- Investors buying private company stocks at record discounts as sellers continue lowering prices

- Q4 shows narrowing variance in private market issuer performance

- Cooling inflation may lead to improved macroeconomic conditions

A year to remember or a year to forget? No matter the view, 2022 will go down as one of the most notable years in recent history for participants in nearly every corner of the economy.

In the private market, seemingly every stakeholder felt the effects of this year’s challenging macroeconomic environment. Investors, employee shareholders, and private companies navigated unanticipated turbulence and worked to position themselves for a much different future than the low interest-rate environment of the past.

And yet, 2022 concludes with positive news on inflation and an economic environment that seems challenging, yet not catastrophic. Most people will be glad to turn the calendar to a new year. Still, if we learned anything in 2022, it is to expect the unexpected.

After years of rapid hiring, tech layoffs soared in 2022 – with Q4 particularly challenging. Roughly 64,000 global tech jobs were lost during October and November, surpassing Q2 2020 layoffs during the early days of COVID-19.1

But overall, the job market remained relatively strong – and this may be a bellwether for the broader economy. Across the U.S., the number of non-farm layoffs and discharges has remained relatively flat over the past two years and sits below pre-COVID levels.2 The November jobs report also showed relative strength, with total non-farm payrolls growing by 263,000 and the unemployment rate staying at 3.7%.3

The evolving health of the job market means the Fed is likely to continue walking a monetary -policy tightrope to ensure inflation doesn’t flare up again. “Labor market tightness and strength keeps the Fed on its monetary policy tightening path at least through the first half of 2023, and could raise its policy rate to a higher level where it could stay for sometime,” reports Reuters.4

That could tie into an economic slowdown, with many economists still predicting a recession in 2023. But it’s also possible that a soft landing remains in play.

A recent Wall Street Journal headline touts investor confidence in a soft landing, with mutual funds and hedge funds “putting money in stocks that would benefit from slowing inflation, falling rates.”5 Similarly, the New York Times quotes Harvard economist Jason Furman who said, “There is better reason to believe that inflation will fall this year than last year.” However, he adds, “if you pocket all the good news and ignore the countervailing bad news, that’s a mistake.”6

Because of their lag to public markets, private markets are still in the process of adjusting to these changes. Global private market fundraising, for example, fell 7.7% year over year as of September 30, 2022, according to PitchBook.7

