While the AI industry may be capturing most of the investment headlines lately, the aerospace & defense (A&D) sector is also on a tear. In fact, in both September and October 2025, the Forge thematic basket of A&D4 private market stocks outperformed the Forge AI thematic basket.5 And over the past year, the A&D basket is up around 139%, almost as much as the whopping 171% gain for AI.6

Much of that A&D growth over the past year has come from companies like Anduril and SpaceX, but there are many other private market companies that could also be worth reviewing — even if they don't have the same gains to show for it yet.

For example, Loft Orbital is an A&D startup that provides space-infrastructure-as-a-service. While its performance of late has trended downward, zooming out still shows a significant growth story, such as by nearly reaching unicorn status with its last primary funding round in early 2025.7 Meanwhile, Loft is enmeshed in a sector with rapidly evolving technology, including overlap with AI, such as for image detection from space.8

For now, Loft has not made any public announcements about seeking an IPO, so interested investors might look at investing in private market shares of Loft Orbital through Forge's next-generation marketplace for accredited investors.

Non-accredited investors may also be able to gain indirect or related exposure to Loft Orbital stock through other avenues, as we'll explore in this guide on how to invest in Loft Orbital stock pre-IPO.

Loft Orbital: Company background

Loft Orbital, founded in 2017 and based in San Francisco, is a hardware and software provider that sells space-infrastructure-as-a-service. Essentially, customers rent space on Loft Orbital's satellite buses, such as putting their own cameras and sensors on Loft's buses, rather than customers having to build and launch their own satellites to get their payloads into space.9

Loft buys generic satellite buses (buses are the main bodies of satellites) from other manufacturers and launches them through partners such as SpaceX.10 Loft's proprietary technology then enables customers' payloads to easily integrate with the satellite bus. Customers can also use Loft's software to run applications, including virtual missions, such as using existing sensors to monitor issues such as border security or wildfire detection.11

Sitting at the infrastructure layer also means that Loft overlaps with many other A&D companies, such as with Anduril being a customer, along with NASA and tech companies like Microsoft.12

Loft was founded by Antoine de Chassy, Alexander Greenberg and Pierre-Damien Vaujour, who all previously worked for Spire, a nanosatellite company.13

Loft Orbital history and funding history

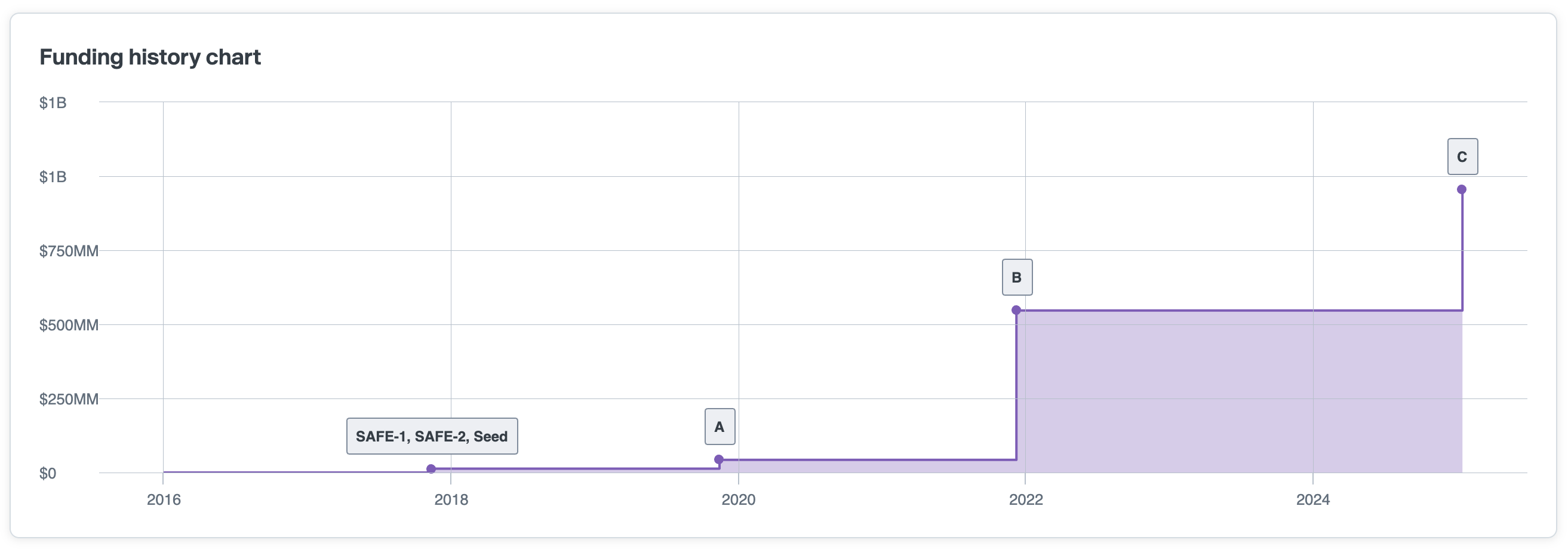

Loft Orbital started in 2017 with Simple Agreement for Future Equity (SAFE) rounds and a seed round that combined brought in about $3.2 million, valuing the company at $12.91 million, with its implied stock price as high as $1.15 per share.14

