How to sell private shares on Forge: A complete guide

Overview

Congratulations on taking the first step in accessing liquidity for your private company shares with Forge. As some of the world’s most innovative companies opt to stay private for longer, many employees are looking to access liquidity for the equity they hold. However, compared with publicly traded securities listed on the NYSE or Nasdaq stock exchanges, transacting in pre-IPO company shares is often more complex, usually requiring significantly more time to execute, and potentially facing more restrictions.

This guide answers key questions, outlines a step-by-step guide to selling your shares on Forge, and addresses how a majority of shares are traded in our marketplace. Please note that because many private companies have idiosyncratic rules and varying levels of sophistication in trading shares, you may encounter additional steps or other requirements in selling your shares.

Your selling options

There are two main ways to sell your private shares on Forge:

1. In a direct transaction, after agreeing to terms (notably price and size), you would sell your shares to an investor on Forge.

2. In a single-company exclusive Forge fund offering, you begin by defining the key terms of the offering—your desired price per share, the total size of the fund and the length of the subscription window, and we work on sourcing demand.

Through this fund structure (that uses a special purpose vehicle, or “SPV”), Forge can aggregate capital from multiple smaller investors into the fund, avoiding the complexity of having to coordinate multiple individual trades. The result is that you get to sell your shares to a single vehicle.

When the subscription period closes and investors' funds are collected into the Forge fund, Forge then notifies the company of a single transaction. This can streamline the process and allow you to receive the proceeds from all the different investors in the fund at the same time.

For a deeper dive into how these fund offerings work, see What Are Forge Fund Offerings and How Do They Work on Forge. For further information on Forge fund offerings, please contact us at [email protected].

Option 1: Sell directly to a buyer through a direct transaction

Direct sales involve several steps, the longest usually being the right of first refusal (ROFR). This involves the company or early investors having the legal right to purchase the shares being offered for sale ahead of an external buyer for the same terms you have agreed to. There is generally a timeframe within which a ROFR must be exercised which can delay the timeline to close a transaction so it is important to understand these procedures (which vary from company to company). For more details on the ROFR process, please see Step 7 (“Notify the company and understand the ROFR process”) below.

Completing a direct transaction often takes approximately 45 to 60 calendar days or more to finalize once matched with an investor, though that time frame can increase or decrease depending on individual circumstances and company nuances.

Option 2: Sell through a Forge fund transaction

In a fund offering, once matched there is a similar timeline and process to that of a direct transaction as the Forge fund will be acting as the counterparty. It is important to note that while the Forge fund is the counterparty that you transact with, the Forge fund would collect funds from participating underlying investors in the fund prior to committing to an investment. Once terms are agreed and funds are collected the company process would begin, please see Step 7 below for more details.

Please note: If you are an investor in an existing Forge fund and would like to explore liquidity for your fund units, generally the transaction process would differ and the timeline would be condensed considerably. In many cases, the timing to finalize a Forge fund redemption such as this can range from as short as approximately five business days to several weeks, depending on the circumstances, including the current level of buyer demand.