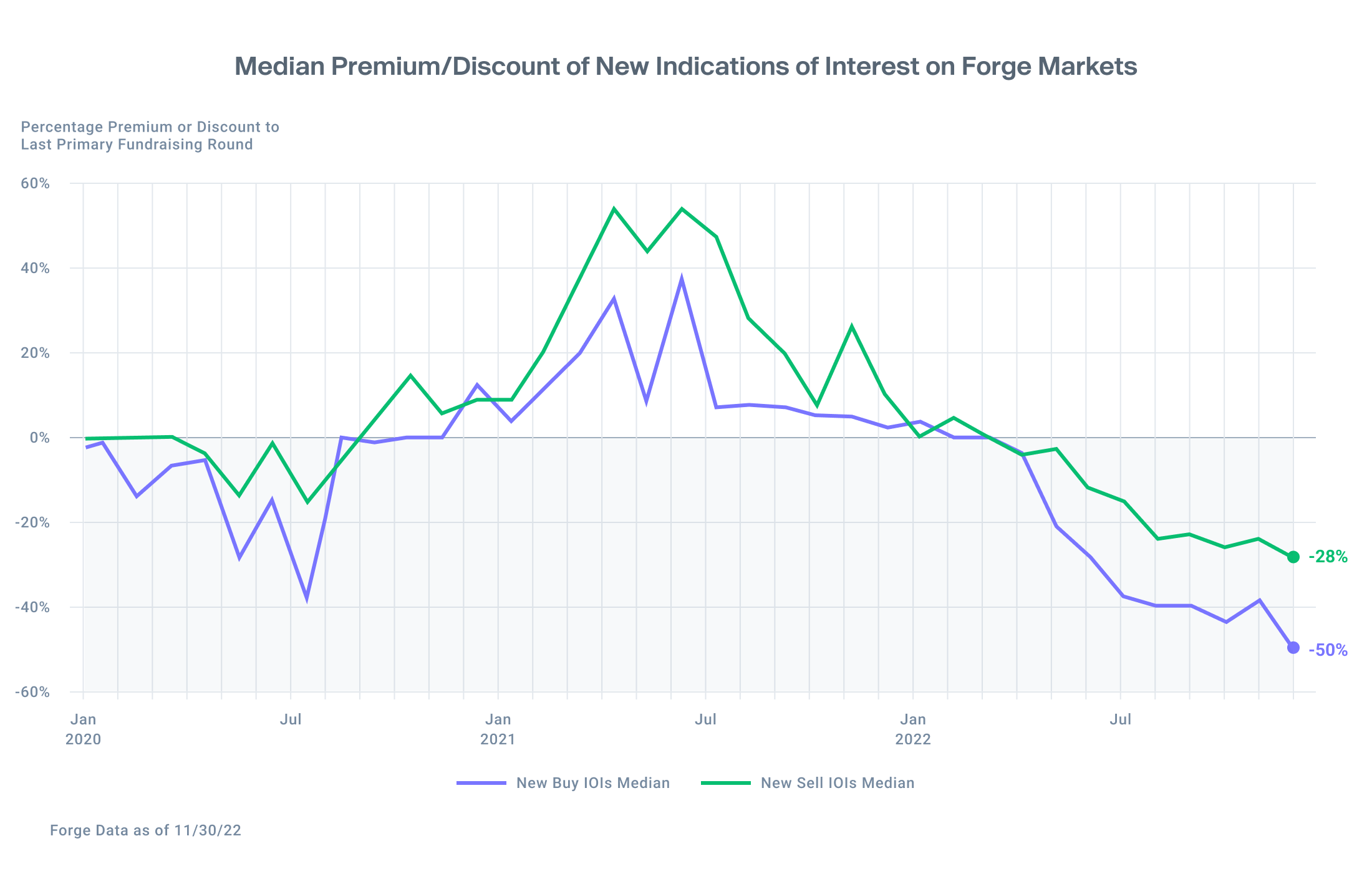

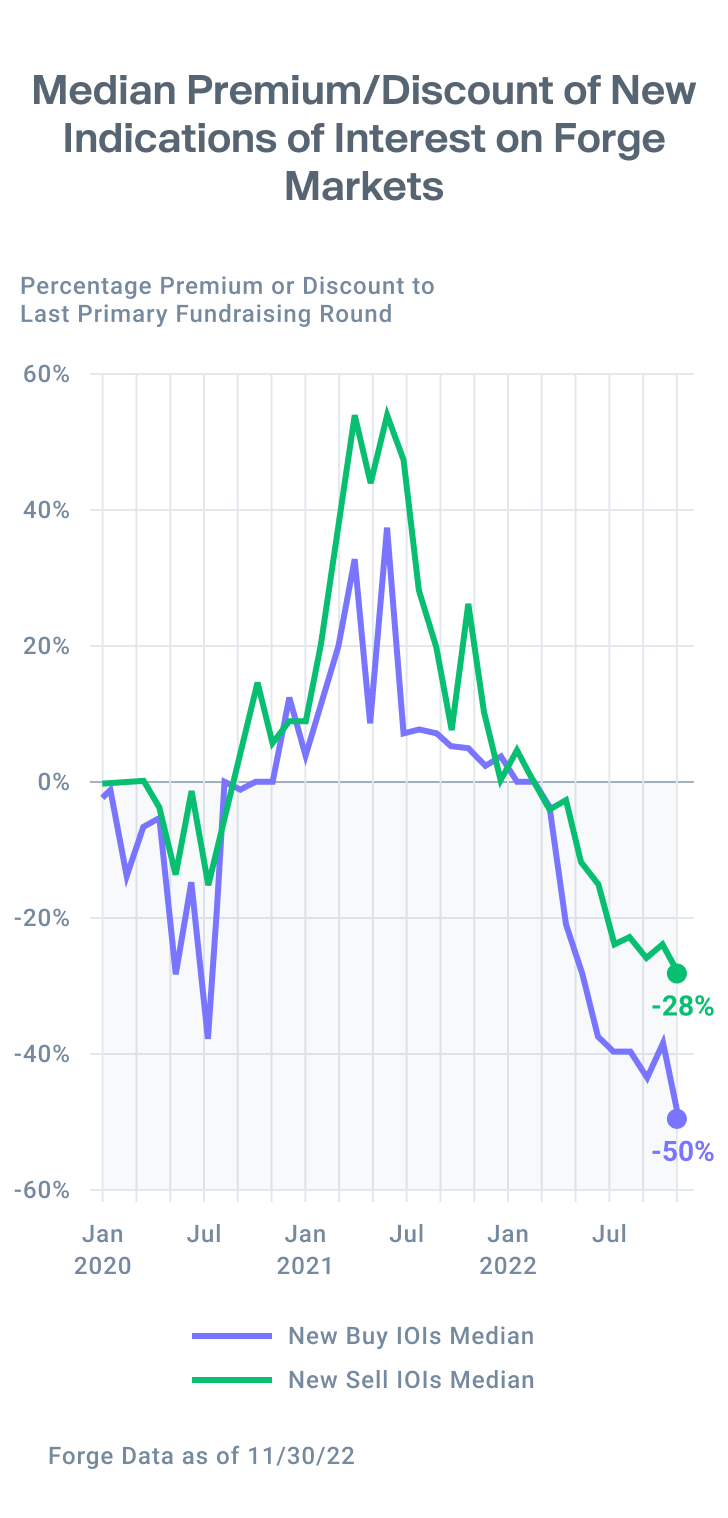

Meanwhile, Forge Data shows that investors are buying private company stock at a record-low median discount of 50.5% compared to these companies’ most recent primary fundraising valuations. Interestingly, that is the same level buyers are bidding on average in their indications of interest (IOIs).8

Still, a gap remains, as sellers seek an average 28% discount to their company’s last primary round valuation.

But Forge is beginning to see signs that prices may be finding some form of equilibrium, with fewer companies trading at deep discounts of 30% or more compared to Q3.9

Taking a closer look, discounts have become more muted, and fewer private names are moving at extreme variations to their last trade. So, there may be signs of equilibrium on the horizon. Even though that means investors might not score deals as often when buying private company stock, it could speak to overall strength in private markets.

