AI exuberance has helped fuel extraordinary returns for many AI-related private market companies like OpenAI, Anthropic, and xAI,2 along with public market companies like AI chip leader Nvidia.3 But it’s not just the largest AI names making moves. The AI search engine Perplexity is another example of an AI company that may be a bit smaller than those in the Private Magnificent 7, but it's been growing exponentially.4

So far, though, Perplexity has not announced any plans for an IPO, nor have there been any significant rumors of one. And while investors can often trade private market shares of popular venture-backed startups through Forge’s next-generation marketplace, that may be difficult to do for Perplexity at this time.

In our experience, Perplexity usually doesn't allow for direct transfers of shares. Instead, investing in Perplexity stock pre-IPO may need to occur through other vehicles, e.g., investing in a VC fund that has already invested in one of Perplexity’s primary funding rounds.

That said, you can submit bids for pre-IPO Perplexity stock. Perplexity made the top 10 list in Q3 for companies with the highest investor demand on Forge.5 If Perplexity shares become available for pre-IPO trading, we will follow up with you if the bid is competitive.

Meanwhile, investors may still be able to gain indirect or correlated exposure to Perplexity stock pre-IPO through other assets, as we’ll examine in this guide.

Perplexity: Company background

Perplexity was founded in 2022,6 the same year ChatGPT was publicly released.7 However, Perplexity differs from ChatGPT and other large language models (LLMs) in that its core focus is its AI-powered search engine. The platform connects to ChatGPT and other LLMs — including its proprietary Sonar model built on top of Meta’s open-source LLM8 — to scour the internet and quickly provide searchers with summarized results and references.

Perplexity has also expanded into additional areas, such as launching its own browser — called Comet9 — as well as additional features for paid subscribers, like an autonomous email assistant for those on its highest-tier plan.10

The company was founded by Aravind Srinivas, Denis Yarats, Johnny Ho, and Andy Konwinski, each bringing strong technical pedigrees. CEO Srinivas previously worked as an AI researcher at OpenAI,11 and CSO Ho previously worked as an engineer at Quora and as a quantitative trader at Tower Research Capital.12

In early 2025, Perplexity crossed $100 million in annual recurring revenue13 and had 22 million active users as of the first half of 2025.14

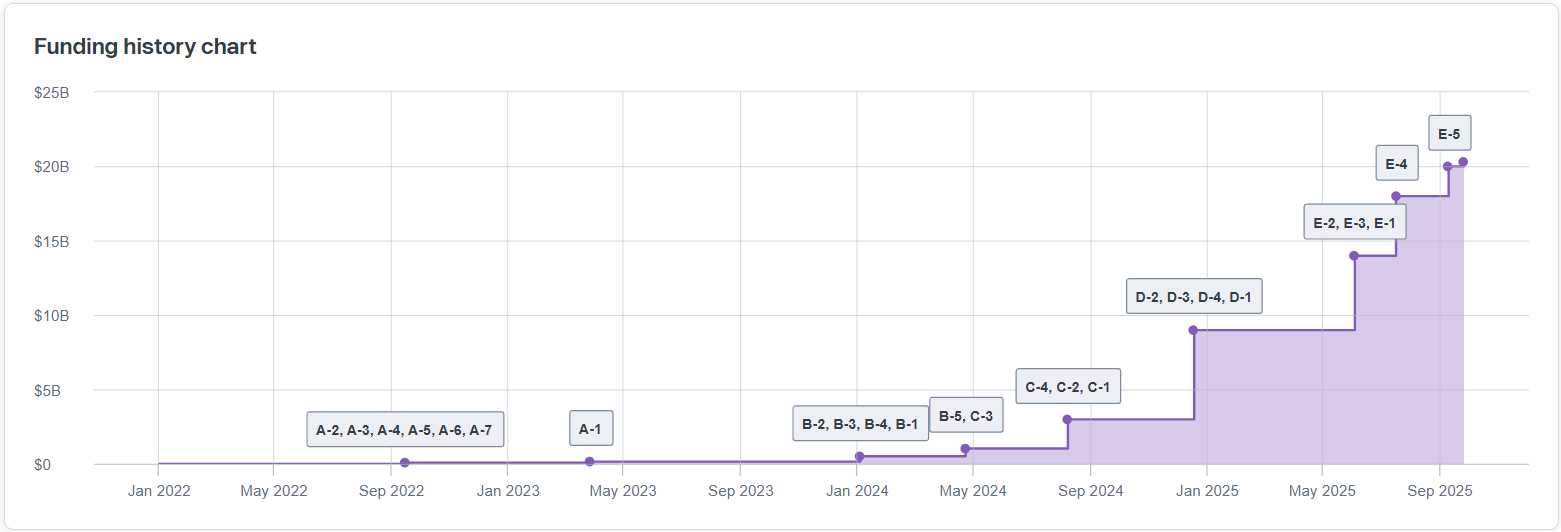

Perplexity's stock started at an implied price of $0.83 after raising $1 million in September 2022 at a $91.84 million valuation, though this was part of a multi-phase Series A. That round eventually closed in early 2023, when Perplexity raised almost $26 million at a valuation over $162 million and an $8.91 stock price.15