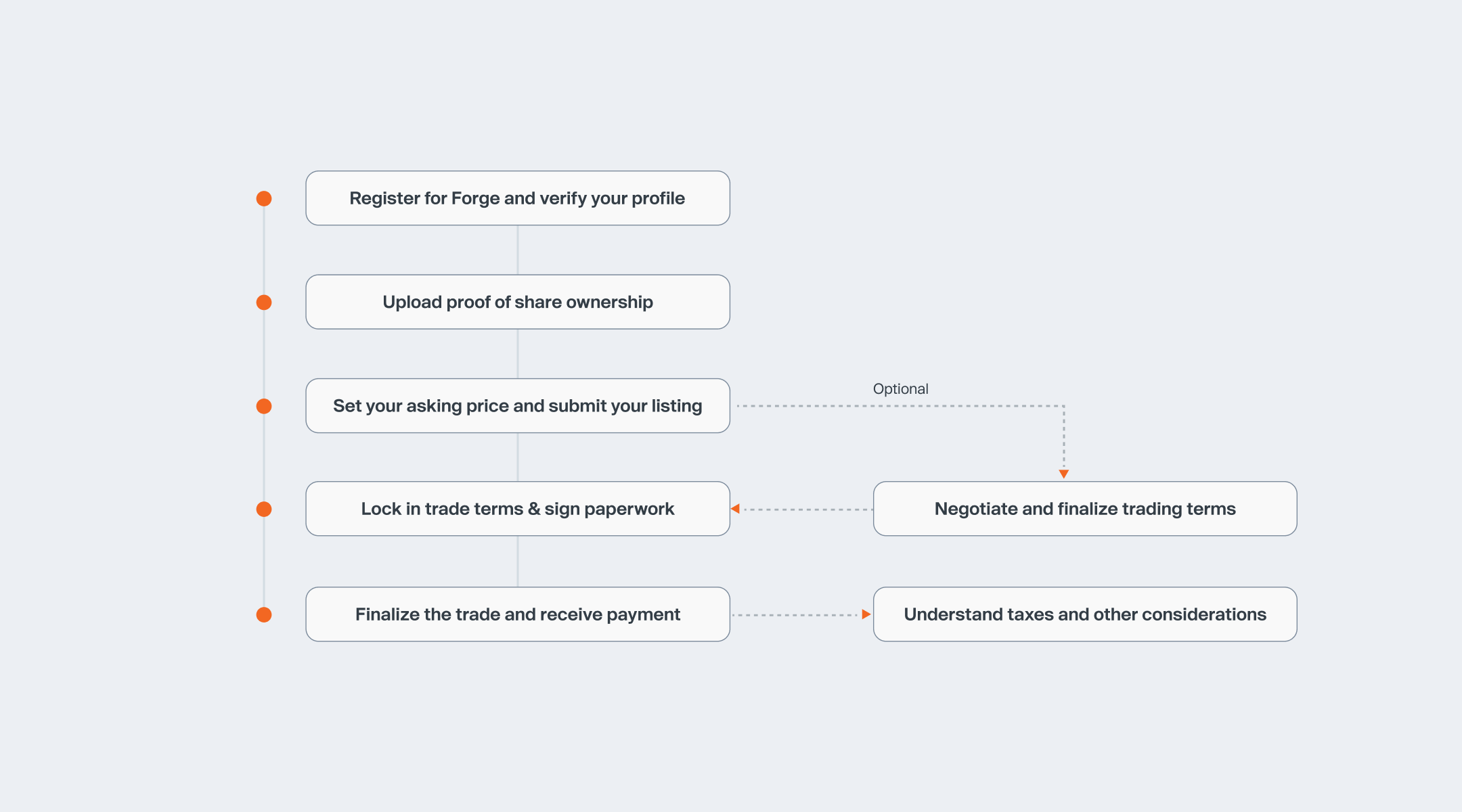

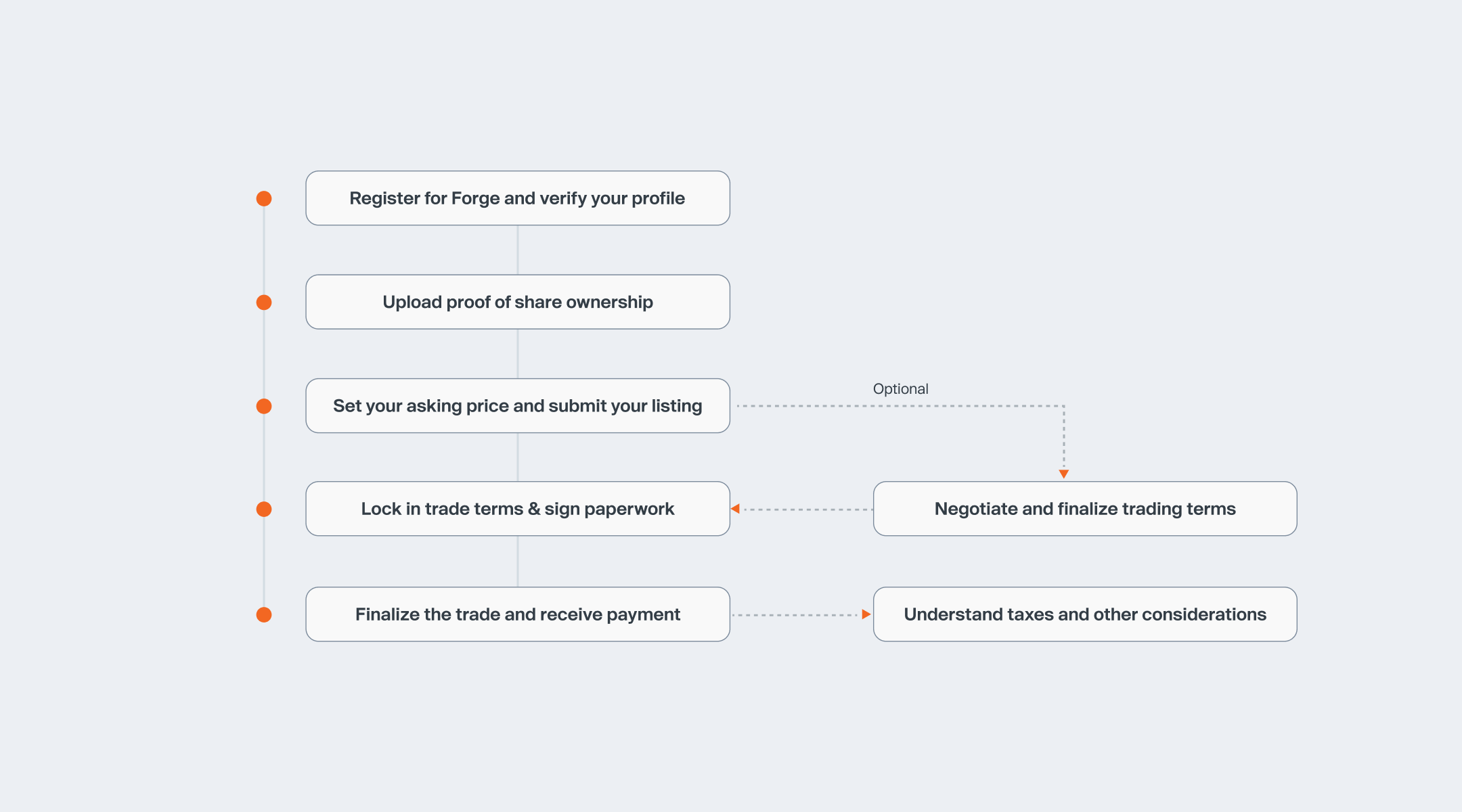

The selling process

Below is the outline of the general steps involved in the selling process. Unless noted, these steps are applicable to both a direct sale of shares and sales through a Forge fund (such as an exclusive Forge Fund offering), while steps that are only applicable to one or the other transaction types are noted. Please bear in mind that some transactions may require additional (or fewer) steps depending on the circumstances, so your experience may differ from this general outline.

