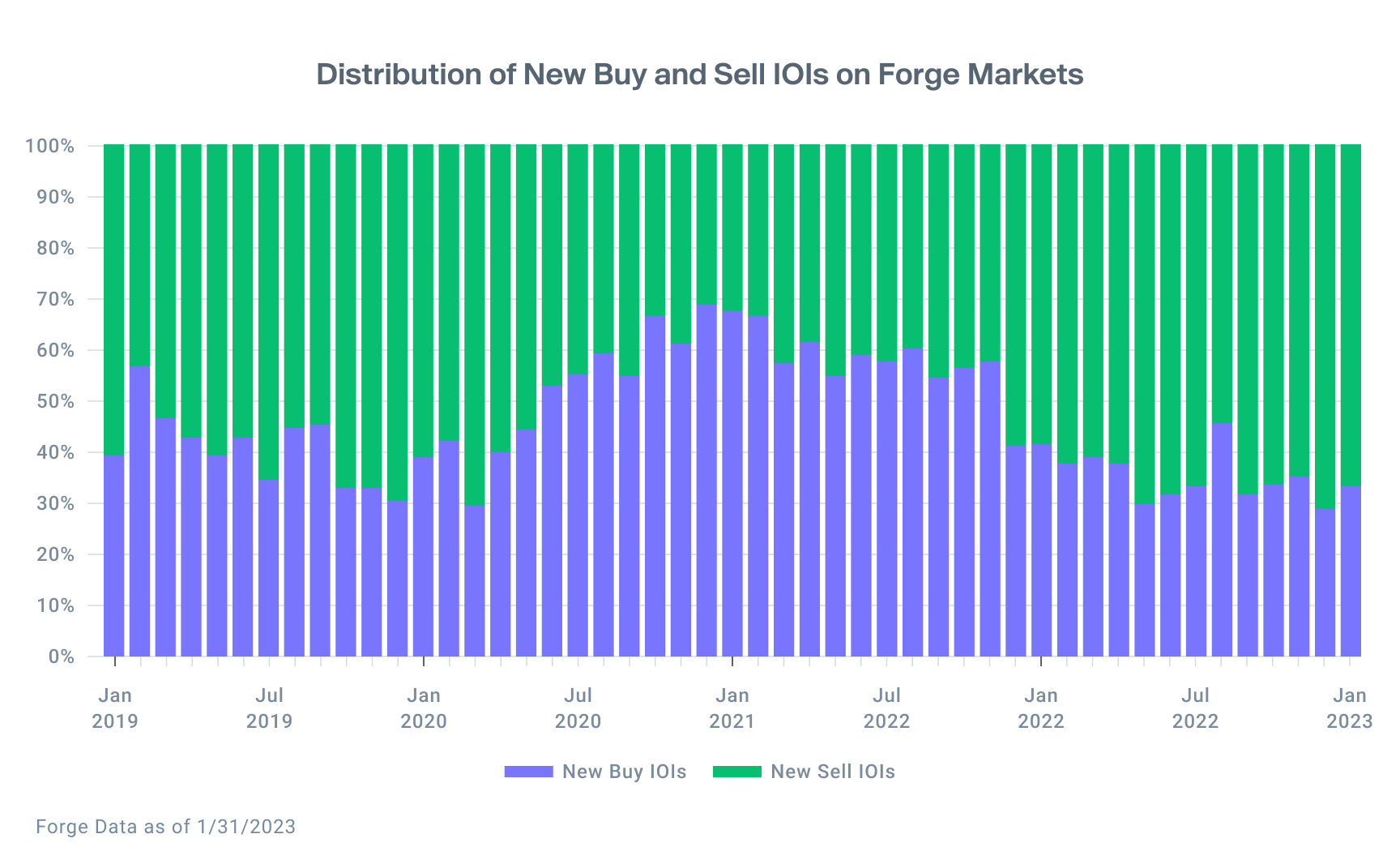

The Buyer’s market persists

Forge’s trading platform saw an uptick in both buy and sell IOIs which left the overall buy-sell distribution relatively unchanged. The overall volume of new IOIs on the Forge platform increased sharply in January, with a more than 40% increase month-over-month.