The fintech market has been somewhat of a mixed bag in recent years, with a pandemic-era boom,3 followed by a funding slowing down in recent years.4 But some fintechs like Mercury have powered through.

Largely focused on business banking and accounting-related offerings, Mercury rapidly grew during the pandemic to reach unicorn status in 2021, and most recently it hit a $3.5 billion valuation with a March 2025 Series C.5

Mercury also took a big step in December 2025 by applying for a national bank charter through Office of the Comptroller of the Currency (OCC), as well as federal deposit insurance with the Federal Deposit Insurance Corporation (FDIC).6

Eventually, the company wants to go public, but there's no specific timeline, according to co-founder and CEO Immad Akhund. So, in the meantime, this latest funding round will help provide employee liquidity via a tender offer.7

Meanwhile, interested investors may still be able to invest in Mercury stock pre-IPO through a private marketplace like Forge. Retail investors may also be able to gain indirect exposure through other assets, as we'll examine in this post.

Mercury: Company background

Mercury was founded in 2017 in San Francisco by Immad Akhund, Max Tagher, and Jason Zhang.8 Akhund previously cofounded mobile adtech startup Heyzap, later sold for $45 million, which Tagher and Zhang also joined.9

Mercury launched its product in 2019, focused on business checking and savings, which then integrates with a broader suite of related tools in areas like treasury and accounting. Mercury also started offering a personal banking product in 2024.10 Still, its core focus arguably remains on businesses, particularly startups.

Like some other fintechs that have gained popularity in recent years, Mercury has been offering financial products like deposit accounts via partnerships with FDIC-insured banks. However, Mercury has applied for a national charter and for FDIC inclusion, which could make it more of a full-fledged bank, not just a software layer.11

Mercury stock and funding history

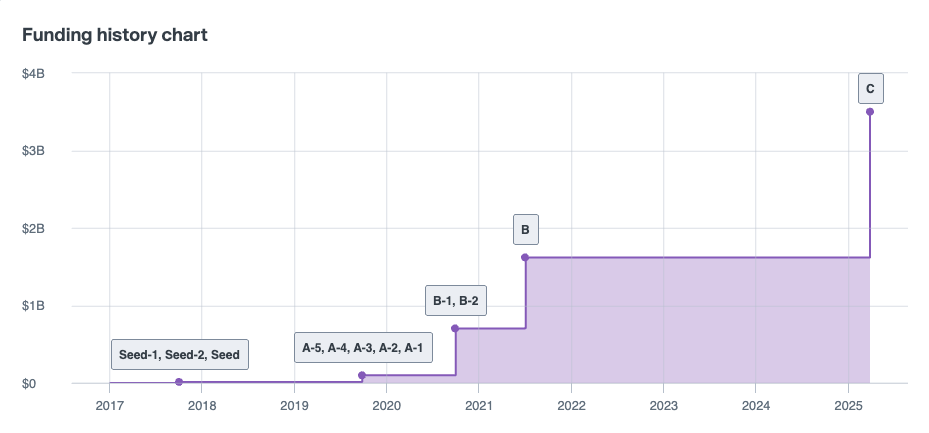

Mercury has raised over $450 million since its founding, starting with approximately $5 million in seed funding in 2017 that valued the company at $14.27 million, with its implied stock price as high as $0.18.12

In 2019, a multi-part Series A raised over $22 million at a $100 million valuation and a stock price as high as $0.60. This round included investors such as CRV, Andreessen Horowitz, and NBA players Kevin Durant and Andre Iguodala.13

In 2020, Mercury raised over $19 million for part of its Series B from Caffeinated Capital and Catapult VC, bringing its stock price all the way up to $3.84 and its valuation over $700 million. Mercury completed its Series B in 2021, raising well over $100 million at a $1.6 billion valuation and a stock price of $7.68. This round added investors such as Coatue Management and Sapphire Ventures.14