Fees

Fees can vary based on the type of transaction, among other considerations. In direct transactions, Forge charges a fee to buyers and sellers. In most direct transactions, seller fees range from approximately 2% to 4% of the total transaction size, though some transactions may be eligible for lower or no fees depending on the circumstances, such as transaction size and market dynamics. Please note that you will see all applicable fees before entering into a trade, and Forge only charges fees on completed transactions.

Seller Minimums

For sellers, minimums vary depending on market dynamics and other factors. The majority of offers to sell start around $100,000. Offers under $100,000 sometimes need to be bundled with other sellers’ shares to find liquidity.

Ultimately, minimums are determined by investor demand, transaction cost and company requirements. Please note that the value of your shares may shift over time as a result of shifting market dynamics, new funding rounds and other company developments.

Selling private company shares: A step-by-step guide

Step 1: Register for Forge

To begin the selling process, you first need to create an account on Forge. Forge does not charge a fee to create an account or to access Forge and join our global network of buyers and sellers. Forge only gets paid upon the completion of a successful transaction.

At this stage, you will need to complete your profile, including confirming your identity by uploading valid identification.

The onboarding steps are key components of transacting on Forge, as all buyers and sellers must be credentialed in order to complete a transaction. This means that the data you see on Forge has been submitted by credentialed users, helping ensure the quality and accuracy of data and a higher likelihood of completing transactions.