In 2024, Perplexity closed a multi-phase Series B, ending at a $1.04 billion valuation and a stock price of $47.77. A few months later, another multi-phase Series A tranche brought the stock price up to $119.23 and a $3 billion valuation. By the end of 2024, Perplexity's multi-step Series D tripled its valuation to $9 billion, with the stock price rising to $328.87.16

So far in 2025, Perplexity's fundraising has continued ramping up through a multi-phase Series E, jumping to a $14 billion valuation and $547.04 stock price in June, followed by an $18 billion valuation and $629.49 stock price in July.17

Note that while Forge has tracked a Series E-6 at a $20.3 billion valuation from a $500 million funding round in September 2025, as part of our waterfall and valuation models based on the most recent available Certificate of Incorporation for Perplexity, we have not yet found independent public information confirming that Perplexity's Series E-6 round has been completed. If confirmed, that would bring Perplexity's total funding to date to over $2 billion.18

Still, even without that round, public sources corroborate19 that Perplexity did raise $200 million in September for its Series E-5, similarly at a $20 billion valuation. Now, Perplexity's Forge Price sits at $695.44.20

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies. It is calculated using a proprietary model that incorporates pricing inputs from primary funding round information, secondary market transactions, and volume of bids/asks on the Forge marketplace.

Perplexity's investors include a mix of angel investors such as Elad Gil and Nat Friedman; venture capital firms including IVP, New Enterprise Associates, and Accel; and other investors such as Nvidia, T. Rowe Price, and SoftBank.21

How to buy Perplexity stock

As a private company, Perplexity's stock is not for sale to the general public, and at this time its shares are generally not available for direct trading on Forge. However, interested investors can still submit bids for Perplexity stock, and we will contact you if shares become available. Or, you can trade other available private market shares that might provide similar AI-related exposure. Note that you generally need to be an accredited investor to trade private company shares.

Another option, likely available only to select high-net-worth investors or institutions, is to invest in private market funds that hold Perplexity shares.

Who can invest in Perplexity pre-IPO?

U.S. regulations generally limit private companies when offering securities for sale, so even if Perplexity stock were more widely available pre-IPO, investment would primarily be limited to accredited investors.

For those who have the opportunity to invest in Perplexity through private investment funds, you likely need to be an accredited investor while also meeting a high minimum investment requirement, which can vary by fund but may be hundreds of thousands of dollars or more.

Where to buy pre-IPO Perplexity stock

As mentioned, pre-IPO Perplexity stock is not available to the general public, and shares are generally not available for direct trading on secondary marketplaces like Forge at this time. Outside of primary funding rounds or vehicles such as venture capital funds that may hold Perplexity shares, pre-IPO investment might not be possible. However, this could change as Perplexity matures.

If you're interested in investing in Perplexity stock pre-IPO, create an account with Forge and add Perplexity to your watchlist to stay updated on potential availability.

Alternatives for investors who want to buy Perplexity stock

While retail investors can't directly invest in Perplexity currently, there may be ways to gain exposure on an indirect or correlated basis through other assets.

For example, Perplexity reportedly attempted to bid for the Google Chrome browser in August 2025,22 which highlights the competitive overlap between Perplexity and Google—though Perplexity remains far smaller. Investors may gain AI search exposure by investing in publicly traded companies such as Alphabet, Google’s parent company.

Perplexity has also received investment from Nvidia. While Nvidia's stock price is driven by many factors beyond Perplexity, investing in Nvidia may provide indirect exposure through both its AI leadership and its investment in Perplexity.

Similarly, retail investors might consider investing in a basket of AI-related companies—such as through a technology-focused ETF—to gain diversified exposure to the sector.

T. Rowe Price has also invested in Perplexity, and while the investment manager has not seemed to open up shares to retail investors, it's possible that some could make their way into T. Rowe Price publicly traded funds in the future. Meanwhile, T. Rowe is a publicly traded company, so buying its stock could provide slight exposure to Perplexity, although T. Rowe has vast quantities of other investments. Still, it could provide a different side of exposure to the AI trade, such as if financial services companies gain based on helping AI companies secure financing, while also potentially benefiting from equity investments that they may have in AI companies.

How to analyze Perplexity stock

Given that private companies provide limited financial details, it can be difficult and highly subjective to analyze Perplexity stock. Still, the company has disclosed some data, such as crossing $100 million in annual recurring revenue in early 2025, which investors might use as a benchmark when comparing the valuations of other startups that hit that revenue mark in a similar timeframe.23

Investors can also review the funding history and valuation growth of Perplexity in comparison to other private market companies by exploring Forge's private stock marketplace. In addition to looking at real-world market signals informing Perplexity's current Forge Price, investors can discover other available investments and review market interest signals in real time. Seeing how other AI-related startups are trading on Forge could help you determine what seems like a fair valuation for Perplexity in your estimation.

Granted, private market shares generally lack the liquidity and transparency of public market shares. So, even with real-time pricing insights on Forge, there can be more subjectivity involved in analyzing Perplexity stock, along with the valuations of other private market companies.

Get ready to invest in Perplexity on Forge

If you want to invest in Perplexity pre-IPO if/when shares become available, create an account with Forge to access our next-generation marketplace of private market shares.

When you create a free account, you'll access additional company and transaction details, and from there you can potentially buy and sell private market shares in Perplexity, along with investing in other startups.

Forge stands out for its transparency into what can otherwise be an opaque private market, and as a publicly traded company itself, Forge provides a regulated, proven way to invest in the private market.