- Investors are using multiple private and public data sources to value private market holdings

- In May, there were a record number of unique companies with sell-side indications of interest on the Forge platform 1

- More investors have allocated capital to “decacorns” in Q2 thus far than previous quarters 2

There are more signs that private market valuations are declining, presenting yet another challenge for fund managers in a year that’s been filled with them.

After all, it’s easy to mark-to-market a portfolio of public market stocks. Public stocks trade every day, and there are hundreds of commoditized data feeds (as well as free tools like Yahoo Finance) that investors can use to value their portfolios down to the minute.

But private market assets trade less frequently, and private market data is less prolific. Plus, there are no universally accepted standards or methodologies for valuing private companies. Should investors use the last primary round price? A revenue multiple, if they have financial data? Reference how mutual funds are valuing those assets? Compare to a basket of comparable public or private stocks? All of the above?

Innovative managers are developing unique solutions to this challenge and – creating potential opportunities for investors. The Private Shares Fund is a 1940 Act fund that invests in private companies, and its Chief Investment Officer Christian Munafo said in a recent Forge webinar that his firm’s valuation approach includes "collecting data from about 16 different sources in both the public and private domains” as they mark-to-market daily.

As a leading private market trading and data provider, Forge Data seeks to help investors value the assets in their portfolios by providing real-time access to Forge marketplace trading activity, along with a wide variety of other data sources like public fund marks.

While investors navigate this correction, more timely and actionable data may help give market participants greater insight and in order to take advantage of opportunities in the current environment.