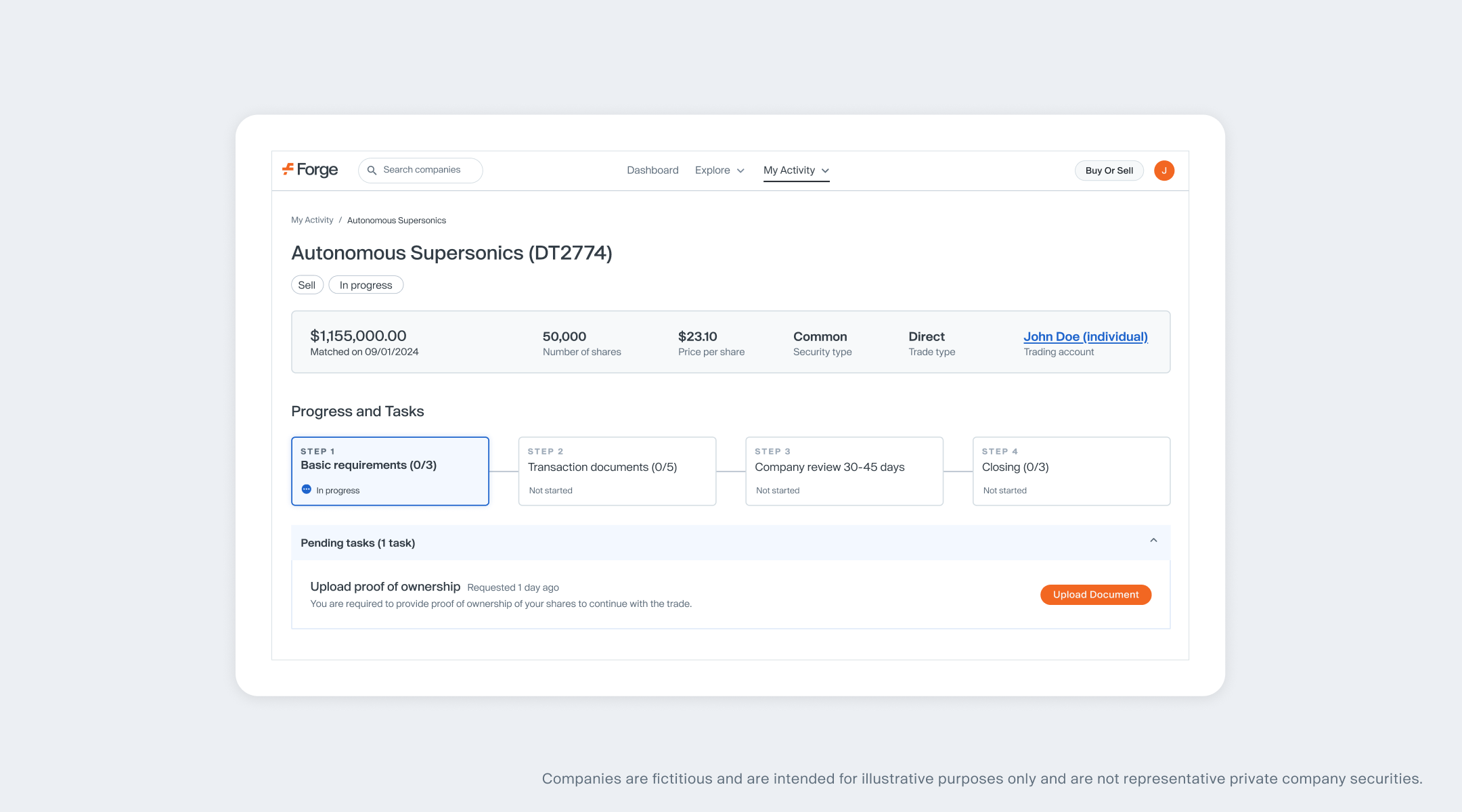

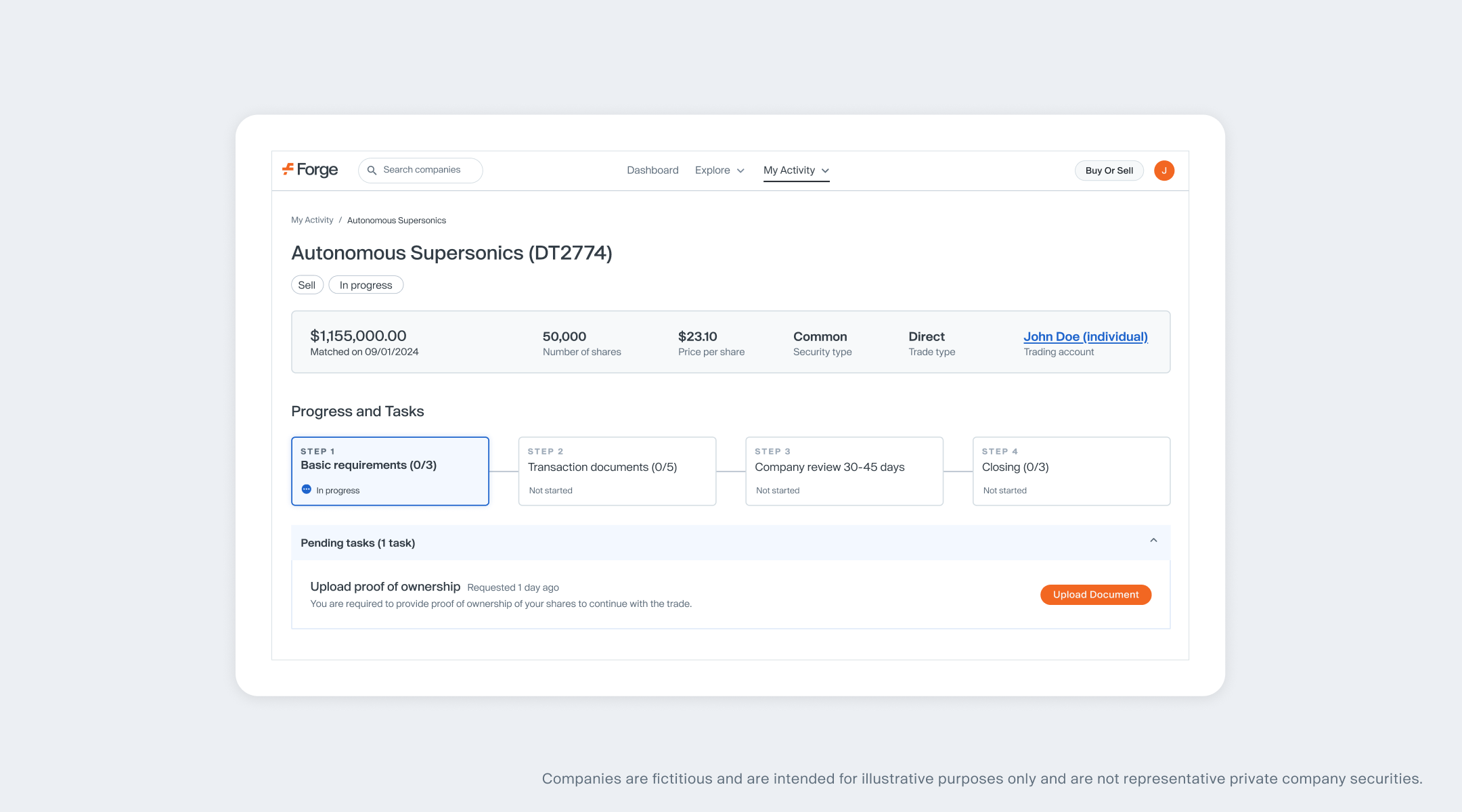

Step 2: Add your holdings and prepare to validate ownership

After you register as a seller on Forge, the first step is to tell us what you own. Your holdings are the types of private shares or options you hold in a company. You can enter these during registration, and afterwards you can see them in the Holdings section of your dashboard (just scroll down).

It’s important to note that adding your holdings is not the same as submitting an ask or an indication of interest to sell. When you’re ready to sell, simply click the Sell button in the Holdings module. You’ll then be prompted to enter the details of your ask and upload your proof of ownership. Providing this proof helps potential buyers feel confident that you truly own the underlying shares or options.

When we request proof of ownership, it could mean confirming that you are the legal owner, an executor of an estate, the control party of a trust, the firm’s authorized signatory, or another authorized representative of the shares.

If you’re not sure how to obtain proof of ownership for private company shares, see our Tips & Tutorials: How to Obtain Proof of Ownership guide for step-by-step instructions.

Step 3: Determine your selling method: Direct or sell through a Forge fund transaction

At this stage, you will likely have the option of selling your shares either directly to a buyer or place an offer to sell indirectly to investors through a Forge fund transaction.