As the calendar turns, Forge will continue sharing data in our effort to make the private market more transparent and accessible for investors, shareholders, and private companies of all kinds.

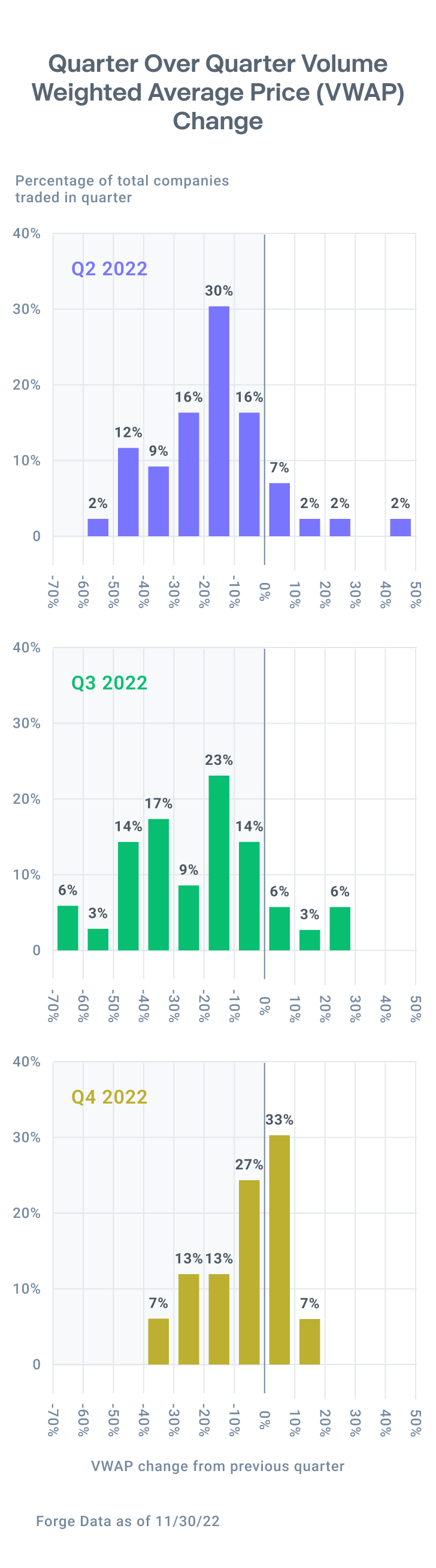

Fewer outliers in Private Market trades in Q4

2022 has been marked by heightened price variance in private market trades, with many companies trading at significant discounts. But that variance appears to be subsiding as investors and shareholders find more alignment on the valuation of private stocks.

In Q2 and Q3, there were swings on both sides. Some private market companies traded at discounts as steep as 60% from the previous quarter’s volume weighted average price (VWAP). At the same time, though it was less common, there were positive outliers, with some private companies trading at 30-40% premiums compared to the previous quarter’s VWAP.

Thus far in Q4, the private market is showing signs of a narrowing performance variance. Most companies are now trading within a 10% discount or premium to their Q3 VWAP. Throughout the year, Forge Data has consistently shown a gap between buyer and seller expectations – but this narrowing may imply that they are starting to find more common ground.