Two years later, in late 2019, the Loft Orbital Series A raised a little over $13 million, bringing the stock price to $2.20 and valuation to nearly $43 million. About two years later, at the end of 2021, Loft Orbital took a big leap forward with its Series B, raising $130 million at a valuation of nearly $550 million, bringing its stock price to $18.31.15

Loft Orbital's most recent primary funding round came in January 2025, which was also its largest round, raising $170 million for its Series C at a valuation just shy of $1 billion and a stock price of $24.77.16

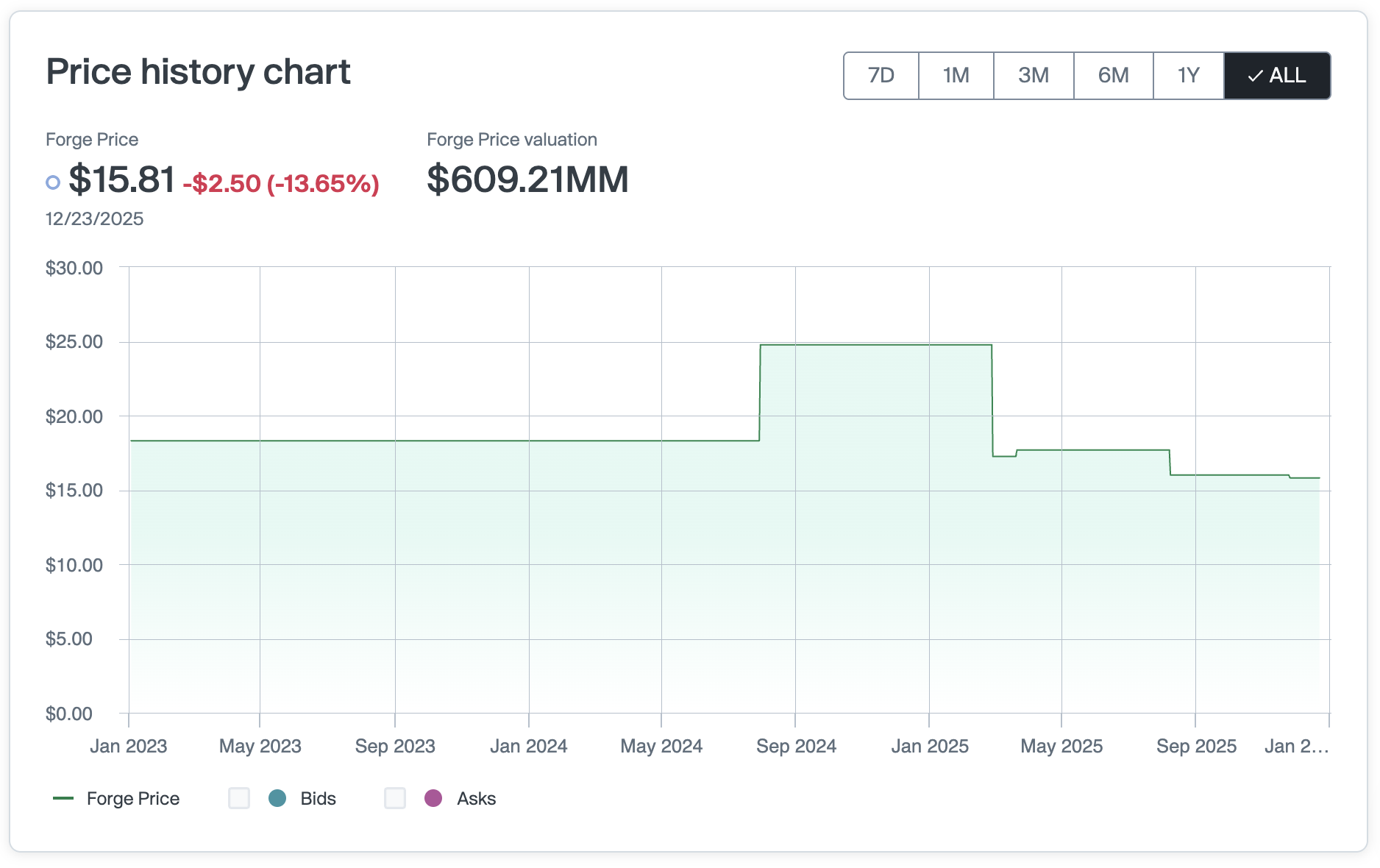

However, Loft Orbital's Forge Price has dipped since that funding round, coming back down to $15.81 as of early December 2025, implying a valuation of about $609 million.17

Forge Price is a derived data point that reflects the up-to-date price performance of venture-backed, late-stage companies, and is calculated based on a proprietary model incorporating pricing inputs from primary funding round information, secondary market transactions, and indications of interest (IOIs) on Forge.