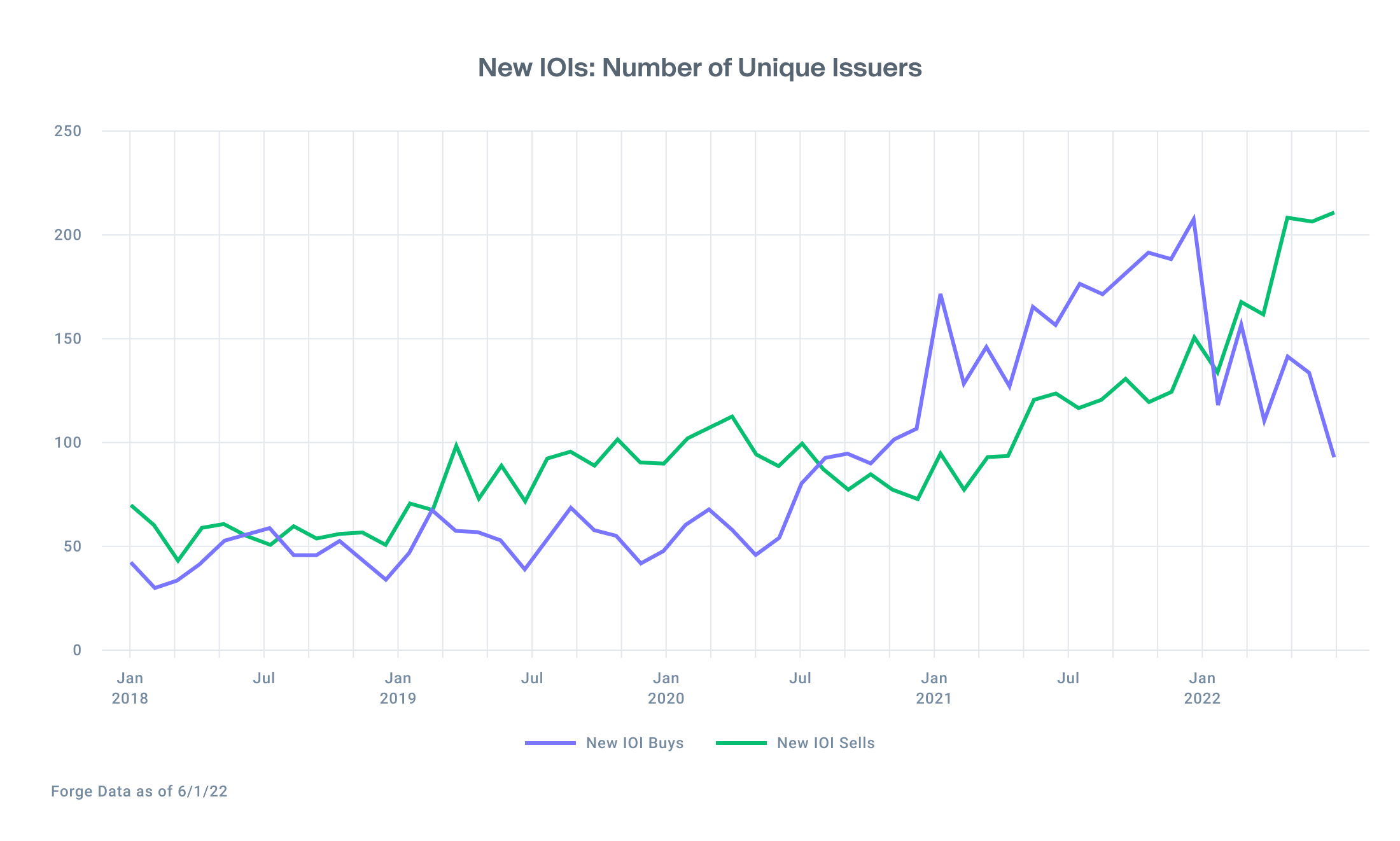

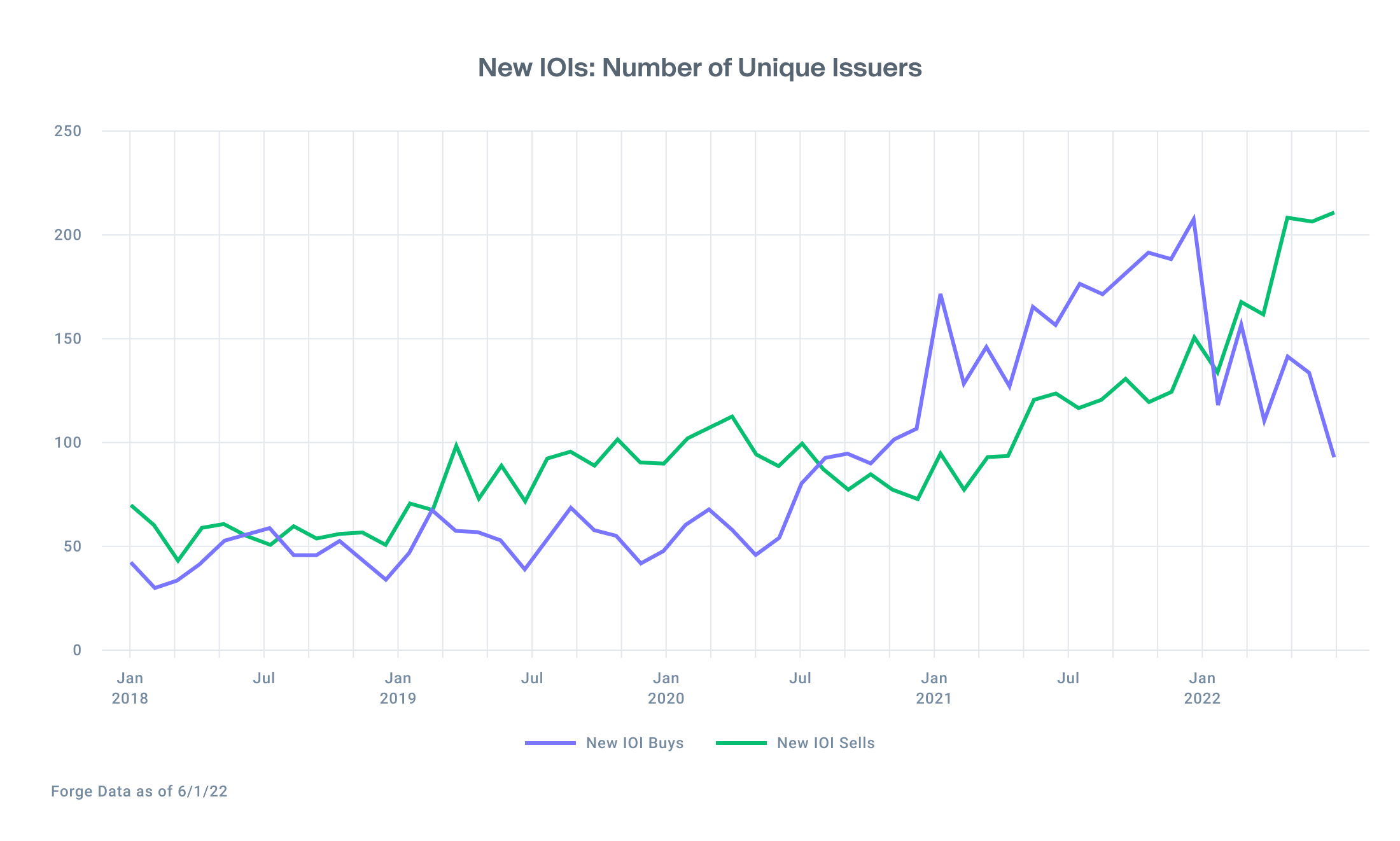

Record number of issuers as ratio of sell-side to buy-side interest remains consistent

A recent article article citing Forge Data succinctly summarizes the current moment in the private market: “lots of sellers, fewer buyers.” In May 2022, Forge saw the highest number of unique issuers with sell-side indications of interest, or IOIs, in the history of our platform. 3