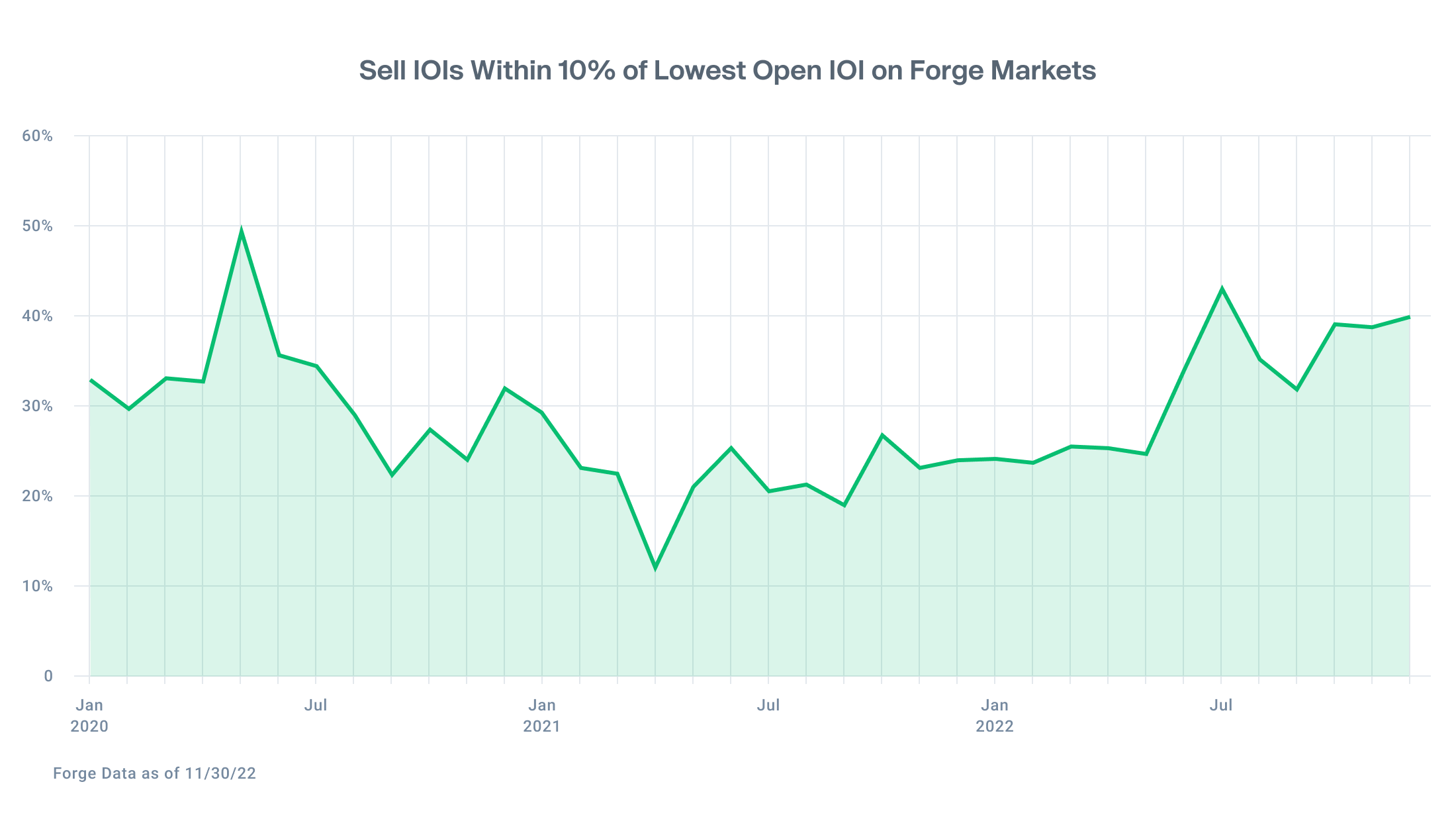

Shareholders willing to sell at lower prices – Buyers remain opportunistic

While investors reacted relatively quickly to the changing economic environment, it has taken shareholders longer to adjust their expectations. Since shareholders tend to be employees and equity is a major part of their compensation, there is inherently more emotion in how they perceive the real-time value of their equity.

It’s clear that sellers are now adjusting their expectations. As of the end of November, nearly 40% of sellers are offering shares at prices that fall within 10% of a company’s lowest open IOI. For investors, this may mean increasing opportunity to access private market stock at new attractive prices.

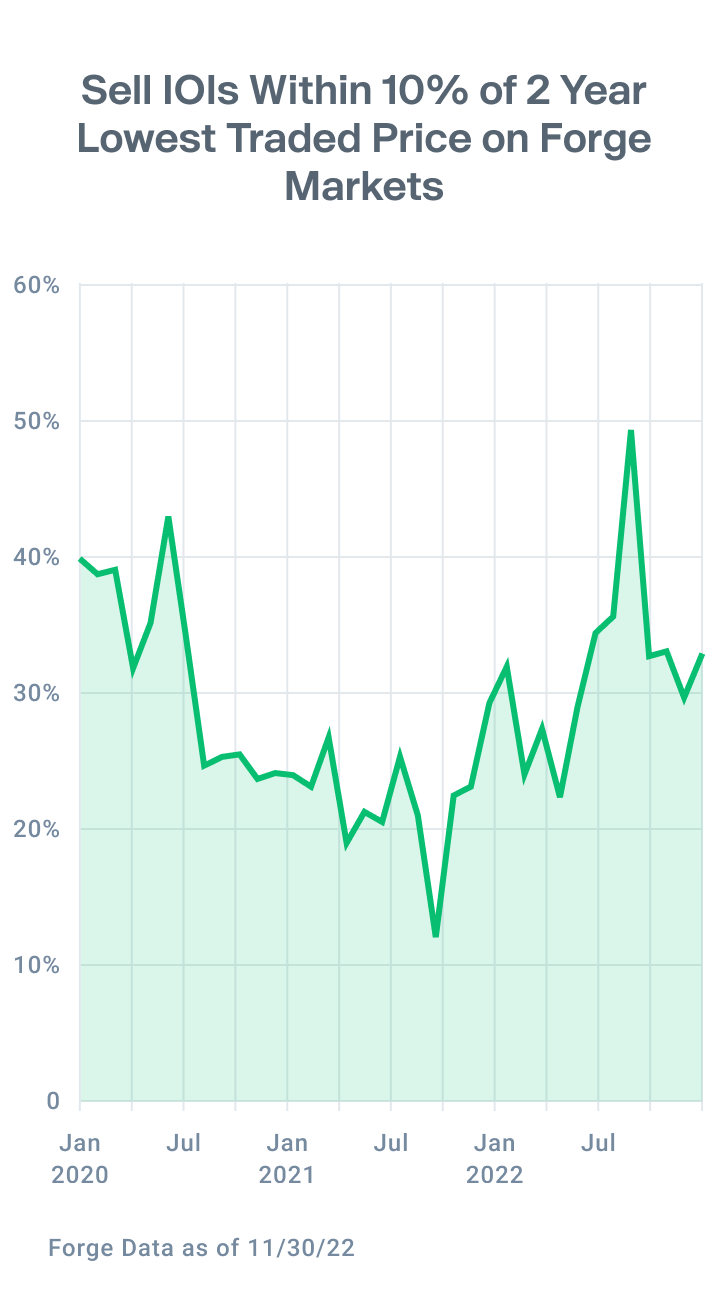

One unique but challenging aspect of the private market is that buyers and sellers commonly use two different methods to value private company stock. They can compare their price per share (1) to a company’s real-time secondary market price or (2) to a company’s most recent primary fundraising valuation.