Direct: If you choose to sell your shares directly, you have the potential to be matched to a buyer(s), which provides the option to actively negotiate terms.

Forge fund transactions: If you sell your shares to a Forge fund, you set the price, size and subscription window—and remain committed to those terms until the transaction closes. Timelines and outcomes will still vary by pricing, company, and fund.

Step 4: Research and submit an asking price

Researching a potential share price

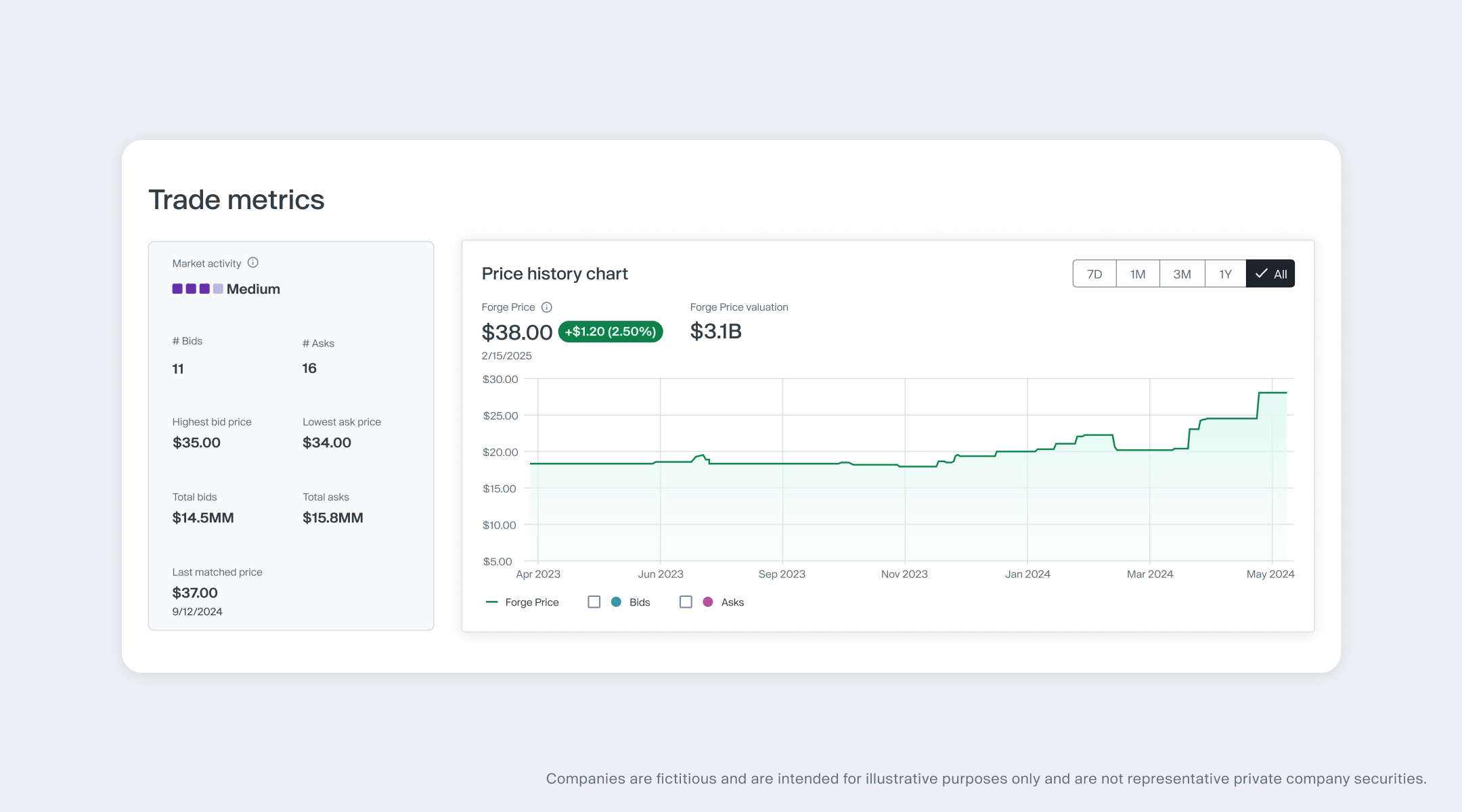

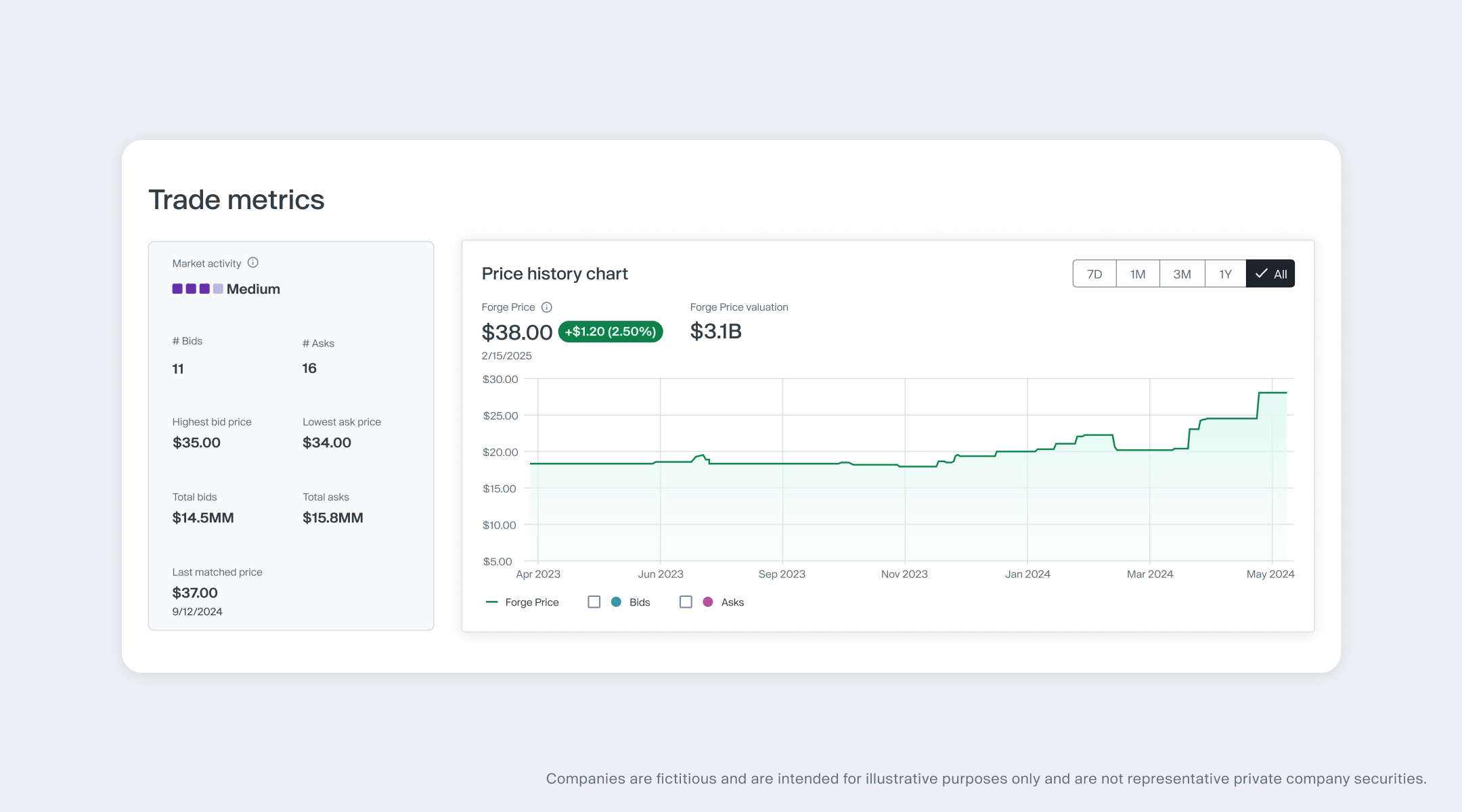

At this stage, you’ll need to determine your desired share price. Like all transactions, buyers and sellers of private shares need to agree on a price to proceed. Again, unlike the public market, which often offers near-instant prices on securities, pricing of pre-IPO company shares is more complex. Forge offers a broad range of data to help you determine the price you’re willing to accept for your shares.

When evaluating market conditions to place an offer, here are some questions to consider:

- What is the lowest current asking price on Forge?

- What is the discount or premium from the company’s last funding round or other liquidity event like a company-sponsored tender offer?

- What is the last-matched price for a closed transaction, and when was it?

- Based on recent transactions, is the company’s price moving upward, downward or staying relatively flat?

- How often has the company’s shares traded recently and at what price range(s)?

For more than 200 companies, you can access a Forge Price™, which is a derived, indicative price that synthesizes data from various sources, including secondary market transactions, recent funding rounds and active bids and asks on Forge. Forge Price™ provides a timely and relevant reflection of company value and price discovery and can serve as a beneficial starting point for sellers seeking a higher likelihood of completing a transaction. However, please note that Forge Price™ is a derived price based on multiple historical data points and may not always be a future-transactable price.

For more in-depth education on how to price your shares, consider reading “Pricing strategies: How to set an asking price for your private shares”.

And if you’re looking for guidance on how to set a potential share price, please contact us at [email protected].

Option 1: Respond to a buyer’s bid by accepting it or negotiating their terms

You can engage with any active bid listed in the market — whether the trade is direct or facilitated through a Forge fund. If the listed terms (price and quantity) work for you, you may accept the bid and move forward with the transaction. If not, you have the option to propose alternate terms (e.g., a lower price or different quantity), initiating a negotiation with the buyer.