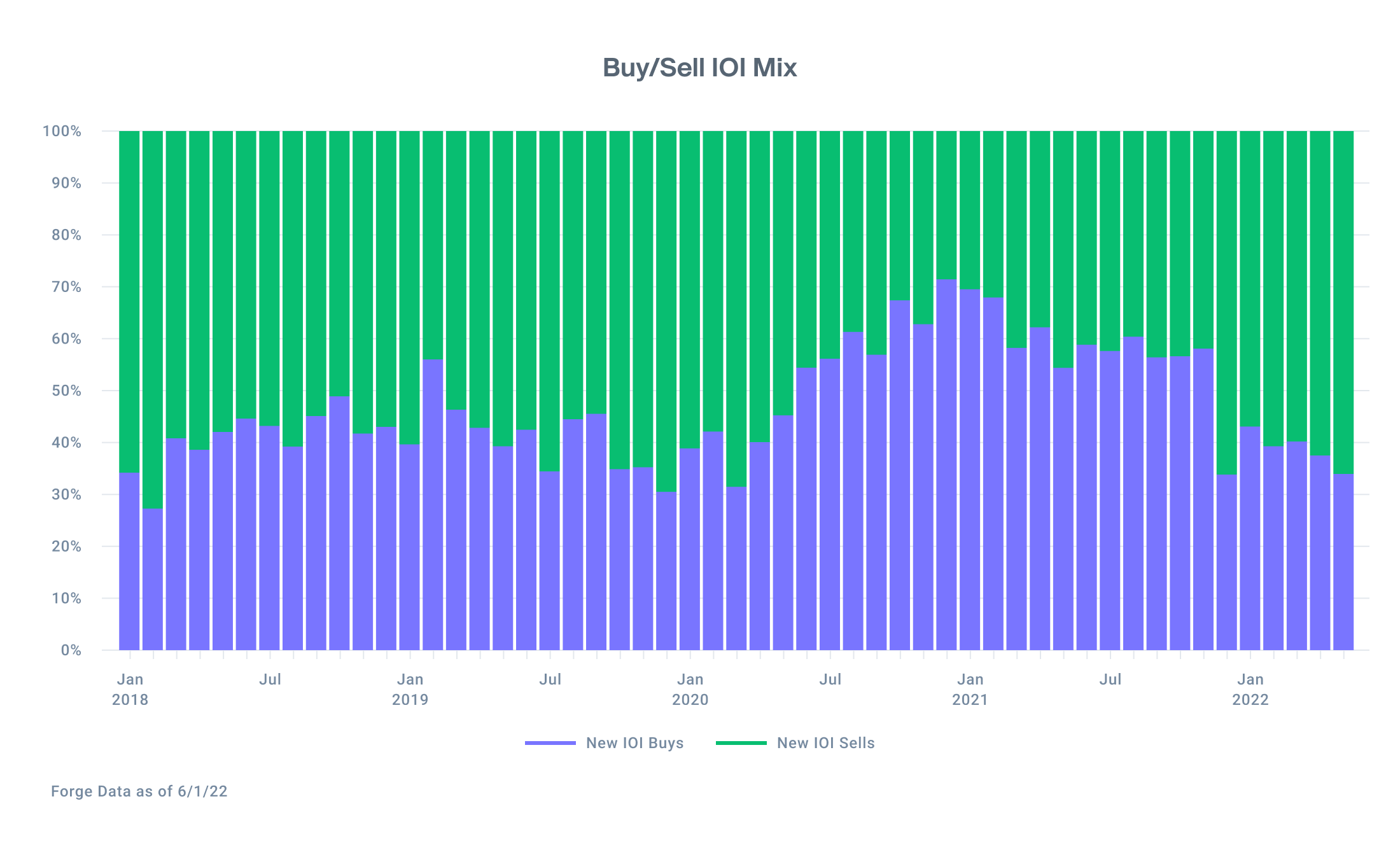

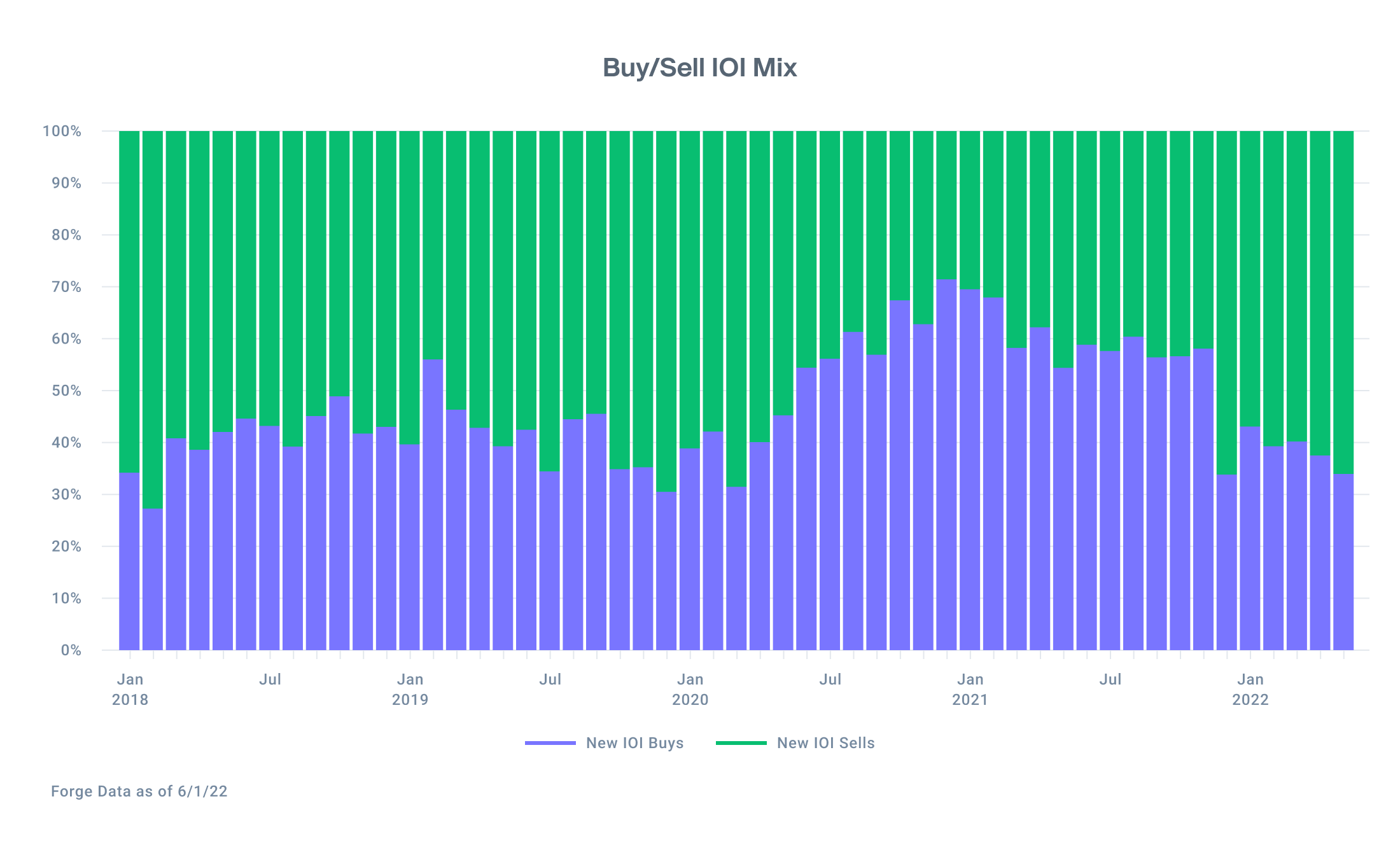

Over the last six months, the ratio of sell-side IOIs to buy-side IOIs has been roughly consistent with sell-side interest taking up roughly 60% of the mix. 4

For savvy investors, this has the potential to be a unique opportunity to buy assets in the private market at a price that makes sense and potentially offers upside.

Investors shifting focus to later stage “decacorns” but focused across sectors

It’s hard to predict investor behavior in choppy markets. As investors navigate challenging economic conditions, will they focus on earlier-stage companies that may have more growth ahead of them, or later-stage companies that may be considered “higher quality?”

