In addition to several $100 billion+ AI-related companies like Databricks and Anthropic indicating that they'll eventually go public, there's also a significant cohort of smaller AI-related startups (still unicorns, just not quite as large) gearing up for IPOs.

One of those companies is Lambda, an AI infrastructure company. Similar to rival CoreWeave — which went public in 2025 — Lambda enables other companies to rent access to its Nvidia GPUs to run AI workloads. Nvidia is also an investor and major customer of Lambda.4

In September, The Information reported that Lambda hired Morgan Stanley, J.P. Morgan and Citi for an IPO that could come as soon as the first half of 2026.5 Then in November, Lambda raised about $1.5 billion for its Series E, bringing its valuation up to $5.9 billion.6 That somewhat tracked with earlier reporting in August by Mergermarket that Lambda was planning a crossover funding round before an IPO.7

This illustrative timeline is a simplified example and does not represent all paths, requirements, or outcomes for companies considering a public listing.

Most recently, in January 2026, The Information reported that Lambda is now planning to go public in the second half of 2026 and is closing in on raising $350 million in convertible notes as pre-IPO funding, led by Mubadala Capital. The terms of the deal will reportedly include pricing the funding at around a 20% discount to the eventual IPO price, and if Lambda doesn't conduct an IPO within one year, there would be financial penalties.8

Lambda: Company background

Lambda — formerly known as Lambda Labs9 — was founded in 2012 in San Francisco10 by twin brothers Stephen Balaban and Michael Balaban. The company, now based in San Jose, initially provided AI facial recognition and photo editing tools, but their own computing cost from Amazon Web Services (AWS) sparked a pivot. In 2017, Lambda started selling AI hardware, including laptops, workstations, and servers with built-in GPUs, primarily to researchers.11,12

In 2018, Lambda started selling cloud services, which it has increasingly shifted to over the years, as the demand for access to Nvidia chips has grown in the generative AI era.13 By August 2025, Lambda shut down its on-premise hardware business14 and now focuses on AI cloud services and building out data centers it calls AI factories. In some cases, these AI factories can be dedicated for a single customer's exclusive use.15

Competing amongst Neocloud and Hyperscalers for AI workloads

Lambda has grown substantially over the years. In 2022, it had estimated annual revenue of $20 million, according to Sacra.16 In comparison, in just the first half of 2025, revenue reached over $250 million, a 33% increase over the prior year, according to The Information.17 The publication later reported that Lambda's revenue hit over $520 million from October 2024 to September 2025, with Q3 sales up 80% year over year. However, the company reportedly had around a $175 million loss during this period.18

This revenue growth coincided with Lambda transitioning from primarily an AI hardware to an AI cloud business. Revenue from these segments flipped in mid-2024, with cloud taking the lead with around $250 million in annualized revenue vs. around $150 million for hardware, according to Sacra.19

Now, with Lambda more entrenched in the AI cloud market, it finds itself competing more directly with neocloud rivals like CoreWeave, Nebius and Crusoe. These tend to provide lower pricing than hyperscalers like AWS, Azure and Google, which have some incumbency advantages, according to Network World.20

At the same time, AI demand is growing so rapidly that enterprises may need to choose multiple providers among both neoclouds and hyperscalers. Nvidia, for example, has a similar multi-pronged relationship with CoreWeave as it does with Lambda.21

In November 2025, Lambda also announced a multi-billion-dollar AI infrastructure agreement with Microsoft, expanding a relationship the two have had since 2018.22 So even though Microsoft has its own Azure unit, there can be capacity constraints that enable some coopetition.

From a stock price perspective, however, the demand might not be quite the same. As a Newcomer analysis showed, Lambda might be going public in an unfriendly environment, with some investors getting concerned about issues like some cloud providers' debt and data center buildout delays. In particular, CoreWeave and Oracle stock had big dips in late 2025.23

Lambda stock price history

Lambda's Forge Price is $62.00 as of early February 2026, nearly three times its price of $22.71 a year ago.24

Forge Data as of 02/11/2026

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information and secondary market transactions on Forge.