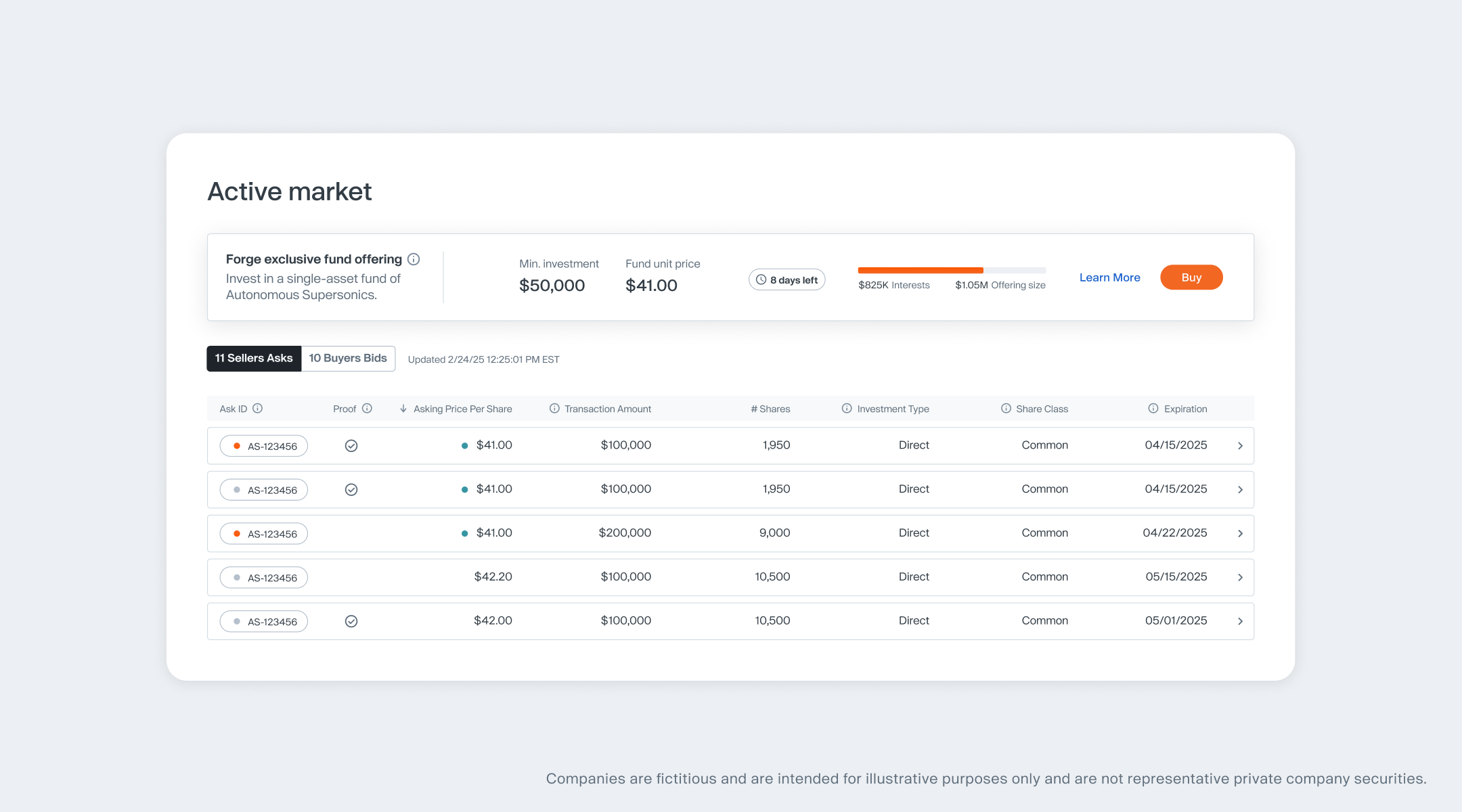

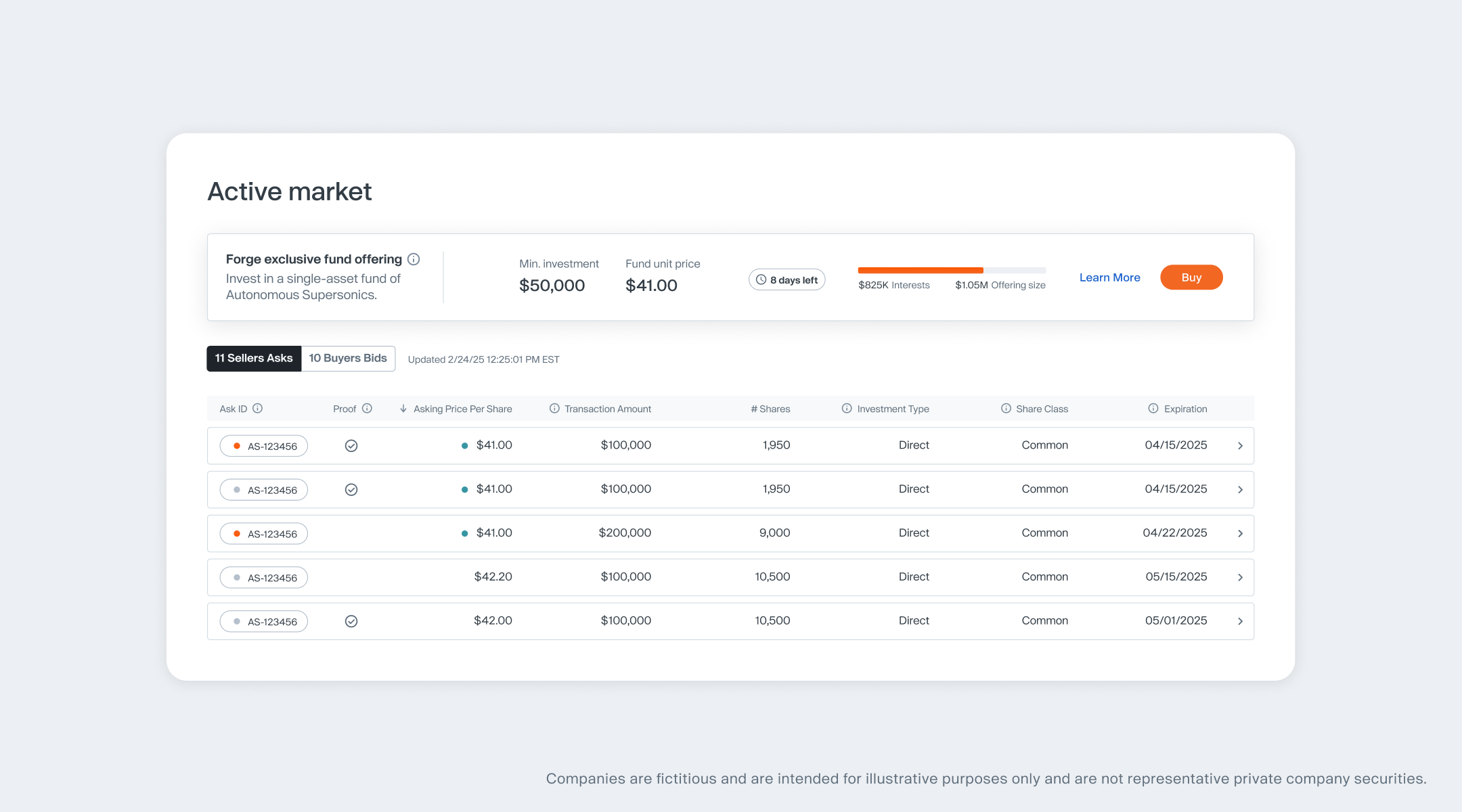

Option 2: Submitting an ask price

If you do not see a current active bid or one that matches your desired price or quantity, you can submit a new asking price. The active market table lists recent bid and ask information, including pricing and share quantities, among other data points. You can use the active market table to see other ask prices and to help set your ask price. If there is a Forge fund available for the Company in which you own shares, you will have the option to sell your shares to the fund. The active market table may indicate that fund units are available to trade, including price information.

Once you submit your ask price, it will show up in the active market table, which buyers (either direct or through a Forge fund) can review and use for negotiation.

Step 5: Negotiate and finalize trading terms

After you have submitted an ask price, you will have the opportunity to negotiate with prospective buyers on the price of your shares. When negotiating, it is important to understand the concept of bid-ask spread. In some circumstances, particularly when markets are volatile, the bid-ask spread might widen, indicating that there is disagreement about what price a private company’s shares should sell at. But if the bid-ask spreads are tight, that is an indication that private market buyers and sellers are in more alignment, which might result in more liquidity.

In the public market, bid-ask spreads can often be as low as one cent due to the broad level of information available for most public securities. However, given the lack of widespread price disclosure of private market stock trades, private market bid-ask spreads can be several percentage points, if not double digits, apart.

Once you have agreed to a price (either via a direct negotiation or via a Forge fund offering transaction), the trade is “accepted” and moves on to the next stages of the process.

Step 6: Sign a selling agreement and complete applicable documents

At this point, you will need to fill out all required paperwork and sign a selling agreement (reiterating the terms that you have agreed to).

The next steps vary depending on the type of transaction. If you are an existing investor in a Forge Fund and are looking to liquidate your previously purchased fund units, can you move to Step 8.

Step 7: Notify the company and understand the ROFR process