While employees increasingly offer stock at lower prices, there’s still a gap between buyers and sellers when comparing to a company’s last primary valuation. Sellers are offering shares at a median 28% discount to their company’s last primary fundraising valuation, whereas buyers are seeking a median 50% discount to that valuation.

Going forward, this remains an area of focus for private market participants. Primary fundraising round valuations are a critical piece of the private market equation, but they may be outdated. Real-time secondary market data has earned a seat at the table with employee sellers increasingly using it as an input in their pricing decisions.

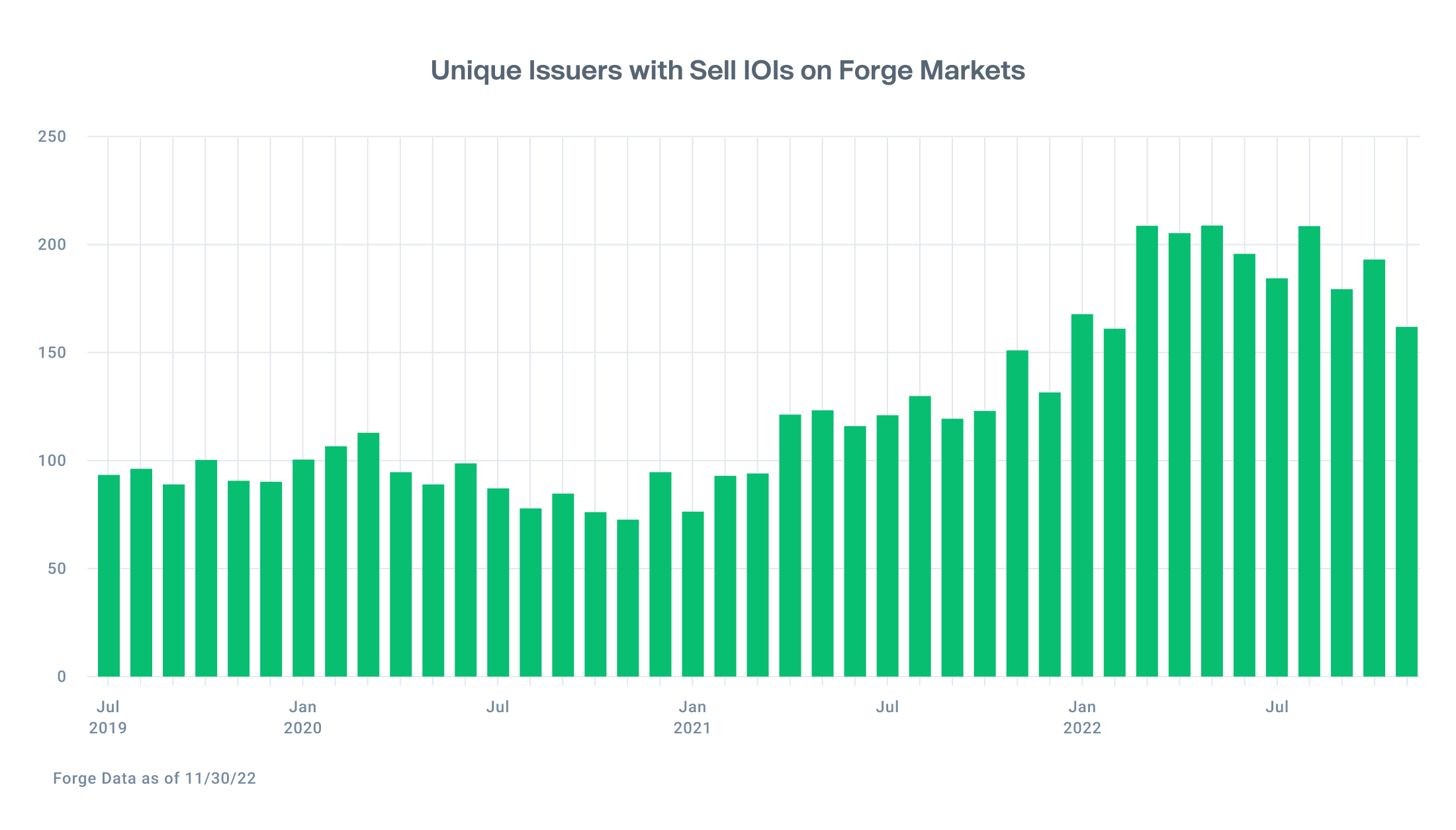

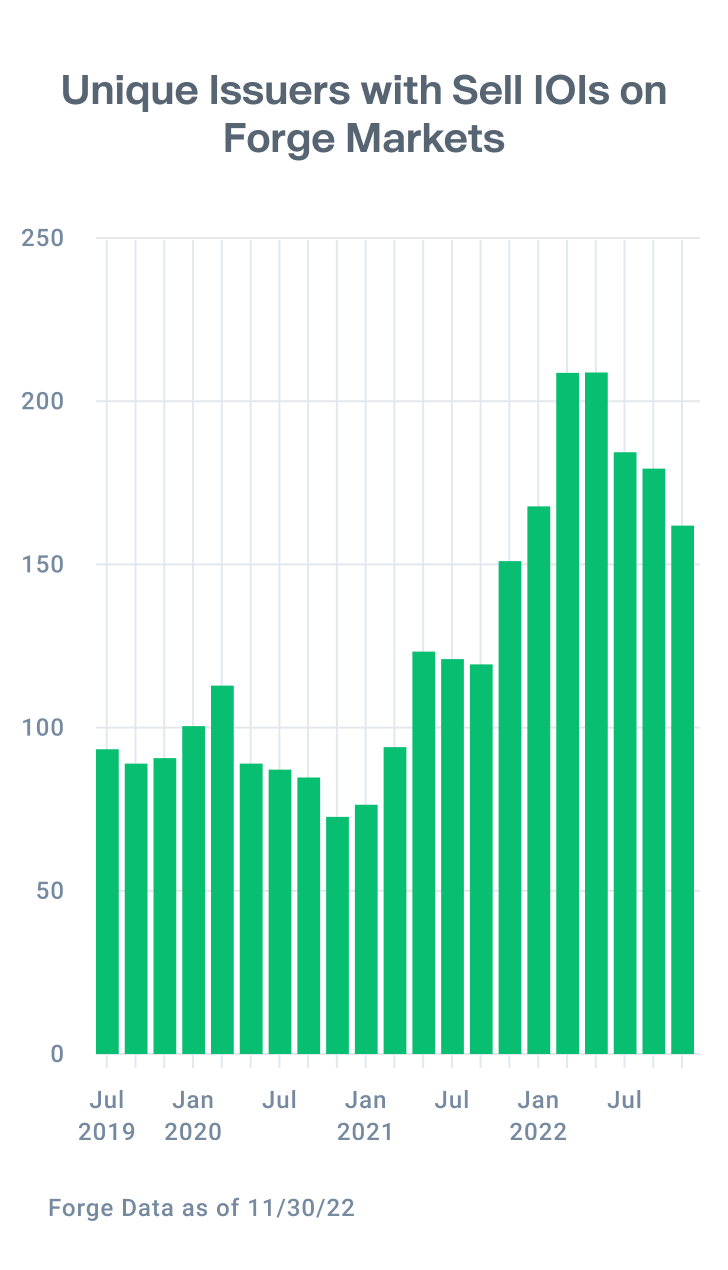

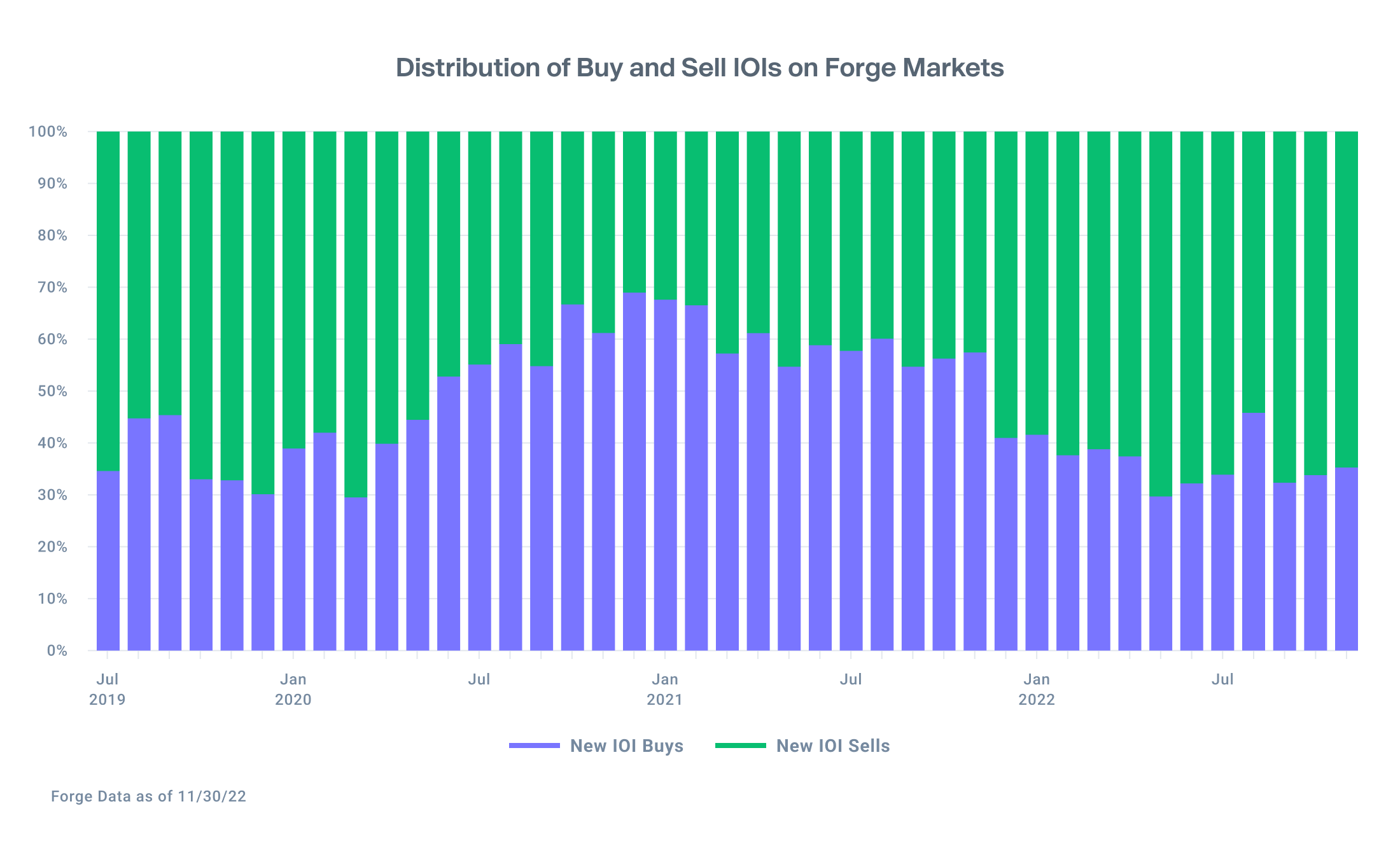

Slight decline in unique companies; slight increase in buyers

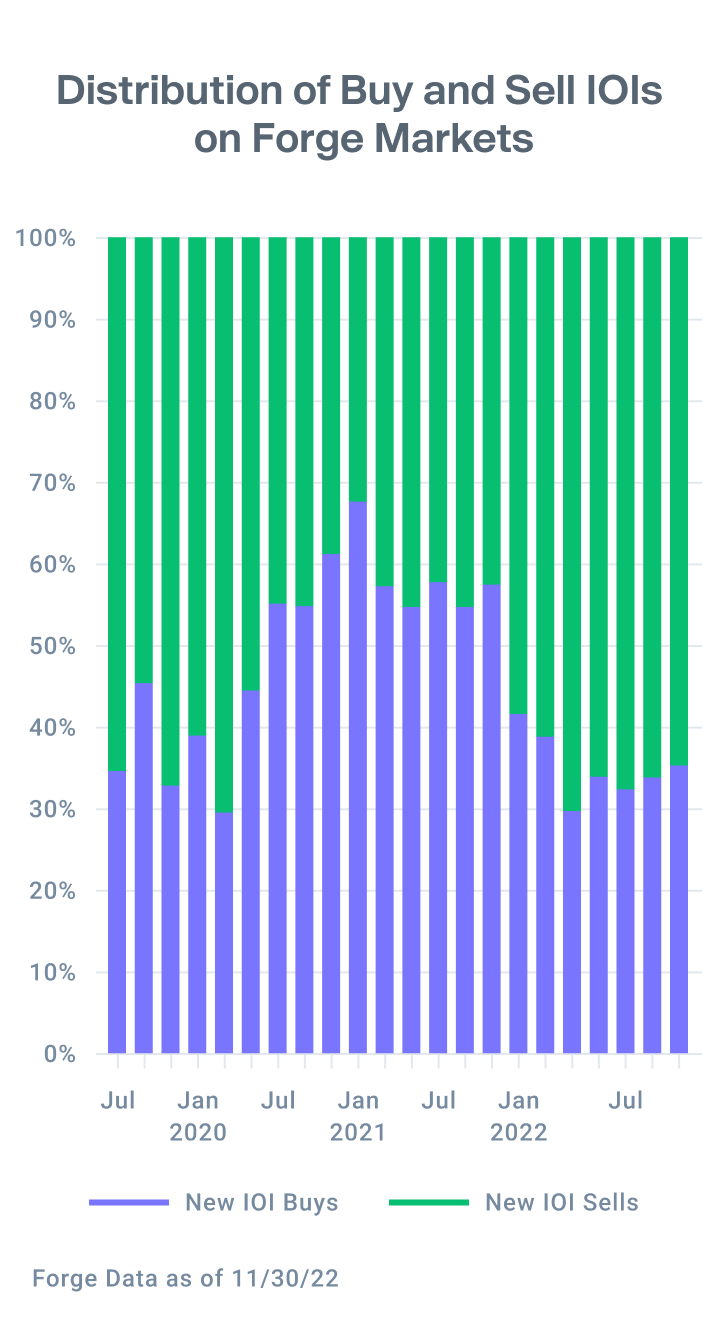

November saw a slight decrease in the number of unique companies with seller IOIs on the Forge platform. Nevertheless, the overall picture remains skewed to the sell-side as it has been throughout the year, with consistently elevated numbers of companies for investors to consider compared to 2021.

But for employee shareholders, one takeaway after a year of volatility is that that there remains a stable, consistent crop of investors who are seeking to buy stock in private companies – and this year has reinforced the lesson that it may be wise for these employee shareholders to diversify their financial picture by “taking some money off the table” and reducing their concentrated exposure to one company.