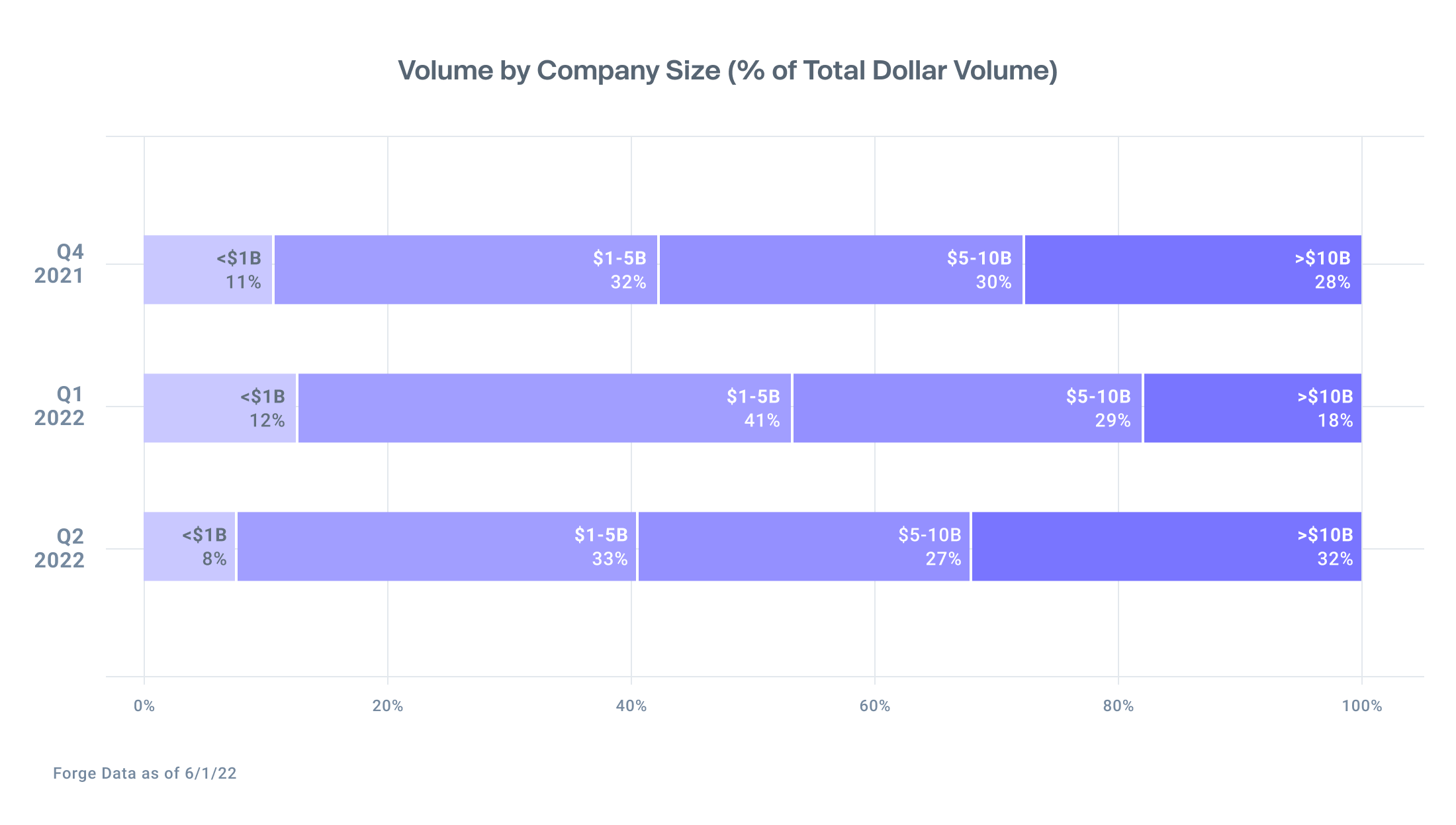

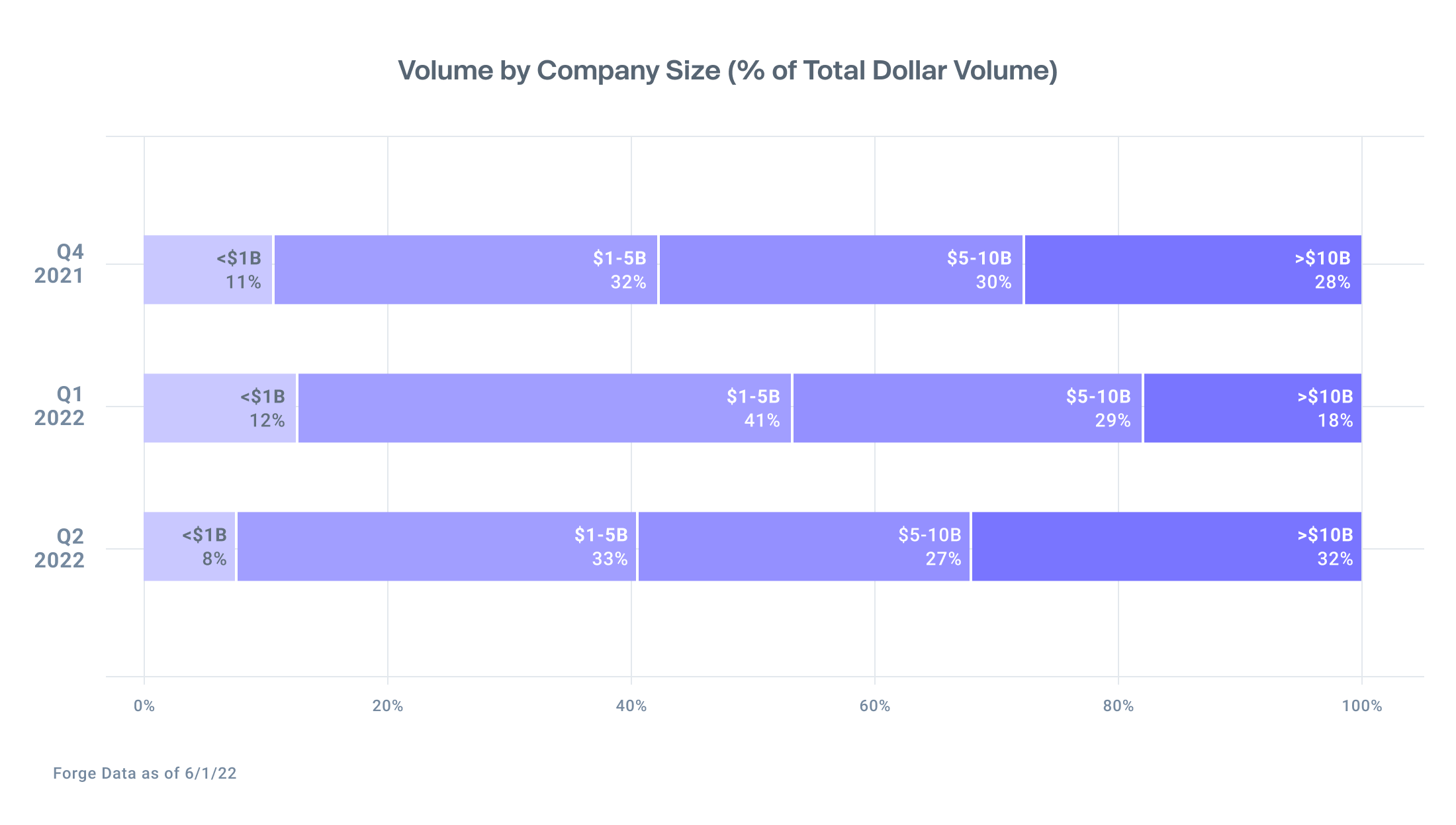

Thus far, Q2 2022 has seen an increase in trading activities in shares of larger companies worth at least $10 billion, or “decacorns,” compared to previous quarters. 32% of trades have taken place in decacorns – up from 18% in Q1 2022 and 28% in Q4 2021. 5

Forge also offers a proprietary sector categorization that helps enables greater precision when analyzing private market companies. This data shows a broad distribution across different sectors over the last three quarters, providing investors with additional detail as they research private market opportunities. Blockchain, Cybersecurity, and Gaming companies maintained high levels of activity while Aerospace & Defense and Cloud/Networking Infrastructure companies have seen recent jumps.

In Q2 2022 thus far, the top 10 most traded sectors comprise 86% of the total dollar volume traded compared to 69% in Q1 2022 and 70% in Q4 2021. As the broader market corrects, the secondary market may be narrowing its focus on a smaller set of sectors in search of stability rather than increasing investment breadth. 6