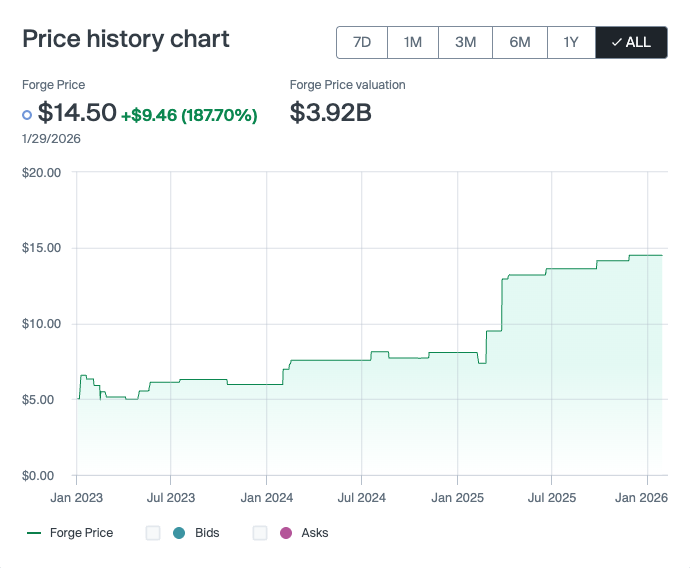

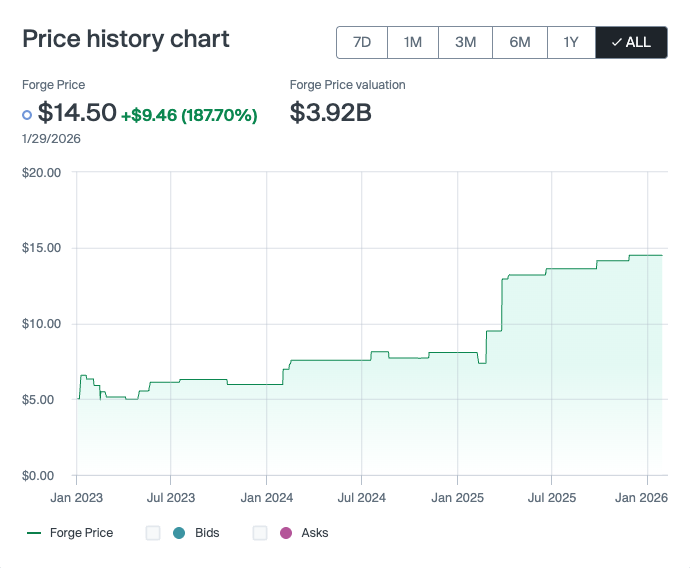

Most recently, the Mercury Series C in March 2025 raised $300 million in primary and secondary funding at a $3.5 billion valuation.15 This round brought Mercury's stock price up to $12.93.16

Since then, Mercury's Forge Price has climbed a bit more to $14.50, implying a $3.92 billion valuation — a 12% increase since its Series C.17

As of 1/1/2026

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions on Forge.

How to buy Mercury stock

While Mercury's CEO has indicated going public is eventually in the cards, for now its stock is not for sale to the general public. However, accredited investors may be able to buy Mercury stock through Forge's next-generation marketplace for private market trades, subject to availability.

Forge's technology and relationships help facilitate the trading of private company shares in companies like Mercury, along with other private market fintech companies.

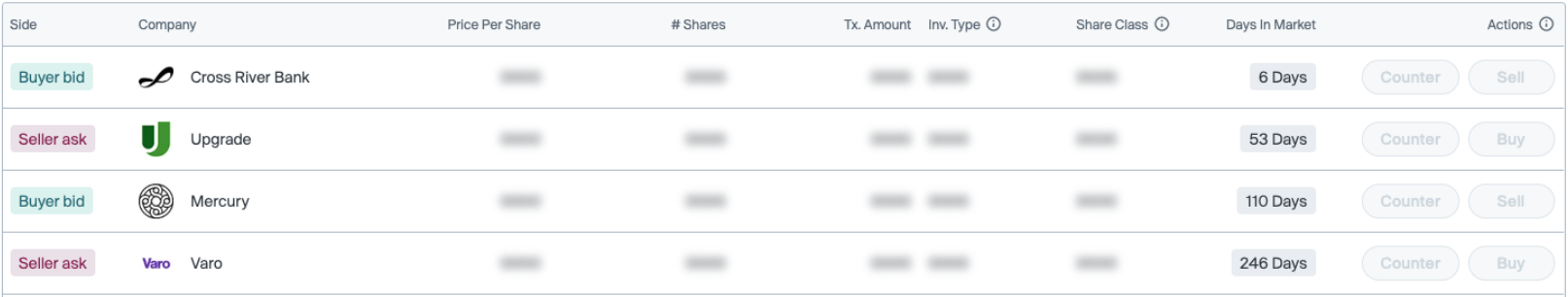

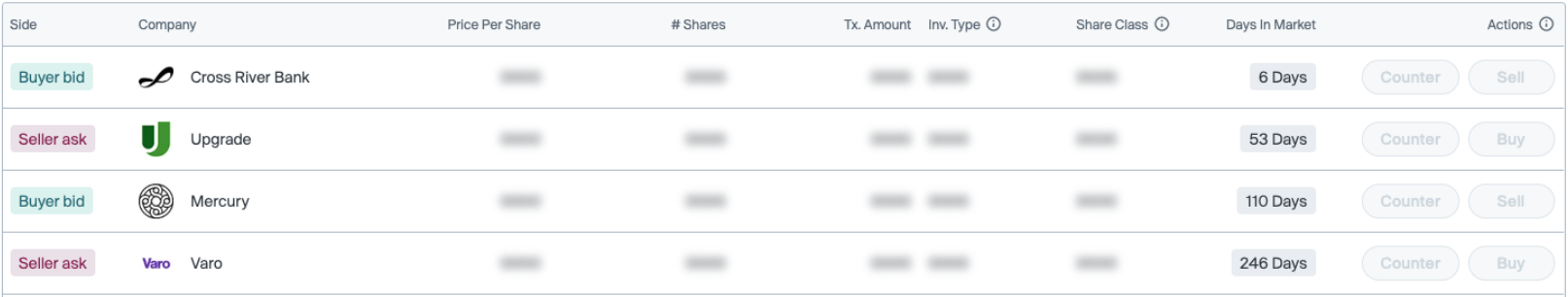

For indirect exposure, investors could also explore opportunities to gain exposure by buying private market shares in other types of finance or fintech companies like:

- Cross River Bank: A Banking-as-a-Service (BaaS) provider, offering financial infrastructure technology to other fintech and finance companies

- Upgrade: A consumer-focused fintech specializing in areas like lending and deposit accounts

- Varo: Another fintech that's similar to Upgrade, although Varo has its own charter

Who can invest in Mercury pre-IPO?

Investment in a non-public company like Mercury is typically limited to accredited investors, due to U.S. regulations that generally restrict the offer and sale of private company securities to such investors.

Some large accredited investors, such as VC funds and certain high-net-worth individuals, may be able to invest in Mercury if selected to participate in primary funding rounds or strategic investment partnerships. Smaller accredited investors may find it more practical to buy Mercury stock through a private stock marketplace like Forge, subject to the availability of shares.

Where to buy pre-IPO Mercury stock

While pre-IPO Mercury stock is not for sale to the general public, accredited investors may be able to find shares for sale through a private marketplace such as Forge for private market trading.

Through Forge, you can access Mercury's Forge Price, which provides real-time transparency by synthesizing data from various sources, including secondary market transactions, recent funding rounds and active bids and asks on Forge.

For registered investors with a verified profile may also explore Forge’s active opportunities for companies similar to Mercury in the Digital Banking sector.

Sample of active opportunities available on Forge marketplace as of 1/9/2026

Image displayed is for illustrative purposes only

Potential indirect exposure to Mercury for non-accredited investors

While retail investors may be able to one day invest in Mercury if it goes public, for now, direct pre-IPO investment in Mercury is generally limited to accredited investors. However, there are publicly available investment options that may provide exposure to broader trends in the fintech or financial services sectors, which could, in turn, impact companies like Mercury.

Some examples include:

1. Publicly traded fintechs

Several publicly traded fintech companies compete or share some similarities with Mercury, such as Chime, SoFi, Wise, and Bill Holdings. However, performance may differ depending on factors like how these fintechs fare in competing for customers, expanding product lines, and optimizing capital.

2. Publicly traded legacy banks and financial software firms

While Mercury is trying to disrupt traditional business banking and accounting, its offerings still overlap in many ways with what legacy firms offer, ranging from JPMorgan Chase to Intuit. However, these legacy companies are significantly larger and have much broader offerings across retail and business customers. Moreover, market-wide factors like economic growth and interest rates may affect legacy firms and startups like Mercury differently.

3. Broader fintech/financial sector funds

Similar to investing in some fintech or financial services companies directly, investors could also consider more diversified fintech or finance industry ETFs or mutual funds. These funds may hold a broader basket of companies that may share some similarities with Mercury but also might cover areas that Mercury does not touch, like financial advisory services, insurance, or real estate investing. As such, performance may differ based on a variety of market-wide factors, depending on the specific funds you might be exploring.

How to analyze Mercury stock

Private companies generally do not face the same disclosure requirements as public companies, which can make analyzing Mercury stock challenging.

However, you can look at the financial data that has been publicly disclosed. For example, in a recent press release announcing it applied for a national bank charter, Mercury noted that the company has 200,000+ customers, $650 million in annualized revenue, and three years of GAAP profitability.18

If Mercury does gain its charter, then it would also have to file quarterly call reports with the Federal Financial Institutions Examination Council (FFIEC), which could make analyzing Mercury stock more viable.

Still, investors might compare what Mercury has publicly shared already vs. similar disclosed data from private market fintech companies. That, combined with reviewing Mercury's valuation data across its funding rounds and its current Forge Price, could help investors determine how Mercury's stock compares to similar private companies listed on Forge's private stock marketplace.

In addition to looking at real-world market signals informing Mercury's current Forge Price, investors can discover other available investments and review market interest signals in real time. Seeing how other fintech companies are trading on Forge could help you determine what seems like a fair valuation for Mercury. There also might be some parallels to draw with public market fintech companies.

Still, even when looking at what Mercury has disclosed and the real-time pricing insights on Forge, private market stocks are generally more opaque than public market ones. So, there can be more subjectivity involved in analyzing Mercury stock, along with the valuations of other private market companies.

Get started investing in Mercury on Forge

If you're interested in investing in Mercury before a potential IPO and shares become available, you can open a free Forge account to explore one of the most established marketplaces for private company securities.

Once your account is active and your accreditation is verified, you may gain access to real-time private market data, context-rich insights and a platform built for self-directed investors.

Not sure where to begin? Start with our buyer’s guide to investing in private market shares. And if questions come up along the way, Forge’s experienced specialists are available to support you.