Meanwhile, the last three months have seen a gradual increase in the percentage of IOIs from the buy side versus the sell side. However, this shift is too small to mark a change in the overall buy/sell ratio, and a buyer’s market clearly remains persistent.

Finally, we can’t turn the calendar without shining a bit of light onto the sector that has captured the world’s attention in 2022. Whether it’s the fluctuating price of bitcoin, FTX imploding, or Tom Brady being sued, cryptocurrency was on everyone’s mind in 2022. But how much exposure has there been in the private market?

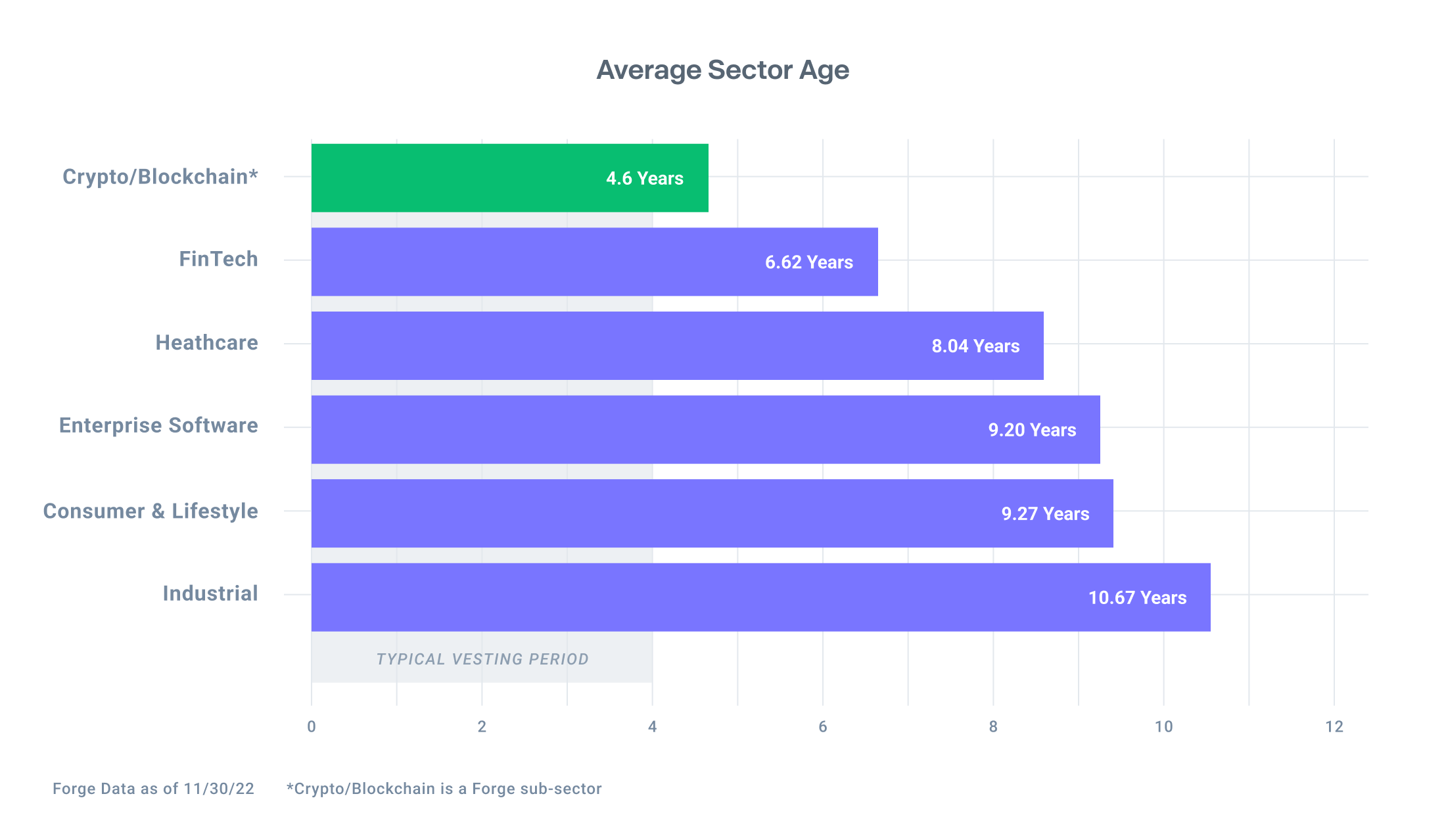

The answer: less than you might think, because of the relative youth of private crypto unicorns.

The average age of cryptocurrency/blockchain companies covered by Forge Data is just 4.63 years. Employees of private market companies typically vest their equity over the course of a four-year grant cycle starting from their hire date – and most employees don’t start on the date the company was founded.

This means there’s a lack of vested stock to transact on the private market and limited pent-up demand from employee shareholders for liquidity compared to other sectors.

Moreover, the rapid growth (and subsequent contraction) of these companies means that many of the largest institutional investors have little exposure to the sector. An insignificant percentage of the 138 mutual funds whose marks are aggregated by Forge Data have exposure to crypto companies, in contrast to longer-tenured sectors like enterprise software, industrial, and the broader fintech category.10

Forge’s goal is to increase private market transparency for all market participants. In 2023, look for more data and insight as we continue our mission to empower more people to exercise ownership in the world's most innovative companies.