In a direct transaction, even after you finalize an agreement with a buyer, the process is not complete. Once you enter into a selling agreement, Forge notifies the company of the pending transaction. In most situations, the company’s Board of Directors will have between 30 and 45 business days to decide to ROFR, though terms may vary significantly between individual companies, and some companies respond more quickly to ROFR requests than others. There may also be legal or other fees required by the issuing company to complete a transaction.

Why would a company choose to exercise its ROFR rights? A company may deem the potential transaction price as too low; they may not want to add another external investor to the company’s cap table, or they may have other reasons. In some cases, an existing stockholder may also have a ROFR in addition to the company. Either way, the ROFR process must be completed before a trade can be finalized. If a company or stockholder decides to exercise their ROFR, you will be selling your shares back to the company or existing stockholder (not to your initial buyer).

Step 8: Finalize the trade process and settle funds

Once all the steps — including ROFR, if applicable — have been completed, the transaction can be finalized.

For a direct transaction, once a Stock Transfer Agreement (STA) has been circulated and signed, the investor (which may be a Forge fund) would distribute the funds to you. This step, depending on the origination of the wire and general banking holidays, can take approximately 1-5 business days.

If the ROFR is exercised, you would continue with the company process which may vary, and you will be wired funds by them. We would charge the Forge Transaction fee when you are wired funds and the transaction closes. Please note that if you are an existing Forge fund investor looking to liquidate currently owned units, once funds have been collected from the fund investors Forge would distribute the net proceeds (sale price minus Forge fees) to you and issue a trade confirmation. This step, depending on the origination of the wire and general banking holidays, can take approximately 1-5 business days.

Step 9: Understand taxes and other considerations

Once you complete the transaction and receive payment for your shares, you will likely be liable for taxes on the proceeds. Please contact your tax professional for advice on how to handle any amounts due and to discuss your individual situation.

Key points to remember

Selling your pre-IPO company shares can help you realize the fruits of your labor and help you build long-term wealth. However, as noted above, the process is not nearly as simple as trading publicly listed stocks, but we are here to help you navigate the process.

Please contact us at [email protected] with any questions along your selling journey.