The IPO window is closed, but the private market is open

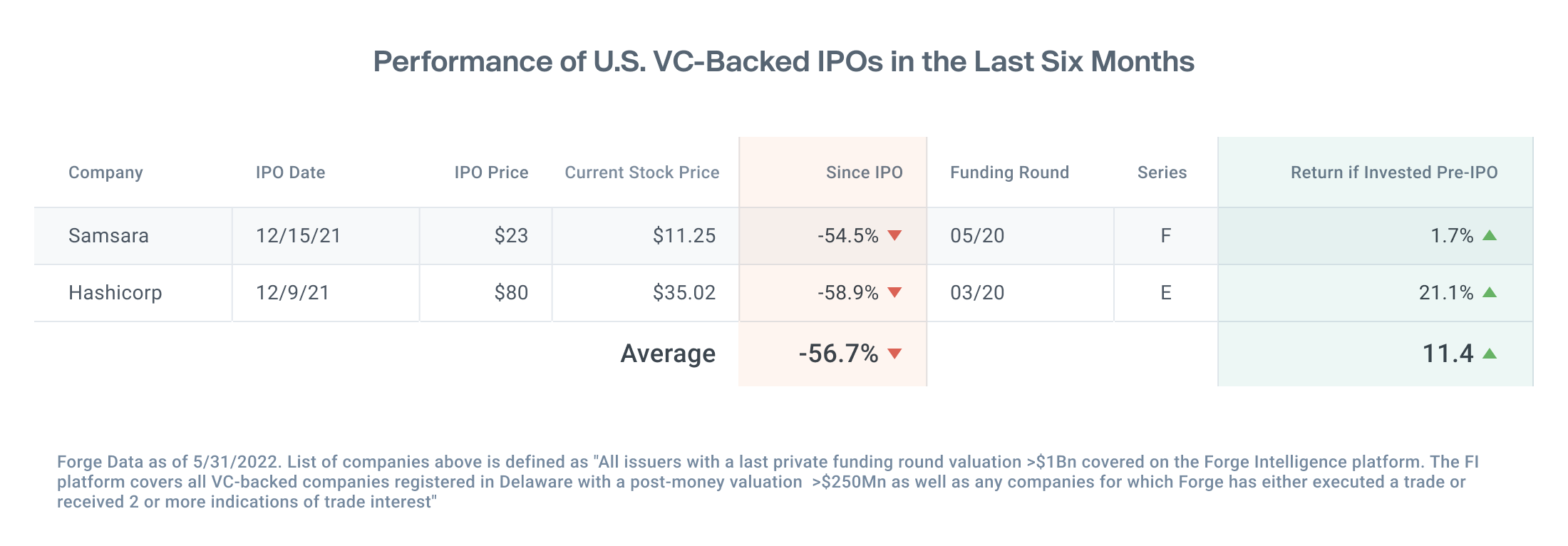

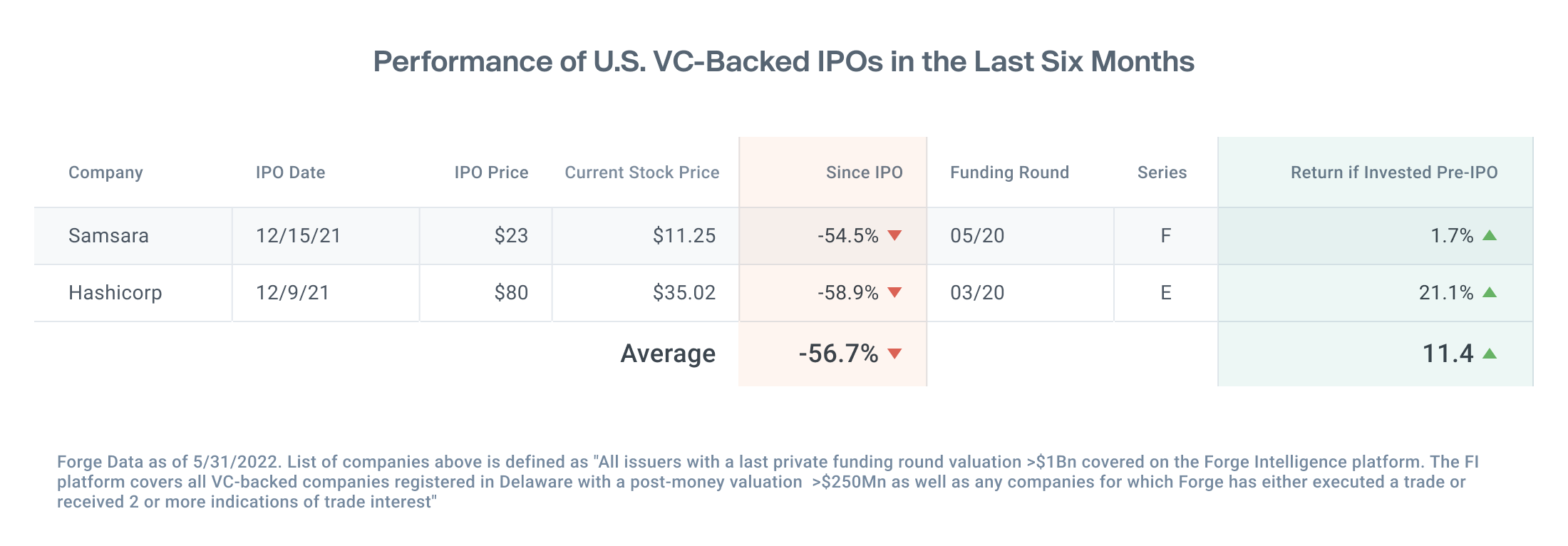

Finally, we end with the performance of IPOs over the last six months compared to their last private market fundraising round price. We have published this every month since re-introducing the Private Market Update in January. While there have been a handful of IPO announcements in recent weeks, this table may remain sparsely populated or disappear altogether for a short period of time.

With sell-side IOIs at an all-time high and IPOs dwindling, this may be a unique opportunity for investors to allocate to high-growth private tech companies at potentially attractive prices.

It’s yet another reminder: in the private markets early is, indeed, everything.