Lambda funding history and private market valuation

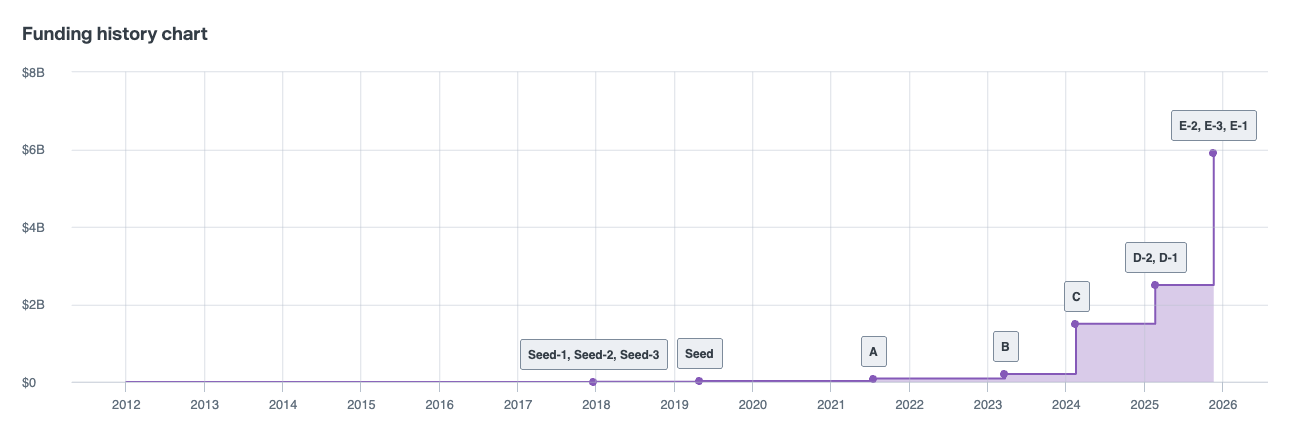

Lambda's funding history includes raising $715,000 for a seed round in 2017 at a $4.54 million valuation, as well as raising nearly $4 million in 2019, which was also a seed round, bringing its valuation to $23.23 million.25

In 2021, Lambda's Series A raised $15 million at a $87.51 million valuation. This grew to $205.08 million with the Lambda Series B in 2023, which raised $44.41 million.26

A year later, in 2024, Lambda reached unicorn status, with its Series C raising $320 million at a $1.5 billion valuation.27

Another year later, in early 2025, Lambda's Series D raised $480 million at a $2.5 billion valuation, and in November 2025, Lambda's Series E raised about $1.5 billion, bringing its valuation up to $5.9 billion.28

Some of Lambda's investors over the years have included 1517 Fund, Andra Capital, B Capital, Bloomberg Beta, Gradient Ventures, Mercato Partners, Nvidia, SGW, TWG Global and US Innovative Technology Fund, to name a few.29

Lambda is also reportedly in the process of raising $350 million in pre-IPO financing, led by Mubadala Capital.30

Forge Data as of 02/06/2026

Looking ahead

Although Lambda has not announced specific IPO plans, reporting indicates that it is intent to go public within the next year, given the potential non-IPO penalties said to be structured in its current financing talks.31

Check back here or take a look at Forge’s upcoming IPO calendar to stay in the loop about a potential Lambda IPO and other pending public offerings.

For now, as it remains a private company, investors interested in exploring potential private market access to companies like Lambda pre-IPO, can create an account with Forge marketplace to access our deep marketplace of private market securities if/when shares become available.

After you create a free account, you may be able to buy and sell private market shares in Lambda and other startups, subject to eligibility and inventory.

Forge provides tools and data designed to help qualified investors navigate private market information, and as a publicly traded company, it operates within a regulated environment that allows participants to explore potential new opportunities.