Some of Loft Orbital's investors include Uncork Capital, Foundation Capital, Bpifrance, Ubiquity VC, Tikehau Capital, and Axial Partners, among several others.18

How to buy Loft Orbital stock

Unless it conducts an IPO in the future, Loft Orbital's stock is not for sale to the general public. However, accredited investors may be able to buy Loft Orbital stock through Forge's next-generation marketplace for private market trades, subject to availability.

Forge's technology and relationships helps facilitate the trade of private company shares in companies like Loft Orbital, along with other private market A&D companies.

Who can invest in Loft Orbital pre-IPO?

Typically, investment in Loft Orbital pre-IPO is limited to accredited investors, due to U.S. regulations that generally limit private companies when offering securities for sale.

Some accredited investors, such as VC funds and other institutional investors, may be able to invest in Loft Orbital if selected to participate in primary funding rounds or strategic investment partnerships. Smaller (but still accredited) individuals may seek to buy Loft Orbital stock through a private stock marketplace like Forge, subject to the availability of shares.

Where to buy pre-IPO Loft Orbital stock

Although pre-IPO Loft Orbital stock is not for sale to the general public, accredited investors may be able to find shares for sale through Forge's marketplace for private market trading.

Through Forge, you can access Loft Orbital's Forge Price, which provides real-time transparency by synthesizing data from various sources, including secondary market transactions, recent funding rounds and active bids and asks on Forge. These contextual pricing insights may help private market investors determine whether to accept or negotiate an existing ask, or see if they want to create a new bid for Loft Orbital shares.

Potential indirect exposure to Loft Orbital for non-accredited investors

While unaccredited investors are generally unable to invest directly in Loft Orbital pre-IPO shares, they may explore potential indirect exposure through other publicly traded entities.

1. Public companies associated with Loft

Some investors consider publicly listed companies that have commercial relationships with Loft, such as Microsoft or BAE Systems. These companies operate across many business areas, so any stock price movements may reflect broader industry trends, such as developments in edge computing or cybersecurity, rather than specific outcomes related to Loft.

Other investors may consider companies that provide services to Loft, such as Airbus, a manufacturer of satellites. Like others in the aerospace sector, Airbus’s performance may be influenced by developments in space infrastructure, among other factors.

2. Public aerospace companies

Publicly traded companies like Firefly Aerospace, which went public in 2025, or Momentus, which offers space infrastructure services, may operate in sectors that overlap with Loft’s market. While these companies have distinct business models and may compete in certain areas, overall activity in the satellite and space services sectors may impact multiple players in different ways.

3. Aerospace & Defense ETFs

Exchange-traded funds (ETFs) focused on aerospace and defense sectors, such as the iShares U.S. Aerospace & Defense ETF, may include exposure to large companies operating in sectors similar to Loft’s. While these ETFs do not directly hold private company shares, their performance may reflect broader trends in aerospace and defense industries.

How to analyze Loft Orbital stock

Considering private companies do not face the same disclosure requirements as public companies, analyzing private market stocks can be more challenging, especially for companies like Loft Orbital that keep their financials closer to the vest.

However, you can look at the financial data that has been publicly disclosed, such as some revenue numbers and its valuation history. For example, Loft Orbital told TechCrunch in January 2025 that the company had grown revenue by 100% two years in a row, as well as that it reached over $500 million in bookings before its Series C in January.19

So, investors might compare this data to how other A&D companies have grown revenue. That, combined with reviewing Loft's valuation data across its funding rounds and its current Forge Price, could help investors determine how Loft Orbital's stock compares to similar private companies listed on Forge's private stock marketplace.

In addition to looking at real-world market signals informing Loft Orbital's current Forge Price, investors can discover other available investments and review market interest signals in real time. Seeing how other A&D companies are trading on Forge could help you determine what seems like a fair valuation for Loft Orbital.

Still, even when looking at what Loft has disclosed and the real-time pricing insights on Forge, private market stocks are generally more opaque than public market ones. So, there can be more subjectivity involved in analyzing Loft Orbital stock, along with the valuations of other private market companies.

Get started investing in Loft Orbital on Forge

If you're looking to invest in Loft Orbital pre-IPO if/when shares become available, create a free Forge account to access a leading marketplace for private company securities.

Once you’ve created your account and confirmed your accreditation, you’ll gain access to real-time pricing transparency, contextual insights may help to inform your decisions and a streamlined platform experience designed for self-directed investors. If you don’t know how to get started, we recommend reading our buyer’s guide to investing in private market shares. Then, if you ever need support, Forge’s experienced team is here to help.

Forge aims to bring greater transparency to an otherwise opaque private market, and as a publicly traded company, it operates within a regulated environment that allows investors to explore private market access.